Fair Isaac Bundle

How Does Fair Isaac Company Dominate the Financial Services Arena?

In the fast-paced world of financial services, understanding risk is key, and Fair Isaac Company (FICO) has long been a pivotal player. From its inception, FICO has revolutionized credit scoring, becoming a cornerstone for lenders worldwide. This analysis dives into the Fair Isaac SWOT Analysis to explore its competitive position.

This exploration of the FICO's competitive landscape will reveal how FICO maintains its market leadership in the face of evolving market trends and fierce competition within the credit scoring and financial services industries. We'll examine who FICO's main competitors are and the strategies it employs to maintain its competitive advantage. This in-depth market analysis will provide valuable insights for anyone interested in the financial performance and growth strategies of Fair Isaac Company.

Where Does Fair Isaac’ Stand in the Current Market?

Fair Isaac Company (FICO) holds a commanding position in the credit scoring and decision management analytics market. Its core operations revolve around the development and provision of credit scoring models and analytics software, with the FICO Score being its flagship product. This score is the industry standard, influencing lending decisions across the United States. The company's value proposition lies in its ability to provide reliable, data-driven solutions that help businesses manage risk, detect fraud, and optimize customer interactions within the financial services sector and beyond.

The company's business model is centered on licensing its scores and software to lenders, credit bureaus, and other businesses. FICO generates revenue through the sale of its products and services, including recurring revenue from subscriptions and updates. This model ensures a steady income stream, reflecting the essential nature of its offerings in today's financial ecosystem. The company’s focus on innovation and continuous improvement of its analytical tools further strengthens its market position.

FICO's extensive geographic presence, serving clients in over 100 countries, highlights its global impact. While it maintains a strong hold in the U.S. credit market, FICO has expanded its international footprint, adapting its solutions to meet the specific regulatory and market needs of various regions. This expansion strategy is crucial for sustaining growth and diversifying its revenue streams, ensuring its relevance in the evolving financial landscape.

The FICO Score is the most widely used credit score in the U.S., with approximately 90% of top lenders using it. This widespread adoption gives FICO significant influence over lending decisions and consumer finance. The FICO Score's established reputation and reliability contribute to its continued dominance in the market.

For the second quarter of fiscal year 2024, FICO reported revenues of $428.1 million, a 9% increase year-over-year. The Scores segment revenue increased by 10% to $201 million, while the Software segment revenue grew by 8% to $227 million. These figures demonstrate the company's strong financial health and its ability to drive growth across its core segments.

FICO has diversified its offerings beyond traditional credit scoring, moving into broader decision management platforms. This strategic shift enables businesses to automate and optimize a wide range of operational decisions. The company's expansion into new markets and product areas is key to its long-term growth strategy.

FICO serves clients in over 100 countries, demonstrating its global reach. While the U.S. credit market remains a stronghold, FICO is adapting its solutions to meet the unique demands of different regions. This international presence is a critical component of its overall market strategy.

FICO's competitive advantages include its strong brand recognition, the widespread adoption of its FICO Score, and its comprehensive suite of analytics software. The company's ability to provide reliable and data-driven solutions for risk management and decision-making is a key differentiator. To understand the company's marketing strategy, read about the Marketing Strategy of Fair Isaac.

- Dominant market share in credit scoring.

- Strong financial performance with consistent revenue growth.

- Extensive product portfolio catering to various financial services needs.

- Global presence with solutions adapted for different markets.

