Vale Bundle

Can Vale S.A. Maintain Its Mining Dominance?

The global mining industry is a dynamic landscape, and Vale S.A. stands as a titan within it. From its origins exploiting Brazil's iron ore reserves, Vale has evolved into a global powerhouse, impacting supply chains and commodity markets worldwide. This analysis will explore the Vale SWOT Analysis, its growth strategy, and its future prospects.

Vale's journey from a Brazilian iron ore exporter to a diversified mining giant is a testament to its strategic agility. As of early 2025, understanding Vale's growth strategy is critical for investors and analysts alike. This exploration of Vale's future prospects will provide insights into its expansion initiatives, technological advancements, and financial planning, offering a comprehensive Vale company analysis.

How Is Vale Expanding Its Reach?

The Vale company analysis reveals a robust growth strategy centered on strategic expansion initiatives. These initiatives are designed to boost production capacity and diversify its product portfolio. The primary focus remains on iron ore, with significant investments in Brazil to meet global demand. Simultaneously, Vale is actively growing its presence in the energy transition metals sector, particularly nickel and copper.

Vale's future prospects are closely tied to its ability to execute these expansion plans effectively. The company's approach includes geographical diversification and enhancement of its product offerings. This dual strategy aims to capitalize on market trends and secure long-term growth. The firm is also exploring mergers and acquisitions to accelerate growth and secure resources.

The company's strategic focus on iron ore production in Brazil is evident through ongoing investments in the Northern System operations. These investments aim to optimize mining and logistics for higher output. Vale is also expanding into energy transition metals, recognizing the rising demand for nickel and copper driven by the shift towards renewable energy and electric vehicles.

Vale's Vale growth strategy emphasizes expanding its iron ore production capacity, especially in Brazil. This involves ongoing projects to increase output and improve operational efficiency. The company is focused on optimizing its mining and logistics to achieve higher output volumes in 2024 and 2025.

Vale is actively pursuing growth in energy transition metals, particularly nickel and copper. This is driven by the increasing demand for these metals in renewable energy and electric vehicles. The company is seeking partnerships and investments to unlock the full potential of its copper and nickel assets.

Vale is exploring opportunities in new geographies to secure future resource supply and diversify its operational footprint. Specific new market entries are subject to ongoing assessment and regulatory approvals. This strategy aims to reduce operational risks and access new markets.

The company is evaluating potential mergers and acquisitions in the energy transition minerals space. This strategy aims to accelerate growth and secure critical resources for the future. This approach can quickly increase market share and access new technologies.

Vale's expansion initiatives are crucial for its future prospects, focusing on both iron ore and energy transition metals. These initiatives include increasing iron ore production capacity and growing its presence in the nickel and copper markets. The company is aiming for a copper production increase to between 375-430 kilotonnes and nickel production to between 160-175 kilotonnes by 2024.

- Investment in iron ore projects in Brazil to meet global demand.

- Exploration for new copper and nickel deposits.

- Optimization of existing mines to enhance output and reduce costs.

- Evaluation of mergers and acquisitions in the energy transition minerals space.

