Stripe Bundle

Can Stripe Continue its Fintech Dominance?

Stripe has revolutionized the Stripe SWOT Analysis payment processing industry, becoming a cornerstone of the digital economy since its 2010 launch. From simplifying online payments for startups to powering giants like Amazon, its impact is undeniable. But what's next for this fintech giant, and how will it navigate the evolving landscape of online payment solutions?

This deep dive into Stripe's Stripe growth strategy and Stripe future prospects explores its remarkable journey from a developer-focused tool to a global financial infrastructure platform. We'll examine the Stripe company analysis, including its impressive market share growth, innovative product offerings, and the strategic partnerships that fuel its expansion plans. Understanding Stripe's competitive advantages and its ability to overcome challenges will be key to predicting its long-term success in the dynamic fintech market.

How Is Stripe Expanding Its Reach?

The Stripe growth strategy is significantly driven by aggressive expansion initiatives. These initiatives encompass both geographical reach and product diversification. A key focus for the company in 2024 and beyond is its continued international expansion, particularly in emerging markets. This approach aims to tap into new customer bases and diversify revenue streams, reducing reliance on mature markets.

Beyond geographical expansion, the company is committed to broadening its product and service portfolio. Strategic partnerships also play a crucial role, with the company continually seeking collaborations to expand its ecosystem and reach new customer segments. Furthermore, mergers and acquisitions remain a potential avenue for growth, allowing the company to quickly acquire new technologies, talent, or market share. The overarching goal of these expansion initiatives is to solidify the company's position as the leading financial infrastructure provider globally, offering a comprehensive and integrated suite of tools that addresses the diverse needs of modern businesses.

The company's expansion into Southeast Asia and Latin America is a prime example of its global strategy. Tailoring offerings to local regulations and payment preferences is crucial for onboarding new businesses in these regions. This targeted approach is designed to capitalize on the rapidly accelerating adoption of digital payments in these emerging markets. The company's global presence is a key factor in its continued growth.

The company is actively expanding its presence in Southeast Asia and Latin America. This strategy aims to tap into new customer bases and diversify revenue streams. The focus is on tailoring offerings to local regulations and payment preferences to onboard new businesses. This strategy reduces reliance on mature markets.

The company is investing in financial services beyond core payment processing. This includes products like Capital, which offers financing to businesses, and Treasury, providing banking-as-a-service functionalities. Enhancements to in-person payment solutions, like Stripe Terminal, cater to businesses with both online and physical presences.

The company continually seeks collaborations with platforms, software providers, and financial institutions. These partnerships expand its ecosystem and reach new customer segments. For example, integrations with e-commerce platforms and accounting software provide seamless experiences for shared customers. This is a key element of the company's strategy.

Mergers and acquisitions are a potential avenue for growth, allowing the company to quickly acquire new technologies, talent, or market share. The acquisition of Paystack in 2020 to expand its footprint in Africa is a notable example. This strategy enhances the company's capabilities.

The company's approach to expansion is multifaceted, combining organic growth with strategic acquisitions and partnerships. The company's focus on innovation and its ability to adapt to the evolving needs of businesses worldwide are critical to its long-term success. Understanding the Competitors Landscape of Stripe provides further context on the competitive dynamics driving these expansion efforts.

The company's expansion strategy includes geographical expansion, product diversification, strategic partnerships, and potential mergers and acquisitions. These initiatives aim to solidify the company's position as a leading financial infrastructure provider. The company's focus is on capturing a larger share of businesses' financial operations.

- Geographical expansion into emerging markets like Southeast Asia and Latin America.

- Product diversification with offerings like Capital and Treasury.

- Strategic partnerships with platforms and financial institutions.

- Potential mergers and acquisitions to acquire new technologies and market share.

Stripe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stripe Invest in Innovation?

The sustained growth of Stripe is intricately linked to its dedication to innovation and a robust technology strategy. This approach involves significant investment in research and development, focusing on enhancing its core payment infrastructure, creating new financial products, and leveraging cutting-edge technologies. A key element of Stripe's strategy is the integration of artificial intelligence (AI) and machine learning (ML), which are used extensively for fraud detection and prevention, optimizing payment routing, and personalizing user experiences.

Stripe's commitment to internal development is reflected in its continuous release of new features and platforms. In 2024, Stripe continued to refine its financial reporting tools and introduced new functionalities for managing recurring revenue and subscriptions, streamlining operations for businesses with subscription-based models. The company also focuses on providing highly customizable APIs and developer tools, empowering businesses to build bespoke payment experiences and integrate Stripe's services seamlessly into their existing systems.

