Vale Bundle

How does Vale S.A. dominate the global mining arena?

Vale, a global mining giant, shapes the iron ore and nickel markets. Its strategic decisions and production capacity have a substantial impact on worldwide commodity prices and supply chains. Understanding Vale's competitive landscape is crucial for anyone tracking the Vale SWOT Analysis. This analysis will help you understand how Vale maintains its formidable position.

This deep dive into Vale's competitive landscape will examine its primary rivals and the factors that set it apart. We'll explore Vale's market position within the mining industry overview, considering current mining industry trends and its strategic partnerships. This analysis will also provide insights into Vale's financial performance analysis and its global presence, offering a comprehensive view of its challenges and opportunities in the ever-changing mining sector.

Where Does Vale’ Stand in the Current Market?

Analyzing the Brief History of Vale reveals its dominant market position in the mining industry. Vale is a leading global producer of iron ore and nickel. In 2024, its iron ore production targets were set at between 310-320 million tonnes, solidifying its significant contribution to the global supply. This makes understanding the Vale competitive landscape crucial for investors and industry analysts.

Vale's market share in seaborne iron ore is substantial, often positioning it as a price setter. Beyond iron ore, Vale is a major nickel producer, essential for stainless steel and electric vehicle batteries. The company's strategic focus on increasing copper and nickel output aims to meet the growing demand from the energy transition. Vale's commitment to a 'premiumization' strategy for its iron ore focuses on higher-grade products.

Vale's global footprint spans five continents, with primary iron ore mining operations concentrated in Brazil. The company serves various customer segments, including steel manufacturers and automotive industries. In the first quarter of 2024, Vale reported an adjusted EBITDA of $6.3 billion, reflecting strong operational performance. However, Vale faces challenges related to environmental regulations and community relations in certain regions, impacting its operational flexibility and expansion plans.

Vale's substantial iron ore production capacity significantly influences the mining industry trends. Its market share in seaborne iron ore is a key factor in the global supply chain. Vale's production targets for 2024 are set to maintain its leading position.

Vale has a vast global presence, with operations across five continents. Its primary iron ore mining operations are concentrated in Brazil. Vale serves a broad customer base, including steel manufacturers and automotive industries.

Vale's financial health is robust, with an adjusted EBITDA of $6.3 billion in Q1 2024. The company's financial performance reflects its operational efficiency. Analyzing Vale's financial performance is crucial for understanding its competitive advantages.

Vale is undergoing a strategic transformation, focusing on increasing copper and nickel output. The company aims to increase copper production to 395,000-430,000 tonnes and nickel production to 160,000-175,000 tonnes in 2024. This strategic shift aims to meet the growing demand from the energy transition.

Understanding the Vale market position requires an analysis of its competitive landscape, including Vale competitors. Vale's strategic focus on higher-grade products, or 'premiumization,' aims to improve profitability. The company's global presence and diverse customer base are key aspects of its market strength.

- Dominant position in iron ore and nickel production.

- Strategic focus on increasing copper and nickel output.

- Commitment to 'premiumization' of iron ore products.

- Significant global footprint and diverse customer base.