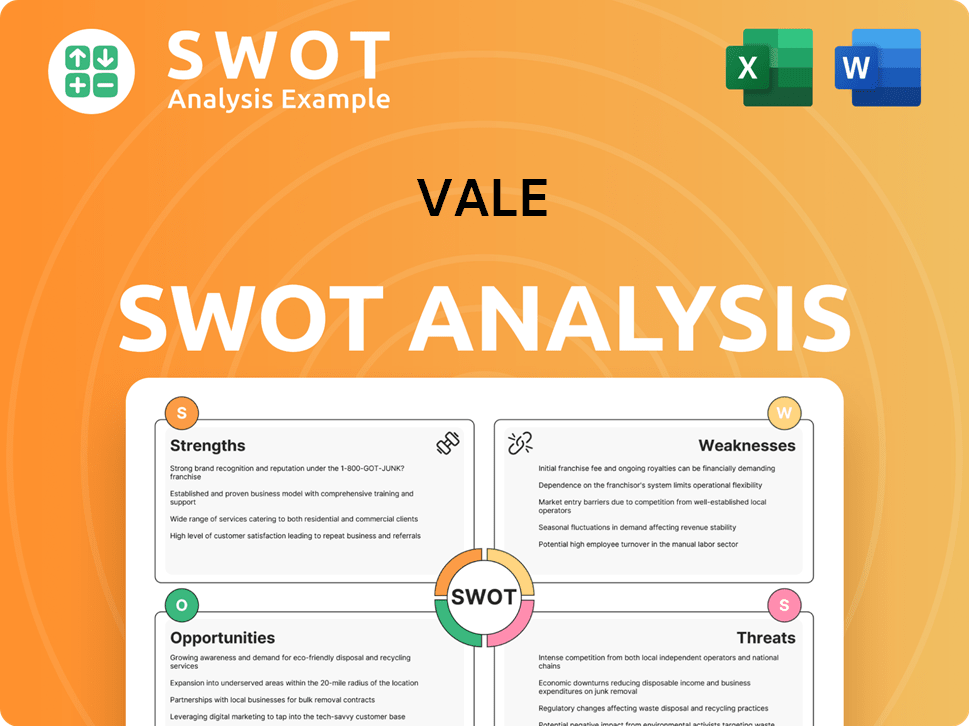

Vale SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vale Invest in Innovation?

The innovation and technology strategy of Vale is central to its Vale growth strategy and future success. The company is heavily invested in digital transformation and sustainable mining practices to enhance operational efficiency. This approach is vital for maintaining a competitive edge in the dynamic mining industry trends.

Vale's commitment to research and development is evident through both internal expertise and collaborations with external innovators. This strategy supports the company's goals of increasing productivity and reducing costs. The integration of advanced technologies aims to improve safety and environmental performance, aligning with broader Vale's sustainability initiatives.

A core aspect of Vale's strategy involves the increased adoption of automation in mining operations. This includes autonomous drilling and truck fleets, which aim to improve safety, reduce operational costs, and enhance productivity. These initiatives are part of the company's broader efforts to streamline its operations and adapt to the evolving Brazilian mining landscape.

Vale is leveraging digital technologies such as AI and IoT to optimize its supply chain. These tools help in predicting equipment failures and improving resource utilization. This digital transformation directly supports Vale's future investment plans.

The company is implementing autonomous drilling rigs and trucks to improve efficiency and safety. These technologies are deployed across several operations, demonstrating a commitment to innovation. This contributes to Vale financial performance.

Vale is focused on sustainability, including tailings management solutions and carbon emission reductions. The company has set ambitious targets, aiming for a 30% reduction in greenhouse gas emissions by 2030. These initiatives are key to Vale's ESG performance.

Vale is exploring innovative technologies for dry processing of iron ore to reduce water consumption. This technology significantly reduces the need for tailings dams. This approach aligns with Vale's company's long-term goals.

Vale invests significantly in research and development, both internally and through collaborations. This investment supports the continuous improvement of operational efficiency and sustainability. This also helps in analyzing Vale company analysis.

Vale aims to achieve carbon neutrality by 2050. This ambitious goal underscores the company's commitment to environmental stewardship. This is part of the broader discussion on Vale's market share in iron ore.

Vale's innovation strategy centers on digital transformation, automation, and sustainability. The company is focused on integrating advanced technologies to improve operational efficiency and reduce environmental impact. These strategies also align with the company's core values, as discussed in Mission, Vision & Core Values of Vale.

- Automation: Implementing autonomous systems in mining operations.

- Digitalization: Utilizing AI and IoT for supply chain optimization and predictive maintenance.

- Sustainability: Developing dry processing technologies and reducing carbon emissions.

- R&D: Investing in research and development to drive innovation.

- Carbon Reduction: Targeting a 30% reduction in emissions by 2030.

