XTB Bundle

Who Does XTB Serve? Unveiling the Broker's Client Base

In the fast-paced world of online trading, understanding the XTB SWOT Analysis is crucial. Knowing the customer demographics and target market is essential for XTB's long-term success. From its origins as a Forex broker to its current status as a multi-asset platform, XTB's evolution reflects a dynamic approach to meeting the needs of its diverse client base. This analysis dives deep into the 'who' and 'why' behind XTB's customer strategy.

This exploration into XTB's customer profile will reveal the characteristics of XTB traders, including their age range, income levels, and trading experience. We'll examine the geographic location of XTB's users and the financial products they trade, such as CFDs, Forex, and stocks. Furthermore, we'll analyze how XTB attracts new customers through various customer acquisition strategies and marketing campaigns, providing insights into XTB's target market for different trading instruments and customer segmentation analysis to better understand their customer satisfaction levels.

Who Are XTB’s Main Customers?

Understanding the XTB customer profile involves examining its primary customer segments, which include both individual investors and institutional clients. The company operates as a B2C and B2B entity, catering to a diverse range of traders and investors. This dual approach allows XTB to serve a broad spectrum of financial market participants, from those new to trading to experienced institutional players.

XTB's significant growth in recent years highlights its success in attracting and retaining a large customer base. The company's ability to expand its client base and increase active users indicates a strong market presence and effective customer acquisition strategies. This expansion reflects XTB's ability to appeal to a wide audience, as detailed in a comprehensive analysis of the Marketing Strategy of XTB.

In 2024, XTB added 498,438 new clients, a 59.8% increase, bringing the total client count to 1.36 million. The number of active clients also rose to a record 658,520, up 61.2% year-on-year. By the end of March 2025, the total client base reached 1.54 million, with active clients at 735,400. This growth trajectory underscores the company's ability to attract and retain customers.

XTB's customer base includes active traders interested in CFDs on various instruments and long-term investors. The company has expanded its offerings to attract a broader audience. This includes real stocks, ETFs, and tax-advantaged accounts, catering to different investment strategies.

XTB aims to acquire an average of 150,000-210,000 new clients quarterly in 2025. This aggressive growth strategy reflects its ambition to expand its reach. The company's focus on both active traders and long-term investors supports this objective.

While specific demographic data for XTB's customer profile is not publicly available, the company's product offerings and marketing strategies suggest a broad appeal. The platform caters to both active traders and long-term investors, offering a range of financial products.

- CFD Traders: Targeting those interested in forex, indices, commodities, stocks, ETFs, and cryptocurrencies.

- Long-Term Investors: Attracting individuals interested in real stocks, ETFs, and tax-advantaged accounts.

- Growing Segment: Nearly 80% of new EU clients in 2024 started by purchasing stocks or opening investment plans.

- Geographic Reach: XTB operates globally, attracting customers from various regions with diverse financial backgrounds.

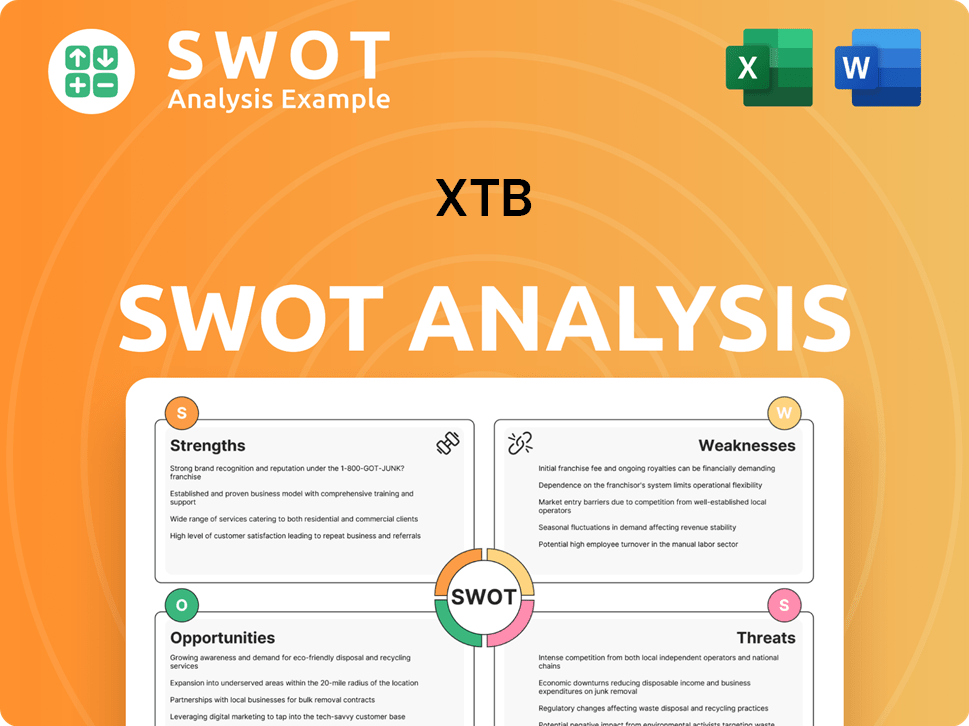

XTB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do XTB’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial services provider. For XTB, a deep dive into these aspects reveals key drivers behind customer choices and platform usage. This knowledge helps tailor services, enhance user experience, and refine marketing strategies to better serve its diverse client base.

