XP Bundle

How Did XP Company Revolutionize Brazilian Finance?

Ever wondered how a company could disrupt an entire financial system? XP Inc. did just that, transforming the Brazilian investment landscape. This XP SWOT Analysis will give you a glimpse into its strategic moves. From its inception, XP Company has been a beacon of change, challenging the status quo and empowering investors.

The story of XP Company is a compelling narrative of innovation and perseverance. Exploring the XP history reveals a fascinating journey from a small startup to a financial powerhouse. Understanding the XP business model and its evolution, including its key milestones and the vision of its founder, provides invaluable insights into its remarkable achievements. This article delves into the early days of XP business, its challenges, and its impact on the industry.

What is the XP Founding Story?

The story of XP Company, a prominent player in the Brazilian financial market, began in 2001. It was founded by Guilherme Benchimol and Marcelo Maisonnave in Porto Alegre, Brazil. Their vision was to revolutionize the financial landscape by offering independent advice and a wider range of investment options.

The founders saw a gap in the market, dominated by large banks with limited offerings and high fees. They aimed to create a brokerage firm that prioritized investor education and provided access to diverse investment products. This focus on client-centric services and financial literacy became the cornerstone of XP's early success.

XP Company's early days were marked by a focus on financial advisory services and online brokerage. Initial funding came from bootstrapping and early investments. The company's commitment to financial literacy was evident from the start.

- The initial offerings primarily included equities and fixed-income products.

- Benchimol personally contacted potential clients and conducted educational seminars.

- The founders' expertise in financial markets was crucial.

- They understood the needs of underserved Brazilian investors.

The early business model of XP focused on providing financial advisory services and access to an online brokerage platform. The initial offerings were primarily focused on equities and fixed-income products. Initial funding came from bootstrapping and early investments from friends and family. This approach reflected the entrepreneurial spirit of the founders, who were determined to build a new financial institution in a concentrated market. The founding team's expertise in financial markets and understanding of the needs of the underserved Brazilian investor were instrumental in shaping XP's early direction.

The founders' commitment to financial literacy was evident from the start. Benchimol personally cold-called potential clients and conducted educational seminars to build trust and attract a client base. This hands-on approach underscored their dedication to empowering investors with knowledge. The company's early success was built on overcoming the initial challenges of establishing a new financial institution in a highly concentrated market.

To understand how XP generates revenue, you can explore the Revenue Streams & Business Model of XP.

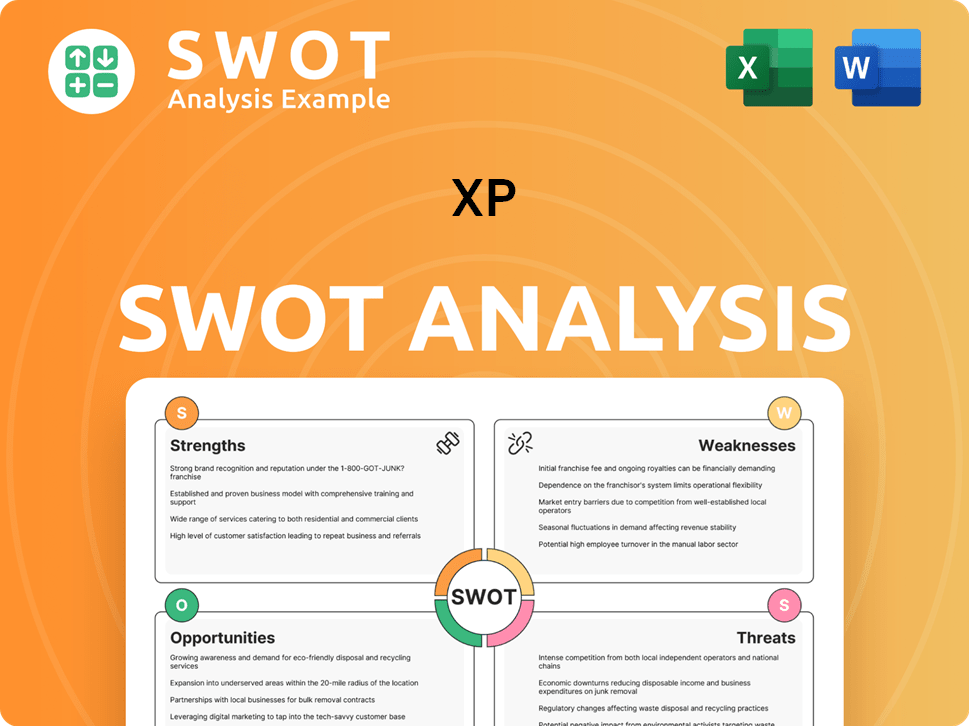

XP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of XP?

