Snam Bundle

How did Snam, a key player in European energy, begin?

From post-war Italy to a continental energy leader, the Snam SWOT Analysis reveals a fascinating story of strategic evolution. This brief history of Snam explores how the company rose to become an essential part of Europe's energy infrastructure. Discover the pivotal moments that shaped Snam company and its role in the energy landscape.

Snam's journey, deeply rooted in the history of natural gas in Italy, showcases remarkable adaptation and growth. Understanding Snam's history is crucial for grasping its current influence on European energy markets. This exploration will delve into Snam's key acquisitions over time, its infrastructure projects, and its commitment to sustainability, offering insights into its enduring success and future prospects.

What is the Snam Founding Story?

The story of the Snam company begins on October 30, 1941. It was founded in San Donato Milanese, Italy, under the original name Società Nazionale Metanodotti, which translates to National Methane Pipelines Company. This marked the start of a journey that would see Snam become a key player in Italy's energy landscape.

The company's establishment was driven by Eni (Ente Nazionale Idrocarburi), a state-owned energy company. This strategic move was part of a larger national plan to develop Italy's natural gas infrastructure. The main goal was to create a comprehensive network for transporting methane gas, a resource seen as crucial for both industrial and household use.

The leaders of Eni were the primary founders, recognizing the potential of Italy's domestic gas reserves. They aimed to reduce reliance on imported energy sources. Snam's initial business model focused on building and managing gas pipelines, providing a fundamental service for the growing natural gas industry in Italy. The initial funding came from Eni, reflecting the Italian government's strong belief in Snam's mission. This establishment was closely tied to the economic context of the time, as Italy sought to rebuild and industrialize after major global conflicts, requiring a dependable and efficient energy supply.

The founding of Snam was a strategic move by Eni to develop Italy's natural gas infrastructure.

- Snam's founding date was October 30, 1941.

- The company was initially named Società Nazionale Metanodotti.

- The primary goal was to establish a gas pipeline network.

- The initial funding came from Eni, a state-owned energy company.

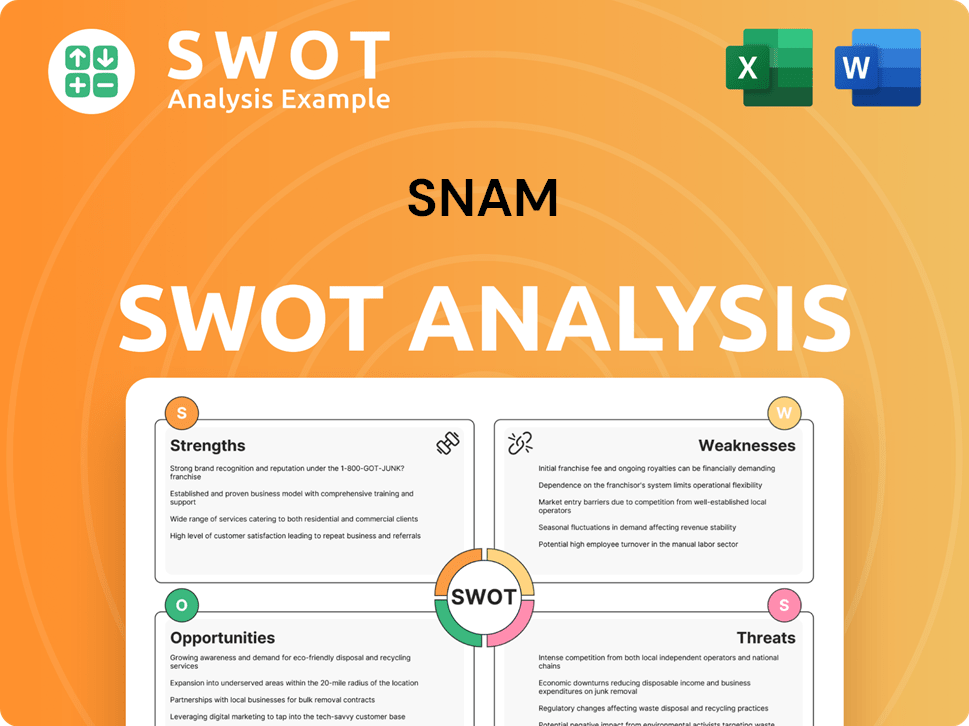

Snam SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Snam?

The early growth of the Snam company, a key player in the energy sector, was closely tied to Italy's post-war economic recovery and industrialization. During the 1950s and 1960s, Snam rapidly expanded its pipeline network, connecting gas fields in the Po Valley to major industrial centers. This period saw significant investments in infrastructure, crucial for the distribution of natural gas across Italy. Understanding the Marketing Strategy of Snam can provide further insights into its growth.

