Welltower Bundle

How Does Welltower Dominate the Healthcare Real Estate Market?

The healthcare real estate sector is a dynamic arena, and Welltower Inc. has established itself as a major player. Its strategic evolution since 1971, from a healthcare fund to a leading Real Estate Investment Trust (REIT), showcases its adaptability. This company's journey has been marked by strategic foresight and robust growth, making it a compelling subject for market analysis.

To understand Welltower's position, we must delve into its competitive landscape. This analysis will explore Welltower's main rivals in senior housing and other healthcare properties, providing insights into its market share and competitive advantages. Furthermore, we'll examine Welltower SWOT Analysis to better understand its strengths, weaknesses, opportunities, and threats within the healthcare real estate and senior housing market.

Where Does Welltower’ Stand in the Current Market?

Welltower maintains a strong market position within the healthcare real estate investment trust (REIT) sector. Its primary focus is on senior housing, post-acute care, and outpatient medical properties. This strategic focus allows the company to capitalize on the growing demand for healthcare services, particularly in aging populations.

The company's diversified portfolio and strategic partnerships contribute to its market leadership. Welltower's operational model emphasizes collaboration with leading operators to enhance performance and improve resident experiences. This approach helps to drive occupancy rates and financial performance, solidifying its competitive advantage in the healthcare real estate market.

Welltower's portfolio includes senior housing (independent living, assisted living, memory care), post-acute care facilities, and medical office buildings/outpatient facilities. Geographically, the company has a significant presence in the United States, Canada, and the United Kingdom. This diversified geographic footprint helps mitigate risks and provides access to various demographic trends.

For the first quarter of 2025, Welltower reported strong performance. The senior housing operating portfolio (SHOP) saw an average same-store occupancy of 83.4%, an increase from 82.3% in Q4 2024. For the full year 2024, the company projected normalized FFO per diluted share to be in the range of $3.60 to $3.70, demonstrating its financial strength.

Welltower is focused on high-growth areas within healthcare, which further solidifies its market leadership. The company's shift towards a more integrated operating model within its senior housing portfolio, focusing on partnerships, enhances its performance and resident experience. This strategic approach allows the company to adapt to changing market dynamics and maintain its competitive edge.

Welltower's competitive advantages include its extensive portfolio, strategic partnerships, and financial health. The company's focus on senior housing and medical office buildings provides a strong foundation. Its strategic focus on high-growth areas within healthcare continues to solidify its overall market leadership. For more detailed insights, you can explore a comprehensive analysis of the Welltower competitive landscape.

