XP Bundle

How Does XP Inc. Navigate the Brazilian Financial Battlefield?

XP Inc. has revolutionized Brazil's financial sector, but its success story is far from over. The company's impressive growth, serving millions and managing trillions in assets, highlights its impact. But in a dynamic market, understanding the XP SWOT Analysis and the competitive forces at play is crucial for sustained success.

This deep dive into the XP Company Competitive Landscape will examine its market position, key rivals, and strategic advantages. We'll explore the XP Company Industry, analyzing the company's business strategy and its ability to maintain its strong market share. Understanding the competitive dynamics provides valuable insights for investors and strategists alike, helping them navigate the challenges and opportunities within the Brazilian financial market, and perform an XP Company market analysis.

Where Does XP’ Stand in the Current Market?

XP Inc. maintains a strong market position within the Brazilian financial services industry, particularly in the investment and wealth management segments. The company's core operations revolve around providing a wide array of investment options, financial advisory services, and educational resources to a diverse clientele. XP Inc. has strategically diversified its distribution channels, enhancing its market reach and customer acquisition strategies.

The company's value proposition centers on offering comprehensive financial solutions, supported by a robust network of advisors and a user-friendly platform. XP Inc. focuses on providing clients with access to various investment products, including stocks, fixed income, and funds. The company also emphasizes customer satisfaction and platform loyalty through its comprehensive Financial Planning solution. This approach helps XP Inc. to maintain a competitive edge in the market.

As of Q1 2025, XP Inc. reported a 13% increase in total client assets, reaching R$1.3 trillion. The company’s financial health is considered 'GOOD' by InvestingPro, with a market capitalization of $9.6 billion as of May 2025. The company's total revenue increased by 7.2% to $4.34 billion in Q1 2025, with net income growing by 20% to $1.24 billion, demonstrating its strong financial performance and market resilience. XP Inc. has also expanded its offerings beyond investments, with 15% to 20% of its revenue now derived from non-investment-related products.

XP Inc. is the largest and most qualified investment advisory network in Brazil. The company reported 4.7 million active clients as of the fourth quarter of 2024. This leadership position is supported by a vast network of 18 thousand advisors.

XP Inc. has successfully diversified its revenue streams beyond traditional investments. Approximately 15% to 20% of its revenue comes from non-investment-related products. This includes digital banking and credit cards, contributing to increased share of wallet and customer satisfaction.

XP Inc. has strategically diversified its distribution channels. Approximately 60% of its retail net inflows in 2024 came from newer channels. These channels include Internal Advisory, Wealth Managers, and RIAs, which has helped to expand its market reach.

In Q1 2025, XP Inc. reported a 13% increase in total client assets to R$1.3 trillion. Total revenue increased by 7.2% to $4.34 billion in Q1 2025. Net income grew by 20% to $1.24 billion, indicating strong financial health and growth.

XP Inc. benefits from a strong market position, a diversified product portfolio, and robust financial performance. The company's extensive network of advisors and comprehensive financial solutions enhance its competitive edge. Furthermore, the company's strategic diversification contributes to its resilience and growth.

- Market Leadership: Largest investment advisory network in Brazil.

- Diversified Offerings: Revenue from non-investment products.

- Strong Financials: Consistent revenue and net income growth.

- Client Focus: Comprehensive financial planning solutions.

For a more in-depth understanding of the company's origins and evolution, you can explore the Brief History of XP.

