Welltower Bundle

How Does Welltower Thrive in the Healthcare Real Estate Market?

Welltower Inc. (NYSE:WELL) is a titan in the healthcare real estate sector, expertly positioned at the intersection of housing, healthcare, and hospitality. With a vast portfolio of senior and wellness housing communities across the U.S., U.K., and Canada, Welltower plays a critical role in providing essential infrastructure for mature renters and older adults. The company's impressive financial performance, including a significant revenue increase to $7.85 billion in 2024 and a +20.4% year-to-date stock price surge as of late May 2025, underscores its market leadership.

This exploration of the Welltower SWOT Analysis will dissect the company's operational intricacies, from its diverse revenue streams to its strategic partnerships. Understanding the Welltower business model is crucial, especially considering the projected demand for senior housing, which is expected to significantly outpace supply by 2030. This in-depth analysis will provide investors and industry observers with a comprehensive understanding of the company's sustained profitability and its strategic advantages within the healthcare REIT landscape, including its investment strategy, and its approach to senior living facilities.

What Are the Key Operations Driving Welltower’s Success?

Welltower creates value by strategically investing in and managing a diverse portfolio of healthcare real estate. The company primarily focuses on senior housing, assisted living facilities, and medical office buildings. Their core offerings include providing high-quality physical infrastructure that supports healthcare services and senior living, serving a broad customer base.

Welltower's operational processes are centered around a robust investment and asset management approach. This involves identifying attractive acquisition opportunities in high-demand healthcare markets, leveraging its industry expertise and relationships. For instance, in Q1 2025, Welltower completed $2.8 billion of pro rata gross investments, including $2.7 billion in acquisitions and loan funding.

A significant aspect of the Welltower company's operations is its strategic partnerships with leading healthcare providers and operators. These collaborations involve deeper alignment of incentives, often through NOI-based management fees and enhanced promote structures, ensuring shared growth opportunities. This partnership model allows Welltower to benefit from improving facility performance and occupancy rates, directly impacting NOI growth.

These partnerships are key to Welltower's success. They align incentives and drive growth through NOI-based management fees. This model allows for shared success and increased facility performance.

Welltower uses a proprietary data science platform and the Welltower Business System (WBS). This enables efficient investment decisions, property management optimization, and improved tenant satisfaction. The WBS rolled out in Q3 2024.

Welltower focuses on acquiring assets at a discount to replacement cost. This strategy, combined with operational expertise, drives value creation. This approach is detailed in Growth Strategy of Welltower.

The company's data-driven approach and focus on regional density in its senior housing portfolio translate into customer benefits. These include high-quality facilities and differentiated market offerings.

Welltower's unique approach includes a proprietary data science platform and the Welltower Business System (WBS). These tools enhance investment decisions and property management. This leads to reduced costs and improved tenant satisfaction.

- Strategic Partnerships: Collaborations with leading healthcare providers.

- Data Analytics: Proprietary platform for informed decisions.

- Operational Expertise: Driving better results post-acquisition.

- Focus on Senior Housing: High-quality facilities and market offerings.

