Fair Isaac Bundle

How Has Fair Isaac Company Dominated the Financial World?

From its humble beginnings in 1956, Fair Isaac Company (FICO) has revolutionized how businesses make critical decisions, most notably with its ubiquitous FICO Score. But how did this data analytics pioneer achieve such dominance in the financial services sector? Discover the innovative sales and marketing strategies that propelled FICO to become a global leader, generating billions in revenue and shaping the financial landscape.

This deep dive explores the evolution of Fair Isaac Company's sales approach, from custom solutions to its current market-leading position. Learn about the marketing campaigns that have built the FICO brand and the strategies behind its impressive growth, including the burgeoning success of the FICO Platform. Furthermore, we will examine Fair Isaac SWOT Analysis to understand the company's competitive advantages and how it continues to adapt in a dynamic market.

How Does Fair Isaac Reach Its Customers?

The sales and marketing strategy of Fair Isaac Company (FICO) centers on a multifaceted approach designed to reach a diverse customer base. This strategy includes direct sales, cloud-based software delivery, and strategic partnerships to maximize market penetration and revenue growth. FICO's sales channels are key to its success in the financial services industry.

FICO's approach is tailored to meet the needs of both business-to-business (B2B) and business-to-consumer (B2C) segments. The company leverages its direct sales force and digital platforms to drive sales and maintain a strong market presence. The evolution of its sales channels reflects a shift towards standardized solutions and cloud-based delivery.

The company's business strategy focuses on providing risk management and analytics solutions to various sectors. This includes banking institutions, credit risk management departments, and FinTech companies. The company's market share and trends are influenced by its ability to adapt to the changing needs of its customers.

FICO primarily uses direct sales channels to reach its B2B customers across over 90 countries. This approach is particularly effective for complex risk management and analytics solutions. The direct sales team targets global banking institutions and FinTech companies.

A significant portion of FICO's software solutions are delivered through cloud-based platforms. In 2024, 95% of its software solutions were delivered this way to over 2,500 enterprise clients globally. The SaaS platform generated $450 million in annual recurring revenue (ARR) in 2024.

FICO engages in B2C sales through its myFICO.com website, allowing individuals to purchase and understand their FICO Scores. While B2B scores revenue saw substantial growth in fiscal 2024, B2C scores revenue decreased by 2%. This channel is essential for reaching individual consumers.

FICO partners with credit bureaus like Experian, TransUnion, and Equifax to distribute its scores. Strategic collaborations, such as the recent partnership with AWS, further contribute to growth. These partnerships help FICO expand its market reach.

The company's sales strategy is designed to address various sales and marketing challenges. The company's digital marketing strategy and customer acquisition strategy are crucial for its success. FICO's competitive analysis and brand awareness strategies are essential for maintaining its market position. The company's focus on cloud-based delivery and strategic partnerships reflects its commitment to innovation and customer satisfaction. For more insights into FICO's growth, consider reading about the Growth Strategy of Fair Isaac.

Several key metrics highlight FICO's sales performance and market position. These metrics show the company's growth and the effectiveness of its sales channels.

- B2B scores revenue was up 27% year-over-year in fiscal year 2024.

- The FICO Platform had an ARR of $227.0 million as of September 30, 2024.

- Dollar-based net retention rate for the Platform was 123% as of September 30, 2024.

- 78% of new software contracts used cloud-based delivery.

