Vale Bundle

Who Buys from Vale Company?

In the complex world of global mining, understanding customer demographics and target markets is not just beneficial—it's essential. For Vale SWOT Analysis, a titan in the industry, knowing its customer base is key to navigating market fluctuations and ensuring sustained profitability. This exploration dives deep into Vale's customer segmentation, revealing the 'who,' 'where,' and 'why' behind its global success.

This deep dive into the Vale Company's customer profile will help you understand the intricacies of its target market. We'll conduct a comprehensive market analysis, examining the company's customer geographic location, their specific needs, and the strategic adaptations Vale employs. This analysis is crucial for anyone seeking to understand the dynamics of the mining industry and the strategies employed by its leaders.

Who Are Vale’s Main Customers?

Understanding the customer demographics and target market is crucial for analyzing the business strategy of Vale Company. Vale operates primarily within a Business-to-Business (B2B) model, serving industrial clients globally. This customer segmentation is essential for understanding Vale's revenue streams and strategic direction.

The company's focus on key industrial sectors highlights its strategic alignment with global economic trends. Market analysis of these segments provides insights into Vale's growth potential and its ability to adapt to changing demands. This customer segmentation strategy is vital for investors and stakeholders.

Vale's target audience analysis reveals a diverse customer base, each with specific needs and preferences. The company's ability to meet these needs directly impacts its financial performance and market position. This analysis is essential for evaluating the company's long-term sustainability and growth prospects.

Steel manufacturers are the primary customers for Vale's iron ore and iron ore pellets, essential for steel production. China is a significant market, accounting for 57.8% of Vale's mineral sales. The demand from this segment is influenced by global infrastructure development and manufacturing activity.

This segment is crucial for Vale's nickel and copper products, essential for electric vehicle (EV) batteries and other electronic components. The demand for nickel in this sector is projected to grow significantly. Nickel-intensive lithium-ion batteries are expected to comprise approximately 70% of the EV market by 2030.

Various minerals supplied by Vale are utilized in construction, reflecting a broad demand across infrastructure projects globally. This segment represents a diverse customer base, contributing to Vale's overall revenue.

Companies within the energy sector utilize Vale's resources for diverse applications. This sector's demand is driven by global energy needs and infrastructure development. This diversification supports Vale's market position.

Iron ore remains Vale's primary revenue driver, contributing approximately 78% of total sales in 2024, while nickel contributed about 12% of revenue ($4.2 billion) in the same year. Over time, Vale has shown a strategic shift towards higher-margin products and a greater focus on energy transition materials like nickel and copper, aligning with global trends towards decarbonization. For more detailed insights, you can refer to this article about Vale's market strategy.

Vale's customer base is segmented into key industrial sectors, each with specific needs. Understanding these segments is crucial for assessing the company's market position and growth potential. This segmentation helps in analyzing the company's strategic direction.

- Steel Manufacturers: Primarily for iron ore.

- Battery and Electronics Manufacturers: Demand for nickel and copper.

- Construction Industry: Utilizes various minerals.

- Energy Sector: Diverse applications of Vale's resources.