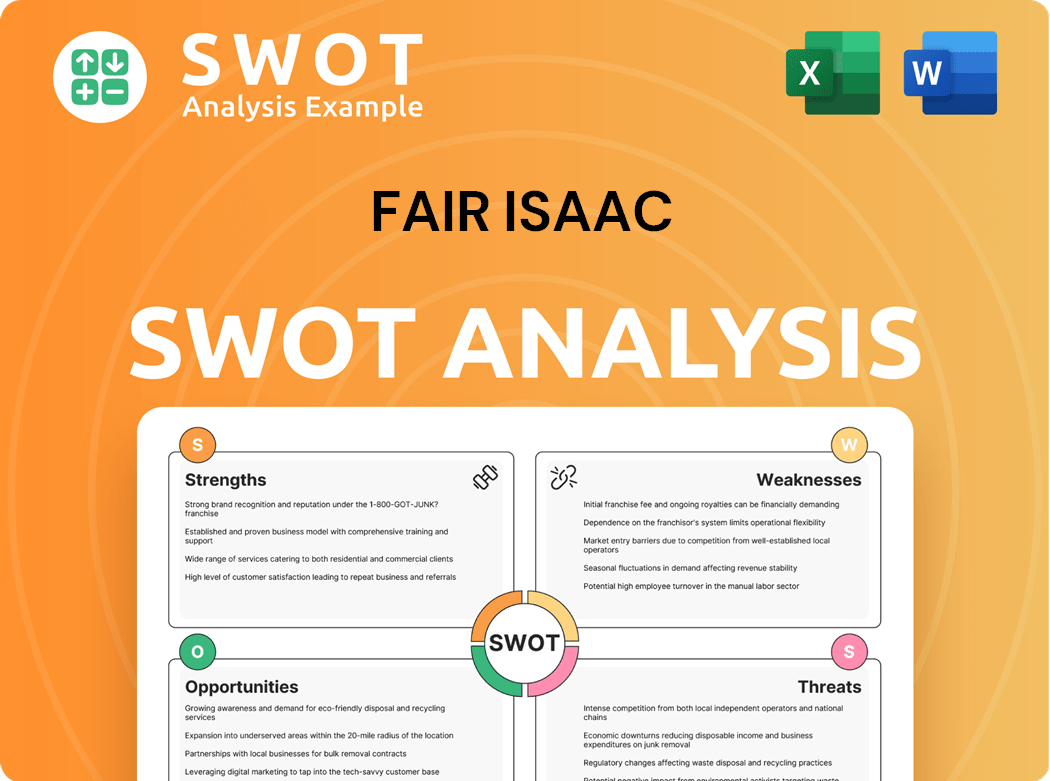

Fair Isaac SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Fair Isaac?

The Fair Isaac Company (FICO) operates within a dynamic competitive landscape, facing challenges and opportunities across various sectors. Understanding its key rivals is crucial for any market analysis or strategic assessment. The company's position is constantly evolving due to technological advancements, shifting consumer behaviors, and the entrance of new players.

FICO's business model relies heavily on its credit scoring and analytics products. These offerings are essential for financial institutions, businesses, and consumers. Its competitive landscape includes established firms and emerging entities, each vying for market share in data analytics, risk management, and credit assessment.

The Fair Isaac Company's competitive environment is complex, with a mix of traditional and innovative competitors. The company's success depends on its ability to adapt and innovate. The FICO's ability to maintain its market position depends on its ability to adapt to these changes. To learn more about the company's origins, you can read a Brief History of Fair Isaac.

The primary direct competitors for FICO in the credit scoring and risk assessment space are the 'Big Three' credit bureaus: Experian, Equifax, and TransUnion. These companies are major players in the financial services sector. They offer similar products and services, directly challenging FICO's dominance.

VantageScore, a credit scoring model developed jointly by Experian, Equifax, and TransUnion, serves as a significant competitor to the FICO Score. It is a widely used alternative in the U.S. market. VantageScore aims to provide a competitive option for lenders and consumers.

In the realm of fraud detection and financial crime prevention, companies like LexisNexis Risk Solutions and NICE Actimize offer robust platforms that compete with FICO's fraud solutions. These companies provide specialized services in risk management. They are significant players in the financial services industry.

Major technology companies such as SAS Institute and IBM, with their extensive data analytics and AI capabilities, present formidable competition for FICO, particularly in enterprise-level deployments. These larger tech players often leverage their vast resources and integrated platforms. They offer comprehensive solutions that can encompass or even supersede FICO's specialized offerings.

Fintech startups are emerging as competitors, especially those using alternative data sources and advanced machine learning. These companies focus on non-traditional credit assessments, such as evaluating banking transaction data or utility payments. They are beginning to carve out niches, especially in serving underserved populations.

