Vale Bundle

How Does Vale Company Thrive in the Global Mining Arena?

Vale S.A., a titan in the Vale SWOT Analysis, is a global mining powerhouse, essential to industries worldwide. As the world's largest iron ore and nickel producer, Vale's operations are fundamental to sectors ranging from steel to electric vehicles. Understanding Vale's inner workings is critical for anyone tracking the mining industry's performance and global commodity markets.

This exploration of Vale Company will reveal its core operations, revenue streams, and strategic decisions. We'll examine its Vale mining activities, competitive landscape, and future outlook, including its iron ore production and sustainability efforts. This in-depth look offers valuable insights into the Vale operations, its impact on the Brazilian mining sector, and its position within the broader mining industry and global economy, providing a comprehensive understanding of this industry leader.

What Are the Key Operations Driving Vale’s Success?

The core operations of the Vale Company are centered on extracting, processing, and selling essential raw materials. These include iron ore and nickel, along with other commodities like copper, manganese ore, and bauxite. The company's value proposition lies in providing high-quality raw materials crucial for global industrial production, serving sectors such as steel, automotive, electronics, and energy.

The operational processes encompass the entire mining value chain, from geological exploration and mine planning to ore extraction, beneficiation, logistics, and global distribution. This integrated approach ensures efficiency and quality control throughout the production cycle. Vale mining operations are extensive and strategically positioned to meet global demand.

A key aspect of Vale's operations is its integrated logistics network, which includes extensive railway systems, ports, and shipping fleets. This infrastructure is vital for efficiently transporting vast quantities of materials from its mines, particularly in Brazil, to global markets. For example, its Carajás mine in Brazil, a major source of high-grade iron ore, relies heavily on the Estrada de Ferro Carajás (EFC) railway and the Ponta da Madeira port for export. The company's supply chain is characterized by its large-scale, capital-intensive nature, with a focus on optimizing production costs and ensuring consistent supply. Partnerships with global shipping companies and local logistics providers further enhance its distribution capabilities. Considering the company's financial performance, understanding its operational efficiency is crucial. You can learn more about its growth strategy in the article Growth Strategy of Vale.

Vale is a leading producer of iron ore, with significant production volumes. The company's iron ore production is a critical component of its revenue and profitability. Understanding its iron ore production capacity is essential for assessing its overall financial health.

Vale is also a major nickel producer, catering to the growing demand for nickel in various industries. Its nickel production is strategically important, contributing to its diversified commodity portfolio. The company's nickel operations are a key aspect of its overall business model.

Vale's extensive logistics network, including railways, ports, and shipping, is a significant competitive advantage. This infrastructure enables efficient transportation of raw materials to global markets. The efficiency of its logistics directly impacts its operational costs and profitability.

Strong customer relationships are crucial for Vale's success, ensuring consistent demand for its products. Long-standing relationships with key customers, particularly in the steel industry, provide stability. These relationships are a key factor in the company's operational effectiveness.

Vale's operational advantages include vast reserves of high-quality iron ore and an efficient logistics network. Its Carajás iron ore, known for high iron content, offers a competitive edge. The company's focus on sustainability and safety further enhances its operational profile.

- High-Quality Iron Ore: Carajás iron ore with high iron content and low impurities.

- Extensive Logistics: Integrated railway, port, and shipping infrastructure.

- Customer Relationships: Long-standing relationships with key customers.

- Sustainability: Commitment to sustainable mining practices.