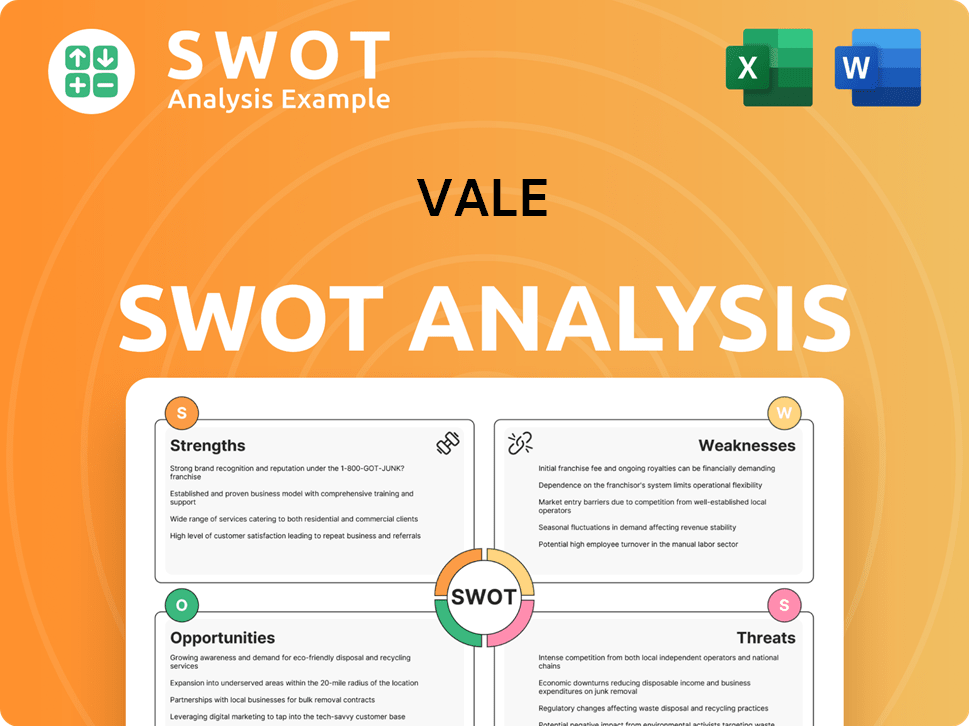

Vale SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Vale’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any company. For the Vale Company, this involves a deep dive into the requirements of its diverse customer base, which spans various industrial sectors. This analysis helps in refining the target market and tailoring product offerings to meet specific demands.

The primary focus for Vale's industrial customers revolves around consistent supply, high product quality, cost efficiency, and a growing emphasis on sustainability. These factors significantly influence the company's strategic decisions, from product development to operational practices. The company continually adapts to meet these evolving needs, ensuring it remains a key player in the mining industry.

The company's approach to addressing customer needs is multifaceted, involving operational improvements, technological investments, and a strong focus on sustainability. This commitment ensures that Vale can effectively serve its target market and maintain its competitive edge. This strategy is essential for navigating the dynamic landscape of the mining industry and meeting the evolving demands of its customers.

Customers, especially in the steel industry, require a reliable supply of high-grade iron ore. This ensures that their steelmaking processes are optimized for efficiency and reduced emissions. Vale's focus on increasing the proportion of higher-grade iron ore in its portfolio is a direct response to this need.

Product quality is paramount, with customers demanding materials that meet stringent specifications. For instance, battery and electronics manufacturers need high-purity, battery-grade nickel. Vale's commitment to quality ensures its products meet these critical requirements.

Cost efficiency is a significant factor for customers, influencing their profitability and competitiveness. Vale's efforts to reduce its C1 cash cost for iron ore fines, which decreased by 10% year-over-year in 2024, demonstrates its commitment to providing cost-effective solutions.

Sustainability is increasingly important, with customers seeking environmentally responsible products. Vale's investments in decarbonization initiatives, totaling R$ 1.38 billion in 2024, reflect its dedication to meeting these evolving preferences.

Vale focuses on operational efficiency to meet customer needs. This includes optimizing mining processes and supply chains to ensure timely delivery and reduce costs. The company's efficiency improvements directly benefit its customers.

Investment in new technologies is crucial for meeting customer demands. This includes developing innovative products like iron ore briquettes and implementing advanced mining techniques. These investments enhance product quality and reduce environmental impact.

Vale's product development is significantly influenced by customer feedback and market trends. The company is actively developing new products and initiatives to meet specific needs, such as reducing carbon emissions in steel production. This customer-centric approach ensures that Vale remains relevant and competitive in the market. For a more in-depth understanding of Vale's strategic direction, consider exploring the Growth Strategy of Vale.

- Iron Ore Briquettes: These can reduce blast furnace emissions by up to 10%, addressing the need for lower-carbon steel production.

- 'Mega Hubs': Focused on low-carbon steel products, these are being implemented with partners in the Middle East, the US, and Brazil, targeting sustainable materials.

- High-Grade Iron Ore: Projects like Vargem Grande and Capanema, ramping up in 2025, are designed to support the demand for higher-grade iron ore.

