Aramco Bundle

How Does Saudi Aramco Dominate the Global Energy Stage?

In a world grappling with energy transitions and geopolitical complexities, understanding the Aramco SWOT Analysis is more critical than ever. Saudi Aramco, a global energy behemoth, navigates a dynamic and fiercely competitive landscape. This deep dive explores the company's market position, dissecting its rivals and strategies.

This analysis of the Aramco competitive landscape provides insights into its strengths, weaknesses, opportunities, and threats within the oil and gas market. We'll examine who Aramco's main rivals are, comparing their market share and strategic approaches to understand how Aramco maintains its dominance. Furthermore, we'll explore Aramco's strategies for market dominance and its responses to the challenges posed by the evolving energy sector, including the rise of renewable energy and the impact of geopolitical events on its competition.

Where Does Aramco’ Stand in the Current Market?

Aramco's market position is unparalleled in the global energy sector, largely due to its massive hydrocarbon reserves and production capabilities. The company holds a significant portion of the world's proven conventional oil reserves, estimated at approximately 259 billion barrels, which ensures a solid long-term production outlook. In 2023, Aramco maintained its status as one of the largest crude oil producers worldwide, with average hydrocarbon production reaching 12.8 million barrels of oil equivalent per day, encompassing crude oil, natural gas liquids, and natural gas.

The company's core offerings include crude oil, refined products, natural gas, and petrochemicals, serving a diverse global customer base across Asia, Europe, and North America. Aramco's strategic moves involve increased downstream integration and expansion into chemicals to enhance value across the hydrocarbon chain. This is evident in continuous investments in refining and petrochemical joint ventures globally. For more details on the company's financial structure, you can explore the Revenue Streams & Business Model of Aramco.

Aramco's financial health is robust, consistently reporting some of the highest profits globally. In the first quarter of 2024, Aramco reported a net income of $27.3 billion. This financial strength, combined with its operational scale, places it far ahead of many industry benchmarks. While its upstream dominance is global, Aramco is actively reinforcing its market presence in key growth regions, particularly in Asia, where energy demand continues to rise.

Aramco's substantial oil reserves and production capacity give it a significant market share in the global oil and gas market. Its proven reserves are a key competitive advantage, allowing it to maintain a strong position. This strong market share is crucial for its strategic analysis.

Aramco's integrated operations, spanning from upstream exploration and production to downstream refining and petrochemicals, enhance its competitive edge. This integration allows for greater control over the value chain. This strategy helps Aramco compete with other oil companies.

Aramco's global presence and customer base across Asia, Europe, and North America support its market position. This diversification reduces dependency on any single market. This helps Aramco's strategies for market dominance.

Aramco's strong financial performance, with high profitability, provides a significant competitive advantage. This financial health enables investments in growth and technological advancements. Aramco's financial performance vs competitors is strong.

Aramco's competitive landscape is shaped by its vast reserves, production capacity, and strategic initiatives. Its focus on downstream integration and geographic diversification further strengthens its market position. Understanding these factors is crucial for an Aramco industry analysis.

- Vast hydrocarbon reserves provide a long-term production outlook.

- Integrated operations enhance value chain control and efficiency.

- Geographic diversification reduces market dependency.

- Strong financial performance supports strategic investments.

