Sun Hung Kai Bundle

Who Does Sun Hung Kai Company Serve?

Delving into the core of Sun Hung Kai & Co. Limited's success requires a deep understanding of its customer base. The firm's ability to thrive in the competitive alternative investment space hinges on its grasp of evolving Sun Hung Kai SWOT Analysis. Understanding the customer demographics and target market is crucial for sustained growth and strategic alignment. This analysis explores the company's journey from its inception to its current position, examining how it has adapted to meet the changing needs of its clientele.

From its early days in traditional financial services to its current focus on alternative investments, Sun Hung Kai Company has continually refined its approach to market segmentation. This evolution reflects a strategic shift towards serving a more sophisticated target market, including institutional investors and high-net-worth individuals. Understanding aspects like the age range of Sun Hung Kai customers, their income levels, and geographic locations provides valuable insights into the company's investment strategies. Furthermore, exploring questions such as "Who are the typical Sun Hung Kai property buyers?" and "How does Sun Hung Kai identify its target market?" will offer a comprehensive view of the company's customer-centric approach, especially in the context of real estate investment and SHK properties.

Who Are Sun Hung Kai’s Main Customers?

Understanding the Owners & Shareholders of Sun Hung Kai involves examining its primary customer segments. The company focuses on sophisticated investors, operating in both B2B and B2C markets. This strategic approach allows it to cater to a diverse range of clients with varying investment needs.

The core demographic of Sun Hung Kai & Co. includes institutional investors and high-net-worth individuals. These investors are characterized by their significant capital, a preference for diversified portfolios, and an interest in alternative investments.

While specific demographic breakdowns like age, gender, and education aren't publicly available, the company's clients typically exhibit high financial literacy. They often come from professional backgrounds, seeking specialized expertise in areas like financial services, healthcare, and real estate.

Institutional investors, such as pension funds and sovereign wealth funds, form a significant part of Sun Hung Kai's customer base. These entities manage substantial capital, making them crucial for revenue generation. Their demand for alternative investments has been growing.

High-net-worth and ultra-high-net-worth individuals also make up a key segment. These clients seek diversified portfolios and are interested in alternative investments for higher returns. Their investment strategies often include real estate and private equity.

The target market of Sun Hung Kai, focusing on customer demographics and target market analysis, is driven by the demand for alternative investments. This shift aligns with the broader trend of investors seeking diversification and higher yields. The company's approach to market segmentation is crucial.

- Significant Investable Assets: Clients possess substantial financial resources.

- Diversified Portfolio Preferences: They seek a mix of traditional and alternative investments.

- Interest in Alternative Investments: Focus on private equity, private credit, and real estate.

- High Financial Literacy: Clients are well-informed and understand complex financial products.

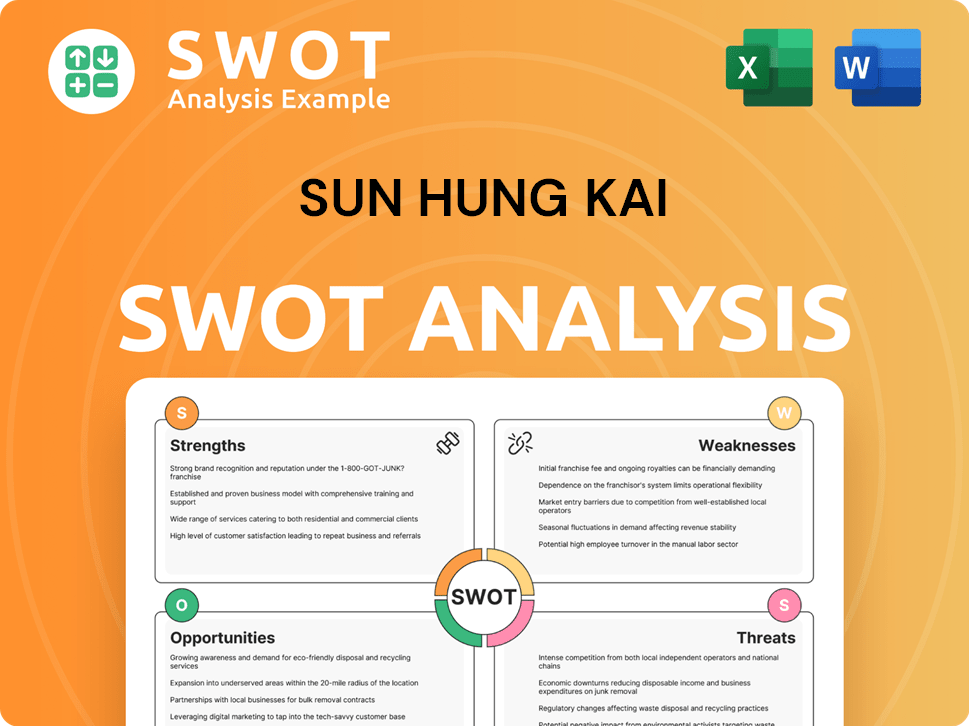

Sun Hung Kai SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Sun Hung Kai’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial institution. For Sun Hung Kai & Co., this involves a deep dive into the motivations and behaviors of their clientele. This analysis helps tailor investment solutions, manage risks effectively, and maintain a competitive edge in the market.

