Stripe Bundle

How Does Stripe Revolutionize Online Payments?

In the ever-evolving digital landscape, understanding the mechanics of financial giants like Stripe is paramount. Stripe, a powerhouse in financial infrastructure, processes trillions in payments, impacting businesses globally. This deep dive explores Stripe SWOT Analysis, its operational intricacies, and its significant influence on the future of commerce.

From startups to Fortune 100 companies, businesses rely on Stripe for seamless Stripe payments. This exploration will dissect how Stripe works, examining its diverse Stripe features, revenue models, and strategic advantages. Whether you're curious about Stripe pricing for small businesses or the intricacies of Stripe API documentation, this analysis provides a comprehensive understanding of this fintech innovator and how to accept payments with Stripe.

What Are the Key Operations Driving Stripe’s Success?

Stripe's core operations revolve around providing a comprehensive financial infrastructure platform. This platform simplifies online and in-person commerce for businesses by offering payment processing, fraud prevention, and financial management tools. The company serves a broad customer base, from small businesses to large enterprises, including a significant portion of the Fortune 100.

The value proposition of Stripe centers on its ability to streamline payment processes and offer a developer-friendly experience. Its comprehensive API integrations allow businesses to quickly integrate payment solutions with minimal coding. This ease of use, combined with robust security and global reach, sets Stripe apart in the competitive payment processing landscape.

Stripe's operational model is built on advanced technology and a developer-centric approach. The company supports over 100 payment methods and 135 currencies, facilitating seamless cross-border transactions. Stripe's commitment to innovation is evident in its continuous R&D efforts and strategic acquisitions, such as 'Bridge' in October 2024, to support stablecoin-based payments.

Stripe offers a robust payment processing system that supports a wide range of payment methods. This includes credit and debit cards, digital wallets, and local payment options. The platform ensures secure and reliable transactions, making it a preferred choice for businesses of all sizes.

Stripe employs advanced fraud detection systems, such as Stripe Radar, to protect businesses from fraudulent activities. In 2024, Stripe Radar prevented $2 billion worth of fraudulent transactions. This proactive approach to security builds trust and ensures the integrity of financial transactions.

Stripe's API is designed to be easy to integrate, allowing developers to quickly implement payment solutions. This ease of integration reduces development time and costs. The platform's comprehensive documentation and resources further support developers in setting up and managing payments.

Stripe supports businesses globally by offering payment processing in over 135 currencies and providing tools for cross-border transactions. This global reach allows businesses to expand their customer base and operate in international markets with ease. Stripe's infrastructure supports businesses in numerous countries, facilitating global commerce.

Stripe's operations are characterized by robust security, continuous innovation, and strategic partnerships. The company invests heavily in R&D to improve its products and services. Its commitment to security includes advanced encryption and tokenization to protect sensitive payment information.

- Security Framework: Advanced encryption and tokenization to safeguard payment information.

- Fraud Detection: AI-powered systems like Stripe Radar to prevent fraudulent transactions.

- R&D Investment: Continuous development of new technologies and product improvements.

- Strategic Partnerships: Acquisitions and collaborations to expand service offerings.

Stripe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stripe Make Money?

The core of [Company Name]'s revenue model centers on transaction fees, directly linked to the volume of payments it processes for its customers. This approach ensures that [Company Name]'s financial success is closely tied to the growth and prosperity of the businesses it serves, making it a partner in their financial journey. The company has expanded beyond its core payment processing services to include a range of products designed to support businesses in various aspects of their operations.

For standard online payments, [Company Name] typically charges a commission of 2.9% plus 30 cents per transaction for domestic cards, which is a common pricing model for payment processing APIs. This model is straightforward and easy for businesses to understand, providing a clear cost structure based on usage. Beyond transaction fees, [Company Name] has diversified its revenue streams through various products and services.

In 2023, [Company Name] generated $16 billion in revenue, marking a 15% year-over-year growth from 2022. The company's annual recurring revenue (ARR) surpassed $5.2 billion, driven by its expanded enterprise client base. The North American market contributed 65% of [Company Name]'s total revenue, with Europe accounting for 25%. To understand more about the company, you can read a Brief History of Stripe.

Beyond its core payment processing, [Company Name] has diversified its revenue streams through various products and services. These additional services provide further monetization opportunities and enhance the company's value proposition to its customers. Here's a breakdown of these revenue streams:

- Stripe Radar (Fraud Protection): This tool charges 5 to 7 cents for each screened transaction, helping businesses protect against fraudulent activities.