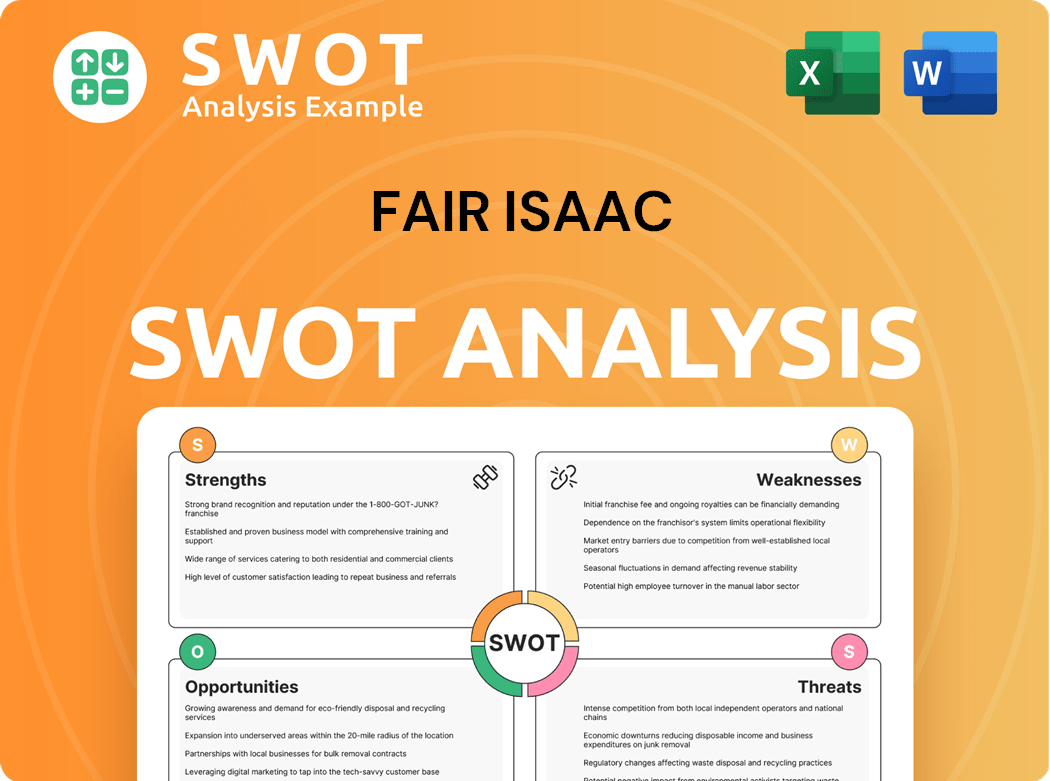

Fair Isaac SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Fair Isaac Use?

The marketing tactics of the Fair Isaac Company, or FICO, are heavily focused on data-driven strategies and customer segmentation. They aim to reach their target audience through a combination of digital marketing, professional networking, and direct outreach. The company utilizes advanced analytics and AI to personalize customer experiences.

FICO's approach includes significant investment in digital platforms like LinkedIn, where they spend approximately $3.6 million annually. This investment supports advertising, targeted campaigns, and professional webinar sponsorships. The company also allocates around $45.3 million each year to targeted marketing efforts within financial services.

By leveraging data analytics, FICO identifies distinct customer personas to tailor their messaging effectively. This allows for dynamic micro-personalization, driven by AI, to anticipate customer needs and deliver targeted solutions in real-time. This approach is crucial for enhancing customer interactions and optimizing decision-making processes.

FICO employs data-driven marketing strategies to understand customer behavior and preferences. They use advanced analytics to derive insights from raw data, translating these into actionable decisions. This approach is central to their Sales Strategy, ensuring targeted and effective campaigns.

FICO focuses on customer segmentation, moving beyond broad categories to dynamic micro-personalization. They use AI to anticipate customer needs and deliver real-time, targeted solutions. This individualized approach enhances customer experiences.

The company invests heavily in digital marketing, particularly on platforms like LinkedIn. This includes advertising, targeted campaigns, and sponsorships. This strategy is part of their overall Marketing Strategy to reach professionals in the Financial Services industry.

FICO heavily promotes its FICO Platform, highlighting its capabilities in hyper-personalization and operational AI. The platform emphasizes its composable ecosystem to reduce time-to-value for partners and customers. This is a key element of their product promotion methods.

FICO promotes financial literacy and emphasizes data-driven decision-making in its marketing strategies. This approach is highlighted by their Chief Marketing Officer, Nikhil Behl. This helps build FICO brand awareness.

AI and machine learning are central to FICO's fraud detection solutions, analyzing transaction patterns to identify suspicious activities in real-time. This integration enhances their product offerings and strengthens their market position. This is a key part of their Business Strategy.

FICO's approach to marketing and sales is heavily influenced by its mission to provide innovative solutions through data and analytics. To learn more about their overall Business Strategy, consider reading the article on the Growth Strategy of Fair Isaac.