Snam's early focus was on extending the reach and capacity of its gas transmission system. Key milestones included constructing major interregional pipelines, facilitating the distribution of natural gas to a growing number of cities and industrial complexes. The company's initial clients were large industrial enterprises and municipal gas distribution companies, driving early demand. This expansion was supported by a growing team of engineers and technicians, with operational centers established across the country.

In the subsequent decades, Snam continued its strategic expansion, entering new geographical markets through international projects and collaborations, particularly within Europe. The company diversified its activities to include gas storage and regasification, adapting to the evolving energy market needs. This growth was fueled by major capital raises, often through bond issuances and partnerships with other energy entities.

Leadership transitions consistently prioritized technological advancement and network optimization. By 2024, Snam's gas transport network in Italy reached approximately 33,000 km, demonstrating substantial growth from its early stages. This expansion was shaped by the increasing demand for natural gas as a cleaner alternative and the need to ensure energy security for Italy and Europe.

Snam's growth was supported by significant financial investments. The company's infrastructure projects were crucial for the Italian economy, and its gas transmission network expanded to meet growing energy demands. Snam's storage facilities and investments in renewable energy also became important aspects of its operations. The company's financial performance history reflects its strategic adaptations and expansions.

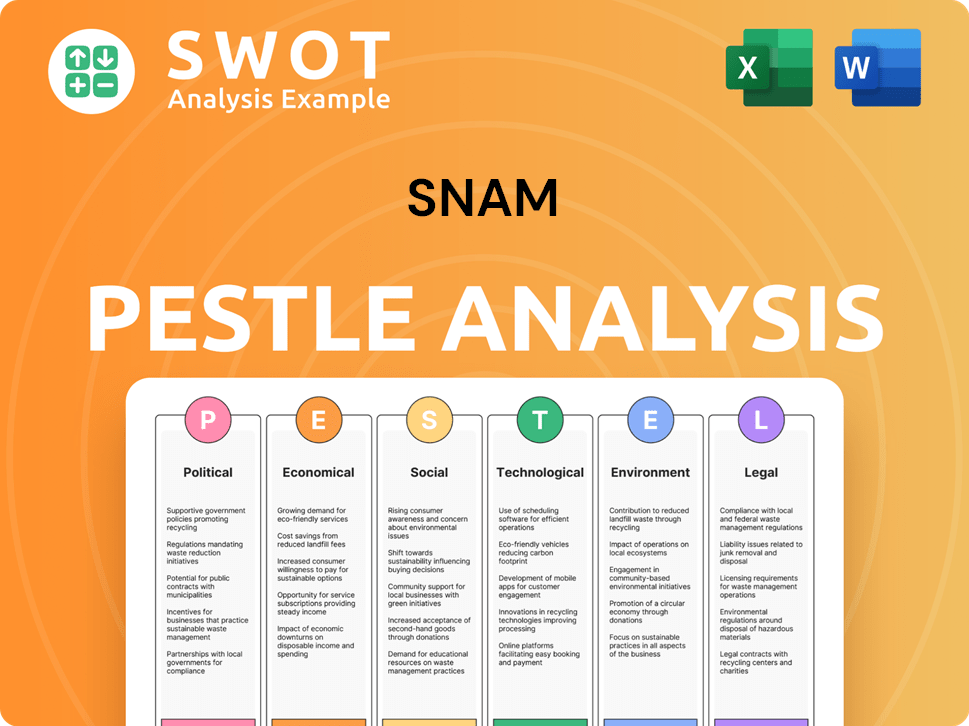

Snam PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Snam history?

The Snam company has a rich Snam history, marked by significant milestones in the natural gas sector. From its origins to its current status as a key player in European energy infrastructure, Snam Italy has continuously adapted and evolved. This evolution is a testament to its strategic vision and commitment to innovation.

| Year | Milestone |

|---|---|

| 1941 | Founding of Snam as a part of Agip, later ENI, marking the beginning of its involvement in Italy's natural gas infrastructure. |

| 1952 | Snam begins the construction of Italy's high-pressure gas pipeline network, a foundational project for the company. |

| 1998 | Snam is listed on the Milan Stock Exchange, a pivotal moment in its corporate history. |

| 2001 | Snam becomes an independent company, separating from ENI and solidifying its role as a key infrastructure provider. |

| 2012 | Snam acquires significant stakes in international gas infrastructure projects, expanding its global footprint. |

| 2017 | Snam launches its sustainability strategy, focusing on environmental and social responsibility. |

| 2020 | Snam commits to investing in hydrogen and biomethane infrastructure, signaling its transition towards renewable energy. |

Snam has consistently championed innovation in the energy sector, particularly in gas transportation and storage. The company has developed advanced monitoring systems to ensure the integrity of its pipelines and has also invested in innovative solutions for gas compression and storage, enhancing efficiency and safety.

