CPI Card Bundle

What Drives CPI Card Company's Success?

Understanding a company's core principles is key to assessing its potential. This exploration delves into the CPI Card SWOT Analysis, examining the fundamental elements that shape its identity and strategic direction. Discover the CPI Card Company's guiding lights: its mission, vision, and core values.

CPI Card Company's mission, vision, and core values are more than just words; they are the foundation upon which the company builds its reputation and drives innovation in CPI payment solutions. Examining these statements provides valuable insights into the company's strategic plan, business ethics, and overall commitment to its stakeholders. Learn about CPI's corporate culture and how these principles influence its decision-making processes, shaping its approach to the market and its commitment to its employees.

Key Takeaways

- CPI Card Group's mission, vision, and values are fundamental to their strategic direction in the payment technology sector.

- Customer focus, innovation, and secure solutions are key strengths driving CPI's market position.

- Their vision of being the most trusted partner is supported by ongoing investments and expansion.

- Alignment with core principles is essential for navigating industry changes and future success.

- A strong corporate purpose is crucial for long-term growth in the evolving payment technology landscape.

Mission: What is CPI Card Mission Statement?

CPI Card Group's mission is to provide secure and innovative payment solutions to financial institutions and other businesses, delivering high-quality card products and related services that meet evolving customer needs while maintaining a commitment to operational excellence and customer satisfaction.

Let's delve into the specifics of CPI Card Group's mission statement and its implications.

The mission clearly identifies financial institutions as a core customer base. However, it also extends to "other businesses," indicating a broader market reach. This includes sectors like retail, healthcare, and transit, all of which utilize CPI payment solutions.

CPI Card Company offers a wide array of products and services. This encompasses physical credit, debit, and prepaid cards, as well as digital solutions and instant issuance services. This comprehensive approach allows CPI to cater to diverse customer needs within the payments landscape.

The emphasis on "secure and innovative solutions" highlights CPI's commitment to staying ahead of the curve. This includes investments in advanced manufacturing technologies, such as EMV chip integration, to ensure card security. The company is also focused on contactless payment capabilities and eco-friendly card materials.

The mission's focus on "high-quality card products" and "customer satisfaction" underscores a customer-centric approach. CPI Card Group aims to provide value to its clients through reliable, top-tier products and services. Recent reports indicate a client satisfaction rate of 98.6%, demonstrating the company's success in this area.

Maintaining "operational excellence" is crucial for CPI Card Group. This involves efficient manufacturing processes, robust security measures, and streamlined customer service. This commitment helps CPI Card Company to deliver on its promises and maintain a competitive edge in the market. This is one of the main goals of CPI Card Company.

CPI Card Group's mission is reflected in its business operations. For instance, their investment in eco-focused card materials demonstrates their commitment to sustainability, aligning with evolving customer needs and expectations. For more insights into CPI's strategic direction, consider reading about the Growth Strategy of CPI Card.

In essence, the mission of CPI Card Company is a customer-centric and innovation-focused statement. It aims to provide value to clients through secure, high-quality, and forward-thinking payment solutions. Understanding the mission provides a foundation for understanding CPI's corporate culture and its strategic plan for the future. This mission statement is a key component of CPI Card Company's company values.

