Sun Hung Kai Bundle

How Does Sun Hung Kai & Co. Thrive in the Alternative Investment Arena?

Sun Hung Kai & Co., a titan in alternative investments, has strategically reshaped its market presence, making its sales and marketing strategies crucial to its success. Founded in Hong Kong, the company's evolution from traditional brokerage to a diversified portfolio across financial services, healthcare, and real estate showcases its adaptability. This transformation highlights the company's commitment to meeting evolving investor demands.

This deep dive into Sun Hung Kai & Co. will dissect its Sun Hung Kai SWOT Analysis, exploring the company's sales and marketing tactics, including its customer relationship management approach and advertising campaigns. We'll examine its digital marketing strategy, target audience, and market analysis to understand its brand positioning and competitive advantage within the Hong Kong real estate market and beyond. Furthermore, we will analyze its sales performance, marketing ROI, and property investment strategy to reveal its pathway to success in property sales Hong Kong and other key sectors.

How Does Sun Hung Kai Reach Its Customers?

The sales channels of Sun Hung Kai & Co. Limited are multifaceted, reflecting its diverse offerings in alternative investments and financial services. Their approach is tailored to engage both institutional investors and high-net-worth individuals, emphasizing personalized service and in-depth product knowledge. This strategy is crucial for navigating the complexities of alternative investments like private equity and real estate.

The company's sales strategy leverages both direct and indirect channels. Direct sales teams focus on building relationships with key clients, while indirect channels, such as brokerage and wealth management services, facilitate cross-selling opportunities. Digital engagement plays an increasingly important role in client relationship management, although direct interactions remain vital for high-value transactions.

Digital platforms, including the corporate website, are used to showcase investment expertise and performance data. Strategic partnerships are also key, expanding reach and deal flow in specialized alternative investment sectors. The company's approach is designed to maximize market share and growth, particularly in the competitive landscape of the Hong Kong financial market.

Direct sales teams are the primary channel for engaging institutional investors and high-net-worth individuals. These teams specialize in offering tailored investment solutions, focusing on alternative investments such as private equity and real estate. This approach allows for in-depth discussions about complex financial products and customized portfolio allocations, crucial for high-value transactions.

The company's financial services arm, including brokerage, wealth management, and investment banking, serves as an indirect sales channel. This channel facilitates cross-selling of alternative investment products to existing clients, leveraging established relationships. The integration of these services enhances the overall sales strategy by providing a broader range of financial solutions.

Digital engagement is a key component of the sales strategy, particularly for client relationship management and information dissemination. The corporate website serves as a vital platform for showcasing investment expertise, thought leadership, and performance data. This approach ensures that clients have access to the latest information and insights.

Strategic partnerships with other financial institutions and co-investment partners are crucial for expanding reach and deal flow. These collaborations are particularly important in specialized alternative investment sectors. By leveraging these partnerships, the company enhances its market share and overall growth.

The company's sales and marketing tactics emphasize personalized service and in-depth product knowledge. This approach is especially important when dealing with complex financial products. The focus is on building strong relationships with clients and providing tailored investment solutions. For more information on the company's structure, you can read about the Owners & Shareholders of Sun Hung Kai.

- Direct engagement with institutional investors and high-net-worth individuals.

- Leveraging the financial services arm for cross-selling opportunities.

- Utilizing digital platforms for client relationship management and information dissemination.

- Forming strategic partnerships to expand market reach and deal flow.