The increasing adoption of cloud-based analytics and AI platforms means that more companies, even those without a traditional credit scoring background, can develop sophisticated risk assessment tools. This trend expands the competitive landscape, allowing new entrants to offer innovative solutions.

FICO's competitive advantage depends on several factors, including its brand recognition, the accuracy and reliability of its scoring models, and its ability to innovate. The company must continuously adapt to maintain its market position. Understanding these factors is crucial for a thorough competitive analysis of FICO.

- Brand Recognition: FICO is a well-established brand, but competitors like Experian, Equifax, and TransUnion also have strong brand presence.

- Scoring Accuracy and Reliability: The accuracy and reliability of credit scores are critical. FICO's historical data and scoring models are well-regarded, but competitors are constantly improving their models.

- Innovation: FICO must innovate to stay ahead. This includes adopting new technologies like AI and machine learning.

- Data Sources: Access to comprehensive and up-to-date data is essential. FICO's competitors have access to similar data sources.

- Customer Relationships: Strong relationships with financial institutions and other clients are crucial. FICO maintains extensive customer relationships.

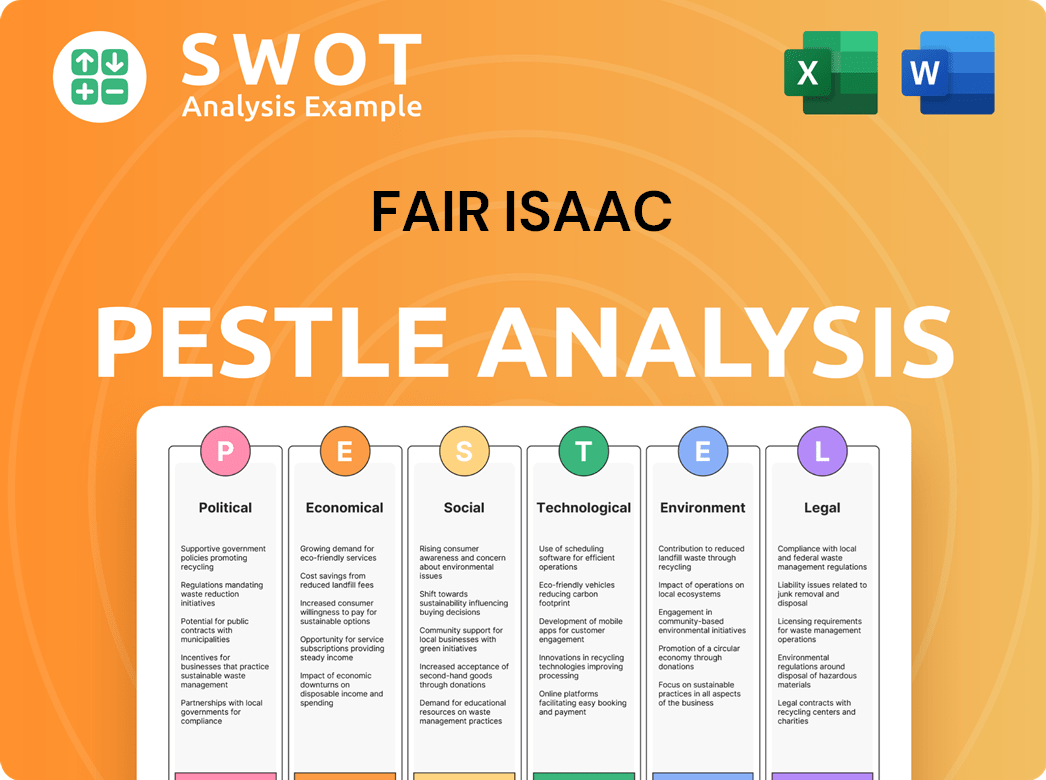

Fair Isaac PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Fair Isaac a Competitive Edge Over Its Rivals?

Fair Isaac Company (FICO) maintains a strong competitive position in the financial services sector. Its primary strength lies in its proprietary technologies, extensive intellectual property, and the widely recognized FICO Score. The FICO Score has become the industry standard for credit risk assessment, particularly in the United States, establishing a significant barrier to entry and fostering high switching costs for lenders.