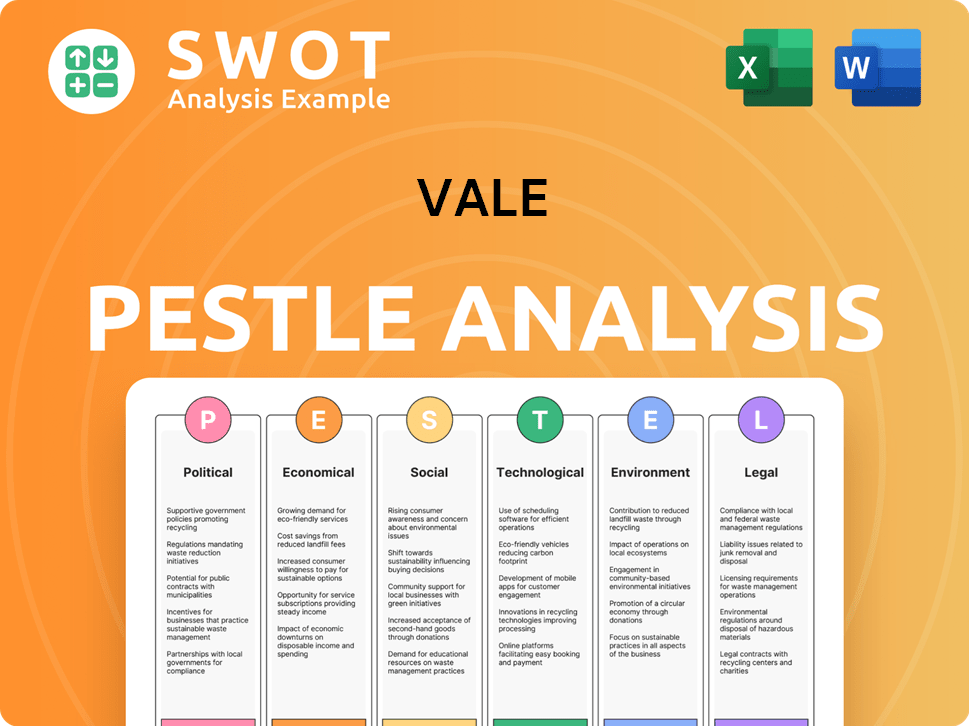

Vale PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vale’s Growth Forecast?

The financial outlook for Vale reflects its strategic focus on growth and shareholder value. The company anticipates strong financial results, supported by favorable commodity prices and increased production volumes, particularly in iron ore and energy transition metals. This positive outlook is crucial for understanding the Owners & Shareholders of Vale and their investment decisions.

For 2024, Vale projects iron ore production to be in the range of 310-320 million tonnes. Capital expenditure (CAPEX) for 2024 is planned to be around $6.0 billion, demonstrating continued investment in key projects and operational improvements. These investments are designed to enhance operational efficiency and support long-term growth within the mining industry trends.

Vale's financial strategy emphasizes disciplined capital allocation to optimize returns while maintaining a strong balance sheet. The company has consistently achieved strong profit margins, reflecting its operational efficiencies and market leadership. In its 2024 financial reports, Vale has highlighted its commitment to shareholder returns through dividends and share buyback programs, while also investing in future growth. Analyst forecasts for Vale in 2025 generally indicate continued strong performance, driven by global demand for raw materials and the company's strategic positioning in critical minerals.

Vale's growth strategy in 2024 focuses on increasing production, particularly in iron ore, and expanding its presence in energy transition metals. This includes strategic investments in key projects and operational improvements to enhance efficiency and output. These initiatives are designed to capitalize on rising demand and maintain its competitive edge.

Vale's future investment plans include significant capital expenditures to support its growth objectives. A substantial portion of these investments will be allocated to projects that increase iron ore production capacity. The company is also focusing on diversifying its portfolio by investing in energy transition metals to meet the growing demand for sustainable resources.

Iron ore prices significantly impact Vale's financial performance. Higher iron ore prices typically lead to increased revenue and profitability, benefiting the company's bottom line. Conversely, a decline in prices can negatively affect earnings. Vale's ability to manage production costs and operational efficiency is crucial in navigating price fluctuations.

Vale is committed to sustainability, with initiatives focused on reducing its environmental footprint and promoting responsible mining practices. These initiatives include investing in cleaner technologies, reducing emissions, and improving waste management. These efforts are crucial for long-term sustainability and aligning with ESG performance goals.

Vale holds a significant market share in the global iron ore market, making it a key player in the mining industry. Its market position is supported by its large-scale operations and high-quality iron ore production. This strong market presence allows Vale to influence pricing and maintain its competitive advantage.

Vale's primary revenue stream is derived from the sale of iron ore, which accounts for a significant portion of its total revenue. The company also generates revenue from the sale of other minerals and metals, including nickel and copper. Diversifying revenue streams is a key strategy for mitigating risks.