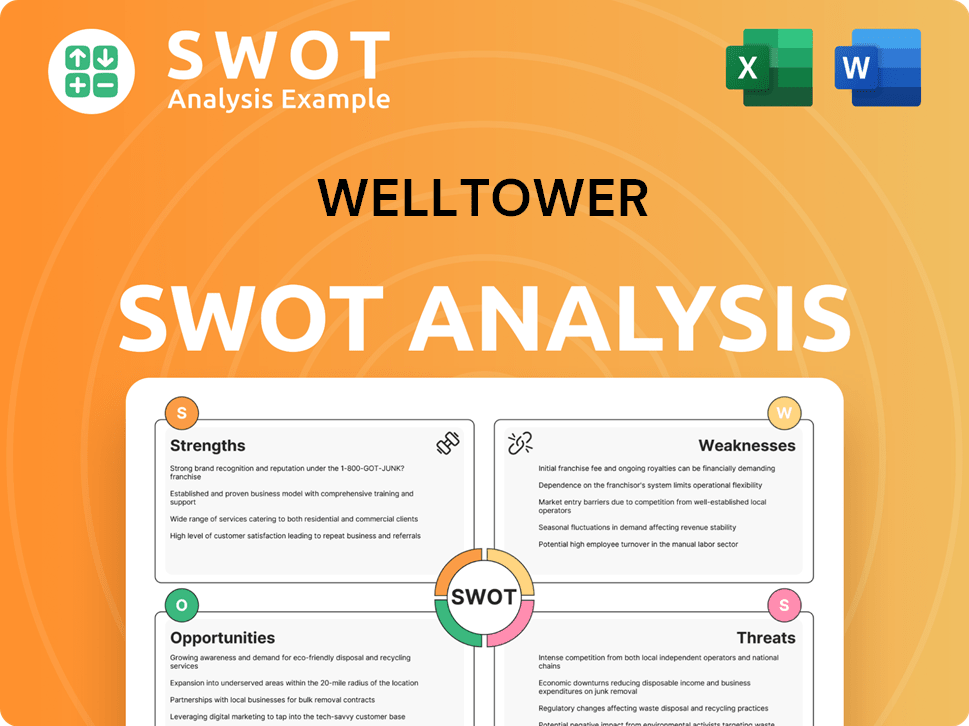

Welltower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Welltower Make Money?

The Welltower company generates revenue primarily through rental and leasing agreements with healthcare providers who utilize its properties. The company's diverse portfolio includes senior housing operating (SHO) properties, triple-net leased properties, and outpatient medical (OM) buildings, which contribute to its revenue streams. The company's financial performance reflects its robust business model and strategic investments in healthcare real estate.

In 2024, Welltower reported a total revenue of $7.85 billion, showcasing substantial growth. The company's Q1 2025 earnings report further highlighted strong performance, with quarterly revenue rising 30.3% year-over-year to $2.42 billion. This growth underscores the effectiveness of its revenue generation strategies and its ability to capitalize on market opportunities within the healthcare real estate sector.

The senior housing operating (SHO) segment is a significant contributor to Welltower's revenue, demonstrating robust growth. This segment's performance is driven by increased occupancy and higher revenue per occupied room, reflecting the company's strategic focus on senior living facilities and healthcare partnerships. For a deeper dive into their expansion plans, consider reading about the Growth Strategy of Welltower.

Welltower's monetization strategies are centered around its real estate portfolio and strategic capital deployment. These strategies are designed to maximize returns and enhance shareholder value. The company's focus on acquiring communities at a discount and improving their performance contributes to enhanced revenue and profitability.

- Senior Housing Operating (SHO) Segment: This segment saw a year-over-year same-store revenue increase of 9.6% in Q1 2025, driven by a 400 basis points (bps) of year-over-year average occupancy growth and Revenue Per Occupied Room (RevPOR) growth of 5.9%. The SHO portfolio's same-store NOI growth was an impressive 21.7% in Q1 2025.

- Strategic Capital Deployment: Welltower actively engages in acquisitions and development funding. In Q1 2025, the company completed $2.8 billion in gross investments, including $2.7 billion in acquisitions and loan funding.

- Portfolio Optimization: The company undertakes property dispositions and loan repayments to recycle capital. In Q1 2025, it completed pro rata property dispositions of $381 million and loan repayments of $123 million.

- Private Funds Management: In January 2025, Welltower launched a private funds management business, with the ability to source up to $2 billion to invest in stable or near-stable seniors housing properties in the U.S., diversifying its monetization avenues by managing third-party capital.