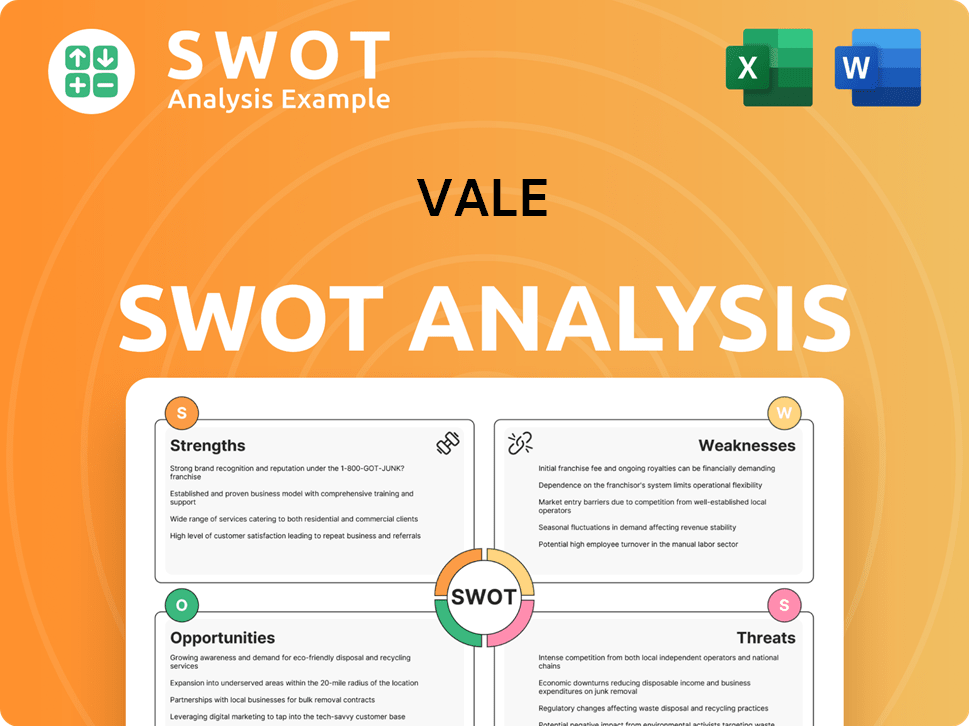

Vale SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vale Make Money?

Understanding the revenue streams and monetization strategies of the Vale Company is crucial for grasping its financial performance and operational dynamics. The company, a major player in the global mining industry, generates revenue primarily from the sale of its mineral products. This chapter breaks down the specifics of its revenue sources and how it turns those resources into profit.

The company's approach to generating revenue is centered on the extraction and sale of various minerals. Its monetization strategies involve selling these commodities at market prices, along with long-term contracts and logistics services. The geographical distribution of its sales, particularly the focus on the Asian market, plays a significant role in its overall financial strategy.

In the first quarter of 2025, the majority of the company's gross operating revenue came from iron ore fines and pellets. Base metals, including nickel and copper, also contribute significantly to the company's revenue. Other materials, such as manganese ore, ferroalloys, and bauxite, make up the remaining revenue streams.

The company's monetization strategy hinges on selling its products at prevailing market prices, which are influenced by global supply and demand. Long-term contracts with key customers provide a degree of revenue stability. The company also generates revenue from logistics services provided to third parties through its rail and port infrastructure. The company's strategy includes:

- Iron Ore and Pellets: Representing the largest portion of revenue, these are sold based on market prices, with a significant portion going to Asia, especially China.

- Base Metals: Nickel and copper sales are globally diversified, serving various industrial sectors. Their revenue contribution fluctuates with global commodity prices and production volumes.

- Other Materials: Manganese ore, ferroalloys, and bauxite contribute to the remaining revenue, diversifying the company's product portfolio.

- Logistics Services: Revenue is generated from providing logistics services to third parties, leveraging its extensive rail and port infrastructure.

- Strategic Focus: The company aims to optimize its product mix, focusing on higher-grade iron ore products and expanding its base metals portfolio to capture value from the growing demand for materials critical to the energy transition.