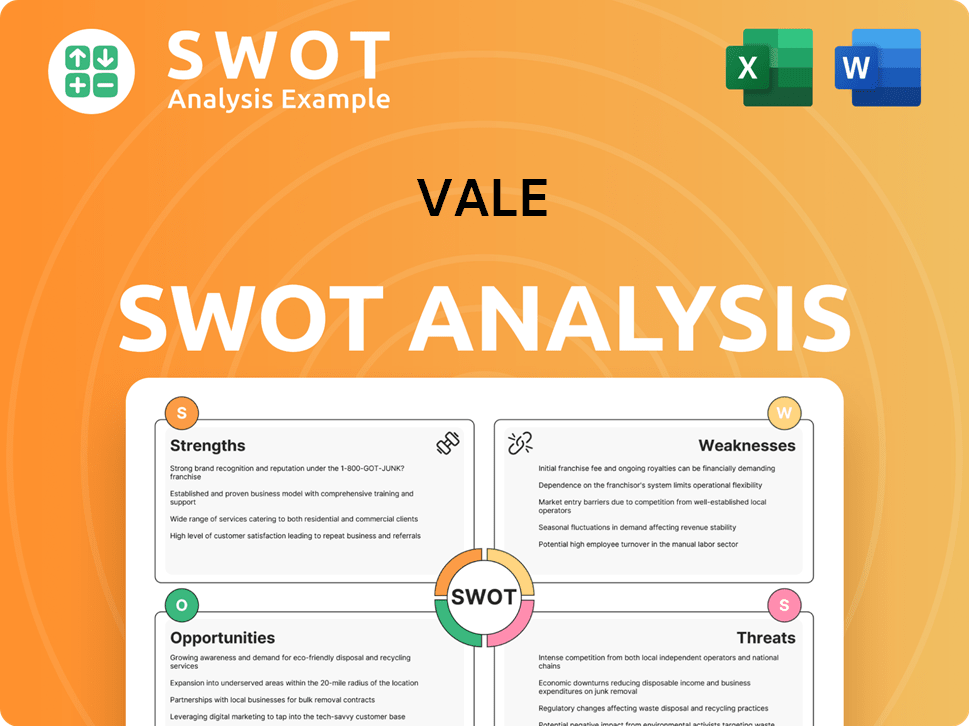

Vale SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vale?

The Owners & Shareholders of Vale faces a dynamic and fiercely competitive global mining industry. The company's success hinges on its ability to navigate this landscape, managing challenges from established players and emerging competitors alike. Understanding the competitive dynamics is crucial for assessing Vale's market position and future prospects.

In the iron ore sector, Vale’s primary competitors are formidable global mining companies. These competitors leverage scale, operational efficiency, and strategic market positioning to challenge Vale’s dominance. The nickel market presents a different set of challenges, with competition intensifying due to the rising demand for electric vehicle batteries and the evolving landscape of sustainable mining practices.

The competitive landscape for Vale is shaped by factors such as market share, pricing strategies, and compliance with environmental, social, and governance (ESG) criteria. The company must continually adapt to maintain its competitive edge, focusing on operational excellence, innovation, and strategic partnerships.

Vale's main competitors in the iron ore market include Rio Tinto, BHP Group, and Fortescue Metals Group (FMG). These companies compete with Vale through their production volumes, operational efficiency, and market reach. They challenge Vale's position in key markets like China.

In the nickel market, Vale faces competition from Norilsk Nickel (Nornickel), Glencore, and regional producers. The increasing demand from the electric vehicle battery sector is reshaping the competitive landscape, leading to new entrants and strategic partnerships. The competition is also influenced by the growing importance of sustainable and ethically sourced nickel.

The battle for market share in key import regions is a key aspect of the competitive landscape. Pricing strategies and the ability to meet ESG criteria are crucial for success. Vale must continually adapt to these market dynamics to maintain its competitive advantage.

Operational efficiency is a critical factor in the competitive landscape. Competitors like BHP Group have highly efficient supply chains. Vale must focus on its operational performance to remain competitive.

Environmental, social, and governance (ESG) criteria are increasingly important. Investors and consumers demand sustainable and ethical practices. Vale's ESG performance is a key factor in its competitive positioning.

Strategic partnerships are becoming more important, especially in the nickel market. These partnerships can help companies secure resources and meet the growing demand for electric vehicle batteries. Vale's ability to form and manage these partnerships will impact its competitive position.

Vale's competitive advantages include its significant iron ore production capacity and its global presence. However, the company faces challenges from competitors with lower production costs and more efficient supply chains. The company's ability to navigate these challenges will determine its future success.

- Production Capacity: Vale has a substantial iron ore production capacity, making it a major player in the global market.

- Global Presence: The company operates in multiple countries, giving it access to diverse markets and resources.