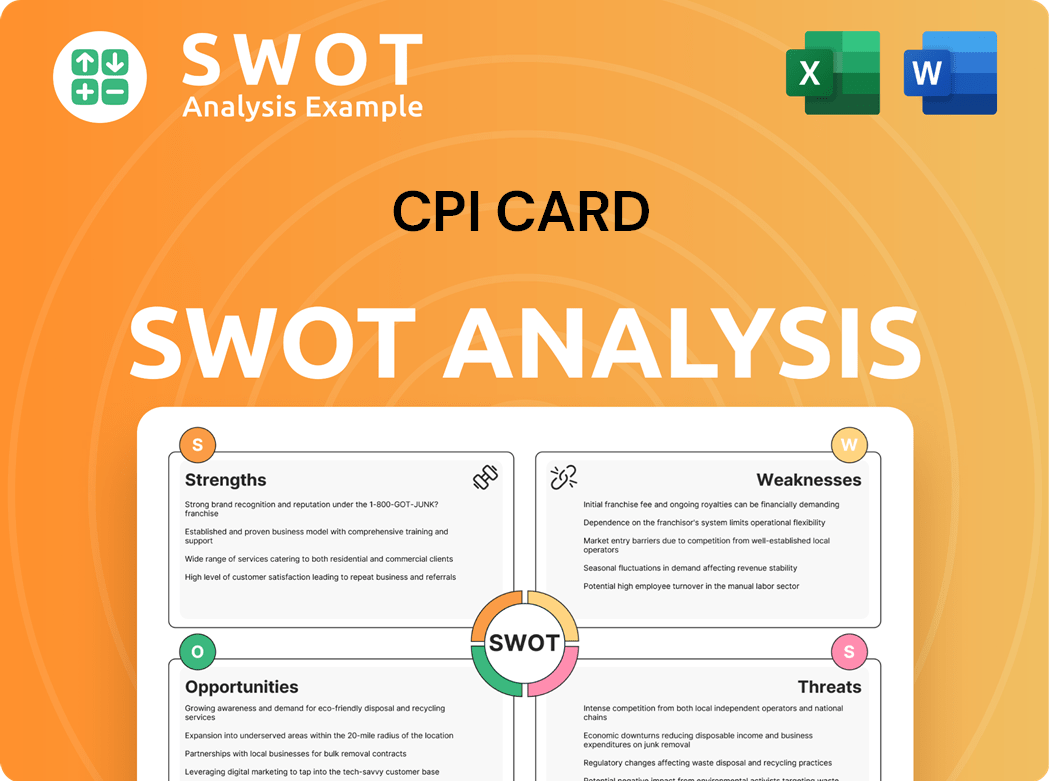

CPI Card SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is CPI Card Vision Statement?

CPI Card Group's vision is 'To be the most trusted partner for innovative payments technology solutions.'

Delving into the vision of CPI Card Group, it's clear that the company is aiming for a position of leadership and trust within the dynamic payments industry. This vision statement, "To be the most trusted partner for innovative payments technology solutions," is forward-looking, encapsulating CPI's aspirations to be at the forefront of technological advancements while fostering strong, reliable relationships with its clients. This commitment to innovation is evident in their substantial investment in research and development, which was reported at $180.2 million in 2024, a figure that underscores their dedication to staying ahead of the curve. Moreover, CPI Card Group's strategic moves, such as the acquisition of Arroweye Solutions in May 2025, which specializes in digitally-driven on-demand payment card solutions, further solidify their commitment to this vision by expanding their capabilities to meet future market demands. This proactive approach positions CPI Card Group to not only adapt to but also shape the future of the payment solutions landscape.

The vision statement clearly outlines CPI Card Group's future goals. It's an ambitious declaration that sets the stage for the company's long-term strategic direction. The focus is on innovation and establishing a position of trust within the industry.

The vision emphasizes market leadership and the importance of trust. CPI Card Group aims to be the 'most trusted partner,' indicating a desire to build strong relationships. This focus on trust is a core element of their Mission, Vision & Core Values of CPI Card.

The vision statement highlights the importance of technological advancements. CPI Card Group aims to be at the forefront of innovation in the payment solutions sector. This will help them achieve their goals and stay ahead of the competition.

Given CPI Card Group's current market position and strategic investments, the vision is both realistic and aspirational. Their investments in R&D and acquisitions, like Arroweye Solutions, support this claim. It's a challenging goal, but one that seems achievable.

CPI Card Group's ongoing investments and strategic initiatives are key to realizing its vision. These moves demonstrate a commitment to innovation and expansion. These initiatives are crucial for achieving their long-term goals.

