Snam Bundle

Can Snam Navigate the Energy Transition and Thrive?

Snam, a cornerstone of Europe's energy infrastructure, is undergoing a significant transformation. From its roots in Italy's natural gas network, Snam is now charting a course towards a decarbonized future. This Snam SWOT Analysis will explore the company's strategic initiatives and ambitious plans for expansion.

This article delves into Snam's Snam growth strategy, examining its expansion into new energy vectors and its commitment to innovation. We'll analyze Snam's future prospects within the evolving Italian energy market and the broader European landscape. Understanding Snam company analysis is crucial for investors and strategists alike, as the company navigates the complexities of the energy transition and aims to maintain its leadership in natural gas transmission and beyond.

How Is Snam Expanding Its Reach?

The Snam growth strategy is centered on expanding its energy infrastructure to support the energy transition. This involves a significant shift from traditional natural gas to renewable gases like biomethane and emerging technologies like hydrogen. This strategic pivot is designed to ensure the company's long-term relevance and sustainability in a changing energy landscape.

A key focus of the Snam future prospects lies in its commitment to investing in innovative technologies. The company is actively developing its infrastructure to accommodate hydrogen, aiming to transport a blend of natural gas and hydrogen, and eventually pure hydrogen. This forward-thinking approach positions Snam to capitalize on the growing demand for cleaner energy sources.

Snam's expansion initiatives are strategically aligned with the evolving demands of the Italian energy market and the broader European energy landscape. By investing in projects that enhance energy security and promote sustainable energy solutions, Snam aims to strengthen its position as a key player in the energy sector.

Snam is actively developing a 'Hydrogen Ready' network, enabling the transport of hydrogen blended with natural gas, and eventually pure hydrogen. The company anticipates that by 2027, 20% of its network will be hydrogen-ready. This initiative is crucial for supporting the adoption of hydrogen as a key component of the energy transition.

Snam is investing in biomethane plants to increase its capacity. The company aims to boost its biomethane capacity to 300 million cubic meters per year by 2027. This expansion aligns with the company's commitment to renewable gases and supports the principles of the circular economy.

Snam is involved in the Adriatic Line project, a new pipeline designed to enhance Italy's gas import capacity from the south. The project is expected to be completed in 2027. This initiative is crucial for diversifying supply routes and increasing energy resilience for Italy and Central Europe.

Snam is exploring new business models related to CO2 capture and storage, reflecting a broader strategic shift towards a multi-energy infrastructure operator. This move highlights Snam's commitment to adapting to decarbonization and embracing innovative solutions.

Snam plans to invest €10.5 billion by 2027, with approximately 60% of this capital expenditure allocated to biomethane and hydrogen infrastructure. This significant investment underscores Snam's commitment to supporting the energy transition and strengthening its position in the energy infrastructure market. For more detailed insights into Snam's strategic direction, consider reading an article about Snam's strategic goals for expansion.

Snam's expansion strategy focuses on diversifying its portfolio and embracing sustainable energy solutions. This involves significant investments in renewable gases, hydrogen infrastructure, and projects that enhance energy security.

- Development of a hydrogen-ready network.

- Expansion of biomethane production capacity.

- Participation in projects like the Adriatic Line to enhance gas import capabilities.

- Exploration of CO2 capture and storage business models.

