XTB Bundle

What's the Story Behind XTB's Rise?

Ever wondered how XTB, a global online broker, became a powerhouse in the trading world? From its humble beginnings in Poland, XTB has charted an impressive course, driven by a vision to democratize access to financial markets. This journey is packed with pivotal moments, including the launch of its game-changing XTB platform. Let's dive into the XTB SWOT Analysis to understand its strategic moves.

Understanding the XTB company background requires looking at its origins and development. Founded in 2002, XTB's commitment to innovation, particularly with its XTB trading platform, fueled its rapid expansion. Today, XTB offers a wide range of financial instruments, making it a key player in the competitive landscape of online trading and a subject of interest in any XTB review.

What is the XTB Founding Story?

The story of the XTB company begins in Poland in 2002, initially as X-Trade Brokers. The founders saw a gap in the market, recognizing the rising demand for online trading solutions, especially in Central and Eastern Europe. Their vision was to give individual investors easier access to global financial markets, which were then largely controlled by traditional institutions.

This marked the beginning of what would become a major player in the online trading world. The company's early focus was on Contracts for Difference (CFDs), which allowed traders to speculate on market movements with leverage. This approach quickly gained popularity, enabling traders to potentially profit from both rising and falling markets. While specific details about the early days are limited, it's understood that XTB started as a relatively small operation, likely using early funding to build its platform and establish a market presence.

The company's growth was fueled by the economic environment of post-communist Poland. The country's financial markets were rapidly developing, and there was a growing interest in investment opportunities. The founders' expertise in financial markets and technology was key to creating a strong trading platform and attracting early users. This early foundation set the stage for the company's expansion and evolution over the years.

XTB was founded in Poland in 2002, initially known as X-Trade Brokers, to provide online trading solutions.

- The company focused on providing Contracts for Difference (CFDs).

- Early growth was supported by Poland's developing financial market.

- The founders' expertise in finance and technology was crucial.

- XTB aimed to give individual investors access to global financial markets.

The initial business model of XTB revolved around offering CFDs. This allowed traders to speculate on various assets without needing to own them. This model was attractive because it provided flexibility and the potential to profit in different market conditions. The company's early success was also influenced by the economic and cultural context of Poland at the time. As the financial markets in Poland developed, there was a growing interest in investment opportunities, creating a favorable environment for XTB's establishment and growth.

XTB's early success can be attributed to several factors. The founders' understanding of financial markets and technology was critical in developing a robust trading platform that met the needs of early adopters. The company's focus on CFDs provided traders with leveraged exposure, allowing them to potentially profit from market movements. The timing was also advantageous, as Poland's financial markets were expanding, and there was increasing interest in investment opportunities. For more information on who uses XTB, you can read about the Target Market of XTB.

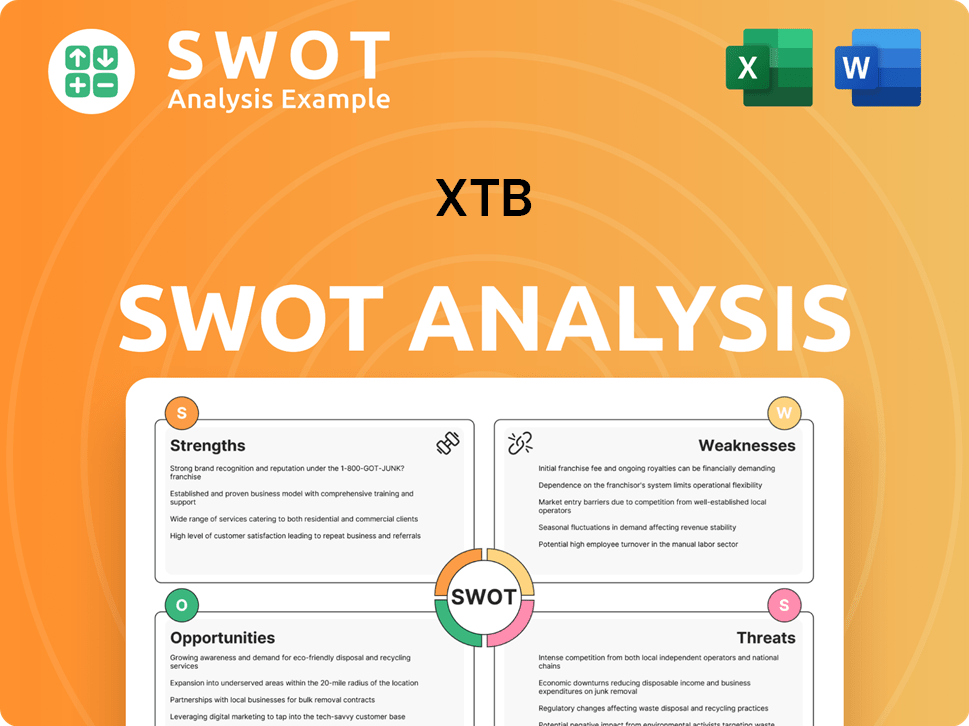

XTB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of XTB?

