EDF Bundle

Can EDF Maintain Its Energy Dominance in a Shifting Market?

The European energy sector is undergoing a massive transformation, driven by decarbonization goals and geopolitical shifts. In this dynamic environment, understanding the competitive positioning of major players like Electricite de France (EDF) is critical. This analysis dives deep into the EDF SWOT Analysis to uncover the key rivals and market dynamics shaping its future.

This exploration of the EDF competitive landscape will provide a comprehensive EDF market analysis, examining its strengths and weaknesses in the face of intense energy sector competition. We'll identify EDF's competitors, evaluate its market share, and assess its strategies for navigating the renewable energy market and broader challenges. This detailed competitive analysis will offer actionable insights into EDF's future growth prospects.

Where Does EDF’ Stand in the Current Market?

Electricite de France (EDF) firmly holds a dominant market position in France's energy sector, functioning as the country's leading electricity producer and supplier. This strong standing is largely attributable to its extensive nuclear power infrastructure, which generates a significant portion of the nation's electricity. Globally, EDF is recognized as one of the largest electricity producers, boasting a gross installed generation capacity of 120.4 GW as of December 31, 2023.

EDF's core operations encompass a broad range of activities, including electricity generation from diverse sources such as nuclear, hydro, thermal, and renewables. It also manages electricity transmission through its subsidiary, RTE, which operates independently, and distribution via Enedis. Furthermore, EDF engages in energy supply and provides energy services. This comprehensive approach allows EDF to maintain a strong presence across the entire electricity value chain.

The company's value proposition lies in its ability to provide reliable and sustainable energy solutions. EDF is increasingly focusing on renewable energy projects and smart energy solutions, aligning with global decarbonization goals. This strategic shift is evident in its financial performance; for the fiscal year 2023, EDF reported a net income of €10.0 billion, a significant recovery from a net loss of €5.0 billion in 2022. Its EBITDA also saw a substantial increase to €39.9 billion in 2023 from €5.3 billion in 2022.

EDF's main offerings include electricity generation, transmission, distribution, supply, and energy services. The company leverages a diverse portfolio of energy sources, with a strong emphasis on nuclear power in France. Additionally, EDF is expanding its renewable energy projects to meet global decarbonization goals.

EDF has a strong presence in Europe, particularly in the UK through EDF Energy, and in Italy with Edison. The company also operates in North America, South America, Asia, and Africa. This global footprint allows EDF to diversify its operations and tap into various energy markets.

In 2023, EDF demonstrated a significant financial recovery, reporting a net income of €10.0 billion. This improvement reflects the company's strategic adjustments and operational efficiencies. The substantial increase in EBITDA to €39.9 billion highlights the company's strong financial health.

EDF is strategically shifting its focus toward renewable energy development and smart energy solutions. This shift aligns with global decarbonization objectives and positions EDF for long-term sustainability. The company's commitment to renewables is a key aspect of its competitive strategy.

The EDF competitive landscape is characterized by its strong position in France and significant global presence. However, the company faces increasing energy sector competition, particularly in the renewable energy market. Understanding EDF's market share compared to competitors is crucial for assessing its future growth prospects. For a deeper dive into EDF's growth strategies, consider reading about the Growth Strategy of EDF.

- Dominant market share in France due to nuclear power infrastructure.

- Expanding renewable energy portfolio to meet global demand.

- Increasing competition in the European energy market.

- Strategic focus on smart energy solutions and sustainability.