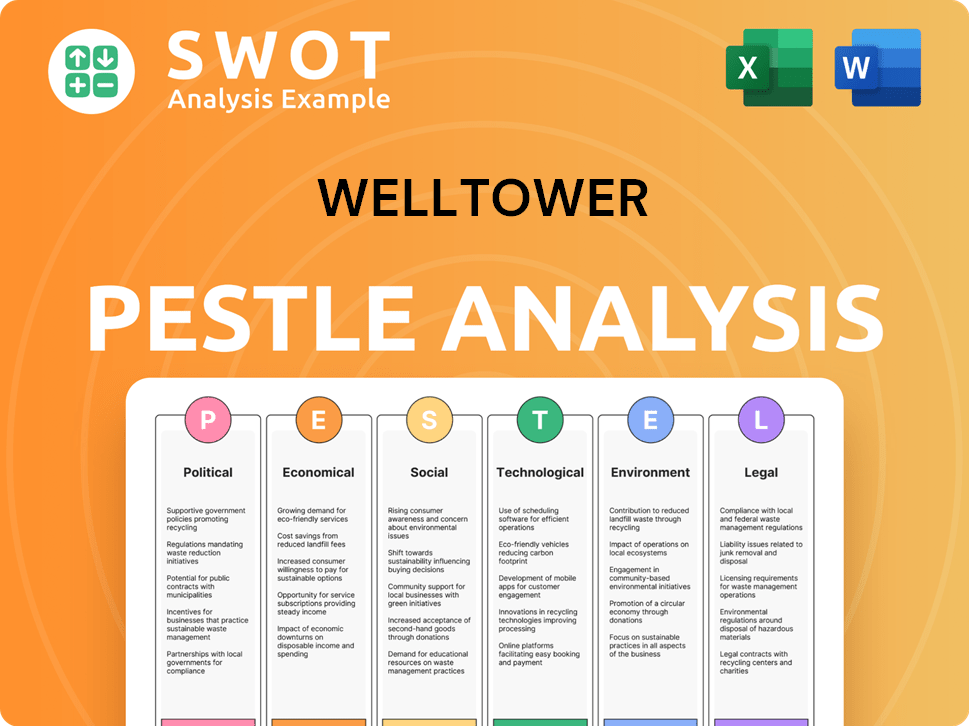

Welltower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Welltower’s Business Model?

The Welltower company has achieved significant milestones and strategic moves that have shaped its operations and financial performance. A recent development in 2025 was the agreement to acquire a portfolio of 38 ultra-luxury senior housing communities and nine development parcels in Canada for C$4.6 billion (approximately $3.2 billion USD), operated by Amica Senior Lifestyles. This acquisition bolstered its presence in the Canadian market. In Q1 2025 alone, Welltower invested a record-setting $6.2 billion in new investments, exceeding its entire 2024 investment total of $6 billion, demonstrating an aggressive investment push.

Operationally, Welltower has faced challenges, including managing rising operating expenses, particularly labor costs, and integrating acquired properties. However, the company has responded by focusing on operational efficiencies and strategic initiatives. For instance, Welltower has been rolling out its Welltower Business System (WBS) across its portfolio since Q3 2024, aiming to provide real-time, actionable data to employees and improve operational management. Additionally, the company has invested in employee retention strategies, such as renovating break rooms in communities, which has shown a significant reduction in turnover rates.

Welltower's competitive advantages are multifaceted, including its strong market position and scale in the senior housing and healthcare real estate sectors. The company's diversified portfolio across the US, UK, and Canada, combined with its established relationships with leading healthcare operators, provides a robust foundation. A critical competitive edge is its advanced data analytics capabilities and the Welltower Business System, which allow for more informed decisions in property acquisition, operational efficiency, and market strategy.

Welltower's recent acquisition in Canada for C$4.6 billion significantly expands its portfolio. The company is aggressively investing, with $6.2 billion in new investments in Q1 2025. These moves demonstrate a commitment to growth and market expansion within the healthcare real estate sector.

Welltower is implementing the Welltower Business System (WBS) to improve operational management. The company focuses on employee retention through facility improvements. These initiatives aim to streamline operations and enhance the overall efficiency of their senior living facilities.

