Aramco Bundle

How Does Saudi Aramco Really Work?

Aramco, the Saudi Arabian Oil Company, is a powerhouse in the global energy sector, shaping the world's oil and gas markets. Its massive scale and integrated operations are critical for supplying the energy that powers economies worldwide. In 2023, Aramco's impressive net income of $121.3 billion underscores its financial strength and industry dominance. The company's core business revolves around exploring, producing, refining, distributing, and marketing petroleum and natural gas, with a growing presence in chemicals and power generation.

Unraveling the intricacies of Aramco SWOT Analysis is essential for investors, customers, and industry analysts alike. Understanding Aramco operations and its vast revenue streams is crucial for grasping the energy sector's stability and global energy trends. This article will explore Aramco's business model, examining its core operations, strategic moves, and competitive advantages. By dissecting its inner workings, we aim to provide a comprehensive understanding of this energy giant's sustained market leadership and its navigation of the dynamic global energy landscape, including how it extracts oil and its refining process.

What Are the Key Operations Driving Aramco’s Success?

Aramco's core operations are built around a fully integrated 'upstream' and 'downstream' model. This structure allows it to generate and deliver value across the entire hydrocarbon value chain. At its core, the company supplies crude oil, natural gas, and refined products to a global customer base, serving a wide array of industries and consumers.

Its upstream activities involve the exploration and production of crude oil and natural gas from vast reserves. This includes the Ghawar field, one of the world's largest conventional oil fields. Operational processes are characterized by advanced drilling technologies, reservoir management expertise, and extensive infrastructure for extraction and transportation. The downstream segment focuses on refining, petrochemicals, and marketing.

The company operates a global network of refineries, converting crude oil into various refined products like gasoline, diesel, and jet fuel. Its growing chemicals business leverages crude oil and natural gas liquids to produce a wide range of petrochemicals, adding significant value. Aramco's supply chain is highly complex and global, involving a vast network of pipelines, terminals, and shipping fleets to distribute its products worldwide.

Aramco's upstream operations focus on the exploration and production of crude oil and natural gas. This includes the use of advanced drilling technologies and reservoir management. The company's production capacity is substantial, contributing significantly to global energy supplies.

The downstream segment involves refining, petrochemicals, and marketing. Aramco operates a global network of refineries. It converts crude oil into various refined products and produces a wide range of petrochemicals, enhancing value.

Strategic partnerships and joint ventures, such as its collaboration with TotalEnergies and SABIC, enhance its refining and petrochemical capabilities. These partnerships expand its global reach and market presence.

Aramco's operational effectiveness stems from its massive scale, access to abundant low-cost reserves, and continuous investment in advanced technologies. This translates into highly competitive production costs and reliable supply for its customers.

Aramco's integrated model, from exploration to distribution, ensures efficiency and control over the entire process. The company's vast reserves and strategic partnerships enhance its market position. Continuous technological advancements and investments in infrastructure are critical for maintaining its competitive edge. For more details, consider reading a Brief History of Aramco.

- Upstream: Exploration and production of crude oil and natural gas.

- Downstream: Refining, petrochemicals, and marketing of products.

- Global Presence: Operations and partnerships worldwide.

- Technology: Advanced drilling and refining technologies.

