CPI Card Bundle

Who Does CPI Card Company Serve?

In the ever-evolving payment card industry, understanding CPI Card SWOT Analysis is crucial. This analysis delves into the core of CPI Card Company's strategy: its customer demographics and target market. Focusing on the dynamic shifts in consumer preferences and technological advancements, we explore how CPI Card Company strategically positions itself within the competitive landscape.

CPI Card Company's success hinges on its ability to identify and cater to specific market segments within the payment card industry. This involves a deep dive into customer demographics and a comprehensive target market analysis, considering factors like location data, income levels, and consumer behavior. By understanding the consumer profile and preferences, CPI Card Company can refine its offerings and customer acquisition strategies to maximize market penetration and customer retention.

Who Are CPI Card’s Main Customers?

Understanding the customer demographics and target market of CPI Card Company is crucial for grasping its business strategy. CPI Card Group operates primarily in the B2B sector, focusing on providing payment card solutions to various industries. This approach allows the company to concentrate on specific market segments with tailored offerings.

The company's primary customer segments are financial institutions, including banks and credit unions. These institutions rely on CPI for credit, debit, and prepaid card programs. CPI also serves the retail, healthcare, and transit markets, expanding its reach beyond traditional financial services.

The target market for CPI Card Company is diverse, reflecting its strategic expansion and adaptation to market trends. This expansion is driven by the increasing adoption of digital payment solutions and a growing emphasis on sustainability.

The core customer base includes banks and credit unions. They utilize CPI's solutions for credit, debit, and prepaid card programs. There's a high demand for contactless cards and eco-friendly options within this segment.

CPI has expanded to include these markets, diversifying its customer base. This expansion aligns with the growing adoption of digital payments and sustainability trends. The acquisition of Arroweye Solutions in May 2025 further supports this expansion.

CPI Card Group's success is significantly influenced by market trends and consumer preferences in the payment card industry. The demand for specific card types and features directly impacts the company's sales and strategic decisions.

- Prepaid Debit Segment Growth: Net sales in the prepaid debit segment increased by 26% in 2024, exceeding $100 million, driven by demand for fraud prevention solutions.

- Debit and Credit Segment Growth: This segment saw a 4% increase in net sales in 2024, particularly in eco-focused and card personalization services.

- Eco-Focused Cards: Over 100 million eco-focused cards have been sold since their launch in late 2019, highlighting the importance of sustainability.

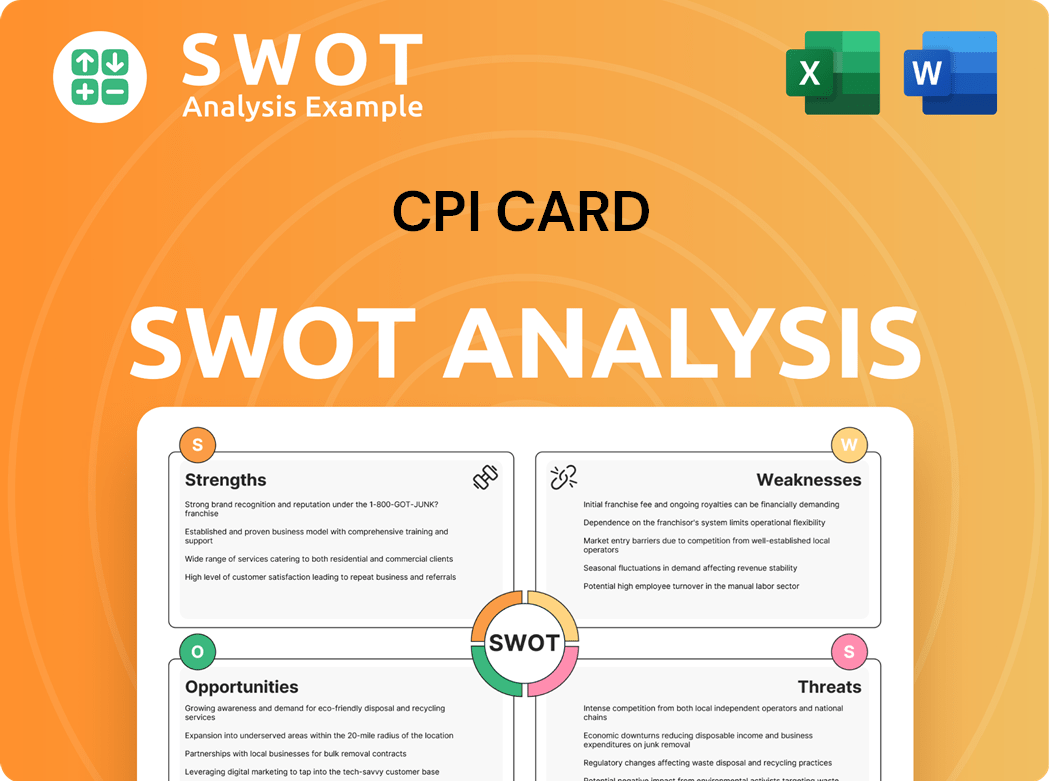

CPI Card SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do CPI Card’s Customers Want?

