Five Star Business Finance Bundle

How Does Five Star Business Finance Stack Up in India's Lending Arena?

The Indian financial services sector is a dynamic environment, and understanding the Five Star Business Finance SWOT Analysis is crucial. This analysis dives deep into the Five Star Business Finance's competitive landscape, a vital aspect for any investor or strategist. We'll explore the company's market position and how it navigates the challenges and opportunities within the Business Finance Company sector.

This detailed examination will equip you with the insights needed to assess Five Star Business Finance's strategic positioning. We'll conduct a thorough market analysis, highlighting key competitors and their strategies. Furthermore, we'll investigate the Five Star Business Finance's financial performance and competitive advantages, providing a comprehensive industry overview.

Where Does Five Star Business Finance’ Stand in the Current Market?

Five Star Business Finance holds a strong market position within the Indian Non-Banking Financial Company (NBFC) sector. It specializes in providing secured loans to micro-entrepreneurs and small business owners. The company mainly focuses on lending against self-occupied residential and small business properties, catering to a segment often underserved by traditional banks.

The company's focus on a specific niche and collateral-backed lending model has allowed it to create a distinct market position. This targeted approach helps in risk management and customer relationship building. The company's financial health and strategic focus contribute to its strong market position.

As of December 31, 2023, Five Star Business Finance had assets under management (AUM) of ₹8,995 crore. This indicates substantial year-on-year growth, reflecting its increasing penetration and acceptance within its target market. Its geographic presence is concentrated in states like Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, and Madhya Pradesh.

Five Star Business Finance concentrates on providing secured loans to micro-entrepreneurs and small business owners. This focus allows for a deeper understanding of the target market's needs. The company's success is rooted in its specialization within this segment.

The company demonstrates robust financial health, with an AUM of ₹8,995 crore as of December 31, 2023. This growth highlights its effective strategies and market acceptance. The consistent growth in AUM reflects its strong market position.

Five Star Business Finance maintains healthy asset quality, with a Gross Non-Performing Assets (GNPA) of 1.40% as of December 31, 2023. This demonstrates effective risk management. This strong asset quality is a key indicator of the company's financial stability.

The company's Capital Adequacy Ratio (CRAR) was 62.4% as of December 31, 2023, significantly above regulatory requirements. This strong capital position provides a buffer against risks. It positions the company favorably within the industry.

The company's competitive advantages include its specialized market focus, strong asset quality, and high capital adequacy. These factors contribute to its resilience and growth. These advantages help it to maintain a strong position in the Competitive Landscape.

- Specialized Lending: Focus on secured loans to micro and small businesses.

- Strong Asset Quality: Low GNPA of 1.40% as of December 31, 2023, indicating effective risk management.

- High Capital Adequacy: CRAR of 62.4% as of December 31, 2023, ensuring financial stability.

- Geographic Concentration: Strategic presence in key states with high micro-entrepreneur populations.

