Sun Hung Kai Bundle

What Drives Sun Hung Kai Company's Success?

Understanding a company's core principles is key to assessing its potential. Delving into the Sun Hung Kai SWOT Analysis, we uncover the crucial elements that shape its strategic direction and influence its market position. This exploration will illuminate the essence of SHK Company's identity.

The mission, vision, and core values of Sun Hung Kai Company are not just abstract concepts; they are the bedrock upon which its operations and future growth are built. Examining these principles provides invaluable insights into the SHK Group's corporate philosophy and its commitment to long-term success. Discover how these elements contribute to Sun Hung Kai Company's financial performance and its impact on the community.

Key Takeaways

- Sun Hung Kai & Co.'s mission, vision, and values are central to its strategy and identity.

- The company's strengths include its alternative investment focus and diversified business model.

- Recent profitability and AUM growth in 2024 highlight the effectiveness of their strategic direction.

- Resilience, agility, and selective collaborations are key for future market navigation.

- Integrity, excellence, innovation, prudence, and professionalism are core to building stakeholder trust.

Mission: What is Sun Hung Kai Mission Statement?

While a formal, concise mission statement isn't readily available, the Sun Hung Kai Company’s mission is implicitly 'to be a leading alternative investment firm, delivering long-term risk-adjusted returns and providing tailored financial solutions.'

Delving into the SHK Company’s core purpose reveals a strategic focus on value creation within the alternative investment landscape. This is achieved through a multifaceted approach, encompassing diverse investment strategies and a commitment to supporting emerging asset managers. Understanding the Sun Hung Kai Company mission is key to grasping its operational focus and long-term goals.

The SHK Group concentrates on investments across public and private markets. This includes expertise in credit, investment management, and funds management. This diversified approach aims to mitigate risk and capitalize on various market opportunities.

The Company Values are reflected in its commitment to delivering long-term, risk-adjusted returns for shareholders. Additionally, they provide tailored financial solutions for partners and ultra-high-net-worth investors. This dual focus underscores their dedication to both financial performance and client service.

The Corporate Philosophy emphasizes a sophisticated investment platform. This is evident in their efforts to support emerging asset managers in Asia, such as through Sun Hung Kai Capital Partners. The Credit business is another example, providing steady returns and cash flow.

A key aspect of Sun Hung Kai Company's mission is supporting the growth of new asset managers. This is achieved through their funds management subsidiary, which brings new managers to market. This approach not only fosters innovation but also diversifies their investment portfolio.

The SHK Company aims to provide tailored financial solutions. This includes a range of services designed to meet the specific needs of their partners and ultra-high-net-worth investors. This commitment to customization sets them apart in the financial services industry.

The Sun Hung Kai Company's long-term goals are focused on sustainable value creation. This involves a commitment to delivering consistent, risk-adjusted returns over time. This long-term perspective is crucial for building trust and ensuring lasting success in the financial markets. For more insights into their target market, read this article: Target Market of Sun Hung Kai.

The Sun Hung Kai Company mission statement analysis reveals a strategic focus on alternative investments, tailored financial solutions, and long-term value creation. Their commitment to supporting emerging managers and providing customized services further underscores their dedication to both financial performance and client satisfaction. Understanding these aspects is essential for anyone looking to understand the SHK Company's operational focus and long-term objectives.

