Five Star Business Finance Bundle

Who Does Five Star Business Finance Serve?

Embark on a journey to understand the core of Five Star Business Finance: its customers. In the dynamic world of business finance, grasping customer demographics and the target market is not just beneficial—it's essential for success. This analysis delves into the crucial aspects that drive Five Star Business Finance's strategic approach.

The evolution of Five Star Business Finance, from its inception in 1984 to its current specialized focus, highlights a strategic adaptation to meet the underserved needs of micro-entrepreneurs and small business owners. Understanding the customer profile, including their business size and income levels, is critical. This Five Star Business Finance SWOT Analysis provides further insights into the company's strategic positioning within its target market, including customer acquisition and retention strategies. This detailed market analysis will help investors and analysts understand the company's long-term value.

Who Are Five Star Business Finance’s Main Customers?

Understanding the customer demographics and target market is crucial for any financial institution. For Five Star Business Finance, the primary focus is on micro-entrepreneurs and small business owners. These individuals often face challenges accessing traditional financial services, making them a key segment for the company.

The company's customer base primarily consists of those seeking secured loans. These loans are typically secured against self-occupied residential properties and small business properties. This approach allows the company to serve a specific niche within the broader financial market.

The company operates mainly under a Business-to-Consumer (B2C) model, directly serving micro-entrepreneurs and small business owners. These customers are involved in various small-scale economic activities, from local retail to small manufacturing units. This segment represents a significant portion of India's economic activity.

The core customer demographics include individuals running small businesses or working as micro-entrepreneurs. They often lack formal documentation or credit history, making them underserved by traditional banks. These customers are the primary focus of the company's lending activities.

The company specializes in secured loans. These loans are typically secured against self-occupied residential property or small business property. This focus on secured lending aligns with the company’s risk management and growth strategy.

The company operates on a Business-to-Consumer (B2C) model, directly lending to micro-entrepreneurs and small business owners. This direct approach allows for a more personalized service. This model is crucial for reaching the target market.

The company has shifted its focus to a specialized secured lending model. This shift was based on market research. This strategic move allows for better risk management and growth within a specific niche.

The target market for Five Star Business Finance is defined by occupational and asset-based characteristics. The company focuses on providing financial solutions to those who may not meet the criteria of traditional lenders. This approach has allowed the company to establish a strong presence in this market.

- Micro-entrepreneurs and small business owners are the primary customers.

- Loans are typically secured by self-occupied residential or small business property.

- The company operates under a direct B2C model.

- The market focus is on secured lending, driven by market research.

