CVS Health Bundle

Who Really Controls CVS Health?

The $69 billion acquisition of Aetna by CVS Health in 2018 dramatically reshaped the healthcare industry, highlighting the crucial impact of corporate ownership. This merger redefined CVS Health's core business, expanding its reach and affecting millions of consumers. Understanding CVS Health SWOT Analysis is key to grasping its strategic direction.

From its origins as Consumer Value Stores in 1963, CVS Health, now a healthcare giant, has undergone significant ownership evolution. Knowing who owns CVS, including its major shareholders and the CVS parent company, is vital for investors and analysts. This knowledge sheds light on the company's strategic priorities and its capacity to influence the future of healthcare. The company's structure involves a vast network of institutional investors and public shareholders, making the question of CVS ownership a complex one.

Who Founded CVS Health?

CVS Health, a prominent player in the healthcare industry, traces its origins back to 1963. It was founded by brothers Stanley and Sidney Goldstein, along with Ralph Hoagland, in Lowell, Massachusetts. This marked the beginning of what would become a significant retail and healthcare enterprise.

The initial ownership structure of CVS Health was a partnership among the founders. While specific equity splits at the company's inception are not publicly detailed, the founders' vision was centered on providing value to consumers. This focus on value was a key element of their early strategy.

Early operations were likely supported by the founders' own funds and potentially small investments from their network. As the company expanded, it evolved from a closely held private entity to one that sought external capital to fuel its growth. The founders' commitment and the management of ownership changes were crucial as the company scaled. The founders' commitment to accessible consumer value was fundamental to the company's identity, influencing the initial distribution of control.

The founders of CVS Health, Stanley and Sidney Goldstein, along with Ralph Hoagland, established the company in 1963. The early ownership structure was a partnership among the founders. As the company grew, it transitioned from a closely held private entity to one that sought external capital. The founders' vision of providing accessible consumer value was foundational to the company's identity and influenced the initial distribution of control, emphasizing a unified approach to expansion.

- The founders' initial goal was to create a retail environment focused on value.

- Early growth involved rapid expansion within Massachusetts and beyond.

- Specific early agreements regarding vesting schedules or buy-sell clauses are not widely publicized.

- The founders' vision of accessible consumer value was foundational to the company's identity.

