Stripe Bundle

How Did Stripe Revolutionize Online Payments?

From its humble beginnings, the Stripe SWOT Analysis reveals a fascinating journey of innovation and disruption in the financial technology sector. Founded in 2010, Stripe's mission was to simplify online transactions, a vision that quickly transformed the e-commerce landscape. This brief history of Stripe payment processing explores how a simple idea evolved into a global powerhouse.

Delving into the Stripe company origin story, we'll uncover the key milestones and challenges that shaped Stripe's growth. Understanding who founded Stripe payment platform and their early funding rounds offers insights into the company's strategic decisions. Explore how Stripe's technology and services have impacted e-commerce and its current valuation, along with its global expansion and security features, to understand its enduring influence on the financial world.

What is the Stripe Founding Story?

The Stripe story begins in 2010 with Irish brothers Patrick and John Collison. Their journey into the world of online payments was driven by a clear understanding of the challenges businesses faced. They aimed to create a seamless payment experience, which would revolutionize how businesses handle online transactions.

The Collison brothers saw a gap in the market. Existing payment solutions were complex and slow, hindering the growth of online businesses. Their goal was to simplify the process, making it easy for any business to accept payments. This vision led to the creation of a developer-friendly platform, making it easier for businesses to accept credit card payments.

The Stripe company origin story is a tale of identifying a problem and creating a solution. The brothers' focus on simplicity and developer experience set the stage for rapid growth. This approach helped them quickly gain traction in the evolving e-commerce landscape.

Patrick and John Collison founded Stripe in 2010. Their entrepreneurial background, including Patrick's early success and the sale of Auctomatic, provided a solid foundation. They quickly developed a straightforward API for online payment processing, focusing on a minimum viable product (MVP) approach.

- The early days involved manually setting up merchant accounts.

- Initial funding came from Y Combinator, facilitated by Patrick's existing connections.

- Notable investors, including Peter Thiel and Elon Musk, participated in a $2 million investment round in May 2011.

- The name change from '/dev/payments' to Stripe reflected their goal to simplify online transactions.

The Stripe history includes early funding from Y Combinator, with a $2 million investment in May 2011. This investment round included prominent figures like Peter Thiel and Elon Musk. The company's focus on developers and simplicity was key to its early success. Stripe's initial focus on developer experience and simplicity laid the groundwork for their rapid ascent.

Their mission was to simplify online payments, creating a developer-friendly platform. This focus on simplicity and ease of use was a key factor in their early success. The company's commitment to innovation and user experience has driven its growth. For more insights into the company's values, consider reading about the Mission, Vision & Core Values of Stripe.

Stripe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Stripe?

The early growth of the company, a key part of the Stripe history, was marked by a focus on simplicity and developer experience. After launching publicly in September 2011, the company quickly gained traction, leading to over 100,000 active accounts within two years. By 2015, it was processing billions of dollars in transactions annually, demonstrating its rapid expansion and impact on the payment processing landscape.

A pivotal product launch was Stripe Connect in 2012, designed for platforms and marketplaces. This expansion allowed the company to move beyond simple transactions. The company prioritized making its foundational services, Payments and Connect, the best possible product experience for several years.

Early growth was fueled by strong word-of-mouth referrals among developers. Clear documentation and developer meetups supported this growth. In 2014, the company achieved unicorn status, reaching a valuation of over $1 billion in less than three years.

The company expanded its geographical reach to over 46 countries by June 2023 and 50 countries by February 2025. Major capital raises, including a $600 million round in March 2021 that valued the company at $95 billion, fueled its global expansion. By February 2025, over 748,000 active websites using Stripe were based in the U.S.

The UK had the second-largest number of users by February 2025. This expansion and investment demonstrate the company's commitment to growth. The company's focus on innovation and strategic partnerships has been key to its success.

Stripe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Stripe history?

