CVS Health Bundle

Can CVS Health Maintain Its Healthcare Dominance?

CVS Health has dramatically transformed itself, evolving from a pharmacy chain into a healthcare powerhouse. This strategic shift, marked by significant acquisitions and expansions, has positioned CVS Health at the forefront of the CVS Health SWOT Analysis. But, how does CVS Health navigate the complex CVS Health competitive landscape in the ever-changing healthcare industry?

Understanding the CVS Health market analysis is crucial to grasping its future. This analysis will identify key CVS Health competitors, evaluate their strategies, and explore the CVS Health industry dynamics. We will explore CVS Health's challenges in the market and its growth opportunities, providing a comprehensive view of its position within the pharmacy market and the broader healthcare ecosystem.

Where Does CVS Health’ Stand in the Current Market?

CVS Health's core operations revolve around an integrated healthcare model, encompassing pharmacy services, health benefits, and retail clinics. This structure allows the company to offer a comprehensive suite of services, from prescription fulfillment to health insurance plans. The value proposition lies in providing accessible, convenient, and coordinated healthcare solutions, aiming to improve health outcomes and reduce costs for consumers and payers.

As of early 2024, the company operates a vast network of over 9,000 retail locations, solidifying its presence in the pharmacy market. Through its Pharmacy Services segment, particularly CVS Caremark, CVS Health manages prescription drug programs for millions of individuals. Furthermore, the acquisition of Aetna in 2018 expanded its Health Care Benefits segment, serving over 38 million members, positioning it as a major player in the health insurance sector.

The company's strategic shift towards a more comprehensive healthcare provider model is evident in its emphasis on digital health solutions and the expansion of its MinuteClinic walk-in clinics. This evolution enhances accessibility and convenience, aligning with consumer preferences for integrated healthcare services. For a deeper understanding of the company's financial structure, you can explore Revenue Streams & Business Model of CVS Health.

CVS Health, through CVS Caremark, holds a significant market share in pharmacy benefit management (PBM). Although specific percentages fluctuate, it consistently ranks among the top PBMs in the United States. This strong position allows CVS Health to influence drug costs and access for a substantial portion of the population.

The acquisition of Aetna significantly boosted CVS Health's presence in the health insurance market. As of 2024, CVS Health is a major player, competing with other large insurers. The company's ability to integrate pharmacy and healthcare benefits provides a competitive edge in the market.

With over 9,000 retail locations, CVS Health maintains a vast retail pharmacy network across the United States. This extensive footprint provides broad access to prescription drugs and healthcare services for a large customer base. The company strategically manages its store locations to maximize efficiency and market coverage.

CVS Health's financial performance reflects its significant scale and market presence. For the full year 2023, the company reported total revenues of $357.8 billion. This financial strength supports its ongoing investments in healthcare services and strategic initiatives.

CVS Health's competitive advantages stem from its integrated model, extensive retail network, and strong presence in pharmacy services and health insurance. These factors enable the company to offer a comprehensive suite of healthcare solutions, creating value for consumers and payers. The company continues to evolve its business strategy to maintain its competitive edge in the healthcare industry.

- Integrated Healthcare Model: Combining pharmacy services, health benefits, and retail clinics.

- Extensive Retail Network: Over 9,000 retail locations provide broad market coverage.

- Pharmacy Benefit Management: CVS Caremark's market leadership in managing prescription drug programs.

- Health Insurance: Aetna's membership base strengthens its position in the insurance market.

CVS Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CVS Health?

The CVS Health competitive landscape is multifaceted, encompassing various sectors within the healthcare industry. It faces competition in retail pharmacy, pharmacy benefit management (PBM), and health insurance, along with the emergence of digital health companies. Understanding these competitors is crucial for a thorough CVS Health market analysis.

CVS Health's competitive environment is dynamic, with traditional rivals and innovative disruptors vying for market share. The company's strategic responses to these competitive pressures are critical for maintaining its position and achieving growth. The healthcare industry is constantly evolving, requiring CVS Health to adapt and innovate continuously.

CVS Health's primary direct competitor in the retail pharmacy space is Walgreens Boots Alliance. Both companies operate extensive networks of drugstores offering prescription fulfillment, over-the-counter medications, and health services. According to recent data, Walgreens reported revenues of approximately $136.8 billion in fiscal year 2024, indicating the scale of competition in this sector.

Walmart and Kroger also compete in the retail pharmacy market. They leverage their broad consumer reach and competitive pricing strategies. Walmart's pharmacy sales were a significant portion of its overall revenue, demonstrating the importance of this segment.

CVS Caremark, the PBM arm of CVS Health, competes with Express Scripts (part of Cigna's Evernorth) and OptumRx (part of UnitedHealth Group). These PBMs compete on negotiated drug prices and formulary management. OptumRx reported revenues of over $117 billion in 2024.