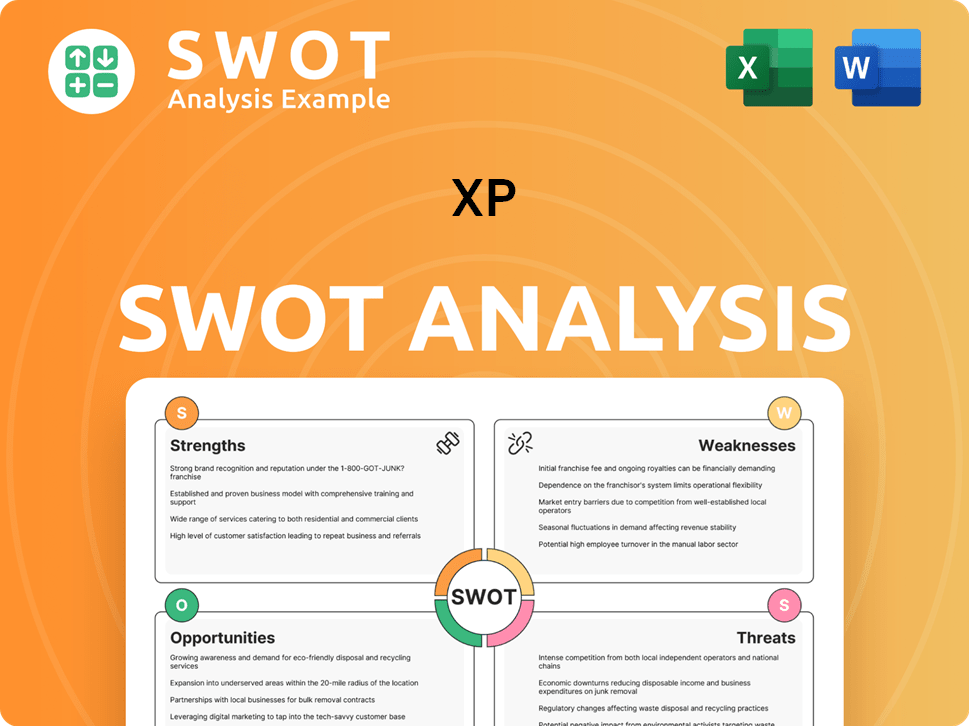

XP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging XP?

The Brazilian financial services market is highly competitive, and this is especially true for companies like XP Inc. The XP Company Competitive Landscape is shaped by traditional banks, digital fintechs, and evolving regulatory frameworks. The ability to navigate this complex environment is crucial for success.

Understanding the XP Company Market Analysis requires a deep dive into its key competitors, their strategies, and the broader industry trends. This analysis helps in assessing the competitive advantages and disadvantages of XP Inc. in the market. As the financial sector evolves, so too does the competitive landscape.

XP Company Industry dynamics are influenced by various factors, including technological advancements, regulatory changes, and evolving customer preferences. The rise of digital banking and the increasing adoption of mobile financial services are key trends shaping the competitive environment.

Traditional banks like Itaú Unibanco, Bradesco, Banco do Brasil, and Santander Brasil are significant competitors. These institutions have a long-standing presence in the Brazilian market. They are investing heavily in digital transformation to stay competitive.

Digital fintechs and challenger banks disrupt the market with digital-first strategies. Key players include Nubank, PicPay, C6 Bank, Banco Inter, and Mercado Pago. These companies often offer lower fees and user-friendly interfaces.

Nubank has become one of the largest digital banks globally. It has approximately 90 million clients across Brazil, Mexico, and Colombia as of early 2025. Nubank holds the highest preference rate in Brazil's financial institution market at 25% as of Q1 2025.

PicPay, a comprehensive financial super app, has a substantial user base. As of 2022, it boasts over 60 million registered users. PicPay offers a wide range of services, from payments to investments.

Mercado Pago, integrated with MercadoLibre, provides financial services. It leverages e-commerce user data for credit approvals and tailored products. This approach allows for targeted financial product offerings.

Digital transactions are increasingly dominant in banking operations. In 2023, digital transactions accounted for over 80% of total banking operations in Brazil. This shift highlights the importance of digital capabilities.

These competitors challenge XP Inc. through various means, impacting its XP Company Business Strategy. A thorough XP Company SWOT Analysis is crucial for understanding its position in the market. The competitive landscape is further shaped by mergers and alliances, as well as new regulatory frameworks that encourage open finance and digital innovation. For more insights into the company's structure, consider reading about Owners & Shareholders of XP.

XP Inc. faces challenges from its competitors across several key areas. These challenges require strategic responses to maintain and improve its market position. Understanding these challenges is crucial for long-term success.

- Price: Fintechs often offer lower fees, attracting price-sensitive customers.

- Innovation and Technology: Digital banks lead in technological advancements, offering seamless user experiences and instant payment systems. Pix processed over 6 billion transactions monthly as of December 2024.

- Branding and Customer Loyalty: Companies like Nubank have built strong brands and customer loyalty through a customer-centric approach.

