Snam Bundle

How is Snam Powering Europe's Energy Future?

As a leading Italian energy company, Snam is at the forefront of Europe's energy infrastructure, playing a vital role in the transportation, regasification, and storage of natural gas. In 2024, Snam's impressive financial results, fueled by record investments, underscore its commitment to strengthening energy security and accelerating the sustainable transition. But how exactly does this Snam SWOT Analysis shape its strategic direction?

Understanding Snam operations is key to grasping its impact on the Italian energy market and beyond. The company's strategic vision, encompassing gas, hydrogen, and CCS networks, positions it as a pivotal player in the evolving energy landscape. With a significant share of European gas storage capacity and ambitious international projects, Snam's commitment to energy transmission and sustainable initiatives makes it a compelling case study for investors and industry observers alike.

What Are the Key Operations Driving Snam’s Success?

The core operations of the Snam company center around its extensive natural gas infrastructure, which includes transportation, regasification, and storage services. This infrastructure is vital for ensuring a secure and flexible supply of natural gas to various customer segments. Snam operates a vast network, primarily within Italy, playing a crucial role in the nation's energy landscape.

Snam's value proposition lies in its ability to provide essential energy security and facilitate the energy transition. The company is actively investing in new energy transition businesses such as hydrogen, biomethane, and carbon capture and storage (CCS). This strategic focus positions Snam as a key enabler for Europe's decarbonization goals.

The company’s integrated approach across the gas value chain and its strategic focus on multi-molecule infrastructure are key differentiators. These capabilities translate into tangible benefits for customers, ensuring reliable energy supply and offering solutions for a sustainable energy future. For more insights, consider exploring the Competitors Landscape of Snam.

Snam operates approximately 38,000 kilometers of natural gas pipelines. In Italy, Snam Rete Gas manages a 32,000-kilometer pipeline network, serving around 95% of the Italian market. This extensive network is crucial for the transportation of natural gas across the country.

Snam manages 12 storage sites in Central and Northern Italy, holding 17.1% of European gas storage capacity. The commissioning of the FSRU Ravenna, a floating storage and regasification unit in May 2025, enhances Italy's LNG import capacity by 5 billion cubic meters.

Snam is investing heavily in the energy transition. The company plans to invest approximately €3.6 billion in hydrogen backbone projects by 2029. They are also expanding their biomethane platform, with 14 plants winning tariff auctions.

Snam ensures reliable energy supply and offers solutions for a sustainable energy future. The company's commitment to renewable energy and decarbonization goals positions it as a key player in the European energy market. Snam’s operations are unique due to its integrated approach.

Snam's operations are characterized by a focus on gas infrastructure and a strategic shift towards renewable energy sources. This dual approach ensures both current energy security and future sustainability.

- 38,000 km: Approximate length of Snam's natural gas pipeline network.

- 17.1%: Percentage of European gas storage capacity held by Snam.

- €3.6 billion: Planned investment in hydrogen backbone projects by 2029.

- 5 billion cubic meters: Increase in Italy's LNG import capacity due to the FSRU Ravenna.