The customer base of the company, primarily financial institutions and other businesses within the payment card industry, is driven by a need for secure, innovative, and efficient payment solutions. Their preferences are heavily influenced by the necessity to provide reliable payment options that meet industry standards and enhance the cardholder experience. This focus shapes their purchasing decisions, emphasizing the importance of security and user experience.

These businesses seek to offer their customers advanced payment solutions, including contactless cards, and are increasingly interested in environmentally responsible products. This indicates a clear preference for modern, convenient, and sustainable options. Understanding these needs is crucial for the company to tailor its offerings effectively and maintain a competitive edge in the market.

The company's clients, when making decisions, prioritize product quality, turnaround time, and cost-effectiveness. They also look for solutions that differentiate their offerings. For instance, the demand for fraud prevention packaging in the prepaid segment highlights the importance of risk mitigation and security. The company's ability to simplify secure payment solution production and provide exceptional cardholder experiences are also key drivers.

Customers prioritize security, innovation, efficiency, and sustainability in their payment solutions. They seek to provide secure and reliable payment options to their cardholders. The demand for contactless and eco-friendly solutions reflects modern preferences.

Clients focus on product quality, turnaround time, cost-effectiveness, and differentiated solutions. The motivation to mitigate risks and enhance security, especially in the prepaid segment, is significant. Clients also seek a trusted partnership and market-leading solutions.

The company addresses the complexity of secure payment solution production and the need for efficient, high-quality card issuance. They offer a single source for financial institutions and SaaS-based instant issuance solutions. The company's solutions include options for loading card credentials to digital wallets.

Feedback and market trends, such as the increasing popularity of mobile wallets, have influenced product development. The company has expanded its offerings to include options for loading card credentials to digital wallets. This adaptation ensures the company remains aligned with evolving consumer preferences.

The company provides a comprehensive range of payment cards, including EMV and non-EMV, contact and contactless, and plastic and encased metal cards, along with digital services. This variety allows clients to choose solutions that perfectly match their specific needs and their customers' preferences. These options support a wide array of applications.

The company adapts to market changes by offering solutions that meet current demands. They focus on providing secure and efficient payment solutions. This includes offering a range of cards and digital services to meet the evolving needs of the payment card industry.

The company’s target market, encompassing financial institutions and businesses in the payment card industry, is driven by the need for secure and innovative payment solutions. Marketing Strategy of CPI Card reveals that CPI Card Group's customer base prioritizes product quality, turnaround time, and cost-effectiveness, with a strong emphasis on mitigating risks and enhancing security. The company addresses common pain points, such as the complexity of secure payment solution production, by offering a single source for financial institutions and SaaS-based instant issuance solutions. As of late 2024, Card@Once®, has over 16,000 installations across more than 2,000 financial institutions in the U.S. The company's customer acquisition and retention strategies are influenced by the need to provide a comprehensive range of payment cards and digital services, adapting to market trends like the increasing popularity of mobile wallets. This approach allows the company to cater to diverse customer demographics and consumer preferences within the payment card industry.

Customers seek secure, innovative, and efficient payment solutions.

- Security and reliability are paramount.

- Demand for contactless and eco-friendly options is growing.

- Clients value product quality, turnaround time, and cost-effectiveness.

- The company provides a wide range of card types and digital services.

