CVS Health Bundle

Who are CVS Health's Customers?

In the ever-changing healthcare landscape, understanding the "who" behind the customer is paramount. For CVS Health, this means more than just knowing who buys their products; it's about understanding the complex needs and preferences of a diverse customer base. From health-conscious individuals to employers managing benefits, CVS Health's success hinges on its ability to adapt and cater to its evolving target market. A deep dive into CVS Health SWOT Analysis can further illuminate these dynamics.

CVS Health's journey from a drugstore chain to a healthcare powerhouse highlights the importance of a well-defined customer profile. This exploration will uncover the nuances of CVS customer segmentation, examining age demographics, gender distribution, and income levels of its clientele. We'll analyze CVS customer buying behavior, geographic location, and psychographics to provide comprehensive CVS consumer insights. Furthermore, this analysis will delve into CVS Health's market segmentation strategy, customer needs and wants, and strategies for customer acquisition and retention to offer a complete picture of the company's approach.

Who Are CVS Health’s Main Customers?

Understanding the primary customer segments of CVS Health is crucial for grasping its market position and strategic direction. The company operates across both Business-to-Consumer (B2C) and Business-to-Business (B2B) models, serving a diverse range of customers with varying needs and preferences. This segmentation allows CVS Health to tailor its services and marketing efforts effectively, ensuring it meets the demands of its broad customer base.

In the B2C sector, CVS Health focuses on individual consumers who utilize its pharmacy services, over-the-counter medications, health and beauty products, and MinuteClinic locations. This segment includes a wide array of age groups, income levels, and family statuses. On the B2B side, CVS Health caters to businesses, offering health insurance plans through Aetna, and to long-term care facilities, providing pharmacy services for their residents. This dual approach enables CVS Health to capture a significant portion of the healthcare market.

The company's strategic initiatives, such as the acquisition of Oak Street Health in 2023 for approximately $10.6 billion, highlight its commitment to expanding its primary care services, particularly for Medicare beneficiaries. This move underscores CVS Health's focus on high-growth segments and its dedication to providing comprehensive healthcare solutions. These actions also demonstrate how CVS Health adapts to changing healthcare needs and market dynamics.

CVS Health's B2C segment encompasses a broad range of consumers. This includes individuals seeking pharmacy services, over-the-counter medications, and health and beauty products. MinuteClinic users often represent a younger, more urban demographic, while traditional pharmacy customers include a significant portion of the elderly population.

The B2B segment includes businesses of all sizes that offer health insurance plans to their employees through Aetna. Long-term care facilities are another key segment, relying on CVS Health for pharmacy services. These segments are driven by the need for cost-effective healthcare benefits and efficient medication management.

MinuteClinic users might skew younger and more urban, seeking convenience, while traditional pharmacy customers represent a wider age demographic, including a significant portion of the elderly population. The expansion of Medicare Advantage plans through Aetna targets the senior demographic.

CVS Health's acquisition of Oak Street Health in 2023 for approximately $10.6 billion emphasizes its commitment to expanding its primary care services for Medicare beneficiaries. This strategic move aligns with the company's focus on high-growth segments and integrated healthcare solutions. This demonstrates CVS Health's adaptability to changing market needs.

The CVS target market is diverse, spanning various age groups, income levels, and geographic locations. The customer base includes individuals seeking pharmacy services, health insurance enrollees, and residents of long-term care facilities. Understanding the CVS Health customer profile is key to tailoring services and marketing strategies.

- CVS customer segmentation is crucial for effective marketing.

- The company's focus on integrated healthcare solutions caters to a broad audience.

- The acquisition of Oak Street Health highlights a strategic shift toward primary care for seniors.

- For more insights, explore the Growth Strategy of CVS Health.

CVS Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do CVS Health’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and for CVS Health, this involves a deep dive into what drives their diverse customer base. The company serves a wide range of individuals, each with unique expectations regarding healthcare and retail experiences. This understanding allows CVS Health to tailor its services, products, and marketing strategies to meet these varied demands effectively.