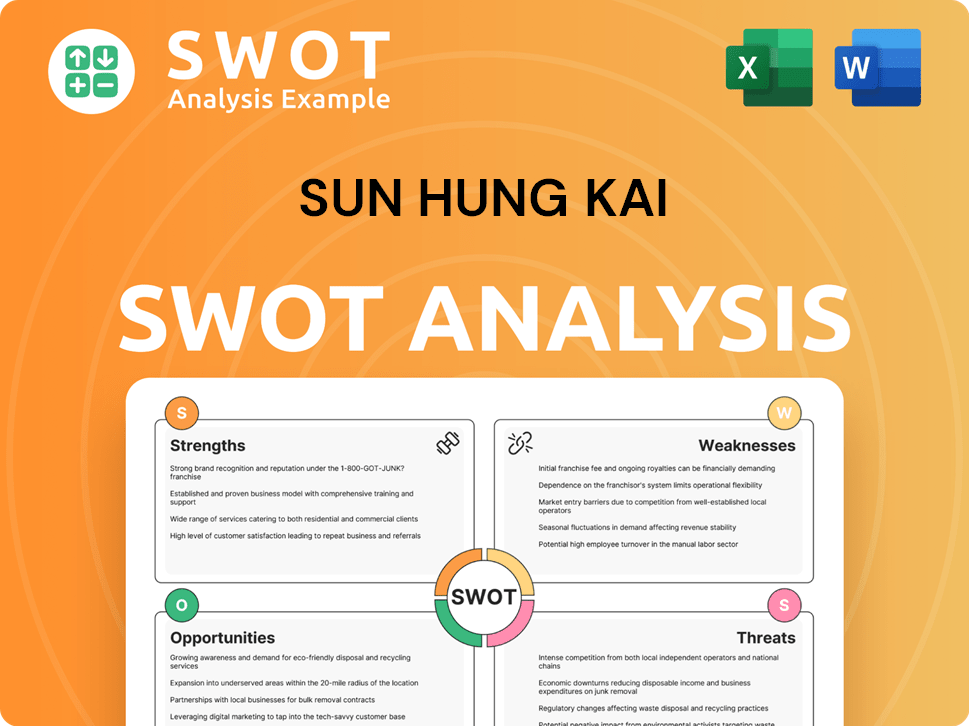

Sun Hung Kai SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Sun Hung Kai Use?

The marketing tactics employed by Sun Hung Kai & Co. Limited are designed to build brand awareness, generate leads, and drive investment in its alternative investment and financial services offerings. Their approach is increasingly centered on digital strategies, leveraging content marketing, targeted advertising, and data-driven insights to connect with their target audience. This comprehensive strategy aims to establish thought leadership and nurture relationships with high-net-worth individuals and institutional investors.

Sun Hung Kai & Co. Limited's marketing strategy is multifaceted, combining digital initiatives with traditional media to enhance credibility and reach. The company focuses on providing valuable content and personalized communications, while also using traditional media to strengthen its brand image. This blend of tactics helps them to effectively engage with their target audience and achieve their sales goals.

Sun Hung Kai & Co. Limited utilizes a variety of marketing tactics to build brand awareness and drive investments. Their approach includes digital marketing strategies, such as content marketing, paid advertising, and email marketing. They also leverage traditional media and data analysis to reach their target audience effectively.

Content marketing is a key element of the company's strategy, involving the publication of research reports, market commentaries, and white papers. This content is distributed on their website and financial news platforms to establish thought leadership. The focus is on attracting financially literate decision-makers and establishing the firm as a trusted source of information.

While traditional SEO may have limited direct impact for complex financial products, optimizing content for relevant financial terms and investor queries remains important. This helps improve visibility in search results and attract potential investors searching for financial information. They focus on content that answers specific investor questions.

Paid advertising is used selectively, often through financial news outlets and industry-specific platforms. The aim is to target institutional investors and ultra-high-net-worth individuals. This targeted approach ensures that advertising efforts reach the desired audience, maximizing the impact of marketing spend.

Email marketing is a vital tool for nurturing leads and disseminating updates to existing clients and prospects. Lists are often segmented based on investment interests and risk profiles. This allows for personalized communication, delivering relevant information to each segment of the audience.

Influencer partnerships focus on collaborations with respected financial analysts, economists, or industry experts. These partnerships provide third-party validation and contribute to thought leadership content. The goal is to leverage the credibility of these experts to build trust with potential investors.

Traditional media, such as features in prominent financial newspapers and interviews on business news channels, also play a role. This enhances their credibility and broadens their reach. This approach helps to solidify the company's reputation within the financial community.

The company's approach to data-driven marketing involves analyzing investor engagement with their content, tracking lead sources, and segmenting their client base. This personalization helps to tailor communication and product offerings. While specific technology platforms are not publicly detailed, the firm likely utilizes robust CRM systems and analytics tools.

