XP Bundle

Can XP Inc. Continue its Ascent in the Brazilian Financial Market?

XP Inc. has revolutionized Brazil's financial landscape, but what's next for this investment powerhouse? From challenging traditional banking models to democratizing investments, XP Inc.'s journey has been nothing short of remarkable. This exploration dives into the XP SWOT Analysis, examining its strategic planning and ambitious expansion plans.

This analysis will uncover XP Company's growth strategy, detailing its expansion initiatives and future market opportunities. We'll examine how XP Inc. is planning for future growth, including its innovative technology strategy and financial outlook. Furthermore, we'll address potential challenges and key success factors, providing a comprehensive view of XP Company's business development and long-term goals within the dynamic Brazilian market and beyond, including its international expansion strategy.

How Is XP Expanding Its Reach?

The XP Company Growth Strategy centers on aggressive expansion across multiple fronts. This approach aims to solidify its position in the Brazilian market and capitalize on emerging opportunities in Latin America. The company is actively pursuing initiatives to diversify its revenue streams and enhance its market share, focusing on both organic and inorganic growth strategies.

XP Company Future Prospects look promising, driven by its strategic investments in technology and product innovation. The company's ability to adapt to market changes and expand its service offerings positions it well for sustained growth. These efforts are designed to meet the evolving needs of its diverse client base and maintain a competitive edge in the fintech sector.

XP Company Business Development is fueled by a combination of internal innovation and strategic acquisitions. This dual approach allows the company to quickly enter new markets, acquire cutting-edge technologies, and enhance its service portfolio. By focusing on these key areas, XP Inc. aims to achieve long-term sustainable growth and increase shareholder value. For a broader view, consider the Competitors Landscape of XP.

XP Inc. is focusing on expanding its client base within Brazil. This includes targeting high-net-worth individuals and institutional clients. The company leverages its strong retail base to cross-sell services and attract new clients.

The company is exploring expansion opportunities within Latin America. This strategy involves adapting its existing expertise and technological infrastructure to new markets. This expansion is designed to diversify its revenue streams and reduce reliance on the Brazilian market.

XP Inc. is continuously launching new investment products and financial services. This includes enhanced credit offerings and insurance products. These new offerings are designed to increase client engagement and wallet share.

Mergers and acquisitions are a key part of XP Inc.'s expansion strategy. These activities allow the company to gain market share and acquire new technologies. While specific targets vary, the company actively seeks opportunities to accelerate growth.

XP Inc.'s expansion plans include penetrating new client segments, expanding geographically, and diversifying its product offerings. These initiatives are supported by strategic mergers and acquisitions. The company's focus on innovation and client needs positions it for continued growth.

- Client Segment Expansion: Targeting high-net-worth individuals and institutional clients to increase market share.

- Geographical Expansion: Exploring opportunities in Latin America to diversify revenue streams.

- Product Diversification: Launching new investment products and financial services to meet evolving client needs.

- Strategic Acquisitions: Utilizing mergers and acquisitions to gain market share and acquire new technologies.