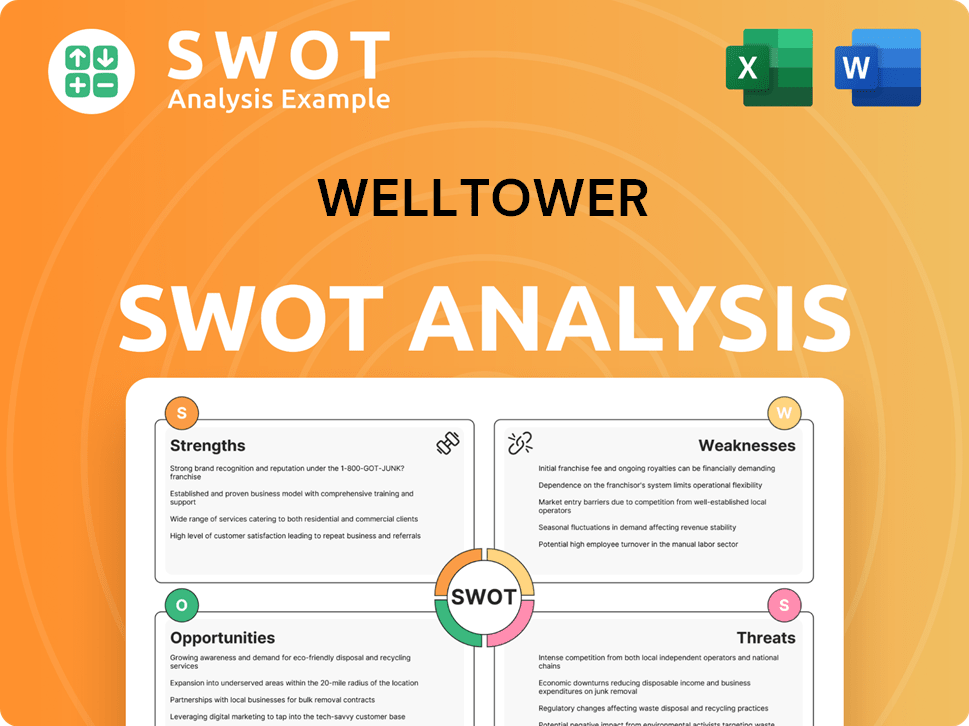

Welltower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Welltower?

The Welltower competitive landscape is shaped by a diverse group of players, ranging from direct competitors in the healthcare real estate investment trust (REIT) sector to institutional investors and private equity firms. Understanding these competitors and their strategies is crucial for a comprehensive Welltower market analysis.

The company faces intense competition in the senior housing market and other healthcare property segments. This competition influences asset pricing, strategic partnerships, and overall financial performance. Analyzing these competitive dynamics is essential for investors and stakeholders to make informed decisions.

Direct REIT competitors include Ventas, Healthpeak Properties, and Omega Healthcare Investors. These companies compete directly with Welltower for similar assets and strategic partnerships. They often vie for high-quality assets and development opportunities.

Ventas is a major healthcare REIT that competes with Welltower across senior housing, medical office buildings, and research & innovation properties. Ventas often competes for similar high-quality assets and strategic partnerships. The company's scale and access to capital are key competitive advantages.

Following its merger with Physicians Realty Trust, Healthpeak has strengthened its position in medical office buildings and life science properties. This merger has intensified competition in these segments. Healthpeak's portfolio diversification is a key competitive factor.

Omega Healthcare Investors primarily focuses on skilled nursing facilities but also competes for post-acute care assets. The company's specialization in skilled nursing facilities sets it apart. Omega's financial performance is closely tied to the post-acute care sector.

Welltower also faces competition from private equity firms, institutional investors, and sovereign wealth funds. These entities have different return requirements and investment horizons. Their increasing allocation of capital to healthcare real estate impacts asset pricing.

Competitors use various strategies, including scale, access to capital, and established relationships with healthcare providers. Innovation in property design and technology integration are also key. Flexible lease structures and attractive amenities are important for attracting tenants.

The competitive landscape is constantly evolving due to mergers, acquisitions, and new entrants. For a deeper dive into the business model, consider reading Revenue Streams & Business Model of Welltower.

Several factors influence the Welltower competitive landscape, including financial performance, geographic presence, and strategic partnerships. Understanding these factors is crucial for evaluating Welltower's position in the market.

- Scale and Financial Strength: Competitors with greater scale and access to capital can often secure more favorable terms and pursue larger acquisitions.

- Property Portfolio: The quality and diversification of a company's property portfolio are critical. Welltower's focus on high-quality assets is a key differentiator.

- Strategic Partnerships: Collaborations with healthcare providers and operators can provide a competitive advantage. These partnerships are essential for operational success.

- Innovation and Technology: Integrating technology and innovative designs in properties is increasingly important. This includes smart home features and telehealth capabilities.

- Geographic Presence: The geographic distribution of a company's portfolio affects its exposure to different market dynamics. Welltower has a significant presence in North America and the UK.