- Distribution: Digital players leverage widespread mobile adoption to reach a broad customer base.

- Diversification: Competitors are diversifying their offerings, expanding into credit, investments, and insurance.

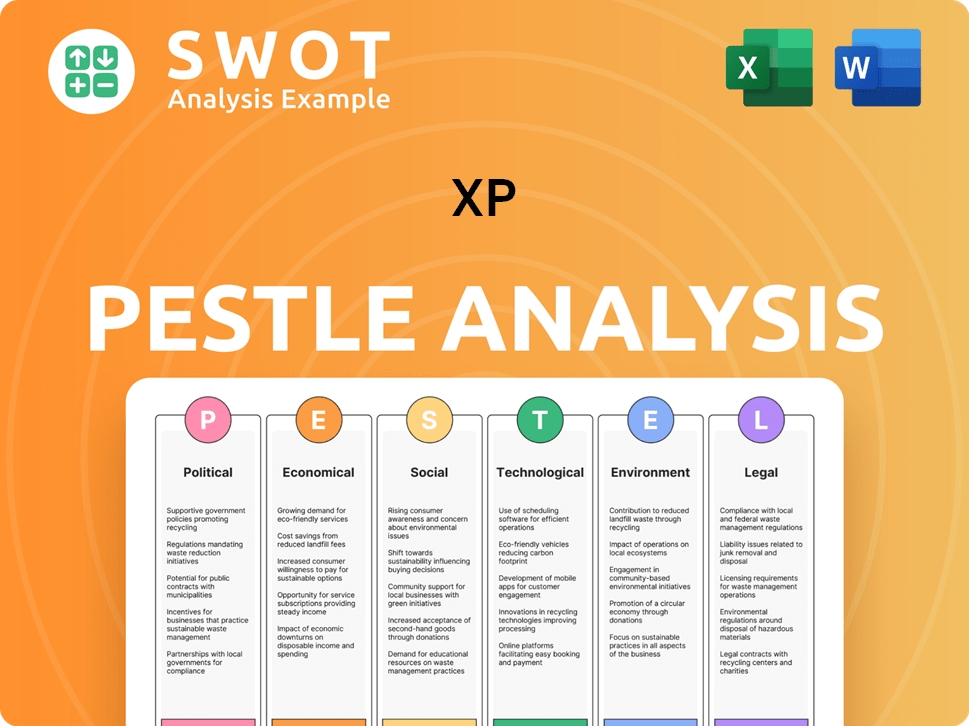

XP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives XP a Competitive Edge Over Its Rivals?

The competitive landscape of XP Inc. is shaped by its strategic initiatives and the advantages it has cultivated over time. The company's approach to the Brazilian financial services sector is marked by a commitment to innovation and customer-centric solutions. Understanding the factors that contribute to its competitive edge is crucial for assessing its market position and future prospects. This analysis will highlight XP Inc.'s key milestones, strategic moves, and the elements that define its competitive strength.

XP Inc. has strategically positioned itself through a combination of technological advancements, a robust advisory model, and strong brand equity. Continuous investment in technology, particularly its investment platform, has been a cornerstone of its strategy. The company's focus on expanding its product offerings and enhancing customer service further strengthens its market position. These efforts are supported by a unique company culture and a vast distribution network, which contribute to its ability to challenge traditional financial institutions.

A key element in understanding XP Inc.'s competitive advantages involves examining its customer-centric approach and its ability to adapt to market changes. The company's focus on providing comprehensive financial solutions, including educational resources and advisory services, has enhanced client satisfaction and loyalty. This commitment to meeting customer needs, combined with its technological investments, has allowed XP Inc. to maintain a strong position in the rapidly evolving fintech landscape. This Marketing Strategy of XP demonstrates how the company builds its brand.

XP Inc. differentiates itself through its distinctive advisory model and extensive product offerings. This includes a wide range of investment products, financial advisory services, and educational resources. The company's comprehensive approach, including a unique Financial Planning solution for clients with assets above R$300,000, enhances client satisfaction and loyalty.

Proprietary technologies and continuous investment in its investment platform are key. XP Inc. has focused heavily on technology and innovation, particularly in modernizing its fixed-income platform, which has driven daily fixed-income trades to approximately 40,000, representing a 38% CAGR since 2020. The company's technology-driven business model is asset-light and highly scalable, providing significant operating efficiency advantages.

