Snam Bundle

How Does Snam Navigate the Complex European Energy Market?

Snam, a key player in Europe's energy infrastructure, is pivotal for natural gas transportation, regasification, and storage. With the increasing focus on energy security and sustainability, understanding Snam's competitive position is crucial. This analysis dives deep into the Snam SWOT Analysis, its rivals, and its unique strengths within the dynamic European energy market.

This exploration of the Snam competitive landscape provides a comprehensive market analysis, identifying Snam's main competitors and evaluating its strategic positioning. We will examine Snam's financial performance compared to competitors, assessing its infrastructure investments and strategic partnerships. Furthermore, we'll analyze Snam's role in the European energy transition and its response to market challenges, offering insights into its future growth prospects within the gas transmission sector and beyond.

Where Does Snam’ Stand in the Current Market?

Snam's core operations center around natural gas transportation, storage, and regasification, primarily within Italy. The company's value proposition lies in providing essential energy infrastructure services, ensuring the reliable supply of natural gas to consumers and businesses. This is achieved through a vast network of pipelines, storage facilities, and regasification terminals, making Snam a crucial link in the European energy market.

Snam's strategic focus has expanded to embrace the energy transition, investing in new infrastructure for biomethane, hydrogen, and CO2 transport. This diversification positions Snam to remain a key player in the evolving energy landscape. The company's commitment to sustainability and innovation is evident in its investments and partnerships, as detailed in Growth Strategy of Snam.

The Snam competitive landscape is characterized by its strong market position in Italy and its strategic presence across Europe. Snam's extensive infrastructure, including over 33,000 km of gas pipelines in Italy, gives it a significant advantage in gas transmission. While specific market share figures fluctuate, Snam's dominance in the Italian gas infrastructure market is undeniable. This strong position is supported by a favorable regulatory environment and a long-standing operational history.

Snam's extensive network of over 33,000 km of high-pressure gas pipelines in Italy solidifies its dominant position in gas transportation within its home country. The company also manages nine storage sites in Italy with a total capacity of approximately 19 billion cubic meters. This infrastructure is critical for ensuring gas supply and managing fluctuations in demand.

In 2023, Snam reported an adjusted net income of €1.15 billion, with adjusted EBITDA reaching €2.78 billion. These figures demonstrate strong financial health and operational efficiency. The company's financial performance reflects its robust market position and effective management of its infrastructure assets.

Snam's 2024-2028 Strategic Plan outlines €2.7 billion in investments dedicated to the energy transition, further solidifying its commitment to new energy vectors. These investments are focused on biomethane, hydrogen, and CO2 transport infrastructure. This strategic shift positions Snam for long-term growth in a changing energy market.

While Italy is its core market, Snam has a significant international presence through strategic investments and partnerships in countries like Austria (TAG pipeline), France (Teréga), and the UK (Interconnector). This diversification helps mitigate risks and expands its operational footprint across the European energy market.

Snam's competitive advantages include its extensive infrastructure network, strong financial performance, and strategic investments in the energy transition. The company's focus on innovation and sustainability further strengthens its market position. These factors contribute to Snam's resilience and growth potential in the Snam competitive landscape.

- Dominant position in the Italian gas infrastructure market.

- Significant investments in the energy transition, including biomethane, hydrogen, and CO2 transport.

- Strong financial performance, with adjusted net income of €1.15 billion in 2023.

- Strategic partnerships and international presence in key European markets.