The early growth of the company, starting from its foundation in 2002, was marked by strategic expansion and product diversification. This period saw the company establish itself as a key online broker, particularly in Central and Eastern Europe. Key to this growth was the continuous development of its trading platform, evolving into the sophisticated xStation platform. This evolution is a crucial part of the Competitors Landscape of XTB.

A significant aspect of the company's early expansion involved entering new European markets. Regulatory licenses were secured across various jurisdictions, broadening its service availability. This geographical growth was coupled with the addition of new product categories, including indices, commodities, and later, stocks and ETFs. By 2007, the company had already established offices in multiple European countries.

The company's initial success was driven by its competitive spreads and user-friendly interface, attracting a diverse clientele. The continuous improvement of the trading platform, culminating in the xStation platform, was a key factor. The platform's evolution and the addition of diverse financial instruments, beyond just CFDs on forex, were critical to its market appeal.

The market generally responded positively to the company's offerings, providing an alternative to traditional brokerage services. The company differentiated itself through technology and customer support. Strategic shifts included adapting to varying regulatory demands and continuously enhancing the platform based on user feedback. The company reported a record of 288,000 active clients in the first quarter of 2024, demonstrating substantial growth.

Early milestones included securing regulatory licenses and expanding into new markets. The company's focus on technological advancements, such as the development of the xStation platform, was crucial. The initial public offering (IPO) and subsequent capital raises were essential for funding expansion and technological development. The company's growth trajectory has been marked by strategic decisions and a focus on technological innovation.

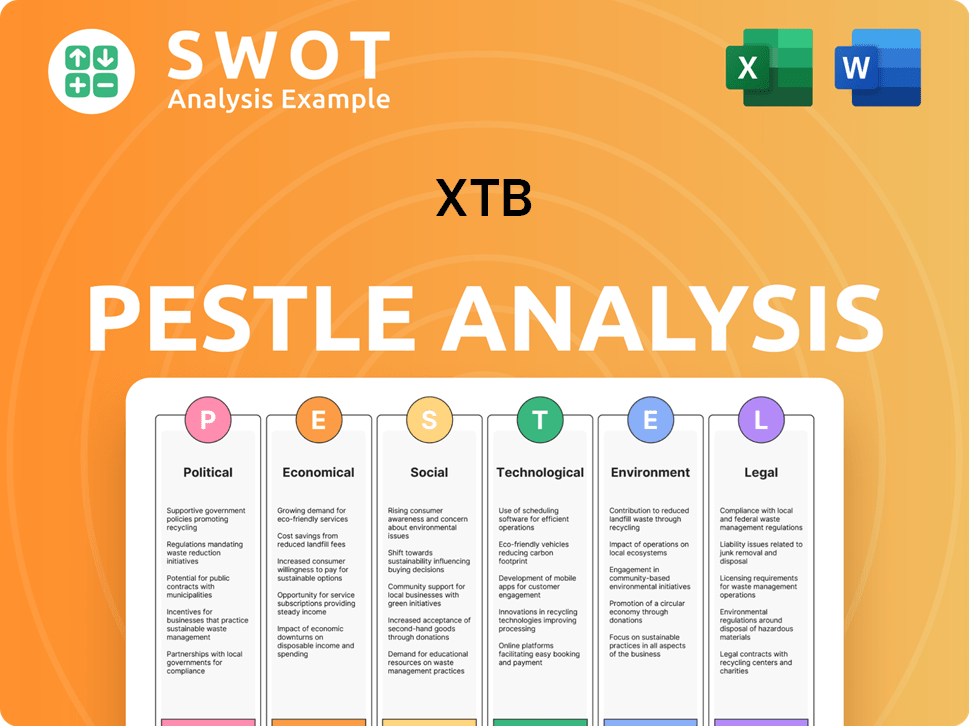

XTB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in XTB history?

The XTB company has experienced a dynamic journey marked by significant milestones, strategic innovations, and the navigation of various challenges within the financial market. Its evolution reflects a commitment to technological advancement, market expansion, and client-centric solutions.

| Year | Milestone |

|---|---|

| 2002 | XTB was founded, marking the beginning of its journey in the financial services industry. |

| 2004 | XTB expanded its operations, establishing a presence in international markets. |

| 2008 | The company launched its proprietary XTB trading platform, enhancing its service offerings. |

| 2010 | XTB expanded its global footprint, entering new markets and increasing its client base. |

| 2016 | XTB became a publicly listed company, further solidifying its position in the financial market. |

| 2024 | XTB reported a net profit of PLN 302.9 million in Q1, with an average of 288,000 active clients. |

A key innovation for

The XTB trading platform has seen continuous improvements, integrating advanced charting tools and economic calendars.

XTB has consistently invested in technology, integrating features like sentiment analysis directly into the platform.

The company diversified its product offerings beyond CFDs to include commission-free stock and ETF trading.

XTB has focused on providing educational resources to empower its clients, improving their trading knowledge.