- CRM Systems: Likely use Customer Relationship Management (CRM) systems to manage client interactions and track leads.

- Analytics Tools: Employ analytics tools to monitor marketing campaign effectiveness and measure ROI.

- Client Segmentation: Segment clients based on investment interests and risk profiles for personalized communication.

- Lead Tracking: Track lead sources to understand which marketing channels are most effective.

The marketing mix of Sun Hung Kai & Co. Limited has evolved, embracing digital platforms for content dissemination and engagement while continuing to rely on the trust conveyed through traditional financial media and direct client interactions. This integrated approach supports their overall Growth Strategy of Sun Hung Kai, helping them to maintain a strong presence in the competitive financial services market. In 2024, the global wealth management market was valued at approximately $120 trillion, with projections indicating continued growth, underscoring the importance of effective marketing strategies within the financial sector.

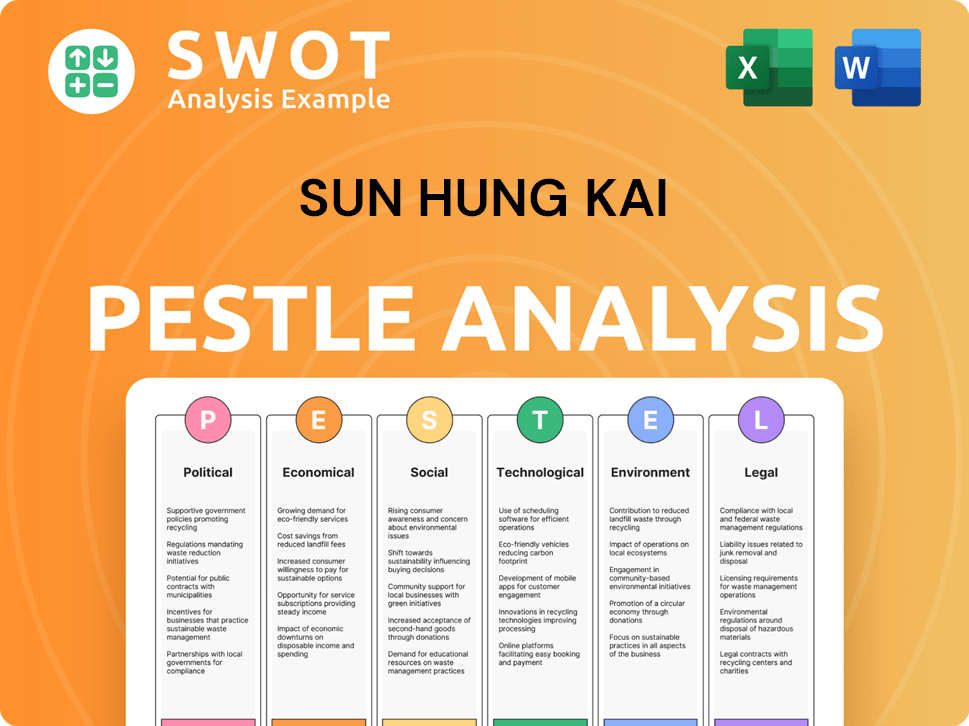

Sun Hung Kai PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Sun Hung Kai Positioned in the Market?

Sun Hung Kai & Co. Limited strategically positions itself as a leading alternative investment firm. This positioning emphasizes its expertise, diversified portfolio, and extensive track record within the financial industry. Their brand identity is built on trust, experience, and a forward-looking approach to investment. The core message focuses on providing sophisticated and differentiated investment opportunities across public and private markets.

The company's brand message revolves around delivering long-term value to its investors. Visually, the brand likely conveys professionalism and stability, reflecting its status in the financial sector. The tone of voice in its communications is authoritative, insightful, and client-centric. This approach appeals to a discerning audience of institutional investors, family offices, and high-net-worth individuals.

The firm differentiates itself through deep sector knowledge, especially in financial services, healthcare, and real estate, and by identifying and capitalizing on emerging trends in alternative assets. This approach allows them to attract their target audience by offering unique investment opportunities not available through traditional channels. They also emphasize rigorous due diligence and risk management. For more insights into their target audience, consider reading about the Target Market of Sun Hung Kai.