Beyond the FICO Score, the company leverages its expertise in predictive analytics, machine learning, and artificial intelligence to develop sophisticated solutions for risk management, fraud detection, and customer engagement. This data advantage, built upon decades of data collection and analysis, is a key differentiator. FICO's consistent investment in research and development, such as FICO Score 10 T, underscores its commitment to innovation and maintaining a technological edge.

FICO's competitive advantages also include strong customer loyalty, built through long-standing relationships with major financial institutions. Its solutions are often deeply integrated into clients' operational workflows, making FICO a critical partner. However, the company faces potential threats from alternative data sources, advancements in open-source AI, and increasing regulatory scrutiny.

FICO has a long history of innovation, with the FICO Score becoming the industry standard. The company has consistently updated its scoring models to adapt to changing market conditions. Recent developments include the introduction of FICO Score 10 T, which incorporates trended credit data.

FICO focuses on continuous product development and strategic partnerships to maintain its market position. The company invests heavily in research and development to enhance its analytics software and decision management platforms. FICO aims to deliver measurable value to its diverse client base by evolving its offerings.

FICO's competitive edge stems from its proprietary technologies, extensive intellectual property, and brand recognition. The FICO Score's widespread adoption creates high switching costs for lenders. FICO's expertise in predictive analytics and machine learning provides a significant data advantage.

The competitive landscape for FICO includes both established and emerging players in the credit scoring and risk management sectors. Market trends indicate a growing demand for advanced analytics and AI-driven solutions. The company's ability to adapt to these trends will be crucial for its continued success.

FICO's competitive advantages are rooted in its proprietary technologies and the FICO Score's widespread adoption. The company's strong brand recognition and established relationships with major financial institutions are also key strengths. These factors contribute to high switching costs for clients and a sticky customer base.

- Proprietary Technology: FICO's scoring models and analytical platforms are protected by numerous patents, creating a barrier to entry.

- Data Advantage: FICO has decades of experience in collecting and analyzing vast datasets, which gives it an edge over competitors.

- Strong Customer Relationships: Long-standing relationships with major financial institutions foster customer loyalty and provide valuable feedback.

- Continuous Innovation: FICO consistently invests in research and development, such as FICO Score 10 T, to improve its offerings.