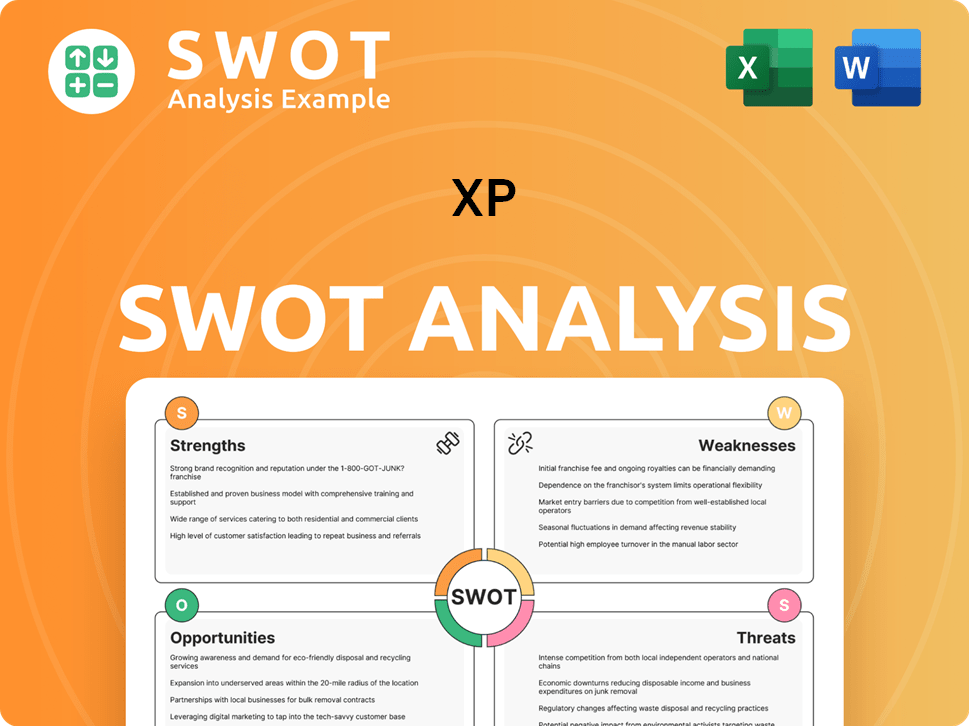

XP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does XP Invest in Innovation?

The innovation and technology strategy of XP Inc. is crucial for its sustained growth and future prospects. The company strategically invests in research and development (R&D) to maintain a competitive edge. This focus on technological advancement supports its business development and expansion plans.

XP Inc. heavily relies on technology to drive its growth. The company focuses on internal development of its platforms, advisory tools, and client-facing applications. This approach allows for greater control and customization to meet specific market demands. Furthermore, strategic partnerships with fintech startups help to integrate cutting-edge solutions.

Digital transformation is at the core of XP Inc.'s strategy. This includes automating back-office operations, improving user experience, and using advanced analytics for personalized client insights. These initiatives are vital for enhancing operational efficiency and supporting the company's rapid growth.

XP Inc. dedicates significant resources to R&D. This commitment enables the company to create proprietary trading platforms and advisory tools. These in-house developments are key to offering unique and competitive services.

The company leverages artificial intelligence (AI) and data analytics. AI is used to provide personalized investment recommendations. Data analytics optimizes product offerings and client segmentation, enhancing the overall client experience.

XP Inc. is committed to digital transformation. This strategy includes automating back-office operations and enhancing user interfaces. These improvements streamline processes and improve client interactions.

Collaborations with fintech startups are part of XP Inc.'s strategy. These partnerships allow for the integration of innovative solutions. This approach helps to enhance service offerings and keep the company at the forefront of technological advancements.

XP Inc. prioritizes enhancing the client experience. This is achieved through intuitive digital interfaces and personalized insights. The aim is to attract and retain more investors by providing superior service.

The company continuously upgrades its technological infrastructure. This supports rapid growth and a large client base. The focus is on developing new platforms and technical capabilities to improve operational efficiency.

XP Inc.'s commitment to innovation and technology directly supports its growth objectives, improving operational efficiency, expanding service offerings, and enhancing the client experience. For a deeper understanding of how XP Inc. approaches its market, consider reading about the Marketing Strategy of XP.

XP Company's future market opportunities are significantly influenced by its tech-driven initiatives. These initiatives are integral to its strategic planning and expansion plans.

- AI-Driven Personalization: Implementing AI for personalized investment recommendations and fraud detection.

- Data Analytics Optimization: Utilizing data analytics to refine product offerings and client segmentation.

- Platform Development: Continuously developing new platforms and technical capabilities.

- Automation: Automating back-office operations to improve efficiency.

- User Experience Enhancement: Improving user interfaces for a better client experience.

