Welltower Bundle

Who Does Welltower Serve, and Why Does It Matter?

In the ever-evolving landscape of healthcare real estate, understanding the Welltower SWOT Analysis is crucial. Welltower Company, a leading REIT, thrives on the demographic shifts of an aging global population. This deep dive into its customer demographics and target market illuminates its strategic prowess and market resilience.

As the senior housing market expands, Welltower's focus on healthcare infrastructure becomes increasingly vital. The company's success hinges on its ability to understand and cater to the needs of its Welltower target market and the aging population. Examining Welltower's customer profile analysis reveals how it adapts to the changing landscape of healthcare real estate, ensuring long-term growth. This includes a close look at Welltower's geographic focus and how it aligns with demographic trends.

Who Are Welltower’s Main Customers?

Understanding the customer demographics and Welltower target market is crucial for analyzing the company's strategic positioning. Primarily operating in a business-to-business (B2B) model, Welltower's core customers are healthcare providers and operators. However, the ultimate beneficiaries of its real estate investments are seniors and patients utilizing outpatient medical services.

The Welltower Company focuses on the senior population and healthcare sectors. This focus allows the company to align its investments with the evolving needs of an aging population and the changing healthcare landscape. Analyzing the demographics of these end-users is vital to understanding Welltower's investment strategies.

Welltower's strategic approach involves a deep understanding of the customer demographics within the senior housing and healthcare sectors. This includes assessing the needs of the aging population and the demand for various living and care options.

The primary customer segment for Welltower's senior housing portfolio is older adults, particularly the 80-and-older population. This demographic is expected to almost double over the next decade, increasing the demand for senior living options. Welltower's focus is on high-quality facilities, suggesting a segment with higher income levels.

For its medical office buildings, Welltower's customers are healthcare systems and physicians. These customers require modern, accessible infrastructure for delivering outpatient care. The focus on outpatient care aligns with the evolving healthcare landscape. Welltower benefits from favorable outpatient care trends.

Welltower has strategically shifted towards deepening its regional density within its Seniors Housing Operating (SHOP) portfolio. This approach allows the company to concentrate on specific micro-markets where demographic tailwinds are strong. The formation of a private funds management business in January 2025, with an intent to invest up to $2 billion in U.S. seniors housing properties, highlights this focus.

- The 80+ population is projected to almost double in the coming decade, driving demand for senior housing.

- Welltower's investment strategy focuses on areas with strong demographic trends.

- The company is expanding its presence in the senior housing market through strategic investments.

- Welltower's approach includes deepening partnerships with leading managers in the senior housing sector.