Challenges faced by XTB include navigating volatile market conditions and intense competition from both established brokers and new fintech entrants. Adapting to evolving regulatory landscapes across different jurisdictions has also been a key challenge.

XTB has had to navigate volatile market downturns, impacting trading volumes and client activity.

Intense competition from established brokers and new fintech entrants has required XTB to continuously innovate.

Adapting to evolving regulatory landscapes across different jurisdictions has presented ongoing challenges.

Like any financial institution, XTB has encountered operational hurdles and market-specific pressures.

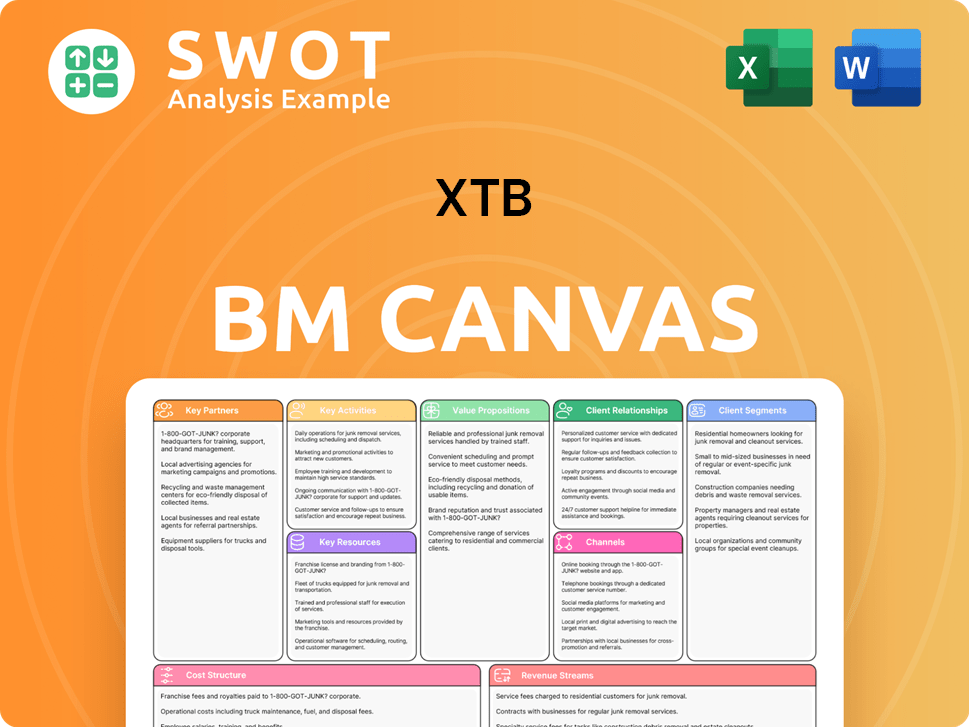

XTB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for XTB?

The brief history of XTB showcases its evolution from a Polish startup to a global financial services provider. Founded in 2002 as X-Trade Brokers, the company has consistently expanded its offerings and geographical reach, marking significant milestones like the launch of its proprietary xStation trading platform in 2009 and its listing on the Warsaw Stock Exchange in 2016. XTB has focused on innovation, client acquisition, and market expansion. The company's strategic initiatives and commitment to client education have positioned it to capitalize on industry trends and maintain a positive future outlook.

| Year | Key Event |

|---|---|

| 2002 | X-Trade Brokers, later known as XTB, was established in Poland. |

| 2007 | XTB began its international expansion, opening offices across Europe. |

| 2009 | The xStation trading platform was launched. |

| 2016 | XTB was listed on the Warsaw Stock Exchange. |

| 2018 | Commission-free stock and ETF trading was introduced. |

| 2020-2021 | Significant growth in client acquisition and trading volumes occurred. |

| 2023 | XTB strengthened its position as a leading global broker. |

| Q1 2024 | XTB reported a record net profit of PLN 302.9 million and an average of 288,000 active clients. |

XTB is focused on expanding into new geographical markets to increase its global footprint. The company aims to target regions with high growth potential in online trading. This expansion is a key component of their long-term strategic initiatives.

Continuous development of the xStation platform is a priority, with plans to incorporate advanced tools and AI-driven insights. XTB aims to provide personalized trading experiences for its clients. These improvements are designed to enhance the overall trading experience.

XTB plans to diversify its product offerings by exploring new asset classes and investment solutions. This strategy aims to cater to a broader range of investor needs. Diversification is a key element of their long-term growth strategy.

XTB is well-positioned to capitalize on industry trends such as the growth of retail investing and the increasing adoption of digital platforms. The company's robust technological infrastructure and strong regulatory compliance are key strengths. Leadership emphasizes client education and transparent trading solutions.

XTB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of XTB Company?

- What is Growth Strategy and Future Prospects of XTB Company?

- How Does XTB Company Work?

- What is Sales and Marketing Strategy of XTB Company?

- What is Brief History of XTB Company?

- Who Owns XTB Company?

- What is Customer Demographics and Target Market of XTB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.