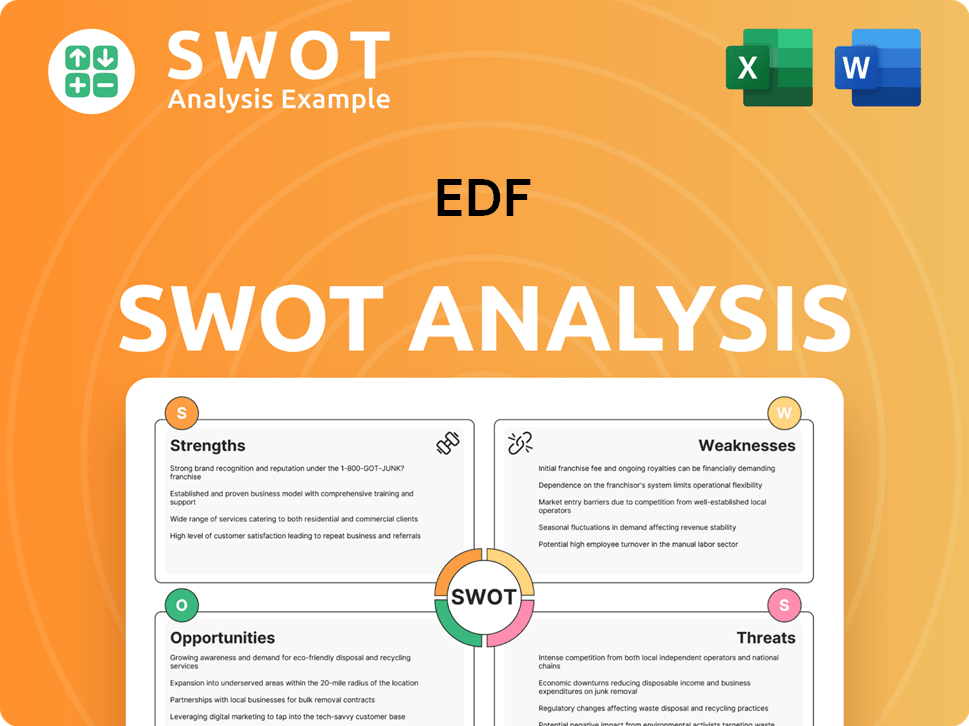

EDF SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging EDF?

The Owners & Shareholders of EDF faces a complex and dynamic competitive landscape, particularly within the energy sector. Its position is challenged by a variety of players across different geographical markets and business segments. Understanding these competitors is crucial for assessing EDF's strategic positioning and future prospects.

The company operates in a market characterized by significant capital investments, regulatory oversight, and technological advancements. This environment necessitates continuous adaptation and strategic maneuvering to maintain or improve its market share. The competitive dynamics are further shaped by the global push towards renewable energy sources and the evolving demands of consumers.

EDF's competitive landscape is multifaceted, encompassing both established and emerging players. The company must navigate these challenges to maintain its market position and achieve its strategic goals. The competitive dynamics are also influenced by the increasing focus on decentralized energy and prosumer models, which introduces new local and regional competitors.

In electricity generation, especially in Europe, EDF competes with major integrated utilities. These competitors often challenge EDF in renewable energy auctions and conventional power generation.

Key rivals include Enel (Italy), E.ON and RWE (Germany), Iberdrola (Spain), and Engie (France). These companies compete in renewable energy and energy supply.

In the UK, EDF Energy competes with British Gas (Centrica), E.ON UK, ScottishPower (Iberdrola subsidiary), and OVO Energy. These companies focus on retail electricity and gas supply.

Emerging players and independent power producers, like Ørsted in offshore wind, are challenging traditional utilities. These companies rapidly deploy large-scale renewable projects.

The energy services sector sees competition from specialized firms and tech companies. These entrants focus on smart home and energy management.

Mergers and alliances, like those in renewable energy, create larger rivals. This consolidation impacts the competitive dynamics significantly.

EDF's competitive strategies involve maintaining a balance between traditional energy sources and investments in renewable energy. The company faces challenges from fluctuating energy prices, regulatory changes, and the need to innovate in a rapidly evolving market. The shift towards decentralized energy and prosumer models also brings new local and regional competitors into play.

- Market Share: EDF's market share varies by region, with significant presence in France and the UK. In France, EDF holds a substantial share of the electricity market.

- Financial Performance: EDF's financial performance is influenced by factors like energy prices, operational efficiency, and investments in new projects. The company's financial results are closely watched by investors and analysts.

- Renewable Energy Investments: EDF has been actively investing in renewable energy projects, including wind and solar. These investments are crucial for long-term competitiveness.

- Regulatory Impact: Government regulations and policies significantly impact EDF's operations. Changes in energy policies can affect the company's profitability and strategic direction.