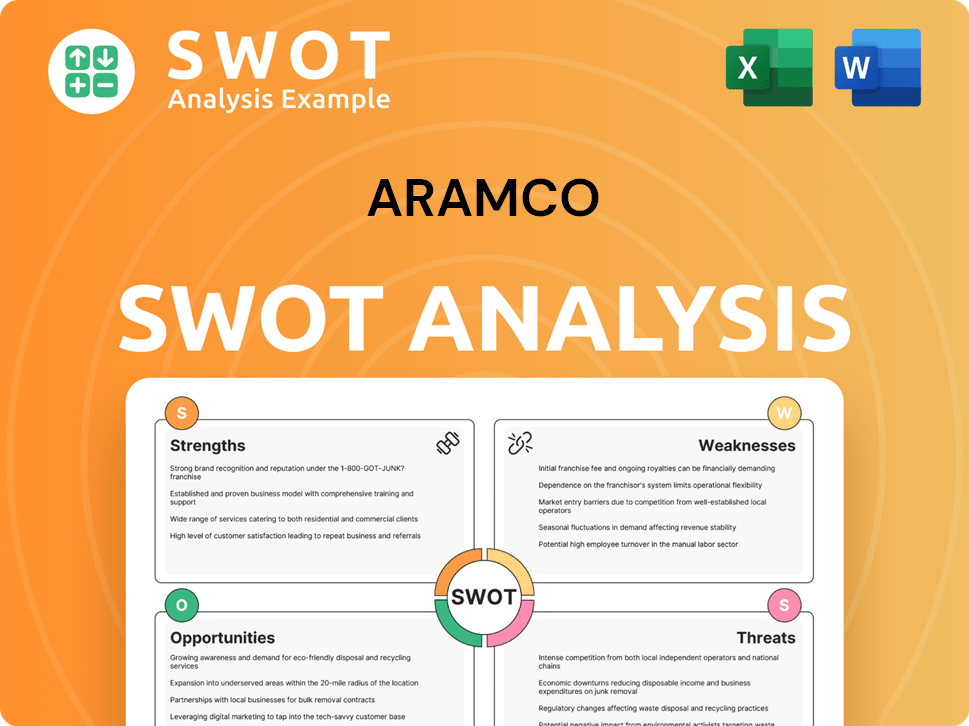

Aramco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Aramco?

The competitive landscape for Aramco, a leading player in the global energy market, is multifaceted, encompassing both traditional oil and gas rivals and emerging forces in renewable energy. Understanding the dynamics of this competition is crucial for assessing Aramco's market position and strategic outlook. The company faces a complex web of challenges and opportunities as it navigates the evolving energy sector.

Aramco's strategic analysis reveals a competitive environment shaped by geopolitical factors, technological advancements, and the global push for sustainable energy solutions. The company's ability to maintain its market share and drive future growth hinges on its response to these evolving dynamics. The strategies employed by Aramco to maintain its market dominance are constantly being tested.

The Marketing Strategy of Aramco plays a significant role in how it positions itself against its competitors. This includes how it communicates its value proposition to stakeholders.

Aramco's primary competitors include other NOCs such as Russia's Rosneft, China National Petroleum Corporation (CNPC), and National Iranian Oil Company (NIOC). These entities often have significant control over vast hydrocarbon resources. They may also operate with strategic national interests, which can influence pricing and supply decisions.

ExxonMobil, Shell, Chevron, and BP are key IOC rivals, particularly in integrated operations like exploration, production, refining, and marketing. These companies compete through technological innovation, global distribution networks, and brand recognition. For example, in 2024, ExxonMobil's proved reserves were approximately 17.7 billion barrels of oil equivalent.

Companies like BASF, Dow Chemical, and SABIC (in which Aramco holds a significant stake) are major competitors in the petrochemical sector. They compete for market share in various chemical products. In 2024, Dow Chemical reported net sales of approximately $45 billion.

Ørsted, NextEra Energy, and national utility providers are increasingly competing for energy investments and market share in the broader energy transition. This shift potentially impacts long-term demand for hydrocarbons. NextEra Energy's market capitalization in early 2024 was around $140 billion.

Consolidations in the US shale industry and other strategic partnerships impact competitive dynamics by creating larger, more efficient entities. These moves can increase the efficiency and competitiveness of the involved companies. The recent merger of two major shale producers created a company with a combined output of over 3 million barrels of oil equivalent per day.

Technological innovation in extraction, refining, and distribution is a key area of competition. Companies that invest in advanced technologies gain a competitive edge. Aramco is investing heavily in digital transformation and new extraction technologies to improve efficiency and reduce costs.

Aramco's competitive advantages include its vast reserves, low production costs, and integrated operations. However, it faces challenges from fluctuating oil prices, geopolitical risks, and the transition to renewable energy sources. The company's ability to adapt to these challenges will determine its future success.

- Reserves and Production: Aramco holds the world's second-largest proven crude oil reserves, estimated at over 258 billion barrels as of 2024.