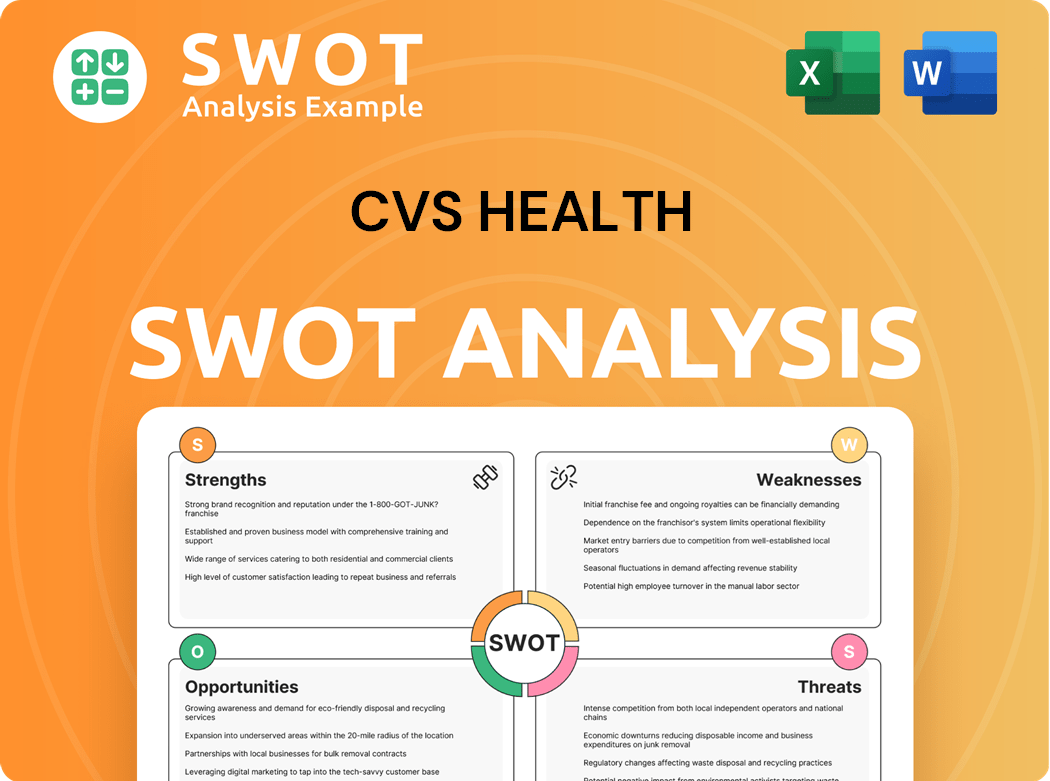

CVS Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CVS Health’s Ownership Changed Over Time?

The evolution of CVS Health's ownership structure is a story of growth and transformation since its initial public offering (IPO) in 1996. Initially, the company's ownership was more dispersed, but over time, it has shifted towards institutional investors. This change is typical for large, publicly traded corporations like CVS Health, reflecting a maturing market and increased investor confidence.

A pivotal moment in CVS Health's history was the acquisition of Aetna in 2018. This strategic move significantly altered the company's financial profile and market capitalization. The integration of Aetna expanded CVS Health's healthcare offerings, attracting substantial institutional investments. This shift solidified its position as a major player in the healthcare industry, influencing its stock performance and the composition of its shareholder base. This expansion also led to changes in the CVS parent company structure, as the combined entity became a more integrated healthcare provider.

| Major Stakeholders (as of March 31, 2024) | Percentage of Shares Held | |

|---|---|---|

| The Vanguard Group, Inc. | 8.94% | |

| BlackRock Inc. | 8.01% | |

| State Street Corp. | 4.14% | |

| Capital Research Global Investors | 3.39% | |

| Newport Trust Co. | 2.91% |

As of early 2024, institutional ownership of CVS Health is substantial. Major stakeholders, including prominent asset management firms and mutual funds, hold significant portions of the company's shares. These large institutional holdings reflect broad market confidence in CVS Health's long-term strategy and financial stability. These investors often engage with company management on governance, strategic direction, and financial performance. Considering the question of who owns CVS, it's clear that institutional investors play a crucial role in shaping the company's future.

CVS Health's ownership has evolved significantly since its IPO in 1996, with a shift towards institutional investors.

- The Vanguard Group, Inc. and BlackRock Inc. are among the largest institutional holders.

- The acquisition of Aetna in 2018 was a transformative event, attracting more institutional investment.

- These major shareholders influence company strategy and financial performance.

- Understanding CVS ownership is crucial for investors and stakeholders.

