XTB Bundle

How Does XTB Company Thrive in the Financial Markets?

XTB, a leading global online broker, has rapidly expanded its footprint, offering access to a wide array of financial instruments to a growing client base. With record-breaking profits and a significant increase in users, understanding XTB's operational model is crucial. This analysis will explore the core aspects of XTB SWOT Analysis, revenue generation, and strategic positioning within the competitive online trading landscape.

From Forex trading to CFD trading on various assets, XTB platform provides tools for both novice and experienced traders. The company's robust performance, including its impressive client growth, highlights its importance in the online trading industry. This deep dive will help you understand how to open an XTB account, navigate the XTB trading platform, and assess XTB fees and commissions.

What Are the Key Operations Driving XTB’s Success?

The core operations of the XTB company center on providing a comprehensive online trading environment. It offers access to a wide array of financial instruments, primarily serving individual investors and institutional clients. This includes Contracts for Difference (CFDs) on forex, indices, commodities, stocks, ETFs, and cryptocurrencies, facilitating diverse trading strategies.

XTB's value proposition is built around its user-friendly XTB platform, designed for both novice and experienced traders. The platform is complemented by extensive educational resources, including trading academies, webinars, and analytical tools. This empowers clients to make well-informed trading decisions, enhancing their overall trading experience.

Operational processes at XTB are driven by robust technology, ensuring the stability and speed of its trading platforms. The company focuses on continuous improvement of its technology infrastructure, including sophisticated order execution systems and real-time market data feeds. Customer service is a critical component, with multi-lingual support available to address client inquiries and technical issues. XTB's distribution network is primarily digital, leveraging online marketing and partnerships to acquire and retain clients globally.

XTB offers the xStation 5 and xStation Mobile platforms, designed for user-friendliness. These platforms support a wide range of financial instruments, including forex trading and CFD trading. They provide advanced charting tools and real-time market data, enhancing the trading experience.

XTB provides extensive educational resources, including trading academies and webinars. These resources help traders of all levels to improve their trading knowledge. The platform also offers analytical tools to support informed decision-making.

XTB provides multi-lingual customer support to address client inquiries and technical issues. This support system is crucial for ensuring a smooth trading experience. It helps in resolving issues and providing guidance to traders.

XTB's digital distribution network allows it to reach a global audience, offering a wide range of trading instruments. This includes access to forex trading, CFD trading on various assets, and other financial instruments. The platform's broad market access is a key advantage.

XTB distinguishes itself through its combination of a wide range of instruments, advanced technology, and strong client support. This integrated approach translates into enhanced trading accessibility and improved decision-making capabilities for traders. The platform's reliability and educational resources further differentiate it in the competitive online brokerage market.

- Wide Range of Instruments: Access to CFDs on forex, indices, commodities, stocks, ETFs, and cryptocurrencies.

- Advanced Technology: User-friendly xStation 5 and xStation Mobile platforms with sophisticated tools.

- Educational Resources: Trading academies, webinars, and analytical tools to support informed trading.

- Customer Support: Multi-lingual support to assist clients with inquiries and technical issues.

The effectiveness of the XTB company stems from its integrated approach to online trading. From its inception, as detailed in the brief history of XTB, the company has focused on providing a comprehensive and accessible platform. This includes a wide range of financial instruments, advanced trading technology, and robust client support. These elements combine to create a reliable trading environment, enhancing the trading experience and helping traders make informed decisions. This integrated approach is a key factor in its competitive edge in the online brokerage market.

XTB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does XTB Make Money?

The core of the XTB company's financial model revolves around its brokerage services. Their revenue streams are primarily generated through transaction fees and spreads on trading activities. The company's financial performance is closely linked to the volume and frequency of trades executed by its clients, making trading activity a critical driver of their earnings.

The monetization strategy of XTB is heavily reliant on the trading activities of its clients. This includes fees from transactions, spreads on CFDs, and commissions on stock and ETF trades. The company's profitability is significantly influenced by market volatility and the number of active traders on its platform.

