XTB Bundle

How Does XTB Stack Up in the Brokerage Battleground?

The online brokerage arena is fiercely contested, with firms constantly vying for investor attention and market share. XTB, a prominent global player, has experienced remarkable growth since its 2002 launch. But how does XTB navigate this competitive landscape and what strategies does it employ to stay ahead?

This analysis delves into the XTB SWOT Analysis, providing a comprehensive XTB market analysis and exploring its key XTB competitors. We'll examine XTB's financial performance, assess its competitive advantages, and offer insights into its future growth trajectory within the dynamic XTB industry overview. Understanding XTB's position requires a deep dive into its XTB trading platform, financial services, and how it compares to its rivals.

Where Does XTB’ Stand in the Current Market?

XTB operates primarily in the online brokerage industry, specializing in Contracts for Difference (CFDs) and forex trading. Their core business involves providing a platform for clients to trade various financial instruments, including forex, indices, commodities, stocks, and ETFs. The company's value proposition centers around offering a user-friendly trading platform, competitive trading conditions, and educational resources to both novice and experienced traders.

The company focuses on providing access to a wide range of financial instruments through its trading platform, catering to a diverse clientele seeking leveraged trading opportunities. This allows clients to trade with potentially higher returns, although it also increases the risk involved. XTB's commitment to regulatory compliance and financial stability, supported by licenses from major financial authorities, enhances its credibility and attracts a broad customer base globally.

XTB's market position is strong within the online brokerage industry, especially in CFD and forex trading. While specific global market share figures are proprietary, XTB consistently ranks among the top brokers in terms of client numbers and trading volume across several key regions. For instance, in Q1 2024, XTB reported a significant increase in its active client base, reaching 312,000 active clients, up from 254,000 in Q1 2023, demonstrating strong growth and competitive standing. This growth is supported by the company's robust financial performance, with a net profit of PLN 302.8 million in Q1 2024, enabling further investment in technology, marketing, and client acquisition.

XTB's market share is substantial, particularly in Europe and Latin America, where it has a strong presence. The company's ability to attract and retain a large client base is a key indicator of its market position. Continuous growth in active clients shows XTB's competitive advantage.

The XTB trading platform is a crucial element of its market position. It offers a user-friendly interface and advanced trading tools. The platform's features attract both new and experienced traders, enhancing its competitive edge.

XTB's financial performance is a key factor in its market position. The company's profitability allows for continued investment in technology and client acquisition. Strong financial results support XTB's growth strategy and expansion plans.

XTB's competitive advantages include its diverse product offerings, strong regulatory compliance, and user-friendly trading platform. These advantages help the company attract and retain clients. Furthermore, XTB's expansion into new markets enhances its overall market position.

XTB's strengths include its strong financial performance, diverse product offerings, and global presence. A potential weakness could be the volatility associated with CFD trading, which can impact client outcomes. Understanding these factors is crucial for assessing XTB's competitive landscape.

