Welltower Bundle

How Does Welltower Dominate the Healthcare Real Estate Market?

Welltower Inc. (NYSE: WELL) isn't just a REIT; it's a healthcare real estate powerhouse, and its impressive financial results, including an 18.8% year-over-year increase in normalized funds from operations (FFO) per diluted share in Q1 2025, speak volumes. But what fuels this remarkable growth? The answer lies in its sophisticated Welltower SWOT Analysis, innovative sales and marketing strategies, and strategic business model that have reshaped the senior housing market.

This deep dive into Welltower's sales and marketing approach explores how they've cultivated a leading position in the healthcare real estate sector. We'll dissect their strategies for targeting the senior housing market, examine their competitive advantages, and analyze the impact of their recent marketing campaigns. Furthermore, we'll uncover key performance metrics and explore how Welltower generates revenue through its carefully crafted sales and marketing efforts within the real estate investment trust (REIT) landscape.

How Does Welltower Reach Its Customers?

The sales strategy of Welltower centers on a business-to-business (B2B) model. It focuses on establishing and maintaining strategic partnerships with leading healthcare providers and operators. This approach is key to its operations within the healthcare real estate sector. The company's primary sales channels involve acquiring, developing, and managing properties that are then leased to these healthcare entities.

Welltower's marketing strategy is closely tied to its sales channels. The company's approach is not direct-to-consumer sales. Instead, it is focused on building relationships with key players in the senior housing market and healthcare industry. This strategy supports its real estate investment trust (REIT) model.

Welltower's business model relies on these strategic alliances. This model allows the company to expand its property portfolio and increase its market share. As of 2023, Welltower had collaborations with over 570 healthcare systems and hospitals across the United States. This includes 87 academic medical centers, 214 regional hospital networks, and 279 community healthcare systems.

Welltower partners with major senior living property operators. These partnerships are critical for managing a significant portion of its senior housing portfolio. Key partners include Sunrise Senior Living, Brookdale Senior Living, Benchmark Senior Living, and Holiday Retirement.

Welltower is increasing its operational involvement. It converts triple-net leased properties to Seniors Housing Operating (SHO or RIDEA) structures. This allows the company to directly benefit from the cash flow growth of the communities. In 2024, agreements were made to convert 68 triple-net leased properties to SHO structures.

The company utilizes its 'Welltower Business System.' This system uses machine learning and other technologies. It helps operators make informed decisions. Welltower focuses on acquiring communities below replacement cost and improving their performance through this system.

Welltower's investment activity in 2024 was significant. The company invested a record $6 billion in acquisitions. By April 2025, investments reached $6.2 billion. This includes acquisitions like the Amica Senior Lifestyles portfolio, valued at C$4.6 billion.

Welltower's sales and marketing approach is enhanced by its scale and strategic focus. This approach allows them to capitalize on expansion opportunities. It also strengthens its position in the senior housing market. For more insights into Welltower's strategic growth, you can read about the Growth Strategy of Welltower.

- Access to capital markets.

- Large-scale acquisition opportunities.

- Expanding portfolio in high-growth markets.

- Deepening regional density.