The early growth and expansion of XP Inc. was marked by a strong emphasis on investor education and broadening its product range. In its initial phase, the company distinguished itself by offering educational courses and seminars, a novel approach in Brazil's financial sector. This strategy helped build trust and draw in a growing clientele, gradually shifting assets from traditional banks. Looking into the Owners & Shareholders of XP, we can see the foundation of this growth.

One of the key strategies in the early days of XP business was investor education. The company provided courses and seminars to educate potential investors. This approach helped in building trust and attracting a larger client base. This was a significant factor in XP's early success and its ability to attract clients, setting it apart from competitors.

XP's early product offerings expanded beyond equities to include a wider array of fixed-income instruments and access to mutual funds from various asset managers. This diversification was crucial for attracting a broader client base. By offering a more comprehensive range of investment options, XP was able to cater to different investor needs and risk profiles.

The opening of major offices in São Paulo, the financial hub of Brazil, was a pivotal move for XP's expansion. This allowed for greater proximity to a larger investor base and financial institutions. This strategic location played a crucial role in the company's growth by improving accessibility and facilitating stronger relationships within the financial industry.

The acquisition of Infomoney in 2007 significantly boosted XP's reach and content distribution. By 2012, XP had surpassed 100,000 active clients, demonstrating rapid growth. The integration of independent financial advisors was a pivotal decision that significantly scaled its distribution capabilities and client reach, shaping its trajectory as a dominant player in the Brazilian investment landscape. These milestones are key in the XP timeline.

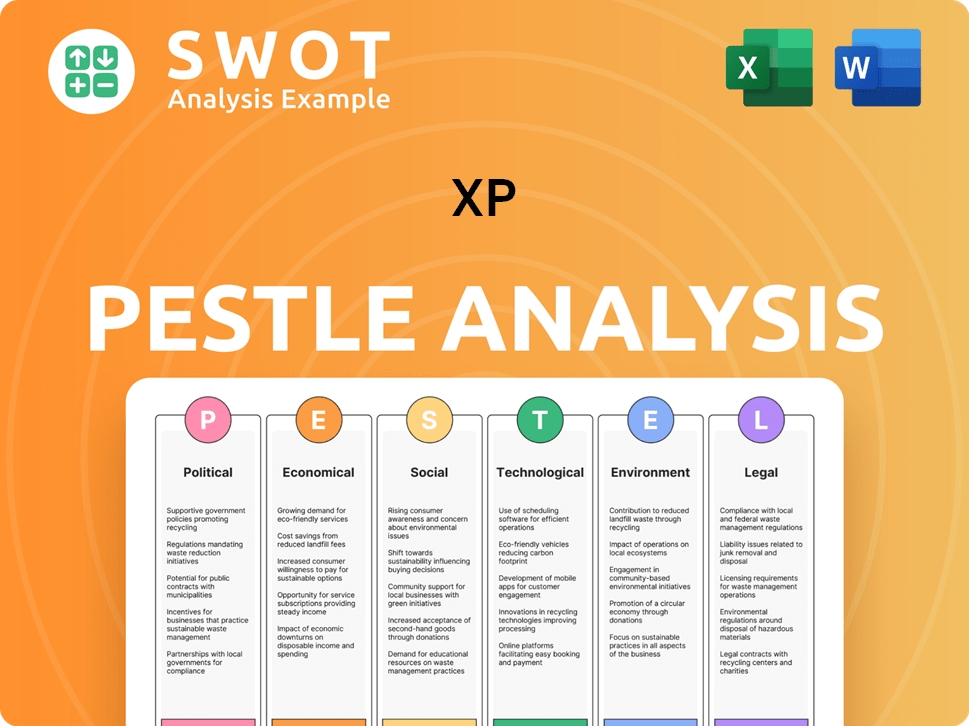

XP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in XP history?

The XP Company has experienced a dynamic journey marked by significant milestones. Understanding the XP history involves recognizing its key achievements and the evolution of its XP business model. The XP timeline showcases the company's growth and impact on the financial sector.

| Year | Milestone |

|---|---|

| 2001 | Founded by Guilherme Benchimol and Marcelo Maisonnave, marking the start of the XP Company. |

| 2007 | Received its first investment from the private equity firm Actis, fueling its expansion. |

| 2017 | It was reported that the company had over 1 million clients, demonstrating significant growth. |

| December 2019 | The XP Company went public on Nasdaq, raising approximately $2.25 billion. |

| 2020 | The company faced increased regulatory scrutiny, leading to adjustments in its practices. |

| 2023 | The company reported a net income of BRL 4.3 billion, showcasing financial strength. |

One of the most important innovations of the XP Company was the development of its open architecture platform, providing clients access to a wide array of investment products. This shift changed the financial landscape in Brazil. The company consistently invested in technology to enhance user experience and streamline investment processes.