These systems use cutting-edge technology to detect and prevent potential issues in the pipeline network, ensuring operational safety and reliability. This includes real-time monitoring and predictive maintenance capabilities.

Snam has developed and implemented advanced gas compression technologies to improve the efficiency of gas transportation. These innovations reduce energy consumption and operational costs.

Snam has invested in smart metering and digitalization to enhance the efficiency of its operations. This includes the use of data analytics for predictive maintenance.

Snam is actively involved in developing hydrogen infrastructure, including pipelines and storage facilities, to support the growth of the hydrogen economy. This involves pilot projects and strategic partnerships.

Snam supports the injection of biomethane into its gas grid, promoting the use of renewable energy sources. This initiative helps reduce carbon emissions and supports sustainable energy practices.

Snam is focused on enhancing energy storage solutions to improve grid stability and flexibility. This includes the development of advanced storage technologies.

Snam has faced challenges such as market fluctuations and regulatory changes, particularly those related to the energy transition. Competitive pressures from other energy sources have also required strategic adaptation. Understanding Snam's core values provides insights into its approach to these challenges.

Fluctuations in gas prices and economic downturns have required Snam to adjust its strategies. These adjustments include optimizing operations and exploring new business avenues.

Regulatory changes, especially those related to decarbonization and energy transition, have presented both challenges and opportunities. Snam has adapted by investing in sustainable projects.

The rise of renewable energy sources has increased competitive pressure on Snam. Snam has responded by diversifying its portfolio and investing in green technologies.

Geopolitical events and international conflicts can impact energy supply and demand. Snam manages these risks through diversification and strategic partnerships.

The need to invest in new technologies, such as hydrogen and biomethane, requires significant capital expenditure. Snam is allocating resources to these areas.

The shift towards renewable energy requires Snam to transform its business model. This includes divesting from non-core assets and rebranding efforts.

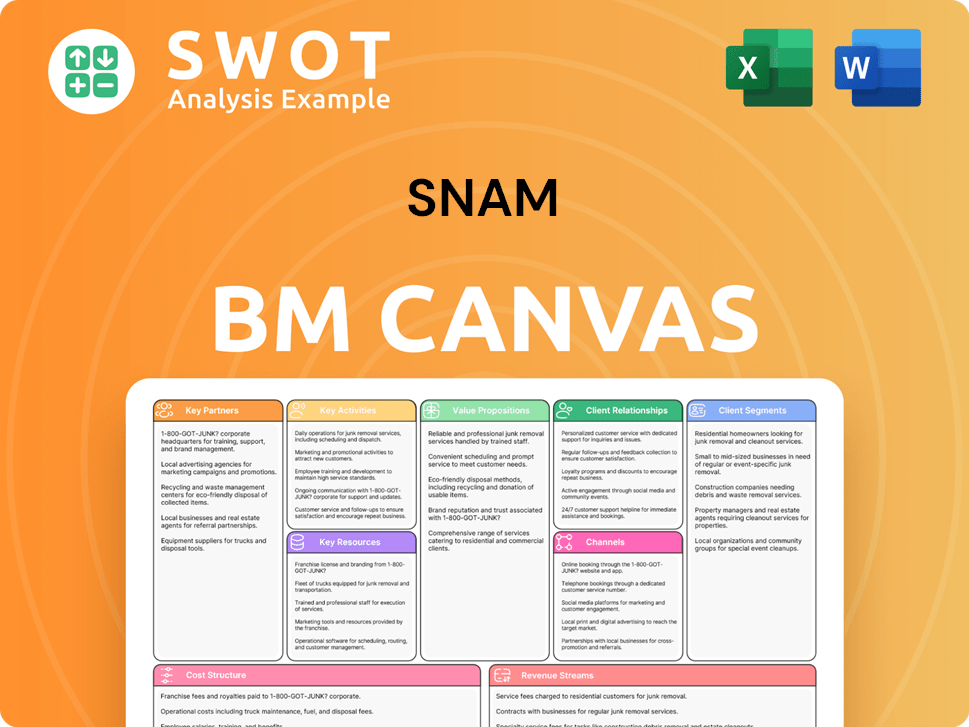

Snam Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Snam?