- Battery-Grade Nickel: Meeting the growing demand from battery and electronics manufacturers for high-purity nickel, essential for EV battery production.

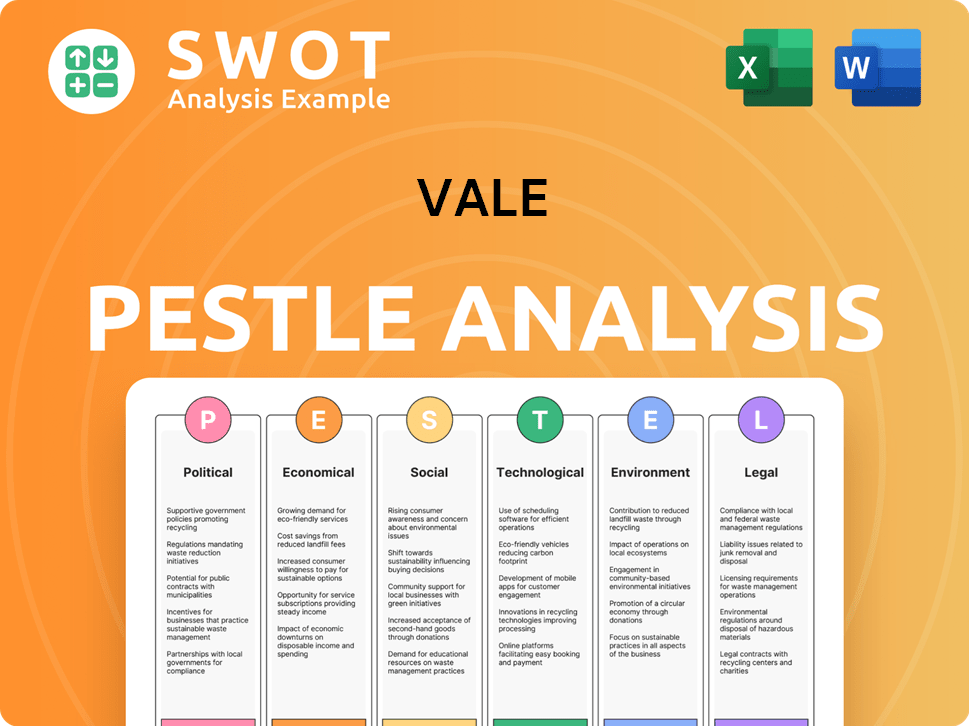

Vale PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Vale operate?

The geographical market presence of the Vale Company is extensive, with operations spread across approximately 30 countries. This global footprint includes the Americas, Europe, Asia, the Middle East, Africa, and Oceania. The company's integrated logistics, encompassing railroads, maritime terminals, and ports, is crucial for supporting its worldwide distribution network, ensuring efficient delivery of its products to various customer segments.

Vale's strategic focus on key markets is evident in its revenue distribution. The company's market analysis reveals a strong emphasis on Asia, Europe, and the Americas, with each region contributing significantly to its overall sales. Understanding the customer demographics and preferences within these diverse regions is critical for tailoring its offerings and maintaining a competitive edge in the mining industry.

Vale's adaptability is highlighted by recent strategic expansions and partnerships. These moves underscore its commitment to localizing its offerings and strengthening its position in key markets, reflecting a proactive approach to customer segmentation and target market analysis. For a deeper dive into the company's origins and evolution, consider reading the Brief History of Vale.

Asia is the largest market for Vale, accounting for 42% of total mineral sales. China is particularly significant within Asia, consuming 57.8% of Vale's revenues geographically. This strong presence is driven by China's robust industrialization and high demand for steel, making it a key target market.

Europe represents 23% of Vale's total mineral sales. The company's customer base in Europe benefits from the region's demand for various minerals, including those used in manufacturing and infrastructure. This market is crucial for Vale's overall revenue and strategic planning.

The Americas account for 35% of total mineral sales. Brazil contributes 7.3%, and the United States contributes 2.6% of Vale's revenues. This region is a key focus for Vale's operations, with significant customer demographics and strategic importance.