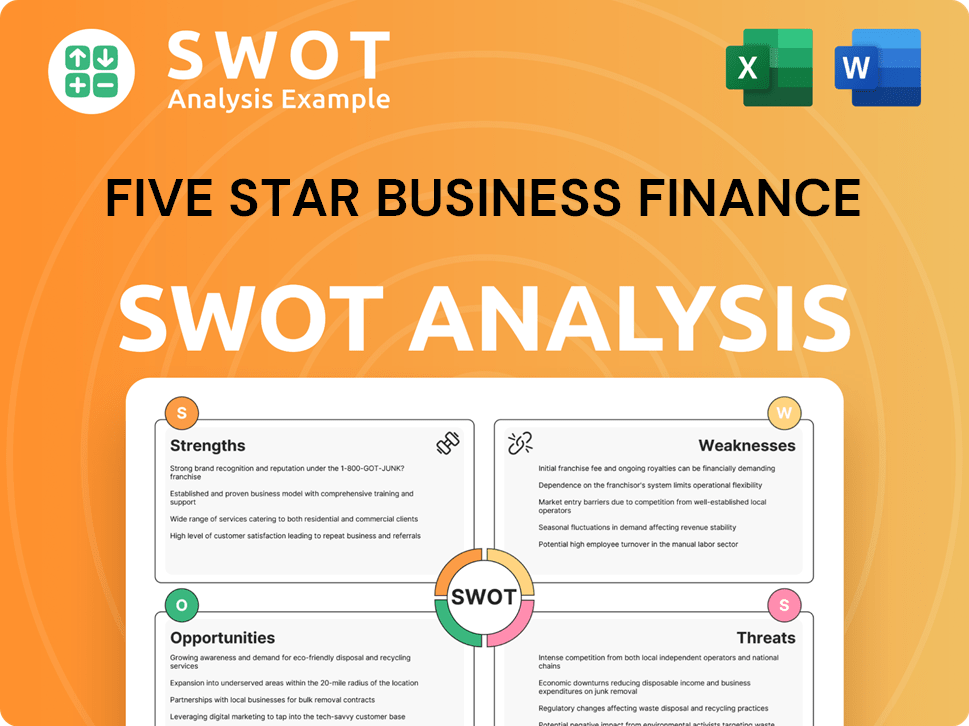

Five Star Business Finance SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Five Star Business Finance?

The Competitive Landscape for Five Star Business Finance, a business finance company, is multifaceted, encompassing a range of financial institutions vying for market share in secured lending to micro-entrepreneurs and small businesses in India. This landscape is shaped by the specific focus on secured lending, which differentiates it from purely digital lenders. A comprehensive market analysis reveals a dynamic environment where traditional and emerging players compete on various fronts.

The financial services sector in India is experiencing rapid growth, with increasing demand for credit from the MSME segment. This has intensified competition, requiring companies like Five Star Business Finance to continually adapt their strategies. Understanding the industry overview is crucial for assessing the competitive pressures and opportunities within this sector.

The competition includes a blend of established and emerging players. The company faces competition from a mix of traditional banks, other non-banking financial companies (NBFCs), and increasingly, emerging fintech players. Direct competitors include other NBFCs that specialize in small business loans and loans against property, such as Aptus Value Housing Finance India Ltd. and Home First Finance Company India Ltd., which also target affordable housing and small business segments with a focus on self-employed individuals. These companies often compete on interest rates, turnaround time for loan approvals, and the flexibility of their loan products.

Direct competitors include NBFCs specializing in small business loans and loans against property.

Examples include Aptus Value Housing Finance India Ltd. and Home First Finance Company India Ltd.

Competition is based on interest rates, loan approval speed, and loan product flexibility.

These factors are crucial for attracting and retaining customers in the competitive market.

Public and private sector banks are expanding into the MSME segment.

Microfinance institutions (MFIs) also provide indirect competition, though with different loan sizes and collateral requirements.

Fintech lending platforms use technology to speed up credit assessment and disbursement.

This poses a challenge to traditional lending models.

Five Star Business Finance focuses on secured lending against physical collateral.

This offers a degree of insulation from unsecured lending models.

Competitive dynamics revolve around geographic reach, customer service, and risk management.

Effectively assessing and managing credit risk is essential in the informal and semi-formal segments.

Beyond direct NBFC rivals, public and private sector banks are increasingly expanding their reach into the MSME segment through various schemes and digital offerings. While their processes might be more stringent, their lower cost of funds can allow them to offer more competitive interest rates. Indirect competition also stems from microfinance institutions (MFIs) that cater to even smaller credit needs, although their loan sizes and collateral requirements typically differ from Five Star Business Finance. The rise of fintech lending platforms presents another challenge, as these players leverage technology for faster credit assessment and disbursement, potentially disrupting traditional lending models. However, Five Star Business Finance’s focus on secured lending against physical collateral provides a degree of insulation from purely digital, unsecured lending models. The competitive dynamics often revolve around geographic reach, customer service, and the ability to effectively assess and manage credit risk in the informal and semi-formal segments of the economy. For more on how the company operates, you can explore the Revenue Streams & Business Model of Five Star Business Finance.

Several factors influence the competitive landscape for Five Star Business Finance, including interest rates and loan terms.

The ability to efficiently assess and manage credit risk is crucial.

- Interest Rates: Competitive rates are essential to attract borrowers.

