Stripe Bundle

Can Stripe Maintain Its Fintech Throne?

In the dynamic world of digital finance, understanding the Stripe SWOT Analysis and its rivals is crucial for any investor or business strategist. Stripe, a pioneer in payment processing, has fundamentally reshaped how businesses handle online transactions. But how does Stripe fare against its competitors, and what strategies is it employing to stay ahead?

This exploration into the Stripe competitive landscape will dissect the strategies of Stripe competitors and offer a comprehensive Stripe market analysis. The payment processing industry is fiercely competitive, with numerous Fintech companies vying for market share in the realm of online payment platforms. We'll delve into Stripe's main competitors in 2024, compare its offerings to rivals like PayPal and Square, and examine its Stripe's competitive advantages and disadvantages to provide actionable insights.

Where Does Stripe’ Stand in the Current Market?

Stripe holds a significant market position within the financial infrastructure and payment processing industry. It is particularly strong in the e-commerce sector. The company is consistently ranked among the top global payment processors. Stripe's primary offerings include payment processing for both online and in-person transactions, fraud prevention (Radar), billing and subscription management (Stripe Billing), and corporate cards (Stripe Corporate Card).

The company processes hundreds of billions of dollars in payments annually. This solidifies its standing as a leader alongside major peers in the payment processing industry. Stripe serves millions of businesses across North America, Europe, and Asia-Pacific. It operates in over 120 countries. Stripe has expanded its services beyond simple payment processing. It now caters to a wide range of customers, from small businesses to large enterprises.

Stripe's financial health remains robust, with a valuation of approximately $65 billion as of early 2024. This reflects its scale and the confidence of its investors. While strong in online commerce, Stripe continues to strengthen its position in the in-person payment space. Traditional players have historically dominated this area. To understand more about the company's financial structure, consider reading about the Revenue Streams & Business Model of Stripe.

Stripe's core operations revolve around providing a comprehensive suite of financial tools. These tools are designed to facilitate online and in-person transactions. It offers services such as payment processing, fraud detection, and subscription management. These services are crucial for businesses of all sizes.

The value proposition of Stripe lies in its developer-friendly platform. It offers a seamless integration process. This simplifies the complexities of financial transactions for businesses. Stripe also provides robust security features and a wide range of services. These services are designed to meet the evolving needs of its diverse customer base.

Stripe's market share analysis reveals a strong presence in the payment processing industry. It competes with major players like PayPal and Square. The company's focus on technology and developer tools gives it a competitive edge. Stripe's global expansion strategy has allowed it to serve millions of businesses worldwide.

- Stripe's competitive advantages include its developer-friendly platform and comprehensive suite of services.

- Stripe's disadvantages may include higher pricing compared to some competitors and increased competition.

- The company's key partnerships and alliances help expand its reach and capabilities.

- Stripe's security features are constantly updated to protect against fraud.