The Snam company has a rich history, evolving from its roots in Italy's gas infrastructure to a key player in Europe's energy transition. This brief history of Snam highlights its key milestones and strategic shifts over time.

| Year | Key Event |

|---|---|

| 1941 | Founding of Società Nazionale Metanodotti (Snam), marking the company's inception. |

| 1950s-1960s | Rapid expansion of Italy's national gas pipeline network, establishing Snam's core infrastructure. |

| 1970s | Diversification into gas storage activities, enhancing Snam's operational capabilities. |

| 1980s | International expansion and participation in major European gas projects, broadening its reach. |

| 2001 | Snam Rete Gas is listed on the Milan Stock Exchange, signaling a new era of financial transparency. |

| 2009 | Acquisition of Italgas, expanding its distribution network and increasing its market presence. |

| 2012 | Snam becomes fully independent from Eni, solidifying its autonomy. |

| 2016 | Strategic focus on gas infrastructure in Europe, including acquisitions in various European transmission system operators, reinforcing its European footprint. |

| 2020 | Announcement of a strategic plan focusing on energy transition, including hydrogen and biomethane, showing commitment to sustainable energy. |

| 2023 | Snam's 2023-2027 Strategic Plan outlines a €20 billion investment, with 70% dedicated to gas infrastructure and 30% to energy transition, indicating its financial priorities. |

| 2024 | Continued investment in hydrogen-ready pipelines and biomethane plants, aligning with EU decarbonization targets, demonstrating its support for green initiatives. |

| 2025 | Expected completion of key infrastructure projects supporting increased gas flow and energy transition initiatives, contributing to its long-term strategy. |

Snam is investing heavily in hydrogen infrastructure. The company aims to develop a hydrogen backbone across Europe, leveraging its existing gas network. This includes projects for hydrogen blending and transportation. These investments align with the EU's goals for a hydrogen economy.

Snam is also focusing on biomethane production and integration. They are investing in biomethane plants to support renewable energy sources. This supports the company's shift towards a cleaner energy future, aligning with sustainability goals. These initiatives are part of Snam's broader energy transition strategy.

Carbon capture and storage (CCS) technologies are another focus area for Snam. The company is exploring and investing in CCS projects to reduce carbon emissions. These initiatives are part of Snam's commitment to decarbonization efforts. This will help Snam meet European climate targets.

Snam's strategic plan includes a €20 billion investment from 2023-2027. The company is focusing on gas infrastructure and energy transition projects. This investment strategy underscores Snam's commitment to both traditional and new energy sources. The company aims to be a leader in the European energy market.

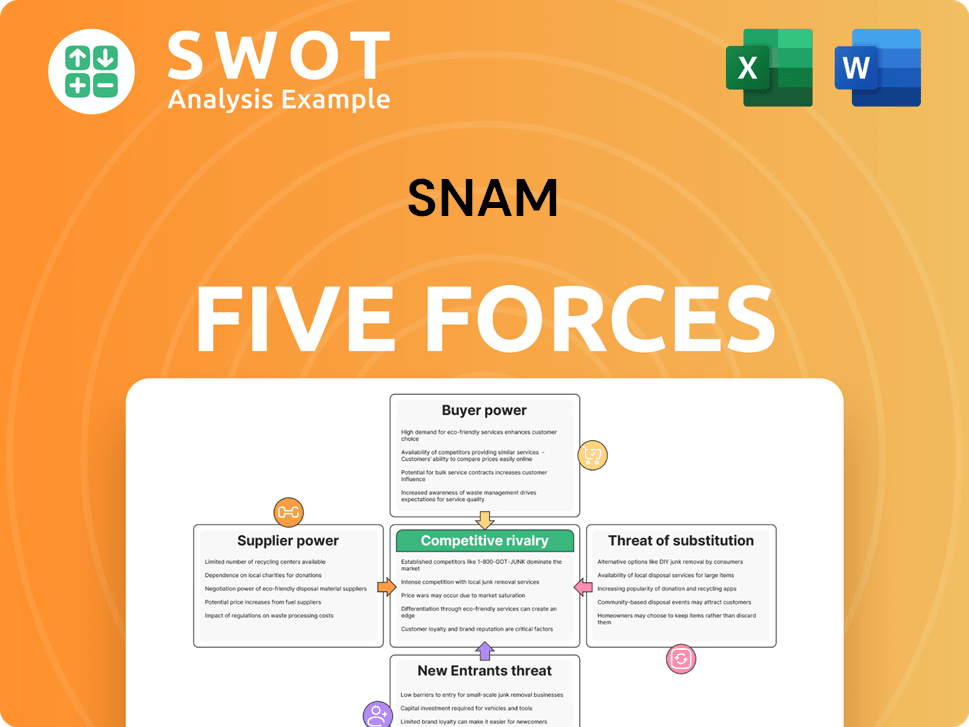

Snam Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Snam Company?

- What is Growth Strategy and Future Prospects of Snam Company?

- How Does Snam Company Work?

- What is Sales and Marketing Strategy of Snam Company?

- What is Brief History of Snam Company?

- Who Owns Snam Company?

- What is Customer Demographics and Target Market of Snam Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.