EDF Bundle

Who Really Owns EDF?

Unraveling the ownership structure of a major energy player like EDF (Électricité de France) is key to understanding its strategic direction and future prospects. The recent complete renationalization of EDF marks a significant shift, but what does this mean for investors and the energy market? Understanding the EDF SWOT Analysis is crucial for any stakeholder.

From its inception as a state-owned entity to its current status, the EDF company's ownership has evolved significantly. This exploration of EDF ownership delves into the French state's role, the influence of EDF shareholders, and the implications for EDF Energy's operations. Discover the intricacies of who controls EDF and how these dynamics shape its position in the global energy landscape, including its subsidiaries and the broader market.

Who Founded EDF?

The story of EDF's founding and early ownership differs significantly from that of most companies. Instead of starting with individual entrepreneurs, it emerged from a pivotal act of nationalization in France. This transformation reshaped the electricity sector, giving rise to a state-owned entity with a unique ownership structure.

The French state, through its legislative and executive branches, effectively became the 'founder' of EDF. This occurred following the nationalization of the electricity and gas industries through the law of April 8, 1946. The objective was to create a unified, publicly controlled electricity system to ensure universal access and support national economic development.

At its inception, EDF was established as an Établissement Public à Caractère Industriel et Commercial (EPIC). This meant it was a public industrial and commercial establishment, wholly owned and controlled by the French state. This structure meant there were no private shareholders or initial public offerings in the traditional sense.

The initial ownership of the EDF company was entirely vested in the French state. This structure was designed to serve public interests. The nationalization law of 1946 defined EDF's public service missions and operational framework, establishing a centralized control system.

- The French state was the sole owner, with no private shareholders.

- The EPIC status ensured state control and public service obligations.

- The nationalization law defined EDF's operational framework.

- The focus was on universal access and economic development, not profit maximization.

EDF SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has EDF’s Ownership Changed Over Time?

The evolution of EDF ownership reflects significant shifts in its structure, beginning as a fully state-owned entity in 1946. The French government's role has been central, with a major change occurring in November 2005 when Electricite de France (EDF) went public on the Euronext Paris stock exchange. This initial public offering (IPO) allowed private investors to purchase shares, yet the French state maintained a dominant position.

The most recent and impactful change is the complete renationalization of the EDF company. In October 2022, the French government announced its plan to acquire the remaining shares, and by June 2024, this process was finalized, returning EDF to nearly 100% state ownership. This move was driven by the need to secure financial stability for large-scale investments in nuclear and renewable energy, crucial for France's energy independence and climate objectives. This shift significantly impacts EDF's strategy and governance, aligning it with the state's long-term energy policies.

| Event | Date | Impact on Ownership |

|---|---|---|

| Creation as State-Owned Entity | 1946 | 100% French State Ownership |

| Initial Public Offering (IPO) | November 2005 | Partial privatization; French State ownership reduced to approximately 85% |

| Renationalization Announcement | October 2022 | French government plans to acquire remaining shares |

| Full Renationalization Completion | June 2024 | French State ownership reaches nearly 100% |

Prior to full renationalization, the EDF shareholders included institutional investors, mutual funds, and individual shareholders. However, the French state consistently held a significant majority. For example, in early 2022, the state controlled approximately 83.88% of EDF's capital and 89.17% of its voting rights. The complete renationalization ensures that EDF's strategic direction and financial resources are now entirely aligned with the French government's energy policy. To understand more about the company's strategic direction, you can read about the Growth Strategy of EDF.

The ownership of EDF has transitioned from complete state control to partial privatization and back to full state ownership.

- The French state has consistently been the primary shareholder.

- The 2024 renationalization aims to support large-scale investments in nuclear and renewable energy.

- The change impacts EDF's strategy and governance, aligning it with the state's energy policy.

- The company's structure is now fully aligned with the state's long-term energy policy and investment priorities.

EDF PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on EDF’s Board?

With the complete renationalization of the EDF company, the composition of its Board of Directors has shifted significantly. Before full renationalization, the board included representatives from the French state, independent directors, and employee representatives. As of early 2024, the Board comprised 18 members: 6 representing the French state, 6 independent directors, and 6 employee representatives. The Chairman and CEO of EDF is Luc Rémont, appointed by presidential decree.

The current board's structure reflects the French state's near-total ownership. This ensures that decisions align with the government's energy policy, focusing on energy transition, nuclear programs, and energy security. The independent directors and employee representatives still offer diverse viewpoints, but the state holds the ultimate control. This structure differs from the pre-renationalization period, where private shareholders had a more significant influence.

| Board Member Category | Number of Members (Early 2024) | Primary Role |

|---|---|---|

| French State Representatives | 6 | Ensure alignment with national energy policy |

| Independent Directors | 6 | Provide diverse perspectives and expertise |

| Employee Representatives | 6 | Represent employee interests |

The voting structure of EDF is now effectively a one-share-one-vote system, with the French state holding nearly 100% of the capital and voting power following the June 2024 renationalization. Before this, the state held 83.88% of the capital and 89.17% of the voting rights as of early 2022. This complete state control eliminates any significant private shareholder influence. The French government's control ensures that EDF's strategic direction aligns with national interests. For more insights, consider reading about the Marketing Strategy of EDF.