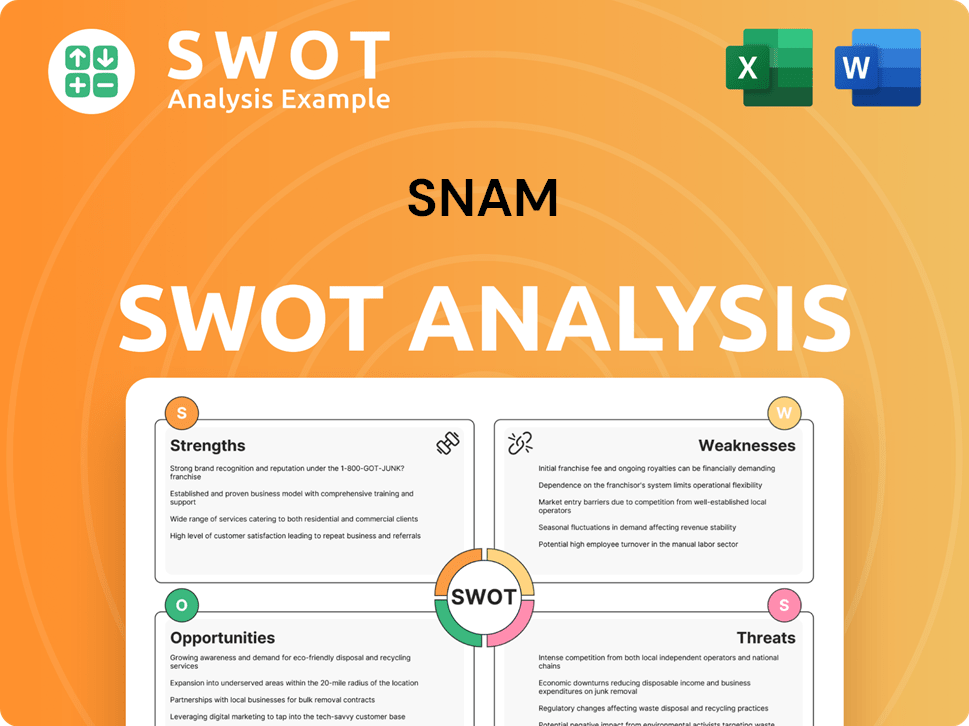

Snam SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Snam Invest in Innovation?

The innovation and technology strategy is crucial for the sustained growth of the company, especially in supporting the energy transition and improving operational efficiency. The company is making substantial investments in research and development (R&D), with a focus on hydrogen technologies, biomethane production, and digital transformation. This approach is a key element of the overall Snam growth strategy.

Snam is actively involved in projects that explore blending hydrogen into its existing gas network. The goal is to have 70% of its pipeline network ready for hydrogen transport by 2030. This includes developing specialized compressors and materials capable of handling hydrogen. Digitalization is another key pillar, using technologies like AI, IoT, and big data analytics to optimize pipeline operations, enhance predictive maintenance, and improve network monitoring.

The company's commitment to innovation is further demonstrated by its participation in various European research projects and partnerships with technology providers and startups. This fosters an ecosystem of innovation to accelerate the development of new energy solutions. Snam's strategic goals for expansion include a strong focus on these technological advancements.

Snam is investing heavily in hydrogen technologies to support the energy transition. This includes research into blending hydrogen into existing gas pipelines and developing infrastructure capable of transporting hydrogen. The aim is to adapt a significant portion of the network for hydrogen use by 2030.

Digitalization is a key focus, with the company leveraging technologies like AI, IoT, and big data. These technologies are used to optimize pipeline operations, improve predictive maintenance, and enhance network monitoring. This improves the efficiency and safety of operations.

Snam is also involved in biomethane production, which is part of its sustainability initiatives. This involves investing in facilities and technologies that can produce and inject biomethane into the gas network. This supports the company's goals for decarbonization.

Significant investments in research and development are a core part of Snam's strategy. These investments support the development of new energy solutions and technologies. This helps the company adapt to the changing energy landscape.

Snam is committed to reducing its own emissions and aims for carbon neutrality by 2040. This involves adopting innovative technologies for methane emission reduction and investing in renewable energy sources. These initiatives are crucial for Snam's sustainability targets.

The company actively participates in various European research projects and collaborates with technology providers and startups. These partnerships foster an ecosystem of innovation. This accelerates the development of new energy solutions.

Snam's technological advancements in gas infrastructure are essential for its future prospects. These advancements are critical for adapting to the energy transition and improving operational efficiency. Snam's role in the European gas market is also influenced by these advancements.

- Smart Sensors and Drones: Deployment of smart sensors and drones for infrastructure inspection, leading to more efficient and safer operations.

- AI for Demand Forecasting: Exploring the use of AI for demand forecasting and optimizing gas flows, contributing to network stability and profitability.

- Hydrogen-Ready Pipelines: Adapting the existing pipeline network to transport hydrogen, with a goal of 70% readiness by 2030.

- Methane Emission Reduction: Implementing innovative technologies to reduce methane emissions from its operations.