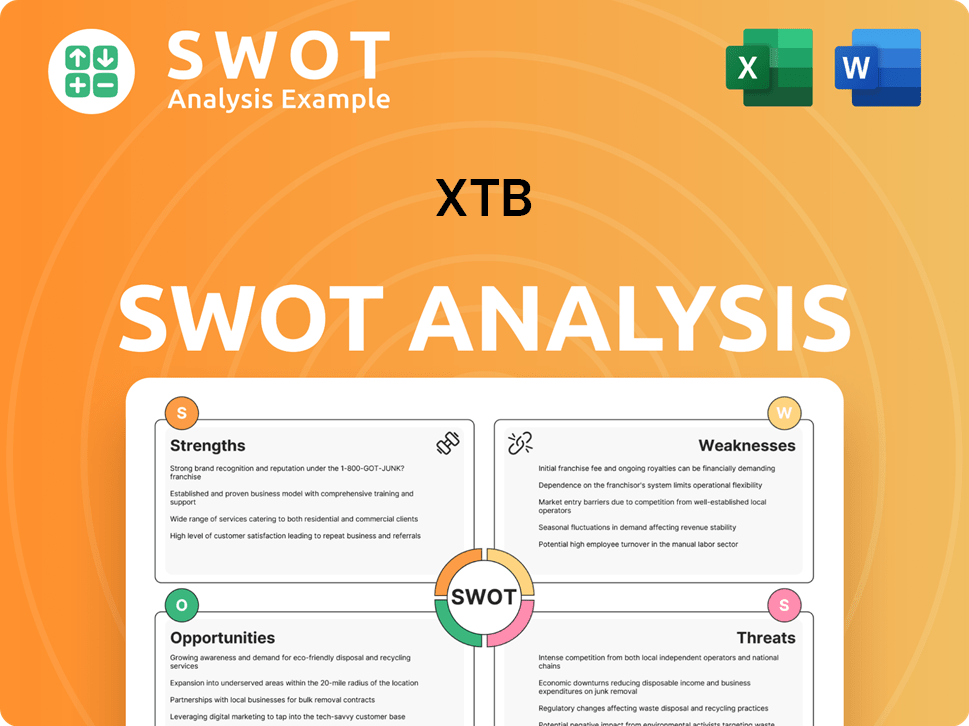

- Strengths: Strong financial performance, diverse product offerings, global presence, and user-friendly trading platform.

- Weaknesses: Dependence on CFD trading, and exposure to market volatility.

- Opportunities: Expansion into new markets and diversification of product offerings.

- Threats: Increased competition from other brokers and regulatory changes.

XTB's strategic focus includes expanding its footprint in emerging markets while consolidating its position in established ones. The company is also enhancing its digital offerings and educational resources to appeal to a broader audience. For a deeper dive into XTB's strategic approach, consider reading about the Growth Strategy of XTB. XTB's expansion plans involve diversifying its offerings, including expanding its real stock and ETF offerings to broaden its appeal and mitigate risks associated with market volatility in specific asset classes. This diversification strategy supports XTB's long-term growth and market resilience.

XTB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging XTB?

The XTB competitive landscape is characterized by intense competition within the online brokerage sector. This environment demands continuous adaptation and innovation to maintain and grow market share. Understanding the key players and their strategies is crucial for XTB to navigate this dynamic market effectively.

XTB's ability to compete depends on its capacity to offer competitive trading conditions, a user-friendly platform, and a wide range of financial products. The company must also focus on regulatory compliance and build a strong brand reputation to attract and retain clients. The following analysis provides an overview of XTB's main competitors and their respective strengths and weaknesses.

The XTB market analysis reveals a complex web of direct and indirect competitors. These entities vary in size, target audience, and service offerings, requiring XTB to adopt a multi-faceted approach to maintain its competitive edge. The following sections delve into the key competitors and their impact on XTB's business.

Direct competitors offer similar CFD and forex trading services. These brokers often compete on pricing, platform features, and the breadth of their product offerings. Understanding their strategies is essential for XTB to differentiate itself and attract clients.

IG Group is a major player in the online trading industry, known for its extensive product range and strong regulatory standing. It targets experienced traders with advanced trading platforms. IG Group's global presence and comprehensive offerings make it a formidable competitor.

Plus500 is recognized for its user-friendly interface and aggressive marketing strategies. It appeals to a broad retail audience, focusing on ease of access and platform simplicity. Plus500's marketing efforts and user-friendly platform are key strengths.

eToro distinguishes itself with its social trading features, attracting a community-driven segment of the market. It offers a unique value proposition through its social trading platform. eToro's social trading features set it apart from competitors.

Saxo Bank targets more affluent clients with sophisticated platforms and broader investment products. It often focuses on high-net-worth individuals with its comprehensive offerings. Saxo Bank's focus on affluent clients and broader products is a key differentiator.

Indirect competitors include traditional stockbrokers, investment apps, and cryptocurrency exchanges. These entities can attract clients interested in specific asset classes or simpler investment approaches. The market is also shaped by mergers and acquisitions, and emerging players. The competitive landscape is constantly evolving, requiring XTB to remain agile and innovative.

- Traditional Stockbrokers: Expanding into online trading, they offer established brands and services.

- Investment Apps: Offering commission-free stock trading, they put pressure on fee structures.

- Cryptocurrency Exchanges: Attracting investors interested in digital assets.