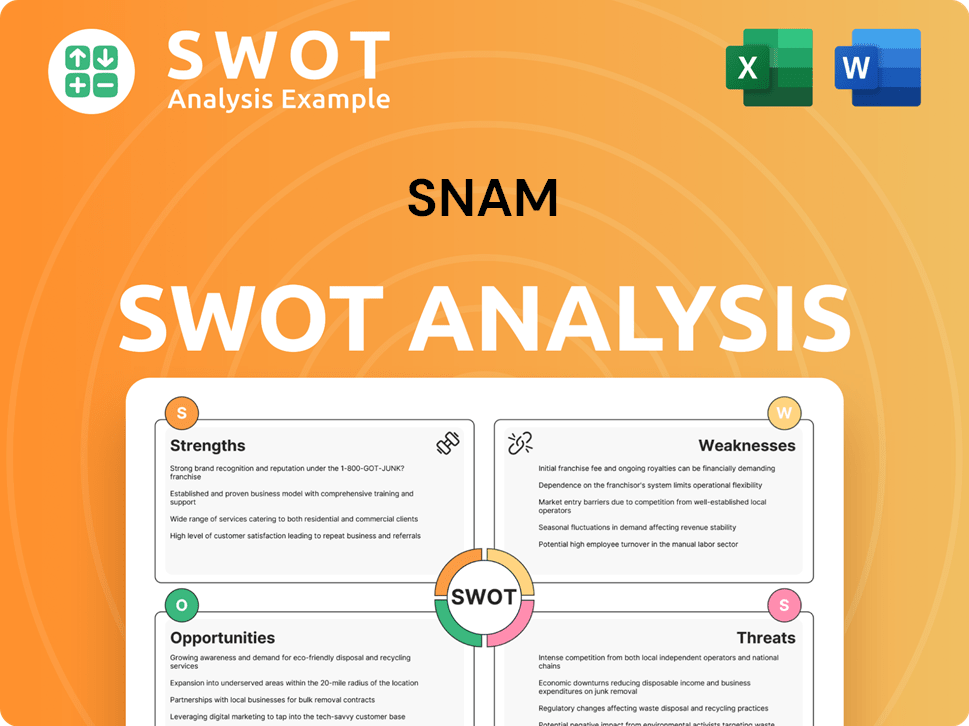

Snam SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Snam Make Money?

The Snam company, a key player in the Italian energy market, primarily generates revenue through its regulated gas infrastructure operations. These include the transportation, regasification, and storage of natural gas. This structure ensures a stable income stream, crucial for the company's financial health and investment in future projects.

In 2024, the Snam operations saw total revenues reach €3.568 billion. While overall revenues decreased slightly, the regulated segment experienced significant growth, driven by factors like the Weighted Average Cost of Capital (WACC) uplift and the expansion of the Regulated Asset Base (RAB). This growth highlights the importance of the gas infrastructure business to the company's financial performance.

For the first quarter of 2025, Snam reported total revenues of €970 million, an 8.3% increase compared to the first quarter of 2024, with regulated gas infrastructure revenues continuing to drive growth. This ongoing expansion is supported by strategic investments and a focus on energy transition initiatives, demonstrating the company's adaptability and forward-thinking approach.

Snam's monetization strategies are centered on its regulated activities, ensuring predictable cash flows. The company is also expanding into energy transition businesses, although revenues from these segments saw a decline in 2024. Snam is investing heavily in new areas like biomethane and hydrogen, aiming for a 'multi-molecule set-up'.

- The strategic plan for 2025-2029 allocates €1.5 billion for energy transition businesses, alongside €10.9 billion for transport, storage, and LNG infrastructure.

- Snam plans to monetize these ventures through various means, including biomethane production platform monetization and seeking a favorable regulatory framework for hydrogen projects.

- Asset rotation is also a key strategy, as demonstrated by the €234 million sale of its indirect stake in ADNOC Gas Pipelines in March 2025, generating a capital gain of €120 million.

- To learn more about their growth strategies, you can read about the Growth Strategy of Snam.

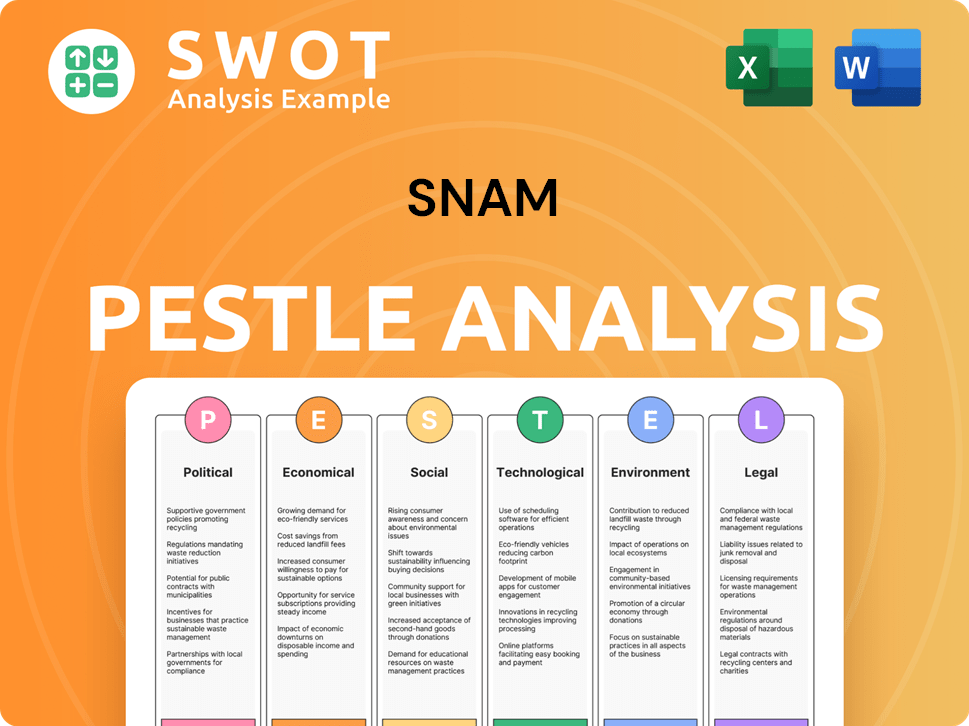

Snam PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Snam’s Business Model?