Welltower's strong market position and scale in senior housing and healthcare real estate are key strengths. Advanced data analytics and the Welltower Business System provide a competitive edge. The company's diversified portfolio and established operator relationships contribute to its robust foundation.

Welltower's net debt to Adjusted EBITDA ratio improved to 3.33x at March 31, 2025, from 4.03x at March 31, 2024. The company's credit ratings were upgraded by S&P Global Ratings to 'A-' and Moody's Investor Services to 'A3' in March 2025. The company uses a data-driven approach to identify opportunities and close deals rapidly.

Welltower leverages its data science platform for a 'data-driven and fact-based approach,' enabling rapid deal closures. This strategy allows the Welltower company to identify opportunities in a 'glacially moving industry' and capitalize on them quickly, often within 45 to 60 days. The company's strategic positioning benefits from the ongoing demographic tailwinds of an aging population, ensuring long-term growth prospects.

- Rapid Deal Closures: Deals are closed in 45-60 days.

- Data Analytics: Advanced data analytics drive investment decisions.

- Financial Strength: Improved net debt to Adjusted EBITDA ratio.

- Market Focus: Senior housing and healthcare real estate.

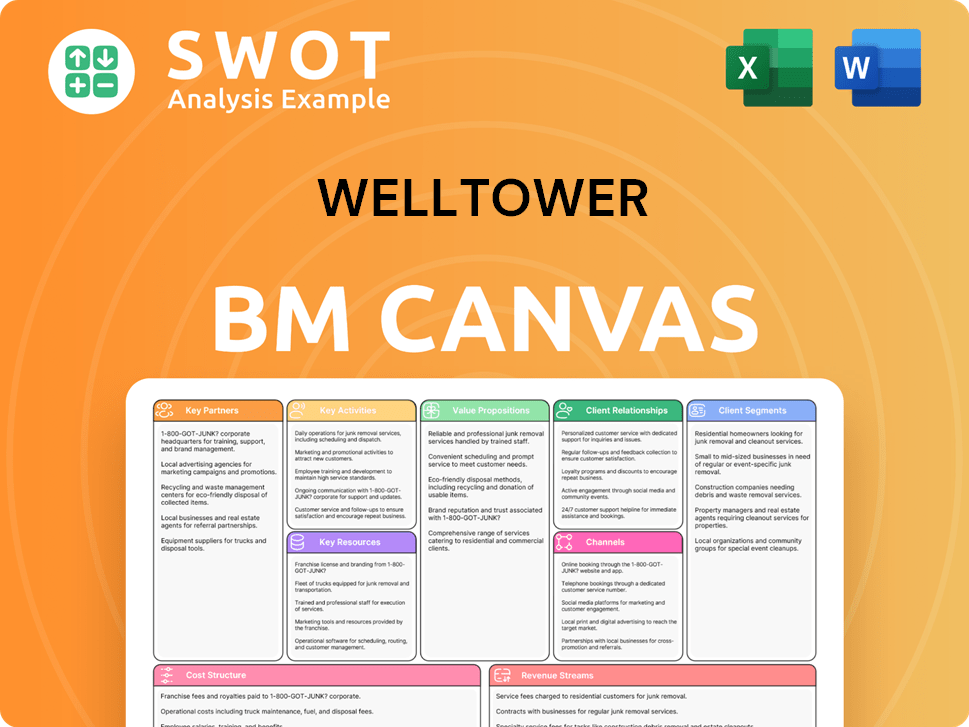

Welltower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Welltower Positioning Itself for Continued Success?

The Welltower company holds a prominent market position within the specialized healthcare REIT sector. It stands as one of the largest players, competing with companies such as Ventas and Healthpeak. Its competitive advantage comes from its large scale, a diversified portfolio across healthcare property types, and established relationships with leading healthcare operators.

Despite its strong position, Welltower faces several key risks and headwinds. These include fluctuations in interest rates, increased competition in senior housing markets, and operational challenges. Furthermore, regulatory changes, shifts in reimbursement models, and economic downturns also pose potential risks.

