Snam Bundle

Who are Snam's Customers in the Evolving Energy Landscape?

Understanding the Snam SWOT Analysis is vital for grasping its strategic direction. This Italian energy infrastructure giant, originally focused on natural gas, is now navigating a dynamic energy sector. But who exactly are the customers driving Snam's transformation, and how is the company adapting to meet their evolving needs?

This exploration of customer demographics and target market for the Snam company delves into its shift from a natural gas infrastructure provider to a multi-molecule energy player. We'll dissect its customer segmentation, analyzing its energy market analysis to reveal how Snam identifies and serves its key customer segments. This analysis will provide insights into Snam's customer acquisition strategy and customer retention strategies within the context of the changing energy sector.

Who Are Snam’s Main Customers?

Understanding the Snam company's customer demographics and target market is essential for grasping its business model. Snam operates primarily in the business-to-business (B2B) sector, focusing on entities within the energy sector. Its core customer base comprises companies requiring natural gas transportation, regasification, and storage services.

Snam's primary customer segments include large utility companies, industrial clients, and other energy operators. These customers are located across Italy and other European markets, reflecting Snam's extensive infrastructure network. The company's operations are divided into four key segments: Transportation, Regasification, Storage, and Energy Transition, each serving distinct customer needs within the energy market.

A detailed market analysis reveals that Snam's customer segmentation strategy is closely tied to its infrastructure and service offerings. The company's ability to provide essential services like natural gas transportation and storage makes it a critical player in the European energy landscape. This strategic focus allows Snam to maintain a strong position in the energy sector.

The Transportation segment is a significant revenue driver for Snam. In 2024, this segment accounted for 68.9% of net sales. It serves clients needing to move natural gas through Snam's extensive pipeline network, which exceeded 40,000 km across Italy and abroad in 2024. This segment is crucial for distributing natural gas across Europe.

The Storage segment provides natural gas storage capacity. This segment represented 16.4% of net sales in 2024. Snam holds approximately 17.1% of European gas storage capacity. These storage facilities are vital for managing gas supply and demand fluctuations.

The Regasification segment focuses on converting liquefied natural gas (LNG) back into its gaseous state. This segment accounted for 4.4% of 2024 net sales. Snam's regasification capacity is approximately 13.5 billion cubic meters per year, which is set to rise to around 28 billion cubic meters with new projects. This segment supports LNG imports.

The Energy Transition segment is focused on sustainable mobility and energy efficiency. This segment represented 10.3% of 2024 net sales. It includes clients engaged in the production of biogas and biomethane. This segment highlights Snam's strategic focus on decarbonization and its evolving customer base.

Snam's strategic direction is evolving towards becoming a pan-European multi-molecule infrastructure operator. This involves supporting the energy transition by enabling the transport of green gases like hydrogen and biomethane. The company is investing in hydrogen and carbon capture and storage (CCS) technologies to attract customers in these emerging areas.

- Snam's acquisition of a 24.99% stake in Vier Gas Holding, which indirectly owns Open Grid Europe (OGE), Germany's largest gas transmission network operator, in April 2025, is a key example of this shift.

- Germany is expected to become a significant hydrogen market.

- Snam's customer base is adapting to include clients focused on sustainable energy solutions.

- The company's focus on energy transition is driven by market research and external trends.