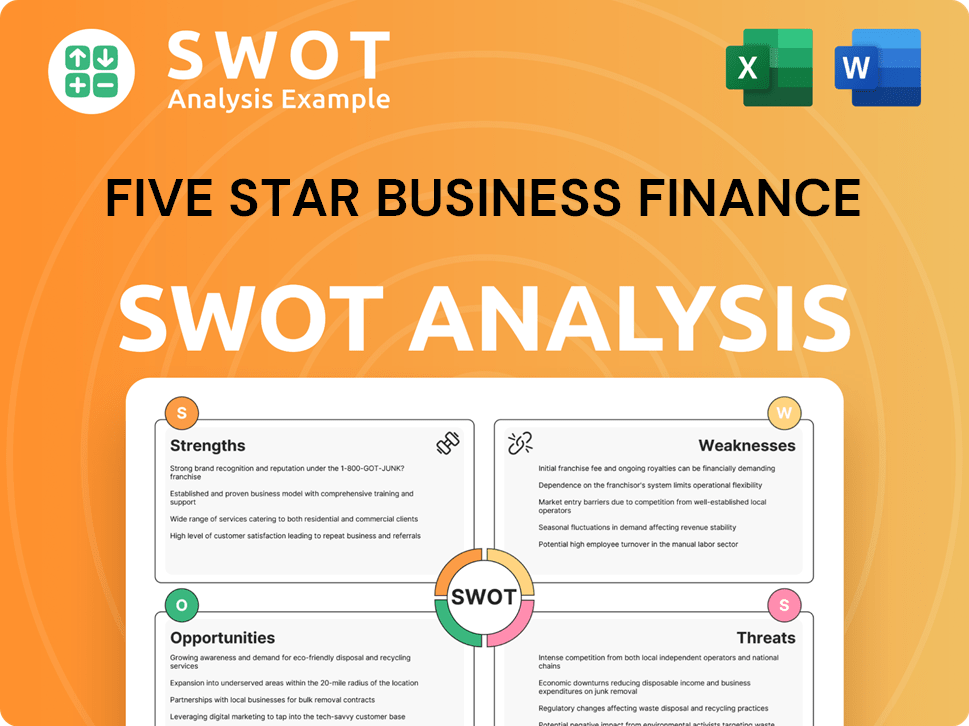

Five Star Business Finance SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Five Star Business Finance’s Customers Want?

Understanding the customer needs and preferences is crucial for Five Star Business Finance. The company's success hinges on its ability to meet the specific financial needs of its target market. This involves a deep dive into the motivations, behaviors, and pain points of its customers, which informs product development and service delivery.

The primary driver for customers seeking business finance from Five Star Business Finance is access to capital. These customers often have limited access to traditional credit channels. They prioritize quick processing, minimal documentation, and secured loan products.

The target market for Five Star Business Finance primarily seeks loans for business expansion, working capital, and managing unforeseen financial needs. The company's offerings are designed to address these specific requirements, providing a tailored financial solution.

Customers need capital for business expansion, working capital, and managing unexpected expenses. They often face challenges in accessing formal credit, making alternative financing options attractive.

The primary motivation is business growth and financial stability. Customers aspire to formalize their operations and seek lenders who understand their unique business models.

Customers prefer quick processing, minimal documentation, and flexible repayment options. They value lenders who offer personalized support and understand their specific business needs.

Purchasing behavior is driven by the urgency of business needs and the ease of loan approval. Decision-making prioritizes quick processing and the availability of secured loan products.

Loans typically range from INR 1 lakh to INR 10 lakhs, with durations of 2 to 5 years. This caters to the specific financial needs of small and medium-sized businesses.

Aspiration for business growth, financial stability, and formalizing operations are key psychological drivers. Customers seek lenders who understand their business models and cash flow patterns.

Five Star Business Finance addresses the pain points of its target market by offering solutions that traditional banks often lack. This includes understanding informal income streams and providing flexible repayment options. The company's approach is tailored to meet the unique needs of micro-entrepreneurs.

- Stringent Collateral Requirements: Traditional banks often require extensive collateral, which can be a barrier for many small businesses. Five Star Business Finance may offer more flexible collateral options.

- Lengthy Approval Processes: The company streamlines its approval processes to provide quicker access to funds compared to the lengthy procedures of traditional banks.

- Lack of Recognition for Informal Income: Traditional banks may not recognize informal income streams. Five Star Business Finance is likely to consider these, making financing more accessible.

- Limited Personalized Support: Large banks often lack personalized support. Five Star Business Finance leverages local branches and relationship managers to build trust and offer tailored assistance.