Beyond AI, Stripe explores and integrates other emerging technologies to enhance its offerings. While not explicitly focused on IoT or blockchain for its core payment processing, the company monitors these advancements for potential future applications, particularly in areas like supply chain finance or new payment rails. Stripe's dedication to digital transformation is reflected in its efforts to automate complex financial processes, allowing businesses to focus on their core operations rather than administrative burdens. The company has also highlighted its commitment to building resilient and scalable infrastructure, ensuring high availability and performance for its global user base, a critical factor for businesses relying on its services for their daily operations.

Stripe heavily utilizes AI and ML for fraud detection and prevention. This includes tools like Radar for Fraud Teams, which uses advanced ML algorithms. In 2023, Radar blocked over $6 billion in fraudulent payments, demonstrating the effectiveness of these technologies.

Stripe provides highly customizable APIs and developer tools. This approach allows businesses to build custom payment experiences and integrate Stripe's services seamlessly. This fosters a vibrant ecosystem, driving adoption and innovation.

Stripe focuses on building resilient and scalable infrastructure. This ensures high availability and performance for its global user base. Stripe is PCI DSS Level 1 certified, highlighting its commitment to security and compliance.

Stripe continually rolls out new features and platforms. In 2024, Stripe refined its financial reporting tools and introduced new functionalities for managing recurring revenue and subscriptions. This demonstrates a commitment to ongoing improvement.

Stripe explores and integrates emerging technologies to enhance its offerings. While not explicitly focused on IoT or blockchain, the company monitors these advancements for potential future applications. This includes areas like supply chain finance and new payment rails.

Stripe is dedicated to digital transformation by automating complex financial processes. This allows businesses to focus on their core operations rather than administrative tasks. This commitment enhances efficiency for its users.

Stripe's focus on innovation and technology is crucial for its future prospects in the payment processing industry and the broader fintech market. The company's strategic investments in AI, developer tools, and infrastructure position it well for continued growth. The company's commitment to security and compliance, demonstrated by its PCI DSS Level 1 certification, further underscores its leadership in building a trusted financial infrastructure. Stripe's approach to innovation helps it maintain a competitive edge, as highlighted in an article about Mission, Vision & Core Values of Stripe.

- Stripe's market share growth is driven by its continuous innovation.

- Stripe's global presence expands due to its robust technology infrastructure.

- Stripe's product offerings are constantly updated to meet evolving market needs.

- Stripe's future innovations will likely involve further AI integration and exploration of emerging technologies.

Stripe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Stripe’s Growth Forecast?

The financial outlook for Stripe remains strong, supported by its increasing transaction volumes and expanding product offerings. As a private company, insights into its performance come from funding rounds, analyst estimates, and reported milestones. In early 2024, the company was valued at approximately $65 billion, reflecting investor confidence in its long-term growth. This valuation underscores the company's potential within the Payment processing industry and the broader Fintech market.

Stripe's revenue model is primarily based on transaction fees, supplemented by fees from additional services such as Radar for Fraud Teams, Billing, and Capital. The company is well-positioned to capitalize on the ongoing trend of businesses digitizing their operations, which is expected to drive consistent revenue growth. Furthermore, Stripe is focused on profitability, with reports suggesting it is nearing or has achieved profitability on a free cash flow basis. This focus on financial efficiency is important for sustainable growth and potential future public offerings. For more information on the company's ownership structure, consider reading the article about Owners & Shareholders of Stripe.

Investment levels are consistently high, with significant capital allocated to research and development, international expansion, and strategic hires. Analyst forecasts generally project continued strong double-digit revenue growth for Stripe over the next few years. This growth is driven by the expansion of e-commerce and the increasing adoption of its comprehensive financial tools by businesses of all sizes. The diversification of revenue streams beyond core payment processing, through products like Capital and Treasury, will significantly influence its future financial success and long-term valuation. The company's Stripe growth strategy centers on these key areas.

Stripe's revenue primarily comes from a percentage of each transaction processed. Additional revenue streams include fees from services like Radar, Billing, and Capital. The Stripe's revenue model is designed to scale with the growth of its customers.

The company is focused on achieving profitability, with reports indicating it is nearing or has achieved profitability on a free cash flow basis. This focus is crucial for sustainable long-term growth. This financial discipline is a key aspect of Stripe's financial performance.

Stripe continues to invest heavily in research and development, international expansion, and strategic hires. These investments support its growth ambitions. These investments are part of Stripe's expansion plans.

The company is expected to experience strong double-digit revenue growth in the coming years, driven by e-commerce expansion and the adoption of its financial tools. The Fintech market is a key driver of this growth.

Several key financial metrics highlight Stripe's strong position in the market. These metrics provide insights into the company's performance and future prospects.

- Valuation: Approximately $65 billion in early 2024.

- Payment Processing Volume: Processed over $1 trillion in payments in 2023.

- Revenue Growth: Projected strong double-digit percentage growth in the coming years.

- Profitability: Nearing or has achieved profitability on a free cash flow basis.

Stripe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Stripe’s Growth?