- Cost Efficiency: Competitors like FMG focus on cost efficiency, which presents a challenge for Vale.

- ESG Compliance: Meeting stringent ESG criteria is essential for attracting investors and customers.

- Market Dynamics: Changing market dynamics, including demand from China, impact the competitive landscape.

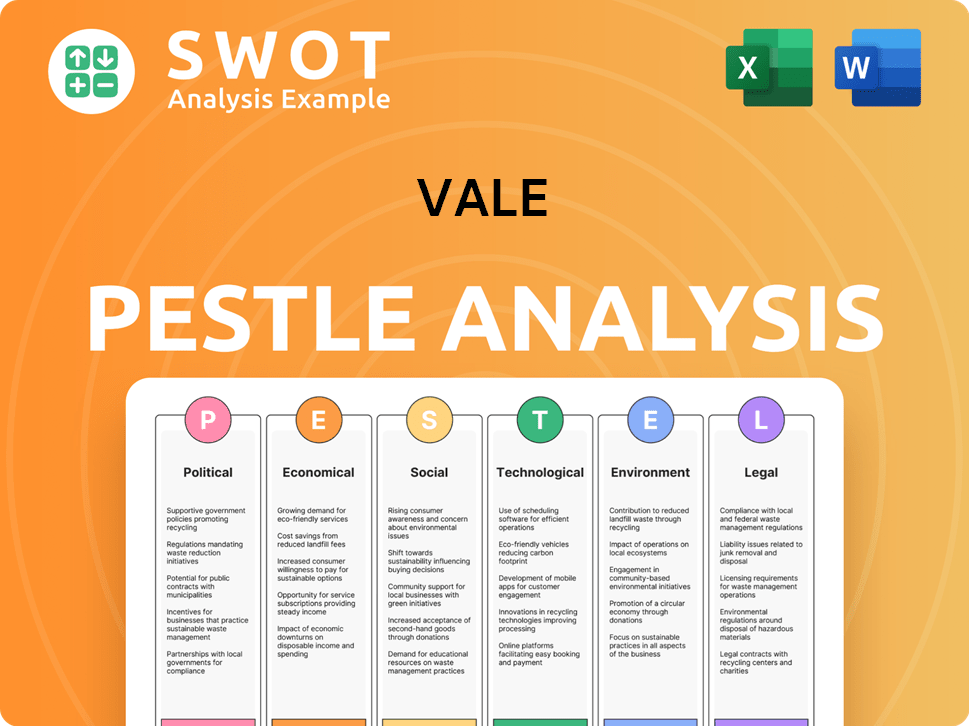

Vale PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vale a Competitive Edge Over Its Rivals?

Understanding the Vale competitive landscape involves recognizing its significant advantages in the global mining industry. As a leading player, the company leverages its extensive resources, infrastructure, and strategic initiatives to maintain a strong market position. This analysis provides a detailed look at how Vale competes and the key factors that shape its success.

Vale company analysis reveals a business deeply rooted in operational excellence and strategic foresight. The company's ability to adapt to market dynamics and invest in sustainable practices further strengthens its position. Furthermore, its commitment to innovation and efficiency ensures it remains competitive in a dynamic global market.

The Vale market position is bolstered by its focus on high-quality assets and integrated logistics. This approach allows Vale to efficiently deliver its products to global markets, establishing a competitive edge. The company's strategic partnerships and investments in technology also contribute to its robust market presence.

Vale's position as the world's largest iron ore producer gives it significant economies of scale. In 2023, Vale produced approximately 300 million metric tons of iron ore. This massive production capacity allows Vale to meet global demand efficiently.

The company's access to high-grade iron ore, particularly from the Carajás mine, is a key differentiator. This high-quality ore commands premium prices. The Carajás mine alone accounts for a significant portion of Vale's production.

