Stripe Bundle

Who Does Stripe Serve? Unveiling Its Customer Base

In the dynamic world of digital finance, understanding the customer demographics and target market is crucial for success. Stripe, a leading force in online payments, has revolutionized how businesses handle transactions. This exploration delves into Stripe's evolution, from its initial focus on simplifying payments for developers to its current expansive reach.

From its inception, Stripe has strategically targeted specific segments, evolving its Stripe SWOT Analysis to adapt to market changes. Its primary focus has always been on providing seamless payment solutions. This analysis will uncover the Stripe user base, examining customer demographics, and revealing how Stripe attracts its customers across various industries and locations, providing a comprehensive view of its ideal customer profile.

Who Are Stripe’s Main Customers?

Understanding the customer demographics of a company like Stripe involves looking at its business-to-business (B2B) focus. Stripe's primary customer segments are businesses of varying sizes and from diverse industries. The company's target market is defined more by business characteristics than by traditional demographic factors like age or income.

The Revenue Streams & Business Model of Stripe highlights how the company has evolved its customer base. Initially, Stripe gained traction with small and medium-sized businesses (SMBs) and startups. These businesses valued the platform's ease of integration and developer-friendly tools. As of 2024, Stripe continues to serve SMBs while also expanding its reach to larger enterprises.

Stripe's customer base is segmented by business size, industry, and technological sophistication. This approach allows the company to tailor its services and marketing efforts effectively. The company's ability to handle large transaction volumes and offer enterprise-grade features appeals to a broader range of businesses.

Stripe's early success was built on attracting small and medium-sized businesses (SMBs). These businesses often lack the resources for in-house payment solutions. Stripe's ease of use and scalable infrastructure made it an attractive option for startups.

In recent years, Stripe has focused on attracting larger enterprises. This includes publicly traded companies and major e-commerce platforms. This expansion is driven by the potential for higher transaction volumes and the need for more sophisticated financial tools.

Industries heavily relying on Stripe include e-commerce, SaaS, on-demand services, and marketplaces. Subscription businesses and platforms also benefit from Stripe's recurring billing capabilities. Stripe's versatility makes it suitable for a wide array of business models.

Stripe attracts customers through its developer-friendly APIs, ease of integration, and robust features. The company's focus on providing scalable and reliable payment processing solutions has been key. Stripe's reputation for security and innovation also plays a significant role.

Stripe's customer base is diverse, spanning various industries and business sizes. The company's ability to handle large transaction volumes and offer enterprise-grade features has expanded its reach. Understanding the customer demographics of Stripe, including its target market, is crucial for businesses looking to integrate payment solutions.

- SMBs and Startups: Attracted by ease of use and developer-friendly APIs.

- Large Enterprises: Seeking advanced reporting and customizable financial tools.

- Key Industries: E-commerce, SaaS, on-demand services, and marketplaces.

- Growth Areas: Subscription businesses and platforms.

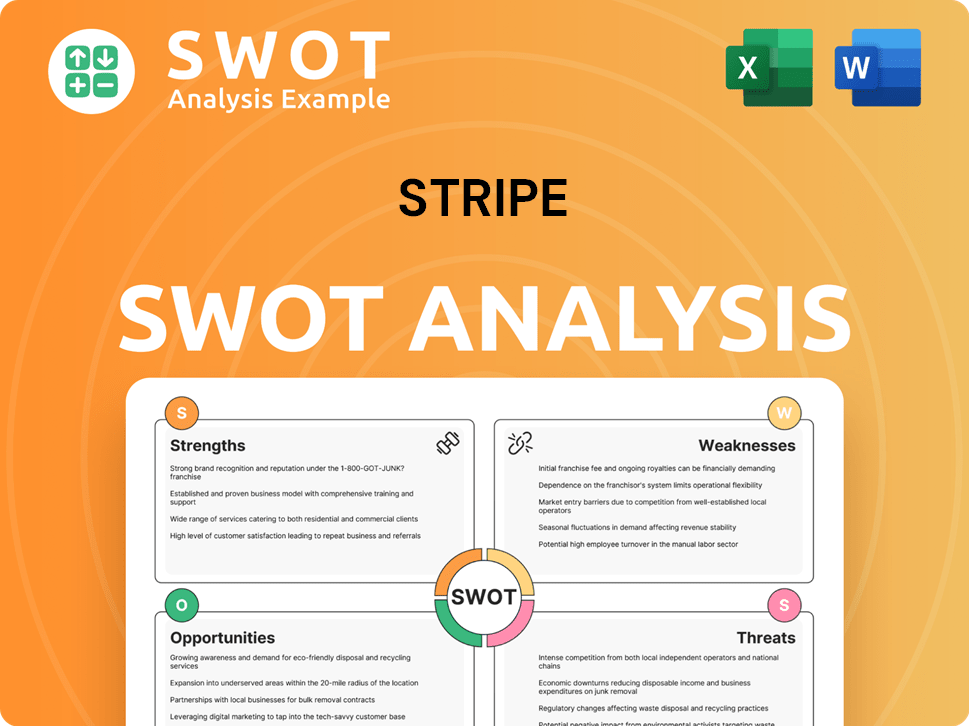

Stripe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Stripe’s Customers Want?