The Stripe history showcases a journey of rapid growth and significant impact on the fintech industry. From its inception, the Stripe company has consistently introduced innovative solutions, adapting to market demands and overcoming challenges to become a leading force in online payments.

| Year | Milestone |

|---|---|

| 2010 | Stripe founders Patrick and John Collison launch the company, aiming to simplify online payments. |

| 2012 | Stripe introduces Stripe Connect, enabling multi-party payments, expanding its Stripe services. |

| 2018 | Stripe launches Stripe Billing for subscriptions and recurring revenue, and Radar for fraud prevention. |

| 2020 | Stripe acquires Paystack, expanding its presence into the African market. |

| 2021 | Stripe introduces Payment Links, a no-code solution, and Stripe Tax, automating tax calculations. |

| 2022 | Stripe lays off approximately 14% of its workforce due to over-optimism about internet economy growth. |

| 2024 | Stripe acquires Octane and Supaglue, enhancing its product offerings. |

| 2025 | Stripe acquires Bridge for stablecoin payments and Stripe Billing surpasses a $500 million revenue run rate. |

Stripe payment processing has been revolutionized through its developer-first approach, offering a user-friendly API and clear documentation. This focus on ease of integration has set a new industry standard, attracting a wide range of businesses.

Stripe's simple API and comprehensive documentation made it easy for businesses to integrate online payments.

Stripe Connect enabled multi-party payments, facilitating transactions for marketplaces and platforms.

Stripe Billing streamlined subscription management, handling recurring revenue for businesses, now used by over 300,000 companies.

Radar provided advanced fraud prevention tools, enhancing the security of transactions.

Stripe Tax automated sales tax calculations across multiple countries and US states, simplifying tax compliance.

Payment Links offered a no-code solution for accepting payments, making it easy for businesses to get started.

Despite its success, Stripe's journey has included challenges, such as navigating market downturns and the complexities of the financial industry. The company's strategic decisions, including workforce reductions in 2022, reflect its adaptability to changing economic conditions.

Stripe has faced challenges related to market fluctuations and economic uncertainties.

In November 2022, Stripe laid off approximately 14% of its workforce, impacting over 1,100 employees.

The fintech sector is highly competitive, requiring continuous innovation and adaptation.

Navigating the complex regulatory environment of the financial industry is an ongoing challenge.

Keeping pace with rapid technological advancements in AI and machine learning is crucial for maintaining a competitive edge.

Expanding into new markets while ensuring compliance and adapting to local needs presents operational challenges.

Stripe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Stripe?

The Stripe company has a rich history, marked by significant milestones and strategic pivots. Founded in 2010 by Stripe founders Patrick and John Collison, the company quickly gained traction, securing early investment and launching its payment processing platform in 2011. Over the years, Stripe expanded its Stripe services, introduced innovative products like Stripe Connect and Radar, and achieved unicorn status. Key acquisitions and funding rounds fueled its growth, leading to a $91.5 billion valuation in February 2025. The company's journey reflects its commitment to revolutionizing online payments and building the financial infrastructure of the internet.

| Year | Key Event |

|---|---|

| 2010 | Founded by Patrick and John Collison in Palo Alto, California. |

| May 2011 | Received $2 million in seed investment from prominent investors including Peter Thiel and Elon Musk. |

| September 2011 | Launched publicly after a private beta period. |

| 2012 | Introduced Stripe Connect, a multi-party payments solution. |

| March 2013 | Made its first acquisition, Kickoff, a chat and task-management application. |

| 2014 | Achieved unicorn status, valued over $1 billion. |

| April 2018 | Released Radar, its anti-fraud tools, and expanded services to include a billing product. |

| June 2019 | Stripe Terminal, its point-of-sale service, became available to US users. |

| October 2019 | Launched Stripe Capital, a merchant cash-advance scheme. |

| October 2020 | Acquired Paystack, a Nigerian payment processor. |

| March 2021 | Raised $600 million, reaching a valuation of $95 billion. |

| May 2021 | Introduced Payment Links, a no-code product. |

| June 2021 | Launched Stripe Tax and Stripe Identity. |

| November 2022 | Laid off approximately 14% of its workforce. |

| March 2023 | Raised $7 billion in Series I funding at a $50 billion valuation. |

