Aramco Bundle

How Will Saudi Aramco Shape the Future of Energy?

Saudi Aramco, a titan of the Aramco SWOT Analysis, stands at the forefront of the global energy landscape, and its growth strategy is constantly evolving. From its origins in 1933, the company has become a cornerstone of the Oil and Gas Industry, shaping the trajectory of the Energy Sector. This exploration delves into Aramco's ambitious plans and strategic initiatives.

This analysis will examine Aramco's future prospects, considering its diversification strategy and technological advancements. We'll explore Aramco's expansion plans in renewable energy and its response to the global energy transition. Understanding Aramco's long-term strategic goals is crucial for investors, analysts, and anyone interested in the future of the energy market and its impact on the Saudi Arabian economy.

How Is Aramco Expanding Its Reach?

Aramco's expansion initiatives are designed to solidify its position as a leading integrated energy and chemicals company. This strategy involves both strengthening its core business and diversifying into new areas to adapt to the evolving global energy landscape. The company is focused on maximizing value from its existing resources while preparing for a future that includes lower-carbon energy solutions.

The company's growth strategy includes significant investments in downstream operations, particularly in refining and petrochemicals. This approach allows Aramco to capture more value from its crude oil production by processing it into higher-value products. International expansion, especially in key markets like Asia, is also a priority, securing long-term supply agreements and expanding its global footprint.

Furthermore, Aramco is exploring opportunities in new energy sectors, such as blue hydrogen and ammonia. These initiatives are part of its broader efforts to reduce emissions and develop lower-carbon energy solutions. The company also continues to optimize its upstream portfolio, aiming to maintain its maximum sustainable crude oil production capacity.

Aramco is significantly expanding its downstream operations, particularly in refining and petrochemicals. The goal is to increase its liquids-to-chemicals capacity to 4 million barrels per day by 2030. This expansion includes major projects like the Ras Al-Khair complex, a partnership with TotalEnergies and Sinopec.

The company is actively pursuing international expansion, focusing on key growth markets in Asia, such as China and India. These efforts aim to secure long-term crude oil supply agreements and expand its downstream footprint in these regions. Strategic partnerships are crucial for this expansion.

Aramco is exploring opportunities in new energy sectors, including blue hydrogen and ammonia. These initiatives are part of its broader efforts to reduce emissions and develop lower-carbon energy solutions. The company is investing in projects to support the energy transition.

Aramco continues to optimize its upstream portfolio to maintain its maximum sustainable crude oil production capacity. The company aims to keep its production capacity at 12 million barrels per day. This focus ensures the company's ability to meet global energy demands.

Aramco's expansion initiatives are multifaceted, encompassing both traditional oil and gas operations and new ventures in the energy sector. These initiatives are critical for the company's long-term growth and sustainability. These strategies are designed to ensure Aramco remains a leader in the Mission, Vision & Core Values of Aramco.

- Expanding downstream operations to increase value capture.

- Focusing on international expansion, especially in Asia.

- Investing in new energy sectors like blue hydrogen and ammonia.

- Optimizing upstream operations to maintain production capacity.

