Welltower Bundle

Can Welltower Continue to Thrive in the Evolving Healthcare Landscape?

Welltower Inc., a titan in the healthcare real estate sector, has consistently demonstrated strategic prowess since its inception in 1970. From its initial mission to provide capital to healthcare providers, Welltower has evolved into a dominant force, managing a vast portfolio of senior housing, assisted living facilities, and medical office buildings across North America and the UK. Its success is deeply intertwined with its ability to anticipate and capitalize on demographic shifts, particularly the aging global population.

This analysis will dissect Welltower's Welltower SWOT Analysis, exploring its growth strategy and meticulously examining its future prospects within the dynamic healthcare real estate market. We'll delve into its expansion plans, innovation strategies, and financial planning to understand how this Healthcare REIT intends to navigate market challenges and capitalize on opportunities. This comprehensive Welltower company analysis provides crucial insights for investors and strategists alike, offering a data-driven perspective on Welltower's long-term growth potential and its impact on the healthcare industry.

How Is Welltower Expanding Its Reach?

The expansion initiatives of the healthcare real estate investment trust (REIT) are strategically designed to bolster its presence in key healthcare segments while exploring new avenues for growth. The company is actively focused on investments in senior housing, particularly in markets with strong demographic tailwinds and high barriers to entry. This approach is part of the broader Welltower growth strategy, aimed at capitalizing on the evolving needs of the aging population and the increasing demand for specialized healthcare facilities.

A significant aspect of this strategy involves expanding its senior housing operating portfolio (SHOP). The company is investing in modernizing existing facilities and developing new, state-of-the-art communities. The focus is on properties that offer a continuum of care, from independent living to skilled nursing. This comprehensive approach allows the company to cater to a wide range of needs within the elderly population. These initiatives are a core component of the Welltower future prospects.

In addition to senior housing, the company is broadening its medical office building (MOB) portfolio. This expansion recognizes the growing demand for outpatient services and specialized medical facilities. This strategy involves developing new MOBs in collaboration with leading health systems and acquiring high-quality assets in growing healthcare markets. These efforts are driven by the desire to diversify revenue streams, take advantage of the shift toward outpatient care, and strengthen partnerships with premier healthcare providers. For more information on the target market, you can read about the Target Market of Welltower.

The company is actively expanding its senior housing operating portfolio (SHOP). Investments focus on modernizing existing facilities and developing new communities. This includes properties offering a continuum of care to meet diverse needs.

The company is expanding its medical office building (MOB) portfolio. This involves developing new MOBs with leading health systems. The goal is to capitalize on the growing demand for outpatient services.

International expansion efforts remain a key part of the growth strategy. The company focuses on the Canadian and UK markets. This leverages established relationships and expertise for strategic acquisitions.

The company aims to strengthen partnerships with premier healthcare providers. This strategy supports diversification and growth. These collaborations are crucial for long-term success.

The company's expansion strategies are multifaceted, focusing on both organic growth and strategic acquisitions. These initiatives are designed to capitalize on the evolving healthcare landscape and strengthen the company's position in the market. The Welltower company analysis reveals a commitment to sustainable growth and value creation.

- Prioritizing investments in senior housing, particularly in markets with strong demographics.

- Expanding the medical office building (MOB) portfolio to meet the growing demand for outpatient services.

- Focusing on international expansion in the Canadian and UK markets.

- Leveraging strategic partnerships with healthcare providers to drive growth.