- Loan Products: Flexibility and variety in loan products cater to diverse needs.

- Turnaround Time: Quick loan approvals enhance customer satisfaction.

- Customer Service: Excellent service builds loyalty and trust.

- Risk Management: Effective credit assessment minimizes losses.

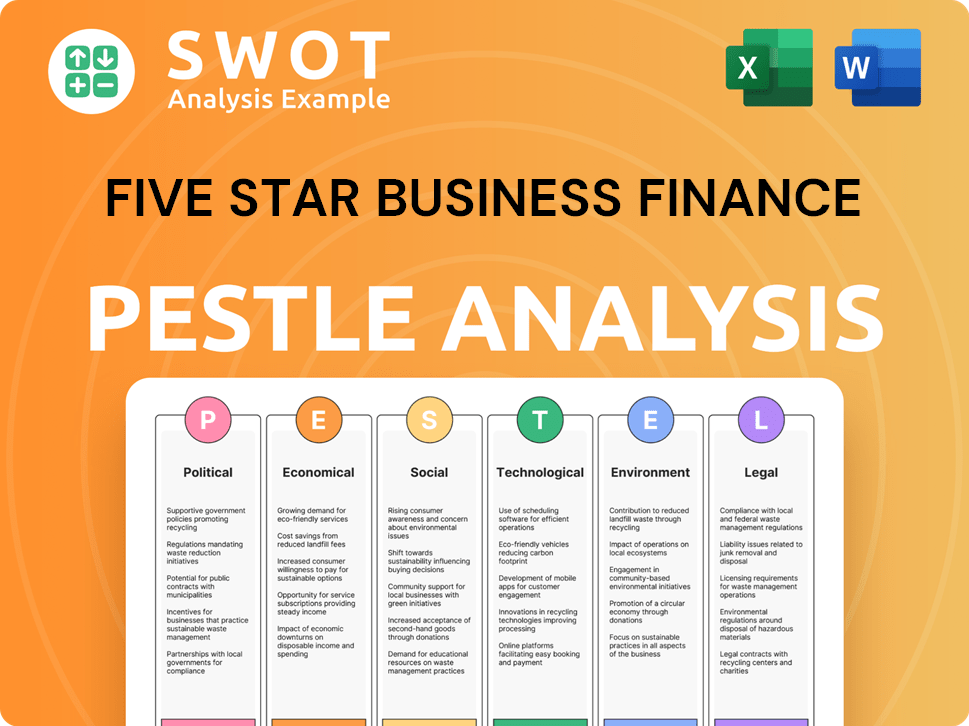

Five Star Business Finance PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Five Star Business Finance a Competitive Edge Over Its Rivals?

Analyzing the Brief History of Five Star Business Finance reveals a strategic focus on securing its position within the competitive landscape of the business finance company sector. The company has consistently targeted the underserved micro and small business segments, differentiating itself through tailored financial products and a deep understanding of its customer base. This approach has allowed it to build a strong market presence.

The company's competitive edge is further solidified by its operational model and risk management strategies. By concentrating on secured lending, primarily against property, it mitigates risks and maintains a healthy loan portfolio. This focused strategy, coupled with a robust branch network in Tier II and Tier III cities, enables direct customer engagement and efficient loan processing.

Five Star Business Finance has several key competitive advantages. The company's specialized focus on providing secured loans to micro-entrepreneurs and small business owners allows for tailored credit assessment and product offerings. This focus leads to higher customer retention and lower credit risk. As of December 31, 2023, the company reported a Gross Non-Performing Assets (GNPA) of only 1.40%, highlighting its strong asset quality.

Five Star Business Finance excels by focusing on micro-entrepreneurs and small business owners, particularly those underserved by traditional banks. This niche focus allows for tailored financial products and a deeper understanding of customer needs. This strategy fosters higher customer retention and lower credit risk, setting it apart in the financial services industry.

The company's extensive branch network, especially in Tier II and Tier III cities, is a key differentiator. This localized presence enables direct customer relationships and thorough on-ground due diligence. This approach fosters strong customer loyalty, as many clients value face-to-face interaction and personalized financial advice.