- Stripe Atlas (Business Incorporation): Setting up a new company through Atlas incurs a $500 setup fee, which includes government fees, followed by a subsequent annual operation fee of $100.

- Stripe Billing (Subscription Management): This is becoming a significant revenue driver for [Company Name]. The 'Revenue and Finance Automation Suite,' with Billing at its core, has surpassed a $500 million revenue run rate. Stripe Billing is used by over 300,000 companies and manages nearly 200 million active subscriptions.

- Stripe Capital (Financing Arm): In 2023, Stripe Capital disbursed $3.1 billion in loans to small businesses, generating $360 million in interest revenue.

- Innovative Monetization Strategies: [Company Name] employs innovative strategies such as tiered pricing and bundled services. For instance, its platform fees, bundled services, and tiered pricing cater to different customer needs, from startups to large enterprises. The company also offers custom pricing options for enterprise clients, deviating from the standard rate for high-volume businesses. [Company Name] is also exploring new revenue streams through stablecoin transactions, with stablecoin transaction volumes more than doubling between Q4 2023 and Q4 2024. This could involve charging for stablecoin conversion, custody, or API usage, and potentially generating interest income from stablecoin float.

Stripe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Stripe’s Business Model?

The following outlines the key milestones, strategic moves, and competitive advantages of Stripe, a leading financial technology company. Stripe's journey is marked by significant achievements in payment processing and financial infrastructure, influencing how businesses handle online transactions. This analysis provides a comprehensive overview of Stripe's evolution, from its early days to its current position in the market.

Stripe has consistently demonstrated its ability to innovate and adapt, expanding its offerings and solidifying its market presence. By focusing on developer-friendly tools and a global reach, Stripe has positioned itself as a crucial partner for businesses of all sizes. The company's strategic decisions and technological advancements continue to drive its growth and influence the future of online payments.

Stripe's success is built on a foundation of strategic decisions and technological advancements. The company's ability to innovate, adapt, and expand its offerings has solidified its market presence. This analysis provides a comprehensive overview of Stripe's evolution, from its early days to its current position in the market.

Stripe surpassed $1 trillion in total payment volume in 2023, reaching $1.4 trillion in 2024, with a year-over-year growth of 38%. The company achieved profitability in 2024 and expects to remain profitable in 2025. This financial stability allows for substantial reinvestment in research and development, fostering continuous innovation.

Stripe has made significant investments in AI and machine learning, improving authorization rates and recovering $6 billion in false decline transactions in 2024. The company has expanded its product offerings beyond payments to include business incorporation, lending, and card issuance. A notable acquisition in October 2024 was 'Bridge,' a stablecoin startup, to support stablecoin-based payments.

Stripe's competitive advantages include strong brand strength, technology leadership, and ecosystem effects. Its API integrations are a core differentiator, allowing developers to streamline setup processes. The company supports merchants in 50 countries and over 135 currencies. Stripe embraces AI-native businesses, with over 700 AI agent startups launching on Stripe in 2024.

Stripe faces challenges in maintaining its competitive edge against rivals like PayPal and Adyen. The company responds by continual innovation and focusing on its developer-friendly approach, which enables flexible and customizable payment integrations. Stripe invests heavily in R&D, with 65% of its earnings going back into product innovation, demonstrating its commitment to staying ahead of technological shifts and competitive threats.

Stripe's competitive advantages are multifaceted, contributing to its strong market position. Its developer-friendly approach, global reach, and continuous innovation set it apart. The company's focus on providing a seamless payment experience for both businesses and developers is a key differentiator, and this is one of the reasons why many businesses are choosing Stripe for their growth strategy.

- Developer-Friendly Platform: Stripe's API integrations enable swift and customizable payment setups.

- Global Reach: Supporting merchants in 50 countries and over 135 currencies.

- Innovation in AI: Utilizing AI to improve authorization rates and reduce transaction declines.

- Product Expansion: Expanding beyond payments to offer business incorporation, lending, and card issuance.

Stripe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Stripe Positioning Itself for Continued Success?

The payment processing industry is where Stripe holds a significant position, particularly in the online business sector. It is the world's second most used payment solution, with a global market share ranging from 17.15% to 19.45%, only behind PayPal. Stripe's customer loyalty is strong, serving millions of businesses, including 75% of Forbes Cloud 100 companies and half of the Fortune 100. Its global reach extends to merchants in 50 countries and supports 135 currencies.