Vale's competitive advantages include its large-scale, high-quality iron ore reserves, efficient operations, and strategic location in Brazil. The company's integrated supply chain and strong relationships with customers also contribute to its competitive edge. These advantages support its ability to withstand market volatility.

Vale's expansion strategies in Brazil involve increasing production capacity at existing mines and developing new projects. These strategies are designed to capitalize on the country's rich mineral resources and growing demand for iron ore. The company is also focused on improving infrastructure to support its operations.

Vale's diversification plans include expanding its presence in energy transition metals, such as nickel and copper, to reduce its reliance on iron ore. The company is also exploring opportunities in other commodities to create a more balanced portfolio. This diversification strategy aims to enhance long-term growth and resilience.

Vale's ESG performance is a critical factor in its long-term success. The company is focused on reducing its environmental impact, improving social responsibility, and enhancing corporate governance. Strong ESG performance helps attract investors and ensures sustainable operations. This focus is essential for long-term value creation.

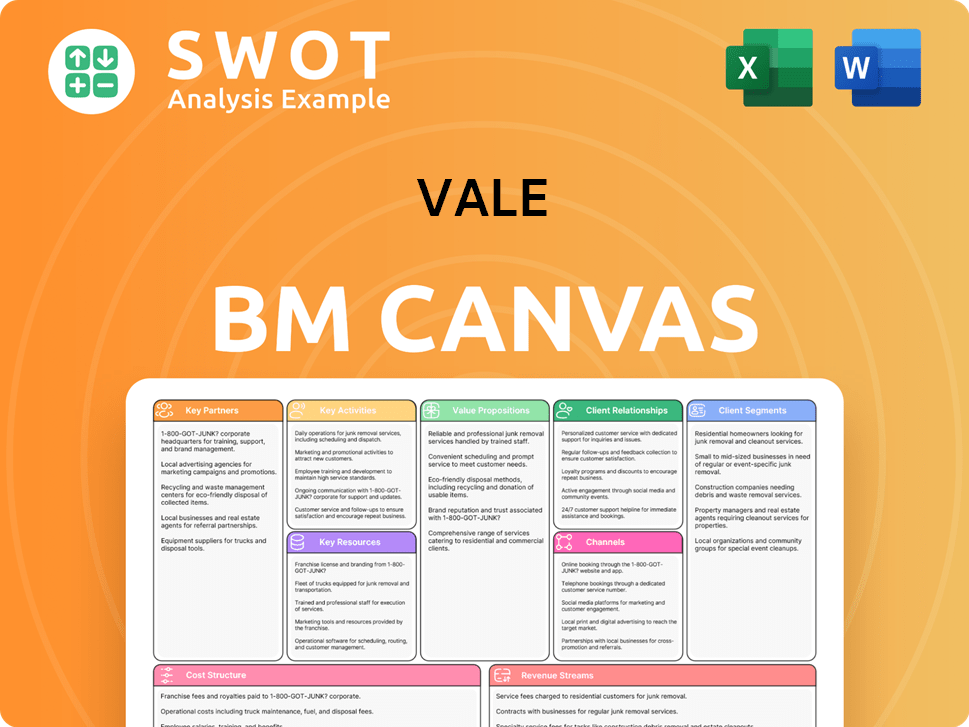

Vale Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vale’s Growth?

The path toward realizing the Vale growth strategy and its Vale future prospects is not without its challenges. The mining industry is inherently risky, and Vale company analysis reveals several potential obstacles that could impact its operational and financial performance. These risks range from market dynamics and commodity price volatility to regulatory changes and supply chain disruptions.

Understanding these potential pitfalls is crucial for investors and stakeholders. Addressing these challenges proactively is essential for ensuring the company's long-term success and sustainable growth. The following sections detail the key risks and obstacles that Vale faces.

The mining industry is highly competitive. Vale's market share in iron ore and other commodities faces pressure from major global mining companies and emerging players. Competition can affect pricing, market share, and profitability, directly impacting Vale's financial performance.

Impact of iron ore prices on Vale is significant, as well as the prices of nickel and copper. Price volatility can lead to unpredictable revenue streams. Economic slowdowns or geopolitical instability can exacerbate these fluctuations, directly affecting Vale's revenue streams.