Understanding the needs and preferences of the Stripe user base is crucial for tailoring services and maintaining a competitive edge. The Stripe target market is diverse, yet specific needs consistently surface. Businesses seek reliable and secure payment infrastructure, alongside features that simplify transactions and enhance developer experience.

Stripe's success hinges on its ability to meet these needs. Key factors influencing customer decisions include ease of integration, scalability, and cost-effectiveness. Addressing pain points like complex payment gateways and high fees further solidifies Stripe's position in the market. The Stripe customer profile for e-commerce businesses, for example, emphasizes the need for robust handling of peak transaction volumes.

Customer demographics Stripe users are varied, spanning across industries and business sizes. Stripe caters to businesses of all sizes, from startups to large enterprises, with a focus on those operating online or with a strong digital presence. The company's approach to product development is heavily influenced by customer feedback and market trends, ensuring its offerings remain relevant and competitive. For more insights into the company's structure, consider exploring the details of Owners & Shareholders of Stripe.

Stripe's customers prioritize several key features and benefits. These include seamless integration, robust security, and flexible payment options. Businesses also value efficient financial reporting and developer-friendly tools. The ability to handle international transactions and a wide range of payment methods is a significant advantage, especially for businesses with global aspirations.

- Ease of Integration: Customers want easy-to-implement solutions.

- Security: Robust fraud detection and data protection are paramount.

- Scalability: The ability to handle increasing transaction volumes without performance issues is critical.

- Developer Experience: Comprehensive API documentation and developer support are highly valued.

- Cost-Effectiveness: Transparent pricing and competitive fees are important considerations.

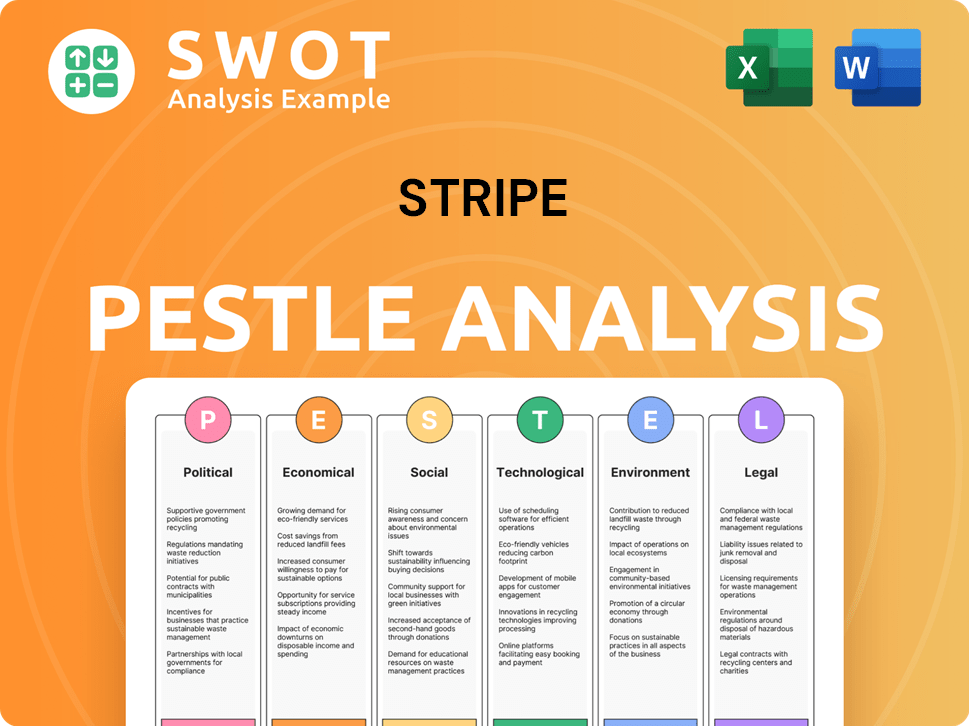

Stripe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Stripe operate?

Stripe's geographical market presence is extensive, serving businesses in over 120 countries. This global reach highlights its commitment to supporting digital commerce worldwide. The company strategically focuses on key regions while expanding into emerging markets to capitalize on the growth of online transactions.