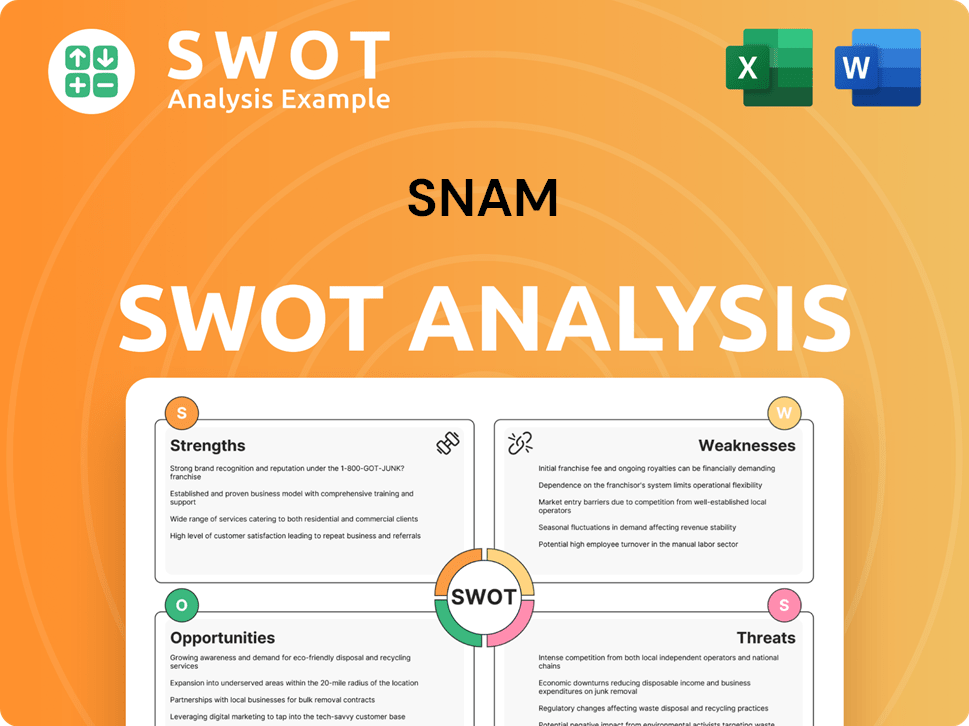

Snam SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Snam’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and for the infrastructure operator, it's no different. The Snam company's customer base, primarily within the energy sector, has specific requirements that drive their choices. These needs are centered around energy security, reliability, efficiency, and the increasing importance of sustainability. Their purchasing decisions are heavily influenced by regulatory frameworks, geopolitical stability, and the shift towards a low-carbon economy.

The target market for Snam is primarily B2B entities. These customers seek dependable and secure energy supply solutions. They rely on the company's extensive infrastructure for the consistent flow and availability of natural gas. Snam's role in providing predictable and efficient transportation, storage, and regasification of natural gas is essential for these customers.

As the energy landscape evolves, so do customer preferences. There's a growing demand for sustainable and decarbonized energy solutions. Snam is actively investing in green gases like biomethane and hydrogen, as well as carbon capture and storage (CCS) technologies to meet these changing needs. This strategic shift reflects the company's commitment to adapting to the evolving demands of its customer base.

A key driver for customers is the need for a reliable and secure energy supply. Snam's extensive pipeline network, exceeding 40,000 km, ensures the consistent flow of natural gas. This infrastructure is crucial for providing predictable and efficient transportation, storage, and regasification services.

Customers are increasingly prioritizing sustainable energy solutions. Snam addresses this by investing in green gases like biomethane and hydrogen. The company is also focusing on carbon capture and storage (CCS) technologies to meet evolving customer demands.

Snam's strategic plan through 2029 includes a significant investment of €12.4 billion, with a strong emphasis on sustainability and innovation. This reflects its commitment to meeting the evolving needs of its customers. The company is enhancing its LNG capacity, which increased from 6 BCM to 19 BCM in 2024.

Snam tailors its offerings and strategic initiatives to these evolving needs. The 'Transition Plan Roadmap,' updated in May 2025, outlines objectives and actions to shift towards a low-carbon economy. This demonstrates how feedback and market trends influence its product development and service offerings.

The company's dual-track innovation strategy, investing in both proven and explorative innovation, further illustrates its adaptation to customer demands for more efficient and environmentally friendly solutions. This includes advanced digitalization, AI, and cutting-edge technologies for decarbonized molecules.

Snam's engagement in projects like the 'Adriatic Backbone' aims to strengthen national infrastructure and facilitate the transport of new molecules. This directly responds to the evolving energy requirements of its customers, ensuring a robust and adaptable energy network.

Snam's ability to understand and respond to these customer needs is crucial for its continued success. By focusing on reliability, sustainability, and innovation, the company can maintain its position as a leader in the energy sector. For more detailed insights into Snam's operations and strategic direction, you can refer to this article about Snam's business model.