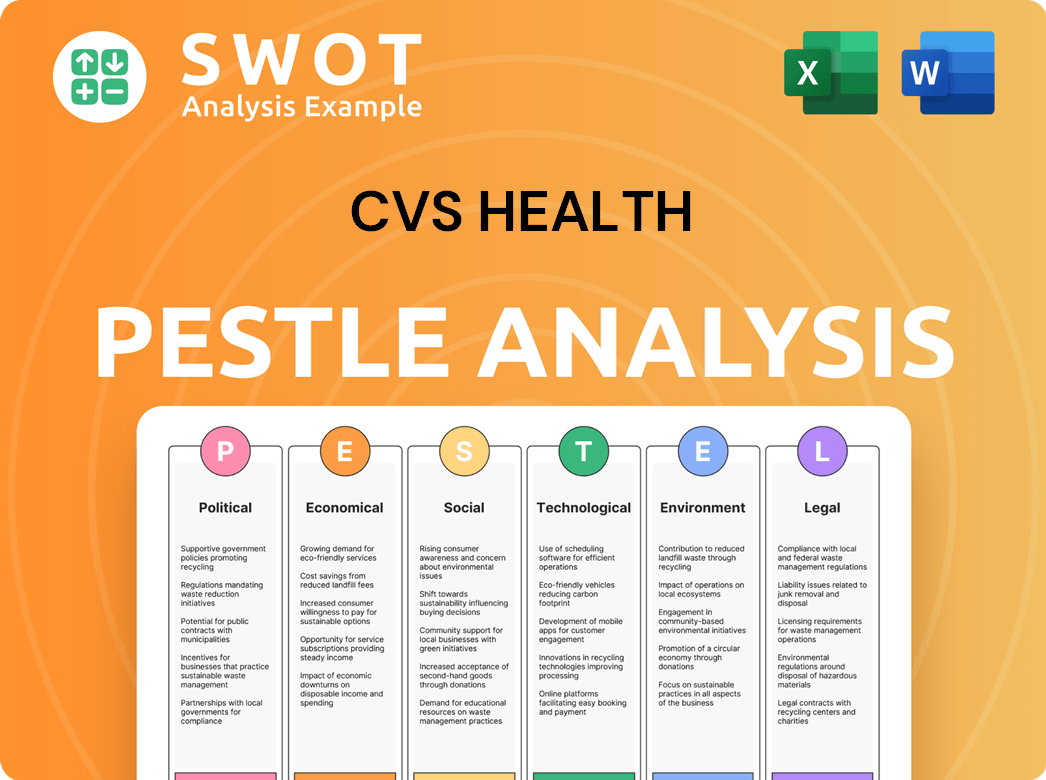

CVS Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CVS Health’s Board?

As of April 2025, the board of directors at CVS Health includes a variety of individuals, many of whom are independent directors. This structure is common among large publicly traded companies. The current Chairman of the Board is John W. Rowe, and Karen S. Lynch serves as President and CEO, also holding a board seat. Other board members bring expertise from healthcare, finance, and technology, which supports a wide range of perspectives in strategic planning. The company's board ensures good governance and oversight.

The board's composition reflects a balance of industry expertise and independent oversight. While specific board members representing major shareholders like Vanguard or BlackRock are not explicitly stated, the board's structure focuses on transparency and accountability to its shareholders. The company's governance framework emphasizes decision-making through a majority vote of shares represented at shareholder meetings. For more information about the company's operations, you can read about the Revenue Streams & Business Model of CVS Health.

| Board Member | Title | Key Affiliations |

|---|---|---|

| John W. Rowe | Chairman of the Board | Former CEO, Mount Sinai Health System |

| Karen S. Lynch | President and CEO | CVS Health |

| Mario J. Gabelli | Lead Independent Director | Founder, Chairman, and CEO of GAMCO Investors, Inc. |

CVS Health operates under a one-share-one-vote structure, meaning each common share has equal voting rights. There are no known dual-class shares or special voting rights. This structure ensures voting power is distributed proportionally among shareholders based on their equity holdings. In recent years, CVS Health has not faced significant proxy battles or activist investor campaigns that have publicly reshaped its governance or decision-making processes. The company's focus remains on transparency and accountability to its shareholders.

CVS Health's board includes independent directors and industry experts, ensuring diverse perspectives. The company uses a one-share-one-vote structure, promoting equitable voting rights for all shareholders. This structure supports transparency and accountability in decision-making.

- Board composition includes a mix of independent and executive directors.

- Voting rights are proportional to share ownership.

- The company focuses on transparent governance practices.

- There are no known special voting rights or dual-class shares.