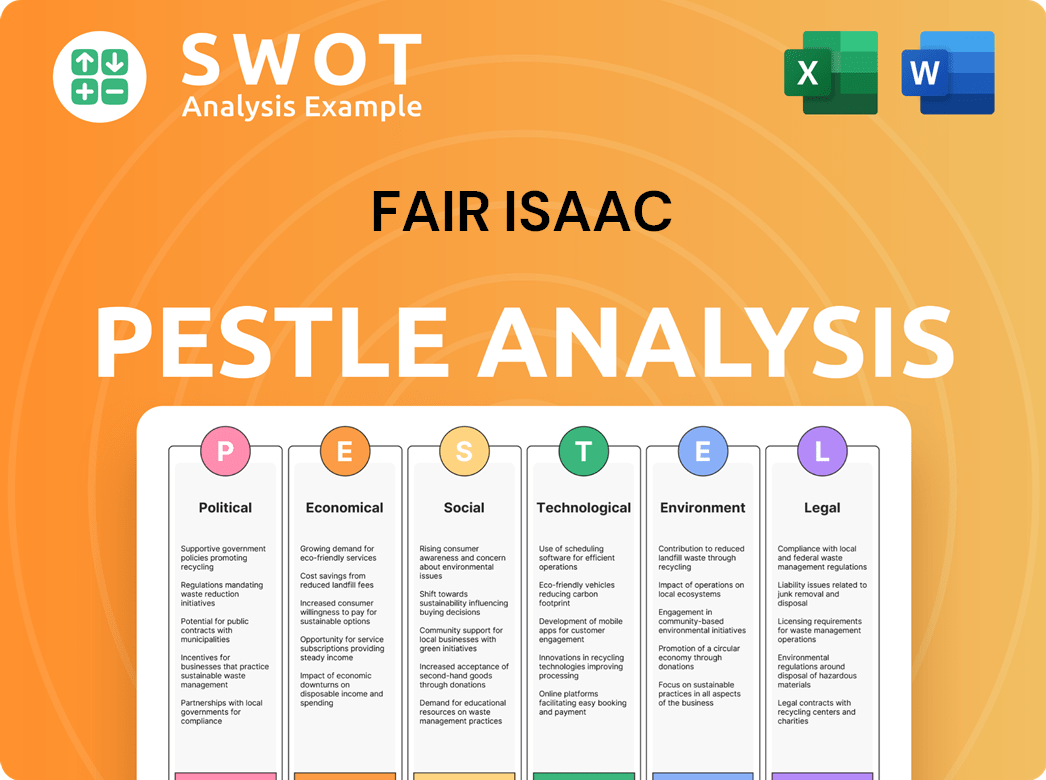

Fair Isaac PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Fair Isaac Positioned in the Market?

The brand positioning of the Fair Isaac Company, commonly known as FICO, is deeply rooted in its legacy as a leader in credit scoring and predictive analytics. Its core message centers on enabling businesses to make informed decisions through data and advanced analytics. This focus has solidified its reputation and market position, particularly with the FICO Score being the standard for U.S. consumer credit risk, used by approximately 90% of top lenders.

FICO's brand is synonymous with reliability and innovation in the financial services industry. The company differentiates itself through its deep expertise in credit, fraud, and regulated decision-making. This allows it to offer solutions that help organizations innovate while maintaining trust and control. This strong market position provides significant pricing power, such as the wholesale royalty for a FICO score for mortgage originations set at $4.95 per score in 2025.

FICO's brand positioning strategy is further enhanced by its responsiveness to market changes and customer needs. The company is actively developing new score variants, such as those incorporating buy-now-pay-later (BNPL) behavior, to address evolving lending segments. Furthermore, FICO's commitment to 'Responsible AI principles' and the development of the FICO Platform, with its focus on 'Intelligent Engagement,' reflects a proactive approach to meeting customer demands.

FICO's brand is built on its dominant position in the credit scoring market. The FICO Score is the industry standard, used by a vast majority of lenders. This provides a strong foundation for brand recognition and trust within the financial services sector.

The company differentiates itself through its deep expertise in credit, fraud detection, and regulated decision-making. This allows FICO to offer innovative solutions that help businesses stay ahead in a rapidly changing market. Recent recognitions, such as being included in the 2024 Gartner Market Guide, highlight this focus.

FICO actively responds to shifts in consumer behavior and competitive threats. By developing new score variants and focusing on 'Intelligent Engagement,' FICO aims to provide hyper-personalized experiences and optimize customer interactions. This customer-centric approach supports its sales strategy.

FICO's commitment to 'Responsible AI principles' underscores its dedication to transparency, auditability, and trust. This is crucial in the sensitive financial data landscape. The company's long-standing reputation and consistent performance reinforce its brand's reliability.

FICO's brand positioning is built on several key elements that contribute to its success in the market. These elements are crucial for its sales strategy and overall business strategy.

- Market Dominance: The FICO Score's widespread use by lenders provides a strong foundation.

- Innovation: Continuous development of new products and solutions, such as score variants for BNPL.

- Expertise: Deep domain knowledge in credit, fraud, and decision management.

- Customer Focus: Efforts to provide personalized experiences and meet evolving customer demands.

- Trust: Commitment to transparency and responsible AI principles.

