XP Bundle

How Does XP Company Thrive in the Brazilian Financial Market?

XP Inc. has revolutionized the Brazilian financial landscape, transforming how individuals and institutions invest. From its origins as a brokerage, XP has blossomed into a comprehensive financial ecosystem, democratizing access to investment opportunities. This shift has challenged traditional banking models, empowering a new generation of investors with unprecedented tools and knowledge.

This exploration will uncover the XP SWOT Analysis, delving into its core business model, XP company operations, and revenue streams. We'll analyze XP company structure and its strategic maneuvers, revealing how XP Company has achieved remarkable growth and sustained its market leadership. Understanding XP services and XP offerings, including its XP business model, is crucial for anyone seeking to understand the dynamics of the financial sector and make informed investment decisions.

What Are the Key Operations Driving XP’s Success?

The core of how the XP Company operates centers around providing a comprehensive investment platform. This platform gives clients access to a wide array of financial products and services. Their business model focuses on democratizing access to investments, making it easier for a broad range of investors to participate in the financial markets.

The XP Company offers brokerage services, covering stocks, fixed income, and derivatives, alongside access to investment funds, private equity, and structured products. Their services cater to individual investors, from beginners to high-net-worth individuals, and institutional clients seeking diversified investment opportunities. The XP company structure is designed to support this wide range of offerings and client needs.

The company's operations are built on a strong technological foundation and a network of independent financial advisors (IFAs). Technology is key, enabling seamless trade execution, portfolio management, and access to educational content. The company sources investment products from various asset managers and financial institutions, providing clients with diverse choices. The distribution network, primarily the IFA ecosystem, is a significant differentiator, allowing it to reach a vast and diverse client base. You can learn more about the company's origins in this Brief History of XP.

The primary offerings of the XP Company include brokerage services for stocks, fixed income, and derivatives. They also provide access to investment funds, private equity, and structured products. These diverse options cater to a wide range of investment preferences and risk profiles.

The operational processes are built around a robust technological infrastructure. This includes seamless trade execution and portfolio management. The company's network of IFAs is crucial for providing personalized advice and fostering client relationships, enhancing the overall customer experience.

The value proposition of the XP Company includes greater transparency and lower fees compared to traditional banks. Clients gain access to sophisticated investment strategies. This approach drives market differentiation and fosters client loyalty.

The distribution network is primarily composed of its IFA ecosystem. This allows the company to reach a vast and diverse client base across Brazil. Partnerships with asset managers and financial institutions contribute to the breadth of products available on its platform.

Clients of the XP Company benefit from the open architecture model, which provides access to a wide variety of investment options. The company's emphasis on financial education and personalized advice further enhances the client experience.

- Greater transparency in investment products and fees.

- Access to a wide range of investment options, including those not available through traditional channels.

- Lower fees compared to traditional banking services.

- Personalized financial advice and support from a network of IFAs.

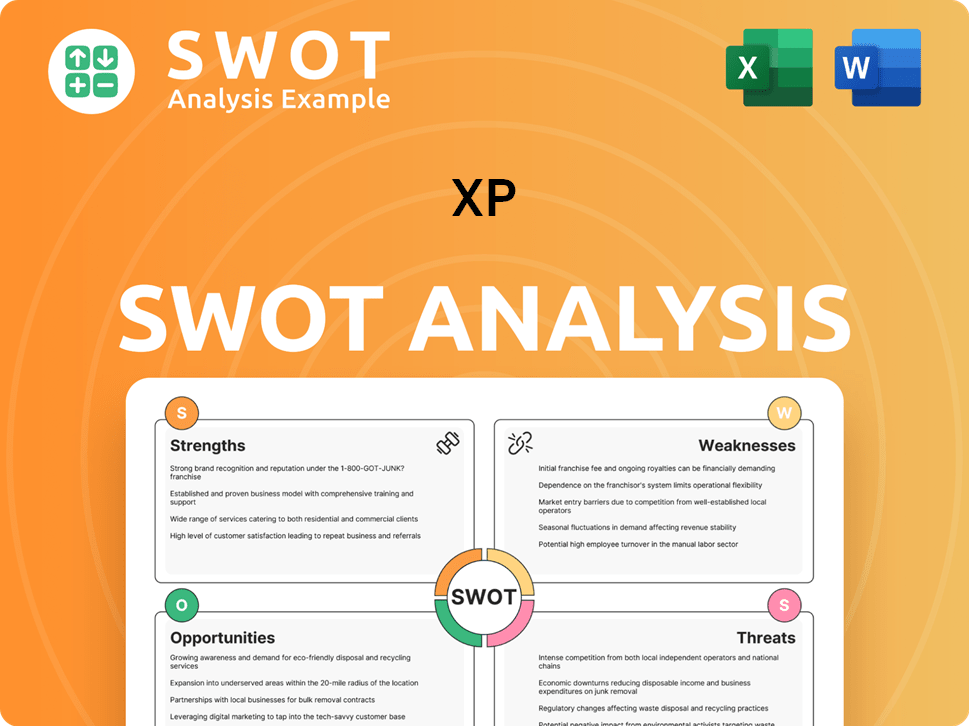

XP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does XP Make Money?

