Welltower Bundle

How has the Welltower Company shaped the Healthcare Real Estate landscape?

Delve into the compelling Welltower SWOT Analysis to understand its journey. From its humble beginnings in 1970 as Health Care Fund in Lima, Ohio, to its current status as a healthcare real estate powerhouse, Welltower's story is one of strategic evolution and significant impact. Discover how this S&P 500 company has become a leader in the Healthcare REIT sector.

This comprehensive overview of the Welltower company history explores its transformation from a nursing home-focused entity to a diversified portfolio encompassing senior housing and medical office buildings. Learn about its early acquisitions and expansion strategies, which have solidified its position as a major player in the healthcare real estate market. Explore the timeline of Welltower's growth and its impact on senior living.

What is the Welltower Founding Story?

The story of Welltower Inc. begins in 1970, marking the birth of what would become a significant player in the healthcare real estate sector. Founded as Health Care Fund, the company was the brainchild of Frederic D. 'Fritz' Wolfe and Bruce Thompson in Lima, Ohio. This pioneering venture set the stage for the first healthcare-focused real estate investment trust (REIT), a model that would later transform the industry.

Wolfe brought a wealth of experience to the table, having been involved in building nursing homes since 1963 and coming from a background in Wolfe Industries, a diversified family-owned construction business. The founders recognized an opportunity to provide consistent, low-cost capital to fund the essential real estate infrastructure needed for healthcare. Their vision was to become a leader, offering innovative solutions to meet the growing demand for healthcare facilities.

The initial business model was centered on investing in healthcare infrastructure, aiming to deliver stable returns while improving patient care. The company's strategy focused on creating a portfolio of high-quality properties to benefit both investors and the communities they served.

- In 1981, Wolfe founded Health Care & Retirement Corp., which later became Manor Care Inc., now ProMedica Senior Care.

- Health Care Fund was renamed Health Care REIT in 1985.

- The headquarters moved to Toledo, Ohio, in 1986.

- The company's early focus laid the foundation for its future growth in the Welltower company.

Welltower's early focus on healthcare real estate, particularly senior housing, positioned it well for future growth. The company's initial investments in nursing homes and other healthcare facilities set the stage for its expansion and diversification over the following decades. The strategic moves made in the early years, including the establishment of Manor Care Inc., demonstrated a commitment to both property ownership and operational expertise within the healthcare sector.

As of the latest available data, Welltower's portfolio includes properties across various healthcare sectors, reflecting its evolution from its early focus on senior housing. The company's commitment to providing capital for healthcare infrastructure remains a core part of its mission, building on the foundation laid by its founders. The company's history showcases its ability to adapt and grow within the dynamic healthcare real estate market.

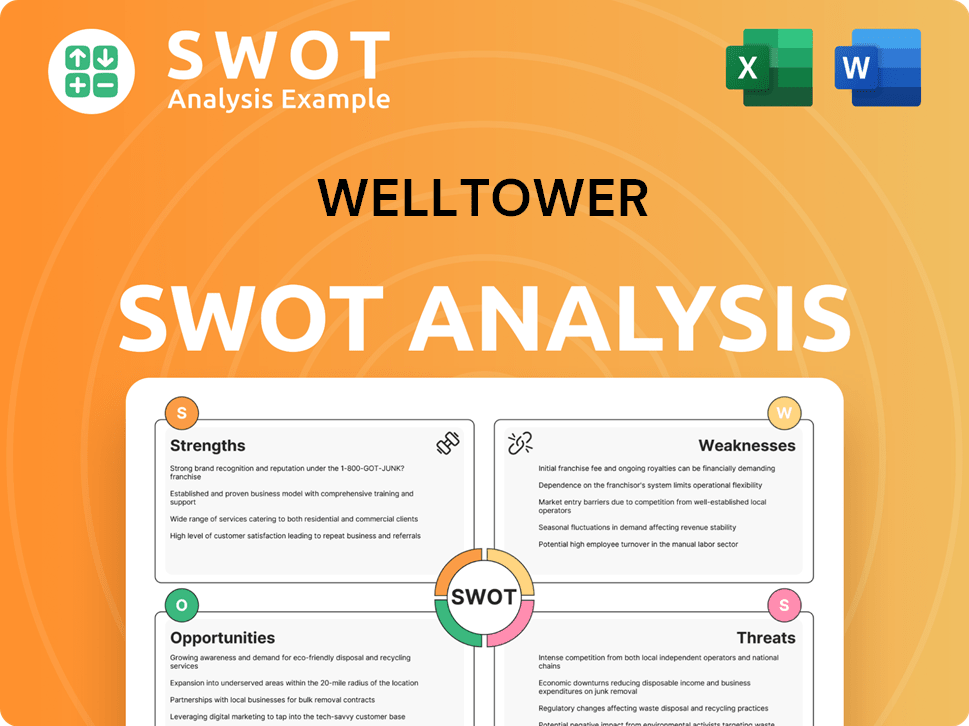

Welltower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Welltower?