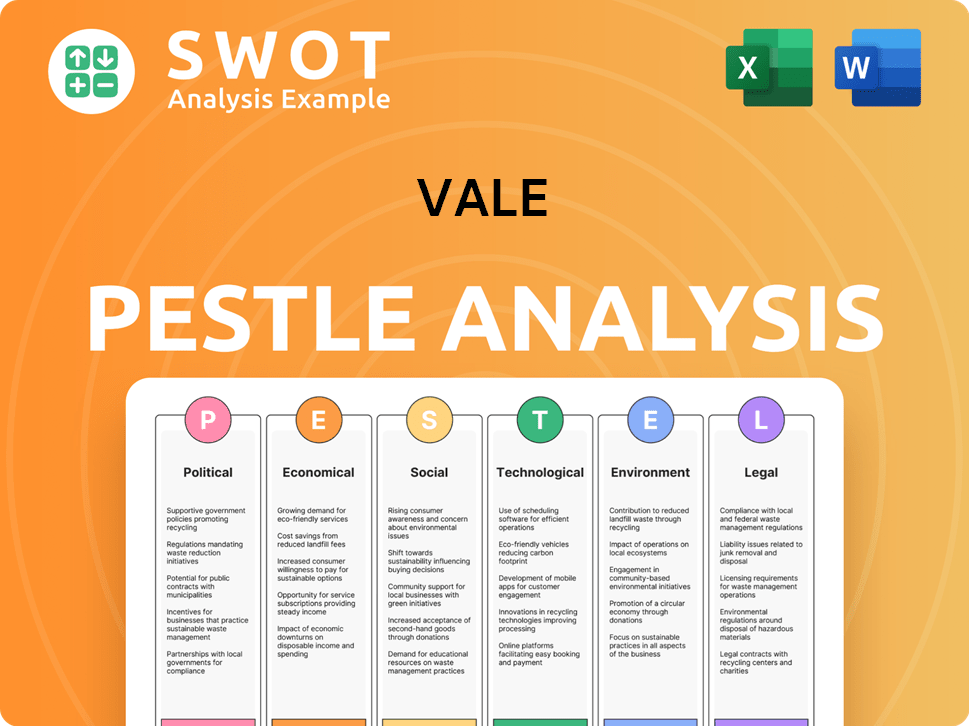

Vale PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vale’s Business Model?

The history of the Vale Company is marked by significant milestones that have shaped its operational and financial landscape. The expansion of its S11D iron ore mine in Carajás, a project aimed at increasing high-grade iron ore production, was a pivotal strategic move. The company has also faced significant operational challenges, including the Brumadinho dam collapse in 2019, which led to a substantial reduction in iron ore output, increased regulatory scrutiny, and significant financial provisions for remediation and compensation.

Vale's response included a comprehensive plan for dam decommissioning and a renewed focus on safety and sustainability, impacting its operational footprint and capital allocation. The company's competitive advantages are rooted in its vast, high-quality mineral reserves, particularly its world-class iron ore deposits. Its extensive and integrated logistics infrastructure, including railways and ports, provides a significant cost advantage in transporting its products to global markets.

Vale also benefits from economies of scale, allowing it to operate efficiently at a massive scale. Furthermore, its long-standing relationships with global customers and its brand recognition within the mining industry contribute to its competitive edge. In adapting to new trends, Vale has been increasingly focused on decarbonization efforts, investing in technologies and processes to reduce its carbon footprint, and exploring opportunities in minerals essential for the energy transition, such as nickel and copper for electric vehicle batteries.

Vale has a long history in the Brazilian mining sector. A major milestone was the expansion of the S11D iron ore mine in Carajás, boosting high-grade iron ore production. The Brumadinho dam collapse in 2019 significantly impacted operations. The company has been working to improve its safety record.

Vale focuses on increasing iron ore production and improving its environmental and social performance. They are investing in technologies to reduce their carbon footprint. The company is also exploring opportunities in minerals like nickel and copper.