This platform allowed clients to access various investment products from different providers, a significant departure from traditional models. This innovation broadened investment choices and promoted greater transparency.

The XP Company embraced digital technologies to enhance user experience, including user-friendly interfaces and mobile applications. This focus on digital solutions streamlined investment processes.

The company prioritized client education and personalized services, creating a strong client base. This approach helped build trust and loyalty among investors.

Expanding beyond brokerage services to include digital banking and asset management broadened the revenue streams. This diversification improved financial stability and resilience.

Collaborating with other financial institutions and technology providers enhanced its service offerings. These partnerships expanded market reach and improved its competitive position.

Using data analytics and artificial intelligence to improve investment strategies and client recommendations. This helped to personalize services and enhance decision-making.

The XP Company has faced challenges, including market downturns and increased competition from established financial institutions and new fintech entrants. Regulatory changes in Brazil also presented ongoing hurdles, requiring continuous adaptation. To understand the competitive landscape, one can explore the Competitors Landscape of XP.

Economic downturns and market fluctuations tested the company's resilience and risk management capabilities. These events required agile responses and strategic adjustments.

Competition from traditional banks and new fintech companies required constant innovation. This pressure demanded continuous improvement in products and services.

Changes in Brazil's financial regulations necessitated ongoing adjustments to compliance and operational frameworks. These shifts required proactive adaptation and strategic planning.

The company faced scrutiny regarding its advisory model and potential conflicts of interest. Addressing these concerns required transparency and ethical practices.

The company experienced product failures or suboptimal launches, which provided lessons in market fit and client expectations. These experiences led to improved product development processes.

Global economic crises tested the company's resilience and risk management capabilities. These events required strategic pivots and strong financial planning.

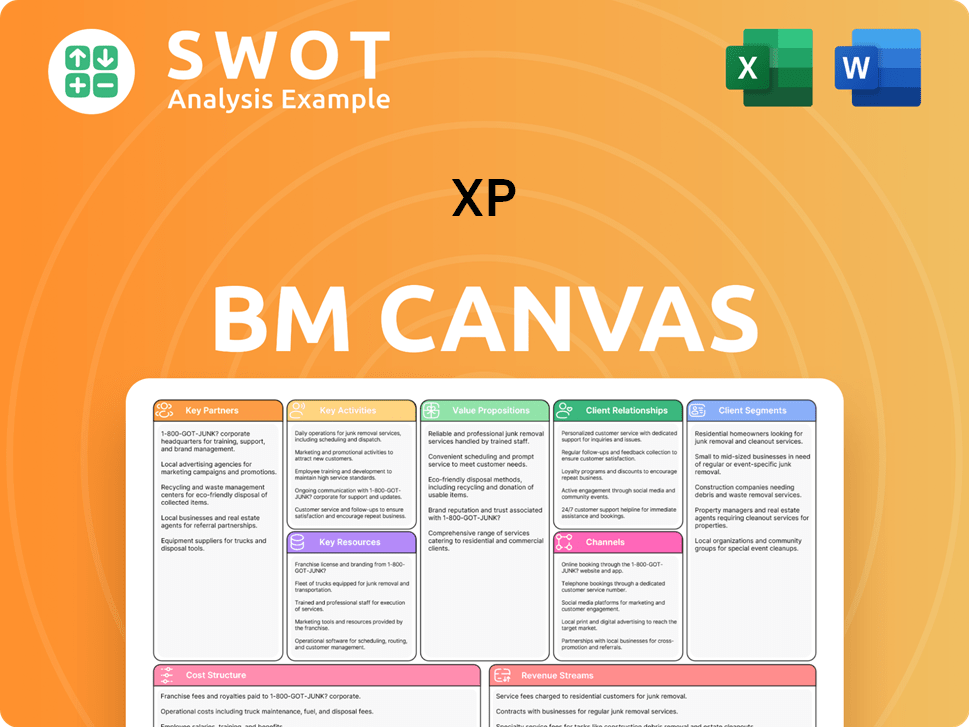

XP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for XP?