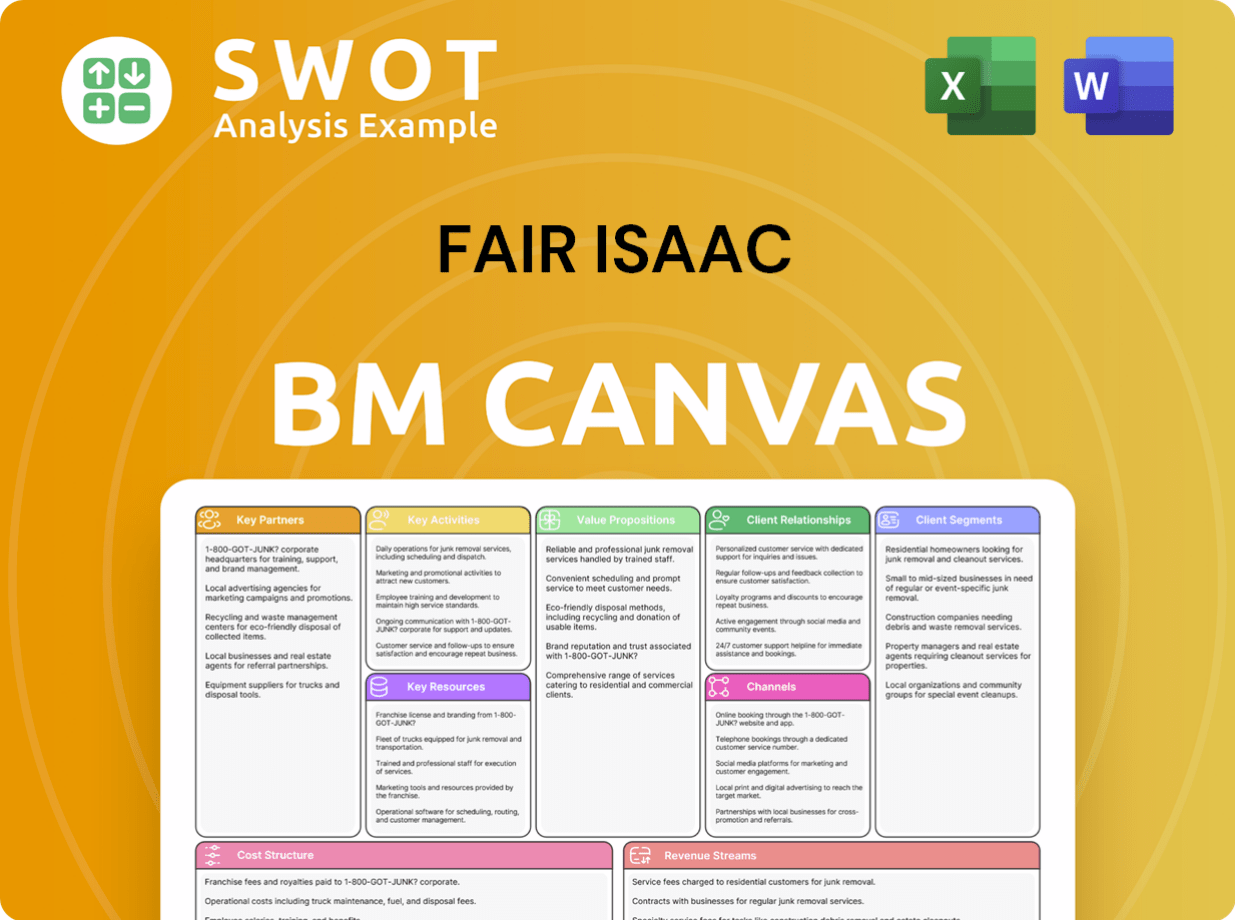

Fair Isaac Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Fair Isaac’s Competitive Landscape?

The competitive landscape for the Fair Isaac Company (FICO) is dynamic, shaped by industry trends and technological advancements. The company faces challenges such as increasing competition and the need for continuous innovation, but also has significant opportunities for growth in emerging markets and through product diversification. Understanding these factors is crucial for a comprehensive market analysis of FICO's position.

FICO's industry position is influenced by its established role in credit scoring and risk management within financial services. Risks include market saturation in developed economies and the emergence of new competitors. The future outlook depends on FICO's ability to adapt to changing data sources, regulatory environments, and technological advancements, as explored in detail in the Growth Strategy of Fair Isaac.

The financial services industry is witnessing a rapid adoption of AI and ML, which impacts credit scoring models. There's a growing focus on alternative data sources for credit assessment, such as utility payments and rental history. Regulatory changes, particularly those focused on data privacy, also present significant industry trends.

Potential market saturation in developed economies poses a challenge for FICO. The need to innovate to stay ahead of fraud schemes is crucial. Increased competition from fintechs and big tech companies entering the credit assessment space could disrupt market share.

Emerging markets offer significant growth potential for FICO, where credit infrastructure is less developed. Further product innovations, such as real-time decisioning platforms, offer avenues for growth. Strategic deployment of advanced analytics and new data partnerships can also drive growth.

FICO's main competitors include VantageScore, Experian, Equifax, and TransUnion. These firms compete in the credit scoring and risk management markets. The competitive landscape is also influenced by the rise of fintech companies and big tech firms.

FICO must leverage AI and ML to enhance its scoring models and offer more dynamic risk assessments. Expanding into alternative data sources is essential to maintain market relevance. Adapting to global regulatory shifts is crucial for long-term success.

- Focus on AI-driven solutions to stay ahead of competitors.

- Integrate alternative data sources to improve credit assessment accuracy.

- Adapt to regulatory changes to ensure compliance and market access.

- Explore emerging markets for expansion and growth.

Fair Isaac Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fair Isaac Company?

- What is Growth Strategy and Future Prospects of Fair Isaac Company?

- How Does Fair Isaac Company Work?

- What is Sales and Marketing Strategy of Fair Isaac Company?

- What is Brief History of Fair Isaac Company?

- Who Owns Fair Isaac Company?

- What is Customer Demographics and Target Market of Fair Isaac Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.