Five Star Business Finance maintains a strong capital adequacy ratio (CRAR), providing a solid financial foundation for growth. This financial strength enables resilience against economic downturns and supports its expansion plans. As of December 31, 2023, the company's CRAR was 62.4%, demonstrating its financial stability.

Efficient loan origination and collection mechanisms contribute to Five Star Business Finance's cost-effectiveness and scalability. These streamlined processes enable the company to manage its operations efficiently and maintain a competitive edge. This operational efficiency supports its ability to serve a large customer base effectively.

Five Star Business Finance's competitive advantages include a specialized market focus, a robust branch network, and efficient operational processes. These strengths enable the company to maintain a strong market position and offer tailored financial solutions. The company's focus on secured lending and its strong capital adequacy ratio further enhance its resilience and growth potential.

- Specialized focus on micro and small businesses.

- Extensive branch network in Tier II and Tier III cities.

- Efficient loan origination and collection processes.

- Strong capital adequacy ratio of 62.4%.

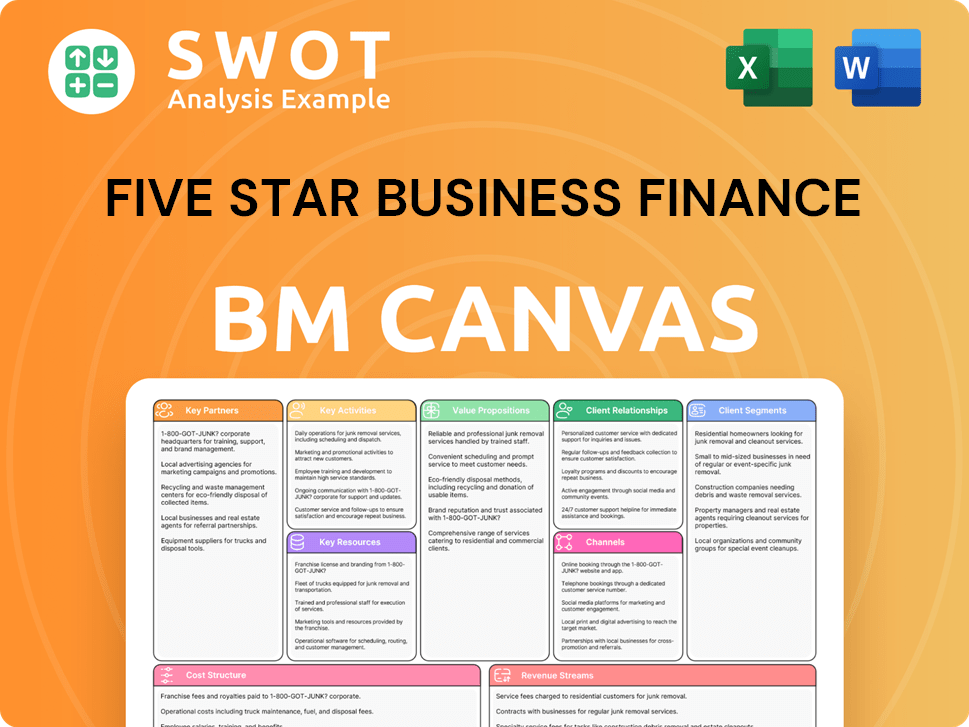

Five Star Business Finance Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Five Star Business Finance’s Competitive Landscape?

The Five Star Business Finance operates within a dynamic Competitive Landscape, significantly shaped by evolving industry trends, regulatory changes, and technological advancements. The company's position is influenced by its focus on providing secured small business loans, primarily in semi-urban and rural markets. Understanding the Industry Overview is crucial for assessing its future prospects.

Risks include intensified competition, interest rate fluctuations, and economic downturns, which could impact loan demand and repayment capabilities. However, opportunities exist in the underserved market and the government's push for financial inclusion. The company's ability to adapt to digital transformation and regulatory changes will be critical for its sustained growth and market share. For more details, you can read this article about Growth Strategy of Five Star Business Finance.