EDF is now almost entirely owned by the French state, giving the government complete control over its operations.

- The Board of Directors includes representatives from the state, independent directors, and employees.

- The Chairman and CEO, Luc Rémont, is appointed by the French government.

- The state's control ensures alignment with national energy goals.

- There are no significant private shareholders influencing decisions.

EDF Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped EDF’s Ownership Landscape?

The most significant recent development regarding the EDF company ownership is its complete renationalization by the French state, finalized in June 2024. The French government acquired the remaining 16% of shares it didn't already own. This move led to the delisting of EDF from the Euronext Paris stock exchange. This strategic decision, announced in 2022, was aimed at providing EDF with the financial stability and strategic flexibility needed for substantial investments in France's nuclear fleet and renewable energy infrastructure.

The total cost of this renationalization for the French state was approximately €9.7 billion. This full state ownership marks a reversal of the partial privatization that occurred in 2005, representing a clear trend toward increased state control over critical energy infrastructure in France. This shift reflects broader industry trends where governments are reasserting control over energy companies to address energy security concerns and accelerate the energy transition. For EDF, this means direct alignment with the French government's ambitious nuclear new build program and further investments in renewables.

Public statements from the French government and EDF leadership, including CEO Luc Rémont, have consistently emphasized that full state ownership will enable EDF to focus on its long-term strategic objectives. This includes tackling the significant debt burden and financing the multi-billion-euro investments required to modernize and expand France's energy production capabilities. The renationalization also aims to simplify governance and decision-making processes, positioning EDF as a key instrument of French energy policy for decades to come. As of 2024, the company is entirely government-owned, removing the influence of EDF shareholders.

The complete renationalization of EDF by the French state, finalized in June 2024, is the most significant recent change in its ownership profile.

The French state spent approximately €9.7 billion to acquire the remaining shares and delist EDF from the stock exchange.

Full state ownership aims to provide financial stability and strategic flexibility for investments in nuclear and renewable energy.

EDF is now positioned to align directly with the French government's energy policy, including nuclear new builds and renewables.

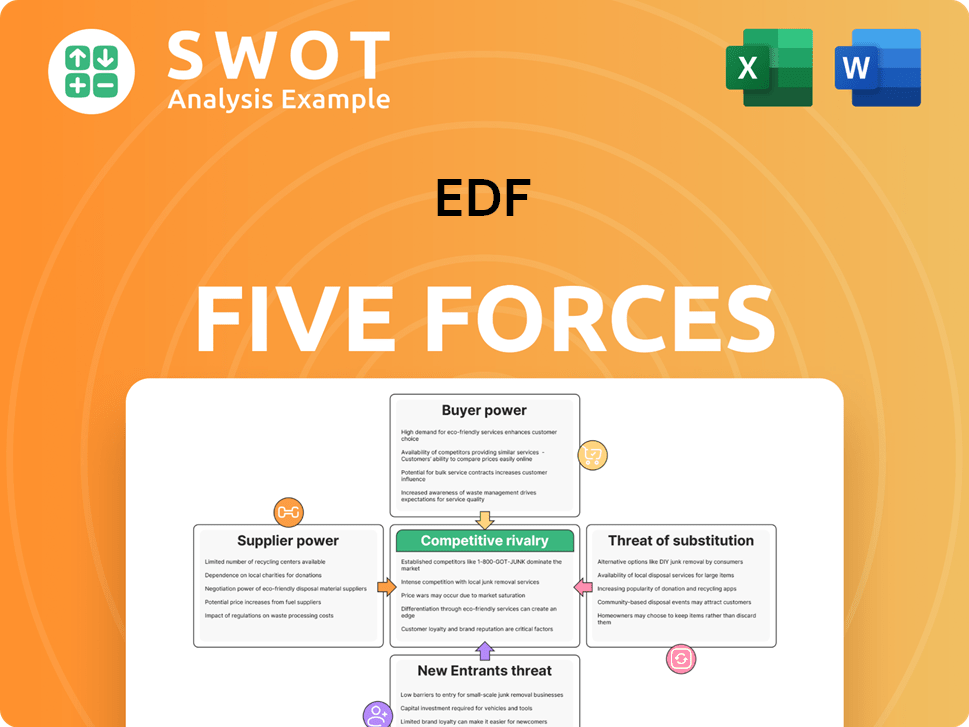

EDF Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EDF Company?

- What is Competitive Landscape of EDF Company?

- What is Growth Strategy and Future Prospects of EDF Company?

- How Does EDF Company Work?

- What is Sales and Marketing Strategy of EDF Company?

- What is Brief History of EDF Company?

- What is Customer Demographics and Target Market of EDF Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.