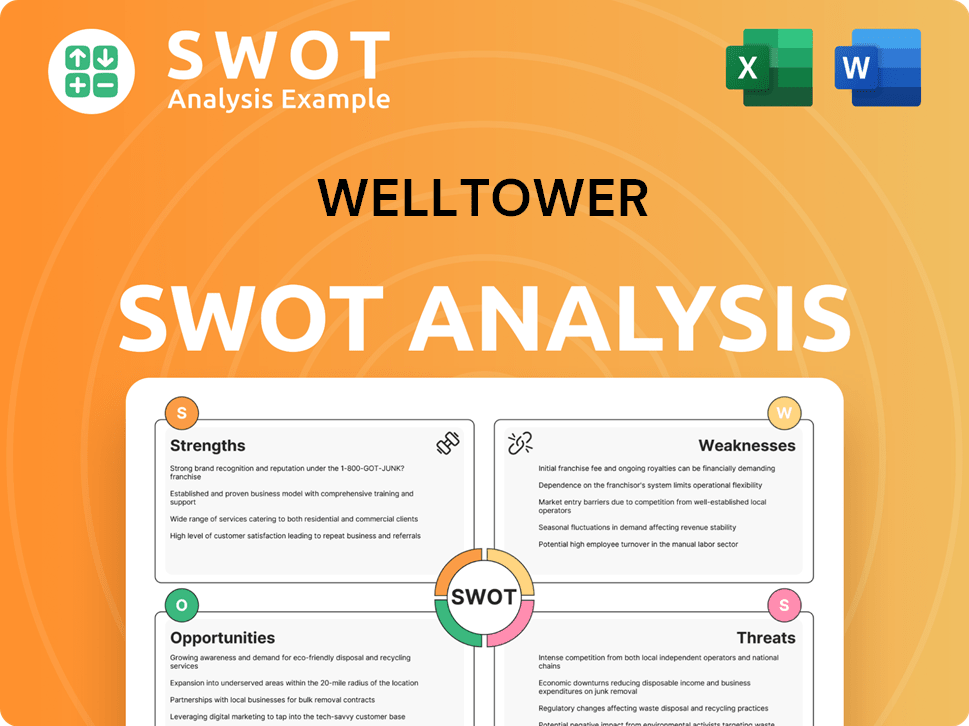

Welltower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Welltower Invest in Innovation?

The Owners & Shareholders of Welltower are focused on leveraging technology and innovation to boost operational efficiency, improve patient outcomes, and optimize its real estate portfolio. This strategic approach is a core component of its sustained growth strategy in the healthcare real estate sector. The company's investments in digital transformation are designed to streamline property management and enhance resident engagement, particularly in senior housing properties.

Welltower's commitment to innovation extends to exploring advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT). These technologies have the potential to revolutionize healthcare infrastructure, offering predictive analytics and smarter building capabilities. This focus on innovation is crucial for maintaining a competitive edge in the evolving healthcare landscape, driving long-term growth potential.

Welltower actively seeks collaborations with external innovators and healthcare technology startups. This open innovation approach allows the company to identify and pilot new solutions that can be scaled across its portfolio. This strategy ensures that Welltower remains at the forefront of technological advancements in healthcare real estate.

Welltower is implementing advanced software platforms to monitor facility performance and predict maintenance needs. These platforms also help personalize services for residents, enhancing their overall experience. This approach supports the company's Welltower growth strategy.

The company is exploring the use of AI for predictive analytics in healthcare delivery and optimizing staffing levels. IoT devices are being considered to create smarter buildings, improving resident safety and energy consumption. These innovations are key to Welltower's future prospects.

Welltower emphasizes collaborations with external innovators and healthcare technology startups. This open innovation approach enables the company to identify and pilot new solutions. These partnerships are crucial for Welltower's market capitalization and valuation.

Technology investments aim to streamline property management and data analytics. This includes predictive maintenance and optimized staffing, leading to cost savings. This enhances Welltower's competitive advantages.

Personalized services and smarter building technologies improve resident comfort and safety. This focus on resident experience is a key part of Welltower's long-term growth potential. These innovations contribute to Welltower's sustainability initiatives.

IoT devices help monitor energy consumption, contributing to sustainability goals. This aligns with broader environmental objectives and enhances operational efficiency. This is part of Welltower's geographic diversification strategy.

Welltower's strategic focus on technology and innovation is designed to drive operational excellence and improve the resident experience. This approach is essential for the company's success in the healthcare REIT sector. The company's investments in technology support its Welltower investment strategy for 2024.

- Operational Efficiency: Streamlining property management and reducing costs through data analytics and predictive maintenance.

- Improved Patient Outcomes: Utilizing AI and IoT to enhance healthcare delivery and personalize services.

- Enhanced Resident Experience: Creating smarter buildings with improved safety and comfort features.

- Sustainability: Implementing IoT devices for energy monitoring and conservation, aligning with environmental goals.

