XP Bundle

Who Does XP Company Serve?

Embark on a journey to uncover the core of XP Company's success: its customers. Understanding the customer demographics and target market is essential for any financial institution, and XP Company is no exception. This exploration delves into the heart of XP Company's strategy, examining who they serve and how they've adapted to a changing financial landscape. This XP SWOT Analysis can provide even more insights.

XP Company's evolution from a financial advisory firm to a comprehensive financial ecosystem reflects a deep understanding of its target market. This analysis will help you understand the demographic profile of XP Company's customers, including their financial aspirations and needs. We will conduct a thorough market analysis to identify the ideal customer profile and explore effective customer segmentation strategies, providing actionable insights for investors and strategists alike. We will explore the geographic location of XP Company's target market and analyze the age groups of XP Company's customers.

Who Are XP’s Main Customers?

Understanding the customer demographics and target market is crucial for the success of any financial services company. The XP Company, a prominent player in the Brazilian financial market, has a diverse customer base segmented into several key groups. This segmentation allows the company to tailor its services and marketing efforts effectively, ensuring it meets the specific needs of each customer segment.

XP Inc. strategically focuses on three key pillars: Leadership in Core Business, Retail Cross-Sell, and Wholesale operations. These pillars underpin the company's approach to serving its varied clientele. The company's ability to cater to different segments is a key factor in its sustained growth and market position. As of Q1 2025, the company reported 4.7 million active clients, demonstrating a 2% year-over-year growth.

This article will delve into the primary customer segments of XP Company, providing insights into their characteristics and how XP caters to their needs. We will explore the retail, high-net-worth, international, and corporate/institutional client segments, examining the strategies and services offered to each.

Retail clients form a significant portion of XP's customer base. In Q1 2025, retail revenue reached R$3.44 billion, marking a 10% year-over-year increase. XP also reported R$20 billion in retail net inflows during the same period. The company offers various services to this segment, including advisory services and financial planning.

XP provides financial planning and wealth planning services tailored to high-net-worth individuals and private clients. The company is uniquely positioned in Brazil, offering comprehensive financial planning for clients with assets above R$300,000. This specialized service helps retain and grow this important segment.

XP serves corporate and institutional clients through its B2B operations. Corporate and issuer services revenue reached R$562 million in Q1 2025, an 11% year-over-year increase. These clients are defined as entities with over R$700 million in annual revenue. This segment benefits from XP's corporate and issuer services.

While not explicitly detailed in recent financial reports, XP likely caters to international clients, though specific data on this segment is not provided. The company's broad range of services and digital platforms likely attract international investors seeking access to the Brazilian market.

XP's marketing mix analysis in January 2025 indicated a strong appeal to a younger, digitally-native demographic. The company's digital platforms show that a significant portion of users are aged 18-34 years, with a smaller percentage in the 35-49 and 50+ age groups. This suggests a focus on digital channels to reach its target audience.

- 72.3% of users aged 18-34 years.

- 21.5% of users aged 35-49 years.

- 6.2% of users aged 50+ years.

- Approximately 60% of XP's retail net inflows in 2024 came from new channels, such as internal advisory and wealth managers. This highlights successful diversification of revenue streams.