- Technological Advancements: Technological advancements, such as smart grids and energy storage solutions, are transforming the energy sector. EDF must adapt to these changes to remain competitive.

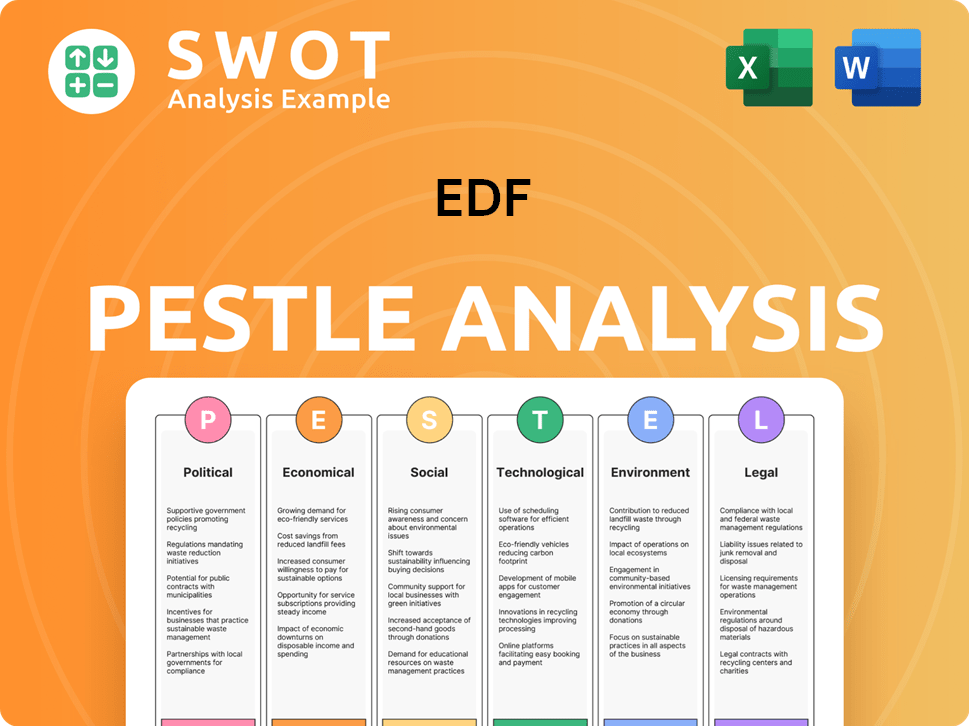

EDF PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives EDF a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Electricite de France (EDF) involves assessing its core strengths in a dynamic energy market. EDF's competitive advantages stem from its established position and strategic evolution. The company has a long history, evolving from a national utility to a global energy player. This transition has shaped its current competitive edge, influencing its strategies and market position.

The company's approach to innovation and sustainability, particularly in the renewable energy sector, is crucial for its future. EDF's commitment to decarbonization and renewable energy aligns with global trends, enhancing its long-term sustainability. This focus is essential for maintaining a competitive advantage in a market increasingly driven by environmental concerns and regulatory changes.

The company's integrated business model, encompassing generation, transmission, distribution, and supply, provides economies of scale. This integrated model differentiates it from more specialized competitors. By managing the entire value chain, EDF can optimize operations and respond effectively to market demands, solidifying its competitive position in the energy sector.

EDF's extensive nuclear fleet offers a significant baseload electricity generation capacity. This provides a stable and low-carbon power supply. The expertise in operating and maintaining complex nuclear infrastructure is a proprietary technological advantage, built over decades. This expertise is a sustainable advantage given the high barriers to entry.

The integrated model, including generation, transmission, distribution, and supply, provides operational efficiencies. Economies of scale and optimized value chain management distinguish EDF from competitors. This structure allows for better control over costs and responsiveness to market changes, which is a key element of the Target Market of EDF.

Strong brand recognition and customer loyalty, particularly in France, are significant assets. EDF has historically been the incumbent provider, building a loyal customer base. This brand equity provides a competitive advantage in customer acquisition and retention. As of 2024, EDF serves millions of customers across various markets.