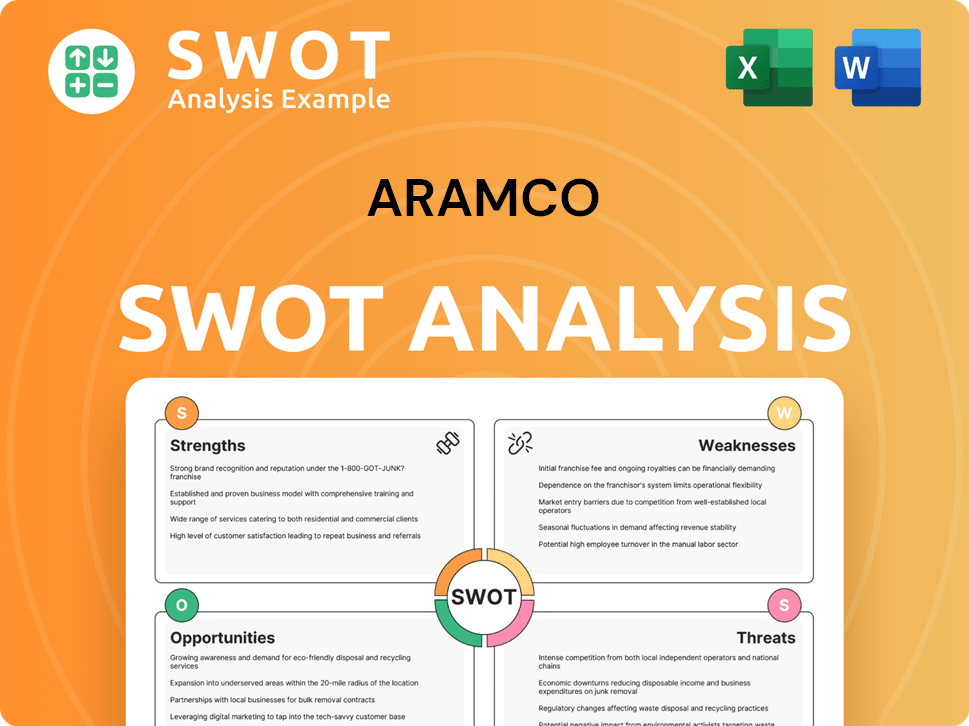

Aramco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Aramco Invest in Innovation?

The innovation and technology strategy of the company is crucial for its sustained growth, focusing on enhancing operational efficiency, developing new energy solutions, and reducing its environmental footprint. This commitment is evident through significant investments in research and development (R&D) and strategic collaborations.

Digital transformation is a core component of the company's strategy, with the deployment of automation and advanced analytics across its upstream and downstream operations. The company aims to achieve net-zero operational emissions by 2050, highlighting its dedication to sustainable practices.

The company's strategic venture capital arm, Aramco Ventures, invests in disruptive technologies across the energy value chain, fostering future growth opportunities. This proactive approach positions the company to adapt and thrive in the evolving energy landscape.

The company invests heavily in research and development (R&D). These investments are channeled through global research centers and collaborations with leading academic and industrial partners. This ensures the company stays at the forefront of technological advancements.

Key areas of focus include advanced materials, artificial intelligence (AI) and machine learning for optimizing exploration and production, and carbon capture, utilization, and storage (CCUS) technologies. These technologies are vital for both efficiency and sustainability.

Digital transformation is a core component of the company's strategy. This involves deploying automation and advanced analytics across its operations. AI-driven predictive maintenance is used to minimize downtime and optimize resource allocation.

In the realm of sustainability, the company is actively pursuing technologies to reduce greenhouse gas emissions. This includes methane emission reduction technologies and the development of more efficient combustion engines. The goal is to achieve net-zero operational emissions by 2050.

The company's strategic venture capital arm, Aramco Ventures, invests in disruptive technologies across the energy value chain. This fosters a pipeline of future growth opportunities, ensuring the company remains competitive. This approach supports the company's long-term strategic goals.

The company's technological advancements are critical for its future. These advancements include AI, machine learning, and CCUS technologies. These innovations improve efficiency and support the global energy transition.

The company's technological advancements are central to its strategy, driving both operational efficiency and sustainability. These initiatives are supported by significant investments and strategic partnerships. The company aims to remain a leader in the Revenue Streams & Business Model of Aramco.

- AI and Machine Learning: Used to optimize exploration, production, and predictive maintenance, reducing downtime and improving resource allocation.

- Carbon Capture, Utilization, and Storage (CCUS): Actively developing and deploying CCUS technologies to reduce carbon emissions and support sustainability goals.

- Methane Emission Reduction: Implementing technologies to minimize methane leaks and reduce overall greenhouse gas emissions.

- Advanced Materials: Investing in advanced materials to improve the efficiency and durability of its operations.

- Renewable Energy Projects: Expanding into renewable energy projects to diversify its portfolio and support the global energy transition.