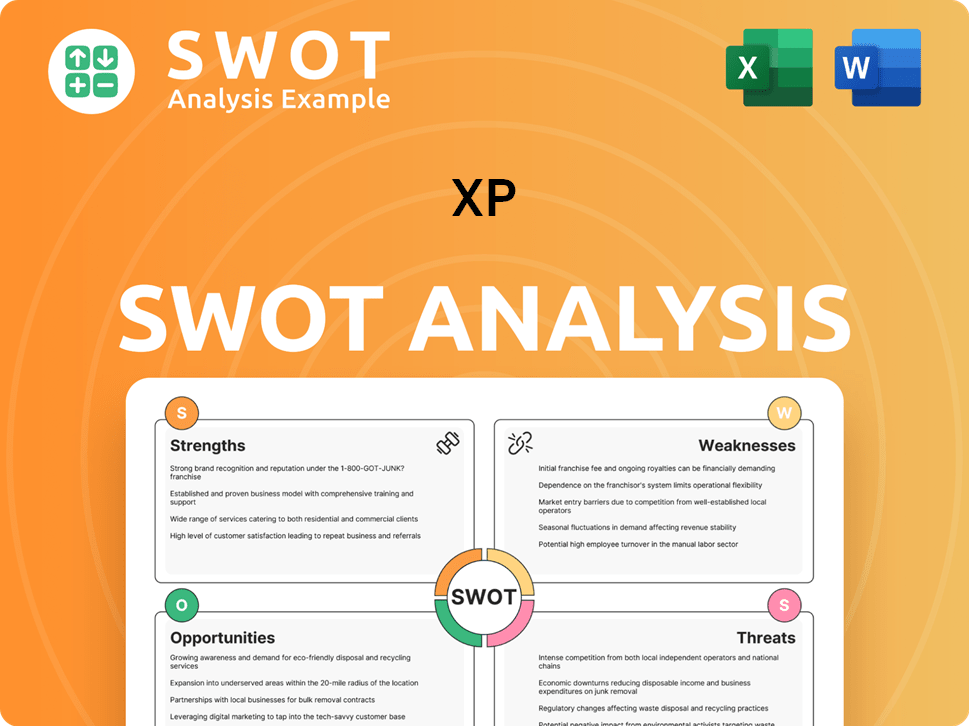

XP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do XP’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, and XP Inc. is no exception. The company focuses on meeting the demands of its clients by providing accessible, diverse, and low-fee financial products and services. This approach is designed to address the common pain points associated with traditional banking, offering a modern alternative.

The company's commitment to customer satisfaction is evident in its operational strategies. XP Inc. primarily operates through its digital channels, serving a significant number of active clients. This digital focus aligns with the purchasing behaviors of its customers, who increasingly prefer digital platforms for managing their finances. The company's emphasis on financial education and empowerment also resonates with clients seeking to make informed financial decisions.

XP Inc. has a strong focus on customer satisfaction, which is reflected in its Net Promoter Score (NPS). The NPS of 73 in Q1 2025 indicates a high level of customer loyalty. This metric is critical for the company's business model, as it demonstrates the effectiveness of its customer-centric approach. For more insights, consider reading about Owners & Shareholders of XP.

XP Inc. tailors its offerings and customer experiences to specific segments, which is a key aspect of its strategy. This approach is designed to enhance client satisfaction and increase platform loyalty. By understanding the varying needs across wealth tiers, the company provides customized services.

- New credit card products were launched in early Q2 2025, specifically aimed at affluent and private bank segments to drive growth in the credit card business.

- Advisory services are offered to retail clients.

- Financial planning is provided to high-net-worth clients.

- Wealth planning is offered to private clients.

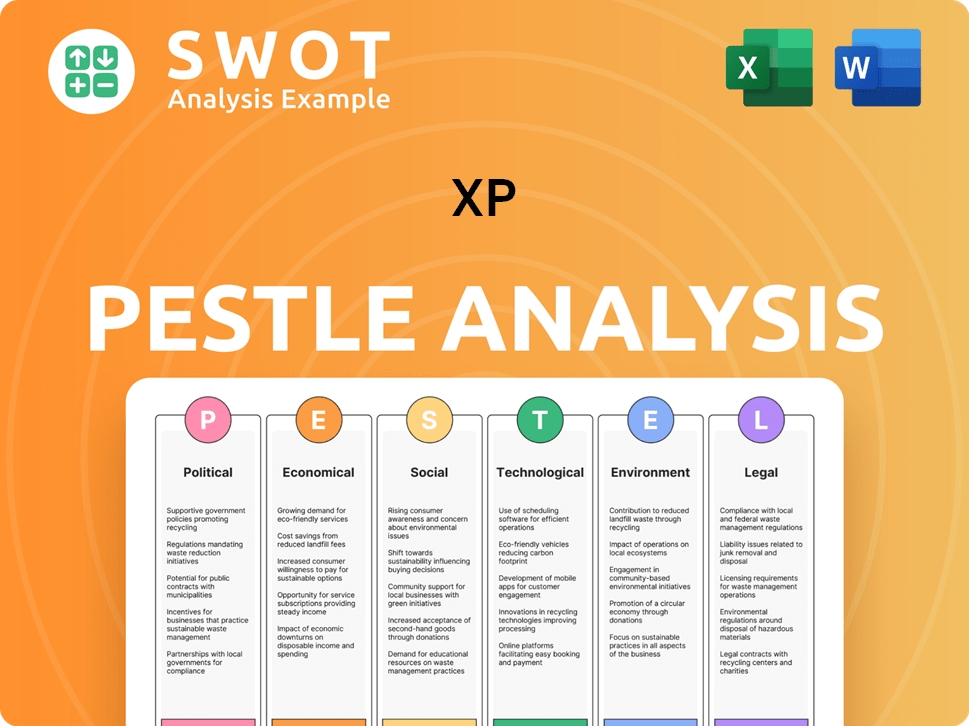

XP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does XP operate?