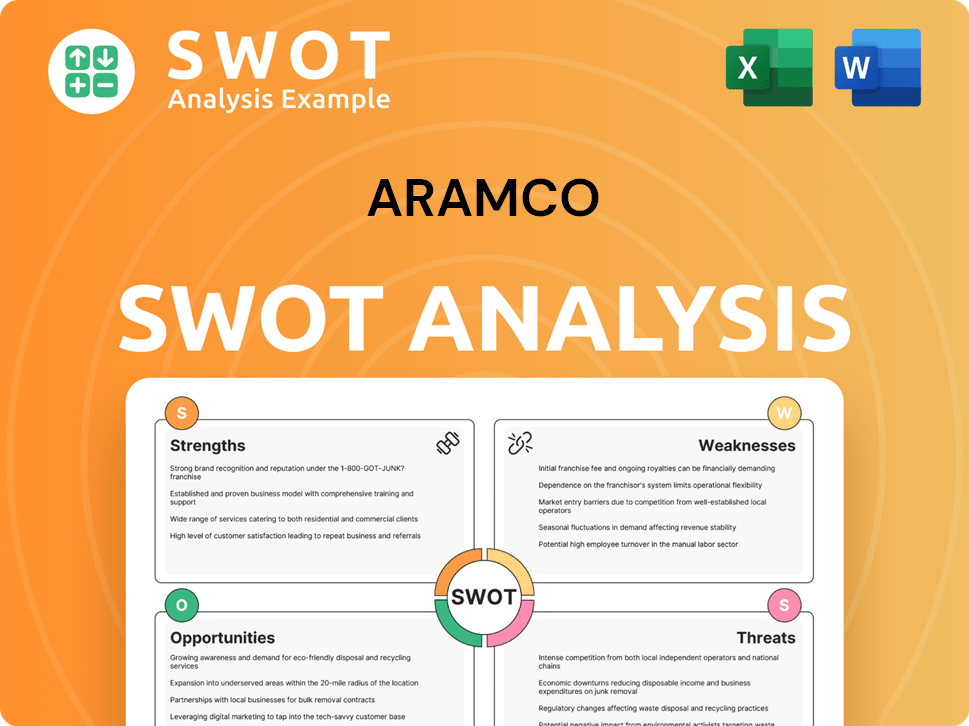

Aramco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Aramco Make Money?

The core of Aramco's revenue generation lies in the sale of hydrocarbons. As a leading Oil company, it primarily earns from selling crude oil, refined products, and chemicals. This diversified approach allows it to capture value across the energy value chain, from extraction to distribution.

In 2023, the company reported a substantial net income of $121.3 billion, demonstrating its financial strength. This performance reflects robust oil prices and strong demand, highlighting the importance of crude oil sales in its overall revenue structure. Additionally, the company's monetization strategies extend beyond direct sales to include value-added activities and strategic partnerships.

The company's revenue streams are primarily fueled by its extensive oil and gas operations. These operations are critical to the Energy sector and the global economy. The company's ability to efficiently extract, process, and distribute hydrocarbons is key to its financial success.

The largest revenue stream for Saudi Aramco comes from the sale of crude oil. This includes both domestic and international sales, with the company being a major supplier to global markets. The volume of crude oil sold and the prevailing market prices significantly influence its financial performance.

Downstream operations, including refining, contribute significantly to revenue. The company refines crude oil into various products like gasoline, diesel, and jet fuel. These refined products are then sold to consumers and businesses worldwide.

The company's chemicals business also generates substantial revenue. This involves producing and selling various chemicals derived from hydrocarbons. These chemicals are used in various industries, including plastics, construction, and manufacturing.

The company also monetizes its natural gas reserves. Natural gas is sold to domestic industries for power generation and other uses. The demand for natural gas and its pricing impact the company's revenue.

The company engages in strategic partnerships and joint ventures to expand its revenue streams. These collaborations often involve refining and petrochemical projects, contributing to diversified revenue and global market penetration.

The company's integrated refining and chemicals operations add value to crude oil. This allows for higher-value products and reduces the impact of crude oil price fluctuations. This vertical integration enhances profitability.

The company employs several strategies to maximize revenue and profitability. These strategies are crucial for its Aramco operations and overall financial success. The company's focus is on efficient extraction, processing, and global distribution of hydrocarbons.

- Vertical Integration: Integrating refining and chemicals operations to add value to crude oil.

- Strategic Partnerships: Forming joint ventures to expand market reach and diversify revenue streams.

- Global Distribution: Efficiently distributing products worldwide to capture global market opportunities.

- Technology Licensing: Leveraging technology through licensing agreements to generate additional revenue.

- Diversification: Expanding into new areas like hydrogen and blue ammonia to diversify its energy portfolio.

