Aramco Bundle

Who Buys from Saudi Aramco?

Delving into the world of Aramco SWOT Analysis, understanding the company's customer demographics and target market is crucial for investors and strategists alike. As a global energy leader, Aramco's success hinges on its ability to identify and serve its diverse customer base effectively. This exploration reveals the intricate layers of Aramco's audience, from direct buyers to end-users, and how the company adapts to the evolving energy landscape.

Aramco's customer profile has dramatically evolved, moving beyond simply selling crude oil. Today, the company's target market spans various industries and geographic locations, reflecting the changing energy sector. This analysis provides insights into Aramco's customer segmentation, including customer needs analysis and purchasing behavior, offering a comprehensive Aramco market analysis. Understanding Aramco's customer acquisition strategies and customer relationship management is key to assessing its future potential.

Who Are Aramco’s Main Customers?

Understanding the customer demographics of Aramco is crucial for grasping its market position and strategic direction. The company primarily operates in a business-to-business (B2B) model, with its core customer base concentrated in the energy and petrochemical sectors. Aramco's customer profile is diverse, spanning across various industries and geographical locations, reflecting its global reach and impact.

The company's target market is primarily composed of large-scale industrial customers. These include independent refiners, integrated oil companies, and petrochemical manufacturers. Aramco's customer segmentation is also evolving, with a growing focus on downstream operations and new energy ventures, expanding its reach to include utility companies and, to a lesser extent, business-to-consumer (B2C) markets.

Aramco's customer base is critical to its financial performance. In 2023, the company reported a net income of $121.3 billion, demonstrating the continued demand from its diverse customer base across its upstream and downstream operations. This underscores the significance of understanding and catering to the needs of its primary customer segments.

Aramco's largest customer segment is within the refining sector. It supplies crude oil to independent refiners and integrated oil companies worldwide. These customers vary in size and location, playing a crucial role in the global energy supply chain.

Another significant segment is the petrochemical industry. Aramco provides feedstock for producing plastics, chemicals, and other derivatives. This segment often involves long-term contracts with large industrial customers.

Aramco's gas production and distribution operations cater to utility companies and industrial clients in the power generation sector. This segment is growing as Aramco expands its gas business.

Through downstream acquisitions and joint ventures, Aramco serves a broader range of industrial customers. It is also expanding into chemicals and new energy sectors. These strategic investments align with global energy transition trends.

Aramco's customer base is diverse and includes major international oil companies, regional players, and petrochemical manufacturers. The company's focus on long-term contracts and strategic partnerships ensures a stable demand for its products. Aramco's strategic investments in downstream operations, such as the acquisition of a 70% stake in SABIC in 2020, have broadened its customer base.

- Refining Sector: Independent refiners and integrated oil companies.

- Petrochemical Industry: Large industrial customers for feedstock.

- Power Generation: Utility companies and industrial clients.

- Downstream and New Energy: Industrial customers for specialized chemicals and materials.