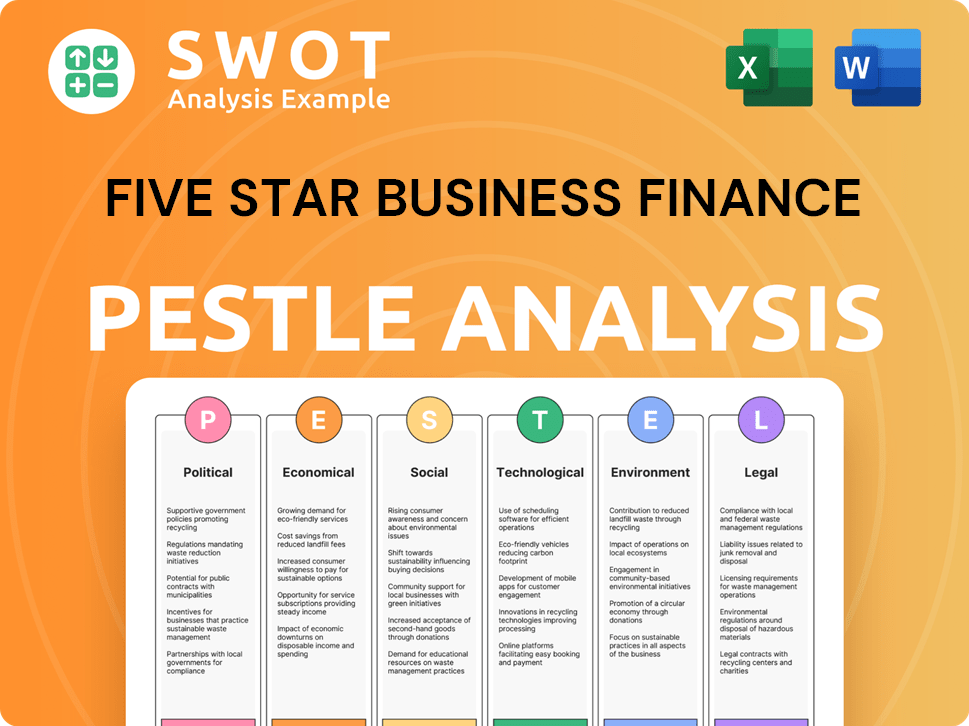

Five Star Business Finance PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Five Star Business Finance operate?

The geographical market presence of Five Star Business Finance is primarily focused on rural and semi-urban areas across India. This strategic choice is driven by the significant concentration of micro-entrepreneurs and small business owners in these regions, who are often underserved by traditional banking institutions. This targeted approach allows the company to establish a strong foothold in areas with high potential for growth in the business finance sector.

While specific details on major markets by country or region are not widely available beyond India, Five Star Business Finance has a broad operational footprint across multiple states. Their focus is on regions with robust economic activity among small businesses, specifically targeting areas with accessible self-occupied residential or small business properties. This localized approach enables the company to build strong relationships and tailor its services to meet the specific needs of its target customers.

The company has built a strong market share and brand recognition in these localized markets. This success is often attributed to their deep understanding of regional economic nuances and strong community ties. Their ability to adapt loan products and repayment schedules to align with regional economic cycles and business practices further enhances their appeal to local customers. Furthermore, their localized marketing efforts, using regional languages and culturally relevant communication, resonate well with the target audience.

Five Star Business Finance strategically places its branch network in areas with high concentrations of its target customers. This allows for direct engagement and a better understanding of local market dynamics. This customer-centric approach helps in better understanding the Growth Strategy of Five Star Business Finance.

They customize loan products and repayment schedules to match regional economic cycles and business practices. This localization strategy enhances customer satisfaction and improves repayment rates. This approach is critical for serving the diverse needs of their target market.

Marketing efforts are localized, using regional languages and culturally relevant communication. This approach helps in building trust and resonating with the target audience. This strategy ensures that the company's message is effectively communicated.

The company's expansion strategy has been organic, focusing on deepening its presence in existing states and gradually entering contiguous markets. This approach allows for sustainable growth and effective market penetration. Recent expansions have focused on states like Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, and Uttar Pradesh.

The geographic distribution of sales and growth reflects a concentrated effort in these high-potential, underserved markets. This targeted approach allows Five Star Business Finance to effectively reach its target market and achieve sustainable growth. The company's focus on these regions indicates a strategic commitment to serving the financial needs of micro and small enterprises.