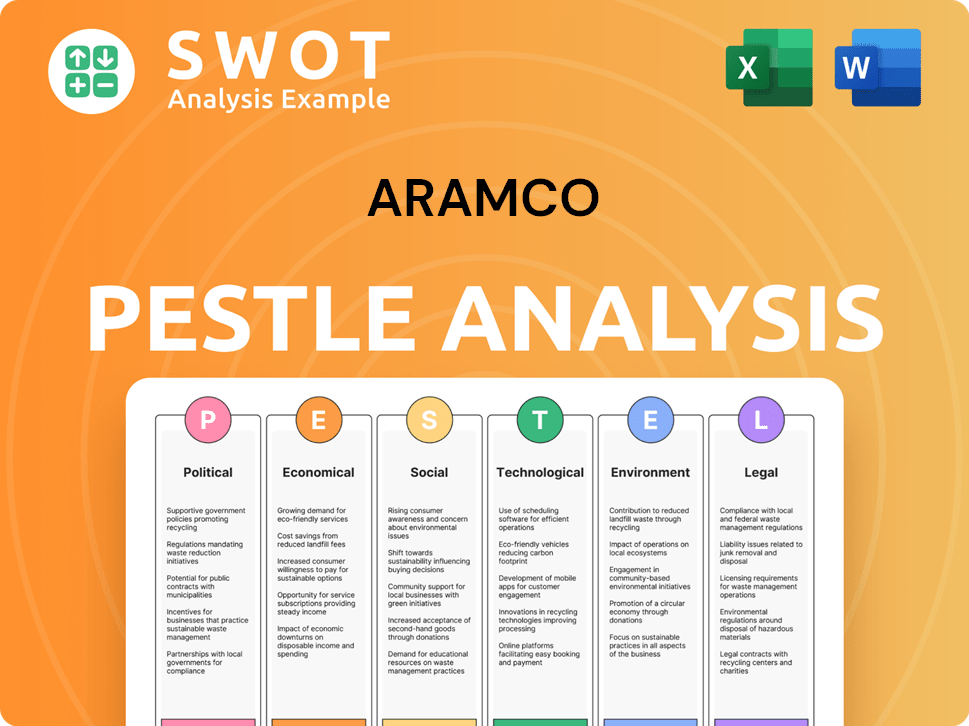

Aramco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Aramco’s Business Model?

Aramco, also known as Saudi Aramco, has a rich history marked by significant milestones and strategic maneuvers that have solidified its position as a dominant force in the global energy sector. A pivotal moment was its initial public offering (IPO) in December 2019, a landmark event that raised a staggering $25.6 billion, making it the world's largest IPO to date and valuing the company at $1.7 trillion. This move provided substantial capital for strategic investments and enhanced transparency in its operations.

Aramco's operations have consistently navigated the volatile oil markets, geopolitical tensions, and the ongoing energy transition. The company has responded by maintaining low production costs, investing in advanced technologies to optimize recovery rates, and diversifying its portfolio beyond crude oil. This strategic agility has been crucial in sustaining its competitive edge in a dynamic global environment. The company's ability to adapt and innovate is a key factor in its continued success.

In 2023, Aramco's net income was $121.3 billion, demonstrating its financial strength. The company's crude oil production capacity is approximately 12 million barrels per day, highlighting its significant contribution to the global energy supply. Furthermore, Aramco's commitment to sustainability is evident through its investments in renewable energy and carbon capture technologies, positioning it for long-term relevance in a changing energy landscape. For more information about the competitive environment, you can read about the Competitors Landscape of Aramco.

The 2019 IPO was a major milestone, raising $25.6 billion. Aramco has consistently adapted to market volatility and geopolitical challenges. The company continues to invest in advanced technologies to optimize its operations.

Focus on low production costs is a key strategy. Diversification beyond crude oil is a priority. Investments in sustainability and new energy solutions are ongoing.

Unparalleled access to vast, low-cost oil reserves gives a significant cost advantage. An integrated business model allows for greater control over the value chain. Aramco's brand strength is globally recognized.