The early growth and expansion of Welltower, formerly known as Health Care REIT, involved strategic acquisitions and a focus on healthcare properties. The company's Initial Public Offering (IPO) in 1971 was a crucial step, providing capital for further development. A significant shift occurred in the 1990s, as the company recognized the growing demand for senior care facilities, which became a key driver of its expansion.

Welltower's journey began with its IPO in 1971, which fueled the acquisition and development of healthcare properties. The acquisition of Mediplex Group Inc. in 1985 expanded its portfolio to include psychiatric hospitals and rehabilitation centers. These early moves set the stage for the company's future in the healthcare real estate sector.

The 1990s marked a strategic pivot towards senior housing, recognizing its growing importance. This shift significantly influenced Welltower's investment strategy and became a primary focus. This focus on senior housing has continued to be a key driver for the company's growth and expansion.

In September 2015, the company changed its name to Welltower Inc., reflecting a broader investment focus. This change also signified a shift in its business model, moving beyond traditional nursing homes. This evolution has allowed Welltower to diversify its portfolio and adapt to changing market demands.

Welltower has consistently expanded through acquisitions and joint ventures, particularly in senior housing and healthcare real estate. In the first quarter of 2025, the company completed approximately $2.8 billion of pro rata gross investments. The company's total revenues increased by 20% to $8,991 million in 2024, driven by acquisitions and construction conversions. For more details, check out the Marketing Strategy of Welltower.

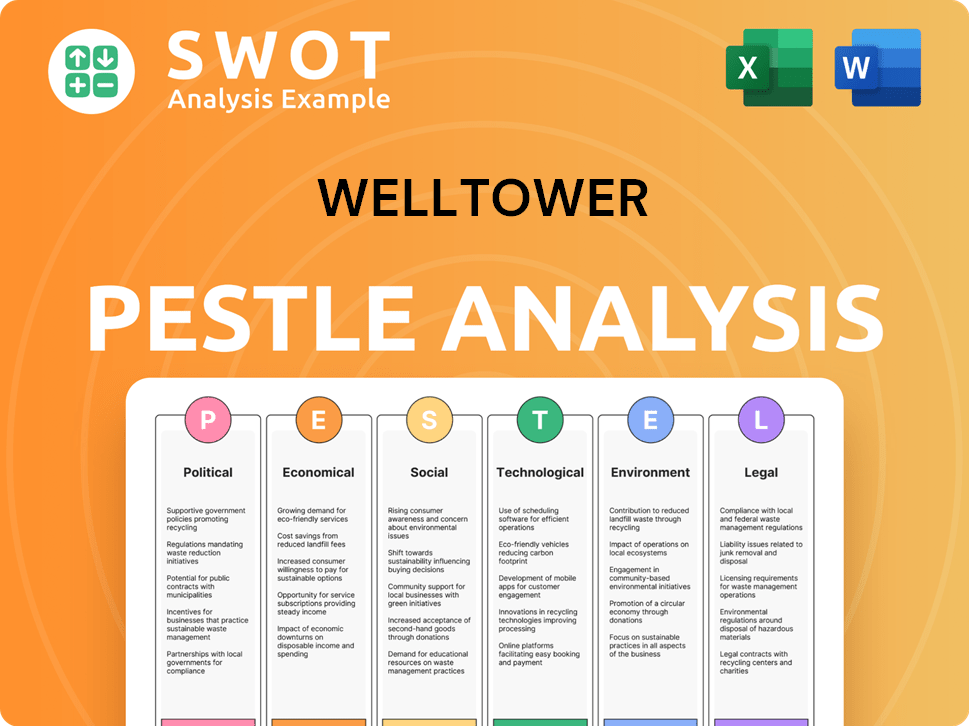

Welltower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Welltower history?

The Welltower company has achieved significant milestones, solidifying its position in the healthcare real estate sector. Its journey reflects strategic foresight and adaptability, making it a key player in the healthcare REIT landscape. The Welltower history is marked by innovation and resilience.

| Year | Milestone |

|---|---|

| 1970 | Founded as Health Care REIT, Inc., marking the beginning of its journey in healthcare real estate. |

| Early 2000s | Expanded its portfolio through strategic acquisitions, focusing on senior housing and post-acute care facilities. |

| 2010s | Transitioned from a traditional nursing home focus to a broader range of senior housing options, anticipating demographic shifts. |

| 2015 | Rebranded as Welltower, reflecting its evolution and broader healthcare focus. |

| 2020 | Navigated the COVID-19 pandemic by selling assets and strengthening its balance sheet. |

| 2021-2024 | Made significant investments, totaling $18.3 billion, net of dispositions, demonstrating its commitment to growth. |

| 2024 | Continued to invest in healthcare real estate, with $5.4 billion in investments, largely funded by equity issuances. |

A key area of innovation for Welltower has been its strategic shift towards a diverse range of senior housing options. This proactive approach, combined with partnerships, has enabled the company to expand its portfolio and enhance the quality of care.