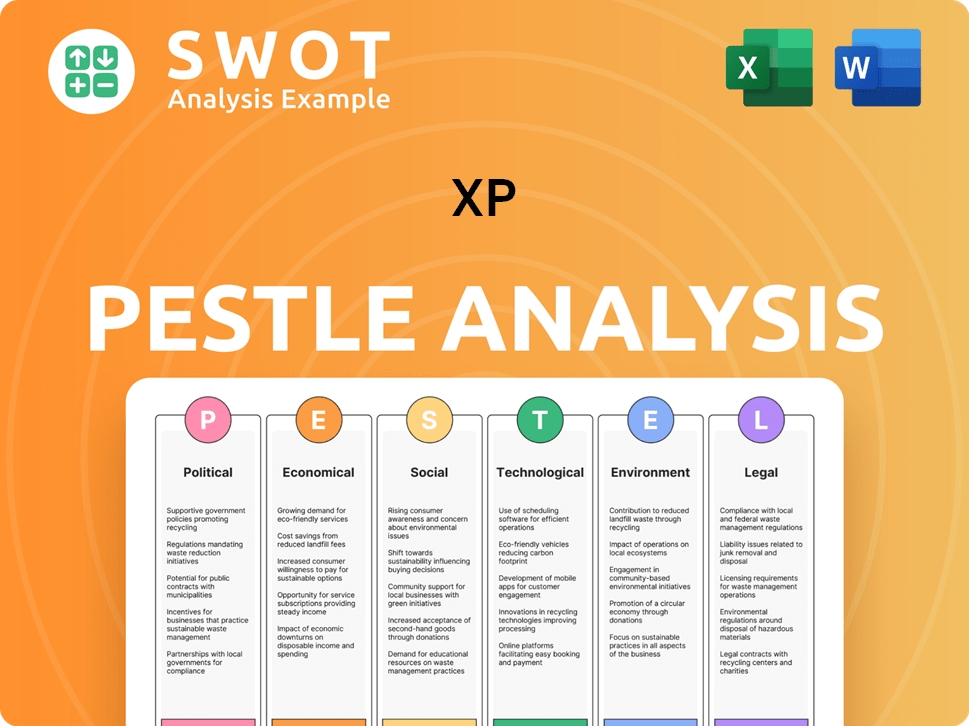

XP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is XP’s Growth Forecast?

The financial outlook for XP Inc. anticipates continued growth, fueled by strategic expansion and innovation. Recent reports indicate strong financial performance, with consistent revenue growth driven by an expanding client base and increased platform engagement. In the first quarter of 2024, XP Inc. demonstrated a significant increase in net income and assets under custody, reflecting positive business momentum. The company has set public revenue targets and aims to maintain healthy profit margins by optimizing operational efficiency and scaling its technology platform.

Investment levels remain substantial as XP Inc. continues to invest in technology, product development, and strategic acquisitions to drive future growth. Analyst forecasts for 2024 and 2025 generally project a positive trajectory for XP Inc.'s financial performance, citing the ongoing shift of Brazilian investors towards diversified investment products and digital platforms. The company's financial ambitions are often compared to its historical performance, which has shown consistent growth since its inception, and industry benchmarks, where it often outperforms traditional financial institutions in terms of client acquisition and digital engagement. For a deeper dive into the company's origins, consider reading a Brief History of XP.

XP Inc. has also engaged in capital raises, including its initial public offering (IPO), to support its aggressive growth strategy and provide the necessary capital for expansion and innovation. The financial narrative underpinning XP Inc.'s strategic plans is one of sustained growth through market penetration, product diversification, and technological leadership, aiming to capitalize on the vast untapped investment potential in Brazil. The company's ability to adapt to market changes and its focus on client acquisition are key factors in its success.

XP Inc.'s market analysis reveals significant opportunities within the Brazilian investment landscape. The company benefits from a growing trend of individual investors seeking diversified investment products and digital platforms. This shift provides a fertile ground for XP Inc.'s expansion plans and future market opportunities.

Strategic planning at XP Inc. focuses on leveraging technological advancements and product diversification. The company's investment strategy for expansion includes continuous innovation in its platform and services. This approach supports its long-term business goals and enhances its competitive advantages in the market.