In the health insurance segment, CVS Health, through Aetna, competes with major insurers like UnitedHealth Group, Elevance Health (formerly Anthem), and Kaiser Permanente. These companies offer a range of health benefits and services. UnitedHealth Group's revenue in 2024 reached approximately $372 billion.

Emerging players like Amazon, with its PillPack online pharmacy, and various telehealth providers challenge traditional distribution channels and care delivery models. These companies are rapidly growing in the CVS Health industry.

Consolidation within the healthcare industry, including mergers and alliances, reshapes competitive dynamics. These shifts require CVS Health to adapt its strategies to maintain its market leadership. The healthcare market is subject to frequent changes.

CVS Health's competitive advantages include its integrated model, combining retail pharmacies, PBM, and health insurance. This integration allows for better coordination of care. CVS Health's extensive network provides a significant advantage in the pharmacy market.

Several factors influence the competitive landscape for CVS Health. These include pricing strategies, formulary management, and the ability to attract and retain customers.

- Pricing: Competitive drug pricing is crucial in the PBM sector.

- Formulary Management: Effective management of drug formularies impacts costs and access.

- Customer Retention: Maintaining and growing customer bases in all segments is vital.

- Technology: Digital health initiatives and telehealth services are increasingly important.

- Market Share: CVS Health's market share analysis shows its position in the healthcare market.

CVS Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CVS Health a Competitive Edge Over Its Rivals?

Analyzing the Brief History of CVS Health reveals its strategic evolution and competitive positioning within the dynamic healthcare industry. The company's ability to integrate pharmacy services, health benefits, and retail clinics forms the core of its competitive advantages. This integrated model allows for a comprehensive approach to patient care and cost management, setting it apart in the

CVS Health's extensive physical footprint, with over 9,000 retail locations, provides unparalleled accessibility for prescription fulfillment and convenient healthcare services. This vast network acts as a significant barrier to entry for new competitors. Brand recognition and customer loyalty, built over decades, are substantial advantages, fostering a strong customer base across the U.S. The company's strategic moves, including acquisitions and mergers, have expanded its service offerings and market reach, influencing its competitive position.

Economies of scale, particularly in its PBM operations, enable CVS Health to negotiate favorable drug prices, translating into cost savings. Supply chain strengths further enhance operational efficiency. However, the healthcare industry is constantly evolving, with challenges and opportunities impacting CVS Health's market share. Understanding these aspects is crucial for a comprehensive

CVS Health's integrated model, combining pharmacy services, health benefits, and retail clinics, is a primary competitive advantage. This integration allows for better coordination of care, improved medication adherence, and a more personalized patient experience. This comprehensive approach sets CVS Health apart from competitors in the

The company's vast network of over 9,000 retail locations provides unparalleled accessibility for prescription fulfillment and convenient access to healthcare services. This extensive presence acts as a significant barrier to entry for new competitors. The widespread accessibility strengthens its position in the

CVS Health has built substantial brand equity and customer loyalty over decades of providing essential health services. It is a recognized and trusted name, fostering a strong customer base. This long-standing reputation contributes to its sustained success and market leadership.

Economies of scale, particularly in its PBM operations, enable CVS Health to negotiate favorable drug prices. Its supply chain strengths, honed over years of managing complex pharmaceutical distribution, further enhance its operational efficiency. These factors contribute to cost savings and operational advantages.

CVS Health's competitive advantages are rooted in its integrated healthcare ecosystem, extensive physical presence, and strong brand recognition. These strengths enable better patient care and cost management. However, these advantages face threats from imitation, particularly as other healthcare players seek to integrate their offerings.

- Integrated Healthcare Model: Combining pharmacy services, health benefits, and retail clinics.

- Extensive Network: Over 9,000 retail locations for accessibility.

- Brand Equity: A trusted name with strong customer loyalty.

- Economies of Scale: Favorable drug pricing through PBM operations.

- Supply Chain: Efficient pharmaceutical distribution.

CVS Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CVS Health’s Competitive Landscape?

The healthcare industry is undergoing a significant transformation, creating both challenges and opportunities for companies like CVS Health. Technological advancements, regulatory changes, and evolving consumer preferences are key drivers shaping the CVS Health competitive landscape. Understanding these trends is critical for assessing the company's future prospects and strategic positioning in the healthcare industry.

CVS Health's ability to adapt to these shifts will determine its success. The company faces competition from various players, including traditional pharmacies, healthcare providers, and tech-driven startups. A thorough CVS Health market analysis is essential to identify its strengths, weaknesses, opportunities, and threats within this dynamic environment.