The CVS Health customer profile is multifaceted, encompassing those seeking pharmacy services, MinuteClinic visits, and Aetna insurance coverage, among others. Each segment has distinct priorities, from convenience and affordability to comprehensive coverage and personalized care. The company's ability to address these diverse needs directly impacts customer satisfaction and loyalty, driving overall business performance.

For pharmacy customers, convenience is a significant factor. They seek easy prescription refills, often preferring digital platforms or drive-thru options. Affordability and trust in medication accuracy and pharmacist advice are also paramount. Personalized care and clear communication about medications are crucial, especially for those managing chronic conditions. The company’s adherence programs and medication synchronization services directly address the need for simplified medication management.

Pharmacy customers prioritize convenience, affordability, and trust. They often prefer digital platforms and drive-thru options for refills.

MinuteClinic users value accessibility and speed for minor ailments. They prefer walk-in availability and quick diagnoses.

Aetna members prioritize comprehensive coverage, access to a broad provider network, and transparent pricing. They seek a balance between premium costs and service scope.

Customers are increasingly seeking technology-enabled healthcare solutions. They prefer digital tools for managing health and accessing personalized insights.

The integration of CVS Health and Aetna aims to provide a seamless healthcare experience. This includes prescription fulfillment and insurance claims.

CVS Health uses customer feedback and market trends to influence product development. This includes expanding telehealth options and developing new health and wellness programs.

CVS Health continually adapts to meet evolving customer needs, focusing on convenience, personalized care, and comprehensive services. This approach is reflected in its strategic initiatives and investments in digital tools.

- Convenience: Customers value easy access to services, including prescription refills and MinuteClinic visits. This is supported by digital platforms and drive-thru options.

- Affordability: Customers seek cost-effective healthcare solutions and transparent pricing, especially Aetna members.

- Personalized Care: Tailored medication management, clear communication, and health insights are important, especially for those with chronic conditions.

- Comprehensive Coverage: Aetna members prioritize broad provider networks and extensive service offerings.

- Technology Integration: Customers appreciate technology-enabled healthcare solutions, including telehealth and digital health tools.

The company's commitment to understanding and addressing these needs is evident in its strategic initiatives, such as the integration of CVS Health and Aetna, and its investments in digital tools. This approach, as highlighted in the Growth Strategy of CVS Health, aims to enhance customer engagement and provide personalized health insights, reflecting a consumer preference for technology-enabled healthcare solutions.

CVS Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does CVS Health operate?

CVS Health maintains a substantial geographical footprint across the United States, with a robust retail presence and nationwide reach for its pharmacy services and health insurance products. As of early 2024, the company operates approximately 9,000 retail locations, including pharmacies and MinuteClinics, giving it a significant physical presence in communities nationwide. Its major markets are broadly distributed across urban, suburban, and even some rural areas, with a particularly strong concentration in densely populated regions where access to healthcare services is in high demand.

The company's market share and customer demographics can vary regionally, though CVS Health's brand recognition is strong nationally. For instance, states with a higher proportion of elderly residents might show a greater uptake of Medicare Advantage plans through Aetna. Urban centers with younger populations might see higher usage of MinuteClinics for acute, minor illnesses. CVS Health tailors its offerings by adjusting store formats, product assortments, and community outreach programs to specific regional needs, demonstrating a commitment to understanding its Revenue Streams & Business Model of CVS Health.

Recent strategic expansions, such as the acquisition of Oak Street Health, are focused on increasing CVS Health's presence in primary care, especially in underserved communities and areas with a high concentration of Medicare beneficiaries, further solidifying its presence in key demographic regions. The geographic distribution of sales and growth often mirrors population density and the prevalence of chronic conditions, with states like Florida, California, and Texas representing significant markets due to their large and growing populations.