Key risks for Stripe include regulatory changes, especially concerning digital assets and stablecoins. New competitors and technological disruptions also pose ongoing challenges, requiring continuous innovation. The company is attentive to broader economic trends, with its founders expressing concerns about the European economy and calling for regulatory reform.

In the U.S., Stripe commands a substantial market share, approximately 18.7% to 68.02% of e-commerce payment processing platforms. This positions Stripe ahead of competitors like Square and Adyen. Stripe's strong market presence is a testament to its robust payment solutions.

Regulatory changes, especially in digital assets, and the emergence of new competitors pose significant challenges. Economic trends and the need for continuous innovation are also critical factors. These elements can impact Stripe's market position and operational strategies.

Stripe is focused on AI integration, expanding into new payment methods, and enhancing embedded finance products. Expansion plans include a 17% increase in its workforce by 2025. The company aims to build the financial infrastructure of the internet economy.

Stripe is advising enterprises on strategies for faster global expansion and easier funds custody using stablecoins. They are also developing AI-driven commerce tools. The company is focused on programmable financial services, leveraging emerging trends in stablecoins and AI.

Stripe's strategy involves deepening AI integration and expanding into new payment methods, like stablecoins. They are also enhancing their embedded finance products to drive growth. The company is preparing for significant growth in AI agent startups on its platform by 2025.

- Focus on AI-driven commerce and optimizing transactions by AI agents.

- Expansion of workforce by 17% by 2025, indicating confidence in its strategic direction.

- Development of tools for AI-driven commerce and optimizing for transactions.

- Continued focus on building the financial infrastructure of the internet economy.

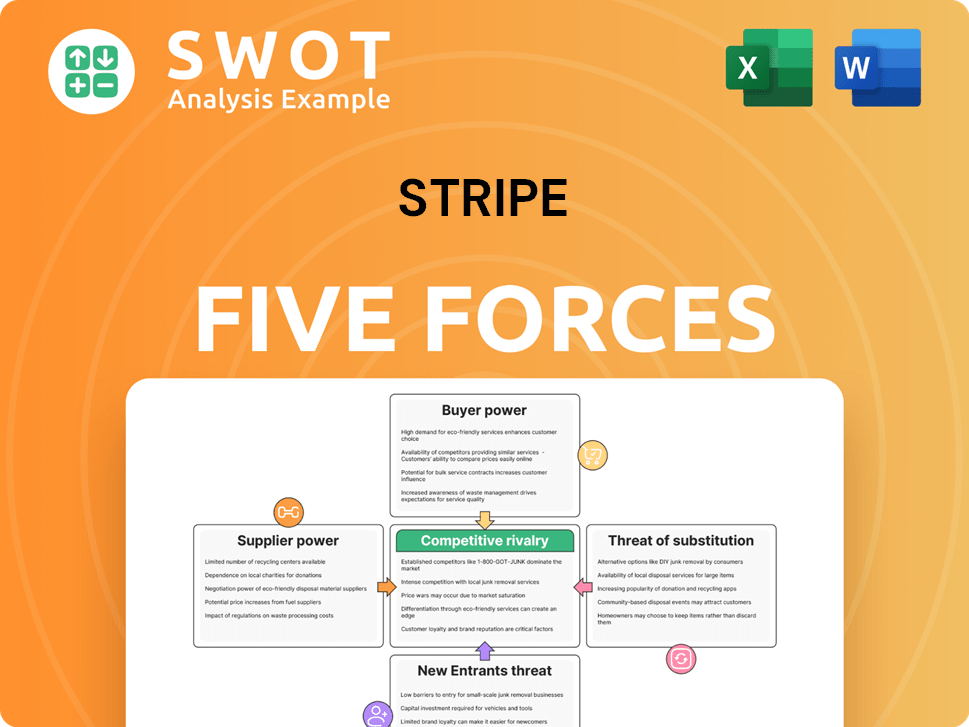

Stripe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stripe Company?

- What is Competitive Landscape of Stripe Company?

- What is Growth Strategy and Future Prospects of Stripe Company?

- What is Sales and Marketing Strategy of Stripe Company?

- What is Brief History of Stripe Company?

- Who Owns Stripe Company?

- What is Customer Demographics and Target Market of Stripe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.