Sun Hung Kai leverages in-depth sector knowledge, particularly in financial services, healthcare, and real estate, to identify lucrative investment opportunities. This focused approach allows them to make informed decisions and provide value to their clients.

The firm offers access to unique investment opportunities that may not be available through traditional channels. This strategy helps them stand out from competitors and provide clients with exclusive investment options.

Sun Hung Kai is committed to rigorous due diligence and risk management. This commitment ensures the safety of client investments and builds trust, which is vital in the financial sector. This approach helps maintain a strong reputation.

The company adapts its positioning in response to shifts in global economic conditions and evolving investor preferences. This adaptability, coupled with strategic foresight, allows them to stay ahead in the competitive market.

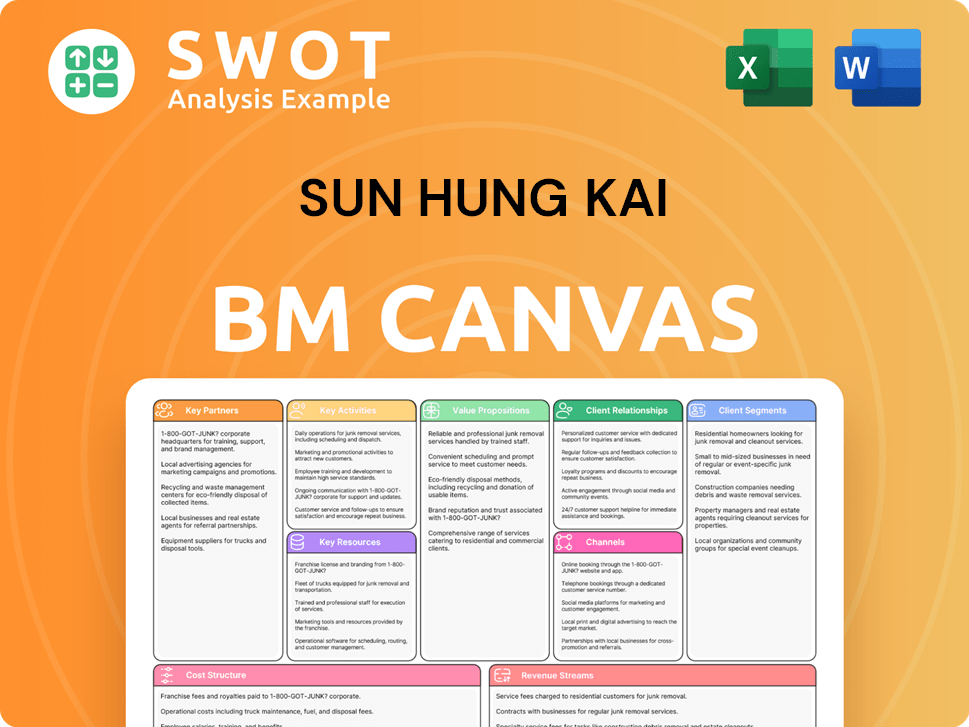

Sun Hung Kai Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Sun Hung Kai’s Most Notable Campaigns?

For an alternative investment firm like Sun Hung Kai & Co. Limited, the term 'campaigns' primarily refers to strategic initiatives aimed at attracting capital from institutional and high-net-worth clients. These are not typical mass-market advertising campaigns but rather focused efforts to build relationships and showcase investment opportunities. This approach is crucial for firms operating in the alternative investment space, where success hinges on securing substantial capital commitments from a select group of investors.

These campaigns often involve highly targeted activities designed to enhance the firm's reputation and attract investment. The primary goal is to secure capital commitments for new fund launches or specific investment vehicles. The success of these campaigns is measured by factors like the amount of funds raised and investor participation, rather than general public awareness.

A key element of Sun Hung Kai's sales and marketing strategy involves the consistent distribution of thought leadership content. This includes market outlooks and in-depth reports on various alternative asset classes. This approach helps to establish the firm as an authority in the industry, generate leads, and strengthen client relationships. This method is crucial for attracting and retaining clients in the competitive Hong Kong real estate market and broader investment landscape.