XTB's customer base is drawn to a comprehensive suite of financial instruments and global market access. This includes a wide array of products, from CFDs on forex, indices, commodities, stocks, and cryptocurrencies, to exchange-traded stocks and ETFs. The platform's design, analytical tools, and educational resources further shape customer preferences, catering to both novice and experienced traders. Competitive pricing and a focus on cost-effectiveness are also significant factors influencing customer decisions.

The company's commitment to providing a user-friendly trading environment, competitive pricing, and educational resources directly addresses the needs and preferences of its target market. Features like auto-investing and multi-currency cards demonstrate a proactive approach to meeting evolving customer demands. Security measures, such as negative balance protection and segregated client accounts, build trust and confidence among XTB's clientele.

Customers seek access to a broad range of financial instruments. XTB offers over 5,500 instruments, including CFDs on forex, indices, commodities, stocks, ETFs, and cryptocurrencies. There are also over 7,300 tradable instruments, including exchange-traded stocks and ETFs.

The proprietary xStation 5 platform is preferred for its intuitive design and advanced tools. These tools include advanced charting, real-time market data, market sentiment indicators, and depth of market (DOM). These features cater to both novice and experienced traders, simplifying complex trading decisions.

Customers value competitive pricing. XTB offers competitive spreads on forex pairs. It also provides commission-free trading on stocks and ETFs up to a monthly volume of €100,000, attracting active traders.

Educational resources are a key preference for many customers. XTB provides video tutorials, guides, and a Trading Academy. These resources support beginners and those seeking to enhance their financial literacy.

Customers are looking for diversified investment strategies. XTB offers features like auto-investing in Investment Plans, IKE accounts in Poland, and ISA accounts in the UK. The introduction of an eWallet with a multi-currency card in 2024 further supports this need.

Trust and security are important for customers. XTB offers negative balance protection, especially for EU clients. They also provide segregated client accounts, which reinforce trust and security.

XTB's customer needs and preferences are varied, reflecting a diverse client base with different trading styles and financial goals. Understanding these preferences is essential for XTB to maintain customer satisfaction and attract new clients. Key factors include platform usability, cost-effectiveness, educational support, and a wide range of trading instruments.

- Platform Usability: Customers prefer intuitive platforms with advanced tools. The xStation 5 platform is designed to meet these needs.

- Cost-Effectiveness: Competitive pricing, including commission-free trading options, is a significant draw.

- Educational Resources: Access to educational materials helps customers improve their trading skills.

- Variety of Instruments: The ability to trade a wide range of assets, including CFDs, stocks, and ETFs, is crucial.

- Security and Trust: Features like negative balance protection and segregated accounts build customer confidence.