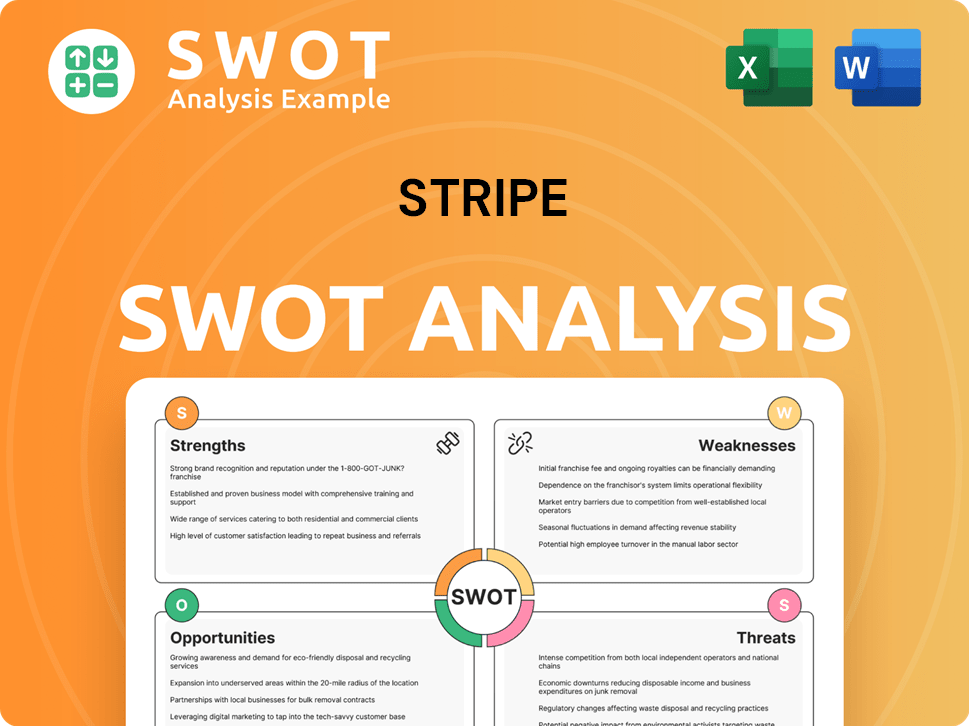

Stripe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Stripe?

The Stripe competitive landscape is dynamic, with numerous players vying for market share in the payment processing industry. Understanding Stripe's competitors is crucial for businesses and investors alike, as it provides insights into the company's strengths, weaknesses, and strategic positioning.

Stripe's market analysis reveals a complex ecosystem where direct and indirect competitors challenge its dominance. This chapter will delve into the key players, their offerings, and how they stack up against Stripe in terms of pricing, features, and market reach. The competitive landscape is constantly evolving, with new fintech companies and established giants reshaping the online payment platforms arena.

Stripe's main competitors in 2024 include payment processing giants and innovative fintech firms. These companies offer similar services, competing directly for the same customer base. The competition often revolves around pricing, features, and developer-friendliness.

Stripe vs PayPal comparison highlights PayPal's extensive user base and brand recognition. Braintree, PayPal's subsidiary, directly competes with Stripe by offering similar payment processing solutions for online businesses. PayPal's established presence gives it a significant advantage in the market.

Adyen is a formidable competitor, particularly for large enterprises. Known for its unified global payment platform, Adyen boasts a strong international presence. The competition between Stripe and Adyen often centers on their ability to serve large, complex global enterprises with sophisticated payment needs.

Square (now Block Inc.) competes directly in both online and in-person payment processing. It focuses on small businesses and offers a comprehensive ecosystem of hardware and software solutions. Square's integrated approach and brand recognition make it a strong competitor.

Indirect competitors include traditional financial institutions and new entrants in specific niches. These players may not offer the exact same services but still impact Stripe's market share. The competition comes from various angles, including pricing, features, and target market.

Banks and legacy payment processors like Fiserv and FIS offer merchant services. While they may have more complex integration processes, they still pose a competitive challenge. These institutions often have established relationships with businesses.

Several factors drive competition in the payment processing market. These include pricing models, developer-friendliness, global reach, and the breadth of integrated financial services. Understanding these factors helps assess Stripe's competitive advantages and disadvantages.

- Pricing: Stripe's pricing model vs competitors is a key differentiator. Competitors often offer varying rates and fee structures.

- Developer-Friendliness: Stripe's reputation for developer-friendly tools is a significant advantage.

- Global Reach: Stripe's global expansion strategy and ability to support multiple currencies and payment methods are crucial.

- Integrated Services: The range of financial services offered, such as fraud protection and billing, impacts competitiveness.

- Security: Stripe's security features compared to rivals are essential for attracting and retaining customers.

For a deeper understanding of the businesses that use Stripe, explore the Target Market of Stripe. This analysis provides insights into the customer base and the types of businesses that rely on Stripe for their payment processing needs.