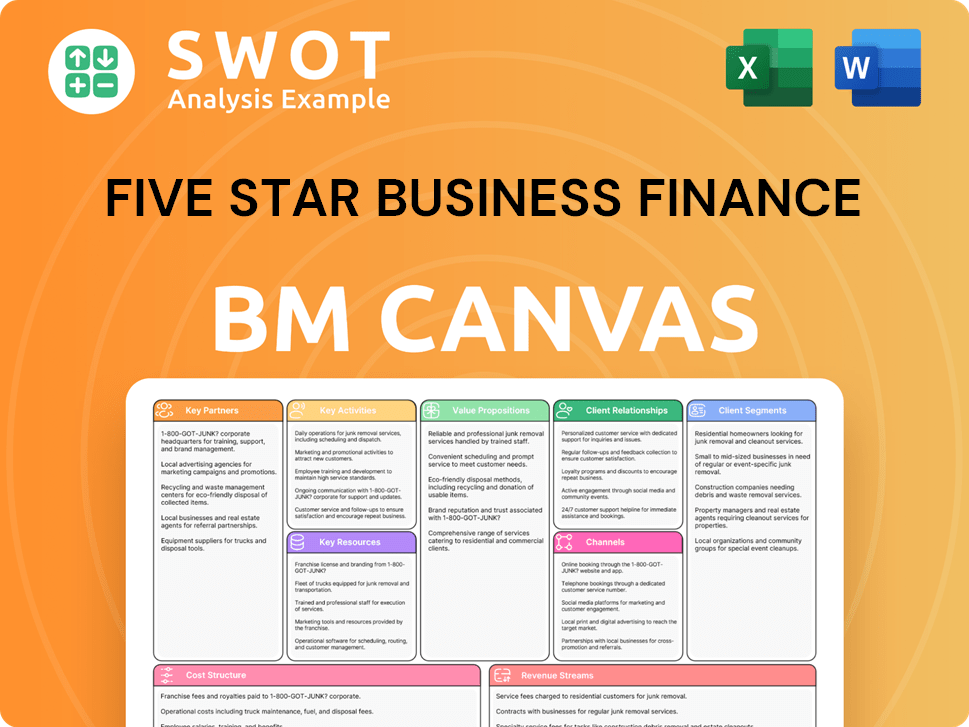

Five Star Business Finance Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Five Star Business Finance Win & Keep Customers?

The [Company Name] employs a multifaceted strategy for acquiring and retaining customers, emphasizing its extensive branch network and direct interactions. Its approach is particularly effective in semi-urban and rural markets, focusing on personalized service and community engagement. The company's success hinges on understanding the customer demographics and tailoring its offerings to meet specific needs, as highlighted in a recent Marketing Strategy of Five Star Business Finance article.

Key marketing channels include local outreach, word-of-mouth referrals, and community involvement, reflecting a deep understanding of its target market. Relationship-based selling, where loan officers build trust, is crucial for guiding potential borrowers. The company prioritizes customer service and efficient processing to foster loyalty, adapting to the needs of its customers.

Customer data and internal CRM systems are vital in segmenting the customer base and tailoring loan offerings. Successful acquisition campaigns often result from a strong local presence and positive testimonials. Technology has been increasingly leveraged to streamline internal processes, improving turnaround times and directly impacting customer satisfaction and retention.

These programs involve direct engagement with local communities through events, workshops, and partnerships. This approach helps in building trust and awareness within the target market. The impact of these programs is often measured by the increase in loan applications and customer acquisition rates in specific regions.

Referrals from existing customers are a significant source of new business. Incentivizing referrals through rewards or discounts can boost this channel's effectiveness. The conversion rate from referrals is typically higher than other channels, indicating a strong level of trust and satisfaction among existing customers.

Participating in local events, sponsoring community projects, and supporting local businesses are crucial. This builds goodwill and enhances the company's reputation within the community. These initiatives often lead to increased brand visibility and positive associations with the company.

Loan officers focus on building strong relationships with potential borrowers. This involves providing personalized assistance and guidance throughout the loan application process. This approach is particularly effective in building trust and ensuring customer satisfaction.