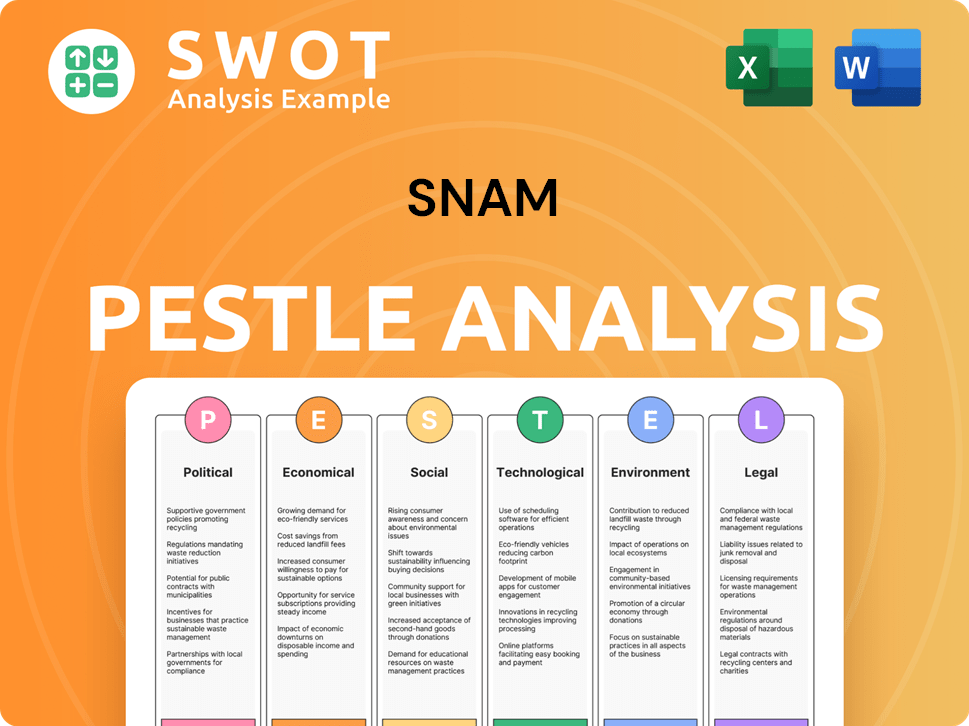

Snam PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Snam’s Growth Forecast?

The financial outlook for Snam is strongly tied to its strategic investments in both traditional energy infrastructure and the energy transition. The company's commitment to these areas is reflected in its ambitious investment plans. This focus is expected to drive significant growth in its regulated asset base (RAB) and overall financial performance. Understanding the Owners & Shareholders of Snam is crucial for grasping the company's financial stability and future direction.

Snam's 2023-2027 Strategic Plan outlines substantial investments, with a total of €10.5 billion allocated over the period. This represents a 15% increase compared to the previous plan, indicating a strong push towards expanding and modernizing its infrastructure. These investments are designed to support the company's growth objectives and enhance its position in the energy market. The company's financial strategies are designed to support its long-term goals.

The company anticipates solid financial growth, projecting an adjusted net income increase of 3-4% annually through 2027. This growth is expected to result in an adjusted net income between €1.2 billion and €1.28 billion by the end of the period. Furthermore, Snam forecasts an average annual adjusted EBITDA growth of 5% over the same timeframe. These financial targets underscore the company's confidence in its strategic initiatives and its ability to deliver value to its stakeholders. These projections are key to understanding the Snam growth strategy.

In the first quarter of 2024, Snam reported an adjusted net profit of €304 million. This represents a 9.4% increase compared to the same period in 2023, demonstrating a strong start to the year. This positive performance is a key indicator of Snam's financial health and its ability to execute its strategic plan effectively.

Snam's adjusted EBITDA for the first quarter of 2024 reached €678 million, marking a 10.6% increase. This growth in EBITDA is a positive sign of the company's operational efficiency and its ability to generate strong cash flows. This performance aligns with the company's overall growth targets.

Snam maintains a solid financial structure, reflected in its credit ratings. The company is rated Baa2 by Moody's, BBB+ by S&P, and A- by Fitch. These ratings indicate a strong level of financial stability and creditworthiness. These ratings are essential for the company's ability to secure funding for its projects.