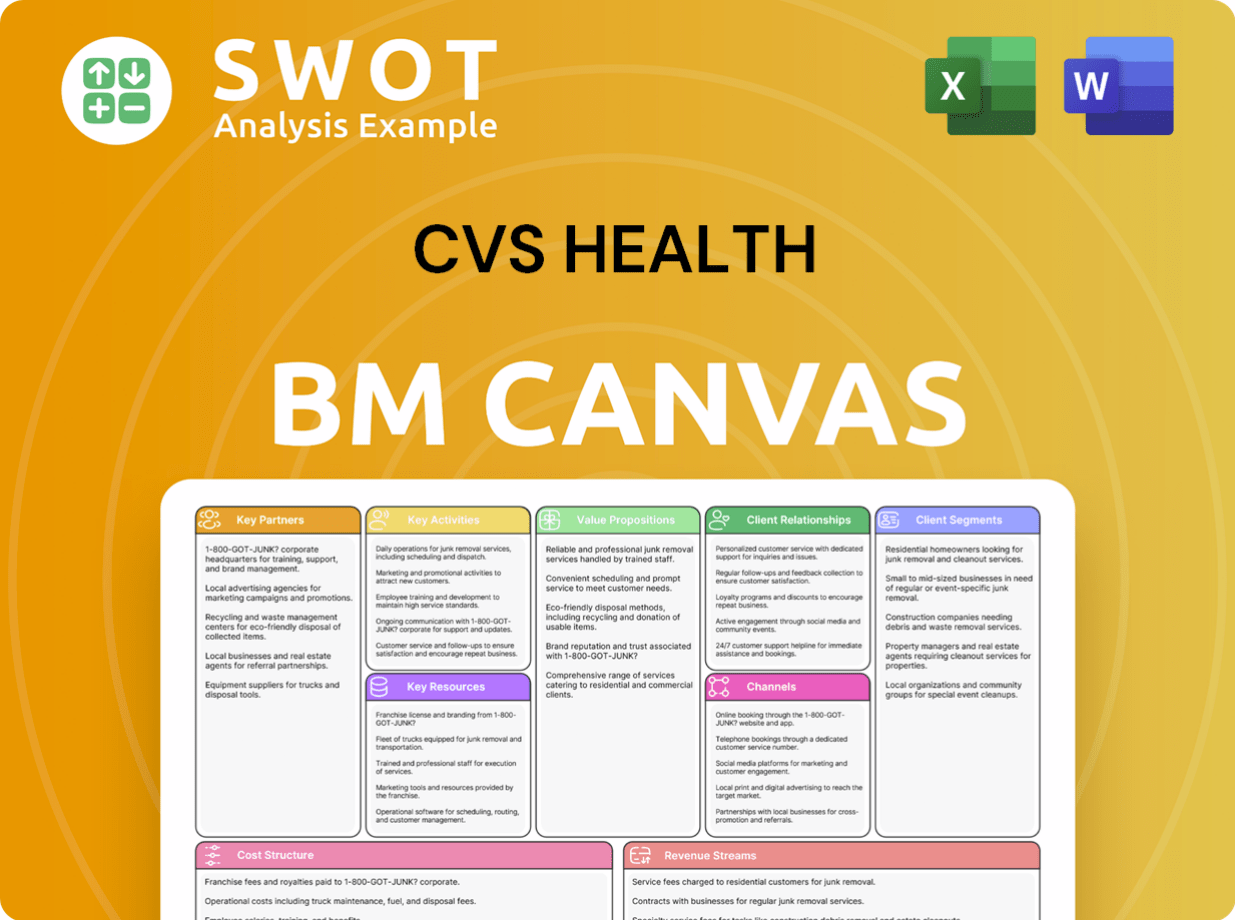

CVS Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CVS Health’s Ownership Landscape?

Over the past few years, the ownership structure of CVS Health, a publicly traded company, has remained largely consistent, with institutional investors holding a significant portion of the shares. This stability is typical for large-cap companies. The acquisition of Aetna, a major strategic move, has been a key development, integrating healthcare services and likely attracting long-term investors. This has solidified its position as an integrated healthcare provider.

The company's focus on strategic growth, digital transformation, and expanding its healthcare services continues to attract and retain investors. In 2023, CVS Health reported a substantial revenue of $357.8 billion, a key factor in maintaining investor interest. The company's stock symbol is CVS, and it is a Fortune 500 company. Furthermore, you can learn more about the Marketing Strategy of CVS Health.

Industry trends show a continued rise in institutional ownership across major corporations. While founder dilution is a natural progression for companies that have been public for decades, the current ownership is primarily distributed among a vast number of institutional and individual shareholders. There have been no public statements by the company or analysts about potential privatization or significant changes in the overall ownership structure in the near future. The company's financial performance and strategic initiatives remain key drivers for investor interest.

The Aetna acquisition significantly impacted CVS Health's strategic direction, solidifying its position in the integrated healthcare market. This move has likely attracted long-term investors. The focus remains on strategic growth and expansion of healthcare services.

Institutional investors continue to dominate the ownership profile of CVS Health. There have been no major share buybacks or secondary offerings. The company's robust financial performance, including the $357.8 billion revenue in 2023, supports investor confidence.

CVS Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CVS Health Company?

- What is Competitive Landscape of CVS Health Company?

- What is Growth Strategy and Future Prospects of CVS Health Company?

- How Does CVS Health Company Work?

- What is Sales and Marketing Strategy of CVS Health Company?

- What is Brief History of CVS Health Company?

- What is Customer Demographics and Target Market of CVS Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.