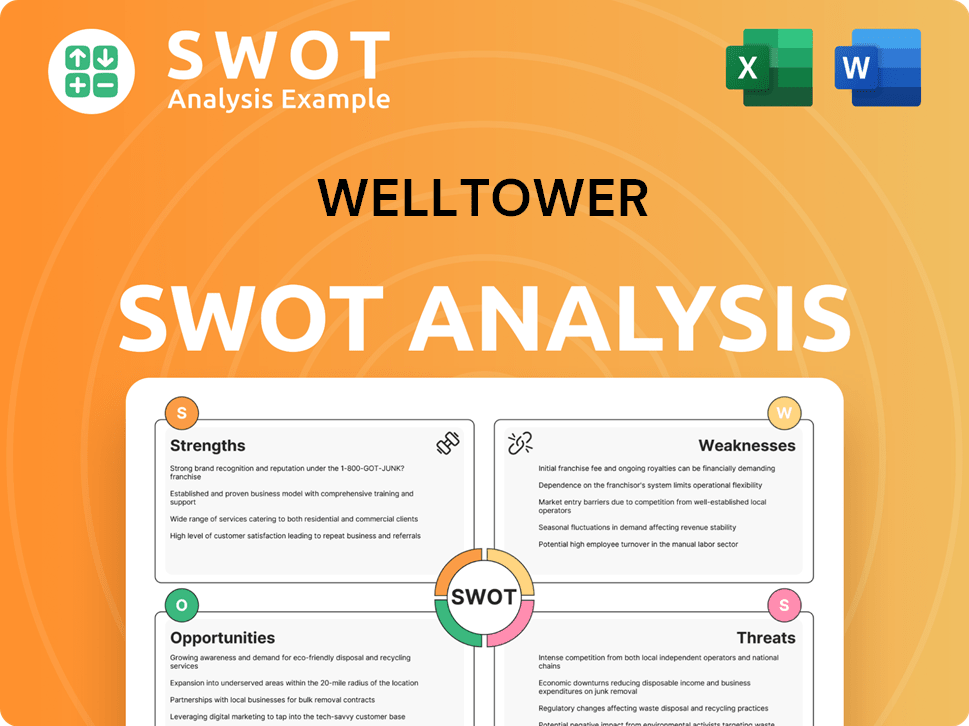

Welltower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Welltower’s Customers Want?

Understanding the needs and preferences of its customers is central to the strategy of the company. This involves a deep dive into the requirements of both end-users, primarily seniors and patients, and direct customers, which are healthcare operators. The goal is to create value by providing high-quality care and comfortable living environments.

The company aims to position its communities at the intersection of housing, healthcare, and hospitality. This approach focuses on creating vibrant environments for mature renters and older adults. This strategic focus is critical in the context of the evolving needs of the aging population and the senior housing market.

Purchasing behaviors and decision-making criteria for senior housing often involve family input and are influenced by factors such as location, quality of care services, reputation of the operator, and the range of available amenities. For medical office buildings, the needs of healthcare providers revolve around modern facilities, strategic locations that offer accessibility for patients, and infrastructure that supports efficient healthcare delivery. The company strives to support physicians with the critical infrastructure needed to deliver quality care.

For seniors, the key needs revolve around high-quality care, a safe and comfortable living environment, and access to amenities. A sense of community and social interaction are also highly valued. These factors collectively influence the quality of life and overall well-being of residents.

Healthcare operators require modern facilities, strategic locations for patient accessibility, and efficient infrastructure. They seek support in delivering quality care and operational efficiency. These needs are addressed through strategic acquisitions and partnerships.

The company addresses fragmentation in senior housing through strategic acquisitions and partnerships. The Welltower Business System leverages technology to improve operational efficiency and enhance the resident experience. This system supports better decision-making by operators.

Market trends and feedback significantly influence investment strategies and product development. Regional densification within the SHOP portfolio aims to improve employee career growth and reduce turnover. Renovations to improve employee facilities also contribute to better community operations.

The company's operational system allows for acquiring communities at a discount. This system drives better results through operational improvements. This approach tailors product features and operational strategies to market realities.

The company's customer acquisition strategies are influenced by the aging population and demographic trends. Understanding the needs of the aging population is crucial for success. The company's geographic focus and property types are aligned with market demands.

The company's understanding of the customer demographics and the Welltower target market is crucial for its success. The focus on the senior housing market and healthcare real estate reflects a strategic response to the aging population. The company's approach involves addressing pain points and unmet needs within the healthcare real estate sector.

- Customer Profile Analysis: The company's strategy is informed by a detailed Welltower customer profile analysis, including the age demographics of Welltower residents.

- Investment Strategy: The company's investment strategy demographics are influenced by market trends and feedback. The company aims to acquire communities at a discount to replacement cost and then drive better results through its operational system.

- Market Share: The company's market share in senior housing is a key indicator of its success. The company's ability to adapt to demographic trends in senior living is critical.

- Financial Performance: The company's financial performance and demographics are closely linked. For example, in Q1 2024, the company reported a net income attributable to common stockholders of $160 million, or $0.36 per diluted share.

For a deeper dive into the company's approach, consider reading about the Marketing Strategy of Welltower.