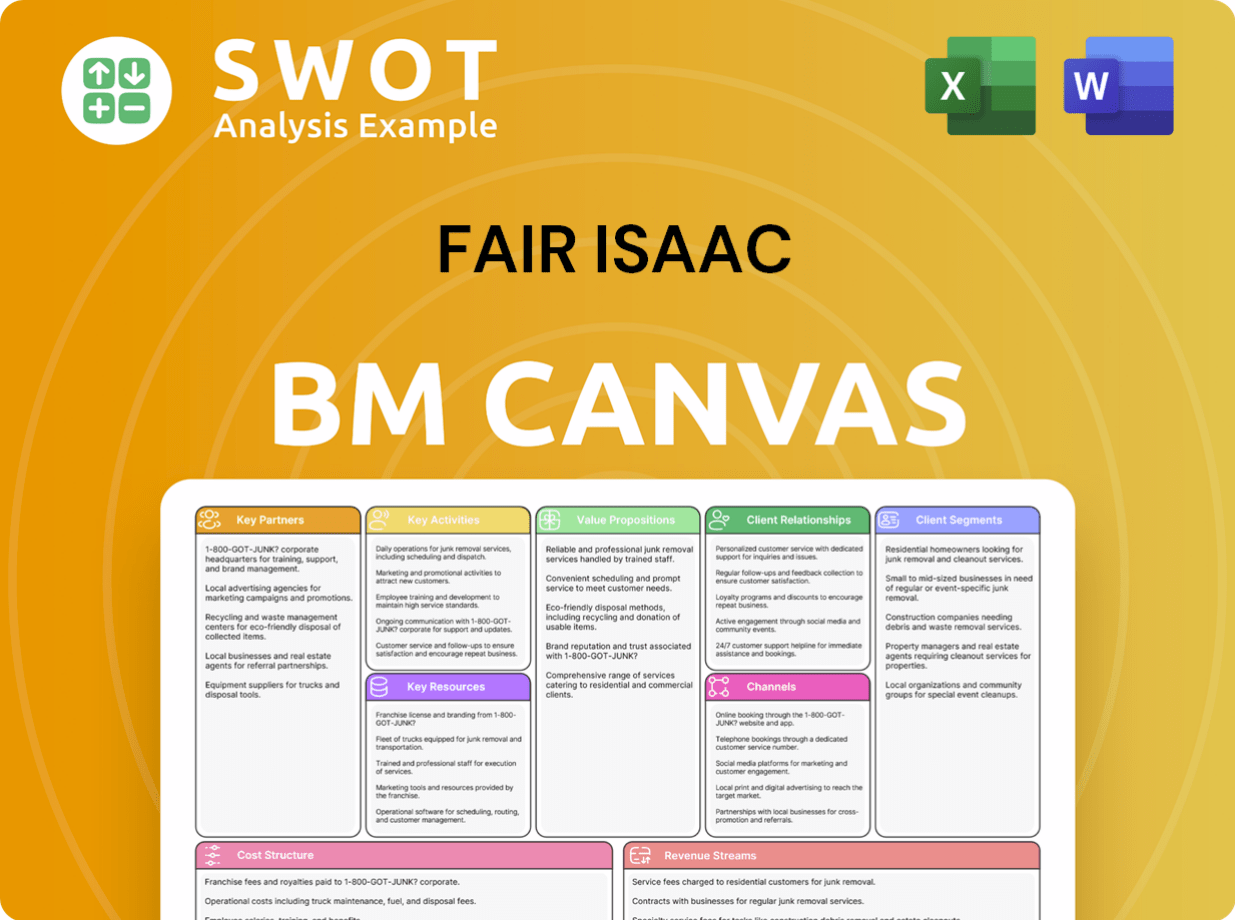

Fair Isaac Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Fair Isaac’s Most Notable Campaigns?

The Fair Isaac Company (FICO) employs robust sales and marketing strategies centered around its core offerings and emerging technologies. These strategies aim to highlight FICO's leadership in enterprise AI, decision intelligence, and real-time customer engagement. Key campaigns focus on promoting the adoption of its latest score models, such as FICO Score 10 and 10 T, and emphasizing its fraud detection and prevention solutions to address growing market needs.

A primary objective of FICO's marketing efforts is to showcase its innovation and thought leadership within the financial services sector. This is achieved through a combination of product-specific campaigns, industry events, and strategic collaborations. The company's approach is designed to resonate with a diverse audience of financial institutions, businesses, and consumers, all of whom rely on accurate and reliable data analytics and decision-making tools.

The company's sales strategy is deeply integrated with its marketing campaigns, ensuring a cohesive message that emphasizes the value and impact of FICO's products and services. This integrated approach aims to drive customer acquisition and retention, strengthen brand awareness, and ultimately increase market share.