- Production Costs: Aramco's production costs are among the lowest globally, estimated at around $2.80 per barrel in 2024, giving it a significant cost advantage.

- Market Share: Aramco controls a substantial share of the global oil market, with exports accounting for a significant portion of its revenue.

- Geopolitical Influence: As a key player in OPEC, Aramco's decisions can impact global oil prices and supply.

- Diversification: Aramco is expanding into petrochemicals, refining, and renewable energy to diversify its revenue streams.

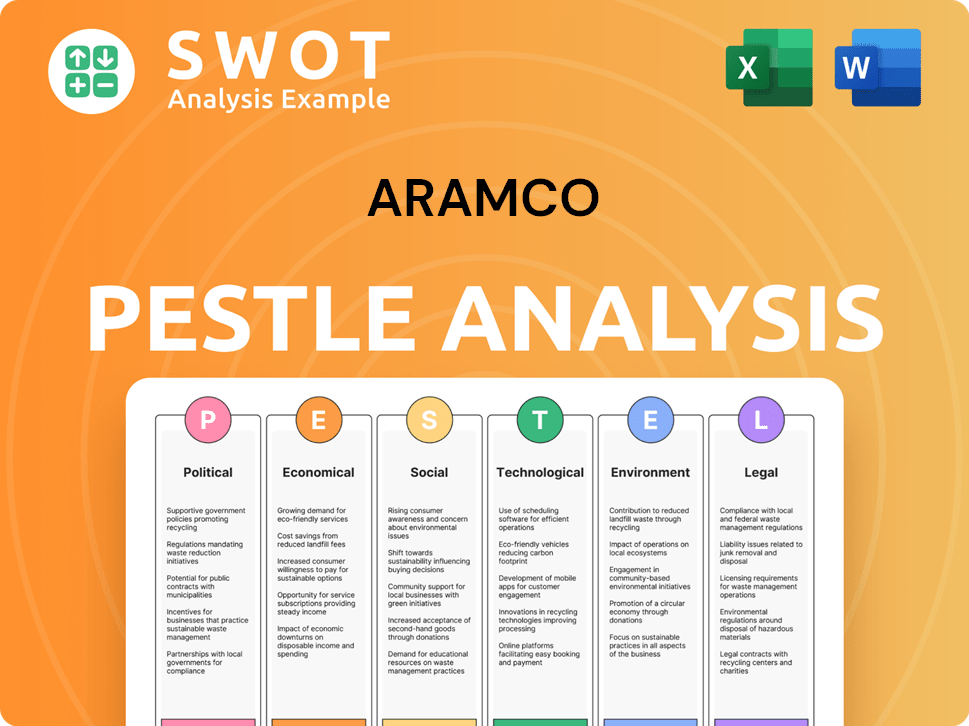

Aramco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Aramco a Competitive Edge Over Its Rivals?

Aramco's competitive advantages are deeply rooted in its extensive oil reserves and integrated operations. The company's strategic moves and market position are significantly influenced by its access to vast, low-cost hydrocarbon reserves. These advantages allow it to maintain profitability even during periods of lower oil prices, shaping its competitive edge in the global energy market.

The company's integrated operational model, including a vast network of pipelines, processing facilities, and export terminals, ensures efficient and reliable delivery of its products. Aramco's brand equity within the industry is also significant, recognized for its reliability and scale of supply. This is supported by strong government backing, providing a stable operating environment and strategic alignment with national energy policies, influencing the Aramco competitive landscape.

In terms of technology, Aramco invests heavily in advanced exploration and production technologies, including enhanced oil recovery techniques and digital solutions for optimizing operations. This is complemented by a robust research and development arm focused on future energy solutions and carbon capture technologies. Its integrated supply chain provides economies of scale and allows for optimized value capture across the hydrocarbon chain. For more insights, explore the Growth Strategy of Aramco.

Aramco holds some of the world's largest proven conventional oil reserves, giving it a significant cost advantage. These reserves are characterized by their relatively low lifting costs, allowing the company to maintain profitability even during periods of lower oil prices. This cost advantage is a crucial factor in its competitive position.