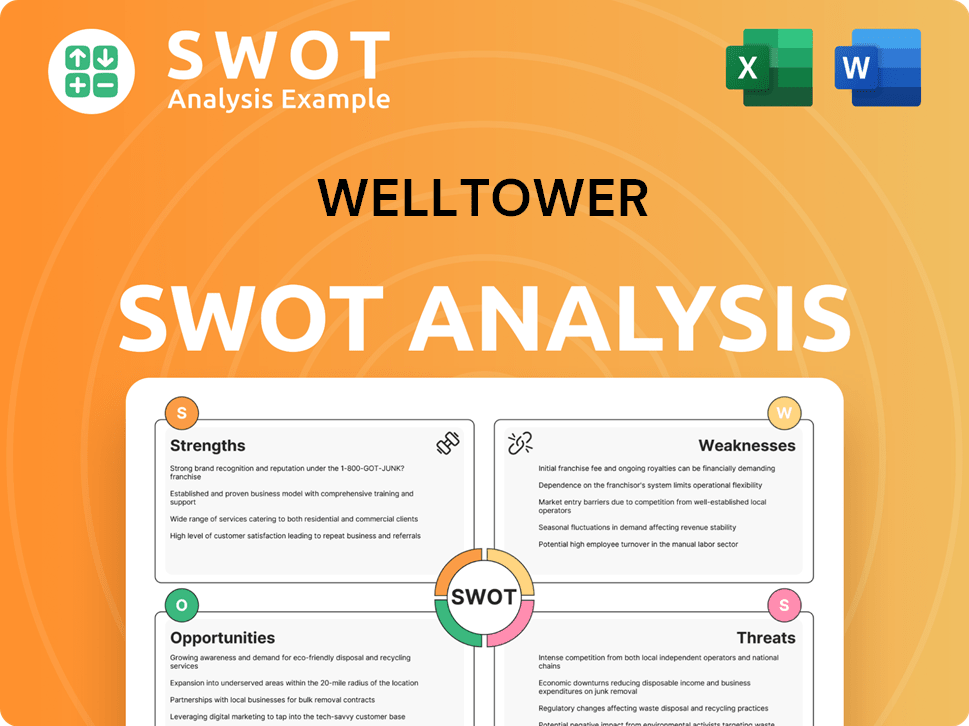

Welltower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Welltower Use?

The marketing tactics employed by Welltower are primarily focused on its business-to-business (B2B) relationships. This strategy targets healthcare providers, operators, and institutional investors. A key element of its approach is data-driven marketing, leveraging its robust data analytics capabilities.

Welltower's sophisticated data science and machine learning platform, part of the Welltower Business System (WBS), is a significant competitive advantage. This system influences both property-level and transaction market performance. The company aims to redefine senior housing marketing through these insights to optimize operations and identify attractive investment opportunities.

While traditional advertising is likely minimized given its B2B focus, digital tactics are crucial for Welltower. Its website plays a central role, employing SEO optimization and content marketing to engage its target audience of financially literate decision-makers.

Welltower utilizes data analytics to refine its marketing strategies. This includes leveraging its 'industry-leading seniors housing data and analytics capabilities' to optimize operations and identify investment opportunities.

The company focuses on its website for engaging its target audience. This includes SEO optimization and content marketing to reach financially literate decision-makers.

Welltower regularly updates investor relations materials on its website. These materials include corporate and fixed income presentations, which serve as a vital communication tool for investors.

Welltower highlights its ability to improve occupancy rates faster than its peers. This leads to higher revenue per property and improved profit margins, which is a key element in its marketing narrative.

The company emphasizes its commitment to sustainable practices. This enhances its reputation and attracts socially responsible investors, which is part of its overall marketing strategy.

Welltower focuses on technology integration for enhancing resident care and improving operational efficiency. This demonstrates its innovative strategies and commitment to modern solutions.

The company's marketing mix has evolved to emphasize its operational excellence and strategic capital deployment. Welltower highlights its ability to improve occupancy rates faster than peers, which translates to higher revenue per property and improved profit margins. This operational efficiency, coupled with its strategic partnerships and acquisitions, forms a compelling narrative for investors. Furthermore, Welltower emphasizes its commitment to sustainable practices, which enhances its reputation and attracts socially responsible investors. The company's focus on technology integration for enhancing resident care and improving operational efficiency further demonstrates its innovative strategies. For more details on how Welltower generates revenue, explore Revenue Streams & Business Model of Welltower.

Welltower's Welltower sales strategy and Welltower marketing strategy are centered on data-driven insights and digital engagement, targeting B2B stakeholders within the Healthcare real estate and Senior housing market.

- Data Analytics: Utilizing advanced data science and machine learning to refine its approach.

- Digital Marketing: Employing SEO and content marketing on its website.

- Investor Relations: Providing regular updates and presentations to investors.

- Operational Efficiency: Highlighting the ability to improve occupancy rates and profit margins.

- Sustainability: Emphasizing commitment to sustainable practices.

- Technology Integration: Focusing on technology to enhance resident care and operational efficiency.