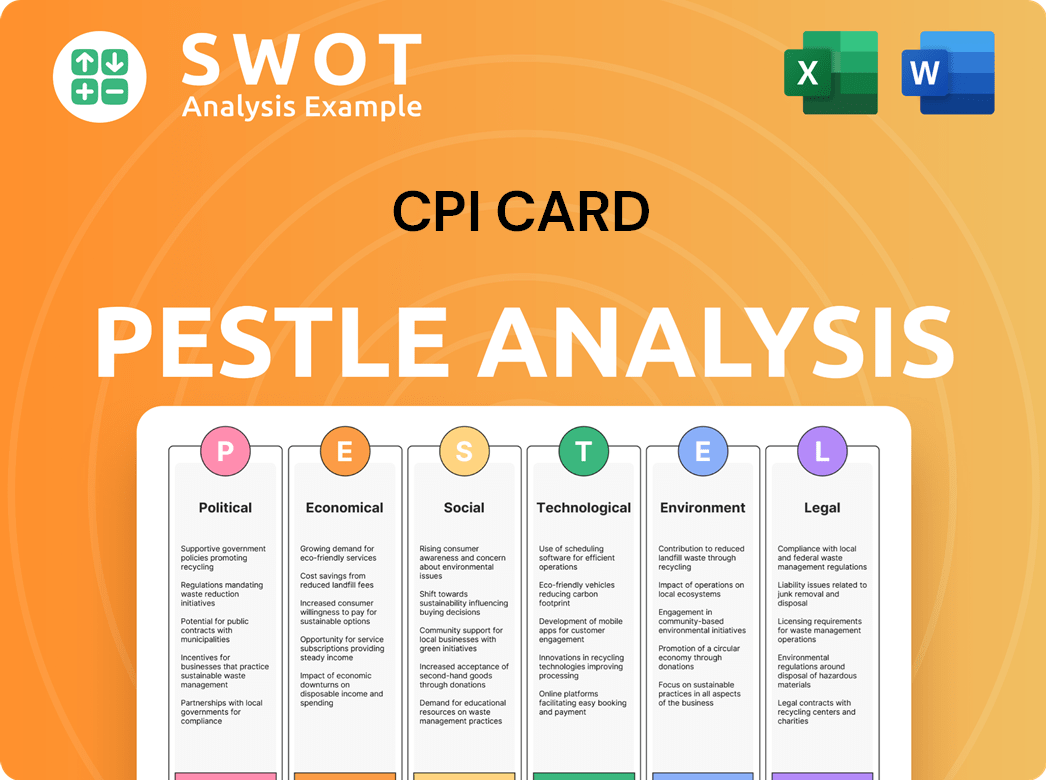

CPI Card PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does CPI Card operate?

The geographical market presence of CPI Card Group is predominantly focused on the United States. The company offers payment card and digital solutions to financial institutions and various other markets across the U.S. This strategic concentration allows for a targeted approach to meet the specific needs of the U.S. market.

CPI Card Group's extensive network of Card@Once® instant issuance installations demonstrates its strong presence within the United States. By the end of 2024, the company had over 16,000 installations across more than 2,000 financial institutions in the U.S., highlighting its broad reach and market penetration.

Recent expansions and strategic acquisitions further cement CPI's commitment to the U.S. market. The company's investments in manufacturing and digital solutions are designed to enhance its capabilities and service offerings within the country, ensuring it remains competitive in the payment card industry.

CPI Card Group primarily targets the United States, serving financial institutions and other markets. This focus allows for a deep understanding of the local market dynamics and customer needs. The company's strategic decisions, such as the construction of a new manufacturing facility in Fort Wayne, Indiana, emphasize its commitment to the U.S. market.

In April 2024, CPI Card Group announced the construction of a new manufacturing facility in Fort Wayne, Indiana, which will double the size of its existing location there. This expansion is designed to support long-term growth and is expected to commence operations in mid-2025, with employees transitioning by early 2026. This investment underscores CPI's strategy to strengthen its operational footprint within the U.S.

The acquisition of Arroweye Solutions, Inc. in May 2025, further strengthens CPI's market position within the U.S. by adding digitally-driven on-demand payment card solutions. Arroweye is expected to generate mid-$50 million in revenue in 2025, contributing to CPI's overall market diversification and growth. This acquisition supports CPI's focus on providing innovative payment solutions tailored to the U.S. market.

CPI Card Group focuses on U.S. market trends, such as the rising demand for eco-focused cards and contactless technology. This focus on consumer preferences and industry advancements allows CPI to remain competitive. Learn more about the company's financial structure in this article: Revenue Streams & Business Model of CPI Card.