XTB's operational success is closely tied to its ability to attract and retain clients. The company uses competitive pricing and a wide range of trading instruments to draw in new users. In the first quarter of 2023, XTB reported a net profit of PLN 204.8 million, demonstrating the impact of client activity on its financial results.

XTB's revenue model is primarily based on transaction fees and spreads. The company benefits from the difference between the bid and ask prices (spreads) on CFDs, such as forex, indices, and commodities, where wider spreads translate to higher revenue per transaction. Furthermore, overnight funding costs (swaps) on CFD positions held for extended periods also contribute to the revenue. The company's strategy includes attracting new clients and expanding its product offerings to increase transaction-based revenue. Read more about the Growth Strategy of XTB.

- Transaction Fees: These include spreads on CFDs and commissions on stock and ETF transactions.

- Spreads: The difference between the bid and ask prices on CFDs. Wider spreads generate more revenue per transaction.

- Overnight Funding Costs (Swaps): Fees charged on CFD positions held open overnight.

- Client Acquisition: Attracting new clients through competitive pricing and a broad product offering.

XTB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped XTB’s Business Model?

The journey of the XTB company has been marked by significant milestones and strategic moves that have shaped its current market position. A pivotal moment was its initial public offering (IPO), which provided capital for further expansion and solidified its market presence. The continuous expansion of its product offering, including the addition of new CFDs, stocks, and ETFs, has been a consistent strategic move to attract a broader client base.

The company has navigated various market challenges, including regulatory hurdles and periods of market downturns. Its response has often involved adapting its technology and services to comply with evolving regulations and enhancing risk management protocols to protect both the company and its clients during volatile market conditions. XTB's competitive advantages include its strong brand recognition, particularly in Central and Eastern Europe, and its robust technology leadership, exemplified by its proprietary xStation platforms.

XTB continues to adapt to new trends, such as the increasing demand for mobile trading, by enhancing its xStation Mobile app, and addressing competitive threats by continuously improving its product offerings and educational resources. By the end of 2023, XTB reached over 888,000 clients globally, demonstrating successful client acquisition strategies. For more information on who XTB targets, check out the target market analysis of XTB.

XTB's IPO was a crucial step, providing resources for growth. The expansion of its product range, including CFDs, stocks, and ETFs, has broadened its appeal. Reaching over 888,000 clients globally by the end of 2023 is a significant achievement.

Adapting to regulatory changes and market volatility has been key. Continuous enhancement of the xStation platform and mobile app demonstrates a focus on user experience. Investing in educational resources helps clients navigate the complexities of online trading.

Strong brand recognition, especially in Central and Eastern Europe, gives XTB an advantage. The xStation platforms, with their advanced tools and user-friendly interface, provide a superior trading experience. Economies of scale, thanks to a growing client base, contribute to operational efficiency.

XTB is enhancing its xStation Mobile app to meet the demand for mobile trading. Continuous improvement of product offerings and educational resources helps the company stay competitive. The company focuses on providing resources for Forex trading, CFD trading and other online trading instruments.

The XTB platform offers a range of features designed to enhance the trading experience. These features include advanced charting tools, fast execution speeds, and a user-friendly interface. The platform is designed to be accessible for both beginners and experienced traders.

- Advanced charting tools for technical analysis.

- Fast execution speeds to capitalize on market opportunities.

- User-friendly interface for ease of navigation.

- Access to a wide range of trading instruments.

XTB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is XTB Positioning Itself for Continued Success?

The XTB company holds a significant position in the online brokerage industry, particularly in Europe, where it has cultivated a strong market share and client base. As of the end of 2023, XTB had over 888,000 clients globally, demonstrating its broad reach and ability to attract new users. Its global presence is further reinforced by its operations in multiple jurisdictions and compliance with various financial regulatory bodies.

Despite its strong market position, the XTB platform faces several risks, including regulatory changes, competition from new brokers, and technological disruptions like cybersecurity threats. Changing consumer preferences and shifts in market dynamics also pose potential challenges. Addressing these risks requires ongoing investment in technology, platform development, and client education.