- Mergers and Acquisitions: Such as Saxo Bank's strategic partnerships or Plus500's acquisitions, lead to larger entities.

- Emerging Players: Often disrupt the market through niche offerings, innovative technology, or aggressive pricing.

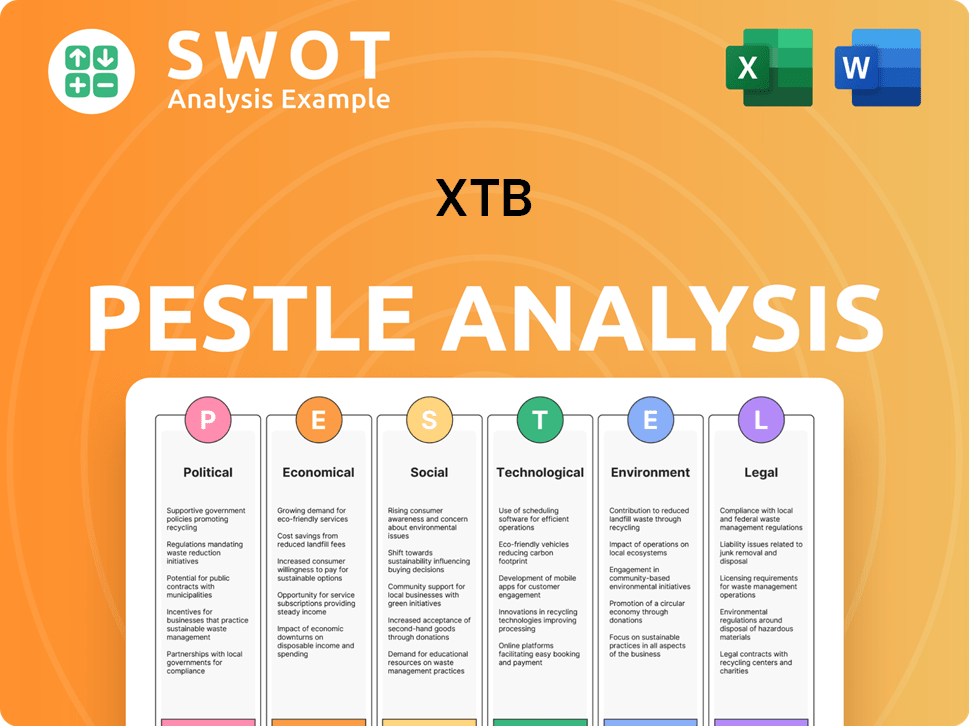

XTB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives XTB a Competitive Edge Over Its Rivals?

The competitive landscape for XTB is shaped by its technological advancements, extensive product offerings, and commitment to regulatory compliance. These factors contribute to its strong market position within the financial services sector. A thorough XTB market analysis reveals the company's strategic focus on client education and support, which further enhances its competitive edge.

XTB's ability to innovate and adapt to client needs is a key aspect of its competitive strategy. The company's proprietary trading platform, xStation 5, is a significant differentiator, providing a superior trading experience compared to many third-party platforms used by competitors. This technological independence allows XTB to rapidly innovate and tailor features to client needs. The company's sustained profitability, with a net profit of PLN 302.8 million in Q1 2024, also highlights its economies of scale and efficient operations, allowing it to invest in further enhancing its competitive edge.

Understanding the XTB competitive landscape involves recognizing the company's core strengths, including its broad range of financial instruments and strong regulatory compliance. These elements are crucial in attracting and retaining clients in the dynamic online trading industry. The company's commitment to client education through webinars, tutorials, and market analysis, empowers traders with the knowledge to make informed decisions.

XTB's proprietary trading platform, xStation 5, offers an intuitive interface and robust analytical tools. This platform provides fast execution speeds, enhancing the overall trading experience. The company's technological independence allows for rapid innovation and customization to meet client needs, setting it apart in the XTB competitive landscape.

XTB provides access to over 5,500 financial instruments, including CFDs on forex, indices, commodities, stocks, and ETFs. This diverse range allows clients to trade various assets under one roof. This broad selection reduces the need for clients to use multiple brokers, enhancing convenience.