Snam is committed to a progressive dividend policy, with a projected dividend growth of 6.5% annually until 2027. This commitment to shareholder value underscores the company's financial strength and its confidence in its future prospects. The dividend policy is a key component of Snam's financial strategy.

Snam’s financial performance and outlook are driven by strategic investments and operational efficiency. The company's strong start to 2024, with increased adjusted net profit and EBITDA, supports its growth targets. The company's commitment to a progressive dividend policy further enhances its appeal to investors.

- €10.5 Billion: Total investments planned in the 2023-2027 Strategic Plan.

- 6.5%: Annual growth expected in the regulated asset base (RAB).

- 3-4%: Annual growth projected for adjusted net income through 2027.

- 5%: Average annual adjusted EBITDA growth expected over the same period.

- €304 Million: Adjusted net profit reported in Q1 2024.

- €678 Million: Adjusted EBITDA reported in Q1 2024.

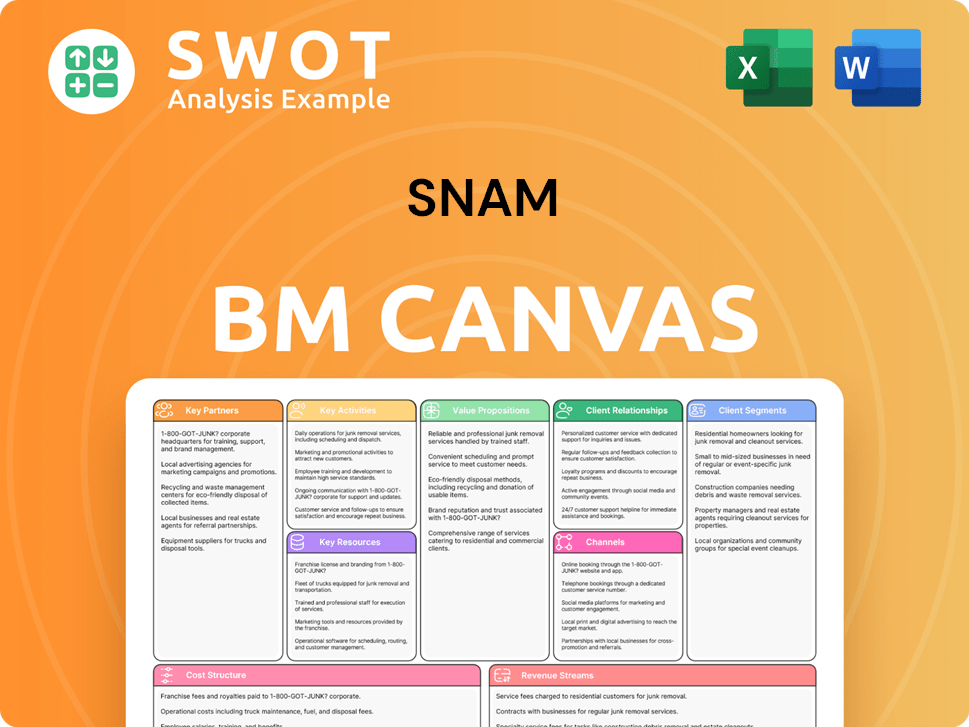

Snam Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Snam’s Growth?

The growth strategy of Snam faces several potential risks and obstacles. These challenges range from regulatory uncertainties to operational hurdles, all of which could impact the company's future prospects. Understanding these risks is crucial for assessing Snam's long-term viability and its ability to execute its strategic goals.

A key area of concern is the evolving regulatory landscape, particularly concerning the energy transition. Changes in policies related to natural gas, hydrogen, and biomethane could affect investment returns. Market competition, especially in emerging sectors like hydrogen and biomethane, also poses a risk to Snam's market share and profitability.

Supply chain vulnerabilities and geopolitical risks add further layers of complexity. Delays and cost increases could arise from supply chain issues, while disruptions to gas supplies or international conflicts could affect gas demand. Operational risks, such as integrating new technologies, also require careful management. For a deeper understanding of Snam's business operations, consider exploring Revenue Streams & Business Model of Snam.