CPI Card Group's focus on eco-friendly cards and contactless technology aligns with the evolving demands of the market. This forward-thinking approach ensures they remain relevant and competitive. Meeting these demands is critical for future success.

The vision statement of CPI Card Company reflects a strong commitment to innovation and partnership within the payments technology sector. The company's strategic investments, such as the $180.2 million allocated to research and development in 2024, and acquisitions like Arroweye Solutions, are tangible steps toward realizing this vision. This proactive approach, combined with a focus on trust and technological advancement, positions CPI Card Group to not only meet but also anticipate the evolving needs of the market. The vision is a clear reflection of CPI's goals and its dedication to shaping the future of CPI payment solutions.

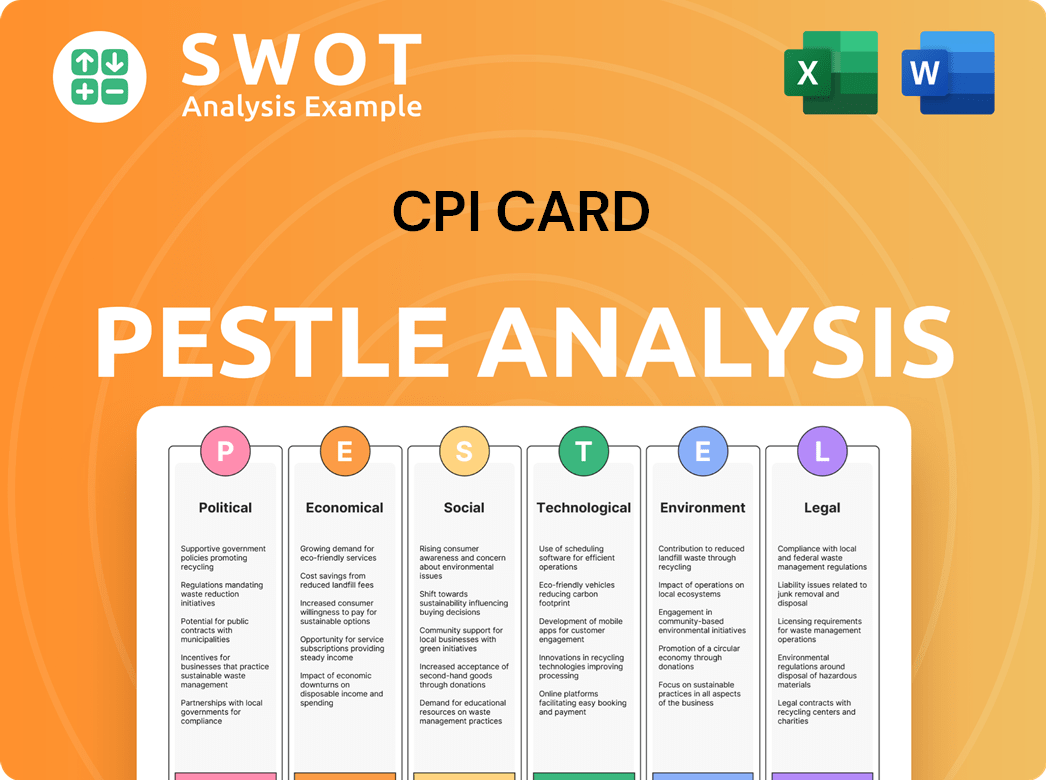

CPI Card PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is CPI Card Core Values Statement?

Understanding the core values of CPI Card Group is crucial to grasping its corporate identity and its approach to the payment solutions industry. These values shape CPI's interactions, guide its operations, and define its commitment to its customers and partners.

Integrity is a cornerstone of CPI Card Group's operations, reflected in its unwavering commitment to ethical and professional conduct. This commitment is evident in its adherence to stringent security standards like EMV and PCI compliance, which are critical in the payment card industry. Building trust with customers, CPI Card Group maintains long-term partnerships; for example, their top 10 clients have an average tenure exceeding 10 years, demonstrating the strength of these relationships.