The XP Company has a dynamic history marked by consistent growth and strategic expansion, evolving from its founding in 2001 to a publicly traded company with millions of clients. The XP history is defined by key milestones, including significant acquisitions, strategic partnerships, and a successful IPO, solidifying its position in the financial sector. The XP business has consistently adapted to market changes, expanding its services and client base to become a leading financial institution in Brazil.

| Year | Key Event |

|---|---|

| 2001 | Founded in Porto Alegre by Guilherme Benchimol, marking the beginning of the XP timeline. |

| 2007 | Acquired Infomoney, a leading financial news portal, expanding its reach and content offerings. |

| 2012 | Reached 100,000 active clients, demonstrating significant early growth for the company. |

| 2014 | Launched its first investment fund platform, diversifying its product offerings and expanding services. |

| 2017 | Itaú Unibanco acquired a significant stake in XP Inc., a major validation of its market position. |

| 2019 | Successful IPO on Nasdaq, raising approximately $2.25 billion, a pivotal moment in its financial journey. |

| 2020 | Launched XP Visa Infinite card, expanding into digital banking services, broadening its financial offerings. |

| 2021 | Reached 3.5 million active clients, showcasing rapid client base expansion and market penetration. |

| 2022 | Announced its intention to expand further into the ultra-high-net-worth segment and institutional clients. |

| 2023 | Reported R$1.0 billion in net income for Q4 2023, with a total of R$3.8 billion for the full year 2023, demonstrating financial success. |

| 2024 | Continues to focus on expanding its credit offerings and digital banking solutions, aiming to deepen client relationships and drive growth. |

XP Inc. is focused on deepening its presence across various financial segments. They plan to expand into the high-net-worth, ultra-high-net-worth segments, and institutional clients. This expansion includes offering more sophisticated products and tailored advisory services to meet diverse client needs.

The company is leveraging technology to enhance client experiences. They are focusing on artificial intelligence and data analytics to personalize investment advice. This approach aims to optimize client portfolios and improve overall service quality.

Industry trends such as digitalization and the growing demand for independent financial advice are key factors. The increasing financial literacy of the Brazilian population is also expected to positively impact XP's future. These trends support continued growth in client assets and revenue.

Leadership emphasizes innovation, client-centricity, and expanding access to financial services. This forward-looking approach aligns with the founding vision of democratizing investments. The company aims to empower investors across Brazil through quality financial services.

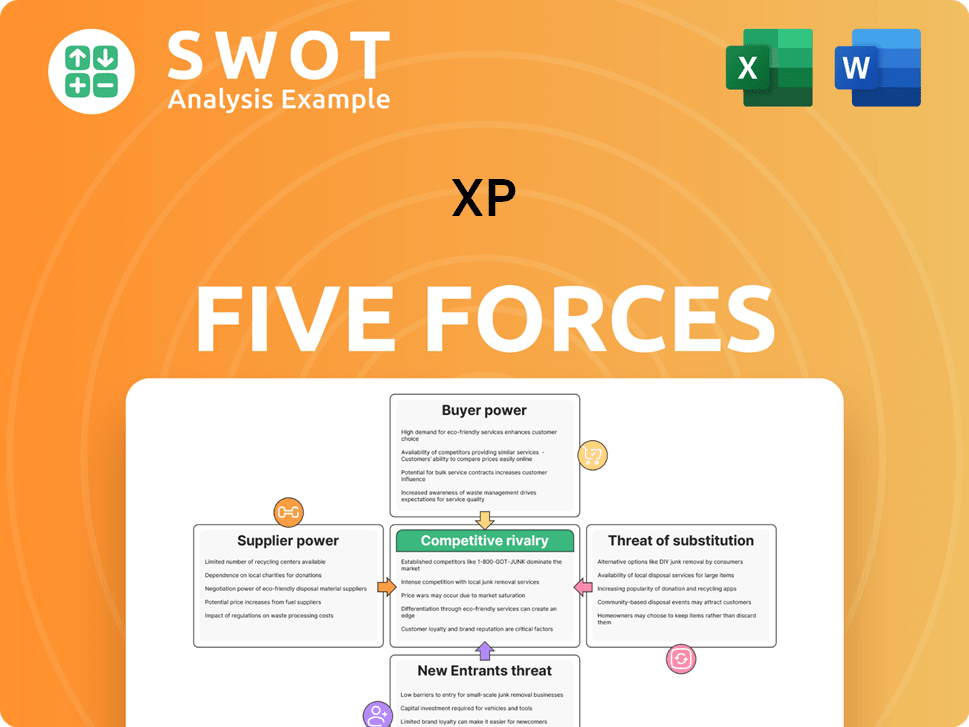

XP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.