The extensive distribution networks, managed by Enedis, offer unparalleled reach within France. This infrastructure allows for efficient delivery of electricity to a vast customer base. The reach and reliability of these networks are critical for maintaining market share and customer satisfaction.

EDF's competitive advantages are multifaceted, encompassing nuclear expertise, an integrated business model, strong brand equity, and extensive distribution networks. These elements collectively position EDF favorably in the energy sector. The company's strategic focus on innovation and sustainability further enhances its long-term prospects.

- Nuclear Power: EDF's nuclear fleet provides a reliable baseload and low-carbon energy source.

- Integrated Model: This structure optimizes operations and enhances value chain management.

- Brand Equity: Strong brand recognition and customer loyalty support market share.

- Distribution Networks: Extensive networks ensure efficient electricity delivery.

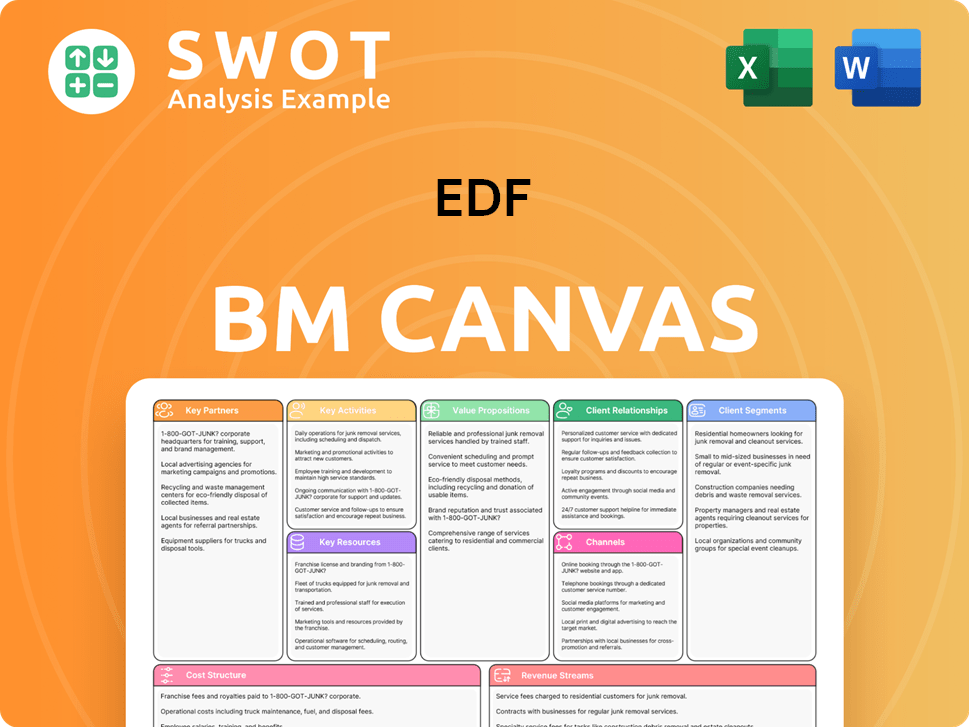

EDF Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping EDF’s Competitive Landscape?

Analyzing the EDF competitive landscape reveals a company navigating a rapidly changing energy sector. The company faces significant challenges and opportunities due to global trends in decarbonization, digitalization, and evolving regulatory environments. Understanding EDF's competitors and its strategic positioning is crucial for stakeholders.

The EDF market analysis indicates a shift towards renewable energy sources and smart grid technologies, which is reshaping the industry. Electricite de France must adapt to these changes while managing its existing nuclear fleet and facing increased competition in the energy sector competition.

The energy industry is experiencing a major shift towards decarbonization, with a strong emphasis on renewable energy sources. Digitalization and smart grid technologies are also reshaping the sector, enabling more efficient energy management and integration of decentralized energy sources. Regulatory changes, particularly in Europe, are pushing for greater market liberalization and stricter environmental standards.