Innovation is a driving force at CPI, evident in its continuous efforts to develop next-generation products and solutions. This value is seen in product development through their creation of eco-focused cards, contactless technology, and instant issuance solutions. CPI likely invests a significant portion of its revenue into R&D to foster a forward-thinking environment that encourages research and development, as supported by their reported R&D investment.

Customer focus is a central value at CPI, with a strong emphasis on putting customers at the center of all activities. This value is demonstrated through providing customized payment solutions and working closely with clients throughout the payment ecosystem. The high client satisfaction rates are a direct outcome of this focus, which is critical in the competitive landscape of CPI payment solutions.

The pursuit of excellence is deeply embedded in CPI's operations, aiming to deliver market-leading quality products and customer service. This value influences product development through rigorous manufacturing standards and quality control, ensuring reliability and performance. It shapes CPI's corporate culture by promoting a high standard of performance and continuous improvement, which is crucial for maintaining a competitive edge.

These core values collectively define CPI Card Group's commitment to ethical conduct, strong customer relationships, and quality, setting it apart in the payment technology landscape. To learn more about CPI Card Group's journey and evolution, read a brief history of CPI Card. Next, we will explore how CPI's mission and vision influence the company's strategic decisions and overall direction.

How Mission & Vision Influence CPI Card Business?

CPI Card Group's mission, vision, and core values are not just abstract statements; they are the driving forces behind its strategic decisions and operational priorities. These guiding principles shape the company's approach to innovation, customer service, and market expansion, influencing every aspect of its business.

CPI Card Group's vision to be the most trusted partner for innovative payment technology solutions directly influences its strategic priorities. This vision emphasizes market-leading quality, customer service, and continuous innovation, which are core tenets of its operational framework.

- This commitment drives investments in solutions like eco-focused cards and instant issuance technology.

- The mission and vision also guide the company's expansion into adjacent markets and digital offerings.

- Financial performance in 2024 reflects the success of these strategies, with increased net sales and strong growth in the prepaid segment.

CPI Card Group's investment in eco-focused card solutions, such as Second Wave® cards made with recovered ocean-bound plastic, is a direct result of its mission to provide innovative solutions and its vision to be a leader in the industry. This initiative also addresses growing sustainability concerns in the market. By the end of 2024, CPI had sold over 350 million eco-focused card or package solutions.

The development and deployment of instant issuance solutions like Card@Once® align with CPI's mission to deliver solutions that meet evolving customer needs and its vision of providing market-leading quality and service. By the end of 2024, CPI had over 16,000 Card@Once® installations across more than 2,000 financial institutions, demonstrating the success of this strategic focus.

CPI's strategic focus on expanding into adjacent markets and broadening its digital offerings, as highlighted by CEO John Lowe, is a direct consequence of its vision to be a comprehensive solutions provider and its mission to deliver innovative solutions. The acquisition of Arroweye Solutions, a provider of digitally-driven on-demand solutions, exemplifies this forward-thinking approach.

The influence of CPI Card Group's mission and vision is evident in its financial performance. In 2024, the company reported an 8% increase in net sales, reaching $480.6 million, with a significant 26% increase in its prepaid segment. This growth underscores the effectiveness of its focus on providing high-quality, innovative solutions that resonate with customer demands, directly reflecting its mission and vision.

The company values of CPI Card Company are not just words; they are the foundation of its corporate culture and guide its employees' actions. The commitment to innovation, sustainability, and customer service is woven into the fabric of the organization. Understanding Revenue Streams & Business Model of CPI Card can further illuminate how these values translate into tangible business outcomes.

The mission and vision statements of CPI Card Company directly shape key decisions and strategic priorities. From product development to market expansion, every initiative is evaluated through the lens of these core principles. This ensures that all actions align with the company's long-term goals and values.