In 2023, Aramco's net income reached $121.3 billion. The company's crude oil production capacity is approximately 12 million barrels per day. Aramco continues to invest in renewable energy and carbon capture technologies.

Aramco's competitive advantage stems from its vast, low-cost oil reserves and integrated business model. The company's brand recognition and financial performance further enhance its position.

- Low production costs.

- Integrated operations.

- Strong brand recognition.

- Adaptation to energy transition.

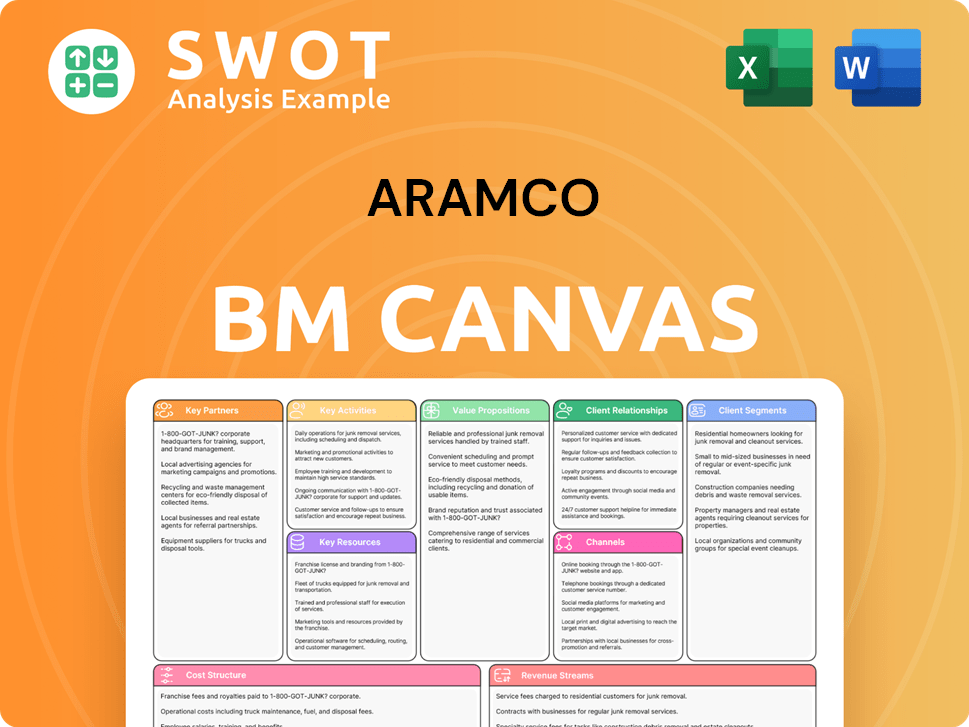

Aramco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Aramco Positioning Itself for Continued Success?

Saudi Aramco, a leading oil company, holds a dominant position in the global energy sector. Its extensive Aramco operations and substantial market share in crude oil production and exports underscore its unparalleled industry status. The company's vast scale and efficiency give it a significant competitive advantage, ensuring a steady supply to major economies worldwide.

Despite its robust standing, Aramco faces several risks. Fluctuating global oil prices and geopolitical instability in the Middle East pose challenges to its revenue and operational continuity. Furthermore, the global shift towards renewable energy sources presents a long-term strategic risk, potentially affecting the demand for fossil fuels.

Aramco is the world's largest integrated oil and gas company, with unparalleled crude oil production capacity. Its global reach extends to major markets across Asia, Europe, and North America. Customer loyalty remains high due to its reliable supply and consistent product quality. Aramco's robust infrastructure and operational efficiency set it apart.

Aramco is vulnerable to volatile oil prices, impacting revenue and profitability. Geopolitical instability in the Middle East can disrupt operations and supply chains. The shift towards renewable energy presents a long-term strategic risk. Regulatory changes concerning environmental policies also pose challenges.