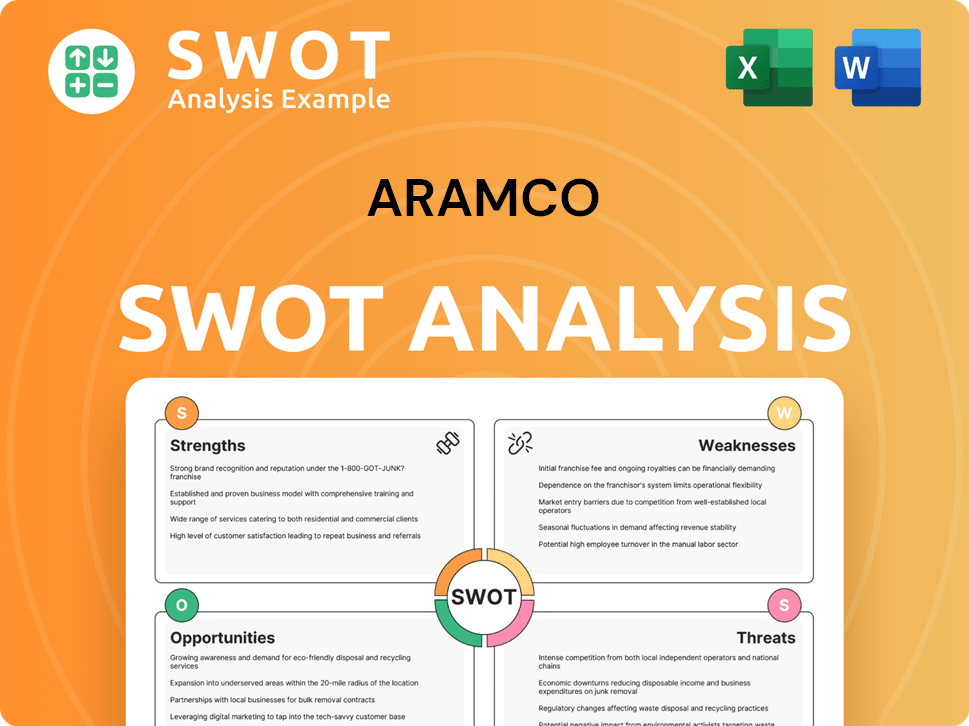

Aramco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Aramco’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for a company like [Company Name], this is particularly true given its global reach and diverse customer base. The company's customer profile spans various sectors, each with unique requirements and expectations. This analysis delves into the specific needs and preferences of [Company Name]'s customers, highlighting the factors that drive their purchasing decisions and the challenges the company addresses to maintain strong customer relationships.

For [Company Name], the customer base is primarily composed of business-to-business (B2B) clients, including those in the refining and petrochemical industries. These customers are the core of the company's operations, and their needs shape the company's strategic direction. Additionally, [Company Name] is expanding its presence in the business-to-consumer (B2C) market, which presents a different set of customer preferences and demands.

The company's approach to customer relationship management is multifaceted, focusing on both long-term partnerships and responsiveness to market trends. The company aims to meet the evolving demands of its customers by investing in technologies and strategies that support sustainable energy solutions and operational excellence. This ensures that [Company Name] remains a reliable and competitive player in the global energy market.

B2B customers, especially in refining and petrochemical sectors, prioritize reliability, consistent supply, and competitive pricing. These factors are crucial for their operational efficiency and long-term planning. Decision-making involves detailed technical specifications and logistical capabilities.

Purchasing behaviors are driven by long-term supply agreements and market dynamics. Refiners require specific crude oil grades to optimize their refinery configurations, while petrochemical producers demand high-purity feedstocks. This ensures the quality of their end products.

Decision-making criteria often involve detailed technical specifications, logistical capabilities, and the ability to meet stringent quality standards. These criteria are essential for ensuring the smooth operation of customer facilities and the quality of their products.

Psychological and practical drivers for choosing [Company Name]'s offerings stem from its reputation as a reliable and large-scale producer. Its extensive global supply chain and commitment to operational excellence play a crucial role in this regard. This builds trust and ensures consistent performance.

Common pain points that [Company Name] addresses include ensuring timely delivery, managing price volatility through various contract mechanisms, and providing technical support. This is achieved through direct engagement with large industrial customers, fostering long-term relationships.

Market trends, such as the increasing demand for lower-carbon fuels and sustainable petrochemicals, influence [Company Name]'s product development and investment strategies. The company is investing in technologies that reduce emissions and developing new products that support the energy transition.

In its more nascent B2C engagements, customer preferences revolve around convenience, fuel efficiency, and brand trust. [Company Name] focuses on optimizing retail experiences and offering quality products to meet these needs. The company is also exploring ways to enhance customer satisfaction through various initiatives.

- Convenience: Customers seek easy access to fuel and services.

- Fuel Efficiency: Demand for high-quality fuels that improve vehicle performance and reduce consumption.

- Brand Trust: Customers prefer reliable brands with a reputation for quality and service.

- Retail Experience: Efforts to optimize retail experiences and offer quality products.

For a deeper dive into the company's strategic approach, consider exploring the Marketing Strategy of Aramco. This will provide additional insights into the company's customer-centric initiatives.