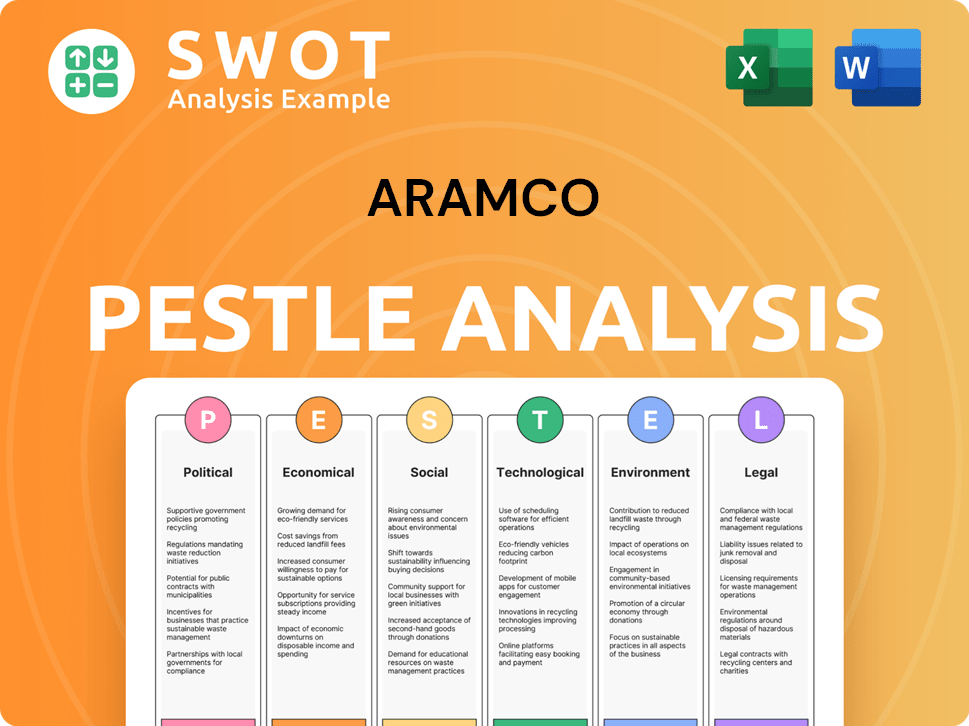

Aramco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Aramco’s Growth Forecast?

The financial outlook for the company remains strong, supported by its substantial hydrocarbon assets and strategic growth initiatives. The company demonstrated significant profitability, even amidst fluctuating oil prices, reporting a net income of $121.3 billion for the full year 2023. This performance underscores the company's resilience and ability to generate substantial earnings in a dynamic market environment. The company's financial strategy is geared towards balancing shareholder returns with strategic investments in new energy technologies and diversification efforts, aiming for long-term sustainable growth.

Capital expenditures for 2023 were $49.7 billion, with a projected range of $48 billion to $58 billion for 2024, reflecting continued investment in both upstream capacity expansion and downstream integration. The company's integrated business model provides a degree of resilience against oil price volatility, as its downstream and chemicals segments can offset some of the fluctuations in its upstream revenues. The company's strong financial position allows it to pursue ambitious growth projects and return value to shareholders.

The company's financial health is further evidenced by its strong balance sheet and healthy cash flows. The company declared a base dividend of $19.5 billion for the fourth quarter of 2023, along with performance-linked dividends. Analyst forecasts generally project stable to growing revenues, driven by continued global energy demand and the company's expanding downstream portfolio. For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of Aramco.

Analysts project stable to growing revenues for the company, supported by sustained global energy demand. The company's expanding downstream portfolio is also expected to contribute to revenue growth. These projections are based on the company's strong market position and strategic investments.

The integrated business model provides a degree of resilience against oil price volatility. Downstream and chemicals segments can offset fluctuations in upstream revenues. This diversification helps to stabilize the company's overall financial performance.

The company is committed to returning value to shareholders through dividends. A base dividend of $19.5 billion was declared for Q4 2023, along with performance-linked dividends. This demonstrates the company's commitment to shareholder returns.

The company is expanding its downstream portfolio, including investments in petrochemicals. These investments aim to diversify revenue streams and enhance long-term growth. This strategy is a key component of the company's diversification efforts.

The company aims for long-term sustainable growth by balancing shareholder returns with strategic investments. This includes investments in new energy technologies and diversification efforts. The company's goals are focused on sustainable growth and value creation.

The company continues to invest in upstream capacity expansion. Capital expenditures for 2024 are projected between $48 billion and $58 billion. These investments are crucial for maintaining and growing production capacity.