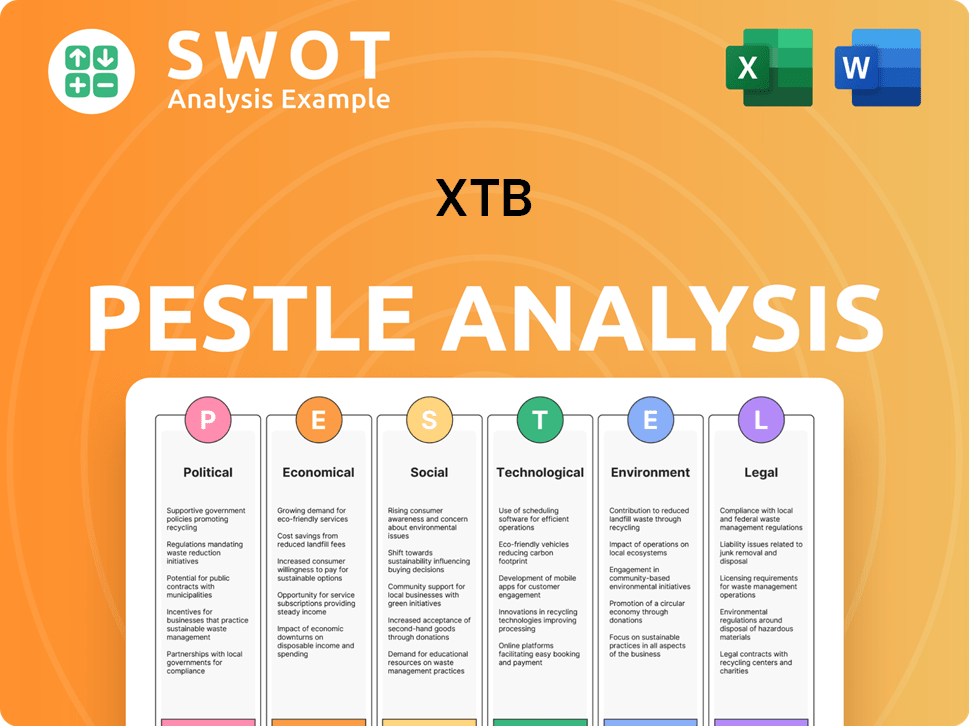

XTB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does XTB operate?

The company has a substantial global presence, with offices spanning across 13 countries and serving over 1.5 million clients worldwide as of March 2025. This widespread reach is supported by regulation from major financial authorities, including the UK's FCA, CySEC, BaFin, and the Polish Financial Supervision Authority (KNF). This regulatory oversight provides a robust framework for its operations, ensuring a secure environment for its diverse XTB client base.

Central and Eastern Europe remains a pivotal region for the company's revenue, contributing significantly to its financial performance. The company's strategic focus on geographic diversification is evident in its expansion into non-European markets, particularly in Latin America and Asia. This expansion is designed to capitalize on growth opportunities in emerging markets, fostering the development of a global brand and attracting a wider range of XTB traders.

The company's commitment to global expansion and regulatory compliance underscores its dedication to providing secure and accessible trading services worldwide. This strategic approach allows the company to cater to a diverse XTB customer profile, offering a range of financial products and services to meet the needs of traders across different regions. For a deeper understanding of the competitive environment, you can explore the Competitors Landscape of XTB.

Central and Eastern Europe is a key market, with its share of revenue reaching 63.9% in 2024. Poland's market share increased by 26.5% year-on-year in 2024, highlighting the company's strong position in its home region.

Western Europe is targeted for intensive expansion in 2025. This expansion is supported by product diversification, including the introduction of ISA accounts in the UK and planned PEA accounts for clients in France.

The Middle East has emerged as the most dynamically developing region, with its revenue share reaching 10.9% by the end of 2024, a 72.5% year-on-year increase. A second office has been opened in Dubai to support this growth.

The company is actively expanding into non-European markets, focusing on Latin America and Asia. In Q1 2025, the company obtained a securities agent license in Chile and is preparing to enter the Brazilian market.

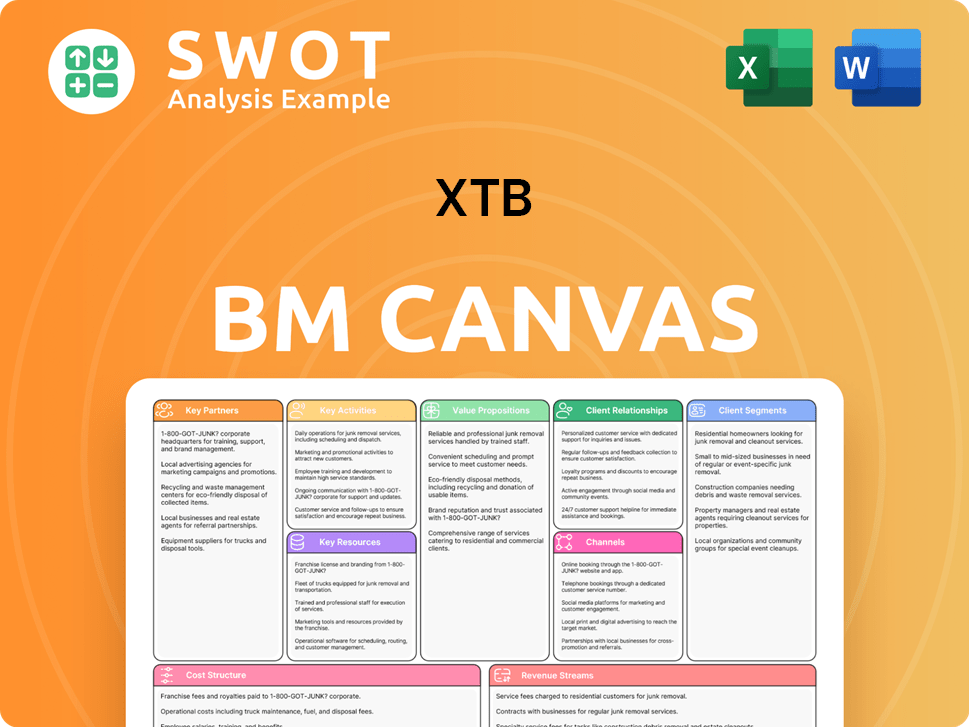

XTB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does XTB Win & Keep Customers?