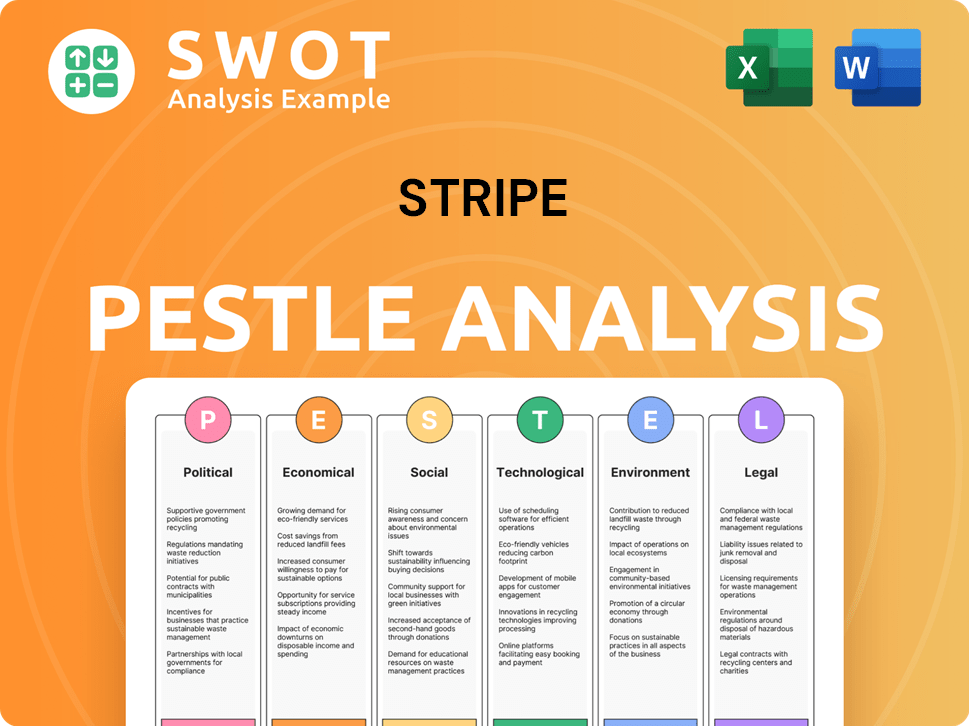

Stripe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Stripe a Competitive Edge Over Its Rivals?

Examining the Stripe competitive landscape reveals a company that has carved a significant niche in the payment processing industry through a developer-first approach and a robust technology stack. Its ease of integration via well-documented APIs has been a key differentiator, simplifying online payment acceptance for businesses. This focus has cultivated strong loyalty within the tech community, establishing Stripe as a preferred choice for many new online ventures.

Stripe's market analysis shows that it has built a strong brand equity within the tech and startup ecosystem. It has also built significant economies of scale by processing billions of dollars in transactions, allowing it to invest heavily in research and development and offer competitive pricing. This technological sophistication reduces financial losses for businesses and builds trust in the platform. Its extensive global infrastructure supports payments in over 120 countries, offering a seamless experience for businesses with international ambitions.

The company has consistently leveraged these strengths in its product development and strategic partnerships, such as its collaborations with major e-commerce platforms and financial institutions. However, the fintech companies landscape is rapidly evolving, necessitating continuous innovation to sustain its advantages against imitation and disruptive industry shifts. For more insights, explore the Growth Strategy of Stripe.

Stripe's core strength lies in its developer-centric design, offering well-documented APIs that simplify integration. This approach has fostered strong loyalty within the tech community. The company consistently updates its APIs and developer tools, ensuring ease of use and adaptability for various business needs.

Stripe's proprietary fraud prevention system, Radar, uses machine learning to adapt to evolving fraud patterns, enhancing security. Stripe invests heavily in its infrastructure, ensuring high uptime and reliability. This advanced technology reduces financial losses for businesses and builds trust in the platform.