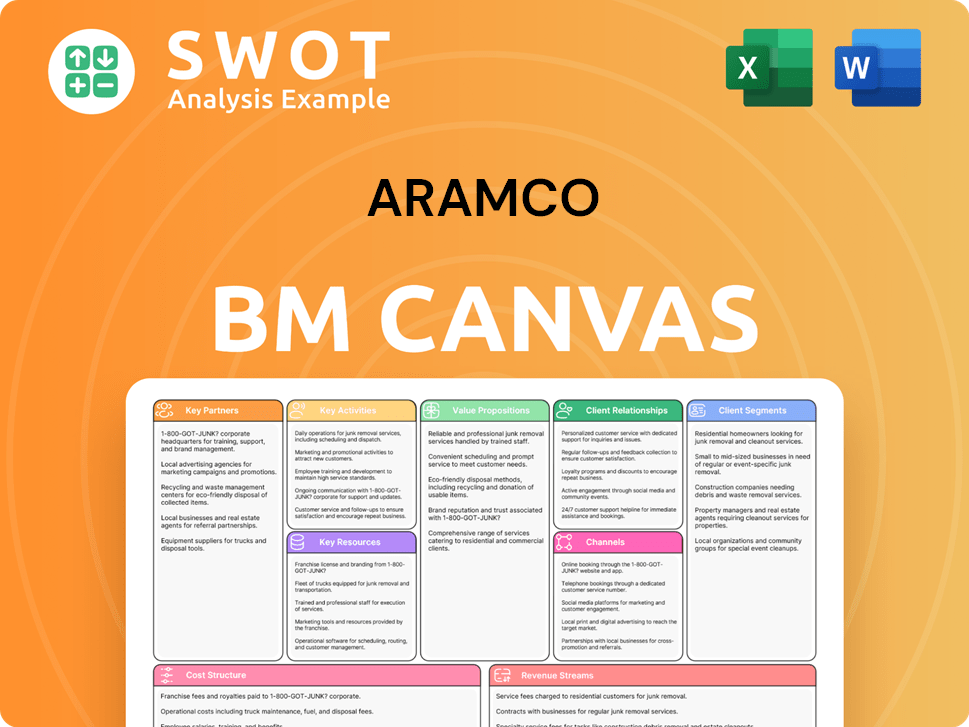

Aramco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Aramco’s Growth?

The Aramco Growth Strategy faces several potential risks and obstacles that could impact its Aramco Future Prospects. These challenges range from market dynamics and regulatory changes to operational and technological disruptions. Understanding these risks is crucial for assessing the company's long-term viability and investment potential within the Oil and Gas Industry.

Market competition, particularly from other major oil and gas companies and the growing renewable energy sector, poses a significant hurdle. Additionally, the transition to lower-carbon energy sources and evolving environmental regulations create uncertainty. These factors necessitate strategic adaptability and proactive risk management to ensure sustained growth.

Geopolitical instability and supply chain vulnerabilities further complicate Aramco's operations. Technological advancements and internal resource constraints also demand careful consideration and strategic planning. The company's ability to navigate these challenges will determine its success in the Energy Sector and its position in the global market.

Intense competition from established oil and gas companies and emerging renewable energy providers challenges Aramco's market share. The company must continuously innovate and adapt to maintain its competitive edge. Market share analysis is crucial for understanding the competitive landscape.

Stringent environmental regulations and climate policies pose risks to Aramco's operations and investments. Compliance costs and potential impacts on future projects are significant concerns. Aramco's sustainability initiatives are essential for mitigating these risks.

The global shift towards lower-carbon energy sources could reduce long-term demand for hydrocarbons. Aramco's strategic investments in new energy solutions are vital for adapting to this transition. Aramco's role in the global energy transition will be key.

Geopolitical disruptions and logistical challenges can disrupt project timelines and operational efficiency. Diversifying supply chains and enhancing risk management are crucial strategies. Aramco's international partnerships play a significant role.

Rapid advancements in renewable energy, energy storage, and carbon capture technologies require Aramco to stay at the forefront of innovation. Continuous investment in research and development is essential. Aramco's technological advancements are critical.

Availability of skilled talent and capital allocation decisions can impact Aramco's growth plans. Efficient resource management and strategic investments are necessary. Aramco's long-term strategic goals require careful planning.