Analyzing the Stripe company analysis, several potential risks and obstacles could influence its future. The intense competition within the payment processing industry, alongside changing regulations, presents significant challenges. Understanding these factors is essential for assessing the long-term viability of Stripe's future prospects.

Stripe's growth strategy faces hurdles like technological disruption and internal resource constraints. The rapid evolution of fintech market, including new payment methods, requires continuous adaptation. Additionally, scaling operations while maintaining service quality and security adds complexity.

Stripe's expansion plans and overall success are also subject to external factors, such as economic downturns or geopolitical tensions. These elements could shape its trajectory and necessitate agile responses from the leadership team.

The payment processing industry is highly competitive, with established players like PayPal and Adyen. New online payment solutions and fintech startups also increase the competitive pressure. Maintaining market share requires continuous innovation and competitive pricing.

The financial services sector is heavily regulated, and changes in data privacy, anti-money laundering (AML), and payment processing rules pose risks. Evolving regulations around cross-border payments demand constant vigilance and adaptation. Compliance costs can be significant.

Rapid technological advancements, including blockchain-based solutions, could disrupt Stripe's revenue model. Adapting quickly to new payment methods and financial infrastructures is crucial. Continuous investment in technology is essential to maintain a competitive edge.

Attracting and retaining top talent in a competitive tech job market can be challenging. Scaling operations globally while maintaining high service and security standards presents operational complexities. These internal constraints could hinder growth.

Increasing geopolitical tensions impacting cross-border trade and economic downturns affecting consumer spending pose risks. These external factors could significantly shape Stripe's future innovations and require agile responses from the company.

Stripe's management addresses these risks through diversification of product offerings and customer base. Robust risk management frameworks are in place to assess and prepare for regulatory changes and cybersecurity threats. Scenario planning helps anticipate market shifts.

Stripe's ability to navigate these challenges will determine its success. The company's focus on innovation and its global presence are key strengths. For example, in 2024, Stripe's valuation was estimated to be around $65 billion, reflecting investor confidence despite the risks.

Stripe's competitive advantages include its developer-friendly platform and broad range of product offerings. However, fierce competition from established players and emerging fintech companies necessitates continuous innovation and strategic partnerships. Stripe's partnerships are critical.

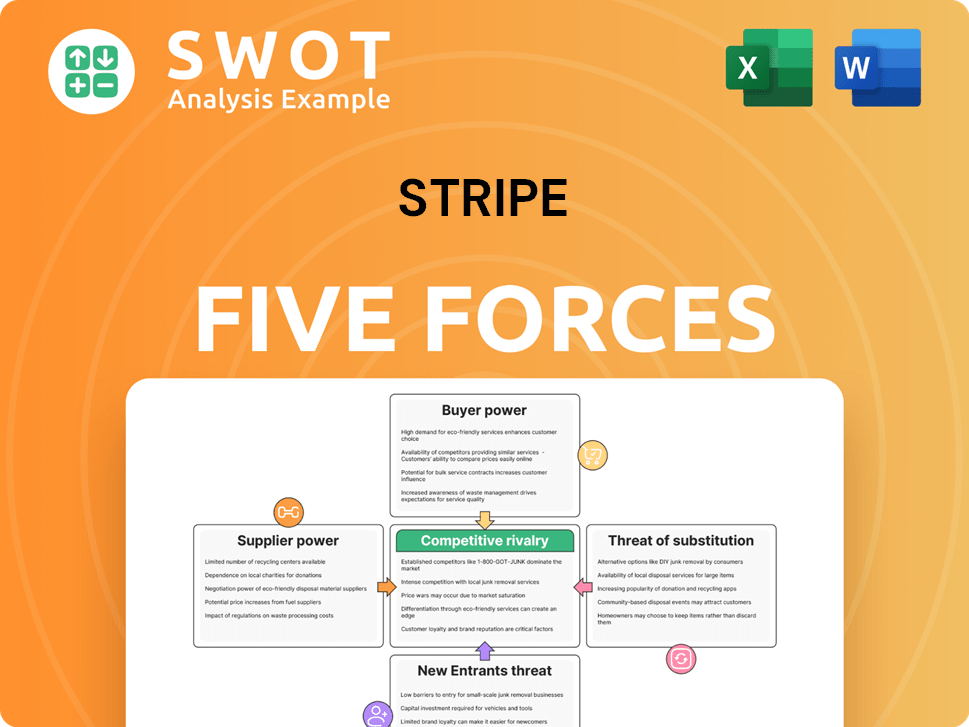

Stripe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stripe Company?

- What is Competitive Landscape of Stripe Company?

- How Does Stripe Company Work?

- What is Sales and Marketing Strategy of Stripe Company?

- What is Brief History of Stripe Company?

- Who Owns Stripe Company?

- What is Customer Demographics and Target Market of Stripe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.