Aramco is investing in downstream operations and exploring new energy ventures. These initiatives include blue hydrogen and carbon capture technologies. The company aims to optimize conventional oil and gas operations while strategically positioning itself for the energy transition. This strategy supports its ability to generate strong returns.

Aramco is focused on diversification to mitigate risks. It is expanding its downstream capabilities, particularly in chemicals, to reduce reliance on crude oil sales. The company is also actively involved in new energy ventures, aligning with global sustainability goals. This includes exploring blue hydrogen and CCUS technologies.

Aramco is actively pursuing strategic initiatives to mitigate risks and ensure future growth. The company is investing in expanding its downstream capabilities, focusing on chemicals to diversify its revenue. It is also exploring new energy ventures, including blue hydrogen and CCUS technologies, to align with global sustainability goals. These initiatives are crucial for the company's long-term success.

- Diversification into chemicals to reduce reliance on crude oil sales.

- Investment in blue hydrogen and CCUS technologies.

- Optimization of conventional oil and gas operations.

- Strategic positioning for the energy transition.

In 2024, Aramco reported a net income of $121.3 billion, reflecting its strong financial performance despite market fluctuations. The company's crude oil production capacity remains at approximately 12 million barrels per day. Aramco's commitment to sustainability is evident through its investments in renewable energy and carbon capture technologies. For more insights into Aramco's strategic direction, consider reading about the Growth Strategy of Aramco.

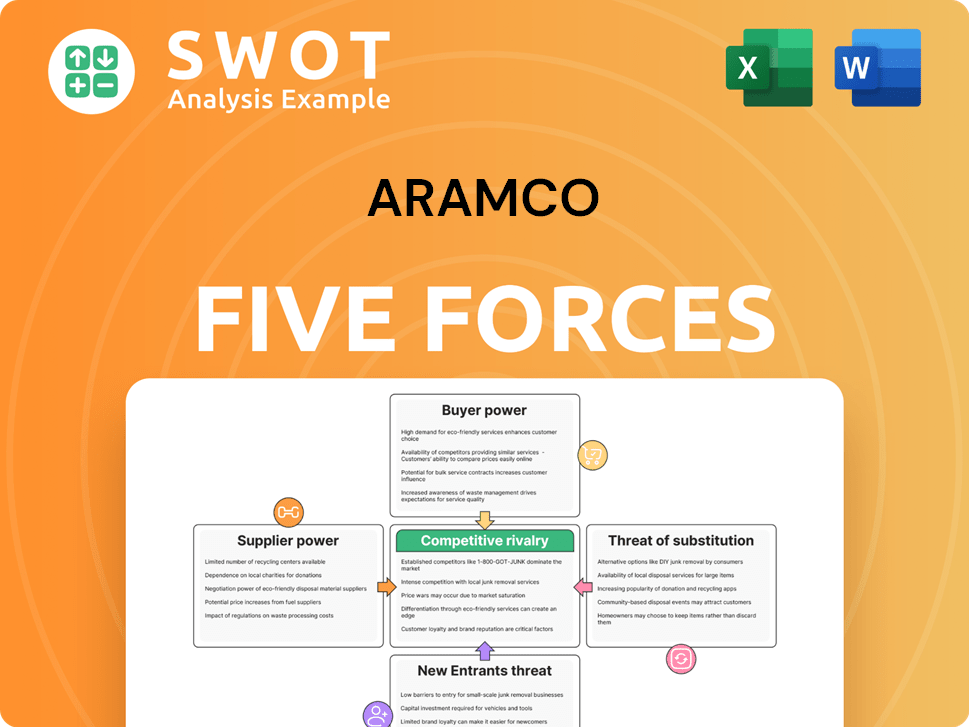

Aramco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aramco Company?

- What is Competitive Landscape of Aramco Company?

- What is Growth Strategy and Future Prospects of Aramco Company?

- What is Sales and Marketing Strategy of Aramco Company?

- What is Brief History of Aramco Company?

- Who Owns Aramco Company?

- What is Customer Demographics and Target Market of Aramco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.