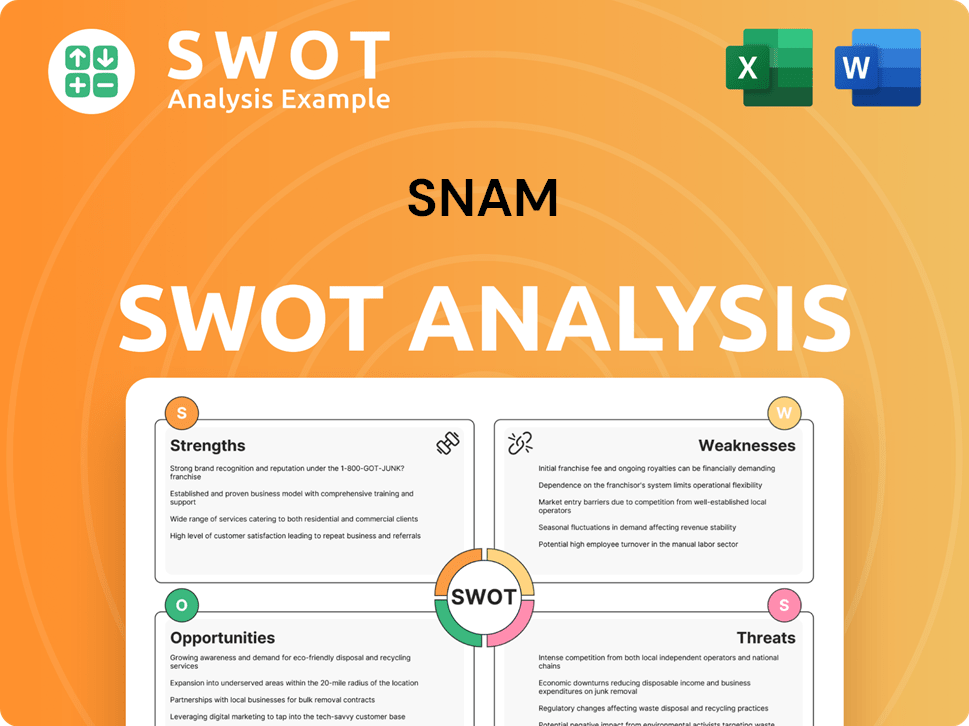

Snam SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Snam?

The Brief History of Snam reveals a competitive landscape shaped by both established and emerging players. The company faces competition from national transmission system operators (TSOs) and storage facility operators across Europe in the gas transportation and storage segments. These competitors challenge through their extensive networks and strategic interconnections, influencing Snam's market analysis.

In the regasification sector, Snam competes with operators of LNG terminals across Europe, vying for LNG import capacity and associated services. The competitive dynamics are also influenced by the evolving supply routes of natural gas, including pipeline imports versus LNG, and the increasing focus on energy security. Understanding Snam's competitive landscape is crucial for assessing its market position.

Emerging players and new technologies are also disrupting the traditional competitive landscape. Companies focused on renewable gas production (biomethane) and hydrogen infrastructure development are becoming increasingly relevant. While not direct competitors in traditional gas infrastructure, they represent future alternatives that could impact the demand for natural gas. Mergers and alliances, such as the consolidation efforts seen in various European energy markets, can also reshape competitive dynamics by creating larger, more integrated energy infrastructure groups.

Key competitors in gas transmission include other national TSOs. These companies operate extensive networks and compete for market share. The competitive intensity varies across different European regions.

Storage facility operators are significant competitors, offering services that complement transmission. These companies compete on capacity, efficiency, and strategic location. The market is influenced by seasonal demand and geopolitical factors.

Operators of LNG terminals compete for LNG import capacity and associated services. The competitive landscape is shaped by global LNG supply dynamics and regional demand. These terminals provide crucial infrastructure for gas supply.

Companies focused on biomethane production pose a future challenge. The growth of renewable gas impacts the demand for traditional natural gas infrastructure. This shift is a key element of the energy transition.

Companies developing hydrogen infrastructure are becoming increasingly relevant. This sector represents a potential future alternative to natural gas. Investment in hydrogen is growing across Europe.

Consolidation efforts reshape competitive dynamics. Larger, integrated energy infrastructure groups emerge through mergers and alliances. This creates new competitive pressures and opportunities.

Snam's competitive advantages include its extensive infrastructure and strategic location in the Italian energy market. Challenges include the need to adapt to the energy transition and the evolving regulatory environment. Understanding these factors is critical for Snam's future growth prospects.

- Extensive Infrastructure: Snam's well-established gas transmission network provides a significant advantage.

- Strategic Location: Italy's position in the European energy market is crucial.

- Energy Transition: Adapting to renewable energy sources is a key challenge.

- Regulatory Environment: Compliance with evolving regulations impacts operations.