Changes in European and national energy policies can significantly impact Snam's investment plans. Stricter emissions targets or delays in hydrogen infrastructure regulations could hinder the company's transition efforts. The regulatory environment's volatility requires Snam to adapt quickly.

Increased competition in the hydrogen and biomethane sectors could affect Snam's market share. New entrants and evolving market dynamics pose challenges to maintaining profitability. Snam must innovate and differentiate to stay competitive.

Dependence on critical components for new energy infrastructure creates supply chain risks. Delays in obtaining necessary materials can lead to project delays and increased costs. Diversifying suppliers and proactive planning are crucial.

Geopolitical events, such as disruptions to gas supplies or international conflicts, can significantly impact gas demand and transit volumes. These events can create uncertainty and affect Snam's operational performance. Monitoring and adapting to global events is essential.

Integrating new technologies, like hydrogen transport and storage, brings technical complexities and safety considerations. Robust risk management frameworks are necessary to address these operational challenges. Continuous monitoring and improvement are key.

Cyber threats to critical infrastructure pose a significant risk. Advanced cybersecurity measures and continuous monitoring are essential to mitigate these threats. Protecting digital assets is vital for maintaining operations.

Snam addresses these risks through a diversified energy portfolio and active engagement with policymakers. The company's strategic storage capacity and diversified supply routes have proven resilient during past energy crises. Continuous investment in advanced risk management and scenario planning tools is also crucial.

In recent financial reports, Snam has demonstrated its ability to navigate market challenges. For example, in 2024, the company reported a stable financial performance despite volatile market conditions, with a focus on investments in energy transition projects. The company's outlook for the future includes a commitment to sustainable growth and shareholder value.

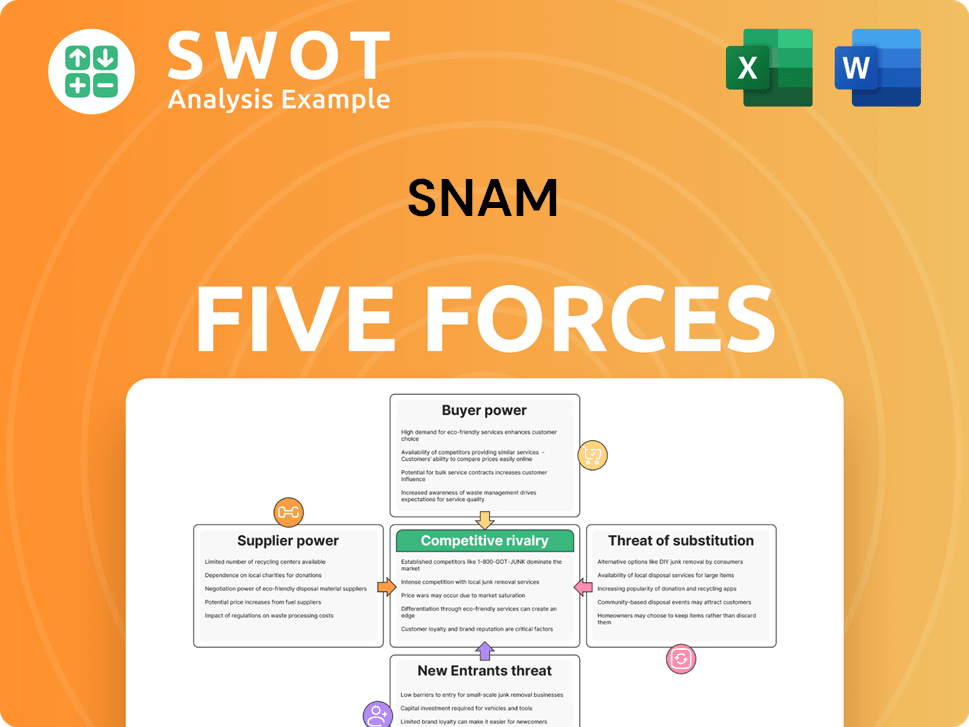

Snam Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Snam Company?

- What is Competitive Landscape of Snam Company?

- How Does Snam Company Work?

- What is Sales and Marketing Strategy of Snam Company?

- What is Brief History of Snam Company?

- Who Owns Snam Company?

- What is Customer Demographics and Target Market of Snam Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.