CPI Card Bundle

How Does CPI Card Company Thrive in the Payment Card Industry?

In the fast-paced world of financial technology, understanding the CPI Card SWOT Analysis is crucial for anyone looking to navigate the complexities of the payment card industry. CPI Card Company, a key player in card manufacturing, faces constant challenges and opportunities. But how does it stack up against its rivals? What strategic advantages does it leverage to stay ahead?

This exploration into the CPI Card Company's competitive landscape will offer a comprehensive market analysis, revealing the company's position within the payment card industry. We'll examine the company's financial performance, product offerings, and business strategy to understand how it competes and what industry trends are shaping its future. This analysis will provide valuable insights into the competitive dynamics and the strategies that drive success in this dynamic market.

Where Does CPI Card’ Stand in the Current Market?

CPI Card Group maintains a robust market position within the payment card industry, particularly as a leading provider of credit, debit, and prepaid solutions. The company is a significant player in the U.S. card manufacturing market, offering a comprehensive suite of physical card products, including EMV-enabled cards, alongside digital and virtual payment solutions. CPI Card Group serves a diverse clientele, from major financial institutions to smaller credit unions, and also caters to the retail, healthcare, and transit sectors.

Geographically, CPI Card Group has a strong presence in North America, serving a substantial portion of the U.S. card market. The company has adapted its positioning to emphasize digital transformation, recognizing the shift towards mobile payments and online transactions. This includes diversifying its offerings beyond traditional physical card production to include digital payment solutions and services that support card personalization and instant issuance.

Financially, CPI Card Group's performance reflects its established position, with revenue and profitability metrics that are closely watched within the industry. For instance, in its Q1 2024 earnings report, the company reported net sales of $98.1 million. This financial health, coupled with its broad service portfolio, demonstrates its scale compared to many smaller industry players. CPI Card Group holds a particularly strong position in providing secure, high-quality physical cards, a segment where its manufacturing capabilities and expertise are highly valued.

CPI Card Group's core operations revolve around the manufacturing and provision of payment card solutions. This includes the production of physical cards, such as credit, debit, and prepaid cards, as well as digital payment solutions. The company focuses on serving financial institutions, retailers, and other sectors that require secure and reliable payment card services.

The value proposition of CPI Card Group lies in its ability to provide comprehensive payment card solutions, encompassing both physical and digital offerings. It offers secure, high-quality card manufacturing and personalization services. The company's focus on digital transformation and its ability to serve a wide range of clients are key aspects of its value proposition.

CPI Card Group has a strong market presence in the payment card industry, particularly in the U.S. card manufacturing market. The company serves a broad spectrum of financial institutions, retailers, and other sectors. Its geographical focus is primarily North America, where it holds a significant market share.

CPI Card Group's product offerings include a wide range of physical card products, such as EMV-enabled cards, and digital payment solutions. The company provides services that support card personalization and instant issuance. This comprehensive suite of products positions CPI Card Group as a key player in the competitive landscape of the payment card industry.

CPI Card Group's competitive advantages include its established market position, comprehensive product offerings, and strong manufacturing capabilities. The company benefits from industry trends such as the increasing demand for digital payment solutions and the ongoing shift towards EMV-enabled cards. To learn more about the company's history, you can read the Brief History of CPI Card.

- Strong market presence in the U.S. card manufacturing market.

- Comprehensive product offerings, including physical and digital payment solutions.

- Adaptation to digital transformation and the shift towards mobile payments.

- Financial health and broad service portfolio.

CPI Card SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CPI Card?

The competitive landscape for the CPI Card Company is shaped by a mix of established players and emerging threats within the payment card industry. This market analysis reveals the key competitors and the dynamics influencing their positions. Understanding these competitive forces is crucial for assessing the company's strategic positioning and potential for growth.

The payment card industry is subject to constant change. Factors such as technological advancements, shifts in consumer behavior, and the emergence of new financial technology (fintech) solutions all contribute to the evolution of the competitive environment. This overview aims to provide insights into the key players and their strategies.

Direct competitors in the card manufacturing and personalization space include major players that compete with CPI Card Company. These companies offer similar products and services, often vying for contracts with financial institutions and other clients. The competitive dynamics are influenced by factors such as pricing, technological capabilities, and service quality.

Gemalto, now part of Thales, is a global leader in digital security, offering a wide range of payment solutions. They compete with CPI Card Company through their extensive global reach and comprehensive technology portfolio. Thales's broader offerings often provide an advantage in securing large contracts.

Idemia is another major player in the payment card industry, providing advanced identity and payment solutions. They compete on innovation and security features, leveraging expertise in biometrics and secure transactions. Idemia's focus on advanced technologies allows them to compete effectively.

G+D is a German company known for high-security printing and smart card solutions. They compete with CPI Card Company on quality, security, and global manufacturing capabilities. G+D's reputation for security and quality makes them a strong competitor.