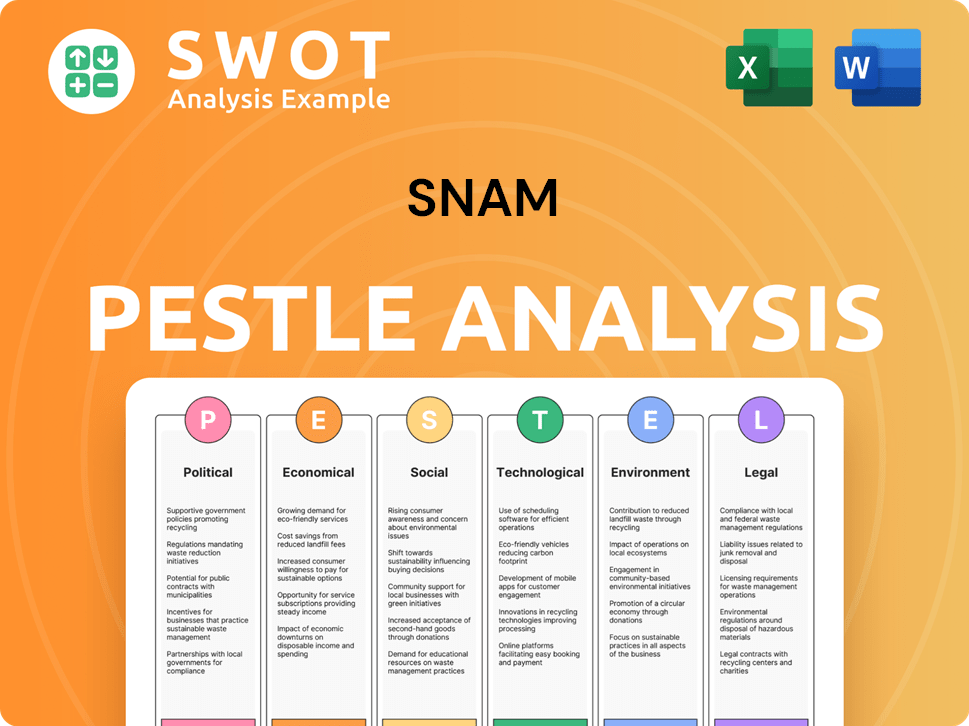

Snam PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Snam a Competitive Edge Over Its Rivals?

Understanding the Snam competitive landscape involves assessing its strengths within the European energy market. The company's strategic moves and infrastructure investments are crucial for its market position. A deep dive into Snam's competitive advantages reveals its core strengths in gas transmission and its evolving role in the energy transition.

Snam's primary competitive edge stems from its vast gas pipeline network in Italy, which is a significant barrier to entry for potential rivals. The company's focus on energy transition technologies and its strategic investments in biomethane, hydrogen-ready pipelines, and CO2 capture and transport projects further enhance its competitive position. This positions Snam favorably for the future.

The company's financial performance and strategic partnerships are also key factors in its competitive landscape. Snam's ability to adapt to market challenges and its technological advancements in gas transmission are crucial for maintaining its position in the European energy market. For a detailed look at how Snam generates revenue, see Revenue Streams & Business Model of Snam.

Snam operates a gas pipeline network in Italy exceeding 33,000 km, representing a substantial barrier to entry. This extensive network ensures reliable gas flow and provides economies of scale in operations. The company's infrastructure investments are a cornerstone of its competitive advantage.

Snam benefits from a stable regulatory framework in Italy, ensuring predictable returns on its regulated asset base. This financial stability is a key advantage compared to less regulated markets. The regulatory environment supports long-term investments and operational certainty.

Snam is actively investing in the green energy sector, including biomethane and hydrogen-ready pipelines. Between 2024 and 2028, Snam plans to invest €2.7 billion in energy transition projects. This proactive approach positions the company well for evolving market demands.

The company's expertise in gas storage and regasification, along with advanced monitoring and control systems, enhances its value proposition. These operational efficiencies contribute to safety and reliability. Snam's brand equity, built over decades, fosters strong stakeholder relationships.

Snam's competitive advantages are underpinned by its extensive infrastructure, a stable regulatory environment, and a strategic focus on the energy transition. These factors contribute to its strong position within the European energy market.

- Extensive gas pipeline network providing a high barrier to entry.

- Stable regulatory framework ensuring predictable returns.