Brand equity and customer loyalty are significant strengths. XP Inc. has built trust and is recognized for democratizing access to high-quality investment products and exclusive advisory services to Brazilian investors. The company achieved a customer satisfaction rating of 95% and an impressive customer retention rate of 85% in 2024. Its Net Promoter Score (NPS) was 70 in Q4 2024.

XP Inc.'s strong and unique culture, developed over two decades, is considered one of its greatest competitive advantages, enabling it to challenge the status quo and lead changes in the financial market. The company's extensive distribution network, comprising 18,000 advisors as of Q4 2024, provides a broad reach across Brazil. This network, coupled with a diversified revenue stream, contributes to a scalable business model.

XP Inc. benefits from several key competitive advantages, including a strong advisory model, technological innovation, and brand recognition. These advantages are supported by a robust distribution network and a unique company culture. These factors contribute to the company's ability to attract and retain customers in the competitive Brazilian financial market.

- Advisory Model: Provides personalized financial planning and investment advice.

- Technology: Investment in platform and AI-powered customer service.

- Brand Equity: High customer satisfaction and loyalty rates.

- Distribution Network: Extensive network of advisors across Brazil.

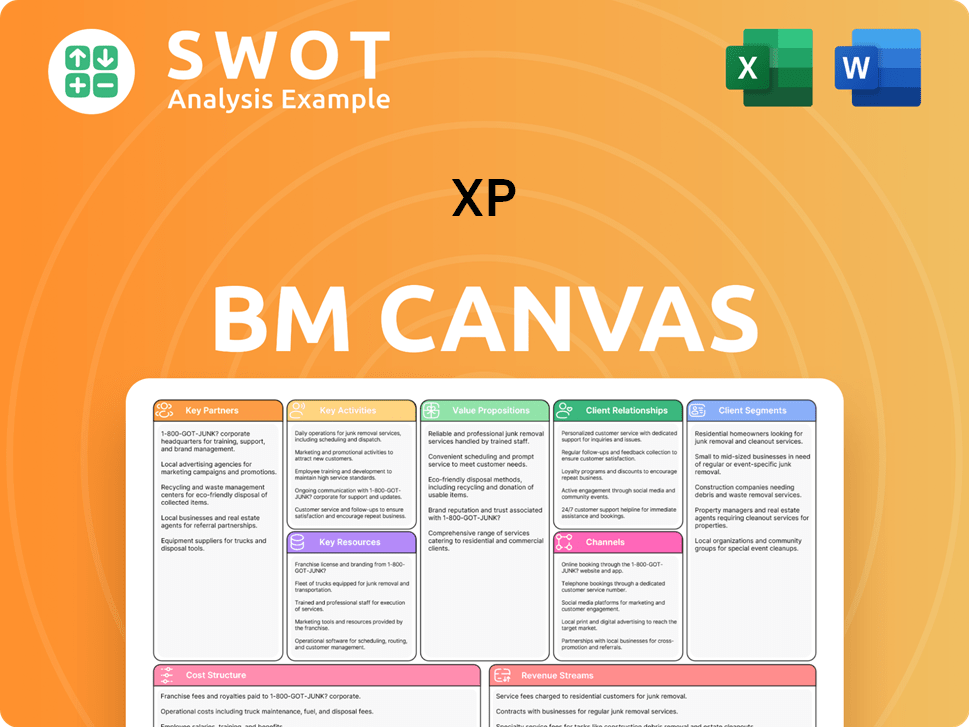

XP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping XP’s Competitive Landscape?

The Brazilian financial services industry is experiencing a period of significant transformation, driven by technological advancements, regulatory changes, and evolving consumer behaviors. This dynamic environment presents both challenges and opportunities for companies like XP Inc. to navigate and capitalize on. A detailed XP Company Competitive Landscape analysis is crucial for understanding its position within this evolving market.

The industry's future is shaped by trends such as the rapid adoption of instant payment systems, like Pix, which processed over 6 billion transactions monthly in December 2024, and the increasing use of artificial intelligence, with banks planning significant investments in AI solutions. These changes require financial institutions to adapt quickly to maintain their competitive edge. Understanding the XP Company Market Analysis is essential to assess its strategic positioning.