Vale's competitive advantages include vast, high-quality mineral reserves, especially iron ore. Its integrated logistics, including railways and ports, gives it a cost advantage. Economies of scale and strong customer relationships also contribute to its success. For more information, check out the Competitors Landscape of Vale.

Vale is actively working on decarbonization efforts and investing in minerals crucial for the energy transition. In 2024, Vale's iron ore production reached approximately 308.8 million metric tons. The company is also focusing on improving its safety record and remediating environmental impacts.

Vale's operations involve significant financial considerations and environmental impacts. In 2024, Vale's net operating revenue was approximately $40.7 billion. The company's focus on sustainability and safety continues to shape its operational strategies.

- Iron ore production is a core activity.

- Significant investments in logistics and infrastructure.

- Commitment to reducing carbon emissions.

- Ongoing efforts to improve safety and environmental performance.

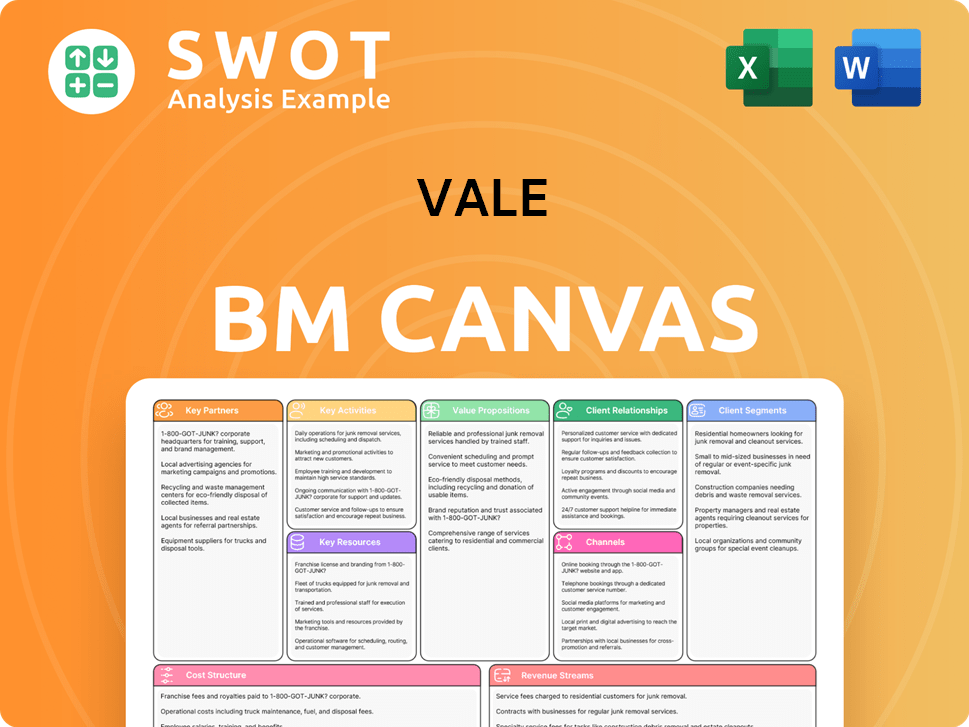

Vale Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vale Positioning Itself for Continued Success?

The Vale Company holds a prominent position in the global mining industry, particularly in iron ore and nickel. As the world's largest iron ore producer, it significantly influences market dynamics. Its operations are spread across multiple continents, ensuring a broad reach within the mining industry.

The company faces several risks, including commodity price volatility, regulatory changes, and environmental concerns. To mitigate these challenges, Vale mining is focusing on operational stability, portfolio optimization, and investments in base metals. The company's future outlook involves navigating market uncertainties while strengthening its position as a sustainable mining leader.

Vale is the world's largest iron ore producer and a major player in the nickel market. This dominant position gives it significant influence over global supply and pricing, especially in the context of Brazilian mining. Its high-grade iron ore products command a premium, fostering strong customer loyalty.