Managing the costs and complexities of nuclear fleet maintenance and new plant construction poses a significant challenge. Intensifying competition in renewable energy markets and adapting to changing consumer preferences for decentralized energy solutions are also key hurdles. Geopolitical shifts and energy security concerns are adding further complexities to the market.

Expanding its renewable energy portfolio, particularly in offshore wind and solar, presents a significant growth opportunity. Developing innovative energy services and storage solutions, along with leveraging nuclear expertise, can also create new avenues for expansion. Strategic partnerships in emerging technologies like hydrogen and small modular reactors (SMRs) offer further potential.

To remain competitive, EDF is likely to evolve towards a more diversified and decentralized model. This will involve a strong emphasis on low-carbon energy production and integrated energy services. The company must strategically invest in renewables and adapt to market dynamics.

EDF's competitive landscape is influenced by its ability to manage its nuclear assets and expand its renewable energy footprint. The company's financial performance and strategic decisions are crucial for its future. Understanding EDF's competitors and their strategies is essential for effective market positioning.

- Renewable Energy Investments: EDF aims to increase its renewable energy capacity. In 2024, EDF Renewables is planning to invest heavily in solar and wind projects.

- Nuclear Fleet Management: The company is focusing on extending the lifespan of existing nuclear plants. The costs associated with nuclear maintenance and new plant construction are significant.

- Market Liberalization: Regulatory changes in Europe are pushing for greater market liberalization. This increases competition and impacts EDF's traditional market dominance.

- Digital Transformation: Digitalization and smart grid technologies are reshaping the sector, allowing EDF to offer smart energy services.

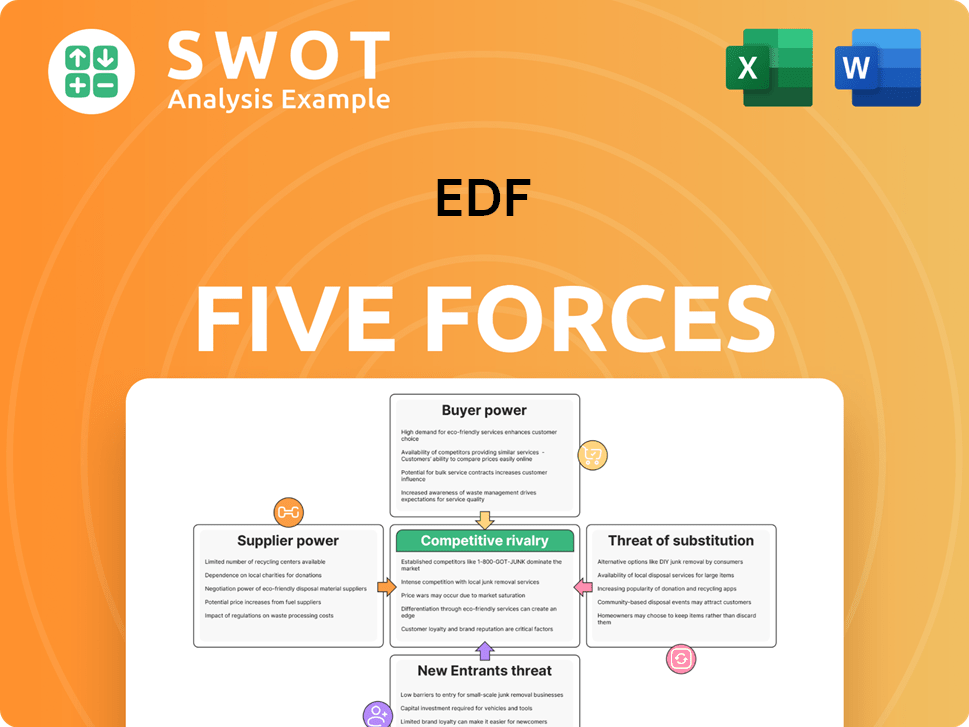

EDF Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EDF Company?

- What is Growth Strategy and Future Prospects of EDF Company?

- How Does EDF Company Work?

- What is Sales and Marketing Strategy of EDF Company?

- What is Brief History of EDF Company?

- Who Owns EDF Company?

- What is Customer Demographics and Target Market of EDF Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.