The target market of Sun Hung Kai & Co. is driven by a desire for sophisticated financial solutions, risk-adjusted returns, and diversification. Their purchasing behaviors are shaped by the need for capital appreciation, income generation, and portfolio resilience across different economic conditions. This focus allows the company to provide tailored investment opportunities.

The company addresses customer pain points through specialized investment teams and robust deal sourcing capabilities. For instance, their focus on private credit in 2024 and 2025 addresses the demand for stable income streams in a volatile interest rate environment.

Customers of Sun Hung Kai & Co. seek sophisticated financial solutions and risk-adjusted returns. They are driven by the need for capital appreciation and income generation.

The primary motivations include wealth preservation and growth. Practical drivers involve optimizing portfolio performance and mitigating market volatility.

Customers prefer tailored investment solutions and access to unique opportunities. They value the firm's track record and expertise in alternative asset classes.

Key criteria include the company's track record, expertise, and risk management frameworks. The ability to provide tailored investment solutions is also crucial.

Customers seek access to private equity, private credit, real estate, and healthcare investments. These opportunities are often unavailable through traditional channels.

Sun Hung Kai & Co. addresses the complexity of alternative investments and illiquidity concerns. They provide expert due diligence and specialized investment teams.

Sun Hung Kai & Co.'s approach to understanding its customer base is multifaceted. They analyze market trends, gather feedback from institutional clients, and develop new products and strategies. This approach ensures that the company remains aligned with emerging market trends and investor demands. For more information on their growth strategy, you can read the article: Growth Strategy of Sun Hung Kai.

The target market includes high-net-worth individuals, institutional investors, and family offices. These clients seek diversified investment portfolios and access to alternative assets.

- Age Range: Typically, clients range from 45 to 70 years old, representing experienced investors.

- Income Levels: Clients generally have high income levels, with significant assets under management.

- Geographic Location: Primarily based in Hong Kong, with a growing presence in other Asian markets.

- Investment Preferences: Focus on capital appreciation, income generation, and portfolio diversification.

- Customer Needs: Access to unique investment opportunities, expert due diligence, and risk management.

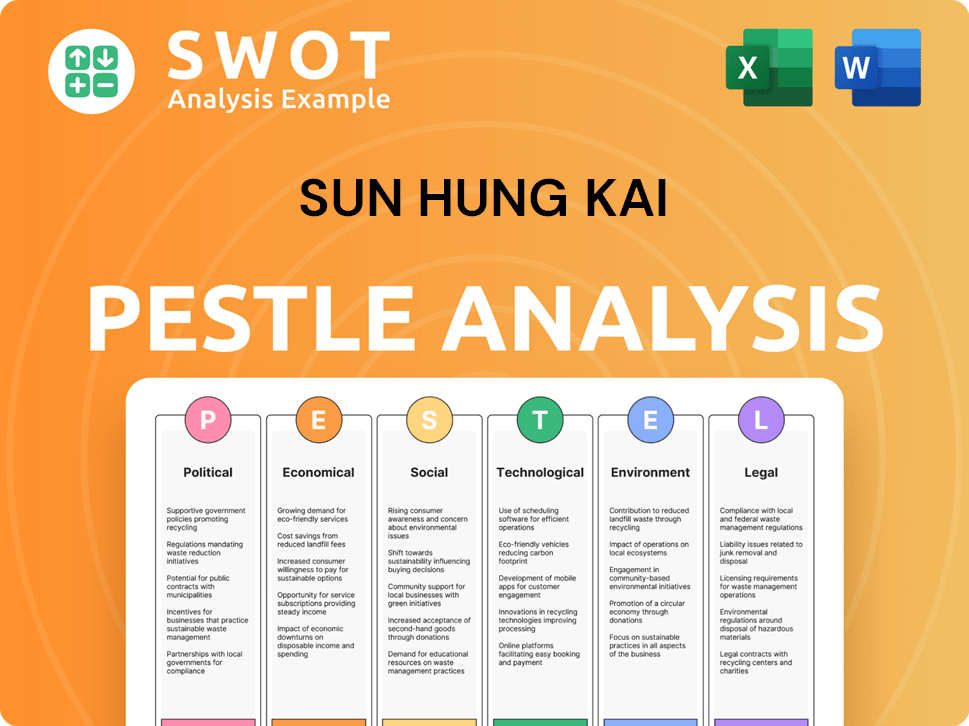

Sun Hung Kai PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Sun Hung Kai operate?