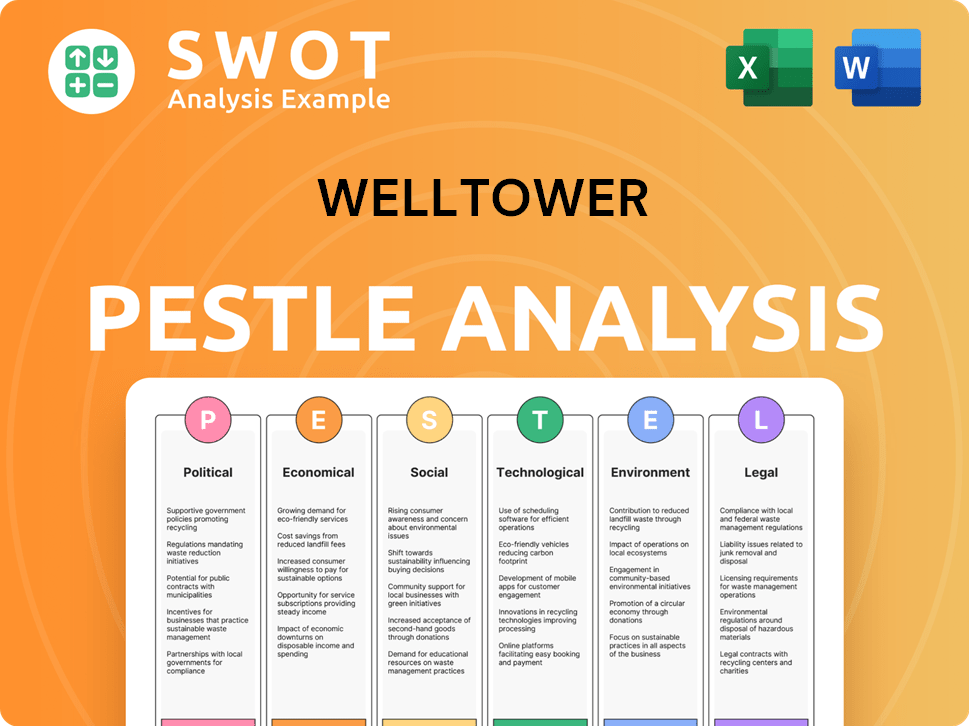

Welltower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Welltower operate?

Welltower maintains a significant geographical market presence, strategically focusing on areas with strong demographic tailwinds. The company has interests in over 1,500 properties, primarily in high-growth markets across the United States, Canada, and the United Kingdom. This strategic focus is particularly evident in regions experiencing a rapid increase in the senior population, aligning with the company's target market.

In the U.S., Welltower's portfolio is diversified across various regions, with a deliberate emphasis on building regional density within its Seniors Housing Operating (SHOP) portfolio. This approach allows for optimized asset and portfolio management, aiming to enhance the experience for both residents and employees. The company's expansion strategies include strategic acquisitions and a granular approach to capital allocation, seeking assets at discounts to replacement cost.

Welltower's Q1 2025 earnings highlighted robust revenue growth across all three regions: the U.S. led with 9.8%, followed by the UK at 9.3%, and Canada at 8.3%. This demonstrates the company's ability to capitalize on the growing senior housing market. Welltower's commitment to expanding its domestic footprint is further demonstrated by the formation of a private funds management business in January 2025, with plans to invest up to $2 billion in U.S. seniors housing properties.

Welltower's expansion includes strategic acquisitions to solidify its presence in key international markets. The C$4.6 billion acquisition of the Amica Senior Lifestyles portfolio in Canada in March 2025 is a prime example. This demonstrates the company's proactive approach to expanding its portfolio and serving its target market.

The company focuses on building regional density within its SHOP portfolio. This strategy is designed to optimize asset and portfolio management. It also aims to improve the experience for both residents and employees, enhancing Welltower's ability to serve its customer demographics effectively.