Vale's integrated logistics network, including railways, ports, and Valemax vessels, provides a crucial competitive edge. This network ensures efficient transportation of its vast mineral output. This integrated approach reduces costs and enhances supply chain reliability.

Vale's strong brand equity as a reliable supplier in the global commodities market is a significant advantage. The company has a long-standing presence in the global market. This reputation fosters trust and supports its market position.

Vale's competitive advantages are further enhanced by its strategic initiatives and investments in technology. The company focuses on operational efficiencies and innovation to optimize its mining processes and reduce costs. These initiatives are essential for maintaining its competitive edge.

- Premiumization Strategy: Vale focuses on supplying high-grade iron ore to command premium prices.

- Base Metals Focus: Strategic focus on base metals for the energy transition.

- Technological Advancements: Investments in autonomous trucks and digital transformation initiatives.

- Sustainability Initiatives: Commitment to ESG (Environmental, Social, and Governance) practices.

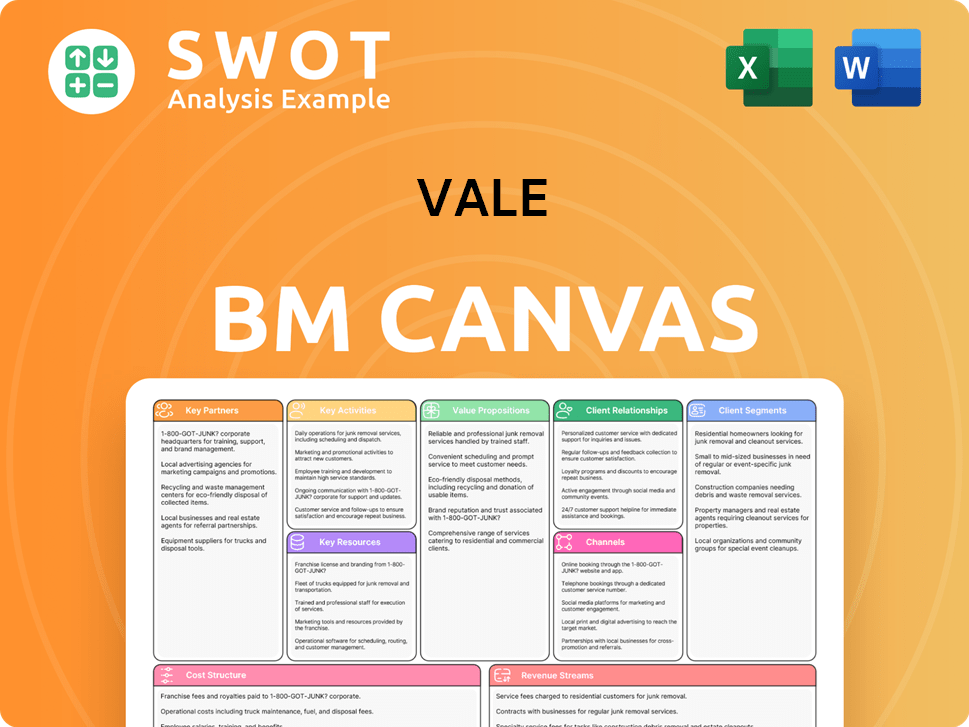

Vale Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vale’s Competitive Landscape?

The global mining industry is experiencing significant transformations, influencing the Vale competitive landscape. Key trends include the increasing focus on decarbonization and the energy transition, leading to rising demand for critical minerals like copper and nickel. Simultaneously, the industry faces pressure to reduce its carbon footprint and adapt to stringent environmental and social governance (ESG) regulations.

Vale company analysis reveals that geopolitical shifts and trade tensions can disrupt supply chains and impact commodity prices. Declining demand for traditional commodities and the emergence of new mining technologies also pose potential threats. However, substantial growth opportunities exist in emerging markets, particularly in Asia, where industrialization and urbanization drive demand for raw materials. Revenue Streams & Business Model of Vale provides additional insights into the company's operations.

