XP Bundle

Who Really Owns XP Inc.?

Understanding the XP SWOT Analysis is crucial, but have you ever wondered who truly steers the ship at XP Inc.? The ownership structure of a company reveals its core values, strategic priorities, and potential for growth. Unraveling the history of XP Company ownership, from its humble beginnings to its current status as a publicly traded entity, is key to grasping its future.

Founded in 2001 by Guilherme Benchimol and Marcelo Maisonnave, XP Investimentos, now XP Inc., has undergone a significant transformation. The initial public offering (IPO) in December 2019, which valued the company at $10.5 billion, marked a pivotal moment, broadening its shareholder base. This analysis will explore the evolution of XP Group's ownership, including major shareholders and the impact of its listing on the Nasdaq.

Who Founded XP?

The story of XP Inc. began in 2001, established by Guilherme Benchimol and Marcelo Maisonnave. Initially known as XP Investimentos CCTVM S.A., the firm started as an independent investment agent in Porto Alegre, Brazil.

Benchimol, now the Chairman of XP Inc., launched the company after leaving a brokerage firm, using an initial investment of roughly $2,000. The early focus was on financial education, aiming to educate Brazilians about investment opportunities, which helped build a strong customer base.

While the exact initial equity split between Benchimol and Maisonnave isn't publicly available, their collaboration was key to the company's early development. Early operations also included the creation of XP Resource Management in 2005. A significant step was the acquisition of Americainvest CCTVM Ltda. in 2007, which transformed XP Investimentos into a full-fledged brokerage.

Guilherme Benchimol and Marcelo Maisonnave founded the company in 2001.

The initial capital was approximately $2,000.

Financial education was a key strategy to attract customers.

The acquisition of Americainvest CCTVM Ltda. in 2007.

XP Resource Management was created in 2005.

The founders aimed to democratize finance in Brazil.

The initial ownership structure, though not fully detailed publicly, was crucial for the strategic direction of XP Inc. Early agreements and potential disputes from this period aren't extensively disclosed, but the founders' vision was central to the company's initial distribution of control and strategic direction. The focus on financial education helped build a loyal customer base, which was crucial for the early growth of the company. The company's expansion included creating XP Resource Management in 2005 and acquiring Americainvest CCTVM Ltda. in 2007, which helped transform XP Investimentos into a full-fledged brokerage firm.

- The company's early emphasis was on financial education.

- XP Resource Management was created in 2005.

- Americainvest CCTVM Ltda. was incorporated in 2007.

- The initial capital was approximately $2,000.

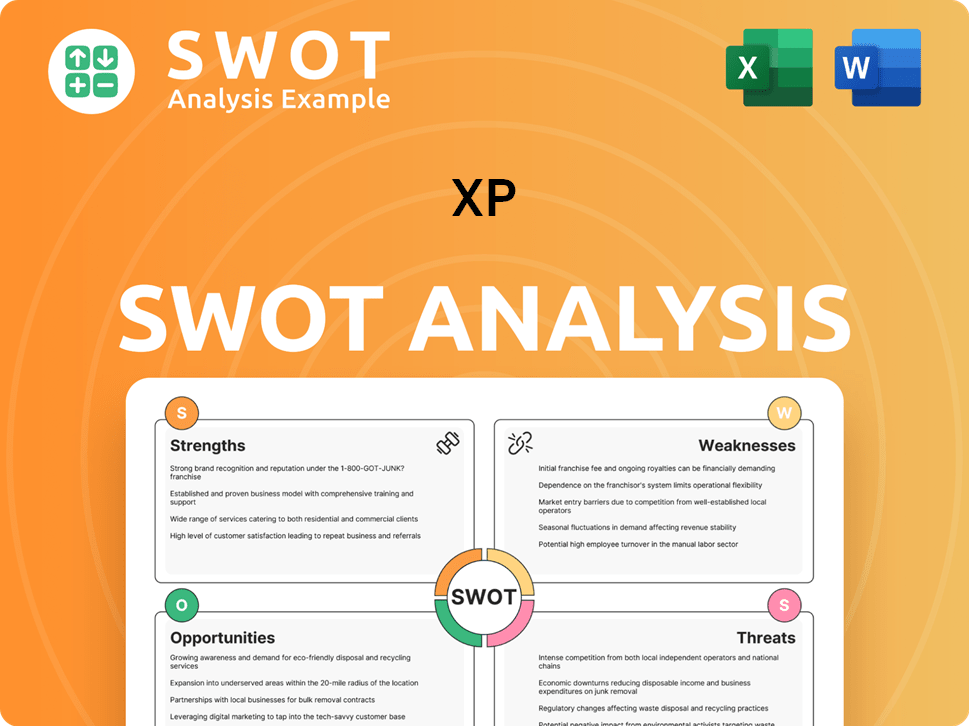

XP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has XP’s Ownership Changed Over Time?