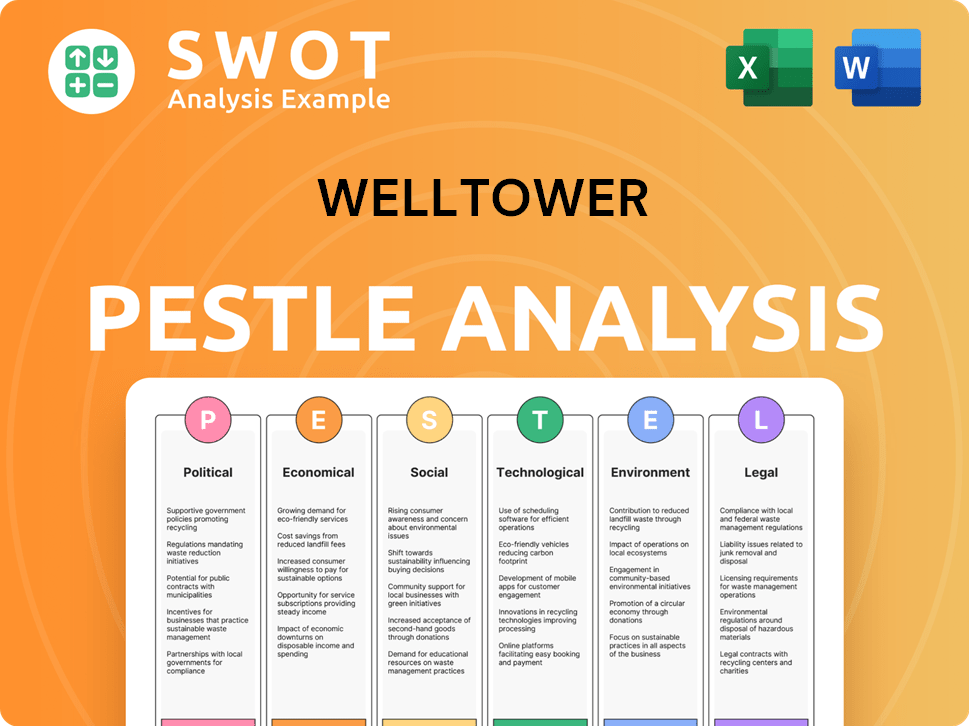

Welltower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Welltower Positioned in the Market?

Welltower's brand positioning centers on its role as a leading residential wellness and healthcare infrastructure company. It operates at the intersection of housing, healthcare, and hospitality, focusing on providing vibrant communities for mature renters and older adults. This approach also includes offering essential infrastructure for physicians through outpatient medical buildings, setting it apart in the healthcare real estate sector.

The company differentiates itself through deep specialization in healthcare real estate, a diversified portfolio, and established relationships with leading healthcare operators. This specialization allows Welltower to possess significant expertise and a nuanced understanding of the healthcare industry's unique requirements. This is a key element of its Welltower sales strategy and overall Welltower business model.

The core message of Welltower's brand is delivering long-term compounding of per-share growth and returns for its investors, which it terms as its 'North Star.' This is achieved through a disciplined approach to capital allocation, supported by its Data Science platform and superior operating results, driven by the Welltower Business System. This focus is critical for its Welltower marketing strategy, which targets both investors and healthcare providers.

Welltower's financial strength is a cornerstone of its brand. In 2024, the company's credit rating was upgraded to A- from S&P and A3 from Moody's, reflecting strong financial performance and balance sheet deleveraging. This solid financial standing supports its ability to attract investors and secure favorable terms in the senior housing market.

Welltower leverages its Data Science platform to drive disciplined capital allocation. This data-driven approach allows the company to make informed decisions about investments and portfolio management, improving operational efficiency. This is a key aspect of its Welltower competitive advantages.

Welltower maintains brand consistency across all touchpoints, from its website to investor presentations and earnings calls. This consistent messaging reinforces its commitment to its core values and strategic goals. The company recently refreshed its brand identity and website in March 2025 to reflect its evolution.

The rebranding effort, launched in March 2025, highlights Welltower's transformation from a traditional healthcare real estate firm to a data-driven operating company. This showcases advancements in capital allocation, portfolio refinement, and strengthened partnerships. It also emphasizes the development of its advanced data science and machine learning platform.