Stripe supports payments in over 120 countries, providing a seamless experience for businesses with international ambitions. This global reach is a significant advantage, especially for e-commerce businesses looking to expand internationally. Stripe's infrastructure is designed to handle various currencies and payment methods.

Stripe's strong brand equity within the tech and startup ecosystem makes it a preferred choice for new online businesses. The company has built significant partnerships with major e-commerce platforms and financial institutions. These partnerships help expand its reach and provide integrated solutions.

Stripe's competitive advantages are multifaceted, combining technological innovation, a developer-friendly approach, and global reach. These advantages are crucial in the Stripe competitive landscape, allowing it to maintain its position in the online payment platforms market.

- Developer-Friendly Platform: Easy integration and comprehensive APIs attract developers and businesses.

- Advanced Security: Radar, the fraud prevention system, enhances security and reduces risk.

- Global Reach: Support for payments in over 120 countries facilitates international expansion.

- Strong Brand Reputation: Preferred choice for many startups and tech-focused businesses.

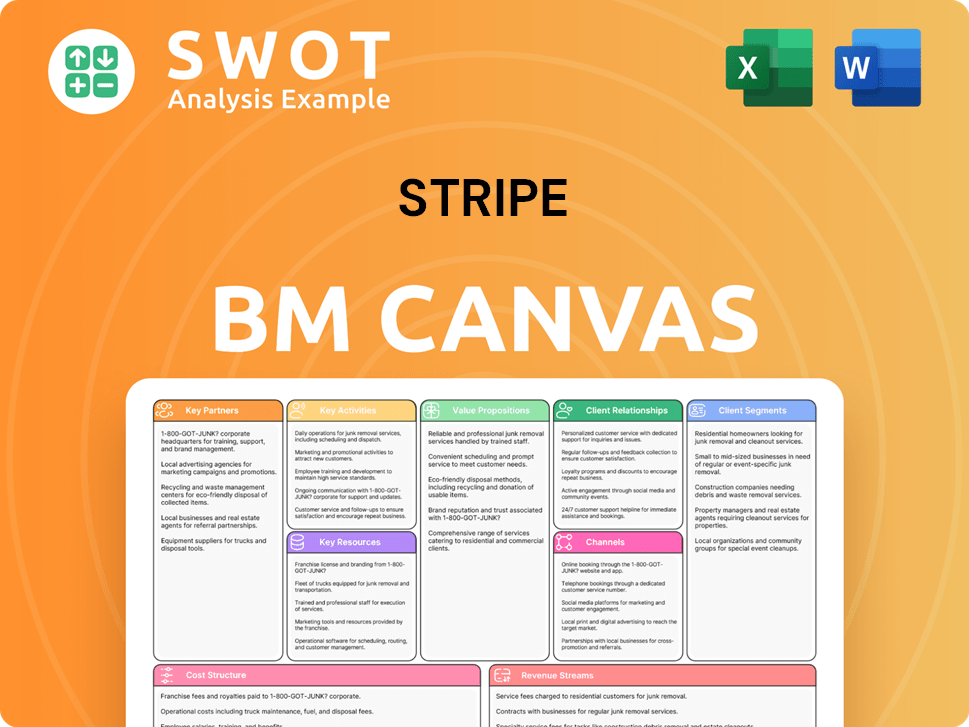

Stripe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Stripe’s Competitive Landscape?

The financial infrastructure sector is experiencing significant shifts, creating both opportunities and challenges for companies like Stripe. Technological advancements, regulatory changes, and evolving consumer preferences are reshaping the landscape. Understanding the Stripe competitive landscape and the broader payment processing industry is crucial for strategic decision-making.

Key factors influencing Stripe's future include the rise of Fintech companies, the need to adapt to global regulatory environments, and the ongoing evolution of online payment platforms. Stripe's ability to navigate these trends will determine its long-term success. A deeper dive into the Stripe market analysis reveals the complexities of the industry.