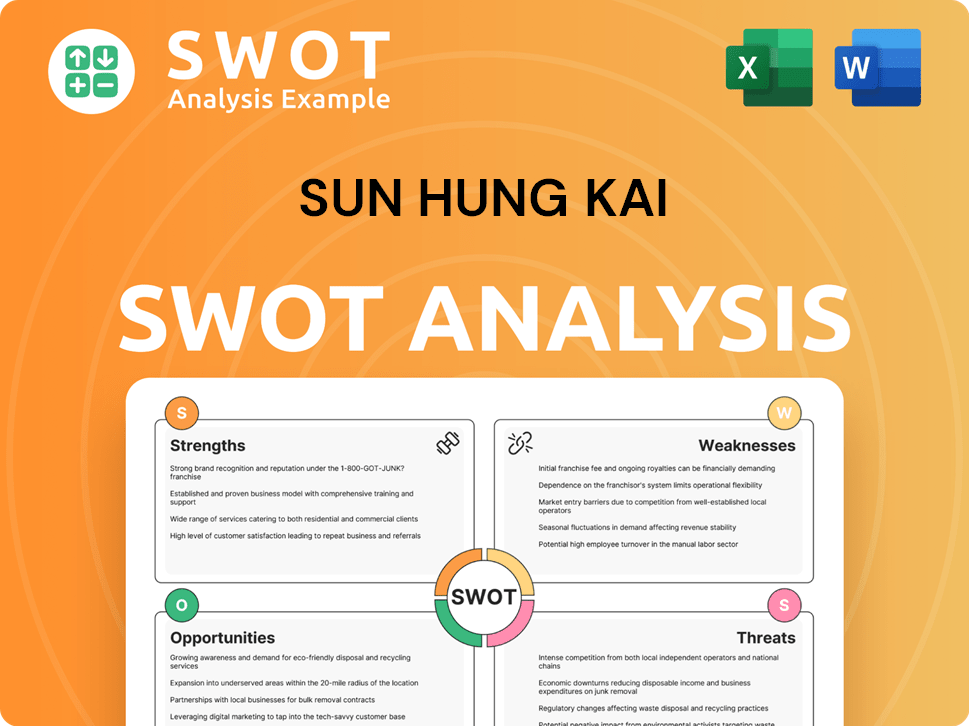

Sun Hung Kai SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Sun Hung Kai Vision Statement?

Sun Hung Kai & Co.'s vision is to build a resilient, agile, and high-performing alternatives investment platform, focusing on growth and expansion through strategic partnerships, particularly in Asia, with a potential global reach.

Let's delve into the vision of Sun Hung Kai & Co. (SHK Company) and analyze its implications.

The SHK Company's vision is decidedly future-oriented. It emphasizes growth, expansion, and the development of a robust alternatives investment platform. This focus indicates a commitment to adapting to evolving market dynamics and identifying new opportunities.

A key element of the SHK Company's vision is the emphasis on strategic partnerships. This approach suggests a desire to leverage external expertise, access new markets, and share resources. This collaborative model can accelerate growth and mitigate risks.

The vision has both regional and global dimensions. The focus on Asia highlights the company's understanding of the region's growth potential. The potential for global scaling indicates a long-term ambition to become a significant player in the alternatives investment space worldwide.

The vision appears realistic, given the company's recent performance. The return to profitability in 2024, with a net profit of HK$377.7 million, and the record US$2.0 billion in assets under management (AUM) demonstrate the company's progress. These figures suggest the vision is achievable, yet ambitious enough to drive further growth.

The vision aligns with the company's strategy of leveraging its investment capabilities. With nearly 80% of its AUM coming from external capital in 2024, SHK Company is successfully building trust and attracting investment, which is a key indicator of the company's successful transformation.

Understanding the competitive landscape is crucial for SHK Company to achieve its vision. For a deeper dive into the competitive environment, consider exploring the Competitors Landscape of Sun Hung Kai.

In summary, the vision of Sun Hung Kai Company (SHK Group) is a forward-looking strategy that emphasizes growth, strategic partnerships, and a global footprint. The company's recent financial performance suggests that this vision is both realistic and aspirational, positioning SHK Company for continued success in the alternatives investment market. The focus on building a resilient and agile platform is particularly relevant in the current dynamic economic environment.