Technological advancements are driving digital transformation in financial services, impacting customer acquisition and loan processing. Regulatory changes, especially from the RBI, are increasing compliance burdens for NBFCs. The increasing formalization of the Indian economy is expanding the addressable market for secured small business loans.

Intensified competition from new entrants, including fintech companies, poses a significant threat. Fluctuations in interest rates could impact borrowing costs and loan demand. Economic downturns can affect the repayment capacity of the target customers. The need to strengthen digital capabilities and diversify funding sources is crucial.

The underserved micro and small business segment in India offers significant growth potential. Strategic partnerships with fintech companies can improve efficiency and reach. Government initiatives promoting financial inclusion can expand the market. The company’s established presence in semi-urban and rural areas offers a competitive advantage.

A strong focus on secured small business loans in underserved markets. Established branch network in semi-urban and rural areas. Potential to leverage technology through strategic partnerships. The company's ability to adapt to changing market conditions and regulatory requirements.

As of 2024, the NBFC sector in India continues to grow, with a focus on digital lending and financial inclusion. The market for small business loans is expanding due to increased formalization and government support. Five Star Business Finance's financial performance is influenced by its ability to manage credit risk and operational efficiency.

- The Indian NBFC sector is valued at over $500 billion as of early 2024.

- Digital lending platforms are projected to grow by over 30% annually through 2025.

- Five Star Business Finance's loan portfolio growth in 2024 is expected to be between 15% and 20%.

- The company's focus on secured lending in rural areas provides a competitive edge.

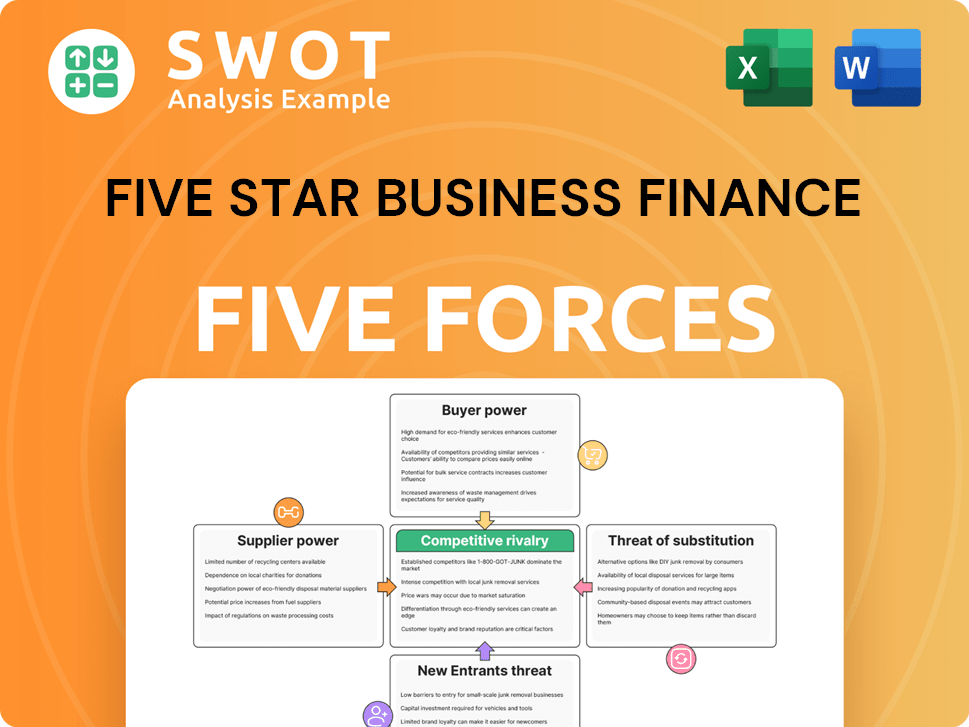

Five Star Business Finance Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Five Star Business Finance Company?

- What is Growth Strategy and Future Prospects of Five Star Business Finance Company?

- How Does Five Star Business Finance Company Work?

- What is Sales and Marketing Strategy of Five Star Business Finance Company?

- What is Brief History of Five Star Business Finance Company?

- Who Owns Five Star Business Finance Company?

- What is Customer Demographics and Target Market of Five Star Business Finance Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.