CVS Health's market presence is extensive across the U.S., with a strong physical retail presence. Its retail locations, including pharmacies and MinuteClinics, are strategically placed to serve diverse communities.

Market share and customer demographics vary regionally. For example, states with more elderly residents may see higher Medicare Advantage plan uptake, while urban areas with younger populations may see more MinuteClinic visits.

Recent acquisitions like Oak Street Health focus on increasing CVS Health's presence in primary care. This expansion targets underserved communities and areas with high Medicare beneficiary concentrations.

Sales and growth often reflect population density and chronic condition prevalence. States like Florida, California, and Texas are significant markets due to their large and growing populations.

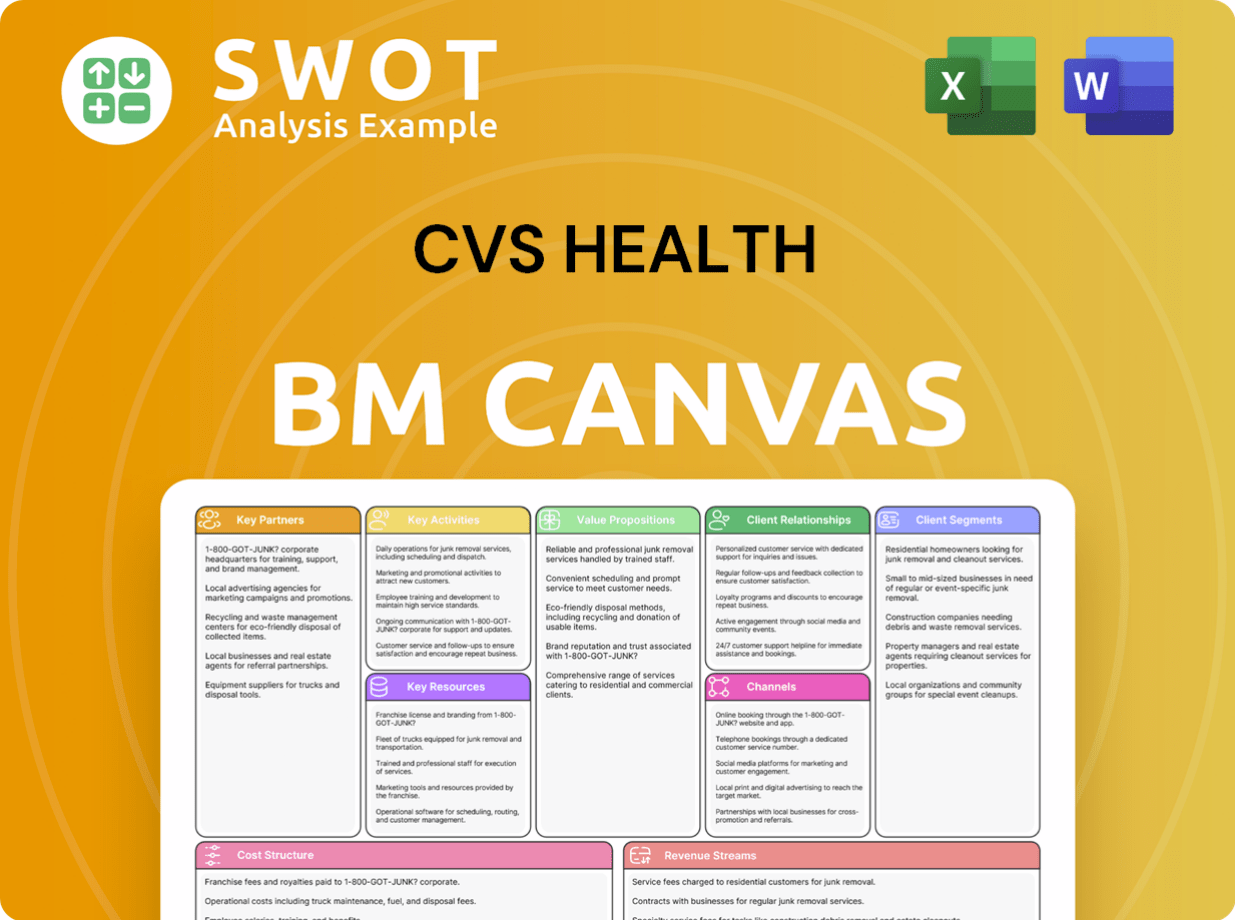

CVS Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does CVS Health Win & Keep Customers?