XP Inc.'s expansion plans include both organic growth and strategic acquisitions. The company aims to increase its market share by attracting new clients and expanding its product offerings. These efforts are crucial for XP Company's growth strategy in the next 5 years.

Business development at XP Inc. involves strengthening its digital platform and enhancing client engagement. The company focuses on adapting to market changes by continuously improving its technology infrastructure. This approach supports XP Company's future prospects and revenue growth projections.

XP Inc.'s key success factors include its robust digital platform, client-centric approach, and strategic investments. The company's ability to attract and retain clients, coupled with its innovative product offerings, drives its financial performance. The company's focus on technological leadership is also a key factor.

- Strong digital platform for client engagement.

- Client-centric approach to financial services.

- Strategic investments in technology and product development.

- Effective adaptation to market changes.

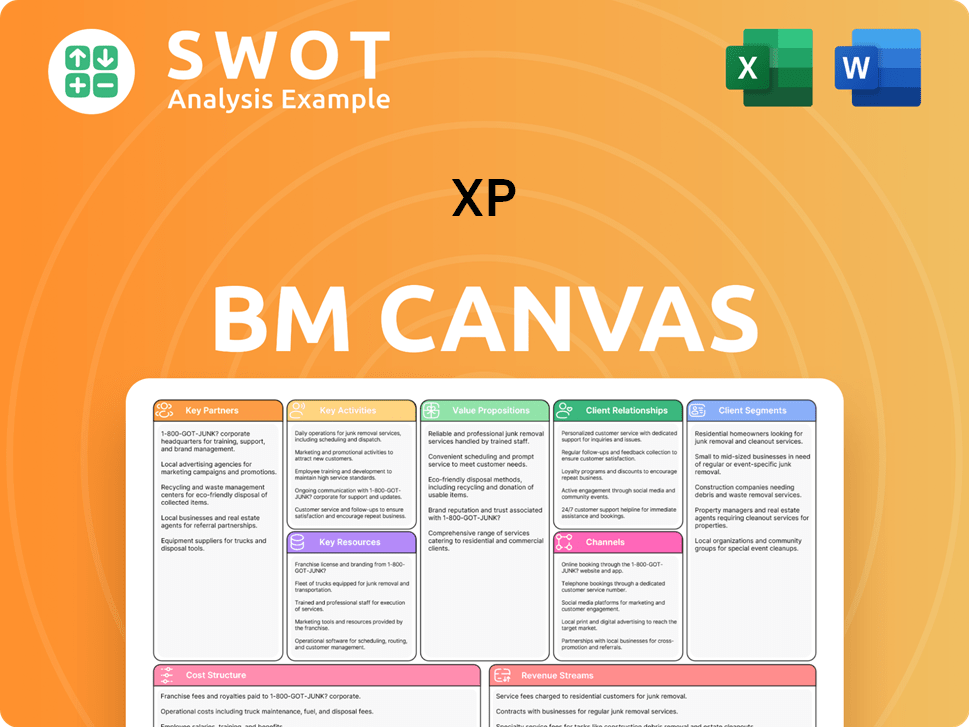

XP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow XP’s Growth?

The growth strategy of XP Inc. faces several potential risks and obstacles. These challenges span market competition, regulatory changes, technological disruptions, and internal resource constraints. Understanding these risks is crucial for assessing XP Inc.'s future prospects and its ability to execute its business development plans effectively.

Market competition presents a significant hurdle, as both traditional financial institutions and fintech startups vie for market share in Brazil. Regulatory changes, especially those from the Central Bank of Brazil and CVM, could necessitate operational adjustments. Furthermore, the company must navigate supply chain vulnerabilities, technological disruptions, and the need to attract and retain top talent.

To mitigate these risks, XP Inc. employs diversification strategies, robust risk management frameworks, and ongoing scenario planning. This approach helps the company anticipate and address potential challenges, ensuring its long-term business goals are achievable. The company's ability to adapt to market changes and maintain strong client relationships is key to its continued success.