The Snam company, a significant player in the European energy landscape, has strategically positioned itself through key milestones and strategic maneuvers. The company's operations are focused on gas infrastructure, playing a crucial role in energy transmission and storage. Recent developments underscore its commitment to enhancing Italy's energy security and advancing its role in the energy transition.

A pivotal move was the approval of its 2025-2029 Strategic Plan, which outlines substantial investments aimed at modernizing and expanding its infrastructure. This plan includes a significant allocation towards transport, storage, and LNG infrastructure, alongside investments in energy transition projects. These strategic investments are designed to strengthen its position in the market and support the shift towards a more sustainable energy future.

In 2024, Snam's total investments saw a 31% increase compared to the previous year, reaching approximately €2.9 billion. This surge reflects the company's dedication to executing its strategic plan and adapting to the evolving energy landscape. Its commitment to innovation and sustainability further enhances its competitive edge.

Snam completed the acquisition of Edison Stoccaggio in March 2025, boosting its energy storage capabilities. The commissioning of the FSRU Ravenna floating storage and regasification unit, set to begin commercial operations in May 2025, is another major achievement. This terminal is expected to increase Italy's LNG import capacity.

The company signed a binding agreement in April 2025 to acquire a 24.99% stake in Vier Gas Holding, which owns Open Grid Europe (OGE). This move aligns with Snam's goal to become a pan-European multi-molecule infrastructure operator. Snam is also focused on decarbonization projects and sustainable finance.

Snam operates one of Europe's largest gas transmission networks and holds significant storage and regasification capacities. Its dual-track innovation strategy enhances operational excellence and drives decarbonized energy solutions. The company's commitment to hydrogen-ready networks and CCS projects further strengthens its market position.

Despite challenges, Snam maintained strong financial results in 2024, with adjusted EBITDA growing by 13.9% and adjusted net profit by 10.4%. In Q1 2025, 52% of its investments supported Sustainable Development Goals, and 28% aligned with EU Taxonomy standards. For more insights, check out the Marketing Strategy of Snam.

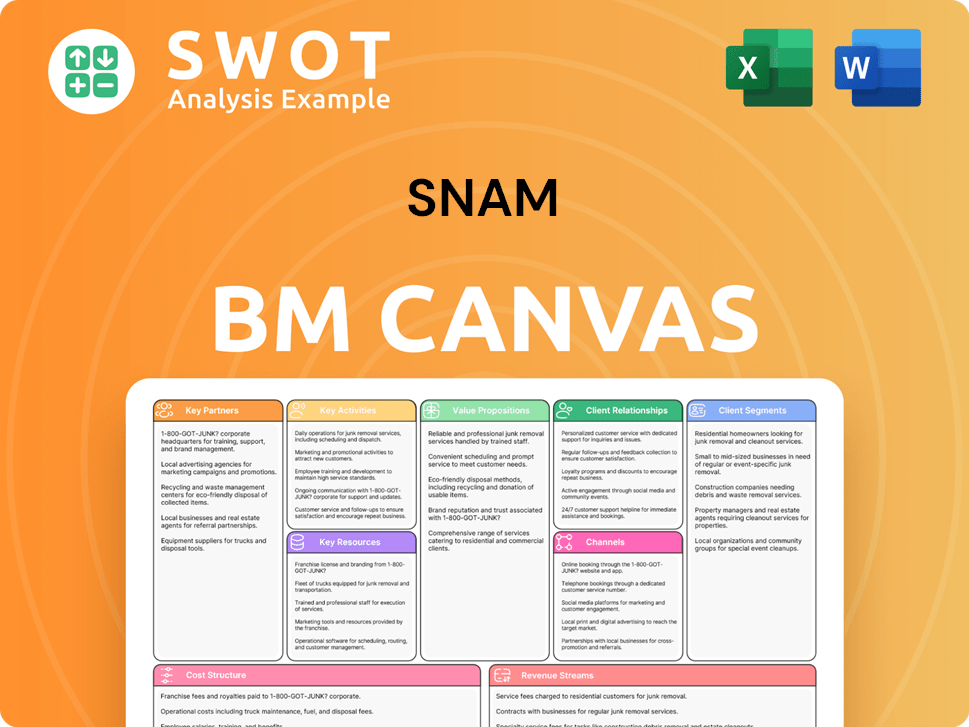

Snam Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Snam Positioning Itself for Continued Success?