The evolution of XP Inc.'s ownership has been marked by significant changes since its inception. The company's initial public offering (IPO) on Nasdaq in December 2019, with an initial market capitalization of $10.5 billion, was a pivotal moment. As of June 13, 2025, the market cap stands at approximately $10.3 billion, with about 527 million shares outstanding. This transition to a publicly traded entity opened the door for a broader investor base and influenced the company's strategic direction.

The ownership structure of XP has been shaped by the involvement of key players. XP Control LLC, representing a coalition of major stakeholders, currently holds a significant influence, owning 19.58% of total shares and controlling 70.94% of the voting rights through a dual-class share structure. This group comprises founding members and early investors, including General Atlantic and Itaú Unibanco. General Atlantic held a 10.8% stake at the time of the IPO, while Itaú Unibanco held 41.4% of XP Inc.'s shares following a 2017 investment. The termination of a shareholders' agreement with Itaú Unibanco in July 2023 was a key event that impacted the company's governance and board composition.

| Shareholder | Stake (as of June 2025) | Notes |

|---|---|---|

| XP Control LLC | 19.58% | Controls 70.94% of voting rights |

| Dodge & Cox | 9.739% | Institutional Investor |

| BlackRock, Inc. | 7.267% | Institutional Investor |

As of June 2025, major institutional shareholders include Dodge & Cox (9.739%), BlackRock, Inc. (7.267%), and Capital World Investors (9.087%). General Atlantic LLC (5.51%) and Mawer Investment Management Ltd. (6.83%) also hold significant stakes. State Street Corp and Vanguard Group Inc. are also notable institutional investors. These shifts in major shareholding have significantly impacted the company's strategy and governance, moving towards a more independent board structure. For more details, check out the Revenue Streams & Business Model of XP.

Understanding XP Company ownership is crucial for investors and stakeholders.

- XP Inc. went public in December 2019.

- XP Control LLC has significant influence.

- Major institutional investors hold substantial stakes.

- The ownership structure impacts the company's strategy and governance.

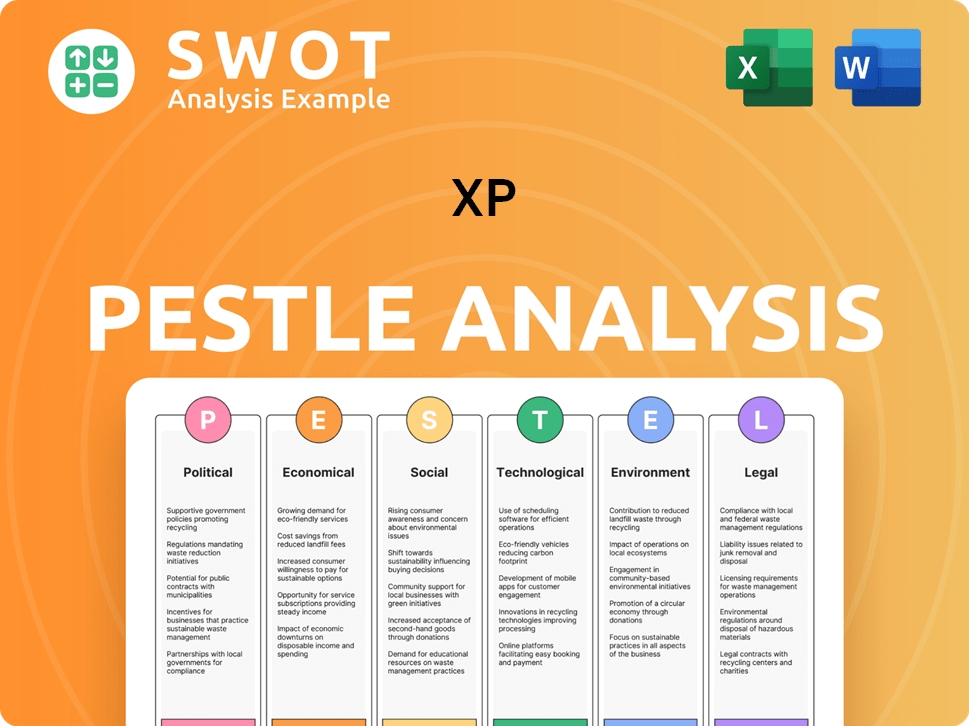

XP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on XP’s Board?