Sun Hung Kai sales and marketing tactics often include investor roadshows and presentations. These are typically invite-only events to showcase new funds or investment strategies, such as private equity or real estate ventures. The firm highlights investment theses, target returns, and the management team's expertise to secure capital commitments.

The consistent publication of thought leadership content is a crucial part of Sun Hung Kai's marketing strategy. This includes annual market outlooks and in-depth reports on alternative asset classes. These reports are distributed via email, financial news syndication, and the company website to establish the firm as an industry authority.

Sun Hung Kai's digital marketing strategy focuses on direct client engagement. This involves targeted email campaigns, webinars, and online portals for clients. The objective is to maintain strong relationships and provide up-to-date information on investment opportunities and market trends. This is crucial for effective customer relationship management.

Sun Hung Kai may form collaborations with academic institutions for research or industry associations to host forums and conferences. These partnerships boost visibility and credibility within their target audience. Such collaborations are a part of Sun Hung Kai's marketing efforts to enhance its brand positioning.

These campaigns are designed to support the firm's growth strategy, as detailed in Growth Strategy of Sun Hung Kai. The firm's focus on alternative investments, including Sun Hung Kai properties, requires a sophisticated approach to sales and marketing, emphasizing relationship building and expert insights.

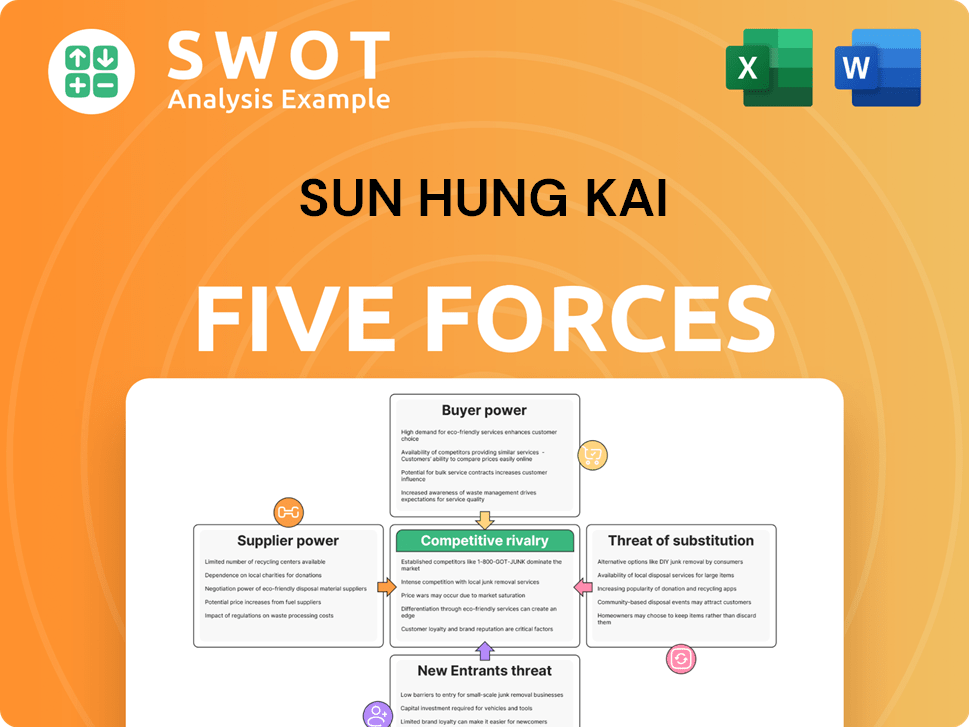

Sun Hung Kai Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sun Hung Kai Company?

- What is Competitive Landscape of Sun Hung Kai Company?

- What is Growth Strategy and Future Prospects of Sun Hung Kai Company?

- How Does Sun Hung Kai Company Work?

- What is Brief History of Sun Hung Kai Company?

- Who Owns Sun Hung Kai Company?

- What is Customer Demographics and Target Market of Sun Hung Kai Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.