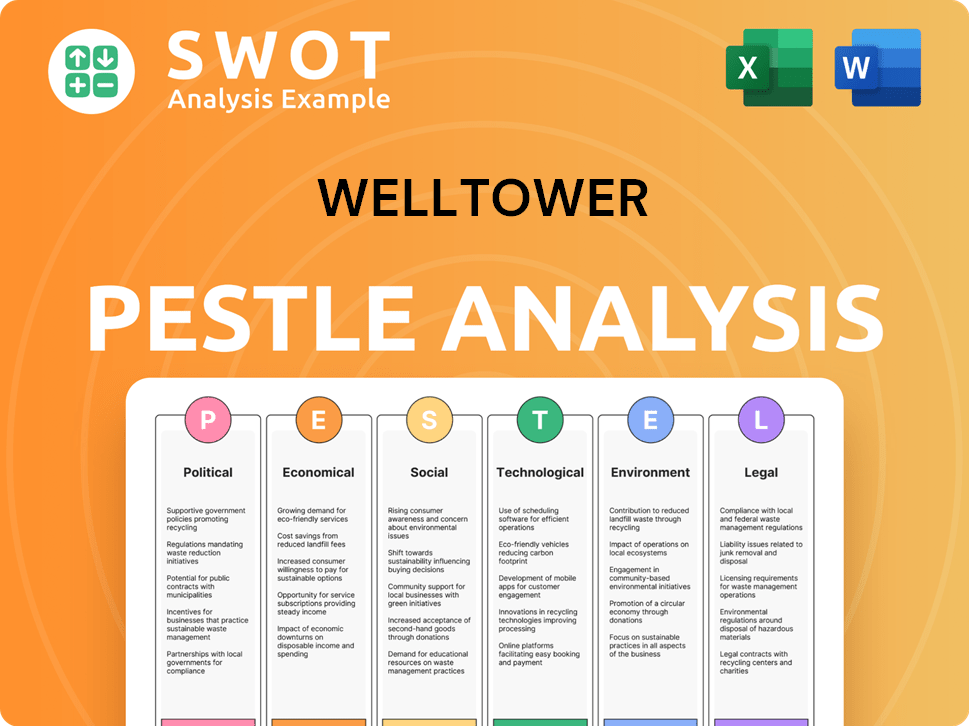

Welltower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Welltower a Competitive Edge Over Its Rivals?

The competitive landscape for healthcare real estate is shaped significantly by companies like Welltower. Its strategic focus, substantial scale, and deep expertise in the healthcare sector are key differentiators. The company's ability to navigate the complexities of the senior housing market and healthcare real estate investment trust (REIT) landscape positions it uniquely among its competitors.

Welltower's success is built on a foundation of high-quality healthcare properties, particularly within the senior housing operating portfolio (SHOP) segment. This focus allows for economies of scale and stronger relationships with leading healthcare providers. The company’s approach to data analytics and market intelligence further enhances its competitive edge, enabling informed investment decisions and proactive portfolio management. Understanding the Growth Strategy of Welltower provides additional context to its strategic moves.

Welltower's competitive advantages are sustained by its specialized approach to healthcare real estate, its established industry relationships, and continuous investment in data and operational excellence. The company's financial health, characterized by a robust balance sheet, provides a distinct advantage in a capital-intensive industry. This financial flexibility allows the company to pursue large-scale acquisitions and development projects, further expanding its market presence.

Welltower's portfolio includes a diverse range of healthcare properties, enhancing its market presence. This diversification helps mitigate risks associated with specific market fluctuations. The company's large-scale acquisitions and developments contribute significantly to its overall market share.

Welltower has established strong partnerships with leading healthcare providers. These partnerships provide a stable tenant base and access to operational insights. These relationships are crucial for navigating the complexities of the senior housing market.

The company utilizes proprietary data analytics and market intelligence to optimize property performance. This data-driven approach enables informed investment decisions. This leads to superior returns and efficient asset management.

Welltower maintains a robust balance sheet and diverse capital sources. This financial strength allows for large-scale acquisitions and development. This financial flexibility is a key advantage in a capital-intensive industry.