CVS Health's customer acquisition and retention strategies are designed to build a loyal customer base by offering integrated healthcare services and convenient access. The company leverages a mix of traditional and digital marketing channels to reach a broad audience. These strategies are crucial for maintaining a strong market position and driving sustainable growth in the competitive healthcare industry.

The company focuses on acquiring customers through extensive advertising campaigns across various platforms, including television, radio, and digital channels. They use their digital channels to target specific demographics with personalized health information and promotions. Retention strategies focus on creating a seamless customer experience and offering value through loyalty programs and integrated services.

CVS Health's approach to customer acquisition and retention is data-driven. They use customer relationship management (CRM) systems and data analytics to tailor communications and promotions, improving customer satisfaction and lifetime value. The integration of pharmacy, MinuteClinic, and Aetna aims to create a cohesive healthcare ecosystem that meets diverse customer needs. These efforts are supported by ongoing investments in digital health tools and telehealth services to attract and retain tech-savvy consumers. For more information about CVS Health's position in the market, consider exploring the Competitors Landscape of CVS Health.

CVS Health utilizes digital platforms like social media and search engine marketing to target specific customer demographics effectively. These channels allow for personalized health information and service promotions. This approach helps in reaching potential customers and driving them to the CVS Pharmacy app and online platforms.

The CVS CarePass loyalty program offers benefits like free prescription delivery, discounts, and monthly promotional rewards. These incentives encourage repeat business and foster customer loyalty. Such programs are essential for retaining customers and increasing their lifetime value within the CVS Health ecosystem.

The integration of pharmacy, MinuteClinic, and Aetna health plans creates a seamless customer journey. This integrated approach makes it convenient for customers to manage their health needs within the CVS Health ecosystem. This integration helps increase customer lifetime value and reduces churn.

CVS Health uses data analytics to personalize customer communications and offer relevant promotions. CRM systems are vital for managing customer interactions and tracking preferences. This focus on personalization enhances customer satisfaction and strengthens relationships.

Aetna's sales tactics involve direct sales teams working with employers and brokers. A strong online presence for individual plan enrollment also plays a key role. These strategies are designed to attract new customers to Aetna plans.

The convenience and accessibility of MinuteClinic services are often highlighted in acquisition campaigns. MinuteClinic offers a quick and easy healthcare option, attracting customers who value convenience. This is a key element in CVS Health's customer acquisition strategy.

Chronic disease management programs and proactive outreach for preventative care are important retention initiatives. These programs improve health outcomes and strengthen customer relationships. They demonstrate CVS Health's commitment to customer well-being.

CVS Health invests in digital health tools and telehealth services to attract tech-savvy consumers and retain existing ones. These modern healthcare solutions enhance convenience and accessibility. This helps to meet the evolving needs of its customer base.

CVS Health uses customer data analysis to understand customer buying behavior and preferences. This helps in tailoring marketing efforts and improving customer satisfaction. This data-driven approach is central to its acquisition and retention strategies.

The goal is to increase customer lifetime value by providing comprehensive healthcare solutions. The integrated model and loyalty programs contribute to this objective. This strategic focus ensures long-term customer relationships and financial success.

CVS Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CVS Health Company?

- What is Competitive Landscape of CVS Health Company?

- What is Growth Strategy and Future Prospects of CVS Health Company?

- How Does CVS Health Company Work?

- What is Sales and Marketing Strategy of CVS Health Company?

- What is Brief History of CVS Health Company?

- Who Owns CVS Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.