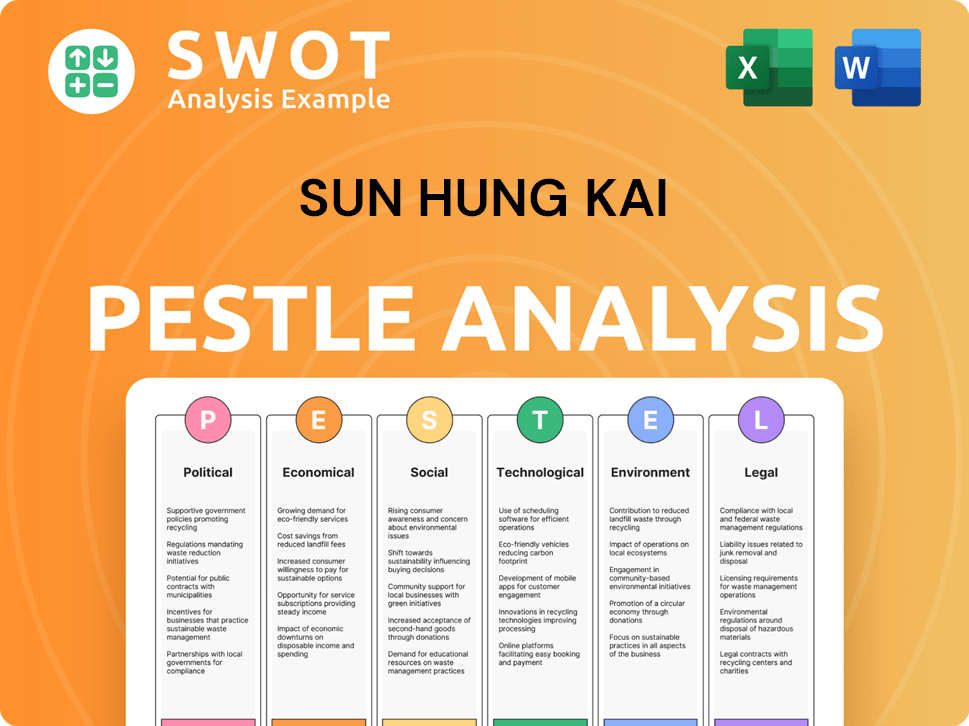

Sun Hung Kai PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Sun Hung Kai Core Values Statement?

Understanding the core values of Sun Hung Kai & Co. Limited (SHK Company) provides crucial insights into its operational principles and corporate identity. These values guide the company's actions, shape its culture, and influence its relationships with stakeholders.

Integrity is a fundamental value for SHK Company, emphasizing honesty, transparency, and accountability in all its dealings. This commitment is reflected in its robust governance structures and risk management practices, ensuring ethical conduct across the organization. For example, SHK Company's adherence to high standards of business ethics and corporate governance is a testament to its commitment to integrity.

Excellence is a core value that drives SHK Company to deliver high-quality products and services, aiming for long-term risk-adjusted returns. This is evident in their disciplined investment approach across various asset classes, reflecting a commitment to superior performance. SHK Company strives to maintain a high level of excellence in its financial services, which is a key factor in its success and reputation.

Innovation is central to SHK Company's approach, particularly in alternative investments and the development of tailored solutions. The company actively seeks new and emerging investment approaches to offer unique opportunities to its clients. For instance, Sun Hung Kai Capital Partners focuses on bringing new and emerging managers to market with unique investment approaches, demonstrating its commitment to innovation.

Prudence is demonstrated through disciplined investment and risk management practices, ensuring balance sheet resilience and capital efficiency. This value is crucial for maintaining stability and achieving sustainable growth. Their Credit business exercises caution in underwriting new loans, which is a practical example of prudent financial management.

These core values of SHK Company—Integrity, Excellence, Innovation, and Prudence—form the foundation of its corporate philosophy. These values are integral to understanding the Growth Strategy of Sun Hung Kai. Next, we will explore how SHK Company's mission and vision influence its strategic decisions.

How Mission & Vision Influence Sun Hung Kai Business?

The Sun Hung Kai Company's (SHK Company) mission and vision serve as the bedrock of its strategic decision-making, shaping its transformation and guiding its actions. This influence is evident across various facets of the business, from investment strategies to financial management.

The SHK Group's mission and vision drive its strategic shift towards a diversified alternatives investment platform. This involves focusing on key segments like credit, investment management, and funds management to build a resilient and agile platform.

- The strategic diversification is a direct reflection of the company’s long-term goals.

- This transformation aims to enhance overall financial performance and adaptability.

- The emphasis is on building a platform that can navigate market fluctuations.

Sun Hung Kai Capital Partners, the funds management arm, exemplifies this strategic direction. It supports emerging asset managers and offers external capital management, aligning with the vision of expanding through collaborations.