Forming strategic partnerships with leading healthcare providers and operators to expand its portfolio and enhance care quality.

Utilizing the RIDEA structure to participate in the operational upside of its properties, enhancing financial performance.

Focusing on data science and technology to transform from a traditional real estate entity to a data-driven operating company.

Developing a proprietary end-to-end operating platform, the 'Welltower Business System,' to improve the experience of residents and employees.

Expanding into different healthcare sectors beyond senior housing, including outpatient medical facilities and healthcare systems.

Strengthening the balance sheet through asset sales, dividend adjustments, and equity issuances to navigate market downturns.

Despite its successes, Welltower has faced significant challenges, particularly during the COVID-19 pandemic and the subsequent inflationary pressures. The company's resilience and strategic responses have been crucial to its continued success.

Navigating the immense pressure on the business during the COVID-19 pandemic, including operational hardships and market uncertainties.

Addressing inflationary pressures and labor market challenges post-COVID, requiring strategic financial management and operational adjustments.

Managing market downturns by strengthening the balance sheet, including asset sales and equity issuances to maintain financial stability.

Overcoming operational challenges, such as managing occupancy rates and adapting to changing healthcare demands.

Competing with other healthcare REITs and navigating the complexities of the senior housing market.

Adapting to regulatory changes within the healthcare sector, which can impact operations and investment strategies.

For more insights into the company's strategic focus, consider reading about the Target Market of Welltower.

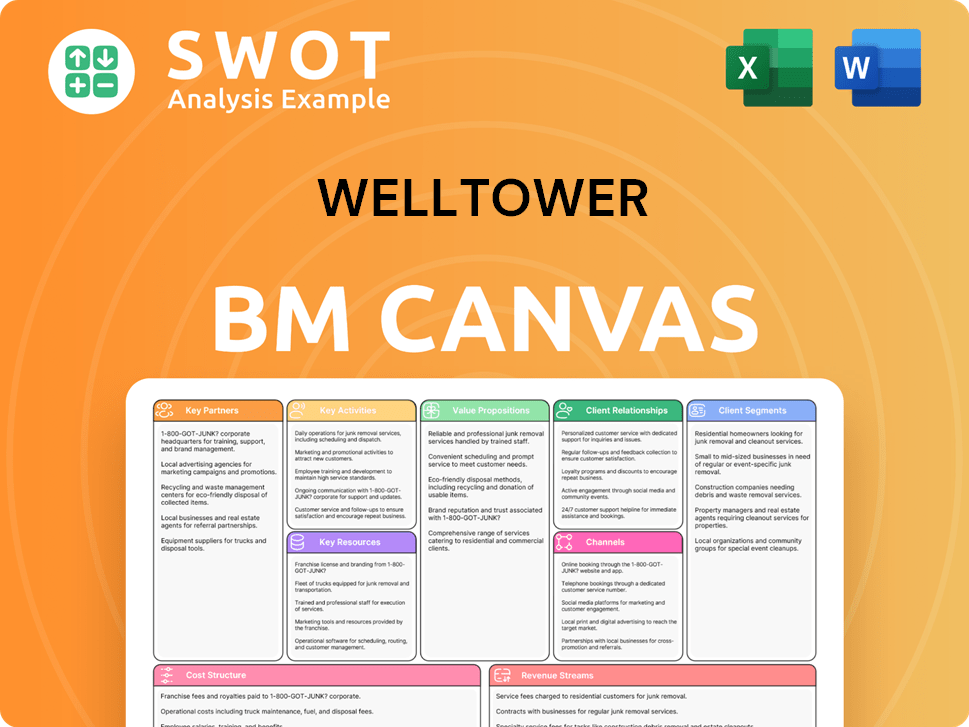

Welltower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Welltower?