Key trends include the rise of instant payment systems like Pix and the integration of artificial intelligence. The Central Bank of Brazil (BCB) is actively promoting innovation, with Open Finance and virtual asset regulations in focus. These trends are reshaping the competitive environment, requiring companies to adapt quickly.

Challenges include intensified competition from digital banks and fintechs, regulatory changes, and potential economic headwinds. Cybersecurity threats also pose a significant risk. Addressing these challenges requires strategic investments and proactive risk management.

Opportunities lie in diversifying offerings, technological leadership, and leveraging Open Finance initiatives. There's also significant potential in untapped market segments and strategic partnerships. Capitalizing on these opportunities can drive growth and strengthen market position.

XP Inc. can focus on sustainable, long-term value creation through disciplined execution and a continued emphasis on its unique culture. The company is investing in its investment platform and expanding its distribution channels. This approach supports its growth strategy, as discussed in XP's Growth Strategy.

The Brazilian financial services sector is highly competitive, with digital banks and fintechs posing significant challenges. Nubank has become the primary financial relationship for almost 30% of Brazilian adults. Understanding the XP Company Competitors and their strategies is crucial for maintaining a competitive edge.

- Intensified Competition: Digital banks and fintechs offer low-fee services, creating aggressive competition.

- Regulatory Changes: New regulations require continuous adaptation and investment in compliance.

- Economic Headwinds: Potential GDP growth moderation to 2.2% in 2025 could impact consumer spending.

- Cybersecurity Threats: Increased digitalization elevates cybersecurity risks, demanding robust fraud detection.

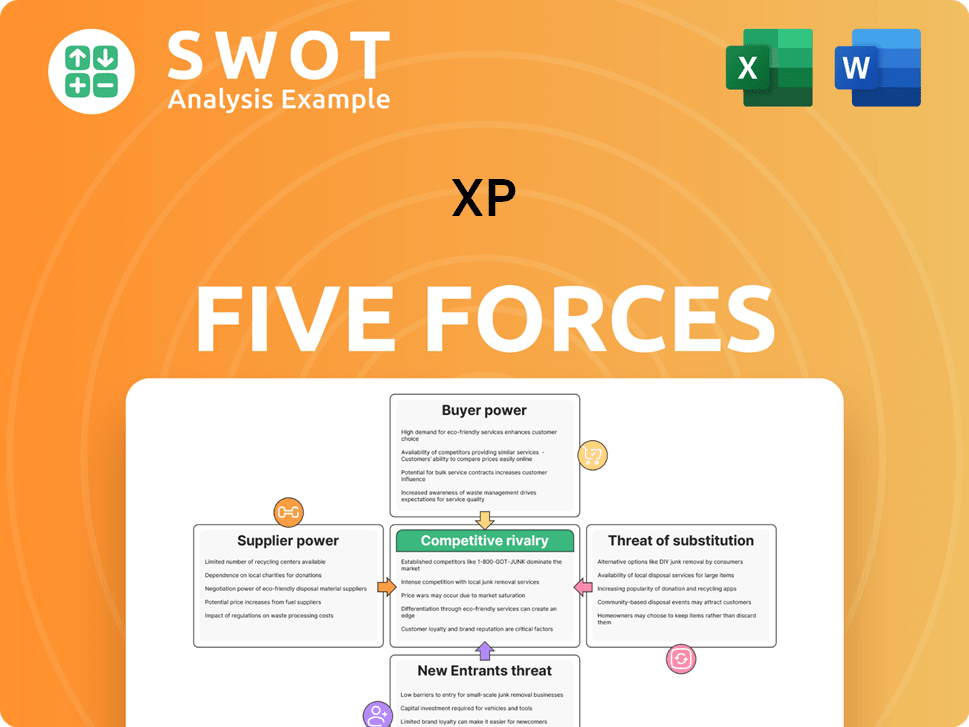

XP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of XP Company?

- What is Growth Strategy and Future Prospects of XP Company?

- How Does XP Company Work?

- What is Sales and Marketing Strategy of XP Company?

- What is Brief History of XP Company?

- Who Owns XP Company?

- What is Customer Demographics and Target Market of XP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.