The United States remains a core market for Stripe due to its large digital economy. Europe is another significant region, with a strong presence in countries like the United Kingdom, Ireland, France, and Germany. Stripe also has a growing footprint in the Asia-Pacific region, including Australia, Singapore, and Japan. Furthermore, the company is actively expanding in Latin America, targeting markets such as Brazil and Mexico.

Stripe's approach to different regions involves tailoring its offerings to meet local needs. This includes supporting local payment methods, complying with regional regulations, and providing localized customer support. For example, in Europe, Stripe supports SEPA Direct Debit and iDEAL. In Asia, it integrates with digital wallets and bank transfer systems. This localization strategy is crucial for attracting and retaining a diverse Stripe user base.

Stripe's primary markets include North America, particularly the United States, and Europe. These regions have well-established digital economies, making them crucial for Stripe's revenue.

The Asia-Pacific region is a key area of growth for Stripe, with operations in Australia, Singapore, and Japan. This expansion reflects the increasing digital commerce activity in the area.

Stripe is actively expanding its presence in Latin America, including Brazil and Mexico. These markets represent significant opportunities due to the rising adoption of digital payments.

Stripe customizes its services to support local payment methods and comply with regional regulations. This approach is essential for attracting and retaining customers in diverse markets.

Stripe's geographical market presence is a key factor in its growth. The company's ability to adapt to local market needs, as highlighted in Growth Strategy of Stripe, is crucial for its success. Here's a breakdown:

- North America: The United States is a core market due to its large digital economy.

- Europe: Strong presence in the UK, Ireland, France, and Germany.

- Asia-Pacific: Operations in Australia, Singapore, and Japan.

- Latin America: Expanding in Brazil and Mexico.

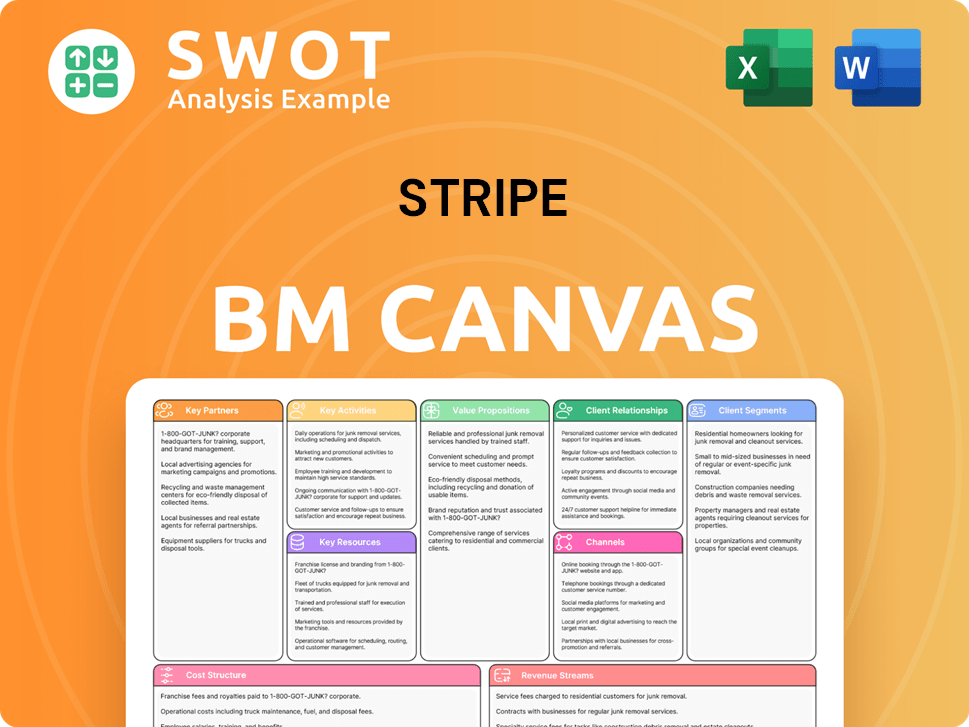

Stripe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Stripe Win & Keep Customers?

The approach to customer acquisition and retention employed by the company is a blend of digital and traditional methods. A strong emphasis is placed on the developer community, leveraging word-of-mouth referrals, which are driven by the company's reputation for robust APIs and an excellent developer experience. Digital marketing, including content creation, search engine optimization (SEO), and targeted online advertising, is crucial for reaching potential customers. Strategic partnerships with e-commerce platforms, web development agencies, and business software providers also play a significant role in expanding its reach.