Welltower consistently seeks to diversify its investment portfolio by property type, relationship, and geographic location. This diversification strategy helps mitigate risks and ensures a broad presence in the senior housing market. This is further detailed in Revenue Streams & Business Model of Welltower.

Welltower's market entry strategies are characterized by a granular approach to capital allocation. The company focuses on acquiring assets at discounts to replacement cost that complement its regional density strategy. This approach supports sustainable growth and enhances its competitive position.

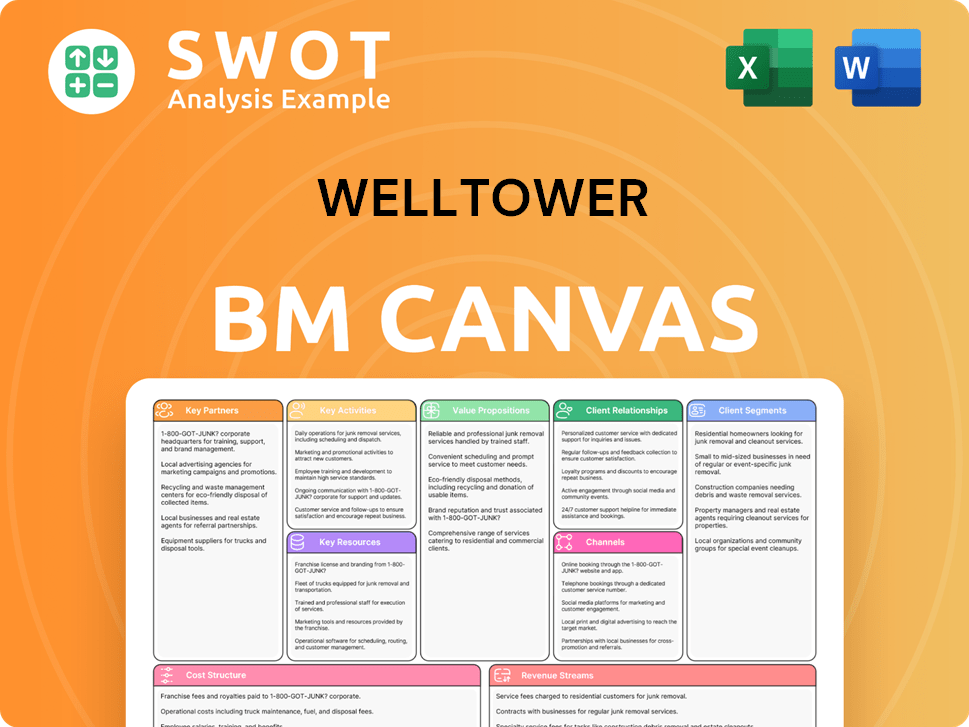

Welltower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Welltower Win & Keep Customers?

Welltower's customer acquisition and retention strategies are centered on building strong relationships with healthcare operators and indirectly influencing the experience of residents. A key aspect of its strategy involves forming long-term partnerships with leading seniors housing operators, post-acute providers, and health systems. These partnerships are crucial for acquiring new properties and ensuring high occupancy within its existing portfolio. This approach is designed to drive demand for its properties by focusing on the quality of care and services provided by its partners.

The company leverages its 'Welltower Business System,' a data science and operating platform, to optimize property management, reduce costs, and improve tenant satisfaction. This data-driven approach allows to identify and source new investment opportunities, assess and mitigate risks, and adapt proactively to market shifts and demographic trends. This focus on data and technology allows Welltower to make informed decisions, enhancing its ability to attract and retain both operators and residents.

Regarding retention, Welltower focuses on enhancing the value proposition for its operating partners and, consequently, for the residents. Initiatives include investing in employee retention strategies at the site level, such as renovating break rooms to create a more inviting environment for staff. This focus on employee experience is a strategic move to reduce turnover, which has historically plagued the industry, and ultimately leads to better community operations and higher satisfaction for residents.