Technological advancements, particularly in AI and machine learning, are enhancing fraud detection and automating compliance. Regulatory changes, such as open banking, require continuous adaptation. Consumer preferences are shifting towards diverse payment methods, including digital wallets and BNPL options.

Intense competition from well-capitalized incumbents and agile startups poses a significant challenge. Market saturation in developed economies and the complexity of global regulations are also concerns. Geopolitical instability and economic downturns could impact transaction volumes.

Significant opportunities exist in emerging markets, where digital payment adoption is accelerating. Further expansion into in-person payments and innovations in embedded finance offer growth avenues. Partnerships and product development in these areas can drive expansion.

Stripe is likely to evolve towards offering more holistic financial services. This includes continued investment in AI and machine learning, strategic acquisitions, and global footprint expansion. The goal is to become an indispensable operating system for businesses, according to recent reports.

Stripe's strategy will focus on expanding its global presence and offering more comprehensive financial services. This includes leveraging AI and machine learning to enhance its offerings and focusing on strategic acquisitions to broaden its capabilities. For example, in 2024, the company is investing heavily in its AI-driven fraud detection systems.

- Continued investment in AI and machine learning for fraud detection and compliance.

- Strategic acquisitions to broaden service offerings and expand market reach.

- Global expansion, particularly into emerging markets, to capture new growth.

- Focus on embedded finance to integrate financial services into non-financial platforms.

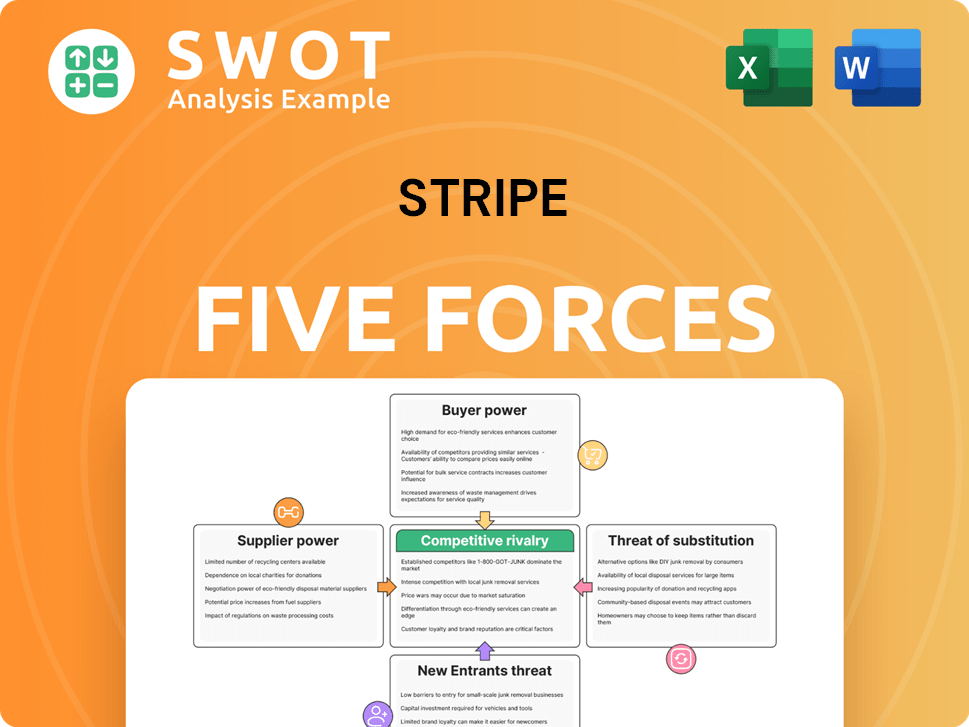

Stripe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stripe Company?

- What is Growth Strategy and Future Prospects of Stripe Company?

- How Does Stripe Company Work?

- What is Sales and Marketing Strategy of Stripe Company?

- What is Brief History of Stripe Company?

- Who Owns Stripe Company?

- What is Customer Demographics and Target Market of Stripe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.