Vale Bundle

How did a Brazilian mining venture become a global powerhouse?

Uncover the fascinating Vale SWOT Analysis and delve into the captivating Vale history, a story of ambition and transformation. From its humble beginnings in 1942 as a state-owned entity, Vale Company has risen to become a titan of the mining industry. Explore the strategic decisions and pivotal moments that shaped its journey.

The Vale mining story is one of remarkable growth, from its roots in Brazilian mining of iron ore to its current status as a global leader. Understanding Vale's past provides critical context for evaluating its current position and future prospects within the competitive global market. This exploration of the early days of Vale mining will reveal its significant impact on Brazil and its evolving role in global mining.

What is the Vale Founding Story?

The story of the Vale Company begins in 1942, a pivotal year for Brazil's industrial ambitions. Established on June 1st of that year, Companhia Vale do Rio Doce (CVRD) emerged through a decree-law orchestrated by Getúlio Vargas. This move was a strategic initiative to nationalize and bolster Brazil's burgeoning mining industry.

The company's formation involved absorbing existing entities, namely Companhia Brasileira de Mineração e Siderurgia and Companhia Itabira de Mineração. This consolidation was a deliberate step to centralize control and capitalize on the rich mineral resources, particularly the vast iron ore deposits found in the state of Minas Gerais. The company's early operations were significantly supported by the Estrada de Ferro Vitória a Minas railway, a critical asset for transporting mined ore.

The initial business model of Vale Company was straightforward: the extraction and export of iron ore. The company's trajectory took a significant turn in the 1950s as it ventured into the global iron ore market. This expansion was fueled by upgrades to its mining infrastructure, including the railway and port facilities, along with a doubling of iron ore prices. Initially, the primary export destination was the United States, with later expansion into European markets. The name 'Companhia Vale do Rio Doce' translates to 'Doce River Valley Company,' reflecting its operational base in the Doce River Valley. Before its rebranding, the company was widely recognized by its acronym CVRD, which was later changed to Vale in November 2007.

The establishment of Companhia Vale do Rio Doce in 1942 marked the beginning of a significant chapter in Vale's mission and Brazil's mining history.

- Founded on June 1, 1942, by Getúlio Vargas.

- Aimed to nationalize and develop the Brazilian mining industry.

- Focused on iron ore extraction and export.

- Utilized the Estrada de Ferro Vitória a Minas railway for ore transportation.

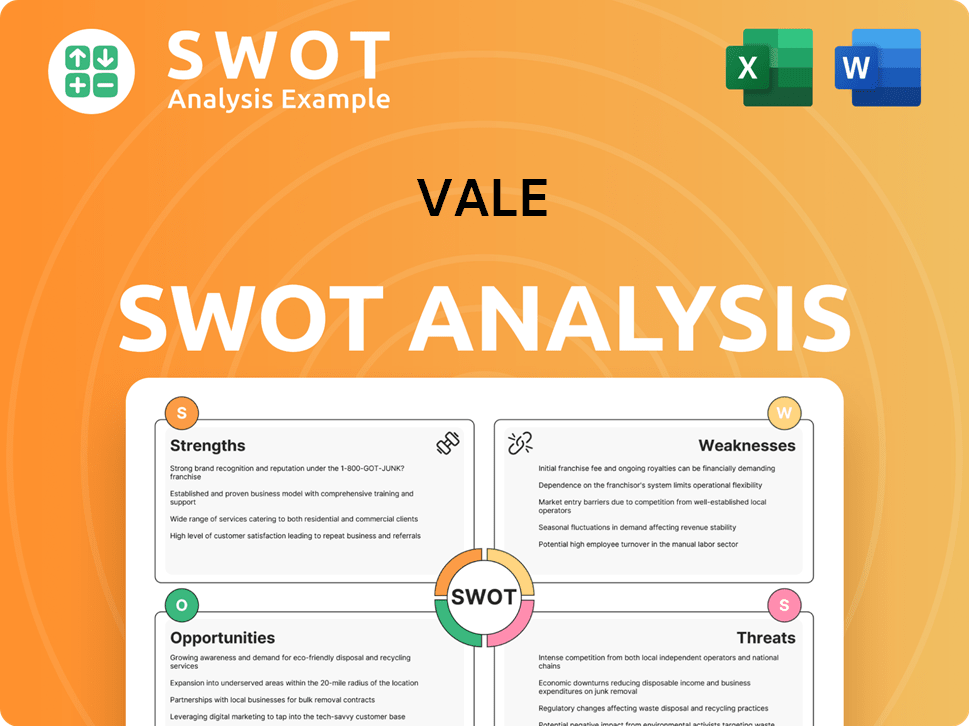

Vale SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Vale?