Welltower is a leading player in the healthcare real estate sector. Its focus on senior housing and healthcare properties gives it a strong market presence. The company's strategic partnerships and global reach enhance its competitive advantage.

The company faces risks from interest rate fluctuations and increased competition. Managing rising operating expenses and integrating new properties are ongoing challenges. Regulatory changes and economic downturns could also impact operations.

Welltower is pursuing strategic initiatives to expand its asset base. The company anticipates continued strong performance, driven by operational improvements and acquisitions. The aging population provides a favorable demographic tailwind.

Welltower has a robust investment pipeline, with investments announced for 2025. The launch of a private funds management business diversifies capital deployment. The Welltower Business System (WBS) aims to enhance efficiency through AI and machine learning.

Welltower's Q1 2025 results showed a normalized FFO per share increase of 18.8% over the prior year. The company raised its 2025 net income guidance to a range of $1.70 to $1.84 per diluted share. Welltower aims to deliver compounding growth for shareholders by leveraging its unique platform.

- The company's improved credit ratings support future growth.

- Welltower had approximately $8.6 billion of available liquidity as of March 31, 2025.

- Strategic acquisitions at discounts to replacement cost are a key focus.

- The company is capitalizing on the demographic tailwinds of an aging population.

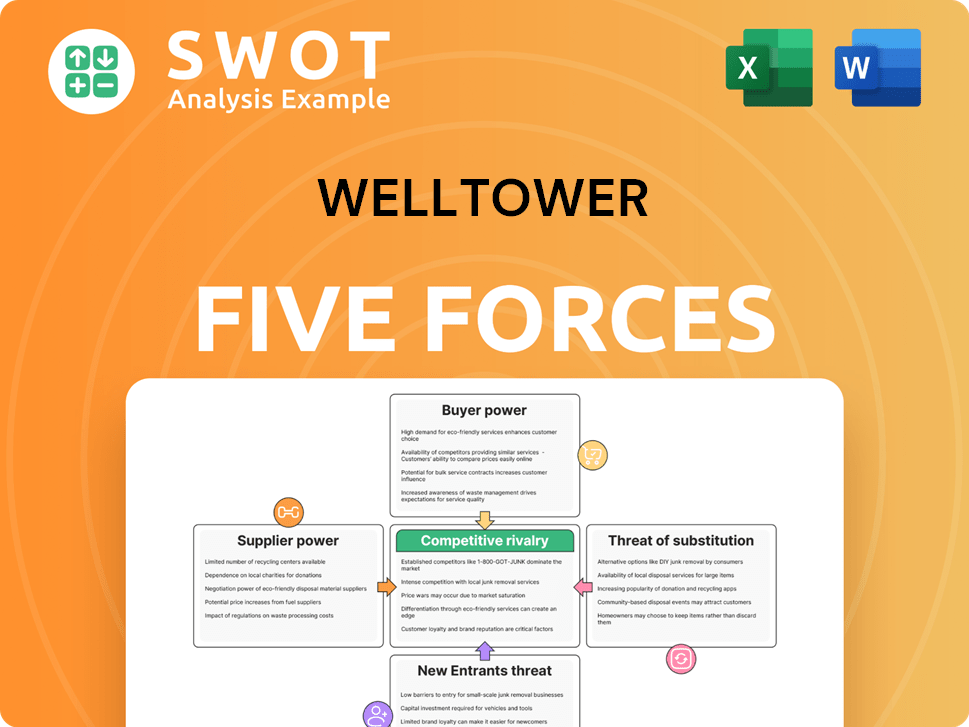

Welltower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Welltower Company?

- What is Competitive Landscape of Welltower Company?

- What is Growth Strategy and Future Prospects of Welltower Company?

- What is Sales and Marketing Strategy of Welltower Company?

- What is Brief History of Welltower Company?

- Who Owns Welltower Company?

- What is Customer Demographics and Target Market of Welltower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.