| April 2024 | Employee stock-sale deal at a $65 billion valuation. |

| January 2024 | Acquired Supaglue. |

| March 2024 | Acquired Octane. |

| July 2024 | Acquired Lemon Squeezy. |

| February 2025 | Achieved a $91.5 billion valuation through a tender offer. |

Stripe anticipates continued growth and profitability, with plans to reinvest in research and development. The company is expanding into AI-powered payment solutions, and digital asset payments, serving major AI companies. Its Revenue and Finance Automation Suite has surpassed a $500 million revenue run rate.

Stripe plans to expand its workforce by 17% by 2025. Key strategies include market expansion, leveraging emerging technologies like stablecoins and AI, and diversifying product offerings. The company is focused on embedded finance and in-person payments.

Stripe's future trajectory is firmly rooted in its founding vision of building and modernizing the financial infrastructure for the internet. Analysts predict a significant IPO if the company goes public. Stripe aims to increase the GDP of the internet.

The company was profitable in 2024 and anticipates sustained profitability in 2025 and beyond. This financial stability will enable substantial investment in innovation and expansion. Stripe's robust financial health supports its long-term growth prospects.

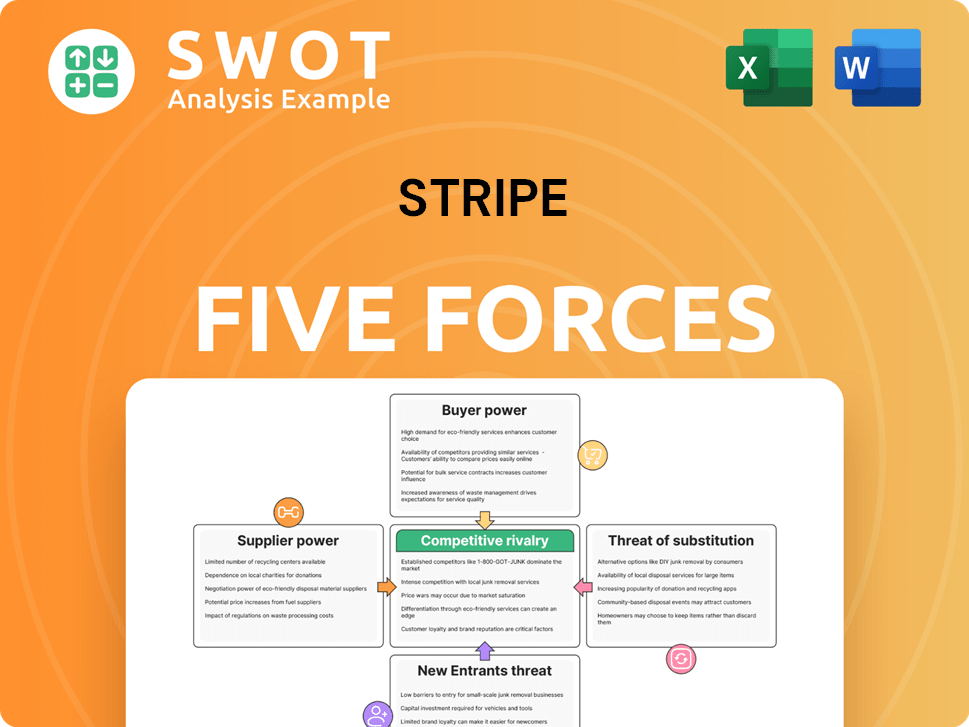

Stripe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Stripe Company?

- What is Growth Strategy and Future Prospects of Stripe Company?

- How Does Stripe Company Work?

- What is Sales and Marketing Strategy of Stripe Company?

- What is Brief History of Stripe Company?

- Who Owns Stripe Company?

- What is Customer Demographics and Target Market of Stripe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.