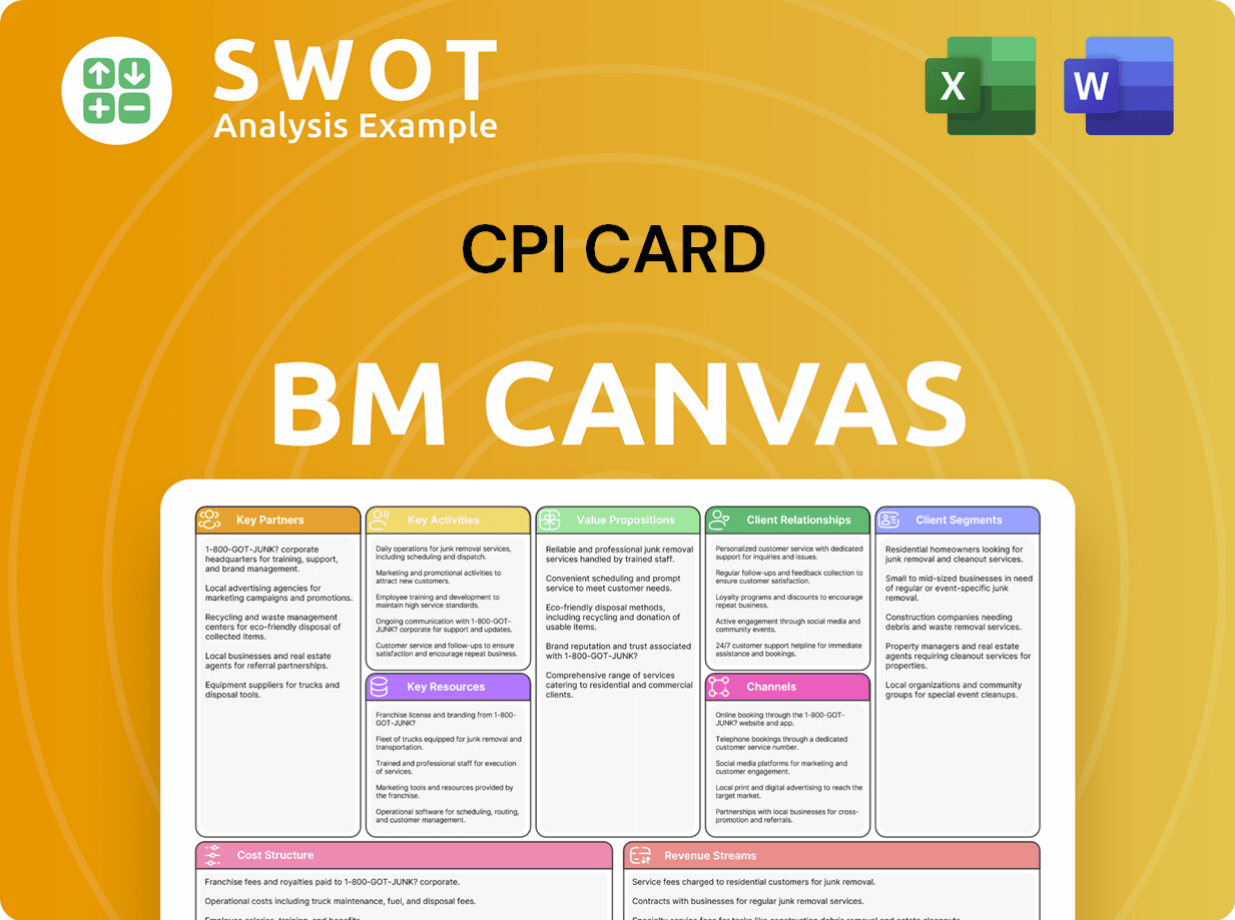

CPI Card Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does CPI Card Win & Keep Customers?

The strategy of CPI Card Group for customer acquisition and retention focuses on building strong relationships within the payment card industry. Their approach centers on offering innovative products and maintaining high service standards to attract and keep customers. This involves a blend of product-led strategies, digital solutions, and long-term relationship management to meet the evolving needs of financial institutions and their cardholders.

CPI Card Group's customer acquisition strategies center on providing market-leading payment solutions. This includes eco-friendly payment cards and advanced digital offerings. They also emphasize superior customer service and product quality to gain market share. The acquisition of Arroweye Solutions in May 2024 enhances their ability to offer on-demand payment card solutions, which is attractive to businesses needing agile solutions.

For retention, CPI Card Group prioritizes long-term relationships. They offer integrated services like card personalization and SaaS-based instant issuance solutions, such as Card@Once®. By the end of 2024, over 16,000 Card@Once® installations were in place across more than 2,000 financial institutions in the U.S., showcasing their commitment to fostering ongoing engagement with their customers.