Changes in environmental regulations and mining licenses, especially in Brazil, can cause operational delays and increase compliance costs. Stricter environmental permitting processes can affect project timelines. Vale's sustainability initiatives must align with evolving regulatory landscapes.

Disruptions in logistics, labor disputes, or other supply chain issues can impede production and delivery. These disruptions can lead to increased costs and reduced output. Proactive supply chain management is crucial for operational efficiency.

What are the challenges for Vale company related to tailings dam safety requires significant investments. The company has committed approximately $2.6 billion in dam safety and decommissioning by 2027. Addressing these safety concerns is critical for long-term sustainability.

Increasing scrutiny on Environmental, Social, and Governance (ESG) factors requires continuous adaptation and investment in sustainable practices. Strong Vale's ESG performance is essential for attracting investors and maintaining a positive reputation. Learn more about the company's marketing strategies in Marketing Strategy of Vale.

Vale's company profile and overview reveals that the company employs comprehensive risk management frameworks. These frameworks help identify, assess, and mitigate potential risks across its operations. Diversification of its asset base reduces reliance on any single commodity or geographic region.

Proactive engagement with stakeholders, including regulatory bodies, communities, and investors, is essential. Open communication and collaboration can help address concerns and build trust. This approach supports Vale's expansion strategies in Brazil and other regions.

Investments in sustainable practices, including environmental remediation and community development, are crucial. Vale's future investment plans include initiatives to reduce its environmental footprint. These efforts support Vale's long-term goals.

Maintaining a strong financial position is vital for weathering economic downturns and commodity price fluctuations. Prudent financial management and cost control measures are critical. These strategies are essential for navigating mining industry trends.

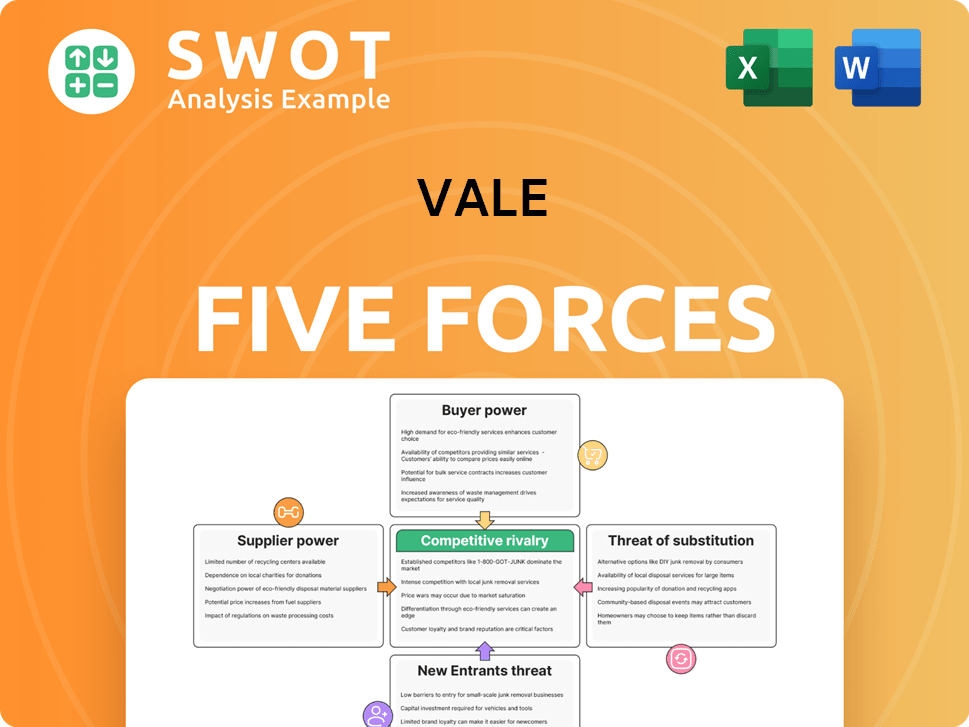

Vale Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vale Company?

- What is Competitive Landscape of Vale Company?

- How Does Vale Company Work?

- What is Sales and Marketing Strategy of Vale Company?

- What is Brief History of Vale Company?

- Who Owns Vale Company?

- What is Customer Demographics and Target Market of Vale Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.