In April 2024, Vale partnered with Manara Minerals, acquiring 10% of Vale Base Metals Limited. In December 2024, Vale acquired a 15% stake in Anglo American Minério de Ferro Brasil S.A. These moves aim to boost production and access high-quality iron ore, showing the company's commitment to its target market.

Differences in customer demographics and preferences across regions are evident. For example, the demand for nickel in the electric vehicle sector varies. Vale aims to navigate these complex demand patterns.

- China, Europe, and North America have different battery chemistries.

- Vale is potentially favoring assets with proximity to growth markets in North America and Europe for nickel.

- These strategic decisions reflect a deep understanding of customer needs and preferences.

- Market analysis helps in refining Vale's market segmentation strategy.

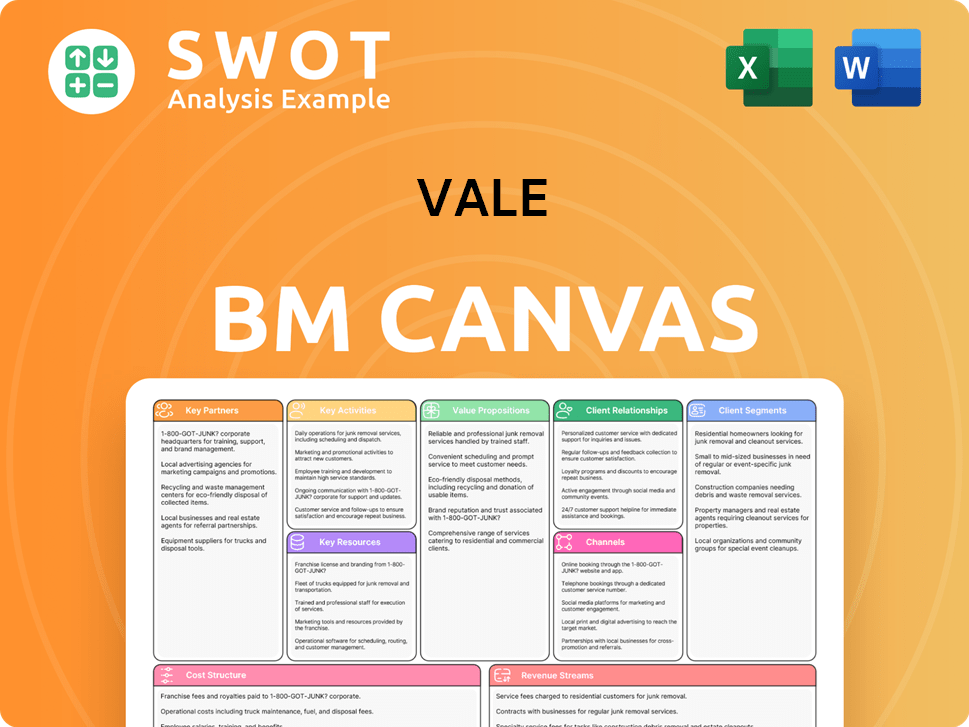

Vale Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Vale Win & Keep Customers?

Customer acquisition and retention strategies for the Vale Company, a significant player in the mining industry, are primarily focused on business-to-business (B2B) relationships. Given its role as a supplier of raw materials, direct consumer marketing is not applicable. Instead, the company concentrates on securing long-term supply agreements and fostering strategic partnerships to maintain a stable customer base.

The company's approach emphasizes operational excellence, product quality, and sustainability. This strategy is designed to build strong, lasting relationships with key customers in the steel, automotive, and construction sectors, ensuring consistent demand for its products. This focus on B2B relationships is crucial for the company's long-term success.

Understanding the Vale Company's customer profile and its market segmentation strategy is essential for grasping its approach to customer acquisition and retention. The company's target audience analysis reveals a focus on major industrial manufacturers globally, particularly those requiring iron ore, nickel, and other minerals. The company's commitment to operational efficiency and sustainability further strengthens its value proposition in a competitive market.

The cornerstone of the company's customer acquisition strategy involves long-term supply agreements. These agreements guarantee consistent demand for its products and create strong, lasting customer relationships. These contracts provide stability and predictability in a volatile market. Learn more about the Revenue Streams & Business Model of Vale.