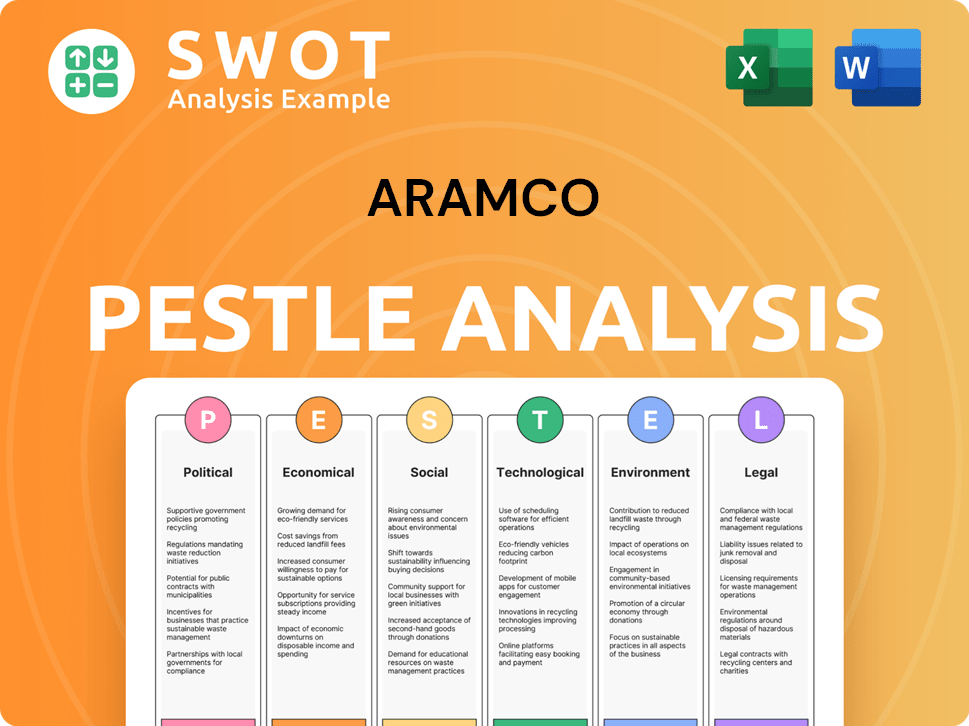

Aramco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Aramco operate?

The geographical market presence of the company is extensive, reflecting its role as a key energy supplier globally. Its primary markets are in Asia, Europe, and North America. Asia, in particular, is a significant market, accounting for a large portion of the world's energy demand, making it a crucial region for the company's operations.

Key markets within Asia include China, India, Japan, and South Korea, where the company has established long-term supply relationships with major refiners and industrial consumers. The company also maintains a substantial presence in Europe and North America. This involves supplying crude oil and refined products to meet the diverse energy needs of these regions. The company's strategic approach includes adapting to the specific demands and regulations of each market, ensuring its continued relevance and competitiveness.

The company's approach to its target market is dynamic, with strategies adjusted based on regional demands and global trends. For instance, in 2023, the company continued to strengthen its position in key Asian markets, leveraging its strategic partnerships and competitive offerings. This demonstrates a commitment to adapting to evolving market dynamics and maintaining a strong global footprint. Understanding the company's geographical market presence is essential for a comprehensive analysis of its customer base and market strategies.

The company's operations span across multiple continents, with a significant focus on Asia, Europe, and North America. This broad geographical presence is a key factor in its ability to meet global energy demands. Its strategic locations ensure that it can efficiently supply crude oil and refined products to various markets, reinforcing its position as a leading energy provider.

China, India, Japan, and South Korea are major markets for the company in Asia. These countries have established long-term supply relationships. The company's presence in these markets is crucial, given Asia's high energy demand. The company's focus on these markets reflects its commitment to meeting the growing energy needs of the region.

The company also maintains a strong presence in Europe and North America. This includes supplying crude oil and refined products to meet the energy demands of these regions. These markets are vital for the company's global operations. The strategic presence in these areas ensures a diversified customer base.

The company utilizes regional offices, joint ventures, and strategic partnerships to localize its offerings. Joint ventures in countries like South Korea (S-Oil) and China (Huajin Aramco Petrochemical Company) allow it to better understand and cater to local market needs. These partnerships are crucial for securing long-term demand for its products.

Differences in customer demographics, preferences, and buying power are significant across these regions, influencing the company's strategies. In Asia, rapid industrialization drives strong demand for energy, often with a focus on cost-effectiveness. In more developed markets like Europe and North America, there is an increasing emphasis on environmental regulations and cleaner energy solutions.

- The company adapts its offerings to meet specific regional demands.

- Investments in lower-carbon technologies are increasing.