The geographical market presence of XP Inc. is primarily centered in Brazil. The company has established a strong foothold in the Brazilian financial services market, leveraging a digital distribution model that provides nationwide reach. This extensive coverage allows access to its platforms across all Brazilian municipalities.

As of Q4 2023, XP Inc. held a significant market share of 43.4% in the Brazilian digital brokerage market, underscoring its dominance within the country. While Brazil remains its core market, XP Inc. has strategic plans for international expansion to diversify its revenue streams.

The company is targeting emerging markets to grow its revenue. This expansion is expected to generate approximately $45 million in revenue growth between 2024 and 2025. The strategic move aims to broaden its geographical footprint beyond Brazil.

XP Inc. has a strong presence in Brazil, with a market share of 43.4% in the digital brokerage market as of Q4 2023. Its digital distribution model ensures access across all Brazilian municipalities.

The company is targeting several emerging markets for potential revenue growth. These markets include Mexico, Argentina, Colombia, Chile, Peru, and Uruguay. This expansion is projected to boost revenue by $45 million between 2024 and 2025.

In Brazil, XP Inc. focuses on strengthening its leadership in its core business. It also aims to expand cross-selling opportunities within its retail segment and develop its wholesale operations. This strategic approach is crucial for maintaining its market position.

XP Inc. is actively targeting several Latin American countries for expansion. These include Mexico, Argentina, Colombia, Chile, Peru, and Uruguay. This expansion is a key part of their strategy to diversify their revenue sources and customer base.

Currently, the geographic distribution of sales is heavily weighted towards Brazil. However, with the planned international expansion, there is an expectation of a shift in revenue generation across different regions. Understanding the Marketing Strategy of XP is crucial.

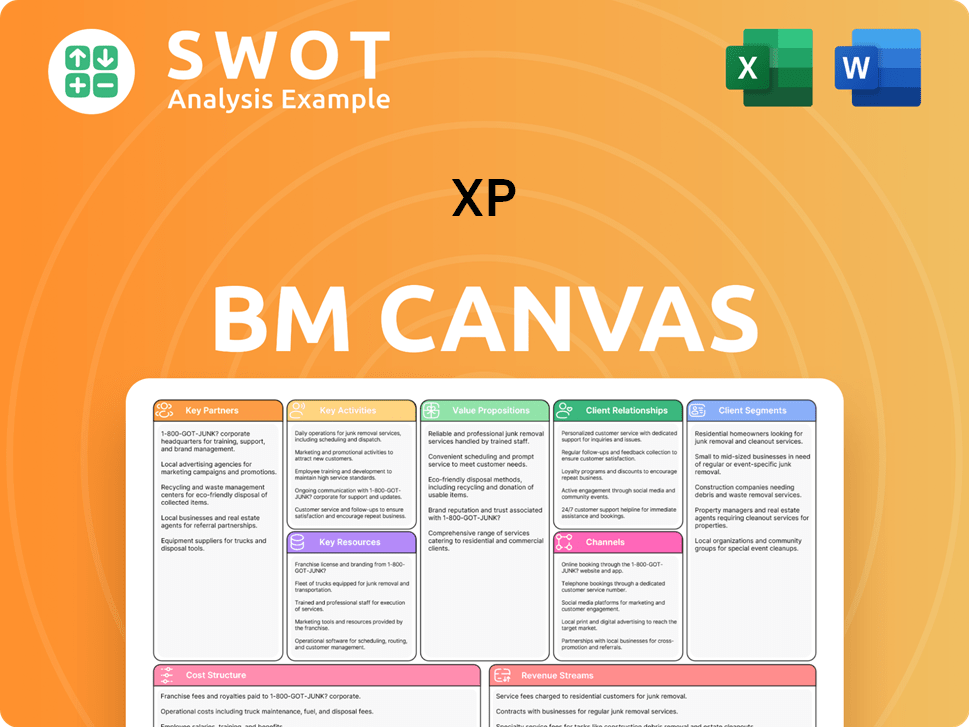

XP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does XP Win & Keep Customers?

To effectively understand the XP Company, it's crucial to examine its customer acquisition and retention strategies. These strategies are vital for the company's growth and market position. The company employs a multi-faceted approach that combines digital and traditional methods, with a strong emphasis on technology and personalized experiences. This approach is designed to attract new customers and keep existing ones engaged.

One of the primary acquisition strategies involves leveraging its extensive network of independent financial advisors (IFAs). This network serves as a crucial channel for acquiring new clients. The company also invests heavily in digital marketing, utilizing first-party data and AI to enhance its advertising effectiveness. This data-driven approach allows for better targeting and more efficient use of marketing resources.