The XP Company generates revenue through a diverse set of streams, primarily driven by its brokerage and advisory services. The XP business model focuses on providing a comprehensive suite of financial products and services to its clients. This approach allows the company to capture a larger share of its clients' financial needs, fostering a more resilient business model.

A significant portion of the XP company operations income comes from transaction fees and commissions on trades executed across various asset classes, including equities, fixed income, and derivatives. Additionally, the company earns revenue from management fees from funds it administers or manages, as well as performance fees from certain investment products. The company's open architecture platform and client-centric approach are key to its monetization strategies.

In the first quarter of 2024, XP reported R$3.6 billion in gross revenue, with a substantial contribution from its retail and institutional segments. This financial performance highlights the company's strong position in the market and its ability to generate significant revenue from its core services. For more insights into the ownership structure, you can explore Owners & Shareholders of XP.

XP's monetization strategies are notable for their emphasis on an open architecture platform and a client-centric approach. The company employs tiered pricing for its brokerage services, offering different commission structures based on trading volume and account type. This approach allows XP to cater to a wide range of clients, from individual investors to institutional clients.

- Tiered Pricing: Commission structures based on trading volume and account type.

- Cross-selling: Offering a comprehensive suite of products and services.

- Digital Banking and Credit Products: Expansion into digital banking services and credit products.

- Insurance: Providing insurance products to capture a larger share of clients' financial needs.

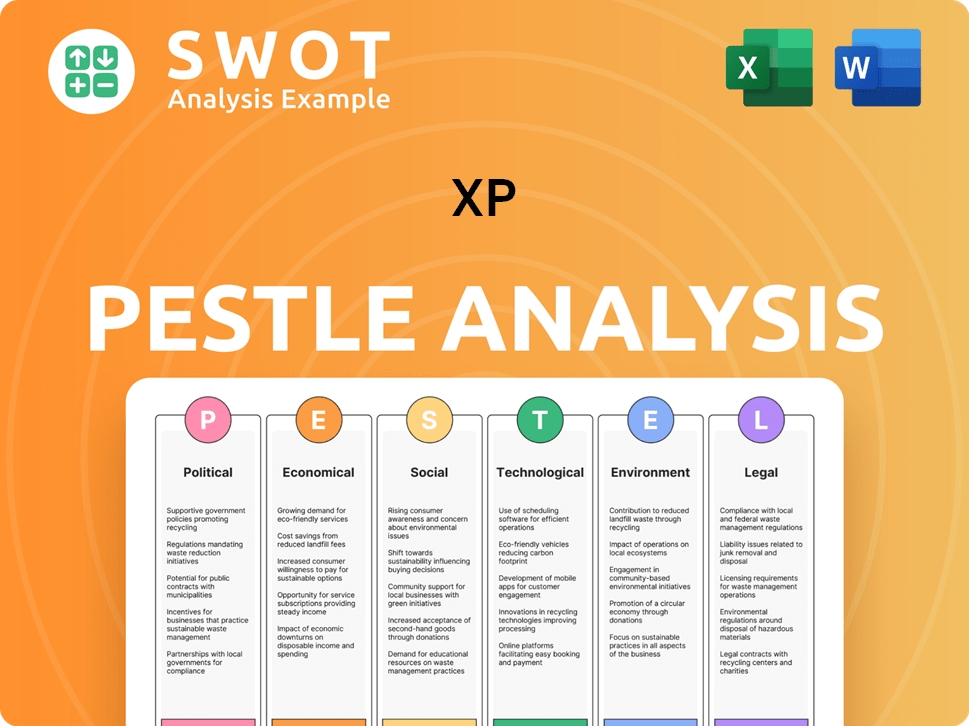

XP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped XP’s Business Model?

The journey of XP Inc. has been marked by significant milestones and strategic moves that have shaped its operations and financial performance. A pivotal moment was its initial public offering (IPO) on Nasdaq in December 2019, which raised approximately $2.25 billion, signaling its ambition and providing capital for expansion. This event was a crucial step in solidifying its position in the financial market.