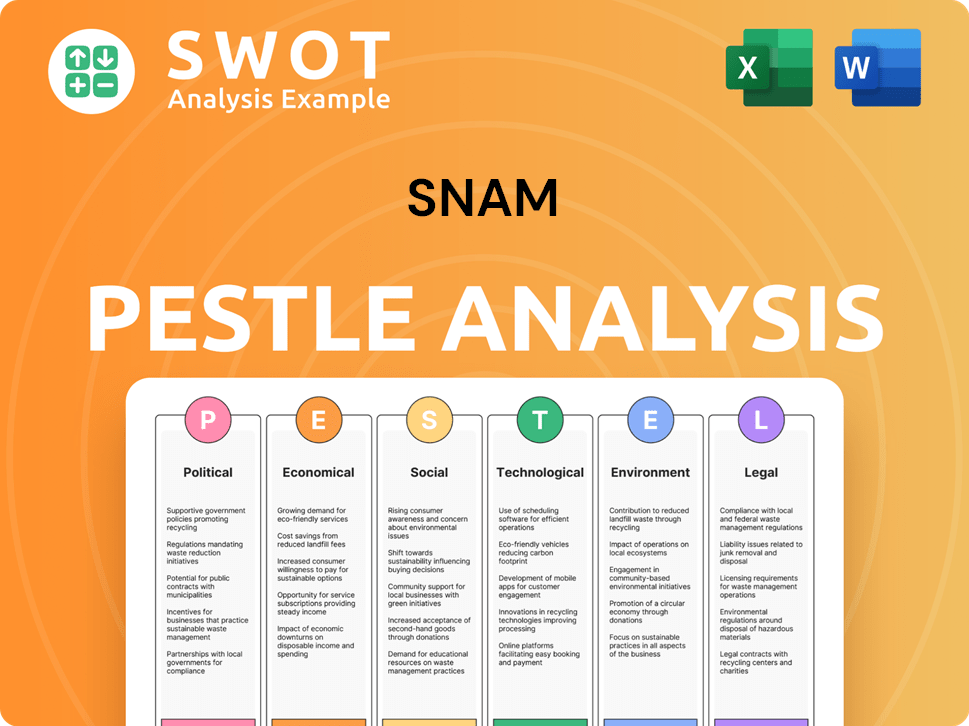

Snam PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Snam operate?

The geographical market presence of the Snam company is primarily concentrated in Italy. This is where it operates nearly all of the nation's natural gas transportation infrastructure. The company's headquarters are located in San Donato Milanese, Italy, reinforcing its commitment to the Italian market. As of December 31, 2023, Snam's Italian network included approximately 32,862 km of gas pipelines.

Beyond Italy, Snam has a growing international footprint. This expansion is primarily through associated companies and strategic partnerships. These ventures are strategically positioned across key European energy corridors. This approach supports Snam's goal of becoming a pan-European multi-molecule infrastructure player.

Snam's approach to its target market involves strategic investments and partnerships. These are designed to strengthen its position in the energy sector. This includes significant stakes in various energy infrastructure companies across Europe and beyond. To learn more about the company's strategic direction, you can read about the Growth Strategy of Snam.

Snam holds stakes in several international energy infrastructure companies. These include Interconnector UK (23.68%), Teréga (40.5%), TAG (84.47%), and TAP (20%). These investments are part of Snam's strategy to expand its geographical reach and influence within the energy market. These partnerships are key to diversifying its offerings and market presence.

In April 2025, Snam signed a binding agreement to acquire a 24.99% stake in Vier Gas Holding. Vier Gas Holding indirectly owns Open Grid Europe (OGE). OGE is Germany's largest gas transmission network operator. This move is consistent with Snam's vision to become a pan-European multi-molecule infrastructure player.

Snam's investments extend beyond Europe. The company has stakes in ADNOC Gas Pipelines (49%) in the UAE and East Mediterranean Gas Company (EMG) with 25%. These investments are part of Snam's strategy to expand its geographical reach and influence within the energy market. This includes a 49.9% stake in subsidiaries operating TTPC and TMPC gas pipelines connecting Algeria to Italy.