A key sales and marketing campaign revolves around the adoption of FICO Score 10 and 10 T. These scores incorporate trended data for enhanced predictive power. In fiscal 2024, significant adoption was seen in non-government-sponsored enterprise mortgages.

FICO actively markets its fraud detection and prevention solutions, emphasizing the increasing threat of financial fraud. The company highlights its role in mitigating risks through AI and machine learning. A focus is placed on solutions addressing real-time payment (RTP) scams.

The annual FICO World conference is a major platform for showcasing innovations and customer success stories. The 2025 event emphasized the company's evolution into a platform leader in enterprise AI. The launch of the FICO Marketplace was a key highlight.

FICO highlights its strategic collaborations to accelerate digital transformation for businesses. The May 2025 agreement with AWS is an example of this. These partnerships enhance FICO's market reach and service capabilities.

The effectiveness of FICO's sales and marketing strategies is reflected in several key metrics. These include adoption rates of new score models, the impact of fraud prevention solutions, and customer engagement at events like FICO World. FICO's approach includes a strong emphasis on data-driven decision-making and continuous improvement.

- In fiscal 2024, clients representing over $241 billion in annualized mortgage originations adopted FICO Score 10 T.

- Approximately $1.33 trillion in eligible mortgage portfolio servicing signed up for the score.

- Financial fraud is projected to reach $42.62 billion by 2029.

- 25% of consumers report money loss to real-time payment (RTP) scams.

- 56% of consumers desire better fraud detection systems.

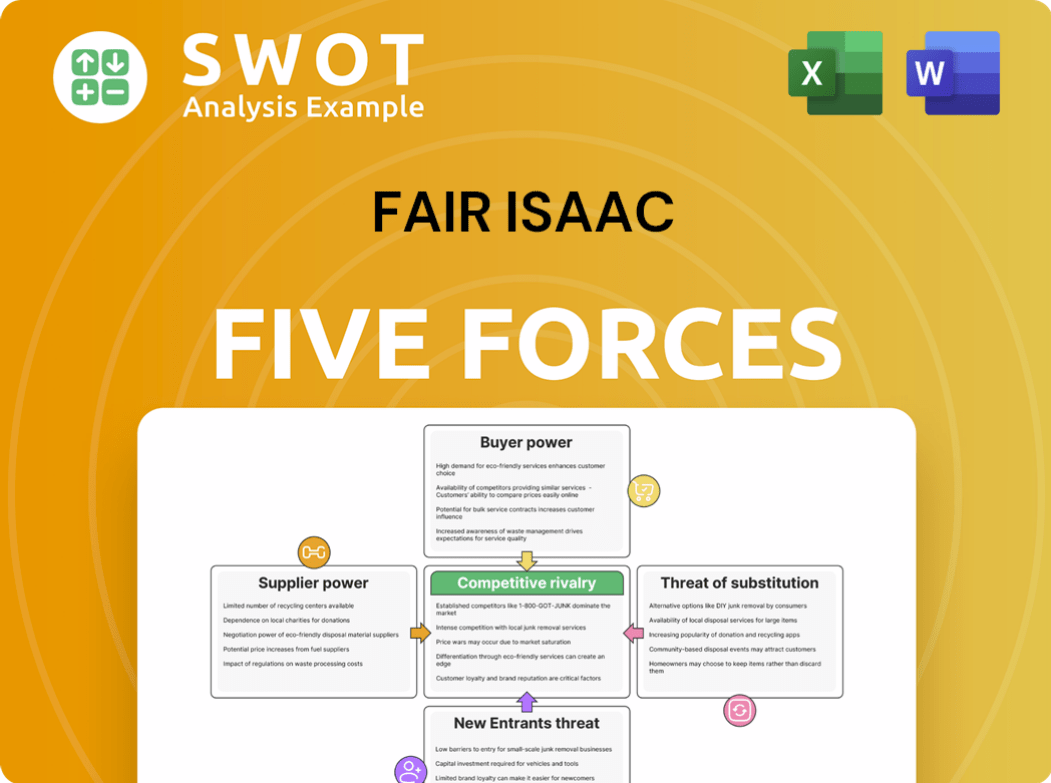

Fair Isaac Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fair Isaac Company?

- What is Competitive Landscape of Fair Isaac Company?

- What is Growth Strategy and Future Prospects of Fair Isaac Company?

- How Does Fair Isaac Company Work?

- What is Brief History of Fair Isaac Company?

- Who Owns Fair Isaac Company?

- What is Customer Demographics and Target Market of Fair Isaac Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.