The continuous expansion of its independent financial advisor (IFA) network has been a key strategic move. This decentralized model has been instrumental in its growth, with IFAs serving as crucial touchpoints for client engagement and service delivery. Investing in technology and digital transformation has also been a priority, enhancing its platform and user experience. This focus has allowed XP to adapt to market changes and offer innovative products.

Operational challenges, such as navigating volatile market conditions or intense competition from incumbent banks and emerging fintechs, have been met with agile responses. XP has consistently invested in technology and digital transformation to enhance its platform, improve user experience, and offer innovative products. For instance, the company has focused on expanding its offerings beyond traditional investments to include digital banking services, credit products, and insurance, thereby diversifying its revenue streams and strengthening its ecosystem. To understand more about their marketing approach, consider reading the Marketing Strategy of XP.

The IPO in December 2019, raising approximately $2.25 billion, was a defining moment. This provided the financial resources needed for expansion and strategic initiatives. The growth of the IFA network was another critical milestone, enhancing client reach and service capabilities.

The expansion of the IFA network has been a cornerstone of its strategy, enabling rapid client acquisition and market penetration. Investing in technology and digital transformation has been continuous, improving the platform and expanding service offerings. Diversifying into digital banking, credit, and insurance has broadened revenue streams.

Strong brand recognition and trust in the Brazilian financial market are significant assets. Its technology leadership, with a robust and user-friendly investment platform, provides a distinct advantage. The economies of scale achieved through its large client base and IFA network allow for competitive pricing and efficient operations.

XP continues to adapt to new trends, such as the increasing demand for ESG (Environmental, Social, and Governance) investments and the integration of AI in financial advisory, ensuring its business model remains relevant and competitive in a rapidly evolving financial landscape. This adaptability is key to its long-term success.

XP's competitive advantages are multifaceted, including strong brand recognition and technology leadership. Its extensive IFA network and large client base enable economies of scale and competitive pricing. The ecosystem effect, where more clients attract more IFAs and product offerings, creates a virtuous cycle.

- Strong Brand Recognition: Built on trust and client empowerment in the Brazilian market.

- Technology Leadership: Robust and user-friendly investment platform.

- Economies of Scale: Achieved through a large client base and IFA network.

- Ecosystem Effect: More clients attract more IFAs and product offerings.

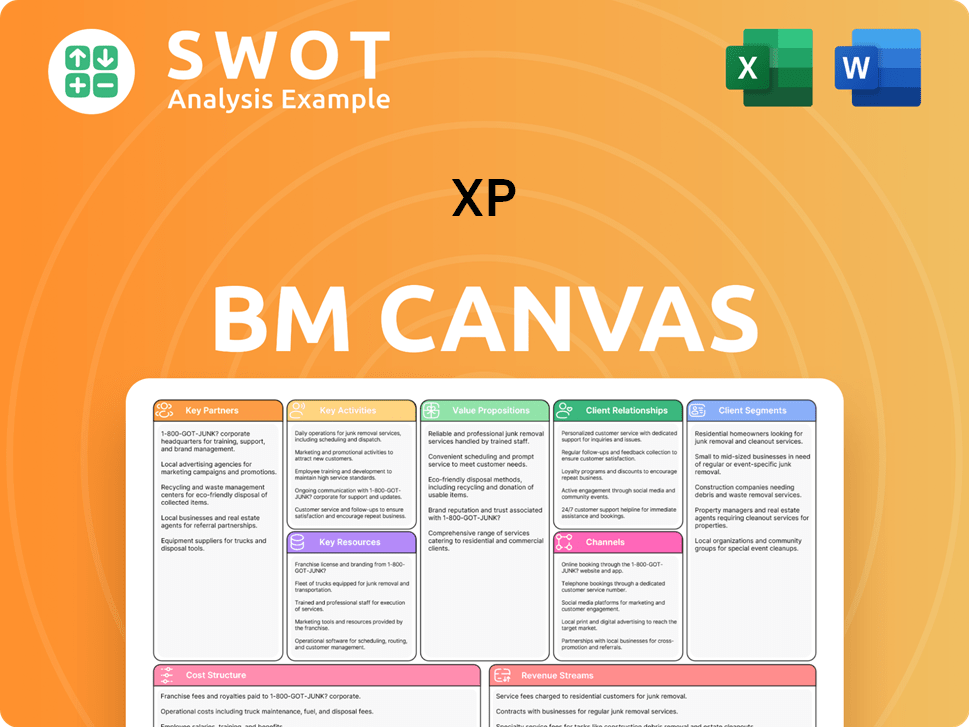

XP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is XP Positioning Itself for Continued Success?