To retain its customer base, the company focuses on providing a continuously evolving suite of products and services. These offerings are designed to grow with its customers' needs, including features like fraud prevention with Radar, data analytics with Sigma, and business financing through Capital. Personalized experiences are emphasized through dedicated account managers for larger clients and proactive customer support. Customer data and CRM systems are critical for segmenting the diverse customer base and tailoring marketing campaigns and product recommendations. The company's ability to reduce churn rates is often attributed to the integrated financial infrastructure, making it difficult for businesses to switch once they are deeply embedded in the ecosystem.

The company's strategy emphasizes the importance of a strong developer community and digital marketing efforts to attract new customers. The company's customer acquisition strategy is multi-faceted, involving digital marketing, strategic partnerships, and a focus on developer satisfaction. This approach helps the company reach a wide range of potential clients, including e-commerce businesses, tech companies, and startups. The company's focus on offering a comprehensive suite of financial tools and personalized customer support further strengthens its ability to retain its customer base, ensuring long-term relationships and sustained growth. Learn more about the Growth Strategy of Stripe.

The company utilizes several channels to acquire customers. Content marketing and SEO are used to attract customers. Partnerships with e-commerce platforms and software providers also contribute to customer acquisition.

Retention strategies include providing new products and services. They also focus on personalized experiences through dedicated account managers and proactive customer support. Continuous product innovation and developer satisfaction are key drivers of customer loyalty.

The company offers several features designed to retain customers. These features include fraud prevention, data analytics, and business financing. These features are designed to meet the evolving needs of its customers.

Customer data and CRM systems are essential for segmenting the customer base. This segmentation allows the company to tailor marketing campaigns and product recommendations. This helps the company to provide a more personalized experience for its customers.

The company's customer acquisition strategy focuses on several key areas. The company leverages its strong developer community to drive word-of-mouth referrals. Digital marketing, including content marketing and SEO, is used to reach potential customers. Strategic partnerships with e-commerce platforms and other providers also play a role.

- Word-of-mouth referrals from the developer community.

- Digital marketing efforts, including content and SEO.

- Strategic partnerships with various platforms and providers.

- Focus on a seamless developer experience.

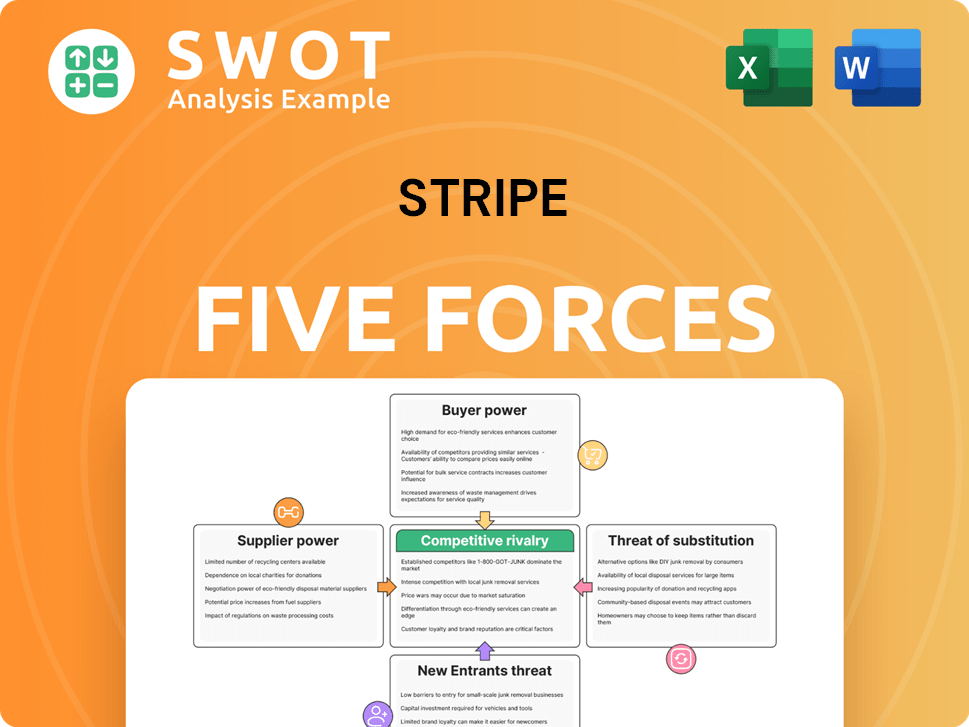

Stripe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stripe Company?

- What is Competitive Landscape of Stripe Company?

- What is Growth Strategy and Future Prospects of Stripe Company?

- How Does Stripe Company Work?

- What is Sales and Marketing Strategy of Stripe Company?

- What is Brief History of Stripe Company?

- Who Owns Stripe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.