To address these risks, Saudi Aramco is actively diversifying its portfolio and implementing robust risk management frameworks. For example, Aramco's strategic investments in petrochemicals and renewable energy demonstrate its proactive approach to adapting to changing market dynamics. The company's exploration and production strategy is also being refined to optimize resource utilization and enhance operational efficiency. For a deeper understanding of Aramco's origins and development, consider exploring a Brief History of Aramco.

The oil and gas market is highly competitive, with fluctuations in oil prices significantly impacting Aramco's financial performance. The company faces competition from both traditional oil producers and renewable energy providers. In 2024, global oil demand is projected to reach approximately 102 million barrels per day, with Aramco aiming to maintain its market share through strategic initiatives. A detailed competitive landscape analysis is crucial for strategic planning.

Environmental regulations and climate policies are increasing operational costs and influencing investment decisions. The company is investing heavily in sustainability initiatives, including carbon capture and renewable energy projects. Aramco aims to reduce its carbon footprint by 15% by 2035. The impact of oil price fluctuations on Aramco requires careful monitoring.

Technological advancements in renewable energy and energy storage pose a challenge. Aramco is investing in technological advancements to stay competitive. Supply chain disruptions due to geopolitical instability and logistical issues are a constant concern. Aramco's international partnerships help mitigate these risks.

The availability of skilled talent and capital allocation decisions can affect Aramco's growth. The company needs to manage its resources efficiently. Aramco's financial performance forecast for 2025 indicates a focus on maintaining strong cash flows and shareholder value, with a dividend policy designed to support long-term investment. Aramco's dividend policy and shareholder value are key considerations.

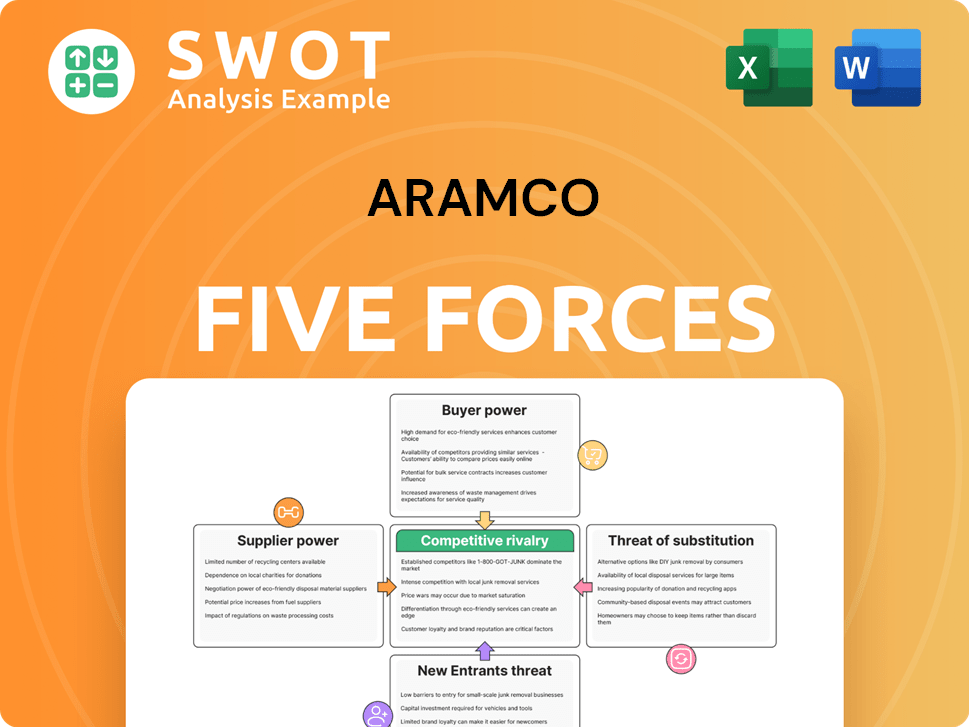

Aramco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aramco Company?

- What is Competitive Landscape of Aramco Company?

- How Does Aramco Company Work?

- What is Sales and Marketing Strategy of Aramco Company?

- What is Brief History of Aramco Company?

- Who Owns Aramco Company?

- What is Customer Demographics and Target Market of Aramco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.