The early growth and expansion of the Vale Company, formerly known as Companhia Vale do Rio Doce, set the stage for its future dominance in the mining industry. This phase was marked by strategic infrastructure investments and significant acquisitions. These moves enabled the company to capitalize on Brazil's rich mineral resources and establish itself as a global leader. The company's history is deeply intertwined with the development of Brazil's mining sector.

A crucial step in Vale's early expansion was the inauguration of the Port of Tubarão in Espírito Santo in 1966. This port became a critical export hub for iron ore, facilitating the efficient transportation of resources from the Minas Gerais region. This strategic infrastructure investment significantly enhanced Vale's logistical capabilities, supporting its growth in the Vale Company's target market.

In 1970, the acquisition of a majority interest in the Carajás Mine was a pivotal moment. This mine held over 1.5 billion tonnes of iron ore reserves, significantly boosting Vale's resource base. This acquisition, coupled with operational improvements, propelled Vale to become the world's largest exporter of iron ore by 1974. This strategic move solidified its position in the Brazilian mining industry.

Vale began diversifying its portfolio in 1982 by entering aluminum production in Rio de Janeiro. The mid-1980s, under Eliezer Batista, saw significant profit increases. This diversification helped the company to mitigate risks and explore new revenue streams. This period was marked by strategic decisions that enhanced both its operational efficiency and financial performance.

Further expansion into iron ore exploration occurred in 1985 with the Carajás Mine in Pará, supported by the newly opened Carajás railroad. The inauguration of the Ponta Madeira port terminal in 1986 was another key development. These infrastructure projects were essential for supporting the extraction and export of iron ore, laying the groundwork for Vale's sustained growth and global dominance in the mining sector. In 2024, Vale's iron ore production reached approximately 307.8 million metric tons.

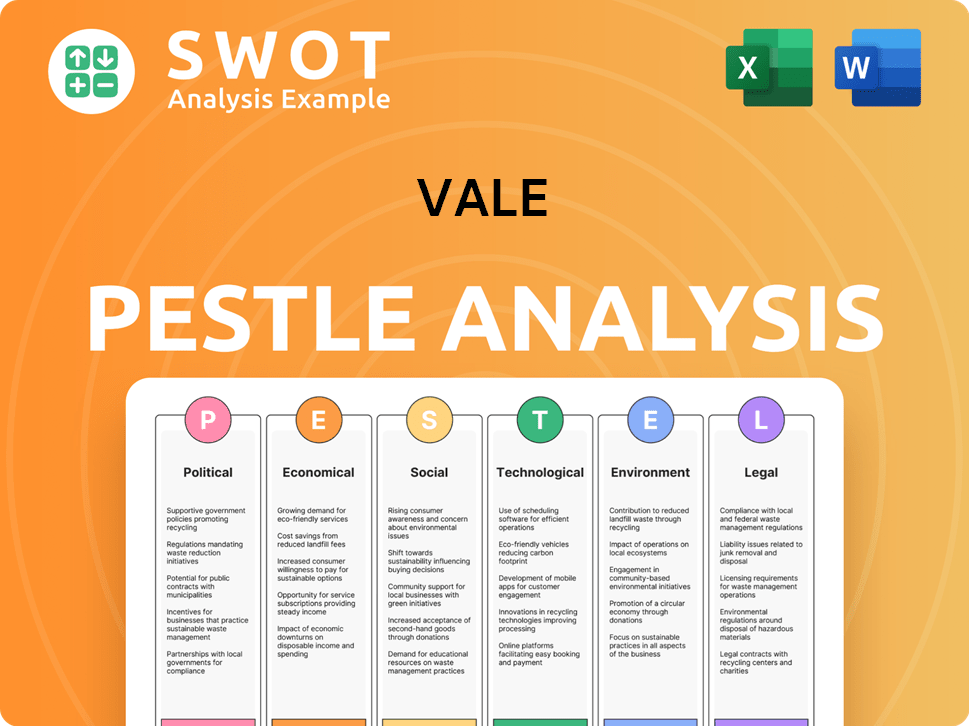

Vale PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Vale history?