The primary geographical market for Sun Hung Kai & Co. Limited is centered in Asia, with a strong focus on Hong Kong, where the company is headquartered. This strategic location provides access to a diverse base of high-net-worth individuals and institutional investors across the Asia-Pacific region. Hong Kong's status as a key financial hub is crucial for the company's operations.

While specific market share data by city or country is not publicly detailed for its alternative investment segments, the company's long-standing presence and extensive network in Hong Kong suggest strong brand recognition and market penetration. The company likely tailors its offerings and marketing strategies to suit the nuances of various Asian markets, understanding that customer demographics and preferences can vary significantly across the region.

Recent expansions or strategic focus areas would likely involve increasing their reach within key Asian financial centers to capture growing wealth and institutional capital. The geographic distribution of sales and growth is heavily concentrated in Asia, leveraging the region's robust economic growth and increasing demand for sophisticated alternative investment solutions. The company's approach to market segmentation is pivotal for its success.

Hong Kong serves as the primary market, offering access to a substantial pool of high-net-worth individuals. The company's strong presence in Hong Kong indicates a high degree of market penetration within this key area. This is crucial for understanding the customer demographics.

Customer preferences and regulatory considerations differ across Asian regions, such as Mainland China and Southeast Asia. The company localizes its offerings and marketing strategies to address these regional differences. This approach is essential for effective market segmentation.

The company leverages strategic partnerships to navigate the complexities of various Asian markets. These partnerships help in understanding local market dynamics and regulatory frameworks. This approach is vital for expanding the customer base.

The company's expansion efforts likely involve increasing its reach within key Asian financial centers. This focus aims to capitalize on the growing wealth and institutional capital in the region. This strategy is crucial for long-term growth.

Investment strategies are tailored to specific regional economic trends and regulatory frameworks. This customization ensures that the investment products remain competitive. This approach helps in attracting a diverse customer base.

The geographic distribution of sales and growth is heavily concentrated in Asia. This concentration leverages the region's robust economic growth and increasing demand for sophisticated alternative investment solutions. This is a key factor for the company's success.

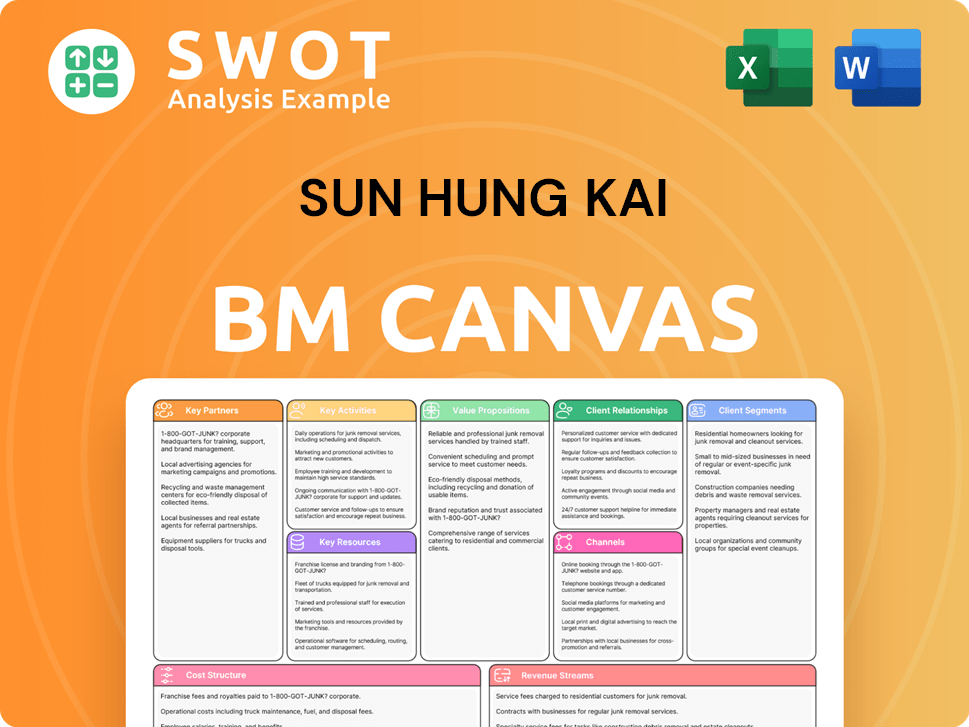

Sun Hung Kai Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Sun Hung Kai Win & Keep Customers?

Sun Hung Kai & Co. Limited's approach to customer acquisition and retention focuses on high-net-worth individuals and sophisticated investors, emphasizing personalized service and long-term relationships. The company leverages its established reputation and extensive network within the financial industry to attract clients. Their strategies are tailored to meet the specific needs of this target market, which includes individuals and institutions seeking alternative investment opportunities.