In conclusion, CPI Card Group's mission and vision are not merely aspirational; they are the very blueprint for its strategic execution and market success. The commitment to innovation, sustainability, and customer satisfaction, as defined by its core values, has propelled the company forward. Read on to discover the Core Improvements to the Company's Mission and Vision.

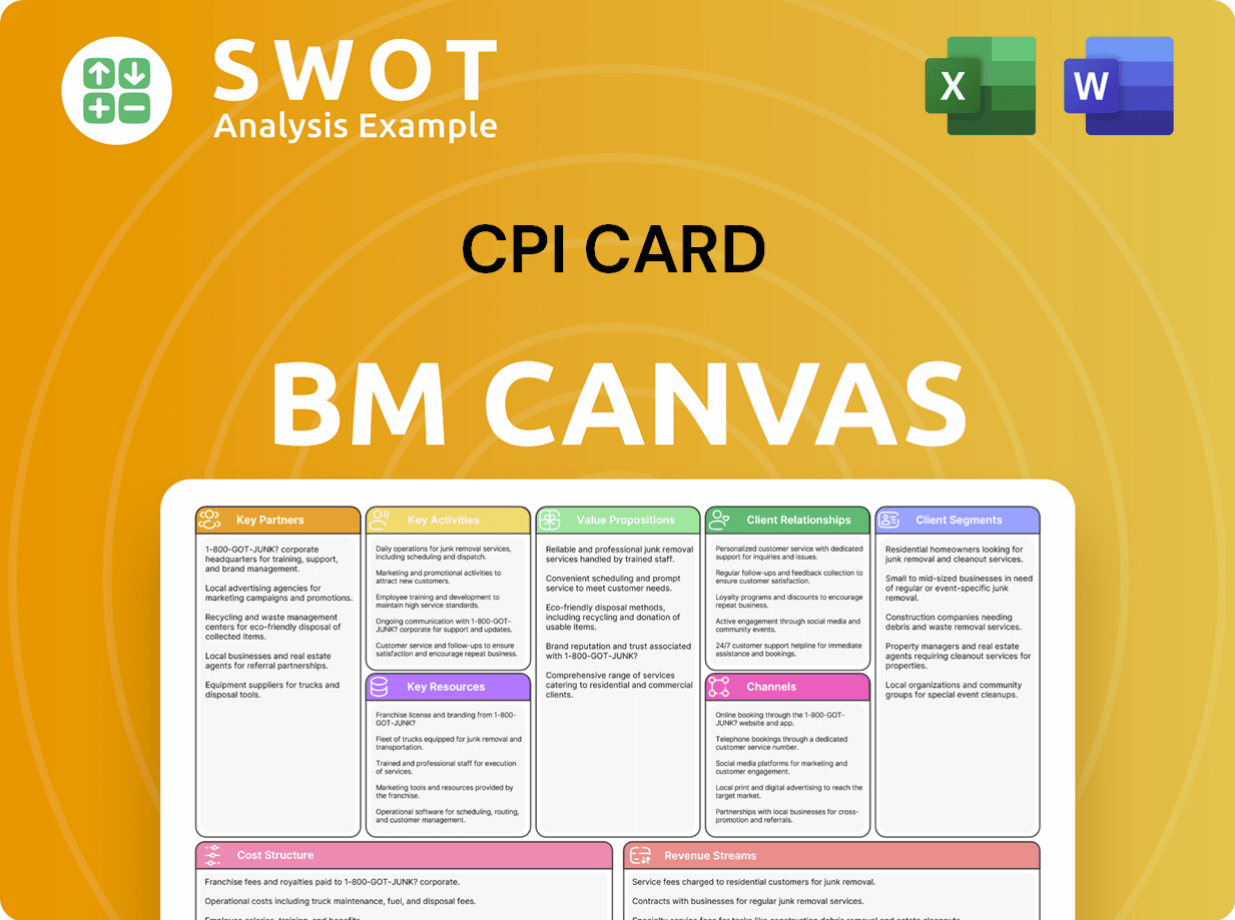

CPI Card Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While CPI Card Company's core statements provide a solid foundation, strategic refinements can enhance their alignment with current market dynamics and future growth opportunities. These improvements focus on strengthening the company's position in a rapidly evolving industry, appealing to a broader range of stakeholders, and ensuring long-term sustainability.