Snam is also actively involved in projects supporting hydrogen and biomethane development. These efforts demonstrate its commitment to localized approaches to energy transition. This includes expanding its stake in Adriatic LNG to 30% in December 2024. These projects are crucial for diversifying gas supplies and enhancing Italy's regasification capacity.

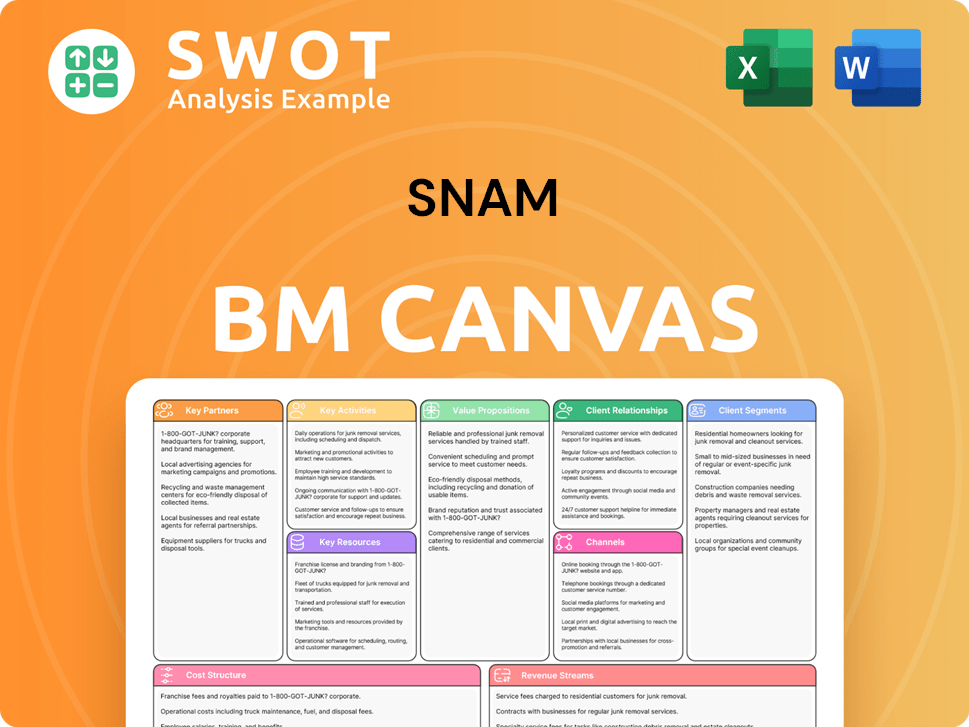

Snam Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Snam Win & Keep Customers?

The customer acquisition and retention strategies of the Snam company are centered on its role as a key energy infrastructure operator. This means a focus on sustained, long-term relationships with business-to-business (B2B) clients. Snam's approach differs from typical business-to-consumer (B2C) marketing because of its regulated nature and the essential services it provides.

A primary focus for acquiring customers involves strategic investments and partnerships. These initiatives expand Snam's network and service offerings, attracting new clients that require gas transportation, storage, and regasification services. The company's strategies are built on building a pan-European multi-molecule infrastructure. This approach inherently broadens its potential customer reach.

Retention strategies at Snam are centered around high service reliability, operational excellence, and adapting to the evolving energy landscape. The company's commitment to strengthening energy security and accelerating the sustainable transition towards Net Zero for its clients is a core retention driver. Snam's focus on innovation, sustainability, and strong stakeholder relationships further supports customer retention.

Snam utilizes strategic investments to expand its network and service offerings. For example, the acquisition of a 24.99% stake in Vier Gas Holding (OGE) in April 2025 enabled Snam to enter the German market, and increasing its stake in Adriatic LNG to 30% in December 2024 enhanced Italy's regasification capacity. These moves are aimed at building a pan-European multi-molecule infrastructure, thereby expanding its potential customer reach.