- Competitive Advantage: Staying at the forefront of technological advancements to maintain a strong position in the market.

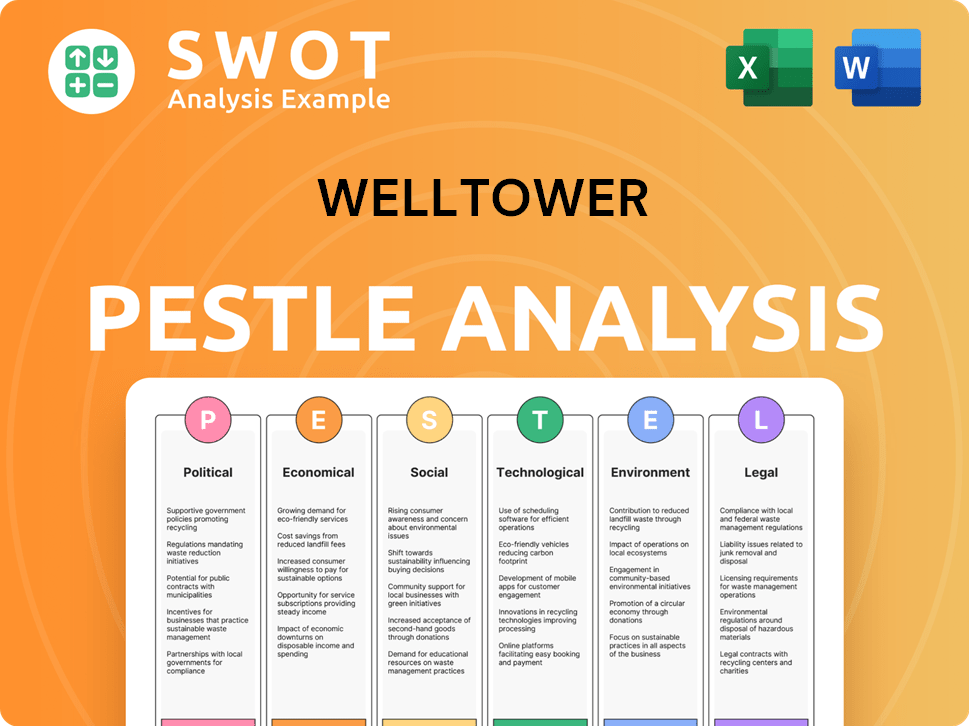

Welltower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Welltower’s Growth Forecast?

The financial outlook for Welltower remains strong, supported by its strategic investments and the growing demand for healthcare real estate. The company's financial health is evident in its performance, with the first-quarter 2025 earnings showing continued growth in Net Operating Income (NOI) and Funds From Operations (FFO).

Analysts project continued revenue growth for Welltower in 2025, with estimates suggesting an increase of approximately 8-10% compared to 2024. This growth is driven by new acquisitions, development projects, and strong occupancy rates across its portfolio. The company's focus on high-growth healthcare real estate segments positions it for sustained profitability and expansion.

Welltower's commitment to strategic investments is clear, with significant capital allocated to both new developments and acquisitions in the senior housing and medical office sectors. The company's long-term financial goals include maintaining a strong balance sheet and increasing shareholder returns. This disciplined approach, combined with a focus on high-growth areas, supports sustained profitability and expansion. For more insights, you can explore a detailed Welltower company analysis.

Welltower's investment strategy for 2024 involves significant capital allocation towards new developments and strategic acquisitions. The company focuses on senior housing and medical office sectors. This approach supports long-term growth and profitability.

The company's financial performance review highlights strong NOI and FFO growth in Q1 2025. Revenue is projected to increase by approximately 8-10% in 2025. These results reflect effective management and strategic investments.

Welltower's expansion plans include investments in assisted living and outpatient facilities. These investments are part of a broader strategy to capitalize on growing healthcare demands. The focus is on high-growth areas.

Welltower aims to consistently increase shareholder returns through dividends and asset appreciation. The company maintains a strong balance sheet to support these goals. This focus enhances shareholder value.

Welltower's market capitalization reflects investor confidence in its long-term growth potential. The company's valuation is supported by its strategic investments. These investments contribute to its overall financial health.