The journey of the Welltower company, formerly known as Health Care Fund, began in 1970. It has evolved significantly over the years, marking key milestones in the healthcare real estate sector. The company strategically shifted its focus towards senior housing during the 1990s, a move that has shaped its trajectory. The company has consistently adapted its strategies to capitalize on emerging opportunities and market dynamics, including significant investments in recent years.

| Year | Key Event |

|---|---|

| 1970 | Founded as Health Care Fund in Lima, Ohio, marking the company's inception. |

| 1971 | Completed its Initial Public Offering (IPO), raising capital for expansion. |

| 1985 | Acquired Mediplex Group Inc. and changed its name to Health Care REIT. |

| 1986 | Relocated its headquarters to Toledo, Ohio, solidifying its operational base. |

| 1990s | Refocused investments on senior housing, a strategic shift. |

| 2015 | Renamed to Welltower Inc., reflecting its evolving identity. |

| 2020 | Sold over $3.7 billion in assets and cut its dividend to strengthen its balance sheet during the pandemic. |

| 2021-2024 | Made $18.3 billion in total investments, largely funded by $19.4 billion in common stock issuances. |

| Q4 2024 | Reported total portfolio year-over-year same-store NOI growth of 12.8%, with the Seniors Housing Operating (SHO) portfolio growing by 23.9%. |

| January 2025 | Launched a private funds management business with the ability to source up to $2 billion for investments in U.S. senior housing properties and announced executive team promotions. |

| Q1 2025 | Reported normalized FFO attributable to common stockholders of $1.20 per diluted share, an 18.8% increase year-over-year. Total portfolio same-store NOI growth of 12.9%. |

| May 2025 | Q1 2025 results show a 30.48% revenue growth rate as of March 31, 2025. |

The aging population in the U.S., UK, and Canada, particularly the 80+ demographic, is expected to drive strong demand for senior housing. This demographic shift will continue to be a significant catalyst for growth. This creates a favorable environment for companies like Welltower to expand and generate revenue.

The company projects normalized FFO attributable to common stockholders in a range of $4.90 to $5.04 per diluted share for 2025. Average blended same-store NOI growth is expected between 10.00% and 13.25% in 2025. The Senior Housing Operating segment is projected to grow at 16.5% to 21.5%.

The company plans to continue strategic investments in high-growth markets. New investments are expected to be funded through a combination of equity issuances, debt financing, and asset dispositions. The company's commitment to dividend payments and portfolio growth remains central.

Analysts currently have a consensus 'Strong Buy' rating for Welltower stock. The average price target is $174.00 by June 2, 2026, representing a potential upside of 14.32% from the current price. This indicates positive expectations for future stock performance.

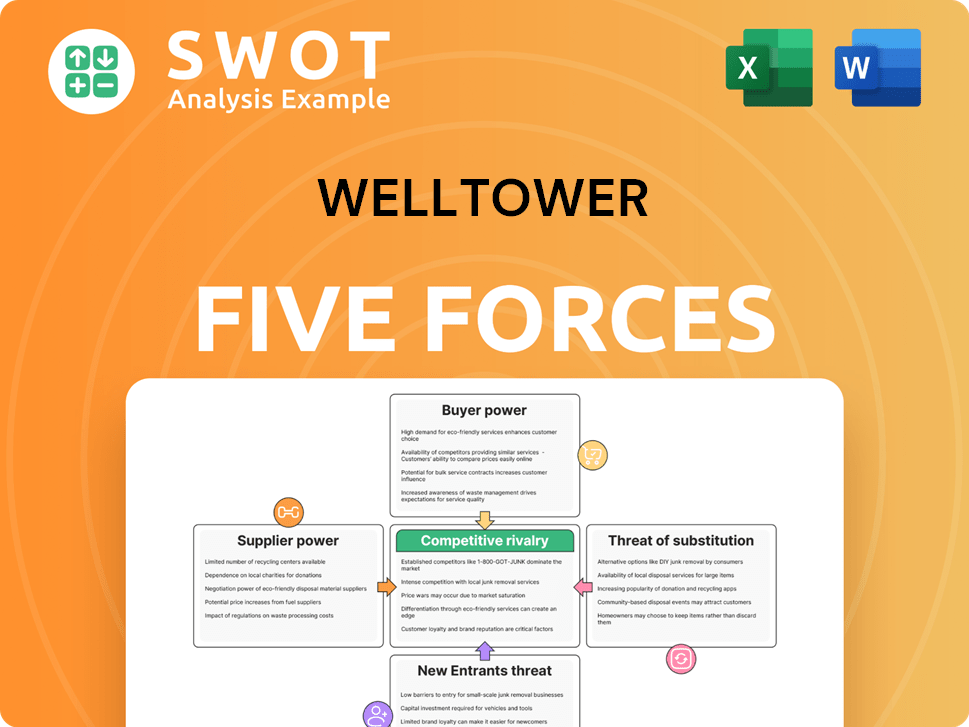

Welltower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Welltower Company?

- What is Growth Strategy and Future Prospects of Welltower Company?

- How Does Welltower Company Work?

- What is Sales and Marketing Strategy of Welltower Company?

- What is Brief History of Welltower Company?

- Who Owns Welltower Company?

- What is Customer Demographics and Target Market of Welltower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.