CPI Card Group focuses on innovation, offering solutions like eco-focused payment cards. Since late 2019, they have sold over 100 million eco-focused cards. This demonstrates a successful product-led acquisition strategy, attracting customers with environmentally friendly options.

Digital solutions are a key part of CPI's acquisition and retention strategy. They provide push provisioning for mobile wallets and payment card fraud solutions. The acquisition of Arroweye Solutions strengthens digital capabilities by offering on-demand payment card solutions.

CPI Card Group emphasizes best-in-class customer service to gain and retain customers. This includes providing comprehensive integrated card services. Their focus is on building strong, long-term relationships with their clients in the payment card industry.

Strategic partnerships are another key element of CPI's strategy. They aim to diversify into adjacent markets like healthcare payment solutions. This can lead to new customer acquisition and expanded relationships with existing clients, increasing their target market.

CPI Card Group focuses on building strong, long-term relationships with its customers. This includes providing comprehensive integrated card services and SaaS-based instant issuance solutions. These efforts aim to increase customer lifetime value and reduce churn within the payment card industry.

- Continuous innovation to meet industry demands.

- High-quality products to maintain customer satisfaction.

- Responsive customer service to address client needs.

- Strategic partnerships to expand market reach.

The company's approach to customer acquisition and retention underscores their commitment to the payment card industry. By focusing on innovative products, excellent service, and strategic partnerships, CPI Card Group aims to meet the evolving needs of its customers. For more insights into the broader strategy of CPI Card Group, you can explore the Growth Strategy of CPI Card.

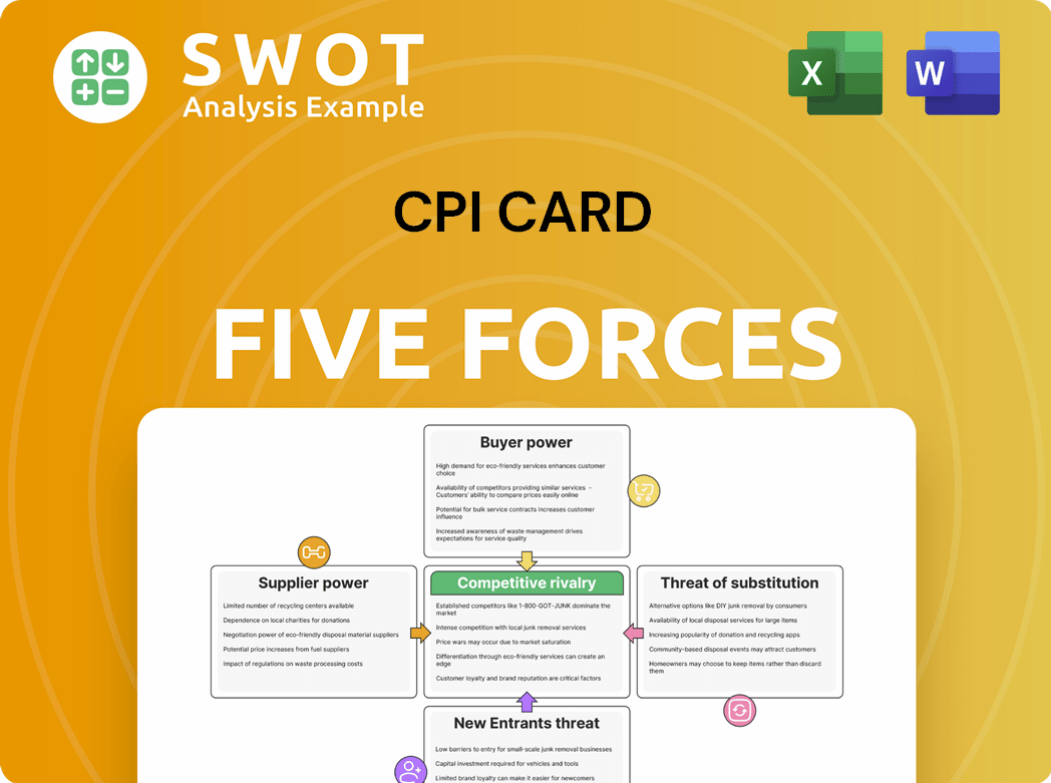

CPI Card Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CPI Card Company?

- What is Competitive Landscape of CPI Card Company?

- What is Growth Strategy and Future Prospects of CPI Card Company?

- How Does CPI Card Company Work?

- What is Sales and Marketing Strategy of CPI Card Company?

- What is Brief History of CPI Card Company?

- Who Owns CPI Card Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.