- Strategic investments in the energy transition, including biomethane and hydrogen.

- Operational excellence in gas storage and regasification.

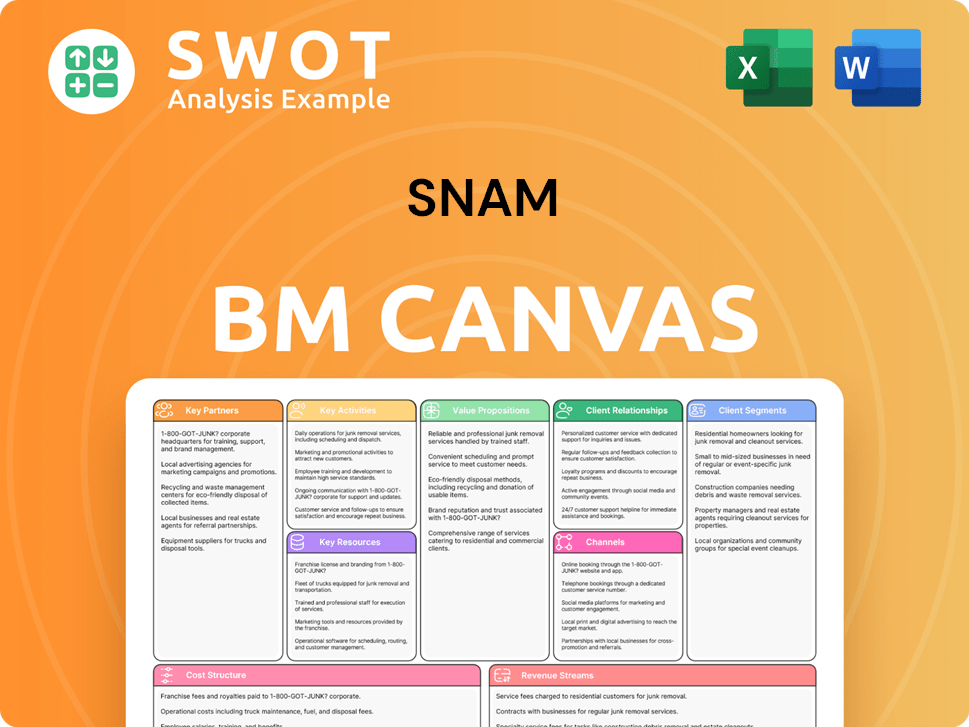

Snam Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Snam’s Competitive Landscape?

The evolving Snam competitive landscape is significantly shaped by the ongoing energy transition, which is driven by climate change concerns and policies aimed at decarbonization. This transition presents both challenges and opportunities for the company. The Snam market analysis indicates that a long-term decline in natural gas demand, favoring renewables, could impact its core business. Regulatory changes, such as stricter emissions targets and incentives for green gases, directly influence investment priorities. Geopolitical shifts and the pursuit of energy independence also drive diversification of supply routes and increased investment in LNG infrastructure.

These trends can pose potential threats to Snam's traditional gas transportation and storage business if the pace of gas demand reduction accelerates beyond current projections. Increased regulation on methane emissions and stricter environmental compliance could also lead to higher operational costs. Additionally, new competitors in the hydrogen and CO2 transport sectors could emerge.

The energy sector is undergoing a significant transformation driven by the need for decarbonization and the shift towards renewable energy sources. This impacts Snam's core business, particularly in gas transmission. The focus is on sustainable solutions, including investments in green gases and hydrogen infrastructure. The European energy market is also influenced by geopolitical factors and the need for energy security.

Key challenges include the potential decline in natural gas demand and the need to adapt to stricter environmental regulations. Increased competition from new entrants in hydrogen and CO2 transport sectors also poses a threat. Snam must navigate these challenges by strategically investing in new technologies and diversifying its portfolio to remain competitive. This requires significant investments.

Snam has significant growth opportunities through investments in biomethane infrastructure and the development of a hydrogen backbone network. The company can leverage its expertise in pipeline development for CCUS infrastructure. Strategic partnerships with renewable energy developers and technology providers are crucial for capitalizing on emerging markets. The company is adapting its assets and developing new capabilities in the green energy space.