The mining industry is increasingly focused on decarbonization and the energy transition. This boosts demand for critical minerals like copper and nickel, essential for electric vehicles and renewable energy infrastructure. There is also a growing emphasis on environmental and social governance (ESG) practices.

Vale competitors face potential threats from declining demand for traditional commodities. New mining technologies could disrupt traditional supply models. Geopolitical shifts and trade tensions can disrupt supply chains and impact commodity prices, creating volatility.

Significant growth opportunities lie in emerging markets, particularly in Asia. Vale's strategic partnerships and investments in innovation can improve operational efficiency and sustainability. The base metals division is well-positioned to benefit from the energy transition.

Vale's global presence allows it to capitalize on demand in emerging markets. The company focuses on its base metals division. It invests in innovation for operational efficiency and sustainability. Strategic partnerships are being explored to unlock new reserves and markets.

Vale's sustainability initiatives are crucial for its long-term success, especially given its past environmental incidents. The company is investing in cleaner technologies and sustainable practices, which is essential for attracting responsible investors. Adapting to evolving trends and proactively addressing challenges will dictate its competitive resilience and market leadership.

- Vale's ESG performance is critical for attracting investors.

- Vale's challenges and opportunities are closely linked to global market trends.

- Vale's recent acquisitions and strategic partnerships expand its market reach.

- Vale's production capacity is a key factor in meeting global demand.

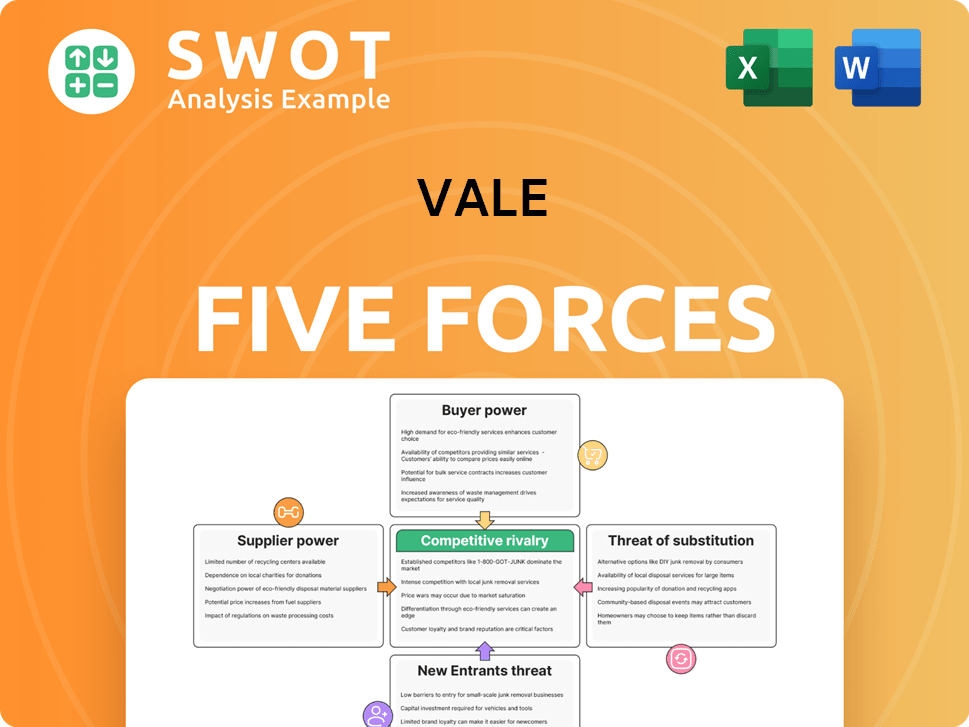

Vale Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vale Company?

- What is Growth Strategy and Future Prospects of Vale Company?

- How Does Vale Company Work?

- What is Sales and Marketing Strategy of Vale Company?

- What is Brief History of Vale Company?

- Who Owns Vale Company?

- What is Customer Demographics and Target Market of Vale Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.