XTB adheres to strong regulatory standards across multiple major financial authorities. This compliance builds trust and confidence among clients. Regulatory adherence also enables XTB to operate in various jurisdictions, expanding its market reach, which is a key factor in the XTB industry overview.

XTB offers comprehensive client education through webinars, tutorials, and market analysis. This focus empowers traders with the knowledge to make informed decisions. The emphasis on support and education fosters customer loyalty, differentiating XTB from competitors.

XTB's competitive advantages are built on technology, product diversity, regulatory compliance, and client-centric services. These strengths are crucial for long-term sustainability in the financial services market. The company's sustained profitability, with a net profit of PLN 302.8 million in Q1 2024, highlights its financial health and operational efficiency.

- Technological Innovation: xStation 5 provides a superior trading experience.

- Product Breadth: Over 5,500 financial instruments offer diverse trading opportunities.

- Regulatory Adherence: Compliance builds trust and enables global operations.

- Client Focus: Education and support foster customer loyalty.

For a deeper understanding of the market, it's beneficial to consider the Target Market of XTB. This helps in appreciating how XTB positions itself within the competitive environment. Analyzing XTB vs competitor name comparison, XTB market share analysis 2024, and XTB financial performance review provides further insights into its standing. Understanding XTB's strengths and weaknesses, along with XTB customer reviews and ratings, helps in assessing its market position. Furthermore, exploring XTB's business model explained, XTB trading fees comparison, and XTB investment products offered gives a comprehensive view of its operations. Also, XTB's growth strategy analysis and XTB expansion plans are important aspects to consider.

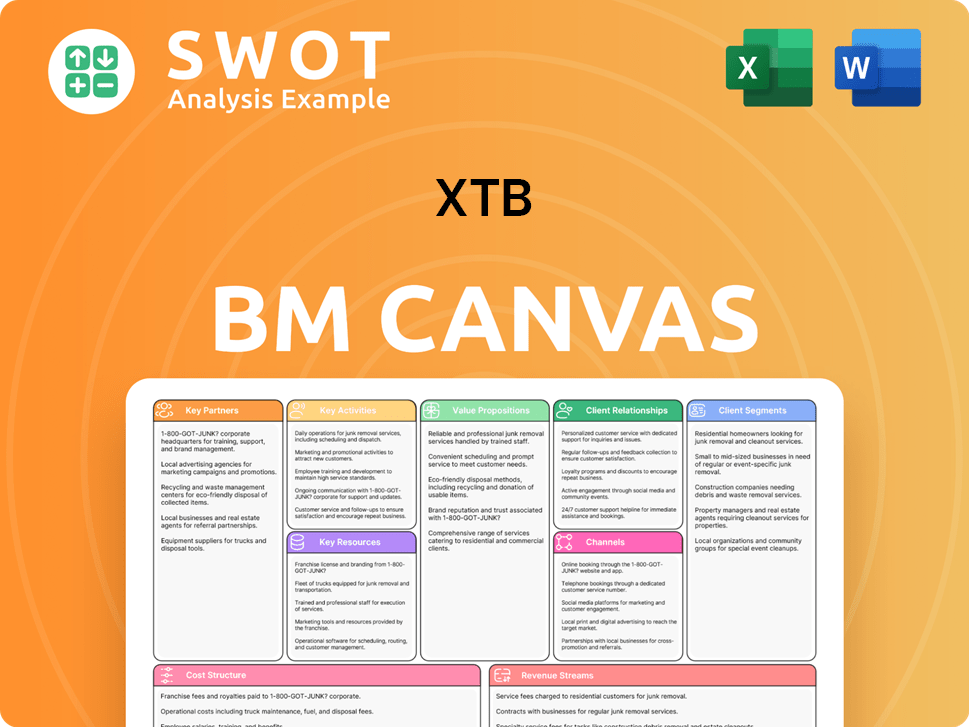

XTB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping XTB’s Competitive Landscape?

The online brokerage industry is undergoing significant shifts, impacting the XTB competitive landscape. Technological advancements, regulatory changes, and evolving consumer preferences are key drivers. Understanding these trends is crucial for assessing XTB's market analysis and future prospects. The company must adapt to maintain its competitive edge.