The company actively engages in joint ventures and strategic partnerships to diversify revenue streams and enhance its market position. A notable example is the partnership with Manara Minerals to accelerate the energy transition metals platform. These collaborations not only secure new markets but also demonstrate a collaborative approach to meeting industry demands.

The company's focus on producing high-grade iron ore and other minerals, coupled with investments in research and development, helps attract and retain customers. The development of iron ore briquettes for lower-carbon steel production is an example of innovation driven by customer needs and environmental trends. This innovation is key for customer retention.

Ensuring timely delivery of high-quality materials and services is vital for customer satisfaction and retention. The company's integrated logistics systems, including its extensive network of railroads, maritime terminals, and ports, are critical to this aspect. Operational stability and efficiency initiatives, which resulted in a 10% year-over-year decrease in C1 cash cost for iron ore fines in 2024, directly benefit customers through competitive pricing.

The company's commitment to sustainable mining practices and decarbonization efforts is becoming a significant differentiator for customer retention. The company invested R$ 1.38 billion in decarbonization initiatives in 2024 and aims to reduce scope 1 and 2 greenhouse gas emissions by 33% by 2030. This aligns with the growing preference of industrial customers for responsibly sourced materials.

Understanding customer needs and preferences is central to the company's strategy. The company focuses on providing high-quality products, ensuring reliable supply, and offering competitive pricing. The company's disciplined capital allocation approach and focus on high-margin products contribute to its long-term value proposition for stakeholders.

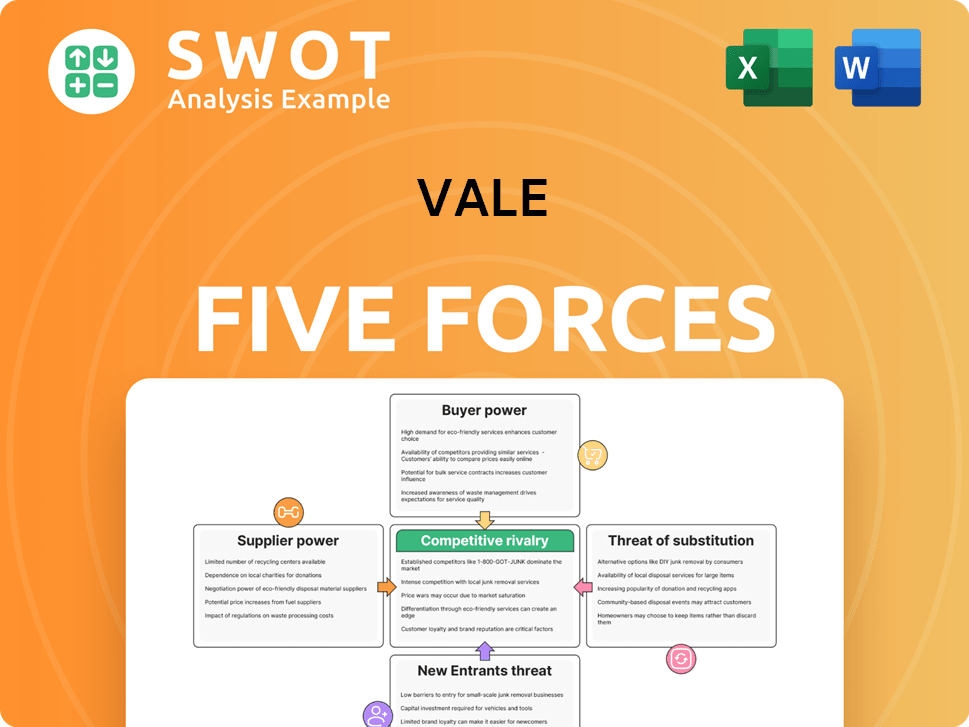

Vale Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vale Company?

- What is Competitive Landscape of Vale Company?

- What is Growth Strategy and Future Prospects of Vale Company?

- How Does Vale Company Work?

- What is Sales and Marketing Strategy of Vale Company?

- What is Brief History of Vale Company?

- Who Owns Vale Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.