The Snam company holds a leading position in the European energy infrastructure sector. It is a key player in natural gas transportation, regasification, and storage. Snam operations are crucial for ensuring energy security across the continent.

The Italian energy company faces various risks, including regulatory and legislative challenges. Macroeconomic and geopolitical factors also pose significant hurdles. Despite these challenges, Snam's future outlook is shaped by ambitious strategic plans and a focus on energy transition.

Snam operates approximately 38,000 kilometers of pipelines. It has a significant presence in European gas storage, holding 17.1% of the total capacity. The company's strategic acquisitions, like the stake in Germany's Open Grid Europe (OGE), strengthen its pan-European reach.

Regulatory decisions by ARERA and other national bodies can influence Snam's financial stability. Italy's complex regulatory framework and geopolitical instability are key risks. Gas consumption in Italy decreased by 19% between 2021 and 2024, affecting the company's operations.

Snam's 2025-2029 Strategic Plan includes €12.4 billion in investments, with a focus on energy transition. The company aims to become a 'multi-molecule' infrastructure operator. Snam projects adjusted EBITDA to reach €2.85 billion and adjusted net profit to be €1.35 billion in 2025.

Snam is committed to sustainability, targeting 90% sustainable financing by 2029. The company's focus on decarbonization and strategic initiatives positions it well. Regulatory clarity for hydrogen projects and geopolitical stability are key for the future.

Snam's role in the energy market is significant, with a focus on gas infrastructure and energy transmission. It is essential to understand Snam's target market to appreciate its strategic positioning. The company's financial performance and sustainability initiatives are crucial for long-term success.

- Snam's pipeline network extends across Europe, ensuring efficient gas transportation.

- The company actively invests in storage facilities to maintain energy security.

- Snam is committed to renewable energy sources and projects.

- The regulatory environment and geopolitical factors significantly impact Snam's operations.

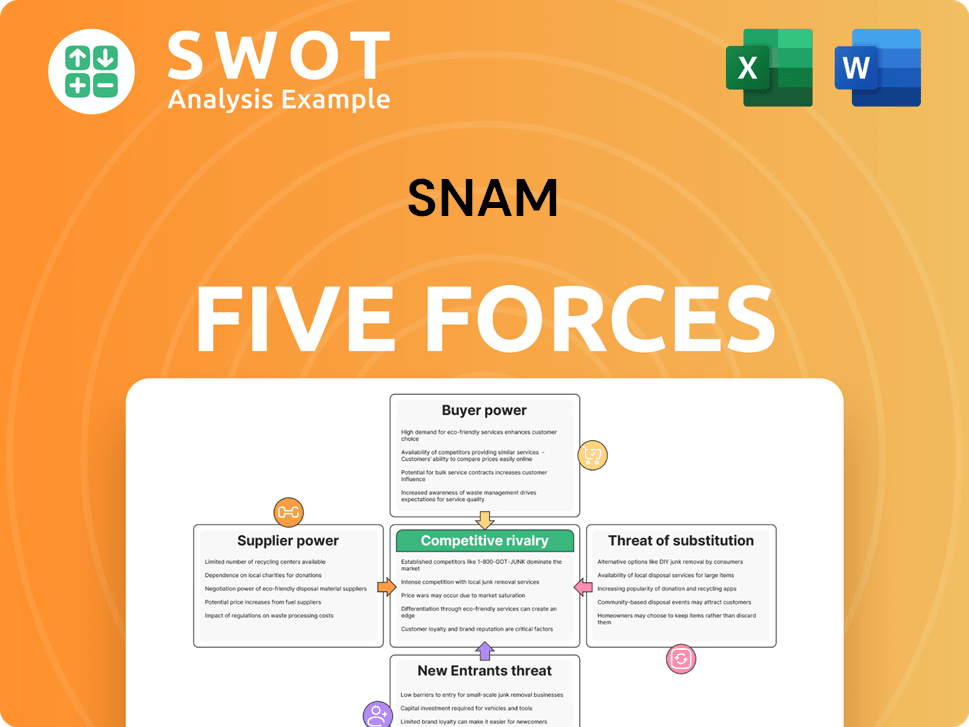

Snam Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Snam Company?

- What is Competitive Landscape of Snam Company?

- What is Growth Strategy and Future Prospects of Snam Company?

- What is Sales and Marketing Strategy of Snam Company?

- What is Brief History of Snam Company?

- Who Owns Snam Company?

- What is Customer Demographics and Target Market of Snam Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.