For retention, XP Company focuses on providing high-quality customer service and fostering a positive client experience. This includes gathering regular customer feedback to understand their needs and preferences. The company also expands its offerings beyond investments, such as credit cards and insurance, to increase the share of wallet and reduce customer churn. The company's commitment to shareholder value, through dividends and buybacks, also indirectly contributes to customer confidence and loyalty. To learn more about the company's broader strategic initiatives, you can explore the Growth Strategy of XP.

The company's network of independent financial advisors is a significant acquisition channel. As of Q1 2025, the network included 18,100 IFAs. Approximately 60% of retail net inflows in 2024 came from new channels, including internal advisory, wealth managers, and RIAs.

XP Company has revamped its advertising strategy using first-party data and AI. This resulted in $66 million in incremental revenue from advertising with the same budget in 2024. Predictive models for customer quality are built and data is connected through a Composable CDP.

XP Company maintains a high Net Promoter Score (NPS) to measure customer satisfaction. In Q1 2025, the NPS was 73, indicating strong customer loyalty. This high score reflects the company's focus on providing excellent customer service and experience.

The customer retention rate was an impressive 87.5% in 2023. This high retention rate shows the effectiveness of the company's strategies. It also reflects the value customers find in the services provided.

XP Company regularly conducts customer feedback programs. These programs provide valuable insights into customer needs and preferences. This helps the company to improve its services and enhance customer satisfaction.

The company offers personalized support to its customers. This includes tailored advice and assistance based on individual needs. Personalized support enhances the customer experience and builds stronger relationships.

XP Company implements loyalty programs to reward and retain customers. These programs offer benefits and incentives to encourage continued engagement. Loyalty programs are a key part of the retention strategy.

The company expands its offerings beyond investments. This includes products like credit cards and insurance. Expanding offerings increases the share of wallet and reduces customer churn.

Total active cards grew 13% year-over-year in Q1 2025. The total number of active cards reached 1.4 million. This growth demonstrates the success of expanding offerings.

XP Company aims to return over 50% of its net income to shareholders. This is done through dividends and buybacks. This commitment to shareholder value indirectly contributes to customer confidence and loyalty.

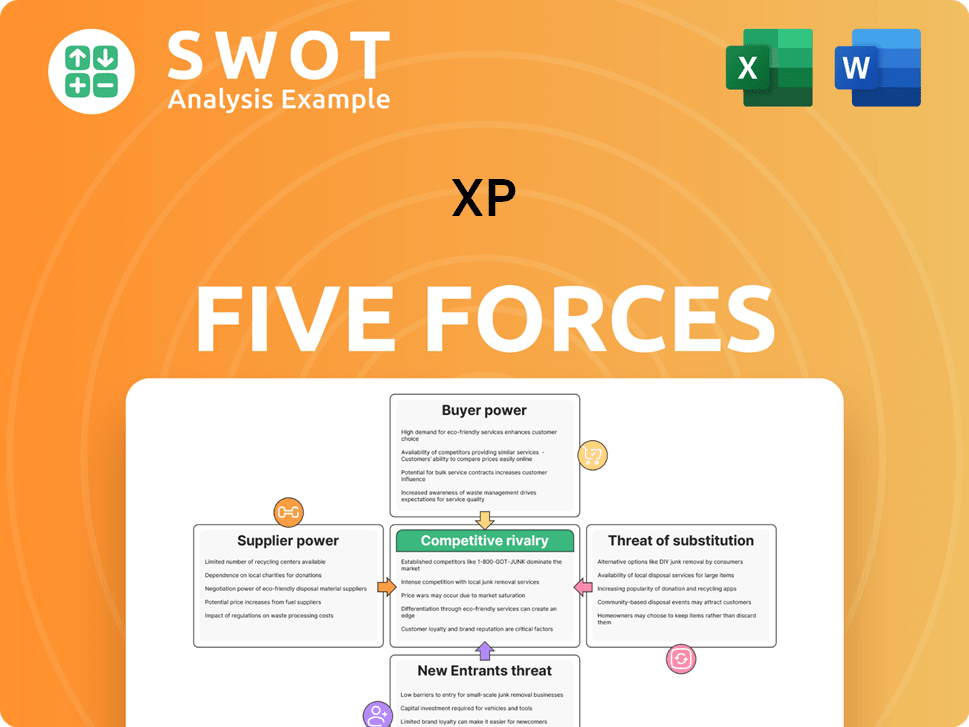

XP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.