The company's approach to investment management, focused on generating long-term risk-adjusted returns, is another key indicator. This disciplined strategy is reflected in the Investment Management segment's performance, which achieved an overall gain in 2024 despite market challenges.

The SHK Company's commitment to financial stability is evident in its focus on balance sheet resilience and capital efficiency. The reduction in the net gearing ratio to 31.2% in 2024 demonstrates a strategic decision guided by the vision of building a robust platform.

The provision of tailored investment solutions, such as Family Office Solutions, caters to the specific needs of partners and ultra-high-net-worth investors. This strategic focus aligns with the goal of being a leading financial institution.

Tony Edwards, Executive Director & Deputy CEO, highlights that the return to profitability in 2024 validates the Group's vision of building a resilient, agile, and high-performing alternatives investment platform, showing real-world traction.

The SHK Company's financial performance, guided by its core values, reflects its commitment to long-term value creation. The company’s strategic decisions are consistently aligned with its mission and vision, ensuring sustainable growth and stakeholder value.

In essence, the SHK Company's mission and vision are not merely statements but active drivers of its corporate strategy. For a deeper understanding of the foundational principles, consider exploring the Mission, Vision & Core Values of Sun Hung Kai. Next, we will delve into the core improvements to the company's mission and vision.

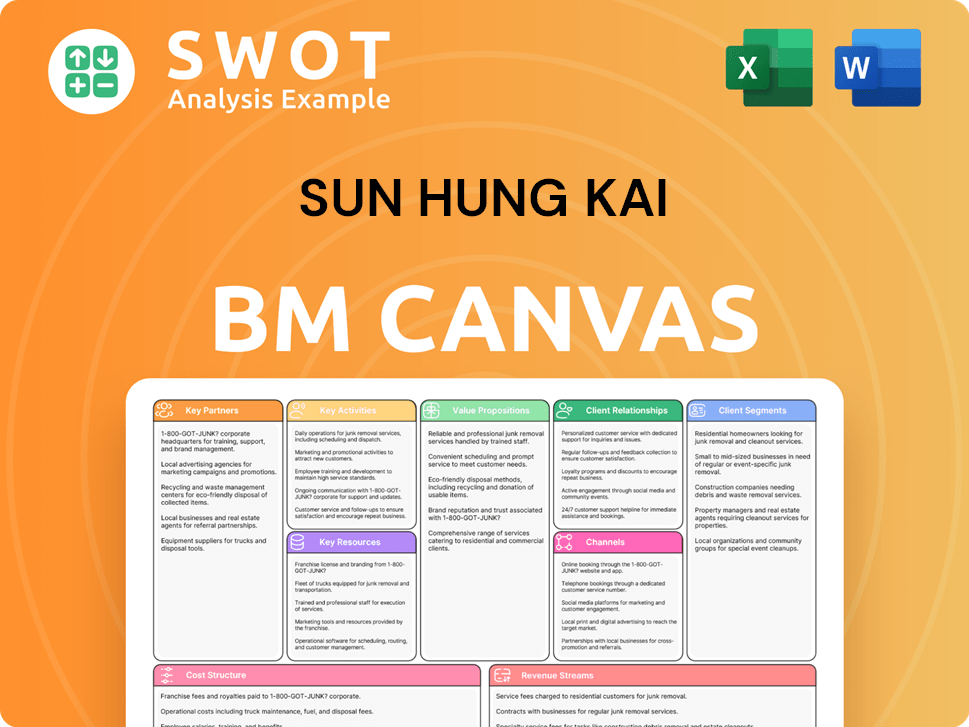

Sun Hung Kai Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Sun Hung Kai & Co. has demonstrated resilience and achieved profitability, continuous improvement is key in today's dynamic financial landscape. This section explores potential refinements to the company's mission, vision, and core values to further enhance its strategic direction and stakeholder engagement.

Explicitly incorporating Environmental, Social, and Governance (ESG) principles into the mission and vision statements would highlight Sun Hung Kai Company's commitment to sustainability. This would resonate with investors, particularly as ESG-focused assets continue to grow; in 2024, global ESG assets are projected to reach $50 trillion. This also aligns with the growing importance of Marketing Strategy of Sun Hung Kai, which emphasizes transparency and stakeholder value.