Customer acquisition at Sun Hung Kai relies heavily on direct outreach, referrals from existing clients, and participation in industry-specific events. This approach is particularly effective given the nature of their customer base. Retention strategies are centered on delivering consistent, risk-adjusted returns, and providing transparent communication. The focus is on building trust and acting as a trusted advisor to clients, understanding and anticipating their needs to foster enduring partnerships.

While specific details on CRM systems and marketing campaigns are not publicly disclosed, it is highly probable that a sophisticated CRM system is used to manage client interactions. This is essential for a company that prioritizes personalized service and manages high-value client relationships. Furthermore, their marketing efforts likely highlight successful investment opportunities and the performance of their alternative investment funds.

Direct communication with potential clients, often through relationship managers, is a key method of acquiring new customers. This involves personalized presentations and discussions tailored to individual investment needs. This is particularly effective with the target market of high-net-worth individuals.

Referrals from existing clients and industry professionals are a crucial source of new business. These referrals often come from satisfied clients who have experienced positive returns and excellent service. The value of a referral program is high in the financial services industry.

Attending and participating in industry conferences and forums allows the company to connect with potential clients. These events provide opportunities to showcase expertise and network with high-net-worth individuals and institutional investors. These events are a good way to meet the Sun Hung Kai Company customer base.

Dedicated client service teams provide personalized experiences, building strong relationships. This includes tailored investment advice, regular portfolio reviews, and proactive communication. This is crucial for retaining high-value clients.

Sun Hung Kai's retention strategies emphasize building long-term partnerships. They prioritize consistent communication and delivering strong, risk-adjusted returns. This approach fosters trust and loyalty among their client base. The client base appreciates transparency and ongoing value.

- Consistent Communication: Regular updates and reports on portfolio performance.

- Transparent Reporting: Providing clear and detailed information on investment strategies.

- Risk-Adjusted Returns: Delivering strong returns while managing risk effectively.

- Trusted Advisor: Acting as a reliable source of financial advice.

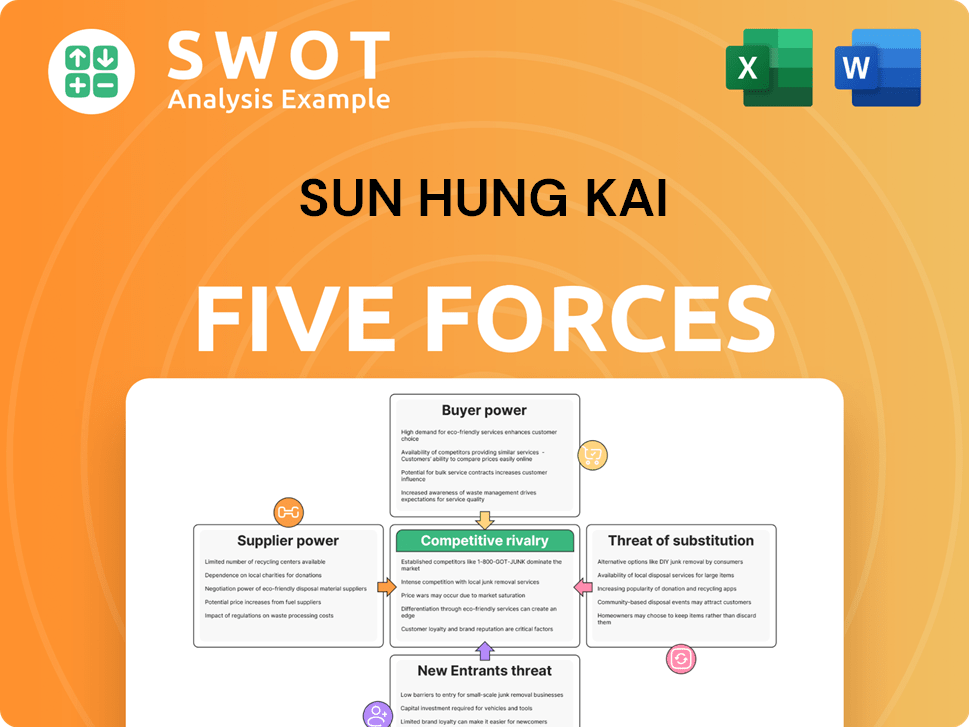

Sun Hung Kai Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sun Hung Kai Company?

- What is Competitive Landscape of Sun Hung Kai Company?

- What is Growth Strategy and Future Prospects of Sun Hung Kai Company?

- How Does Sun Hung Kai Company Work?

- What is Sales and Marketing Strategy of Sun Hung Kai Company?

- What is Brief History of Sun Hung Kai Company?

- Who Owns Sun Hung Kai Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.