Providing excellent customer service is a key retention strategy. This includes prompt responses to inquiries, efficient loan processing, and readily available support. Studies show that improving customer service can increase customer retention rates by up to 5-10%.

Streamlining the loan approval and disbursement process is critical for customer satisfaction. Utilizing technology to reduce turnaround times and minimize paperwork is essential. Faster processing times can significantly improve customer loyalty and reduce churn.

Maintaining transparency in all transactions builds trust and fosters long-term relationships. Clearly communicating loan terms, fees, and repayment schedules is crucial. Transparency helps prevent misunderstandings and ensures customer satisfaction.

Offering flexible repayment options when possible can help retain customers facing financial difficulties. This may include adjusting payment schedules or providing temporary relief. Such flexibility can significantly improve customer loyalty.

Analyzing customer data to understand their needs and preferences is essential. This allows for targeted marketing campaigns and personalized loan offerings. Data-driven insights can help improve customer acquisition and retention rates.

Using CRM systems to manage customer interactions and track loan performance is crucial. This helps in segmenting customers and tailoring services to their specific requirements. Effective CRM systems can improve customer engagement and loyalty.

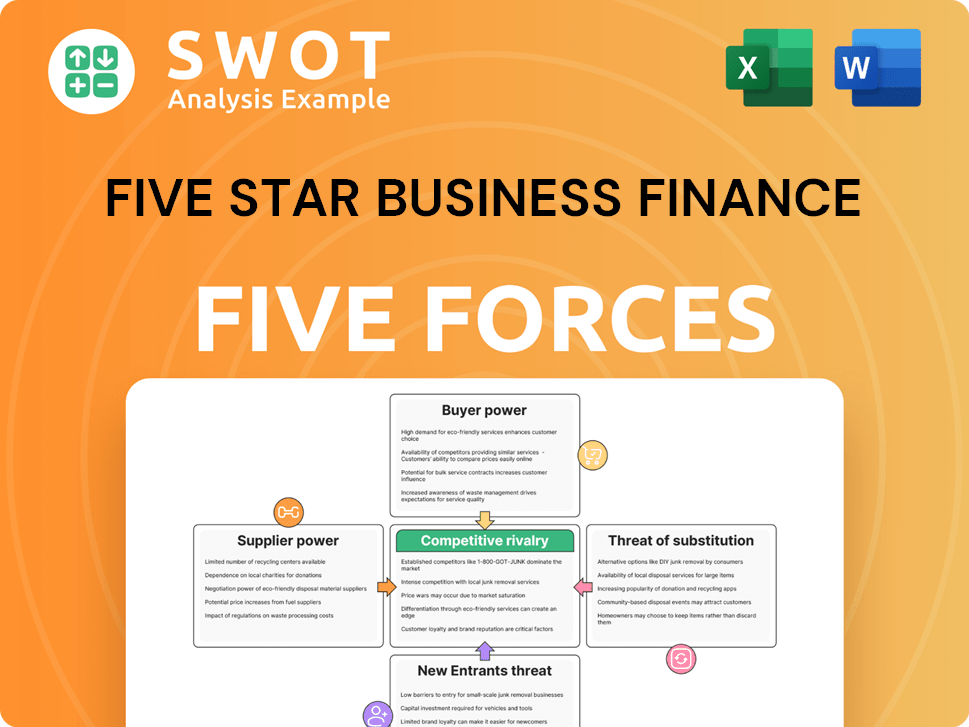

Five Star Business Finance Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Five Star Business Finance Company?

- What is Competitive Landscape of Five Star Business Finance Company?

- What is Growth Strategy and Future Prospects of Five Star Business Finance Company?

- How Does Five Star Business Finance Company Work?

- What is Sales and Marketing Strategy of Five Star Business Finance Company?

- What is Brief History of Five Star Business Finance Company?

- Who Owns Five Star Business Finance Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.