Welltower's competitive advantages are multifaceted, including a robust portfolio, strategic partnerships, and financial strength. The company's focus on data analytics and market intelligence further enhances its ability to identify and capitalize on opportunities within the healthcare real estate sector. As of early 2024, the company's portfolio includes approximately 1,400 properties.

- Portfolio Diversification: Welltower's portfolio includes senior housing, post-acute care, and outpatient medical properties, reducing risk.

- Strategic Partnerships: Collaborations with leading healthcare providers provide stable revenue streams and operational insights.

- Data Analytics: Sophisticated data analysis enables informed investment decisions and proactive portfolio management.

- Financial Health: A strong balance sheet and access to capital support large-scale acquisitions and developments.

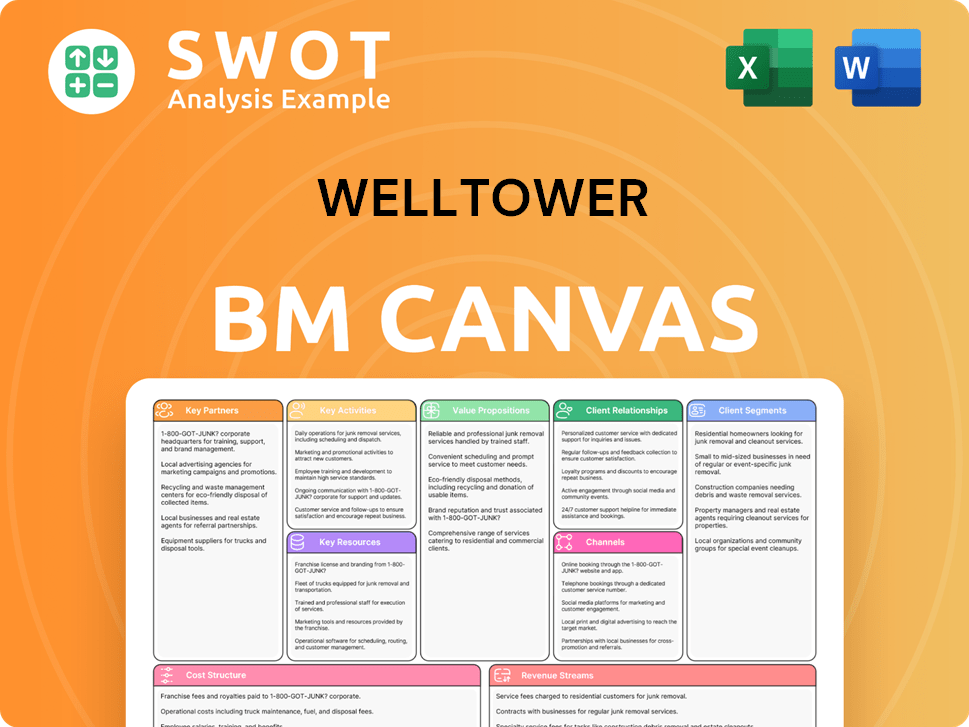

Welltower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Welltower’s Competitive Landscape?

The Welltower competitive landscape is significantly shaped by industry trends, demographic shifts, and technological advancements. As a leading healthcare real estate investment trust (REIT), Welltower faces both challenges and opportunities in a dynamic market. Understanding these factors is crucial for evaluating its future performance and strategic positioning. For a comprehensive overview of Welltower's shareholder information, you can check out Owners & Shareholders of Welltower.

The Welltower market analysis reveals that the company's success hinges on its ability to adapt to evolving healthcare needs and navigate economic uncertainties. Key considerations include managing rising operating costs, intensifying competition for high-quality assets, and the impact of geopolitical and economic factors on capital markets. Welltower's strategic responses to these challenges will be critical for maintaining its competitive edge.

Technological advancements, especially in telehealth and remote monitoring, are influencing healthcare facility demand. Demographic shifts, particularly the aging global population, drive demand for senior housing and specialized healthcare services. Regulatory changes, such as shifts in Medicare and Medicaid reimbursement policies, can impact healthcare providers.