The financial services sector in Brazil is highly competitive, with both established banks and emerging fintech companies vying for customers. This intense competition can impact XP Company's market share and profitability. XP Company's strategic planning must include ways to differentiate itself in this crowded market.

Changes in regulations, particularly from the Central Bank of Brazil and CVM, can significantly affect XP Company's operations. Compliance with new rules can be costly and time-consuming. Adaptability to these regulatory shifts is crucial for XP Company's future growth.

Technological advancements and the emergence of innovative competitors pose a risk. XP Company must continually invest in technology and adapt its services to stay ahead. Failure to do so could lead to a loss of market share and hinder its expansion plans.

Attracting and retaining top talent is essential for XP Company's success. The company operates in a competitive industry where skilled professionals are in high demand. Internal resource constraints can limit XP Company's ability to execute its growth strategies.

Reliance on third-party technology providers and data services can create supply chain vulnerabilities. Disruptions in these services can impact XP Company's operations. XP Company must ensure the resilience of its supply chain to mitigate these risks.

Increasing cybersecurity threats pose a significant risk to digital financial platforms. XP Company must invest in robust cybersecurity measures to protect its clients and data. This is crucial for maintaining trust and ensuring long-term financial performance and growth.

XP Company employs several strategies to mitigate risks, including diversifying its product offerings to reduce reliance on brokerage fees. The company's robust risk management frameworks help identify and address potential challenges proactively. Ongoing scenario planning allows XP Company to anticipate and adapt to market changes effectively.

While specific recent examples of overcoming major obstacles in 2024-2025 are not widely publicized, XP Company has demonstrated resilience in navigating economic downturns and regulatory shifts. The company leverages its strong client relationships and adaptable business model. For more insights into the company's ownership structure, consider reading Owners & Shareholders of XP.

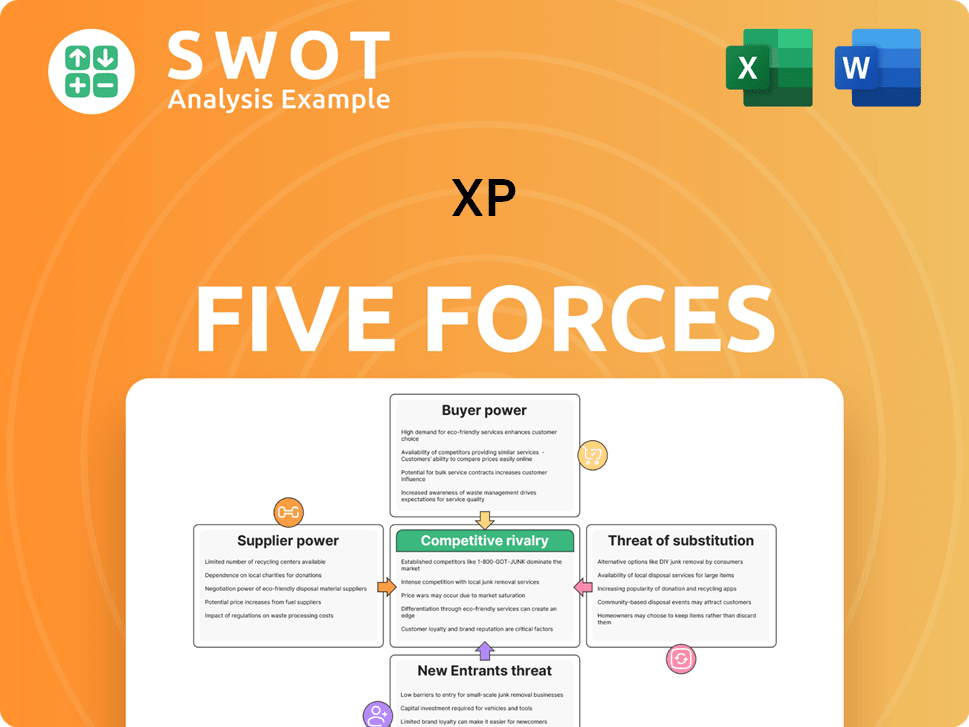

XP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.