The company's customer acquisition and retention strategies are designed to foster growth and maintain a strong client base. These strategies involve significant investment in marketing, product development, and customer support to attract new users and keep existing ones engaged. The company's focus on providing a comprehensive trading experience and educational resources aims to build client loyalty and encourage long-term investment.

Aggressive marketing campaigns, especially online, are a key component of the acquisition strategy. The company also utilizes partnerships with well-known athletes to boost brand recognition. The introduction of new products and features, such as auto-investing and eWallet, is a key part of the retention strategy. The aim is to meet a wide array of investor needs and encouraging long-term engagement.

Customer service plays a critical role, with multilingual support available to assist users. The company also emphasizes financial literacy through educational resources. Continuous product development, with plans for options trading and additional cryptocurrency offerings, aims to keep the platform competitive and relevant to the evolving client demands. The company's commitment to product innovation and customer support is fundamental to its success in the competitive trading market. To learn more about the company's ownership and financial structure, you can read about the Owners & Shareholders of XTB.

The company significantly boosts customer acquisition through marketing, with expenditures increasing by PLN 78.2 million in 2024. The focus is on online marketing campaigns. Partnerships with recognized athletes are also utilized to enhance brand recognition and market position.

The company demonstrated strong client acquisition, adding 498,438 new clients in 2024, a 59.8% increase. The company targets an average of 150,000-210,000 new clients quarterly in 2025. Marketing spending is projected to increase by approximately 80% in 2025.

The company focuses on product enhancement and a superior trading experience for retention. New products launched in 2024 include auto-investing features, IKE and ISA accounts, and an eWallet. Nearly 80% of new EU clients began investing in shares and ETFs.

The proprietary xStation 5 platform plays a crucial role in retaining active traders. The platform offers a user-friendly interface, advanced charting, and real-time data. 24/5 customer support is available in 22 languages via live chat, email, and phone.

The company employs a multi-faceted approach to attract and retain customers.

- Aggressive marketing campaigns, especially online, drive customer acquisition.

- Partnerships with athletes boost brand recognition.

- Introduction of new products like auto-investing caters to a broader audience.

- The xStation 5 platform provides a comprehensive trading environment.

- Multilingual customer service and educational resources enhance the customer experience.

- Continuous product development, including options and cryptocurrency offerings, keeps the platform competitive.

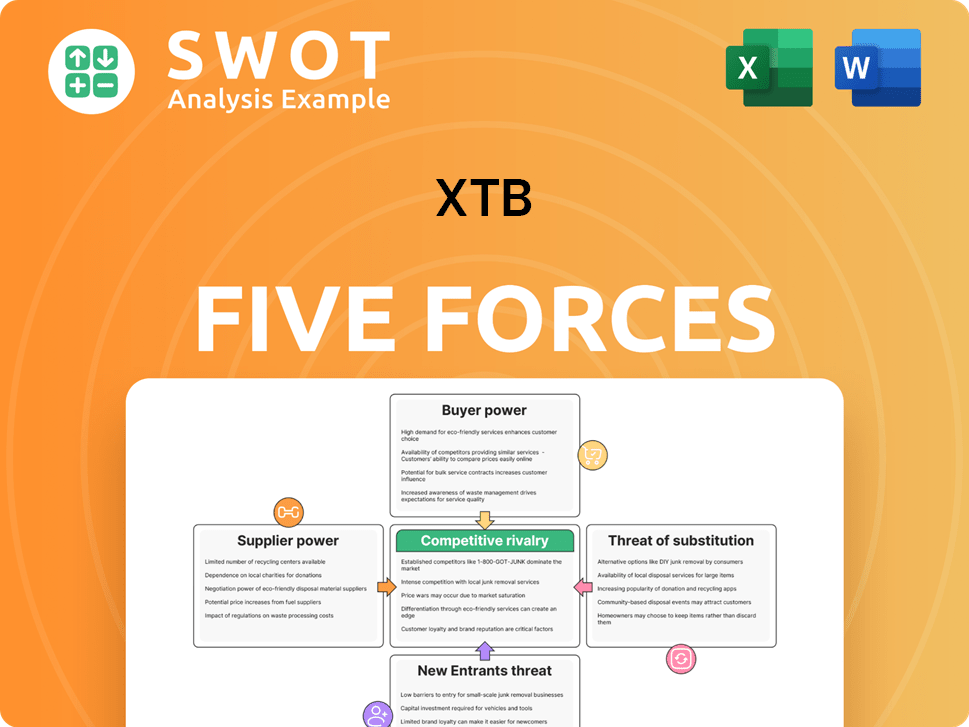

XTB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.