Welltower's geographic diversification strategy helps mitigate risks and capture opportunities in various markets. Diversification supports stable revenue streams. This approach enhances overall financial resilience.

Welltower's investments significantly impact the healthcare industry by supporting essential infrastructure. The company enhances access to care. This impact improves healthcare services.

Welltower's response to market challenges includes proactive management and strategic adjustments. The company adapts to changing market conditions. This approach ensures ongoing success.

Welltower's sustainability initiatives align with its long-term goals. These initiatives enhance its environmental and social performance. This focus is integral to its corporate strategy.

Welltower's partnerships and collaborations enhance its market position and drive innovation. These collaborations support strategic growth. This approach strengthens its industry presence.

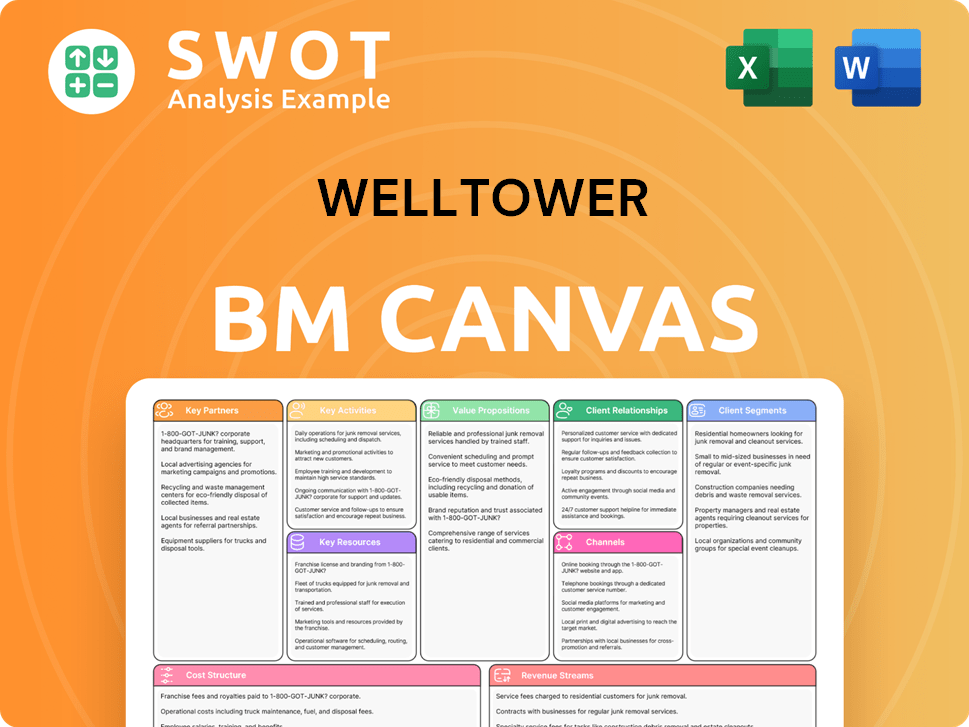

Welltower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Welltower’s Growth?

The path of Welltower's growth strategy is not without its challenges. Several potential risks and obstacles could impact the company's future prospects. These include market competition, regulatory changes, and the evolving healthcare landscape.

Competition within the healthcare real estate sector is fierce, with other REITs and private equity firms vying for similar investment opportunities. This can drive up acquisition costs and potentially lower returns. Moreover, changes in healthcare reimbursement policies and senior care regulations could affect the profitability of Welltower's partners, impacting rental income and property values.

Welltower also faces risks tied to supply chain vulnerabilities, technological disruptions, and shifts in senior housing demand. Successfully navigating these challenges is critical for maintaining its position in the healthcare REIT market and achieving its long-term growth potential.

The healthcare real estate sector is highly competitive. Other REITs and private equity firms actively seek investment opportunities, which can increase acquisition costs and compress cap rates. This competition impacts Welltower's investment returns and its ability to secure favorable deals.

Changes in healthcare reimbursement policies and senior care regulations pose a risk. Shifts in government funding or stricter operational requirements could affect the profitability of Welltower's healthcare provider partners. These changes can indirectly impact Welltower's rental income and property values.