Managing rising operating costs, especially labor and insurance expenses, is a key challenge. Competition for high-quality assets is intensifying, potentially leading to higher acquisition costs. Geopolitical and economic uncertainties could impact capital markets and investment activity.

Expanding into underserved markets and developing specialized facilities create opportunities. Leveraging strategic partnerships to enhance operational efficiencies and introduce innovative care models is beneficial. Continuous portfolio optimization and investment in technology can enhance value.

Welltower's strategic responses include continuous portfolio optimization, focusing on properties with strong demographic fundamentals. Investment in technology and partnerships that enhance the value proposition of its assets is also crucial.

The senior housing market is projected to grow significantly due to the aging population. Rising healthcare costs and labor shortages pose challenges for operators. Welltower's strategic focus on high-quality assets and partnerships aims to mitigate risks and capitalize on opportunities.

- The global geriatric population is expected to reach over 1.5 billion by 2050, driving demand for senior housing.

- Healthcare spending in the U.S. is projected to reach $6.8 trillion by 2030, impacting Welltower's tenants and lease structures.

- Welltower's focus on outpatient facilities and medical office buildings aligns with the growing trend toward outpatient care.

- The company's strategic partnerships are crucial for operational efficiencies and innovative care models.

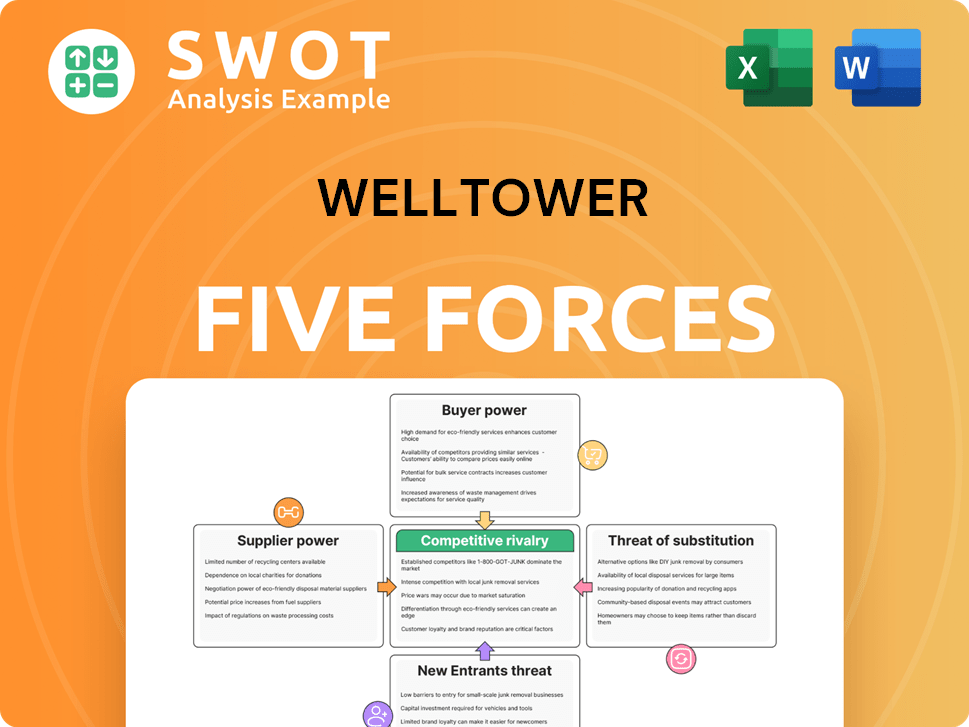

Welltower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Welltower Company?

- What is Growth Strategy and Future Prospects of Welltower Company?

- How Does Welltower Company Work?

- What is Sales and Marketing Strategy of Welltower Company?

- What is Brief History of Welltower Company?

- Who Owns Welltower Company?

- What is Customer Demographics and Target Market of Welltower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.