As of April 2025, the Board of Directors of XP Inc. includes nine members. The board is structured with a majority of five independent directors, a change implemented following announcements in April 2024. This composition is designed to provide enhanced independent oversight and strategic guidance. The current Chairman of the Board is Guilherme Benchimol, the founder of the company.

The company's governance structure also includes the formation of two new Board committees: the Risks, Credit and ESG Committee and the Strategy and Performance Committee. The Audit Committee is composed entirely of independent directors. These changes reflect an ongoing commitment to improving governance and accountability to a wider shareholder base.

| Board Member | Title | Independent Director |

|---|---|---|

| Guilherme Benchimol | Chairman of the Board | No |

| Independent Directors | Various | Yes |

| Other Directors | Various | No |

The voting structure of XP Inc. involves both Class A and Class B common shares. Class A shares have one vote each, while Class B shares have ten votes each. This dual-class structure gives significant control to entities holding Class B shares. As of April 2025, XP Control LLC holds 70.94% of the total voting rights, despite owning 19.58% of the total shares. This structure gives the controlling shareholders substantial influence over corporate decisions. For more information on the Marketing Strategy of XP.

Understanding the board of directors and voting power is key to grasping XP Company ownership. The board is structured to provide independent oversight. The dual-class share structure grants significant control to those holding Class B shares.

- Guilherme Benchimol is the Chairman.

- Majority of independent directors on the board.

- XP Control LLC holds a significant portion of voting rights.

- Changes in 2024 aimed to improve governance.

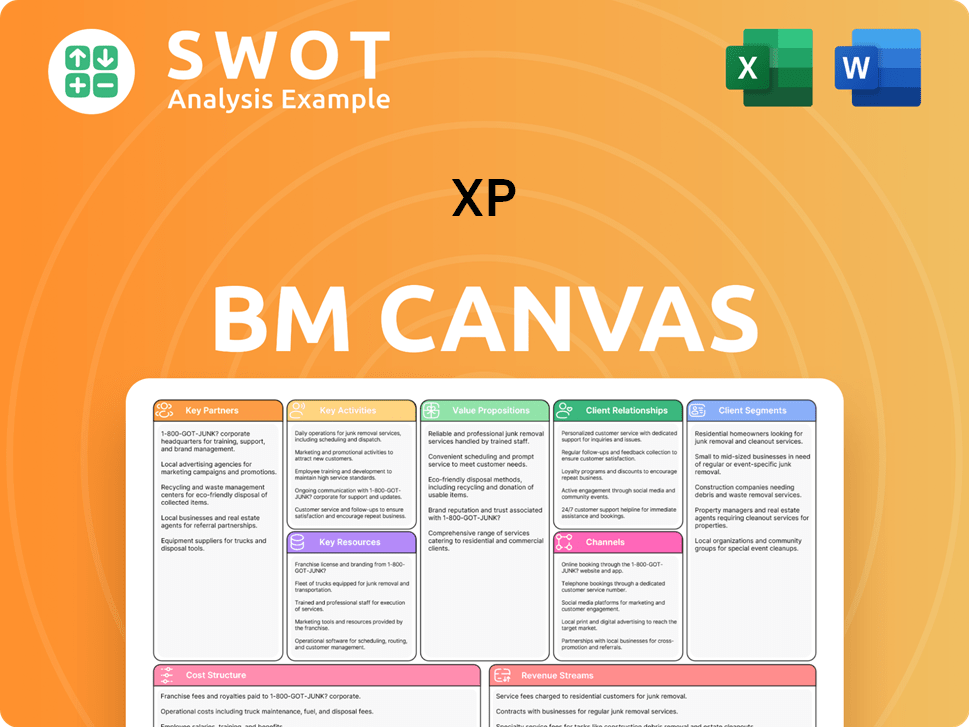

XP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped XP’s Ownership Landscape?

Over the past few years, XP Inc. has actively managed its ownership structure. The company's board approved share repurchase programs in November 2024 and May 2025. These programs authorized the repurchase of up to R$1.0 billion (approximately $190 million USD as of May 2025) of its outstanding Class A common shares. These buybacks are funded by existing cash reserves and are subject to market conditions. In April 2024, XP Inc. also approved the cancellation of 12,053,924 Class A shares, representing 2.2% of total shares, which reduced the total share count from 540,052,383 to 527,998,459.