Defining a clear ambition for global market leadership would provide greater inspiration and direction for SHK Group. A more specific vision statement, such as aiming to be a leading player in the international alternative investment space, could attract talent and partners. This would also help position the company for future growth, especially in emerging markets where alternative investments are gaining traction.

Explicitly mentioning innovation and technology in the vision statement would demonstrate a forward-thinking approach to the future. This would signal the company's commitment to adapting to changing industry trends, such as the increasing use of fintech solutions in financial services. This could help attract tech-savvy investors and employees.

Refining the articulation of SHK Company's values can enhance internal alignment and external communication. This could involve providing more detailed descriptions of each value, offering examples of how they are applied in practice, and showcasing how they contribute to the company's overall success. This can improve employee engagement and strengthen the company's reputation.

How Does Sun Hung Kai Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible results. This involves integrating these guiding principles into every facet of the organization, from daily operations to long-term strategic decisions.

Sun Hung Kai & Co. (SHK Company) demonstrates its commitment to its mission and vision through strategic business initiatives and operational practices. The most prominent example is the multi-year transformation into a diversified alternatives investment platform, a move that directly reflects its vision for the future.

- Diversification Strategy: SHK Company has strategically built and strengthened its Credit, Investment Management, and Funds Management segments. This diversification is aimed at enhancing its resilience and expanding its market presence.

- Focus on Alternatives: The company's shift towards alternatives investments signifies a proactive approach to capture growth opportunities and adapt to evolving market dynamics.

- Appointment of Key Personnel: The appointment of Kelvin Cheung as CEO of Sun Hung Kai Capital Partners in April 2025, further underscores the company's commitment to strengthening its alternatives and asset management arm. This appointment is a key step in executing its strategic vision.

Leadership plays a critical role in reinforcing the company's mission, vision, and core values. The emphasis on disciplined investment, balance sheet resilience, and capital efficiency, as highlighted by executives, demonstrates a commitment to the core tenets of their strategy and vision, which are key components of the SHK Group's corporate philosophy.

The company's commitment to strong corporate governance and risk management provides a framework for upholding its principles across all levels of the organization. This framework helps ensure that the company's actions align with its stated values.

SHK Company effectively communicates its mission, vision, and values to stakeholders through various channels. These channels include official announcements, annual reports, and its website. This transparency helps build trust and ensures that stakeholders are informed about the company's strategic direction and performance.

The 2024 Annual Report details financial performance and strategic direction, reflecting the progress of its business transformation. The investor relations section on its website provides further information on its performance and strategy. For more insights into SHK Company's financial model, consider reading Revenue Streams & Business Model of Sun Hung Kai.

SHK Company demonstrates alignment between its stated values and actual business practices through its ESG initiatives. The 2024 ESG Report details efforts in responsible investment, environmental commitments, and employee care, demonstrating a commitment to social and environmental responsibility alongside financial performance.

The company's Charitable Foundation and the SHK Scallywag Foundation support community initiatives, education, and sports, reflecting a commitment to giving back to society. These initiatives highlight SHK Company's commitment to corporate social responsibility and its impact on the community.

While specific details about formal programs or systems designed to ensure alignment with mission and vision across all levels of the organization are limited in the provided search results, the emphasis on corporate governance and risk management suggests a framework for upholding their principles. This framework likely includes key performance indicators (KPIs) and regular reviews to monitor progress.

The company's financial performance, as detailed in its annual reports, serves as a key indicator of its success in executing its strategic vision. The continuous monitoring and evaluation of these initiatives ensure that SHK Company remains aligned with its core values and long-term goals.

Sun Hung Kai Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sun Hung Kai Company?

- What is Competitive Landscape of Sun Hung Kai Company?

- What is Growth Strategy and Future Prospects of Sun Hung Kai Company?

- How Does Sun Hung Kai Company Work?

- What is Sales and Marketing Strategy of Sun Hung Kai Company?

- Who Owns Sun Hung Kai Company?

- What is Customer Demographics and Target Market of Sun Hung Kai Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.