Welltower actively responds to shifts in consumer sentiment and competitive threats by optimizing its portfolio and investing in technology. This includes enhancing resident care and improving operational efficiency. This proactive approach ensures the company remains competitive in the healthcare real estate market.

- Continuous portfolio optimization.

- Investment in technology for better resident care.

- Enhancements in operational efficiency.

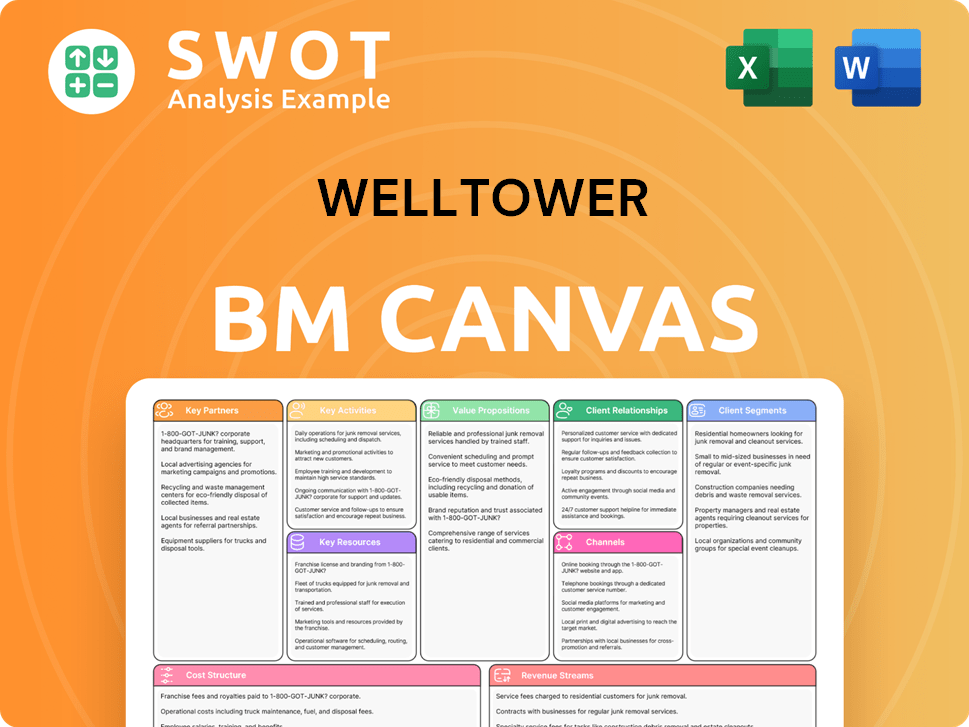

Welltower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Welltower’s Most Notable Campaigns?

The 'campaigns' of Welltower, a leading healthcare real estate investment trust (REIT), are less about traditional marketing and more about strategic initiatives that drive growth in the healthcare real estate sector. These initiatives focus on capital deployment, operational improvements, and technological advancements. This approach is key to understanding the Welltower sales strategy and how it maintains its position in the competitive senior housing market.

A core element of Welltower's strategy involves significant investment activity, particularly in senior housing. The company's focus on strategic acquisitions and portfolio optimization is a cornerstone of its approach. The success of these initiatives is reflected in its financial performance and market position, demonstrating the effectiveness of its healthcare real estate investment strategy.

Welltower's approach is not just about acquiring properties; it's about enhancing their operational performance and integrating them into a cohesive business model. This integrated strategy is essential for understanding the Welltower business model and its long-term growth prospects. Understanding these campaigns is essential for investors and stakeholders interested in the Owners & Shareholders of Welltower.

Welltower's aggressive investment strategy is a primary 'campaign' driving growth. In 2024, the company executed a record $6 billion in acquisitions, often at a discount to replacement cost. By April 2025, investments reached $6.2 billion, surpassing the entire 2024 total. A significant transaction was the March 2025 acquisition of Amica Senior Lifestyles for C$4.6 billion, adding 38 communities in Canada. This demonstrates Welltower's commitment to the senior housing market.