XTB's competitors are also responding to these market dynamics, creating both challenges and opportunities. The increasing digitalization of finance presents opportunities for expansion, while diversification and strategic partnerships could unlock new markets. Assessing these factors is essential for a comprehensive XTB industry overview.

Technological advancements like AI and machine learning are driving innovation in trading algorithms and risk management. Regulatory changes, such as stricter consumer protection laws, also shape the industry. Consumer preference shifts toward commission-free trading and fractional shares are influencing business models.

Continual investment in technology and adapting to regulatory changes pose ongoing challenges. Competition from new market entrants and established banks could intensify. Market downturns can impact trading volumes. Adapting to changing consumer preferences is also a challenge.

Expansion into emerging markets with growing online trading penetration offers significant potential. Diversifying product offerings beyond CFDs, such as real stocks and ETFs, is a key growth avenue. Strategic partnerships could unlock new markets and technological capabilities. The company's strong financial health and focus on client education are advantageous.

XTB's robust financial health, as demonstrated by its Q1 2024 results, supports its ability to navigate challenges. Commitment to technology and client education provides a strong foundation. Expanding product diversification and geographic reach are key strategic advantages, as discussed in this XTB financial performance review.

XTB's ability to adapt to technological advancements and changing regulations is critical. Diversifying product offerings and expanding into new markets are essential for growth. Maintaining a strong financial position and focusing on client education are key to long-term success.

- Technological innovation and integration.

- Regulatory compliance and adaptability.

- Product diversification and market expansion.

- Strategic partnerships and financial health.

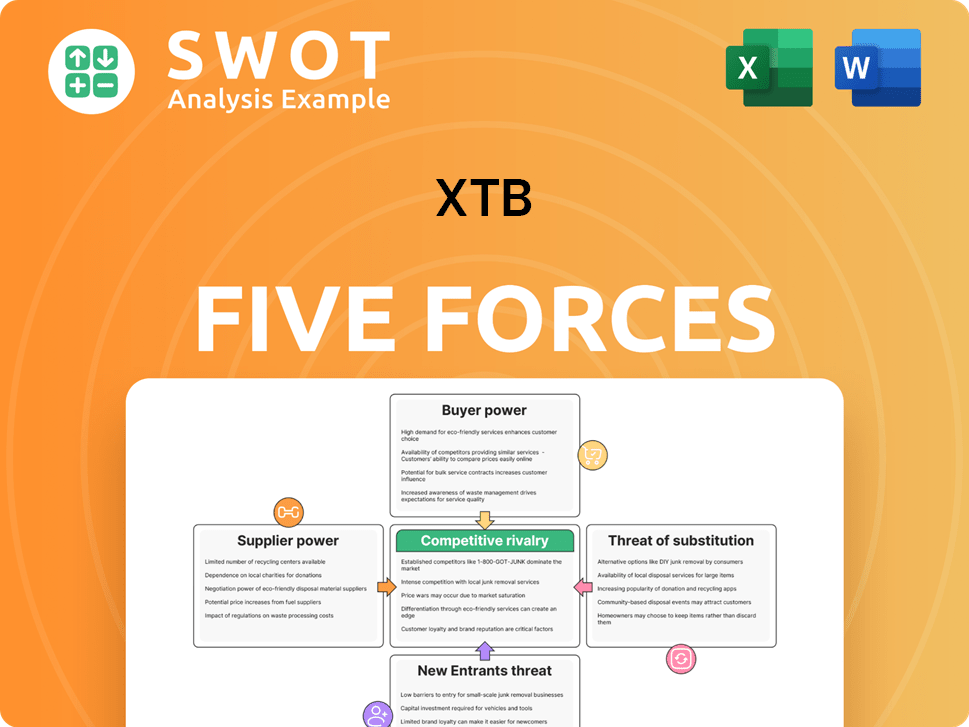

XTB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of XTB Company?

- What is Growth Strategy and Future Prospects of XTB Company?

- How Does XTB Company Work?

- What is Sales and Marketing Strategy of XTB Company?

- What is Brief History of XTB Company?

- Who Owns XTB Company?

- What is Customer Demographics and Target Market of XTB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.