To better reflect its strategic initiatives, CPI Card Company should explicitly incorporate digital transformation into its mission or vision. This would underscore the company's commitment to digital payment solutions and acquisitions like Arroweye Solutions, vital in a market where digital wallets and contactless payments are surging. The global digital payments market is projected to reach $274.8 billion by 2027, highlighting the importance of this focus.

CPI Card Company can elevate its commitment to sustainability by explicitly integrating it into its core mission or vision. This move would resonate with environmentally conscious customers and investors, especially considering the industry's shift towards sustainable practices. For example, Mastercard aims for all new cards on its network to be made of sustainable plastics by 2028, a trend CPI Card Company should mirror.

CPI Card Company could enhance its mission or vision by framing its impact in terms of customer success and end-user payment experience. This approach would make the statements more compelling and highlight the value CPI payment solutions provide within the payment ecosystem. Focusing on customer outcomes is crucial, as customer satisfaction directly impacts market share and brand loyalty.

Reviewing and refining the company values can strengthen CPI corporate culture and employee engagement. The company should ensure its values are relevant, actionable, and reflective of its business ethics. By doing so, CPI Card Company can attract and retain top talent, fostering a positive work environment that supports the company's strategic goals. To learn more about the target market of CPI Card, you can read this article: Target Market of CPI Card.

How Does CPI Card Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for aligning strategy with execution and fostering a strong corporate culture. CPI Card Group demonstrates this implementation through various initiatives that reflect its commitment to its stated principles.

CPI Card Company's leadership, particularly CEO John Lowe, actively reinforces the company's mission, vision, and core values. This is achieved by prioritizing key strategic areas that directly align with these core statements. These priorities include customer focus, quality and efficiency, innovation and diversification, and people and culture.

- CEO's communication helps to cascade the mission and vision throughout the organization, ensuring that all employees understand and work towards common goals.

- Strategic decisions are made with the company's core values in mind, ensuring consistency in actions and messaging.

- The company's strategic plan reflects its mission and vision, providing a roadmap for future growth and development.

CPI Card Group showcases its commitment to innovation and sustainability through its eco-focused card portfolio. This initiative highlights the company's dedication to environmental responsibility and forward-thinking solutions. The development of sustainable products aligns with the vision of providing innovative and responsible CPI payment solutions.

The expansion of instant issuance solutions, such as Card@Once®, demonstrates CPI Card Group's dedication to meeting customer needs and providing market-leading solutions. This initiative reflects the company's focus on customer satisfaction and its commitment to providing convenient and efficient services. This also helps to improve customer retention rates.

Strategic acquisitions, such as Arroweye Solutions, exemplify CPI Card Group's commitment to expanding its offerings and staying at the forefront of payment technology. These acquisitions help the company diversify its services and increase its market share. This also helps to improve the company's overall financial performance.

CPI Card Group communicates its mission, vision, and values to stakeholders through various channels, including investor relations materials, annual reports, and its corporate website. The company also highlights its values and initiatives in press releases and news features. This helps to build trust and transparency with stakeholders.

CPI Card Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CPI Card Company?

- What is Competitive Landscape of CPI Card Company?

- What is Growth Strategy and Future Prospects of CPI Card Company?

- How Does CPI Card Company Work?

- What is Sales and Marketing Strategy of CPI Card Company?

- Who Owns CPI Card Company?

- What is Customer Demographics and Target Market of CPI Card Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.