Snam focuses on ensuring high service reliability and operational excellence. This includes significant investments in infrastructure, with approximately €2.9 billion invested in 2024, driven by projects like the Ravenna LNG terminal and the Adriatic Backbone. These investments directly contribute to enhancing infrastructure and operational efficiency, which helps retain existing customers.

Sustainability plays a key role in Snam's retention strategies. The 'Transition Plan Roadmap,' updated in May 2025, outlines the path to achieving Net Zero by 2050, demonstrating a long-term commitment to decarbonization. This is increasingly important for its clients' sustainability goals. Snam’s strong ESG ratings and recognition as a Sustainable Issuer of the Year by IFR in 2024 further support these efforts.

Snam leverages innovation and advanced technologies for operational excellence. Investments in digitalization, AI, and cutting-edge technologies support more efficient and reliable services, directly impacting customer satisfaction and loyalty. These advancements are critical for adapting to the evolving energy landscape and meeting the needs of its customers.

Understanding Snam's customer base is crucial for effective strategy. The company's primary customers are other B2B entities within the energy sector. The primary customer segments for Snam include:

- Gas Transmission Companies: Companies that transport natural gas.

- Distribution Companies: Companies that distribute gas to end-users.

- Industrial Consumers: Large industrial facilities that consume significant amounts of gas.

- Power Generation Companies: Companies that use gas for electricity generation.

- LNG Importers: Companies involved in importing Liquefied Natural Gas.

Snam's customer acquisition and retention strategies are critical components of its overall Growth Strategy of Snam. These strategies are designed to ensure the company's long-term success in the evolving energy market.

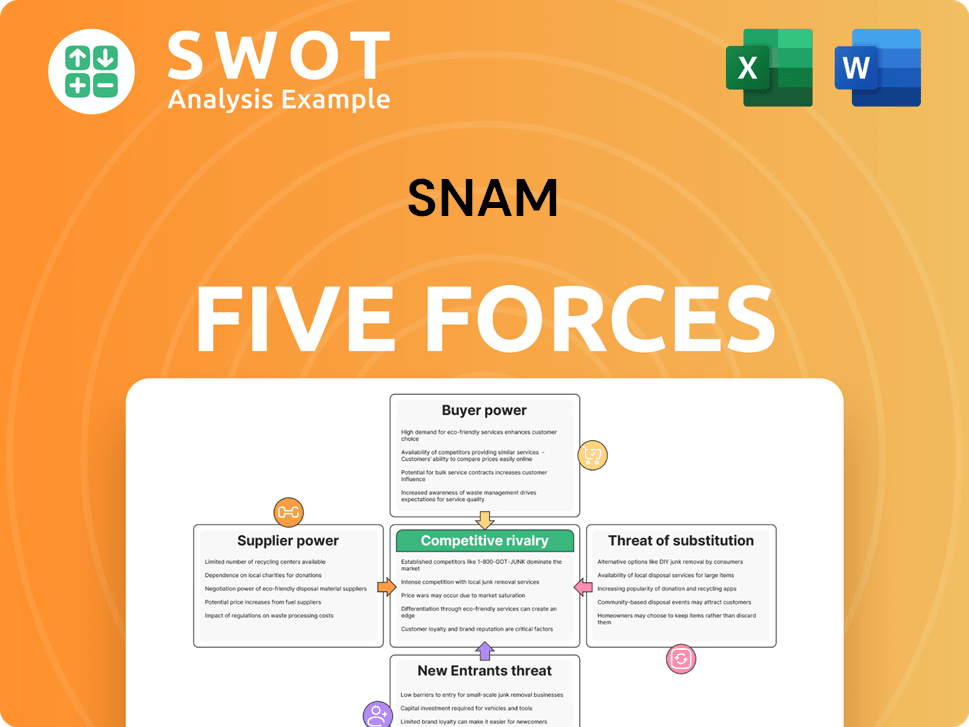

Snam Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Snam Company?

- What is Competitive Landscape of Snam Company?

- What is Growth Strategy and Future Prospects of Snam Company?

- How Does Snam Company Work?

- What is Sales and Marketing Strategy of Snam Company?

- What is Brief History of Snam Company?

- Who Owns Snam Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.