Snam's strategic initiatives focus on adapting its existing assets and developing new capabilities in the green energy space. The company plans to invest a total of €10.8 billion from 2024 to 2028. These investments are designed to position Snam as a key player in the European energy transition, with a focus on hydrogen and CCUS. The company is also actively involved in strategic partnerships.

Conversely, the energy transition presents significant growth opportunities. Snam is actively pursuing these by investing in biomethane infrastructure, leveraging its existing gas grid for renewable gas injection. The development of a hydrogen backbone network is another major opportunity, with Snam aiming to repurpose existing pipelines and build new ones for hydrogen transport, positioning itself as a key enabler of the hydrogen economy in Europe. Opportunities also lie in carbon capture, utilization, and storage (CCUS) infrastructure, where Snam's expertise in pipeline development can be leveraged for CO2 transport. Strategic partnerships with renewable energy developers, industrial emitters, and technology providers will be crucial for Snam to capitalize on these emerging markets. For more details on the company's ownership structure, you can refer to the article Owners & Shareholders of Snam.

Snam's competitive position is evolving towards a more diversified energy infrastructure operator, with strategies focused on adapting its existing assets and developing new capabilities in the green energy space. This includes a focus on hydrogen, CCUS, and biomethane. The company aims to achieve its 2024-2028 strategic plan targets, which include €10.8 billion in total investments.

- Investment in hydrogen infrastructure to support the hydrogen economy.

- Development of CCUS projects to reduce carbon emissions.

- Expansion of biomethane infrastructure to support renewable energy sources.

- Strategic partnerships to enhance capabilities and market reach.

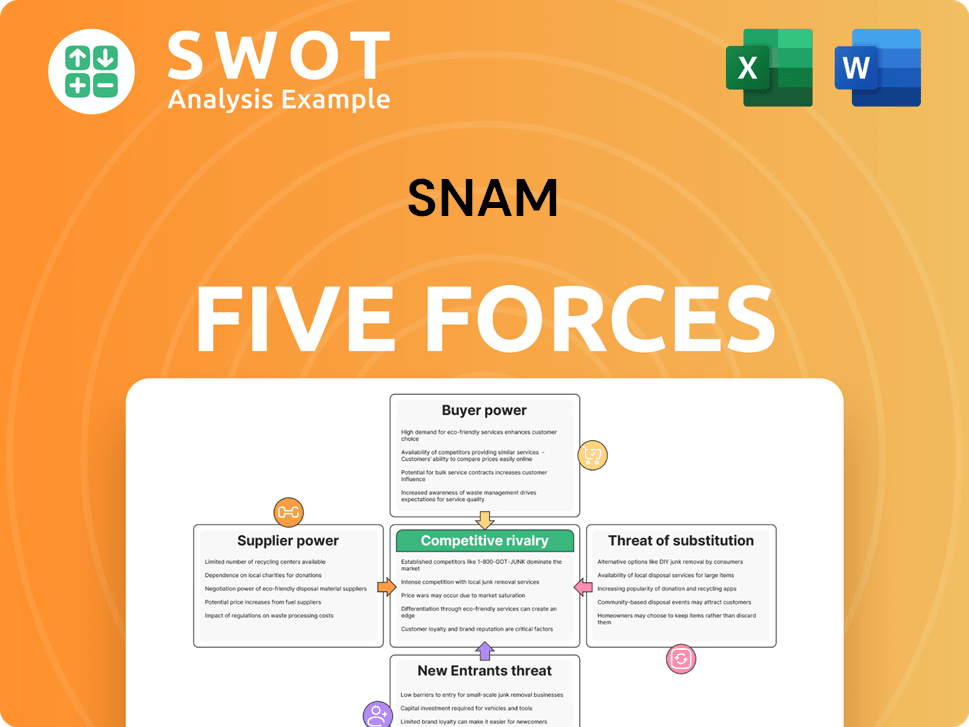

Snam Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Snam Company?

- What is Growth Strategy and Future Prospects of Snam Company?

- How Does Snam Company Work?

- What is Sales and Marketing Strategy of Snam Company?

- What is Brief History of Snam Company?

- Who Owns Snam Company?

- What is Customer Demographics and Target Market of Snam Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.