Commodity price fluctuations, driven by global economic trends and industrial demand, pose a significant risk. Regulatory changes, particularly in Brazil, concerning environmental licensing and dam safety, can disrupt operations. The emergence of new competitors and technological shifts in steelmaking also present challenges.

Vale operations are geared towards adapting to market volatility while prioritizing sustainability. The company aims to expand its profitability through a diversified portfolio and investments in high-demand minerals, supporting the energy transition. For more details, you can read about the Growth Strategy of Vale.

Vale is focusing on safety, operational stability, and optimizing its asset portfolio. Investments in growth projects for base metals are a priority, aligning with the energy transition. The company is also committed to achieving carbon neutrality by 2050.

In recent reports, Vale has shown resilience in iron ore production, with consistent output despite market challenges. The company's focus on cost management and operational efficiency has helped maintain profitability. Vale continues to invest in projects that enhance its long-term sustainability and market position.

- Vale's iron ore production in 2024 reached approximately 300 million metric tons.

- The company's commitment to ESG (Environmental, Social, and Governance) factors is reflected in its sustainability reports.

- Vale's strategic investments in base metals are aimed at capitalizing on the growing demand for materials used in electric vehicles and renewable energy infrastructure.

- The company has shown strong financial results, with revenues and profits remaining stable despite fluctuations in commodity prices.

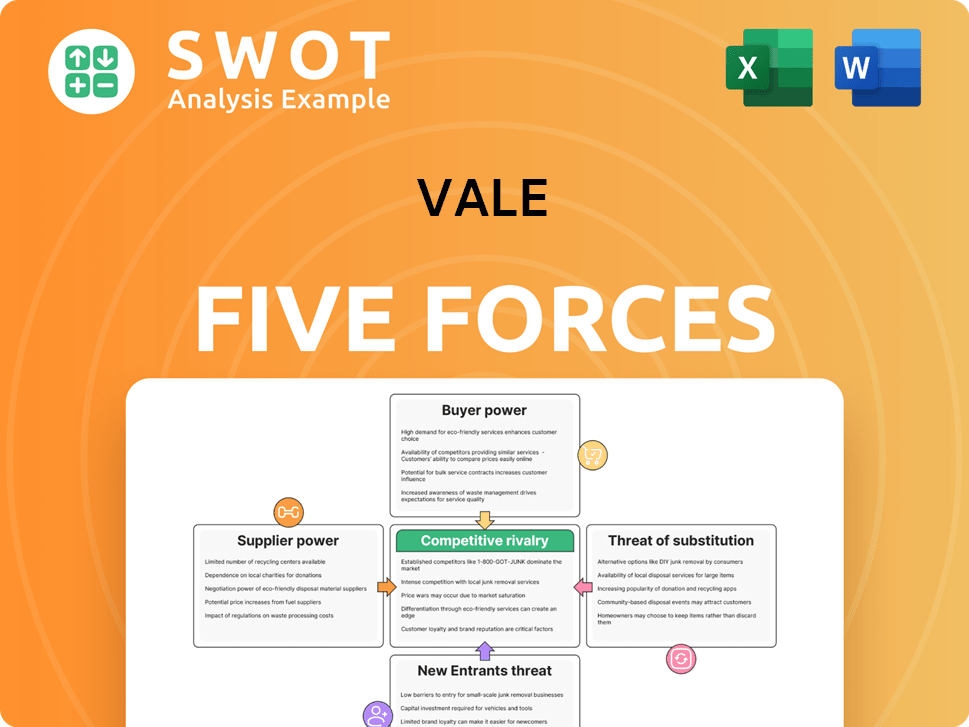

Vale Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vale Company?

- What is Competitive Landscape of Vale Company?

- What is Growth Strategy and Future Prospects of Vale Company?

- What is Sales and Marketing Strategy of Vale Company?

- What is Brief History of Vale Company?

- Who Owns Vale Company?

- What is Customer Demographics and Target Market of Vale Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.