The Vale Company has a rich Vale history, marked by significant achievements and formidable obstacles. Its journey includes becoming a global leader in the mining industry, particularly in Brazilian mining and iron ore, while navigating complex challenges.

| Year | Milestone |

|---|---|

| 1974 | Became the world's largest iron ore exporter, a position it still holds. |

| 2023 | Reached a milestone in sourcing energy from renewables through a joint venture with GIP at Aliança Energia, strengthening its commitment to decarbonization. |

| 2025 (Projected) | Expects to remove the last emergency level 3 dam as part of its dam decharacterization program. |

Vale Company consistently invests in technological innovation to enhance its operations. This includes the implementation of autonomous technology in its mining operations, which aims to boost both productivity and safety.

Vale is expanding the use of autonomous trucks at its Serra Norte mine, with plans to increase the fleet from 14 to 70 within three years. This technology helps to improve efficiency and safety in the mining process.

Vale has partnered with GIP at Aliança Energia to source energy from renewable sources. This strategic move supports Vale's commitment to reducing its carbon footprint and promoting sustainable practices.

Despite its successes, Vale has faced considerable challenges throughout its history. Two catastrophic tailings dam failures in Brazil, notably the Mariana disaster in 2015 and the Brumadinho disaster in 2019, have significantly impacted the company.

The Brumadinho disaster led to the loss of Vale's license to operate eight tailings dams in Minas Gerais. This event resulted in a nearly 25% drop in its stock price in 2024, highlighting the severe impact of the incident.

Vale faces challenges from volatile commodity prices, particularly iron ore, which accounts for approximately 80% of its revenue. Economic fluctuations in key markets such as China also pose significant risks to the company's financial performance.

Vale's Q1 2025 pro forma EBITDA decreased by 8% year-on-year, primarily due to a 16% drop in iron ore prices. Despite higher sales volumes and lower unit costs in iron ore, the company's profitability was affected by market conditions.

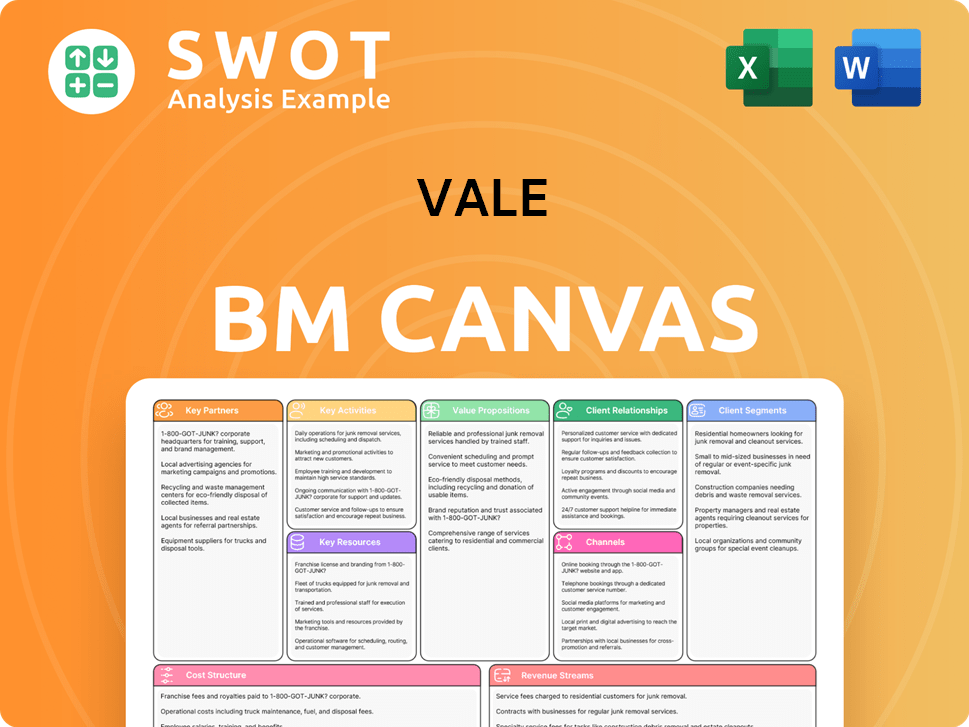

Vale Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Vale?