Another strategic 'campaign' involves converting triple-net leased properties to Seniors Housing Operating (SHO) structures. In 2024, Welltower agreed to convert 68 properties, aiming for direct participation in cash flow growth. This initiative has boosted the Seniors Housing Operating (SHO) portfolio's same-store NOI growth, reaching 21.7% in Q1 2025 and 23.5% in 2024. This highlights Welltower's ability to optimize its portfolio and enhance profitability.

The ongoing development and rollout of the 'Welltower Business System' (WBS) is a key internal campaign. Launched in Q3 2024 with further rollout planned in 2025, the WBS is a tech platform aimed at creating a modern digital experience for residents and employees. This system uses machine learning and data science to provide real-time data, improving operational efficiency and resident care. The company experienced a 320 basis point year-over-year margin expansion in 4Q24.

Welltower's expansion strategy focuses on acquiring properties in supply-constrained and affluent markets. The Amica Senior Lifestyles acquisition, for example, allows Welltower to expand its presence in the Canadian market. These strategic acquisitions are part of Welltower's broader plan to leverage its Welltower Business System to enhance operational results and drive growth in the senior housing market. This is key to its Welltower marketing strategy.

Welltower's key campaigns aim to achieve several strategic objectives, driving its Welltower sales strategy and overall success. These objectives include:

- Expanding the portfolio in attractive markets with high barriers to entry.

- Improving operational efficiencies through technology and data-driven insights.

- Enhancing profitability by converting properties to SHO structures.

- Deepening partnerships with leading operators in the senior housing market.

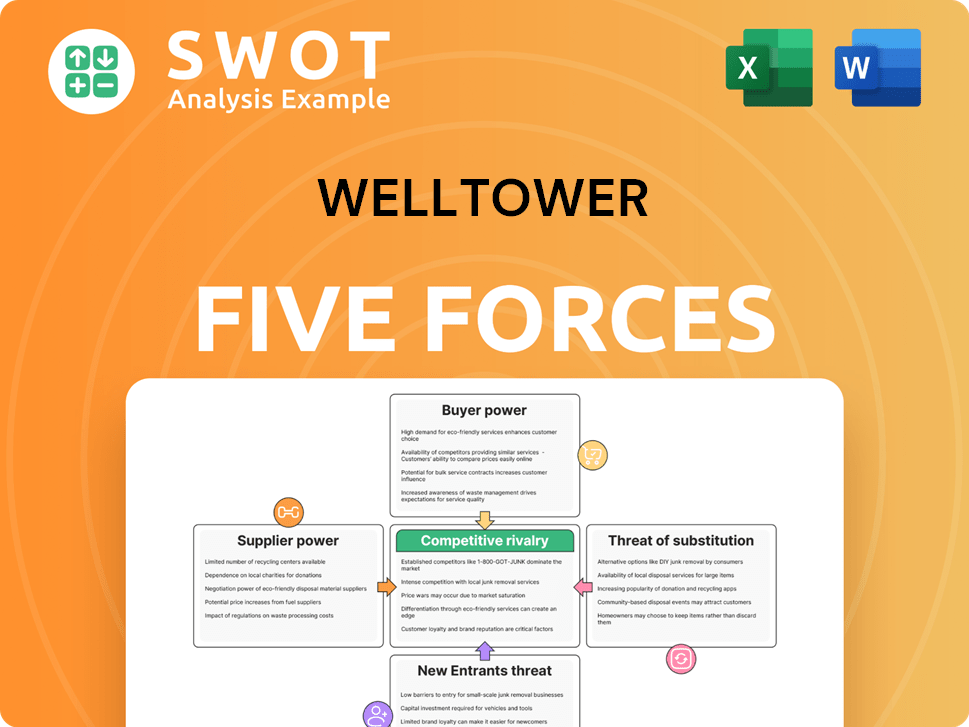

Welltower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Welltower Company?

- What is Competitive Landscape of Welltower Company?

- What is Growth Strategy and Future Prospects of Welltower Company?

- How Does Welltower Company Work?

- What is Brief History of Welltower Company?

- Who Owns Welltower Company?

- What is Customer Demographics and Target Market of Welltower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.