Supply chain issues can impact the development and renovation of healthcare facilities, potentially delaying projects and increasing costs. Technological advancements and new healthcare delivery models also pose risks if Welltower fails to adapt quickly or if competitors leverage technology more effectively.

The rising cost of labor for healthcare providers could indirectly impact their ability to pay rent. Additionally, a slowdown in senior housing demand, if demographic projections do not materialize as expected, could affect occupancy rates and overall financial performance. These factors represent emerging risks for Welltower.

Welltower mitigates these risks through a diversified portfolio across different healthcare segments and geographies. The company employs robust risk management frameworks, including scenario planning and stress testing, to prepare for market and economic downturns. Recent examples include adapting to the operational challenges presented by the COVID-19 pandemic.

In 2024, Welltower's financial performance will be closely watched. The company's ability to maintain occupancy rates and manage expenses in the face of these challenges will be crucial. Investors should monitor key metrics such as net operating income (NOI) and funds from operations (FFO) to assess the company's resilience.

Welltower's competitive advantages include its large and diversified portfolio, experienced management team, and strong relationships with healthcare providers. Its focus on high-quality assets and strategic acquisitions positions it well in the healthcare REIT market. The company's ability to adapt to changing market conditions is a key factor.

Welltower's investments in healthcare real estate significantly impact the healthcare industry. By providing capital and real estate solutions, the company supports the growth and development of healthcare facilities, contributing to improved patient care and access. Its strategic partnerships influence the healthcare landscape.

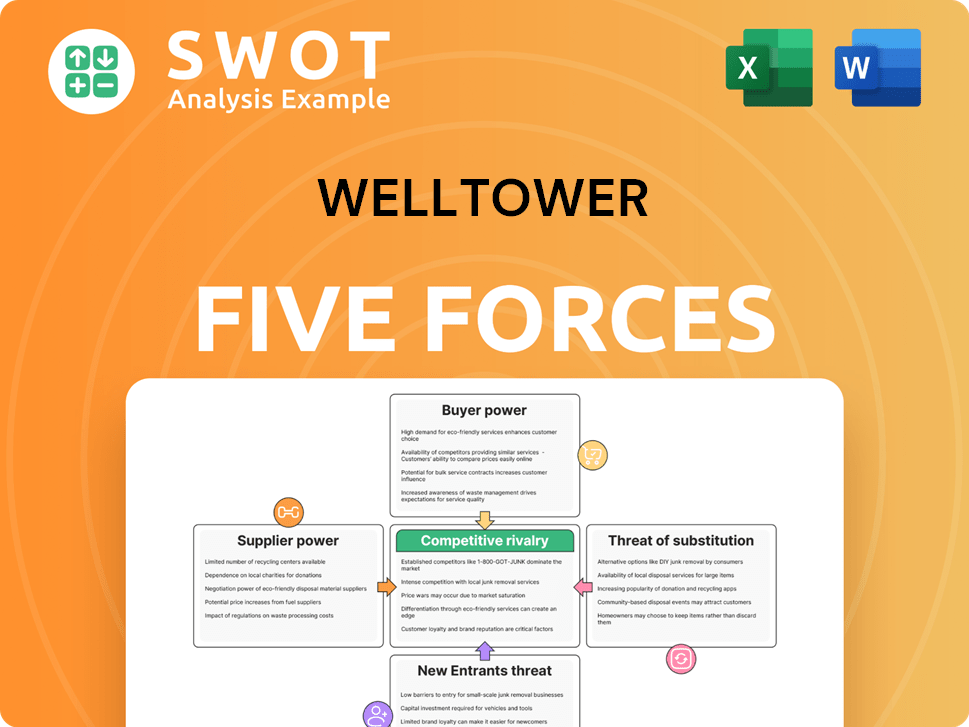

Welltower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Welltower Company?

- What is Competitive Landscape of Welltower Company?

- How Does Welltower Company Work?

- What is Sales and Marketing Strategy of Welltower Company?

- What is Brief History of Welltower Company?

- Who Owns Welltower Company?

- What is Customer Demographics and Target Market of Welltower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.