Technological advancements, such as digital health and telehealth, are reshaping healthcare delivery. Regulatory changes, including those affecting drug pricing and PBM practices, significantly influence the market. Evolving consumer preferences are pushing for greater convenience, affordability, and personalized care, impacting the pharmacy market.

Increased competition from tech-first companies that innovate rapidly and disrupt the market. Declining demand for traditional retail pharmacy services due to online alternatives. Increased regulatory scrutiny on PBM practices and aggressive pricing strategies from competitors pose significant challenges. The industry is expecting continued consolidation.

Expanding into emerging care models like home healthcare and chronic disease management. Further product innovations in preventive care and wellness programs. Strategic partnerships to expand reach and enhance service offerings. Leveraging its integrated platform to capitalize on growth.

Prioritize digital integration and value-based care models. Enhance virtual care offerings and personalize patient engagement. Optimize operational efficiencies through data insights. Focus on expanding MinuteClinic services and comprehensive health plans.

CVS Health competes with companies like Walgreens, UnitedHealth Group, and Amazon, among others. The company's integrated model, combining pharmacy services, PBM, and health insurance, sets it apart. Factors influencing its competitive position include pricing strategies, service offerings, and digital capabilities.

- Market Share: CVS Health holds a significant share in the pharmacy market, with approximately 22% of retail prescription revenue in 2024.

- Digital Health: The company is investing heavily in digital health initiatives, including telehealth services and online prescription management, to compete with other players.

- Strategic Partnerships: CVS Health's partnerships with healthcare providers and technology firms are crucial for expanding its reach and enhancing its service offerings.

- Financial Performance: In Q1 2024, CVS Health reported revenues of approximately $88.4 billion, demonstrating its financial strength and market position.

For a deeper dive into the financial aspects and ownership structure, consider reviewing the analysis of Owners & Shareholders of CVS Health.

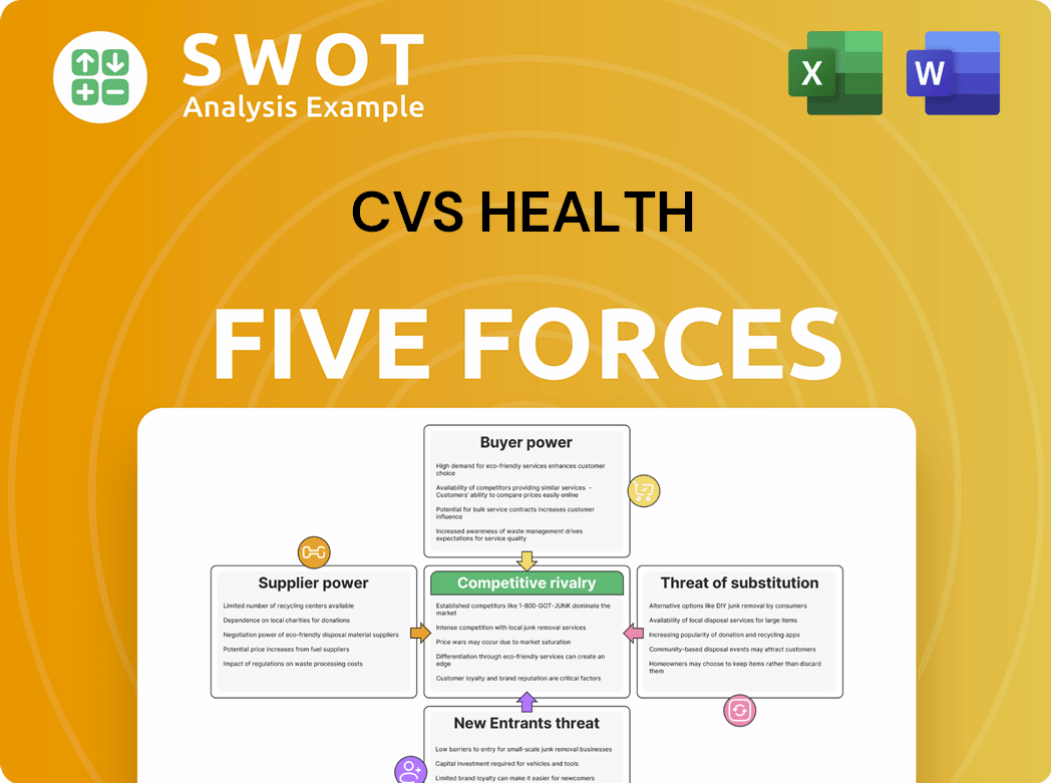

CVS Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CVS Health Company?

- What is Growth Strategy and Future Prospects of CVS Health Company?

- How Does CVS Health Company Work?

- What is Sales and Marketing Strategy of CVS Health Company?

- What is Brief History of CVS Health Company?

- Who Owns CVS Health Company?

- What is Customer Demographics and Target Market of CVS Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.