- Strategic withdrawals or market entry strategies are driven by long-term market outlooks.

- Geopolitical considerations also influence market strategies.

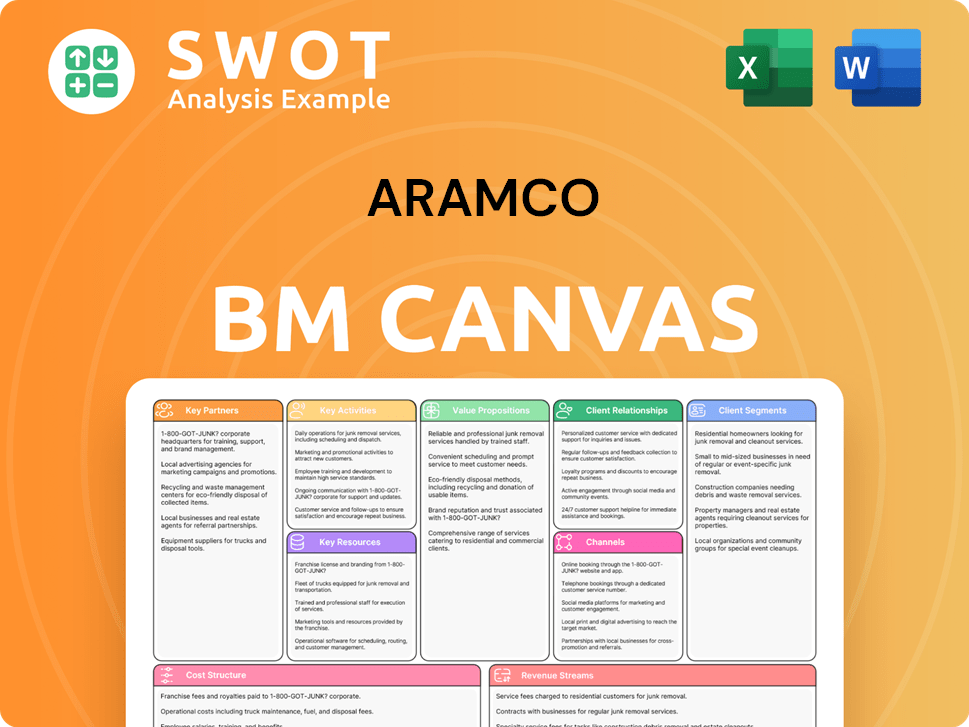

Aramco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Aramco Win & Keep Customers?

In the context of its predominantly B2B operations, the company's customer acquisition and retention strategies are centered around long-term relationships, ensuring a secure supply, and offering competitive value propositions. The company's primary customer acquisition channel involves direct sales and negotiations with national oil companies, major refiners, and petrochemical producers. These are often complex, multi-year contracts that require extensive due diligence and strong relationship-building efforts.

The company leverages its vast production capacity, extensive logistical capabilities, and global reach as key selling points to attract customers. This strategic approach allows the company to consistently supply large volumes of various crude grades, which is a significant competitive advantage. For instance, the company's ability to consistently supply large volumes of various crude grades is a significant competitive advantage.

Retention of customers is achieved through reliable delivery, consistent product quality, and robust after-sales support, including technical assistance and market insights. Understanding the evolving needs of its customers and tailoring its offerings is crucial, which is achieved through customer data and intelligence. The company's customer base size is substantial, reflecting its dominant position in the global energy market.

The primary acquisition channels involve direct sales and negotiations with national oil companies, major refiners, and petrochemical producers. These are often complex, multi-year contracts. The company focuses on building strong, long-term relationships with its customers.

The company uses its vast production capacity, logistical capabilities, and global reach. Its ability to consistently supply large volumes of various crude grades is a significant competitive advantage. It also offers integrated solutions that combine crude oil, refined products, and petrochemicals.

Retention is achieved through reliable delivery, consistent product quality, and strong after-sales support. The company provides technical assistance and market insights to its customers. Customer data and intelligence are crucial for tailoring offerings.

While traditional marketing is less prominent in its core B2B operations, the company engages in industry conferences and trade shows. It also forms strategic partnerships to maintain visibility and foster relationships. In its expanding downstream and retail ventures, digital marketing and brand building are becoming more relevant.