Welltower focuses on forging long-term partnerships with leading seniors housing operators. These partnerships provide a significant pipeline for future capital deployment. They are crucial for acquiring new properties and ensuring high occupancy and operational success.

The 'Welltower Business System' uses machine learning to optimize property management. This system helps reduce costs and improve tenant satisfaction. It enables efficient investment decisions and proactive adaptation to market trends.

Welltower invests in employee retention at the site level, such as renovating break rooms. This approach aims to reduce turnover and improve community operations. It contributes to higher satisfaction for residents.

Welltower's emphasis on regional densification supports career growth opportunities for site-level employees. This strategy further contributes to employee retention. It helps in building a stable and experienced workforce.

Welltower's financial performance in 2024 was strong, with a 23% adjusted revenue growth. The company achieved a 26% EBITDA growth and 19% normalized FFO per diluted share growth. Its consistent same-store net operating income (NOI) growth in its Seniors Housing Operating (SHO) portfolio, exceeding 20% for ten consecutive quarters by Q1 2025, demonstrates its ability to drive revenue and manage expenses effectively.

- Welltower's focus on the senior housing market and healthcare real estate has been successful.

- The company's strategies reflect the impact of the aging population on the demand for its properties.

- For more details, see this article about Welltower's business model.

- The company's customer acquisition strategies are closely linked to its partnerships with operators and its data-driven approach.

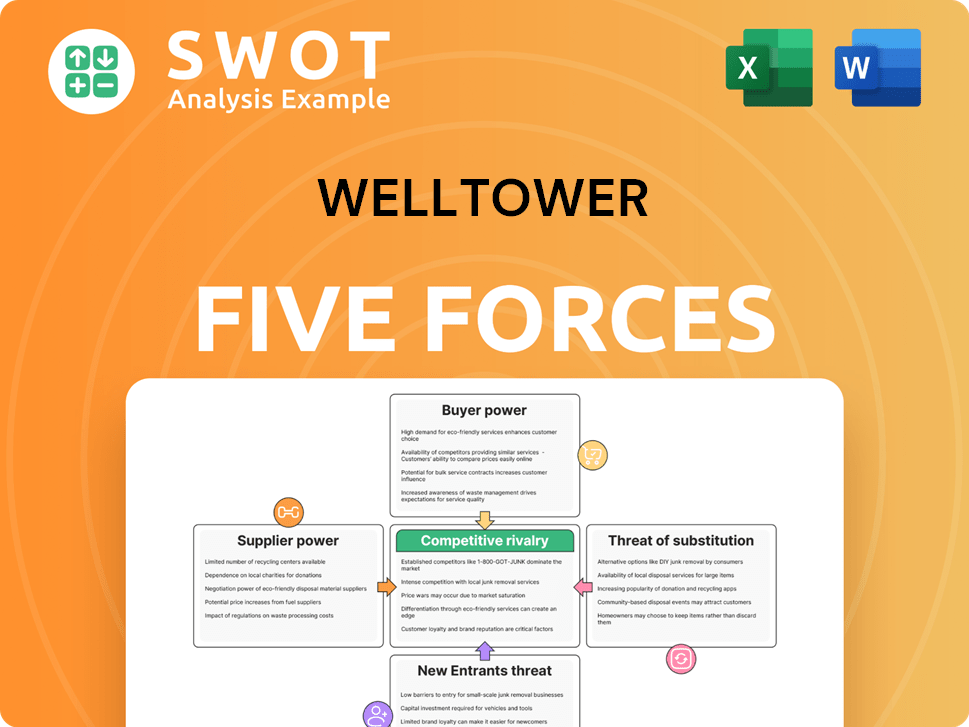

Welltower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Welltower Company?

- What is Competitive Landscape of Welltower Company?

- What is Growth Strategy and Future Prospects of Welltower Company?

- How Does Welltower Company Work?

- What is Sales and Marketing Strategy of Welltower Company?

- What is Brief History of Welltower Company?

- Who Owns Welltower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.