The Growth Strategy of XP has established a strong foothold in the Brazilian financial services sector, disrupting traditional banking models. It holds a significant market share in the investment brokerage segment, fueled by a large client base and a vast network of independent financial advisors. Customer loyalty is high, supported by its commitment to financial education, personalized advisory services, and a wide array of products. While primarily focused on Brazil, its global reach provides clients with access to international investment opportunities.

Despite its strengths, XP faces risks such as regulatory changes in the highly regulated financial sector, which could affect operations or introduce new compliance requirements. Competition from fintech startups with innovative digital solutions poses a constant threat. Technological advancements, including AI and blockchain, necessitate continuous investment in R&D. Adapting to changing consumer preferences, such as the growing demand for sustainable investing, is also crucial.

XP has a strong market position in Brazil's financial services, challenging traditional banks. It leads in the investment brokerage segment with a large client base and financial advisors. Customer loyalty is high due to financial education and personalized services.

Regulatory changes and competition from fintech companies pose risks. Technological advancements require continuous investment in R&D. Adapting to changing consumer preferences is also necessary for sustained growth.

XP plans to invest in its technology platform and diversify its product suite. It aims to expand its financial advisor network and deepen client relationships. The focus is on innovation and client-centricity to enhance the investor experience.

Continued investment in technology, diversification into digital banking and insurance, and expansion of the advisor network. Deepening relationships with clients through comprehensive financial planning solutions.

XP aims to solidify its position as the premier investment ecosystem in Brazil. The company plans to expand market penetration and adapt to clients' evolving needs. The strategy focuses on sustained profitability and growth.

- Continued investment in technology and platform development.

- Expansion of product offerings, including digital banking and insurance.

- Deepening client relationships through comprehensive financial planning.

- Focus on innovation and client-centric solutions.

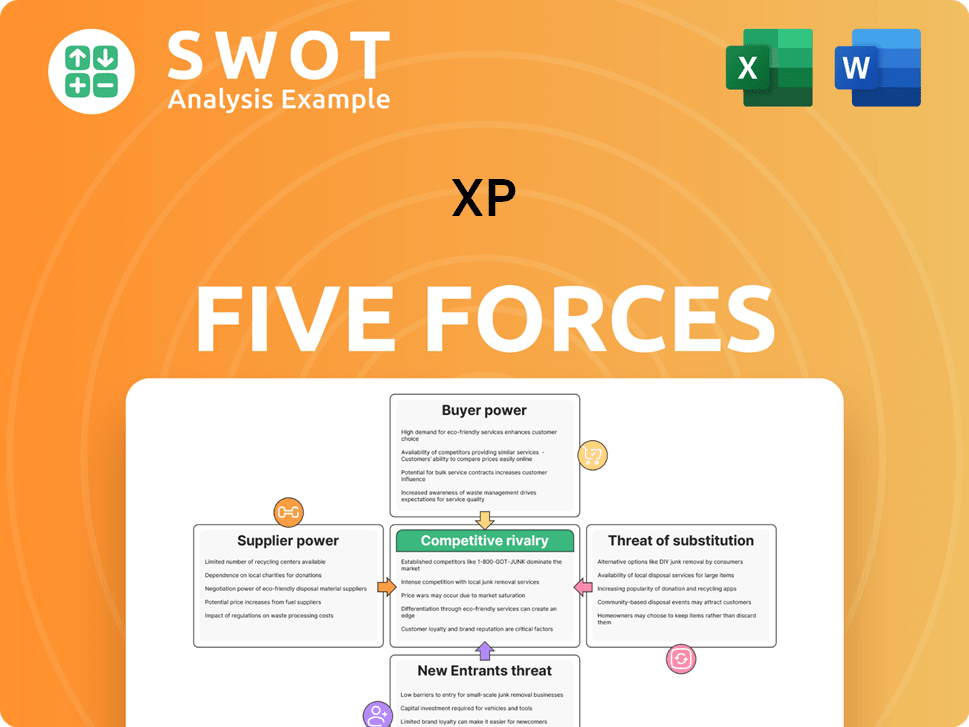

XP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of XP Company?

- What is Competitive Landscape of XP Company?

- What is Growth Strategy and Future Prospects of XP Company?

- What is Sales and Marketing Strategy of XP Company?

- What is Brief History of XP Company?

- Who Owns XP Company?

- What is Customer Demographics and Target Market of XP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.