Leadership changes have also occurred, with Victor Mansur appointed as Chief Financial Officer in August 2024, succeeding Bruno Constantino. Thiago Maffra continues to serve as the Chief Executive Officer. These moves reflect an evolving organizational structure within XP Inc., indicating ongoing adjustments to meet strategic objectives and operational demands. The company's commitment to strategic financial management is evident through these actions.

| Metric | Details | Date |

|---|---|---|

| Institutional Ownership | 88.67% | June 2025 |

| Number of Institutional Owners | 571 | June 2025 |

| Shares Held by Institutions | 427,425,460 | June 2025 |

Industry trends show an increased institutional ownership in XP Inc., with 571 institutional owners holding a total of 427,425,460 shares as of June 2025, representing 88.67% institutional ownership. Major institutional holders include Dodge & Cox, BlackRock, Inc., and Capital World Investors. While founder Guilherme Benchimol remains Chairman, there has been a natural dilution of founder stakes as the company has grown and undergone public offerings and investments. The termination of the shareholders' agreement with Itaú Unibanco in July 2023 also marked a move towards greater independence in governance. As of May 2025, analysts have shown a positive outlook for XP Inc., with upgrades in stock ratings citing potential benefits from declining interest rates and growth in trading activity and assets under management.

XP Company ownership is primarily influenced by institutional investors. Founder Guilherme Benchimol remains as Chairman. The company has a history of strategic share repurchases.

Major shareholders include Dodge & Cox, BlackRock, Inc., and Capital World Investors. Institutional ownership is a significant factor. The company's shareholder base is diverse.

The company approved new share repurchase programs. There were leadership changes, including the appointment of a new CFO. XP Inc. has shown strategic financial management.

Analysts have a positive outlook for XP Inc. Stock ratings have seen upgrades. The outlook cites potential benefits from declining interest rates.

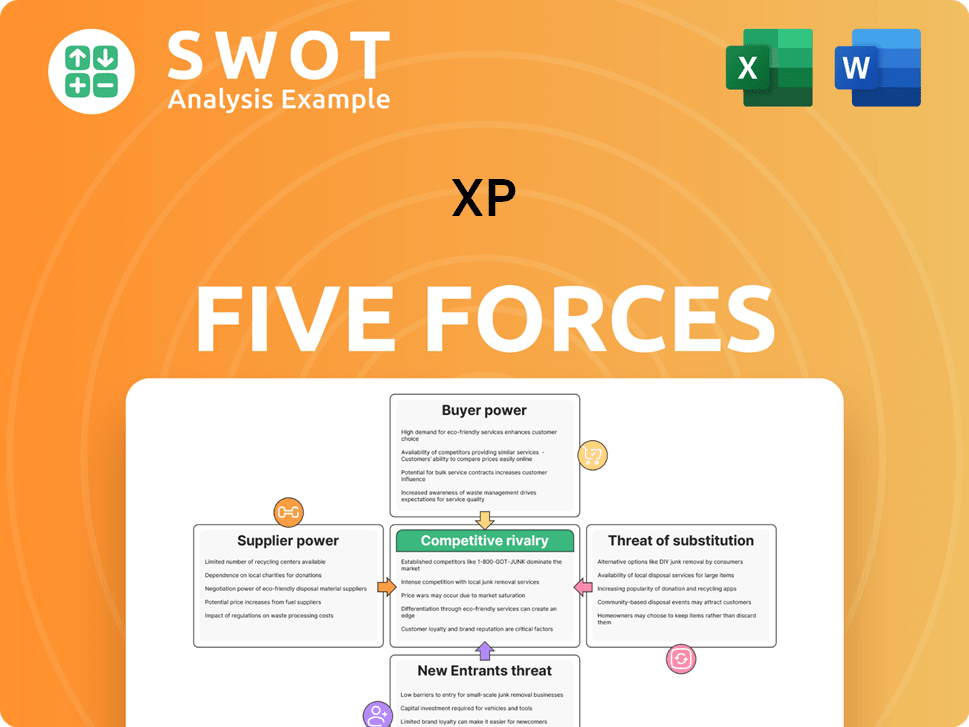

XP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of XP Company?

- What is Competitive Landscape of XP Company?

- What is Growth Strategy and Future Prospects of XP Company?

- How Does XP Company Work?

- What is Sales and Marketing Strategy of XP Company?

- What is Brief History of XP Company?

- What is Customer Demographics and Target Market of XP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.