XTB is a prominent player in the online trading sector, especially in Europe, where it has a substantial market share. The company's ability to attract and retain clients is a key strength. Its global operations and regulatory compliance further solidify its position.

XTB faces risks related to regulatory changes, increased competition, and technological advancements. Consumer preferences and market shifts also present challenges. The company must adapt to these changes to maintain its competitive edge.

XTB's future strategy includes geographic expansion and continuous platform development. The company aims to attract more active clients and increase trading volumes. Technological innovation and client education are key drivers for future growth.

The XTB trading strategy focuses on platform enhancements and market diversification. The company aims to attract more users and increase trading volumes. For more insights, explore the Growth Strategy of XTB.

XTB's strategic initiatives focus on geographic expansion, platform enhancements, and product diversification. The company is committed to technological innovation and client education to sustain growth and profitability in the evolving financial landscape. These strategies are crucial for the long-term success of the XTB company.

- Geographic Expansion: Expanding its presence in new markets to reach a wider audience.

- Platform Development: Continuously improving the XTB platform to enhance user experience and trading capabilities.

- Product Diversification: Offering a broader range of trading instruments to cater to diverse investor needs.

- Technological Innovation: Investing in cutting-edge technologies to maintain a competitive edge.

- Client Education: Providing educational resources to empower clients with knowledge and skills.

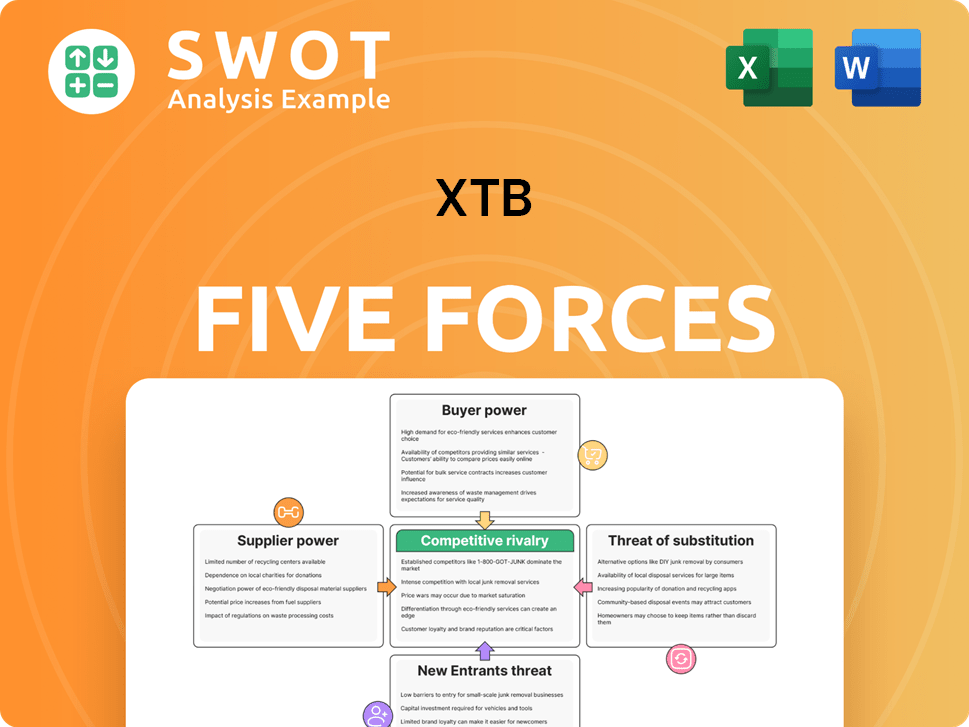

XTB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of XTB Company?

- What is Competitive Landscape of XTB Company?

- What is Growth Strategy and Future Prospects of XTB Company?

- What is Sales and Marketing Strategy of XTB Company?

- What is Brief History of XTB Company?

- Who Owns XTB Company?

- What is Customer Demographics and Target Market of XTB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.