The company's integrated model, spanning upstream, midstream, and downstream operations, provides economies of scale. Its extensive infrastructure, including pipelines, processing facilities, and export terminals, ensures efficient and reliable delivery of its products. This integrated approach enhances operational efficiency and value capture.

Aramco benefits from strong brand equity within the industry, recognized for its reliability and scale. The company also has strong government backing, providing a stable operating environment and strategic alignment with national energy policies. These factors support its market position.

Aramco invests heavily in advanced exploration and production technologies, including enhanced oil recovery techniques and digital solutions. It also has a robust research and development arm focused on future energy solutions and carbon capture technologies. These investments enhance its competitive edge.

Aramco's competitive advantages include access to vast, low-cost reserves, an integrated operational model, and strong brand equity. The company's investments in technology and R&D further enhance its position in the oil and gas market. These factors contribute to Aramco's ability to compete effectively.

- Unmatched reserves and low production costs.

- Integrated operations and extensive infrastructure.

- Strong brand equity and government support.

- Technological advancements and robust R&D.

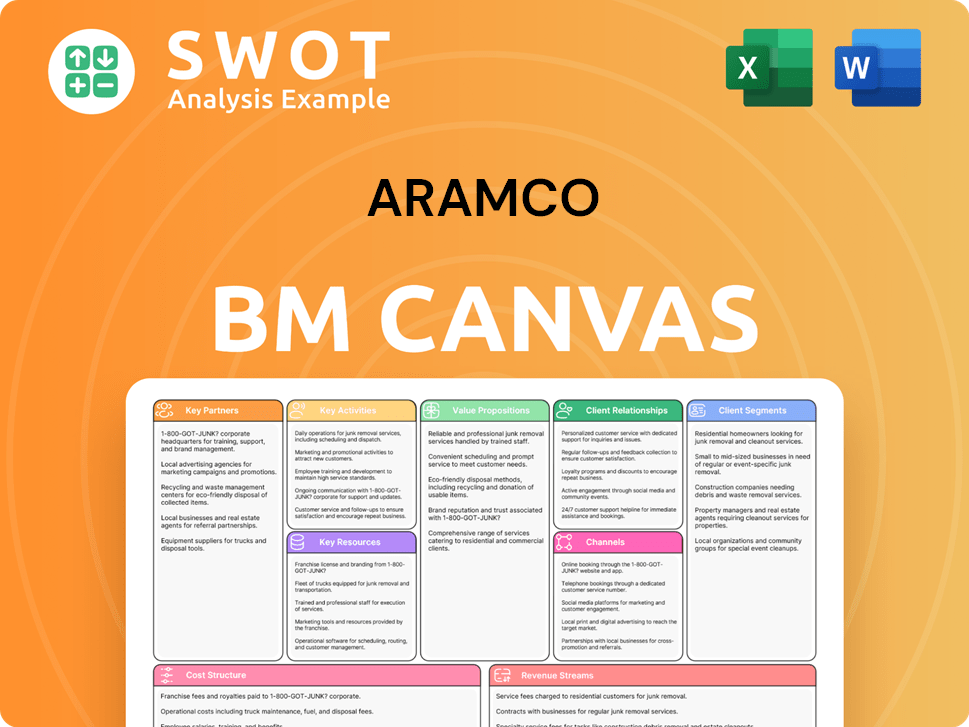

Aramco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Aramco’s Competitive Landscape?

The global energy sector is undergoing significant transformation, influencing the Aramco competitive landscape. Factors such as technological advancements, evolving consumer preferences, and geopolitical shifts are reshaping the industry. Understanding these trends is crucial for analyzing Aramco's market position and future prospects.

Aramco faces both challenges and opportunities. The shift towards cleaner energy sources, coupled with fluctuating oil prices, necessitates strategic adaptation. However, emerging markets and strategic investments in new energy ventures offer avenues for growth and diversification. This Aramco industry analysis will explore these dynamics.