The Vale Company, a major player in the Brazilian mining industry, has a rich history marked by significant milestones. Established by the Brazilian Federal Government, the company has evolved from its origins to become a global leader in iron ore and other commodities. Its journey includes strategic expansions, technological advancements, and responses to critical events, shaping its current position and future trajectory within the global mining landscape. Here's a look at the key events in Vale history.

| Year | Key Event |

|---|---|

| June 1, 1942 | Founded as Companhia Vale do Rio Doce by the Brazilian Federal Government. |

| 1943 | Vitória a Minas railroad inaugurated, facilitating transport. |

| 1950s | Entered the global iron ore market, establishing its international presence. |

| 1966 | Port of Tubarão inaugurated, enhancing export capabilities. |

| 1970 | Acquired majority interest in Carajás Mine, a significant iron ore deposit. |

| 1974 | Became the world's largest exporter of iron ore, a major achievement. |

| 1982 | Began aluminum production, diversifying its portfolio. |

| 1985 | Started exploring Carajás Mine in Pará, expanding operations. |

| 1986 | Ponta Madeira port terminal inaugurated, boosting export capacity. |

| November 2007 | Rebranded from CVRD to Vale, reflecting its global identity. |

| 2015 | Mariana dam disaster, a significant environmental challenge. |

| 2019 | Brumadinho dam disaster, impacting its environmental and social responsibilities. |

| 2024 | Achieved iron ore production levels near 328 Mt. |

| Q1 2025 | Pro forma EBITDA of $3.2 billion, with iron ore C1 cash costs at $21 per ton. |

| April 2025 | Reported a consistent start to the year, focusing on cost management and strategic projects. |

| May 2025 | Analysts forecast the stock could ascend to $15.50, representing a potential gain of 58.16%. |

| June 2025 | Released its first Sustainability-Related Financial Information Report. |

Vale is concentrating on enhancing its portfolio flexibility and boosting operational efficiency, particularly in its base metals business. This strategic direction aims to strengthen its market position.

For 2025, Vale anticipates producing between 325 million and 335 million metric tons of iron ore. The company targets 340 million to 360 million tons in 2026 and around 360 million tons by 2030.

Copper production is expected to range between 340 kt and 370 kt in 2025, with nickel production projected between 160 kt and 175 kt. These figures highlight diversification.

Capital expenditures for 2025 are estimated at approximately $5.9 billion. Vale aims to reduce cash costs by 15% in 2025 compared to 2024 through optimized logistics and automation.

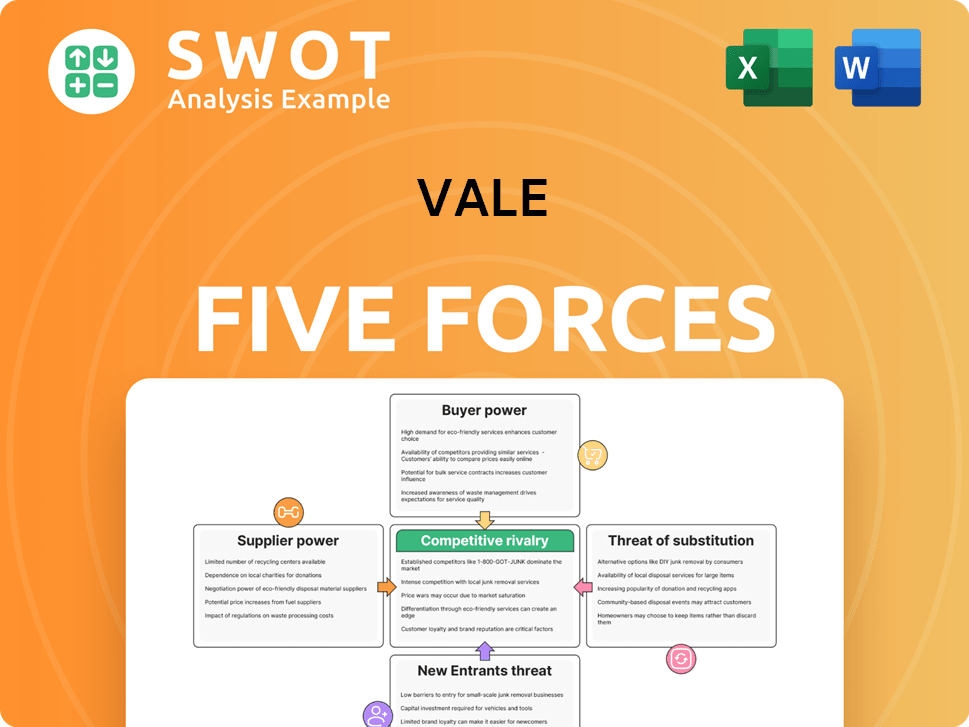

Vale Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Vale Company?

- What is Growth Strategy and Future Prospects of Vale Company?

- How Does Vale Company Work?

- What is Sales and Marketing Strategy of Vale Company?

- What is Brief History of Vale Company?

- Who Owns Vale Company?

- What is Customer Demographics and Target Market of Vale Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.