Indirect threats include fintech companies focused on digital-first payment solutions. These companies bypass traditional physical cards, representing a shift in the payment card market. The rise of digital payments poses a challenge to traditional card manufacturers.

Mergers and acquisitions, such as the acquisition of Gemalto by Thales, impact the competitive landscape by consolidating market power. These changes can increase pressure on companies like CPI Card Company. Market share shifts often occur based on contract wins with major financial institutions.

Competitive advantages are determined by factors such as pricing, turnaround time, technological capabilities, and service quality. Companies must continually innovate and adapt to maintain their position in the market. The ability to secure and retain contracts with major financial institutions is key.

The competitive landscape is shaped by several key factors. These factors influence the success of companies within the payment card industry. The ability to meet the evolving needs of clients and adapt to market trends is crucial.

- Technological Innovation: The adoption of EMV chip cards and other advanced technologies is essential.

- Security: Providing secure payment solutions is paramount in maintaining customer trust.

- Pricing: Competitive pricing strategies are necessary to win contracts.

- Service Quality: Excellent customer service and timely delivery are critical.

- Global Reach: A strong global presence allows companies to serve international clients.

CPI Card PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CPI Card a Competitive Edge Over Its Rivals?

The competitive landscape of the payment card industry is dynamic, and understanding the strengths of key players like CPI Card Company is crucial. CPI Card Group, a significant entity in this sector, has cultivated several competitive advantages that set it apart from rivals. These advantages are critical for maintaining market share and driving growth in an environment shaped by technological advancements and evolving consumer preferences. A comprehensive market analysis reveals the strategies and strengths that enable CPI Card Group to compete effectively.

CPI Card Group's position in the payment card industry is bolstered by its extensive manufacturing capabilities and operational efficiency. This includes the production of various payment card types, such as EMV and dual-interface cards. Furthermore, the company's expertise in secure personalization and fulfillment services provides a comprehensive solution for financial institutions. These capabilities are essential in a market where reliability and security are paramount. The Marketing Strategy of CPI Card highlights how these elements are integrated to meet client needs effectively.

Another key factor is its long-standing relationships with major financial institutions. These partnerships are built on years of dependable service and adherence to strict security standards, fostering strong customer loyalty. This loyalty is a significant barrier to entry for competitors. CPI Card Group also leverages its intellectual property and technological expertise in card design, security features, and digital payment integration. This includes advancements in eco-friendly card materials, such as its Earthwise™ line of environmentally friendly payment cards, which caters to growing demand for sustainable solutions.

CPI Card Group's robust manufacturing infrastructure allows it to produce a wide range of payment cards, including complex EMV and dual-interface cards. This capacity is crucial for meeting the diverse needs of financial institutions. The ability to handle large-scale production efficiently is a significant competitive advantage in the card manufacturing sector.

The company excels in secure personalization and fulfillment services, providing a single-source solution for clients. This integrated approach streamlines the card issuance process, enhancing efficiency and security. This comprehensive service offering simplifies operations for financial institutions.

CPI Card Group has built long-standing relationships with major financial institutions through reliable service and adherence to stringent security standards. These relationships are a cornerstone of their business. This loyalty makes it difficult for competitors to disrupt established partnerships.

CPI Card Group invests in intellectual property and technological expertise in card design, security features, and digital payment integration. This includes advancements in eco-friendly card materials. This focus on innovation enhances its product offering and aligns with corporate social responsibility initiatives.

CPI Card Group's competitive edge in the payment card industry is defined by its manufacturing capabilities, secure personalization services, and strong client relationships. The company's focus on innovation and sustainability, such as its Earthwise™ line, further enhances its market position. These advantages are crucial for navigating the evolving landscape of the payment card industry.

- Extensive manufacturing capabilities for various card types.

- Comprehensive secure personalization and fulfillment services.

- Long-standing relationships with major financial institutions.

- Technological expertise in card design and security features.