Technological advancements, including digitalization and CCUS, are enhancing operational efficiency. Regulatory pressures related to climate change are increasing, pushing for reduced carbon footprints. Consumer demand for cleaner energy is growing, especially in developed markets. These trends influence the oil and gas market and Aramco's strategic analysis.

Potential challenges include a faster-than-anticipated decline in oil demand and increased competition from renewable energy. Stringent environmental regulations could lead to higher compliance costs. Geopolitical instability and market volatility continue to pose risks. Understanding these challenges is key to evaluating Aramco's long-term viability.

Significant growth opportunities exist in emerging markets, particularly in Asia, which drive energy demand. Innovations in advanced materials and specialized chemicals offer diversification potential. Strategic partnerships in hydrogen and renewables are crucial. These elements shape the Aramco competitive landscape and its future direction.

Aramco is evolving towards a more diversified energy portfolio. It will continue to optimize its core hydrocarbon business. The company is strategically investing in lower-carbon solutions. This approach is designed to ensure resilience in a decarbonizing world. This is a key aspect of Aramco's response to changing market dynamics.

Aramco's competitive advantages include its vast oil reserves and low production costs. The company is investing heavily in technology to improve efficiency and reduce emissions. Strategic partnerships and diversification into new energy sectors are also crucial. For more on Aramco's origins, see Brief History of Aramco.

- Large-scale oil reserves and production capacity.

- Investments in carbon capture and other emission reduction technologies.

- Strategic diversification into hydrogen and renewable energy projects.

- Strong financial performance, with reported net income of approximately $121.3 billion in 2023.

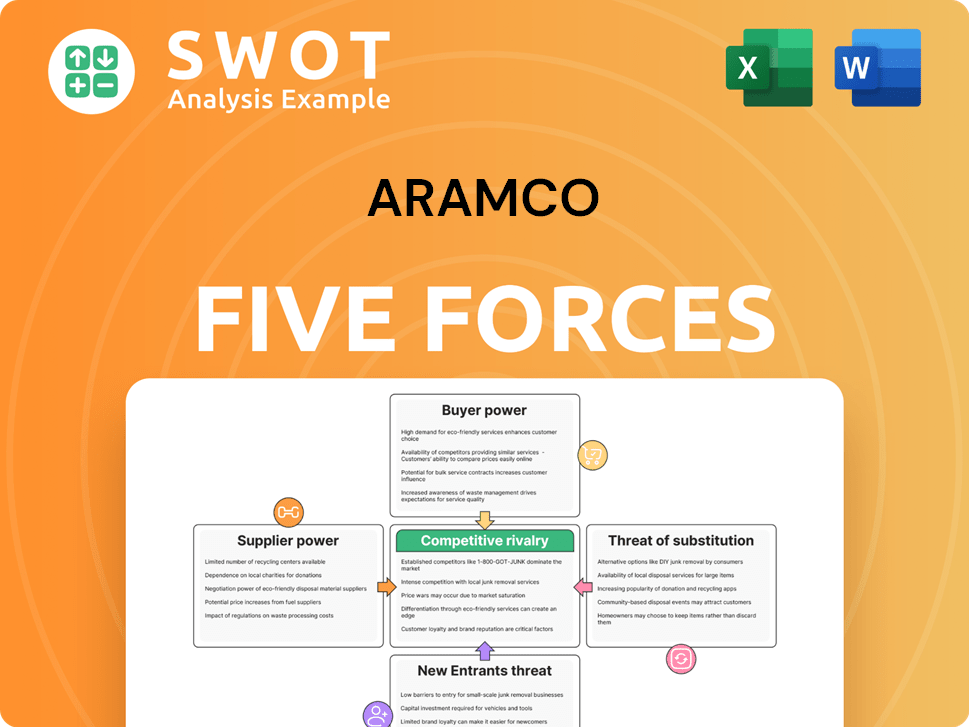

Aramco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aramco Company?

- What is Growth Strategy and Future Prospects of Aramco Company?

- How Does Aramco Company Work?

- What is Sales and Marketing Strategy of Aramco Company?

- What is Brief History of Aramco Company?

- Who Owns Aramco Company?

- What is Customer Demographics and Target Market of Aramco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.