The role of CRM systems for the company is primarily focused on managing large-scale B2B accounts, tracking contract lifecycles, and ensuring seamless operational coordination. Strategic shifts over time include a greater emphasis on integrated solutions that combine crude oil, refined products, and petrochemicals, along with an increased focus on sustainability and lower-carbon offerings to meet evolving customer and regulatory demands. The company's robust financial performance, with a net income of $30.7 billion in Q1 2024, reflects the effectiveness of its core acquisition and retention strategies in maintaining strong customer relationships and market share. For more insights into the company's business model, explore the Revenue Streams & Business Model of Aramco.

The customer profile of the company includes national oil companies, major refiners, and petrochemical producers. These customers are primarily in the B2B sector, requiring long-term contracts and reliable supply. Understanding the needs of these customers is crucial for success.

The company's target market is global, with a significant presence in Asia, Europe, and North America. The company's ability to supply energy worldwide is a key factor in its success. The company's global reach ensures it can meet the diverse needs of its customers.

The company's B2B model means customer segmentation is not primarily based on age. Instead, segmentation is based on factors like volume of purchase, type of product, and geographic location. This approach allows for tailored services.

The company conducts customer needs analysis by closely monitoring market trends and customer feedback. This helps in adapting offerings and ensuring customer satisfaction. This analysis includes understanding the demand for sustainable energy solutions.

CRM systems play a crucial role in managing large-scale B2B accounts, tracking contract lifecycles, and ensuring operational coordination. The company uses CRM to improve customer service and maintain strong relationships. CRM helps streamline operations.

Customer acquisition strategies include direct sales, negotiations, and participation in industry events. The company focuses on building long-term contracts and providing reliable supply. These strategies are key to maintaining market share.

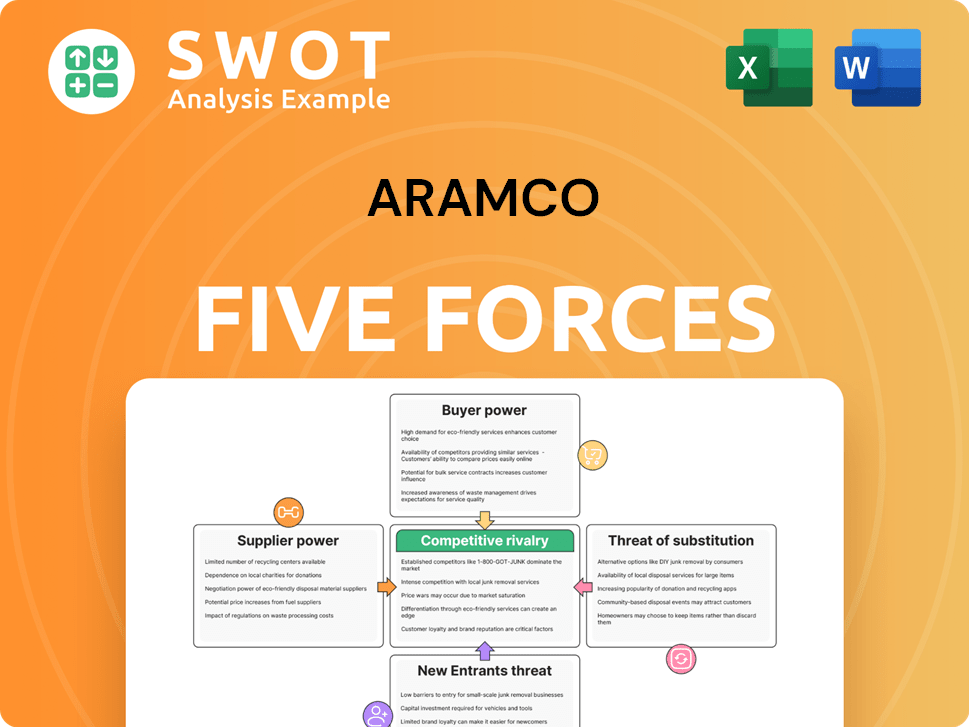

Aramco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aramco Company?

- What is Competitive Landscape of Aramco Company?

- What is Growth Strategy and Future Prospects of Aramco Company?

- How Does Aramco Company Work?

- What is Sales and Marketing Strategy of Aramco Company?

- What is Brief History of Aramco Company?

- Who Owns Aramco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.