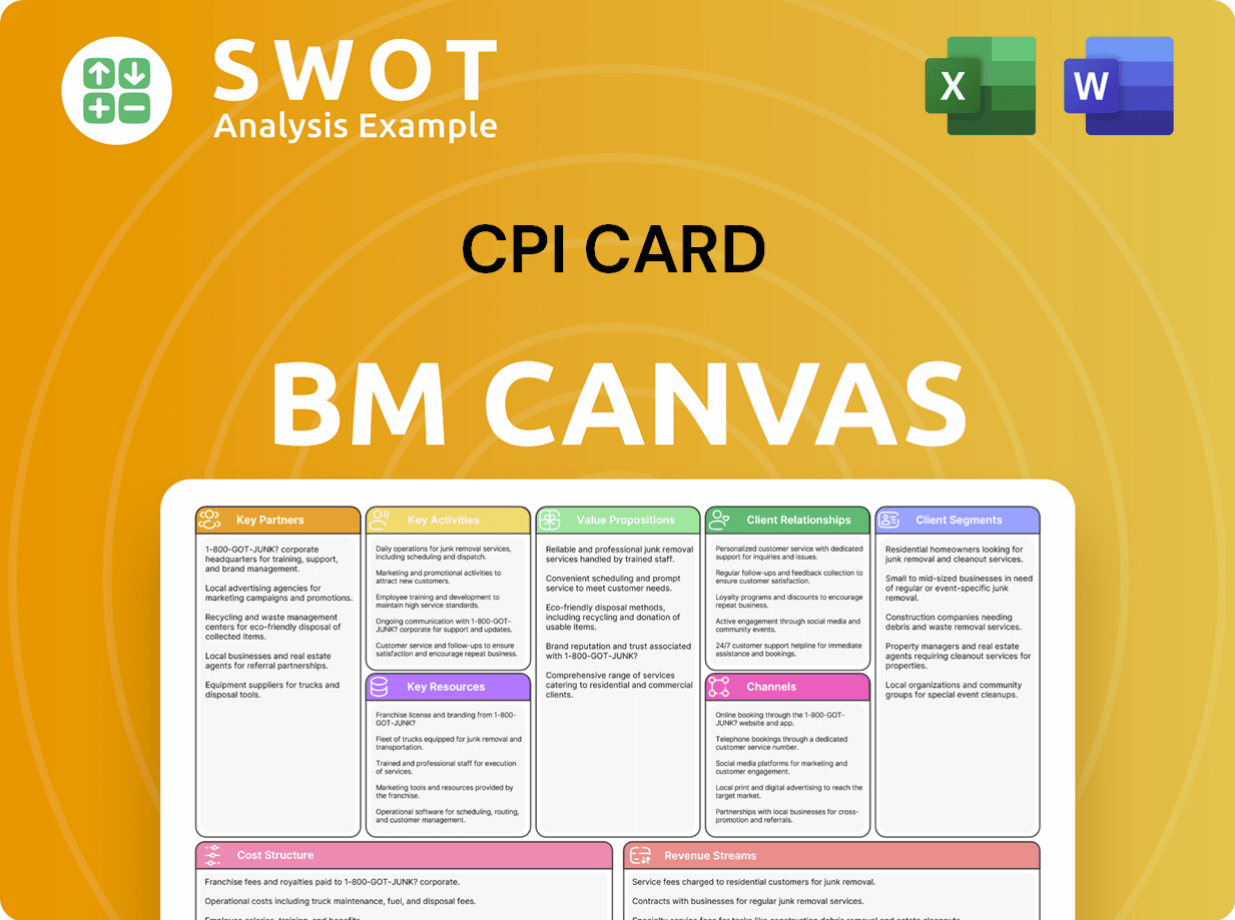

CPI Card Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CPI Card’s Competitive Landscape?

The CPI Card Company operates within the dynamic payment card industry, navigating a landscape shaped by technological advancements, regulatory changes, and evolving consumer preferences. Understanding the competitive landscape is crucial for assessing its position and future prospects. This involves analyzing industry trends, identifying potential risks, and recognizing opportunities for growth and innovation.

The market analysis reveals that CPI Card Company's success hinges on its ability to adapt to shifts in the financial technology sector, including the rise of digital payments. The company must also address challenges related to data security and sustainability while leveraging its strengths in card manufacturing and customer service to maintain a competitive edge.

The payment card industry is experiencing a significant shift towards digital payments, including mobile wallets and contactless transactions. This trend presents both challenges and opportunities for CPI Card Company. While the demand for physical cards may be impacted, there's a chance to expand digital payment solutions.

There's a growing emphasis on sustainability, leading to increased demand for eco-friendly card materials. CPI Card Company has responded with its Earthwise products, positioning itself to capitalize on this growing market segment. This focus aligns with consumer preferences and environmental regulations.

Regulatory changes in data security and privacy pose ongoing challenges for the payment card industry. Compliance with standards like PCI DSS and regional data protection laws requires continuous effort. CPI Card Company's expertise in secure solutions is a competitive differentiator in this area.

The rise of fintech companies and challenger banks is disrupting traditional banking models. This necessitates agile and innovative payment solutions. Furthermore, aggressive pricing from competitors in a mature market segment could impact profitability.

CPI Card Company can capitalize on several opportunities. These include partnering with fintech companies, expanding into emerging markets, and innovating with biometric cards. Strategic partnerships and product diversification are key.

- Partnering with fintechs to support their card programs.

- Exploring emerging markets for growth.

- Developing product innovations like biometric cards.

- Focusing on sustainable card solutions and materials.

CPI Card Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CPI Card Company?

- What is Growth Strategy and Future Prospects of CPI Card Company?

- How Does CPI Card Company Work?

- What is Sales and Marketing Strategy of CPI Card Company?

- What is Brief History of CPI Card Company?

- Who Owns CPI Card Company?

- What is Customer Demographics and Target Market of CPI Card Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.